Asia Pacific 5G Chipset Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD2621

November 2024

98

About the Report

Asia Pacific 5G Chipset Market Overview

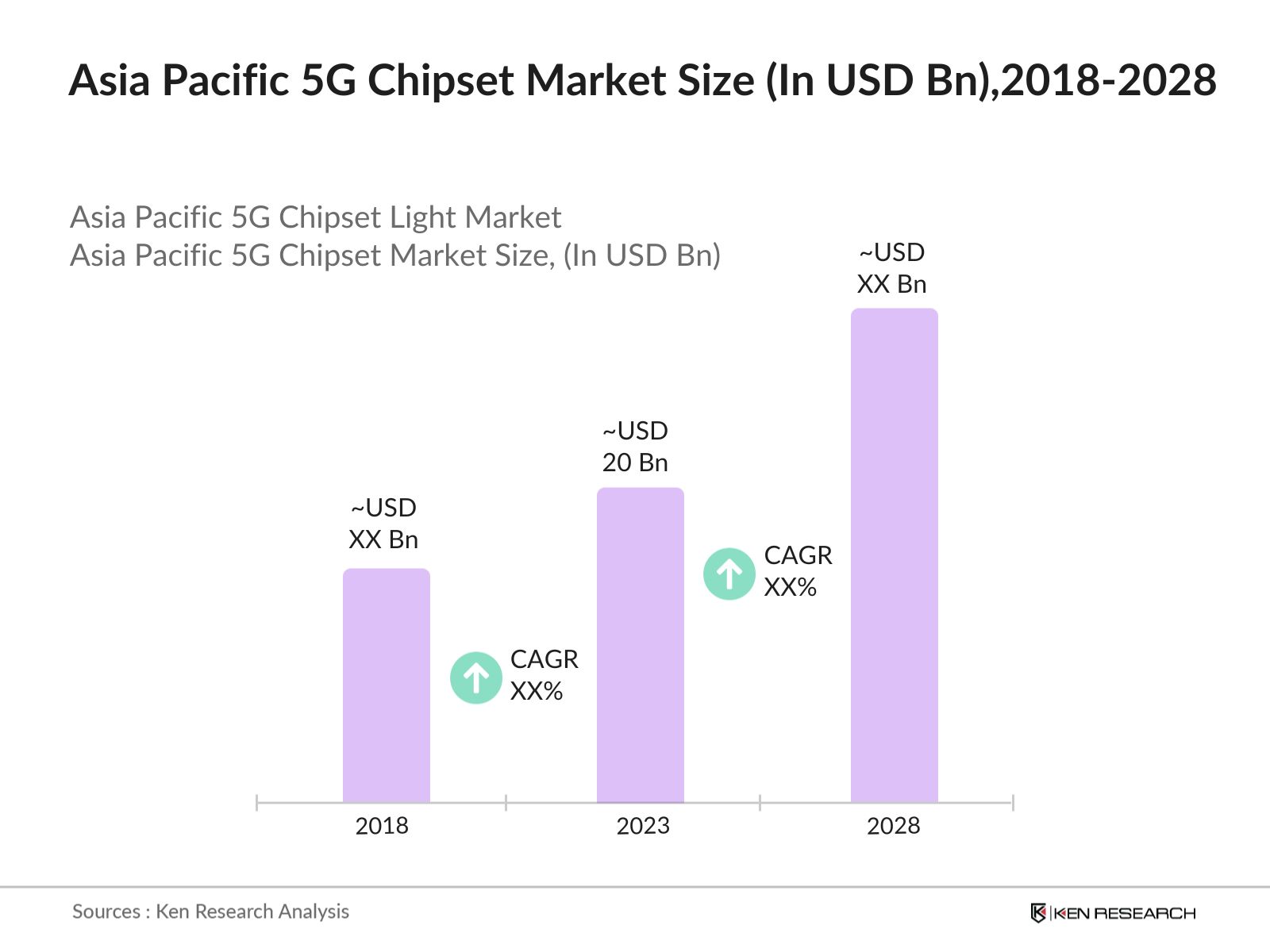

- The 5G chipset market in Asia Pacific was valued at USD 20 Billion based on the historical data of past five years, driven by the widespread adoption of 5G technology across industries such as telecommunications, manufacturing, and smart cities. The increasing number of connected devices, IoT applications, and mobile internet users are pushing for faster data transfer rates, low latency, and increased network capacity.

- Leading global companies dominate the Asia Pacific 5G chipset market, including Qualcomm, MediaTek, Samsung Electronics, Huawei, and Intel. These firms are driving the market by investing in R&D, launching cutting-edge 5G chipset solutions, and partnering with telecom providers to roll out 5G networks across the region.

- In February 2023, Qualcomm launched the Snapdragon X75, its latest 5G chipset designed for premium smartphones, marking a major development in high-speed mobile connectivity. This chipset features AI-powered enhancements and supports Wave and sub-6GHz 5G, aiming to improve power efficiency and network performance.

- China remains the dominant player in the Asia Pacific 5G chipset industry. The country's leadership is attributed to its robust 5G infrastructure, the presence of leading tech giants such as Huawei and ZTE, and aggressive government policies to promote smart cities and IoT adoption. Shenzhen and Beijing are at the forefront of 5G innovation, home to several pilot projects and research initiatives.

Asia Pacific 5G Chipset Market Segmentation

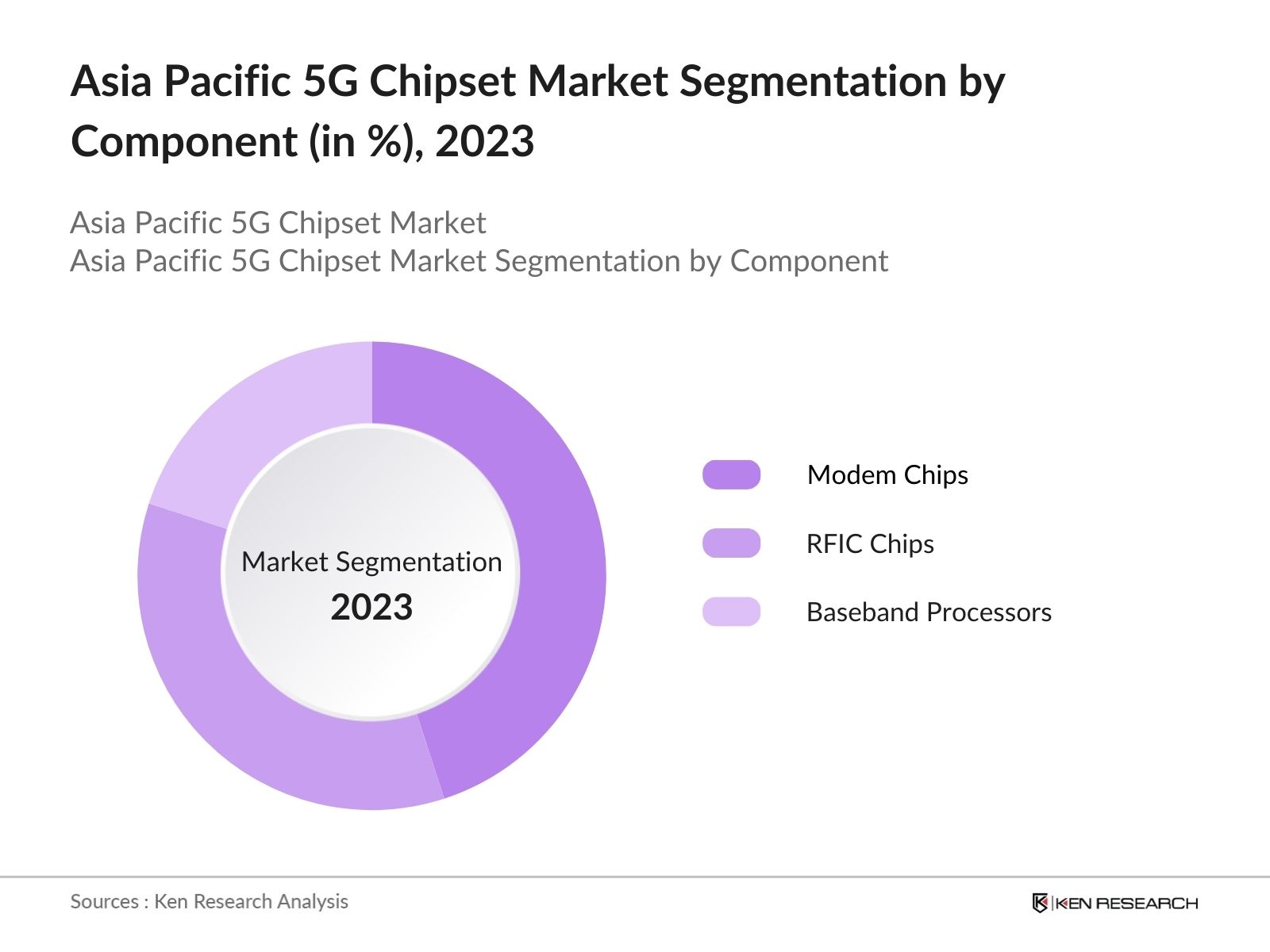

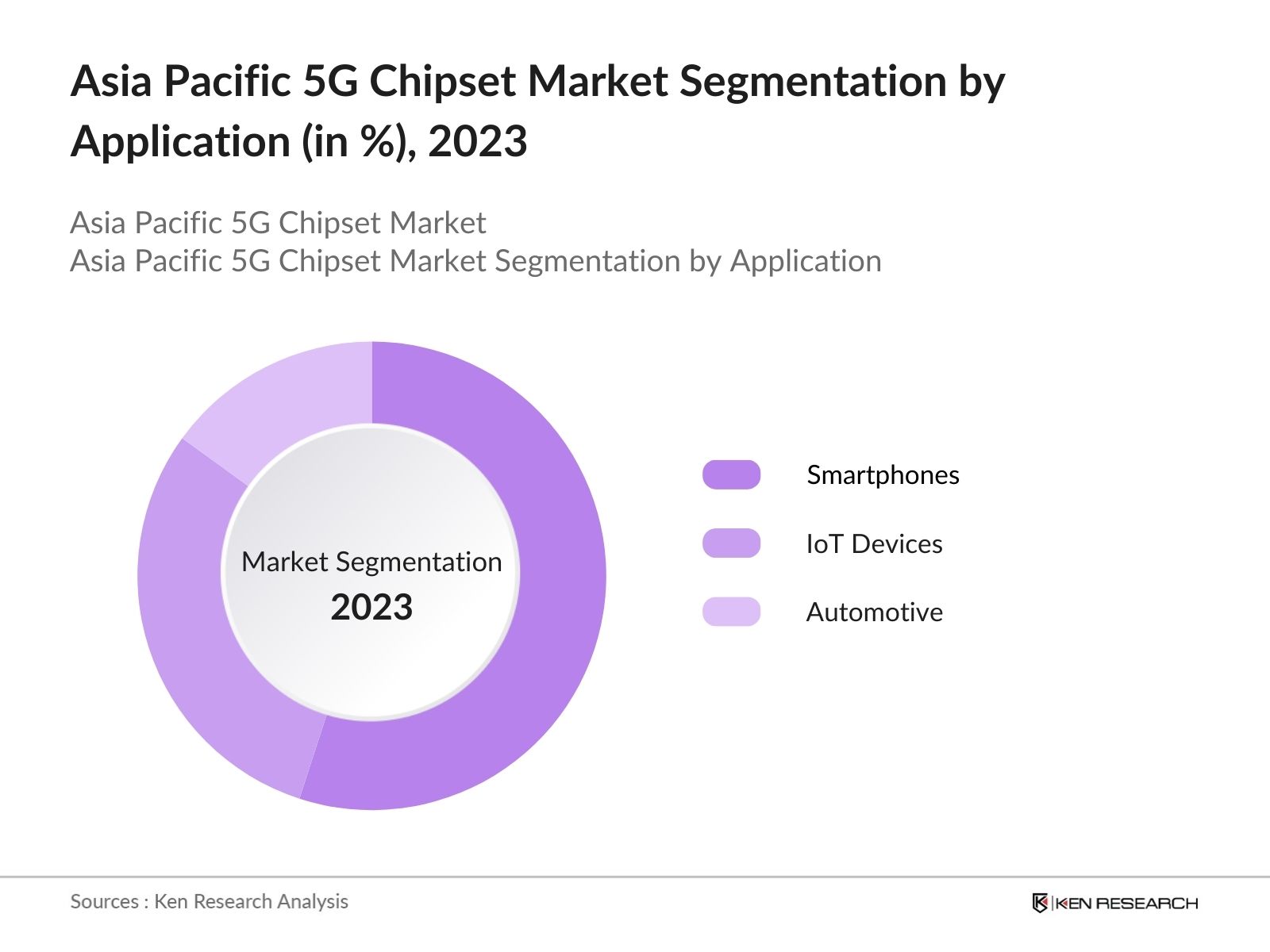

The Asia Pacific 5G chipset market is segmented into various factors such as component, application and region etc.

By Component: The market is segmented by component into modem chips, RFIC chips, and baseband processors. Modem Chips held the dominant market share, due to their essential role in enabling devices to connect to 5G networks. The increasing demand for smartphones and connected devices has driven the growth of this segment.

By Application: The market is segmented by application into smartphones, IoT devices, and automotive. Smartphones held the dominant. The widespread adoption of 5G-enabled smartphones, especially in countries like China and South Korea, has driven this segment's dominance. These devices are integral to smart city projects and industrial automation, areas where 5G has proven to be transformative.

By Region: The market is segmented by region into China, South Korea, Japan, India, Australia, and Rest of APAC. China dominated the market share, driven by government investment in 5G networks and the presence of leading chipset manufacturers, supported by its innovative approach to 5G applications in smart factories and robotics.

Asia Pacific 5G Chipset Market Competitive Landscape

|

Company |

Year of Establishment |

Headquarters |

|---|---|---|

|

Qualcomm |

1985 |

San Diego, USA |

|

MediaTek |

1997 |

Hsinchu, Taiwan |

|

Samsung Electronics |

1938 |

Suwon, South Korea |

|

Huawei |

1987 |

Shenzhen, China |

|

Intel |

1968 |

Santa Clara, USA |

- MediaTek: MediaTek launched its Dimensity 9000 chipset in 2021, targeting premium smartphones in the Asia Pacific market. The chipset has gained significant traction in China and South Korea, where smartphone manufacturers are integrating it into their flagship devices. MediaTek is expected to ship over 200 million chipsets by the end of 2024, bolstering its position in the market.

- SK Telecom: SK Telecom partnered with Singtel to develop next-generation telecom networks, including advancements in AI and 6G technologies. This collaboration aims to leverage their combined strengths to innovate in areas such as network slicing and virtualization, which are crucial for maximizing the capabilities of 5G and preparing for future 6G networks.

Asia Pacific 5G Chipset Industry Analysis

Growth Drivers

- Rising Smartphone Penetration: In 2024, the Asia Pacific region is expected to see over 1.6 billion smartphone users, a significant driver for the 5G chipset market. With more 5G-enabled devices entering the market, demand for high-performance chipsets is on the rise. Countries such as India and China are at the forefront, with millions of 5G devices being sold annually, contributing to the regions growing demand for 5G chipsets.

- Expansion of IoT Applications: The proliferation of IoT devices in the region is a major growth driver. Over 3 billion IoT devices will be connected via 5G networks in Asia Pacific. This is especially significant in countries like Japan and South Korea, where IoT is transforming industries such as healthcare, manufacturing, and logistics. The growth in connected devices will increase demand for low-latency, high-speed chipsets capable of supporting these applications.

- Growth in Smart City Initiatives: Major urban centers like Beijing, Tokyo, and Seoul have been allocated billions in funding for smart city projects that require 5G infrastructure. China alone plans to invest in smart city technologies by 2025, heavily relying on the deployment of 5G networks. These initiatives are expected to bolster the market for 5G chipsets as they form the backbone of high-speed, interconnected systems required for city-wide IoT applications.

Challenges

- Regulatory and Spectrum Allocation Issues: The Asia Pacific region is facing delays in 5G spectrum auctions, especially in countries like India and Indonesia, where legal and regulatory frameworks are still evolving. In 2024, the Indian government is struggling to finalize spectrum allocation, which is delaying 5G network rollouts and, by extension, reducing demand for 5G chipsets.

- High Power Consumption of 5G Devices: One of the key challenges in the adoption of 5G technology is the increased power consumption of 5G chipsets. It has been observed that 5G-enabled devices consume more power compared to their 4G counterparts. This is creating a bottleneck for manufacturers, particularly in sectors like automotive and IoT, where energy efficiency is critical.

Government Initiatives

- India's 5G Push in 2024: The Indian government has initiated a USD 2 billion fund to encourage local manufacturing of 5G chipsets and infrastructure. This initiative, part of the Atmanirbhar Bharat (Self-Reliant India) campaign, aims to reduce reliance on foreign semiconductor imports and promote homegrown technologies, providing a significant boost to the local 5G chipset market.

- Japans Telecommunications Strategy: Japan is investing USD 1 billion by 2024 into the development of 5G-based communication systems, with a focus on public safety and disaster management. The government aims to build a resilient communication network, and this investment will drive the demand for specialized 5G chipsets capable of operating in mission-critical environments.

Asia Pacific 5G Chipset Market Future Outlook

The Asia Pacific 5G chipset market is projected to grow exponentially, supported by the continued expansion of 5G infrastructure, rising demand for ultra-fast communication systems, and IoT growth across sectors like automotive, healthcare, and smart cities. Countries like China, Japan, and India are expected to lead in 5G deployment, further enhancing the market's outlook.

Future Trends

- Rise of 5G in Automotive Applications: The Asia Pacific region is expected to lead in the adoption of 5G-enabled autonomous vehicles. Countries like Japan and South Korea will see more autonomous vehicles operating on 5G networks, creating significant demand for chipsets capable of handling complex data processing and communication between vehicles and infrastructure.

- Increased Focus on Energy Efficiency in 5G Devices: Energy efficiency will be a key trend in the development of 5G chipsets over the next five years. Chipset manufacturers will prioritize creating low-power 5G chipsets to meet the growing demand from IoT devices and wearable technologies that require extended battery life. These advancements will be particularly significant in markets like India and Indonesia, where energy costs are a concern.

Scope of the Report

|

By Component |

Modem Chips RFIC Chips Baseband Processors |

|

By Application |

Smartphones IoT Devices Automotive |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunications Companies

Semiconductor Manufacturers

IoT Device Manufacturers

Automotive Companies

Government Institutions (e.g., Ministry of Telecommunications India)

5G Infrastructure Providers

Smartphone Manufacturers

Investors and VC Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report:

Qualcomm

MediaTek

Samsung Electronics

Huawei

Intel

Broadcom

Nokia

Ericsson

ZTE

Skyworks Solutions

Analog Devices

Texas Instruments

Murata Manufacturing

Qorvo

UNISOC

Table of Contents

1. Asia Pacific 5G Chipset Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific 5G Chipset Market Size (in USD Bn), 2018-2028

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific 5G Chipset Market Analysis

3.1. Growth Drivers

3.1.1. Smartphone Penetration

3.1.2. Government Investments in 5G Infrastructure

3.1.3. Expansion of IoT Applications

3.1.4. Smart City Initiatives

3.2. Restraints

3.2.1. High Deployment Costs

3.2.2. Semiconductor Supply Chain Issues

3.2.3. Spectrum Allocation Delays

3.2.4. Power Consumption of 5G Devices

3.3. Opportunities

3.3.1. Rise of 5G in Automotive Industry

3.3.2. Expansion of Private 5G Networks

3.3.3. Increased Demand for 5G in Smart Factories

3.3.4. IoT Device Expansion

3.4. Trends

3.4.1. AI-Powered 5G Chipsets

3.4.2. Low-Latency Applications in Healthcare

3.4.3. Integration of Edge Computing

3.4.4. mmWave Technology Advancements

3.5. Government Regulation

3.5.1. National 5G Infrastructure Programs

3.5.2. Spectrum Allocation Policies

3.5.3. Industry-Specific 5G Applications

3.5.4. Smart City-Related Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Asia Pacific 5G Chipset Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. Modem Chips

4.1.2. RFIC Chips

4.1.3. Baseband Processors

4.2. By Application (in Value %)

4.2.1. Smartphones

4.2.2. IoT Devices

4.2.3. Automotive

4.3. By Region (in Value %)

4.3.1. China

4.3.2. South Korea

4.3.3. Japan

4.3.4. India

4.3.5. Australia

4.3.6. Rest of APAC

5. Asia Pacific 5G Chipset Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Qualcomm

5.1.2. MediaTek

5.1.3. Samsung Electronics

5.1.4. Huawei

5.1.5. Intel

5.1.6. Broadcom

5.1.7. Ericsson

5.1.8. ZTE

5.1.9. Nokia

5.1.10. Skyworks Solutions

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Asia Pacific 5G Chipset Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Government Grants

6.4.2. Venture Capital Funding

6.4.3. Private Equity Investments

7. Asia Pacific 5G Chipset Market Regulatory Framework

7.1. Spectrum Allocation Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Asia Pacific 5G Chipset Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Asia Pacific 5G Chipset Future Market Segmentation, 2028

9.1. By Component (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. Asia Pacific 5G Chipset Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building

Collating statistics on Asia-Pacific 5G Chipset Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for 5G Chipset Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output

Our team will approach multiple 5G chipset companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Asia-Pacific G5 chipset industry.

Frequently Asked Questions

01 How big is Asia Pacific 5G Chipset Market?

The Asia Pacific 5G chipset market was valued at USD 20 billion driven by the surge in demand for 5G-enabled devices, government support for 5G infrastructure, and increasing IoT applications.

02 What are the challenges in the Asia Pacific 5G Chipset Market?

Challenges in the Asia Pacific 5G chipset market includes high deployment costs for 5G infrastructure, supply chain disruptions affecting semiconductor production, delays in spectrum allocation, and high power consumption in 5G devices, which complicates widespread adoption.

03 Who are the major players in the Asia Pacific 5G Chipset Market?

Key players in the Asia Pacific 5G chipset market include Qualcomm, MediaTek, Samsung Electronics, Huawei, and Intel. These companies lead the market through significant R&D investments, strategic partnerships, and a strong presence in telecommunications and IoT sectors.

04 What are the growth drivers of the Asia Pacific 5G Chipset Market?

The Asia Pacific 5G chipset market is driven by the rising penetration of 5G-enabled smartphones, increased government spending on 5G infrastructure, the rapid expansion of IoT applications, and the growth of smart city projects, especially in countries like China and South Korea.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.