APAC Thermal Imaging Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD4769

December 2024

93

About the Report

APAC Thermal Imaging Market Overview

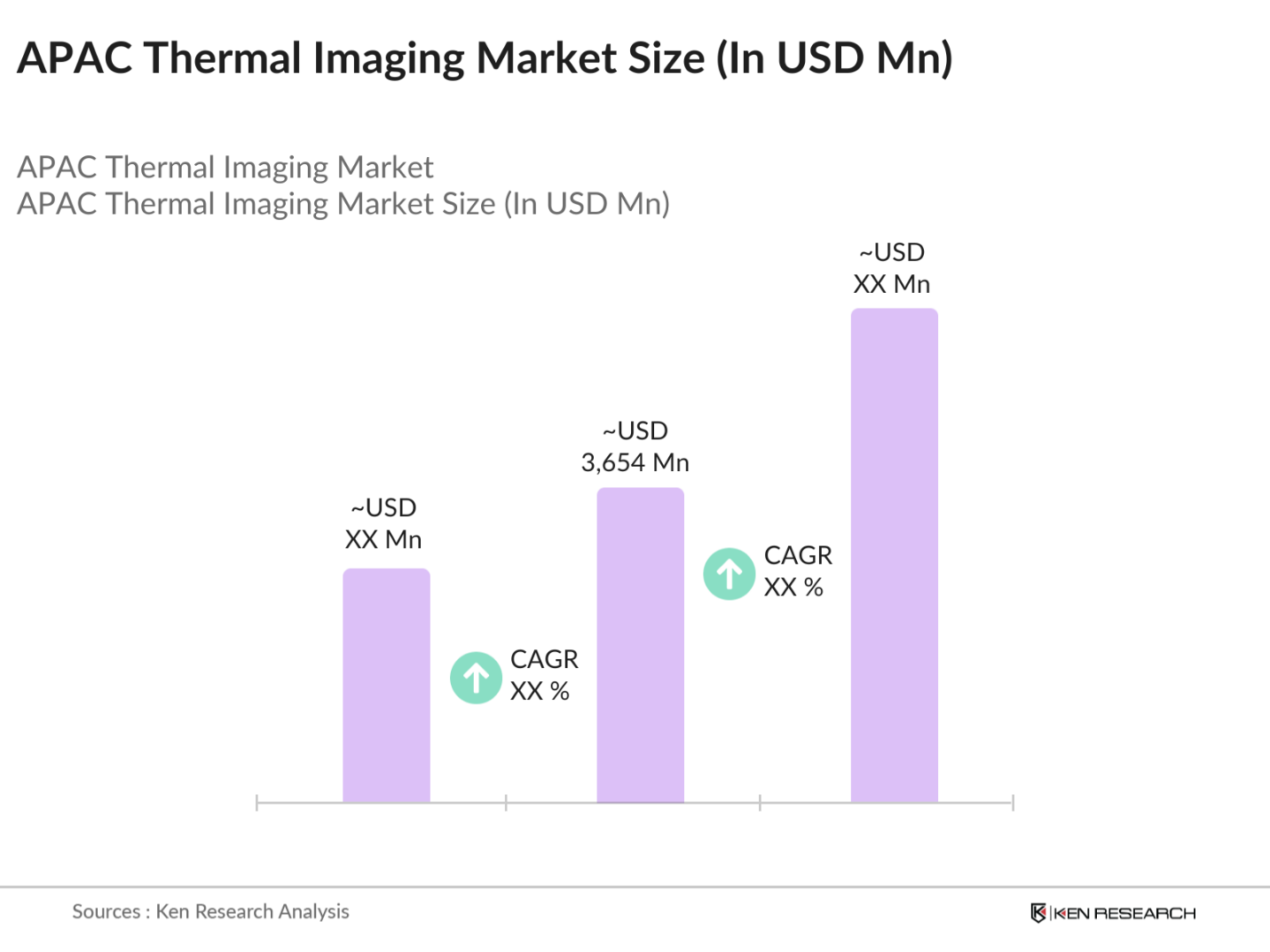

- The APAC thermal imaging market is valued at USD 3,654 million, based on a five-year historical analysis. This market is primarily driven by rapid technological advancements in high-resolution cameras and image processing, as well as an increasing adoption of thermal imaging across various sectors such as defense, automotive, and industrial applications. The need for precise monitoring and surveillance in critical infrastructure has further fueled demand. Additionally, the market's expansion is supported by the rising application of thermal imaging in smart city projects and its integration into autonomous systems

- China, Japan, and India are the leading markets in the APAC region. Chinas dominance is attributed to its substantial defense spending, which has spurred investments in surveillance and border security technologies, including thermal imaging. Japans strong presence is due to the adoption of thermal imaging in automotive safety systems and industrial applications. Meanwhile, Indias market growth is driven by the increasing use of thermal imaging in renewable energy sectors, such as solar energy, and for infrastructure surveillance.

- APAC countries such as Japan and South Korea are updating trade regulations to facilitate the import and export of high-tech imaging equipment. These reforms aim to boost local manufacturing by simplifying the import of essential components, thereby reducing dependence on foreign suppliers and supporting the regions technological growth and innovation.

APAC Thermal Imaging Market Segmentation

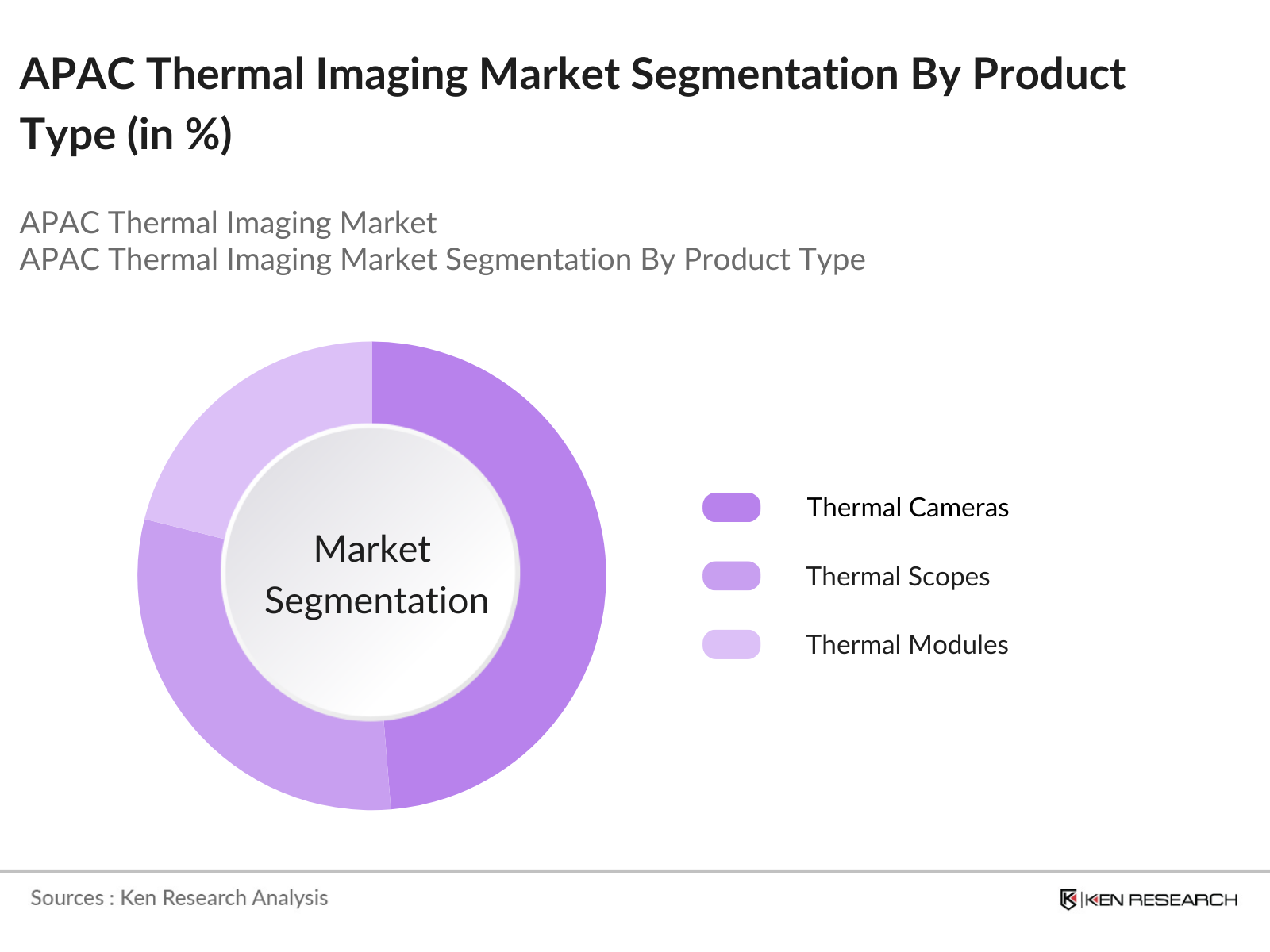

By Product Type: The market is segmented by product type into thermal cameras, thermal scopes, and thermal modules. Thermal cameras have a dominant market share within this segment. This dominance can be attributed to the extensive use of thermal cameras across various industries, such as automotive, defense, and healthcare. In automotive applications, thermal cameras are integral to advanced driver assistance systems (ADAS), helping detect pedestrians and animals in low visibility conditions.

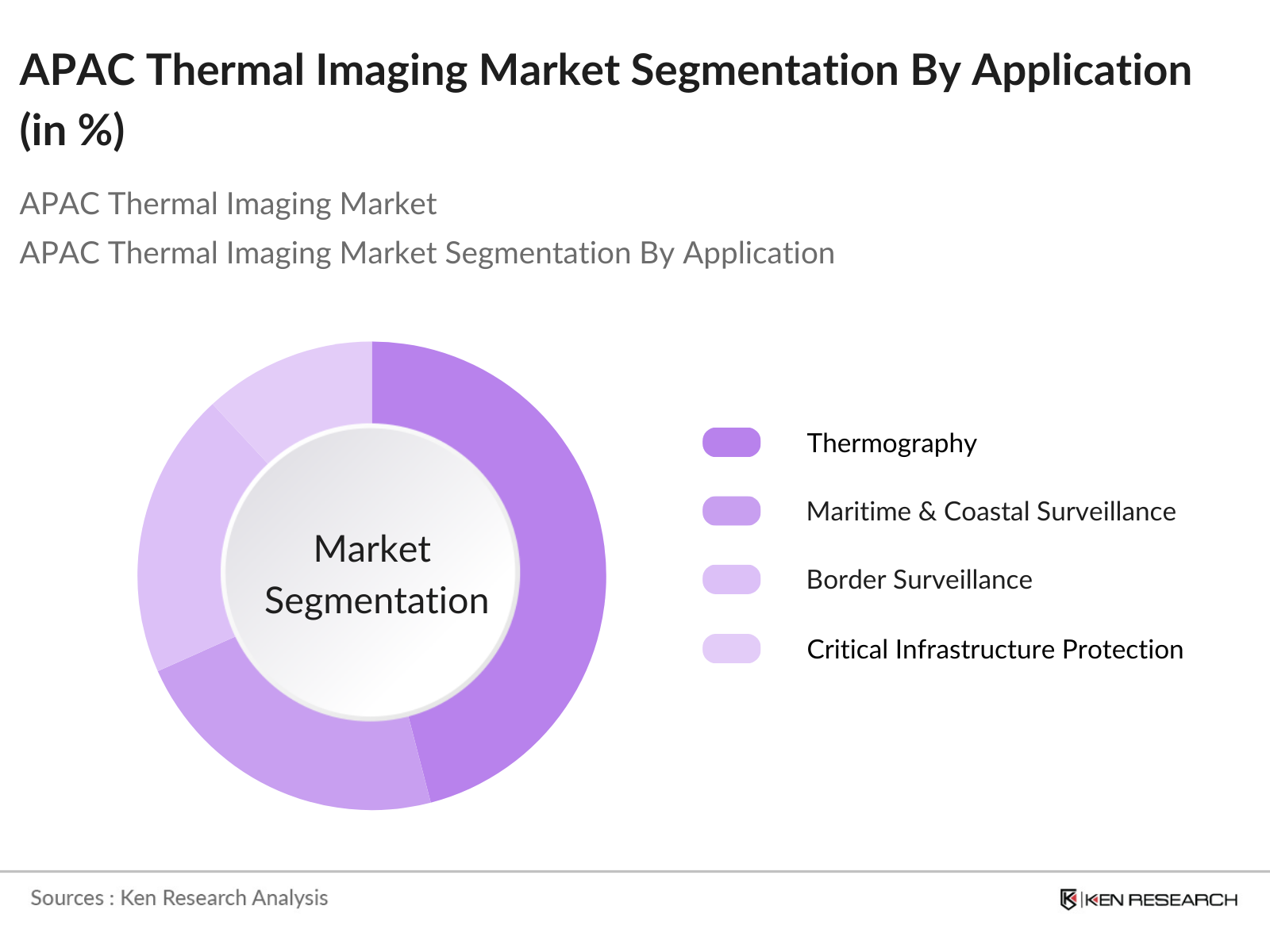

By Application: The market is segmented by application into thermography, maritime & coastal surveillance, border surveillance, critical infrastructure protection, and C-UAS/drones. The thermography segment leads the market share in this segmentation due to its broad utilization in electrical inspections, energy audits, and building diagnostics. Thermographys non-contact and non-destructive testing capabilities enable it to identify overheating components, insulation failures, and detect faults in electrical systems, making it highly valuable in maintenance applications across various industries.

APAC Thermal Imaging Market Competitive Landscape

The APAC thermal imaging market is characterized by the presence of both regional and international players, contributing to a high degree of market consolidation. Leading companies are focusing on product innovation, mergers, and strategic collaborations to maintain their competitive edge. The market is driven by large-scale deployments in sectors like defense, law enforcement, and industrial inspections, with key players establishing strong partnerships and expanding their regional footprint.

APAC Thermal Imaging Industry Analysis

Growth Drivers

- Increase in Defense and Border Surveillance Spending (Military, Law Enforcement): APAC's defense spending is witnessing a strong uptrend, driven by increased budget allocations from key economies like China, India, and Japan. As of 2024, China allocated nearly $250 billion to defense, focusing significantly on border surveillance and technological upgrades, whereas India's defense budget reached $77 billion, primarily aimed at modernizing military capabilities. Japan's defense spending rose to $50 billion, reflecting its commitment to enhancing maritime and air surveillance systems.

- Technological Advancements in High-Resolution Cameras and Image Processing: Algorithms Recent advancements in thermal imaging technology include the development of high-resolution cameras and sophisticated image processing algorithms. The adoption of AI-driven image analysis is enabling more accurate and faster threat detection, critical for defense and commercial applications. As of 2024, countries like South Korea and Singapore are integrating these technologies into public safety and security systems, reflecting a regional push toward enhanced surveillance capabilities.

- Adoption in Commercial and Residential Sectors: Thermal imaging technology is gaining traction in commercial and residential sectors for applications such as building inspections, energy audits, and security systems. In countries like Australia and South Korea, these systems are increasingly used for fire safety and HVAC inspections. In 2024, the adoption rate of thermal cameras for commercial buildings has doubled compared to pre-pandemic levels, driven by stringent safety regulations and the need for energy efficiency.

Market Challenges

- High Cost of Advanced Thermal Imaging Solutions: Despite technological advancements, the cost of high-end thermal imaging systems remains a barrier, especially for small-scale industries in emerging markets like the Philippines and Indonesia. The high price points are primarily due to the integration of complex optics and advanced software capabilities. This has resulted in slower adoption rates in these regions, where industrial and commercial applications are still limited.

- Lack of Awareness in Emerging Markets: There is a significant knowledge gap regarding the benefits of thermal imaging technology in emerging markets such as Myanmar, Laos, and Cambodia. Limited awareness about the technologys potential in applications like building diagnostics and fire safety is restricting market penetration. This lack of understanding is compounded by inadequate training and support infrastructure for potential users.

APAC Thermal Imaging Market Future Outlook

Over the next five years, the APAC thermal imaging market is expected to demonstrate substantial growth driven by increased government investments in defense and security, advancements in thermal imaging technology, and rising demand in automotive safety systems. The proliferation of smart city projects and the integration of AI in thermal imaging systems are set to create new opportunities in the market.

Market Opportunities

- Increased Integration with Autonomous Vehicles: The use of thermal imaging in autonomous vehicles is gaining momentum across APAC, particularly in countries investing in smart city projects like China, Singapore, and Japan. In 2024, the number of thermal imaging-equipped autonomous vehicles in China reached over 10,000, driven by the need for enhanced object detection and navigation in low-visibility conditions

- Expansion into Healthcare and Consumer Electronics: Thermal imaging is making significant inroads into the healthcare and consumer electronics markets in APAC. In countries like Japan and South Korea, thermal cameras are being used for temperature screening and non-invasive diagnostics. As of 2024, over 20% of newly launched smartphones in South Korea featured integrated thermal sensors, catering to consumer demand for advanced health monitoring features.

Scope of the Report

|

Product Type |

Thermal Cameras Thermal Scopes Thermal Modules |

|

Technology |

Cooled Thermal Imaging Systems Uncooled Thermal Imaging Systems |

|

Application |

Thermography Maritime & Coastal Surveillance Border Surveillance Critical Infrastructure Protection C-UAS/Drones |

|

End-User Vertical |

Aerospace & Defense Industrial Commercial Residential |

|

Region |

China India Japan Southeast Asia Australia & New Zealand |

Products

Key Target Audience

Government and Regulatory Bodies (e.g., Ministry of Defense, Border Security Agencies)

Defense Contractors and Systems Integrators

Industrial Manufacturing Companies

Automotive Manufacturers and Suppliers

Healthcare and Diagnostic Equipment Providers

Investments and Venture Capitalist Firms

Security Solutions Providers

Renewable Energy Companies

Companies

Players Mentioned in the Report

Teledyne FLIR LLC

L3 Harris Technologies, Inc.

Leonardo DRS

Honeywell International Inc.

Axis Communications AB

Opgal Optronic Industries Ltd.

Testo SE & Co. KGaA

Lynred USA

Thermoteknix Systems Ltd.

Guide Sensmart Tech Co., Ltd.

Table of Contents

1. APAC Thermal Imaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.3.1. Market Growth Rate

1.3.2. Market Segmentation Overview

1.4. Market Share and Key Trends

2. APAC Thermal Imaging Market Size (in USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Thermal Imaging Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Defense and Border Surveillance Spending (Military, Law Enforcement)

3.1.2. Technological Advancements in High-Resolution Cameras and Image Processing Algorithms

3.1.3. Adoption in Commercial and Residential Sectors

3.1.4. Growing Demand in Industrial Applications for Predictive Maintenance

3.2. Market Challenges

3.2.1. High Cost of Advanced Thermal Imaging Solutions

3.2.2. Lack of Awareness in Emerging Markets

3.2.3. Limited Adoption in Small-Scale Industries

3.3. Opportunities

3.3.1. Increased Integration with Autonomous Vehicles

3.3.2. Expansion into Healthcare and Consumer Electronics

3.4. Trends

3.4.1. Integration of AI for Enhanced Analytics

3.4.2. Use in Renewable Energy Applications (Solar Plant Monitoring)

3.4.3. Rising Adoption in Smart Cities Projects

3.5. Government Regulations and Initiatives

3.5.1. Defense Spending by Key Economies (China, India, Japan)

3.5.2. Subsidies and Support for Technology Adoption in Key Sectors

3.5.3. Trade Regulations and Import-Export Dynamics

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. APAC Thermal Imaging Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Thermal Cameras

4.1.2. Thermal Scopes

4.1.3. Thermal Modules

4.2. By Technology (In Value %)

4.2.1. Cooled Thermal Imaging Systems

4.2.2. Uncooled Thermal Imaging Systems

4.3. By Application (In Value %)

4.3.1. Thermography

4.3.2. Maritime & Coastal Surveillance

4.3.3. Border Surveillance

4.3.4. Critical Infrastructure Protection

4.3.5. C-UAS/Drones

4.4. By End-User Vertical (In Value %)

4.4.1. Aerospace & Defense

4.4.2. Industrial

4.4.3. Commercial

4.4.4. Residential

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Southeast Asia

4.5.5. Australia & New Zealand

5. APAC Thermal Imaging Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Teledyne FLIR LLC

5.1.2. L3 Harris Technologies, Inc.

5.1.3. Fluke Corporation

5.1.4. Leonardo DRS

5.1.5. Axis Communications AB

5.1.6. Opgal Optronic Industries Ltd.

5.1.7. Testo SE & Co. KGaA

5.1.8. Lynred USA

5.1.9. Thermoteknix Systems Ltd.

5.1.10. Honeywell International Inc.

5.1.11. Guide Sensmart Tech Co., Ltd.

5.1.12. BAE Systems Inc.

5.1.13. Lockheed Martin Corporation

5.1.14. Safran Group

5.1.15. Raytheon Technologies Corporation

5.2 Cross-Comparison Parameters (Revenue, No. of Employees, Headquarters, Product Portfolio, R&D Investment, Market Share, Technological Innovations, Recent Developments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. APAC Thermal Imaging Market Regulatory Framework

6.1. Defense and Border Surveillance Policies

6.2. Compliance Requirements for Industrial Applications

6.3. Certification Processes for Technology Use

6.4. Environmental and Safety Standards

7. APAC Thermal Imaging Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. APAC Thermal Imaging Future Market Segmentation

8.1 By Product Type

8.2 By Technology

8.3 By Application

8.4 By End-User Vertical

8.5 By Region

9. APAC Thermal Imaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved creating an ecosystem map encompassing all major stakeholders in the APAC Thermal Imaging Market. This was supported by extensive desk research using secondary and proprietary databases to gather industry-level information. The main objective was to identify and define critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

During this phase, historical data on the APAC thermal imaging market was compiled and analyzed. This included assessing market penetration, the ratio of product segments to revenue generation, and the resultant CAGR. The evaluation also covered service quality statistics to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through computer-assisted telephone interviews (CATI) with industry experts from a diverse array of companies. These consultations provided valuable operational and financial insights from industry practitioners, helping refine and corroborate the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple thermal imaging manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other relevant factors. This interaction served to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the APAC Thermal Imaging market.

Frequently Asked Questions

01. How big is the APAC Thermal Imaging Market?

The APAC thermal imaging market is valued at USD 3,654 million, based on a five-year historical analysis. This market is primarily driven by rapid technological advancements in high-resolution cameras and image processing, as well as an increasing adoption of thermal imaging across various sectors such as defense, automotive, and industrial applications.

02. What are the key challenges in the APAC Thermal Imaging Market?

Key challenges include the high cost of advanced thermal imaging solutions, limited awareness in emerging markets, and the fragmented nature of regulatory compliance across different countries.

03. Who are the major players in the APAC Thermal Imaging Market?

Major players in the market include Teledyne FLIR LLC, L3 Harris Technologies, Leonardo DRS, Honeywell International, and Opgal Optronic Industries, dominating due to strong product portfolios and strategic partnerships.

04. What are the main growth drivers of the APAC Thermal Imaging Market?

The market is propelled by increased government spending on defense and security, adoption of thermal imaging in automotive safety systems, and technological innovations in image processing and AI integration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.