Asia Pacific 3D Printing Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD3981

November 2024

88

About the Report

Asia Pacific 3D Printing Market Overview

- The Asia-Pacific 3D Printing Market is valued at USD 6 billion, driven by rapid advancements in manufacturing technologies, government initiatives supporting industrial digitization, and the increased adoption of additive manufacturing across key sectors like aerospace, automotive, and healthcare. In 2023, the demand for 3D printing in industries such as medical device manufacturing and automotive prototyping grew significantly due to the efficiency and cost-saving benefits of the technology. This adoption is bolstered by the need for rapid prototyping, the ability to customize products, and growing interest in reducing material wastage.

- Key countries driving the market include China, Japan, and South Korea. China dominates the market due to its extensive manufacturing ecosystem and government initiatives to boost additive manufacturing technologies. Japan follows closely, thanks to its innovations in healthcare applications, while South Korea is emerging as a significant player with investments in industrial automation and 3D printing applications in consumer electronics. These countries benefit from strong industrial bases, high R&D investments, and favorable regulatory environments, which support growth in the 3D printing sector.

- Australia's government, through the Therapeutic Goods Administration (TGA), introduced a regulatory framework in 2021 for personalized 3D-printed medical devices, including patient-matched, adaptable, and custom-made devices. The framework ensures that 3D-printed devices, especially those produced in larger quantities, meet safety and efficacy standards. High-risk devices must be included in the Australian Register of Therapeutic Goods (ARTG), while custom-made devices remain exempt from this requirement. This initiative enhances oversight and aligns 3D printing with broader medical manufacturing standards.

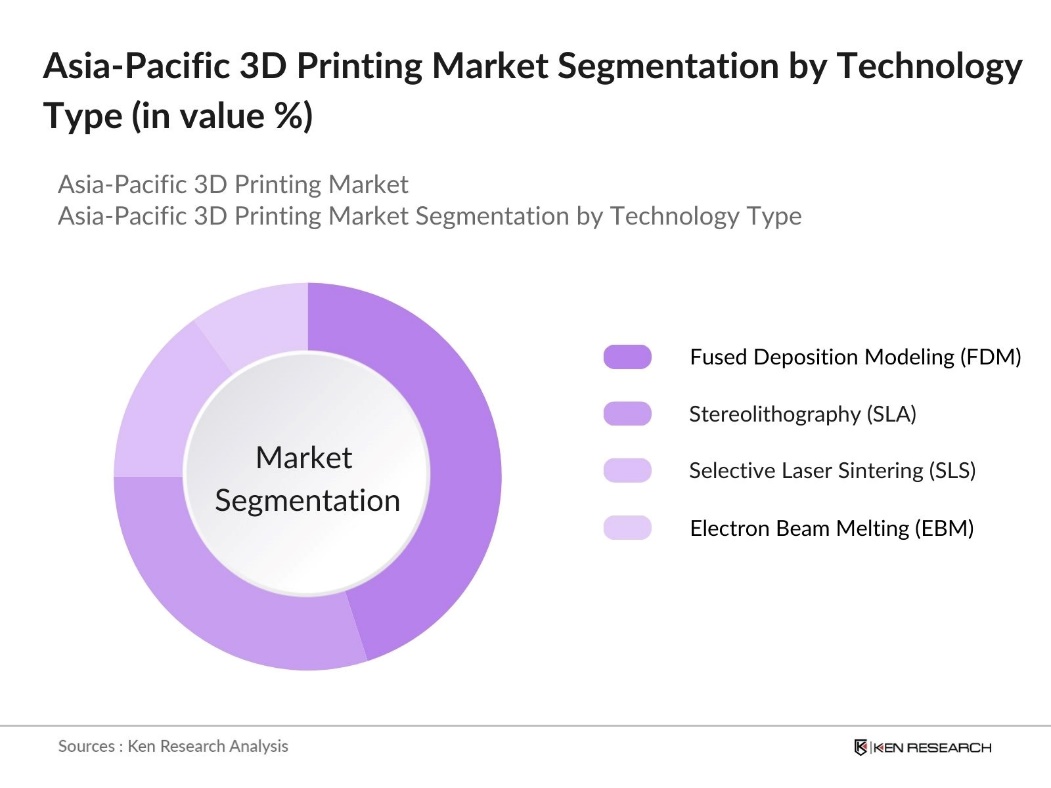

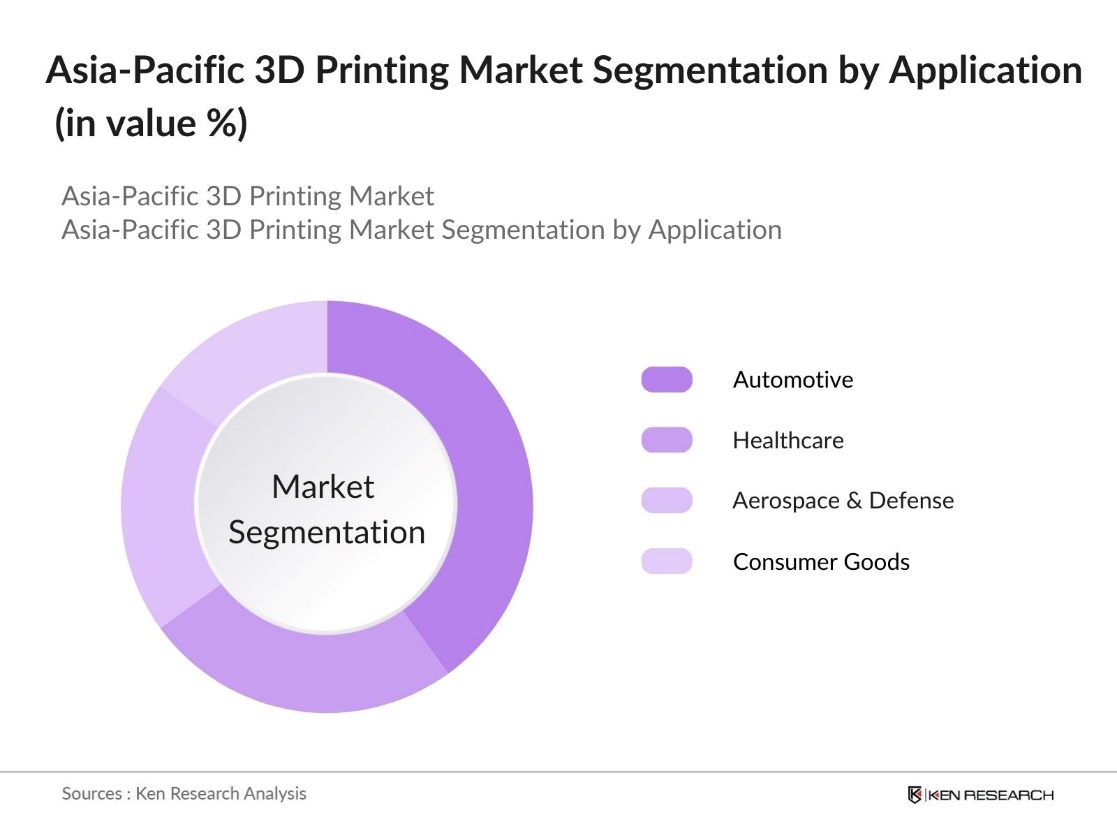

Asia Pacific 3D Printing Market Segmentation

By Technology Type: The Asia-Pacific 3D printing market is segmented by technology type into Stereolithography (SLA), Selective Laser Sintering (SLS), Fused Deposition Modeling (FDM), and Electron Beam Melting (EBM). FDM holds a dominant market share, accounting for 45% of the 3D printing technology market in 2023. This dominance is attributed to its widespread use in industrial and desktop 3D printers, owing to its cost-effectiveness, ease of use, and availability of a variety of materials. Many manufacturers prefer FDM technology for rapid prototyping and the production of low-cost plastic components.

By Application: The Asia-Pacific 3D printing market is segmented by application into Automotive, Healthcare, Aerospace & Defense, and Consumer Goods. The automotive sector dominates the application segmentation, holding a market share of 40% in 2023. This is largely due to the use of 3D printing for prototyping, tooling, and the manufacturing of complex components for electric and autonomous vehicles. Companies within the automotive sector are increasingly leveraging 3D printing to reduce costs, improve time-to-market, and enhance the overall design and manufacturing process.

Asia Pacific 3D Printing Market Competitive Landscape

The Asia-Pacific 3D printing market is dominated by both local and global players that provide a wide range of 3D printing solutions, materials, and services. This market is characterized by consolidation, with key companies focusing on innovations in materials, expansion into new verticals, and strategic collaborations.

|

Company |

Establishment Year |

Headquarters |

R&D Expenditure |

Global Reach |

Revenue (2023) |

Product Portfolio |

Key Applications |

Number of Employees |

|

3D Systems Corporation |

1986 |

Rock Hill, USA |

||||||

|

Stratasys Ltd. |

1989 |

Rehovot, Israel |

||||||

|

EOS GmbH |

1989 |

Krailling, Germany |

||||||

|

HP Inc. |

1939 |

Palo Alto, USA |

||||||

|

GE Additive |

2016 |

Cincinnati, USA |

Asia Pacific 3D Printing Industry Analysis

Growth Drivers

- Industrial Automation: The integration of 3D printing in industrial automation across the Asia-Pacific region is rapidly increasing. In 2023, South Korea maintained its position as a global leader in industrial robot density, reporting approximately 1,012 robots per 10,000 employees. This figure is significantly higher than the global average and underscores the country's commitment to automation in its manufacturing sector. The technology's ability to streamline production, reduce lead times, and enable on-demand manufacturing has pushed its adoption further, with China leading the charge in Asias industrial 3D printing expansion.

- Rising Adoption of 3D Printing in Healthcare and Aerospace: The Asia-Pacific region has seen rapid adoption of 3D printing in healthcare and aerospace. In 2023, Singapore has indeed made significant investments in bioprinting research, with a focus on organ tissue development. Notably, the collaboration between CELLINK and Nanyang Technological University (NTU) is a key example of this investment. Such applications are increasing the demand for precision in 3D printing technologies.

- Cost Efficiency and Material Utilization: 3D printing is widely recognized for its ability to optimize cost efficiency and material usage. Compared to traditional manufacturing methods, 3D printing minimizes waste by precisely using only the necessary materials during production. This makes it particularly beneficial for industries requiring rapid prototyping, custom components, and on-demand production. Additionally, the technology's flexibility allows for significant savings in the production of spare parts and specialized tools, which would otherwise require expensive, labor-intensive processes.

Market Challenges

- High Initial Investment in Industrial 3D Printers: The adoption of industrial 3D printers in the Asia-Pacific region often requires substantial upfront investment. These high-end machines, particularly those used for metal printing and advanced manufacturing applications, can be prohibitively expensive for smaller manufacturers. Beyond the initial purchase, additional costs for setup, maintenance, and the necessary infrastructure contribute to the overall financial burden. This makes it more feasible for large-scale manufacturers, while small and medium-sized enterprises (SMEs) face challenges in justifying the investment, especially in economies where the manufacturing landscape is dominated by smaller players.

- Lack of Skilled Workforce and Training in 3D Technologies: A significant obstacle to the expansion of 3D printing in the Asia-Pacific region is the shortage of a skilled workforce proficient in 3D design and printing technologies. Many industries struggle to find professionals with adequate training in the technical aspects of 3D printing, including design software, machine operation, and post-processing techniques. The lack of formal education programs and limited access to specialized training further exacerbates this issue. This skills gap hinders the ability of companies to fully leverage 3D printing technology, slowing the overall growth and development of the sector across the region.

Asia Pacific 3D Printing Market Future Outlook

Over the next five years, the Asia-Pacific 3D printing market is poised to grow significantly, driven by ongoing advancements in materials science, improvements in 3D printing speeds, and growing demand for customized solutions in the healthcare and automotive sectors. Governments across the region, particularly in China, Japan, and South Korea, are expected to continue offering strong support through subsidies and policies aimed at enhancing digital manufacturing capabilities.

Market Opportunities

- Increased Customization Capabilities: One of the key opportunities in the Asia-Pacific 3D printing market lies in its ability to deliver highly customized products. 3D printing allows manufacturers to create bespoke items tailored to specific customer preferences or industry needs, which is particularly valuable in sectors like automotive, consumer goods, and healthcare. This technology enables companies to quickly produce personalized components, reducing lead times and minimizing waste compared to traditional manufacturing processes.

- Technological Advancements in Material Science: Technological advancements in material science are significantly enhancing the potential of 3D printing in the Asia-Pacific region. New materials are being developed that improve the performance, durability, and sustainability of 3D-printed products. These innovations are expanding the range of applications for 3D printing, particularly in sectors like medical devices, aerospace, and construction. Biodegradable materials, advanced polymers, and composites are enabling manufacturers to create more complex, functional, and environmentally friendly products.

Scope of the Report

|

By Printer Type |

Industrial 3D Printers Desktop 3D Printers Hybrid Printers |

|

By Material Type |

Polymers Metals Ceramics Biocompatible Materials |

|

By Technology |

Stereolithography (SLA) Selective Laser Sintering (SLS) Fused Deposition Modeling (FDM) Electron Beam Melting (EBM) |

|

By Application |

Automotive Healthcare Aerospace & Defense Consumer Goods |

|

By Region |

China Japan South Korea Australia India |

Products

Key Target Audience

3D Printer Manufacturers

Automotive Manufacturing Companies

Medical Device Companies

Additive Manufacturing Service Providers

Government and Regulatory Bodies (Ministry of Industry and Information Technology, Japan's Ministry of Economy, Trade, and Industry)

Investment and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

3D Systems Corporation

Stratasys Ltd.

EOS GmbH

HP Inc.

GE Additive

Materialise NV

Voxeljet AG

SLM Solutions Group AG

Protolabs

Renishaw plc

XYZPrinting, Inc.

Desktop Metal

Carbon 3D, Inc.

Ultimaker BV

Zortrax

Table of Contents

1. Asia-Pacific 3D Printing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Industrial Sector Growth, Manufacturing Advancements, Adoption of Additive Manufacturing)

1.4. Market Segmentation Overview

2. Asia-Pacific 3D Printing Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Technological Innovations, Adoption in Healthcare, Aerospace Expansion)

3. Asia-Pacific 3D Printing Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Automation

3.1.2. Rising Adoption of 3D Printing in Healthcare and Aerospace

3.1.3. Government Support for Industrial Digitization

3.1.4. Cost Efficiency and Material Utilization

3.2. Market Challenges

3.2.1. High Initial Investment in Industrial 3D Printers

3.2.2. Lack of Skilled Workforce and Training in 3D Technologies

3.2.3. Limited Availability of Raw Materials

3.3. Opportunities

3.3.1. Increased Customization Capabilities

3.3.2. Technological Advancements in Material Science

3.3.3. Expanding Application in Automotive, Defense, and Consumer Goods

3.4. Trends

3.4.1. Adoption of Multi-Material 3D Printing

3.4.2. Integration of AI in 3D Printing for Design Optimization

3.4.3. Shift Towards Sustainable and Bio-Compatible Materials

3.5. Government Regulations

3.5.1. National Additive Manufacturing Policies

3.5.2. Standards for 3D Printed Medical Devices

3.5.3. Import-Export Regulations on 3D Printing Materials

3.5.4. Environmental Standards for Waste Reduction

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia-Pacific 3D Printing Market Segmentation

4.1. By Printer Type (In Value %)

4.1.1. Industrial 3D Printers

4.1.2. Desktop 3D Printers

4.1.3. Hybrid Printers

4.2. By Material Type (In Value %)

4.2.1. Polymers

4.2.2. Metals

4.2.3. Ceramics

4.2.4. Biocompatible Materials

4.3. By Technology (In Value %)

4.3.1. Stereolithography (SLA)

4.3.2. Selective Laser Sintering (SLS)

4.3.3. Fused Deposition Modeling (FDM)

4.3.4. Electron Beam Melting (EBM)

4.4. By Application (In Value %)

4.4.1. Automotive

4.4.2. Healthcare

4.4.3. Aerospace & Defense

4.4.4. Consumer Goods

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Australia

4.5.5. India

5. Asia-Pacific 3D Printing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. 3D Systems Corporation

5.1.2. Stratasys Ltd.

5.1.3. EOS GmbH

5.1.4. Materialise NV

5.1.5. HP Inc.

5.1.6. SLM Solutions Group AG

5.1.7. GE Additive

5.1.8. XYZPrinting, Inc.

5.1.9. Carbon 3D, Inc.

5.1.10. Desktop Metal

5.1.11. Voxeljet AG

5.1.12. Protolabs

5.1.13. Renishaw plc

5.1.14. Zortrax

5.1.15. Ultimaker BV

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Penetration, Manufacturing Capabilities, Product Portfolio, Global Reach, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia-Pacific 3D Printing Market Regulatory Framework

6.1. Certification and Compliance Standards (ISO Certifications, FDA Approvals for Medical Devices)

6.2. Industry-Specific Regulations (Medical, Aerospace, Automotive)

6.3. Intellectual Property Protection (Patent Filings, Licensing)

7. Asia-Pacific 3D Printing Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific 3D Printing Market Analysts' Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, the research involved identifying all major stakeholders within the Asia-Pacific 3D Printing Market ecosystem. A combination of desk research and proprietary databases was employed to gather industry-level data, mapping key market variables like product adoption rates, revenue drivers, and technology preferences.

Step 2: Market Analysis and Construction

Historical data for the Asia-Pacific 3D Printing Market was collected, focusing on market penetration, segment-wise demand, and revenue generation across sectors. The data gathered helped in understanding past market dynamics and trends that shaped the current state of the market.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through discussions with industry experts and company representatives. Insights gained from these consultations helped refine market forecasts and corroborated the findings with real-world data.

Step 4: Research Synthesis and Final Output

The final synthesis involved triangulating data from various primary and secondary sources. This step involved direct engagement with 3D printing companies, providing detailed insights into market segmentation, emerging trends, and growth opportunities.

Frequently Asked Questions

01 How big is the Asia-Pacific 3D Printing Market?

The Asia-Pacific 3D Printing Market is valued at USD 6 billion, with substantial demand driven by its application in sectors such as automotive, healthcare, and aerospace.

02 What are the challenges in the Asia-Pacific 3D Printing Market?

Key challenges in Asia-Pacific 3D Printing Market include high initial costs for industrial 3D printers, lack of skilled labor, and material shortages in certain regions, which can hinder the broader adoption of 3D printing technology.

03 Who are the major players in the Asia-Pacific 3D Printing Market?

Major players in the Asia-Pacific 3D Printing Market include 3D Systems Corporation, Stratasys Ltd., EOS GmbH, HP Inc., and GE Additive, which are leading due to their wide range of offerings and focus on innovation.

04 What drives the growth of the Asia-Pacific 3D Printing Market?

Growth driven in the Asia-Pacific 3D Printing Market, by advancements in material science, government policies favoring digital manufacturing, and the increasing demand for customized products in industries like healthcare and automotive.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.