Asia-Pacific Acrylic Polymer Market Outlook to 2030

Region:Asia

Author(s):Shambhavi

Product Code:KROD9502

November 2024

87

About the Report

Asia-Pacific Acrylic Polymer Market Overview

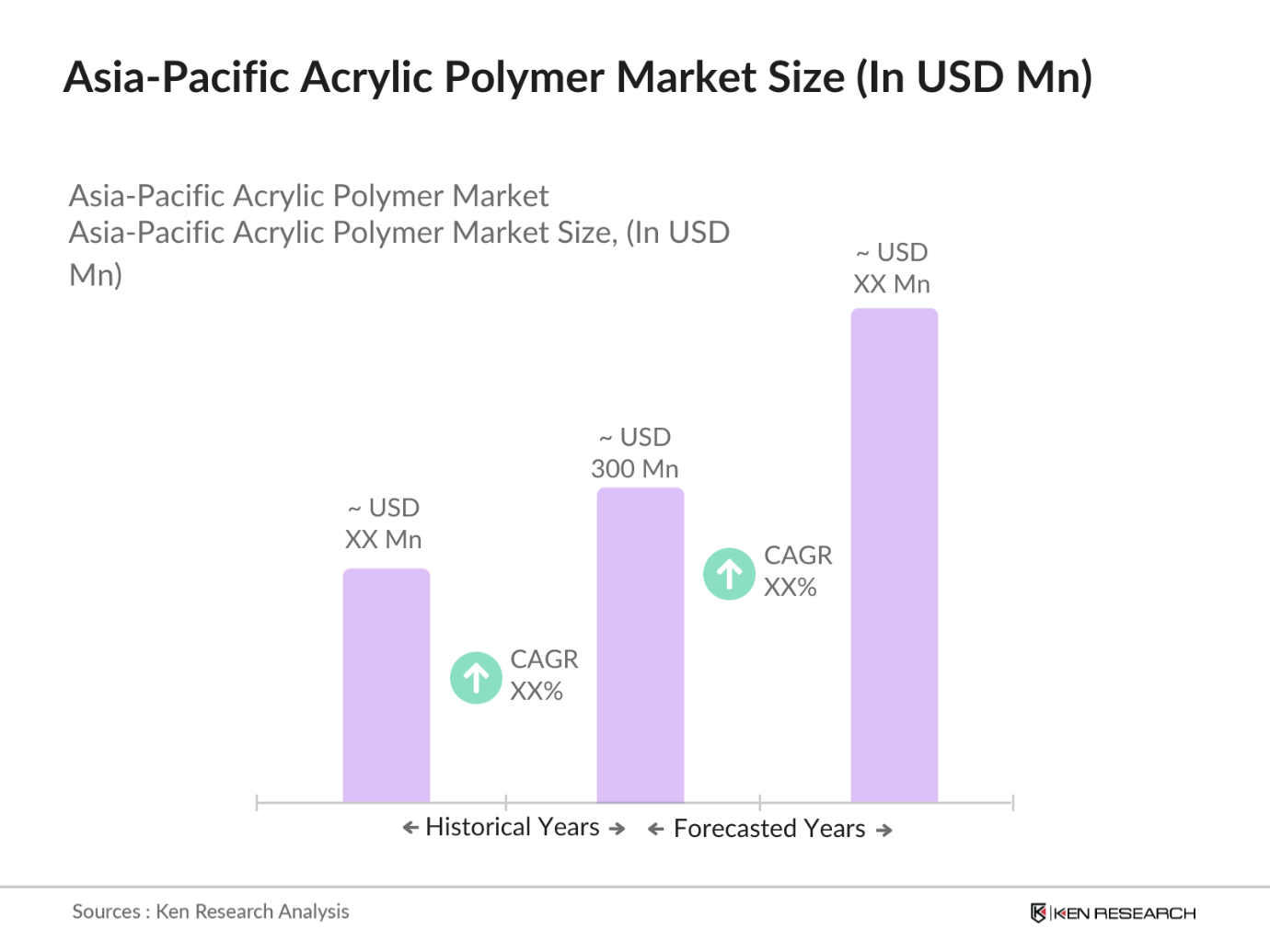

- The Asia-Pacific Acrylic Polymer market valued at USA 300 Million. The growth trajectory is driven by increasing demand from sectors like construction, automotive, and consumer goods, where acrylic polymers are extensively used for coatings, adhesives, and sealants. This demand surge is further influenced by urbanization, expanding middle-class populations, and industrial expansion across the region, specifically in China and India. The availability of raw materials and technological advancements in polymer processing contribute to the markets steady growth, solidifying the Asia-Pacific region as a dominant global player.

- China and India are the leading contributors to the Asia-Pacific Acrylic Polymer market. Chinas dominance stems from its massive manufacturing base, advanced technological infrastructure, and a high volume of exports in polymer-based products. India follows, propelled by rapid urbanization, infrastructural projects, and a growing consumer base demanding high-performance polymers. Additionally, Japan and South Korea contribute significantly due to their advancements in automotive and electronics industries, where acrylic polymers find extensive applications.

- Governments across the Asia-Pacific region have implemented stringent environmental policies to reduce pollution and promote sustainable development. These regulations often mandate the use of low-VOC and eco-friendly materials in manufacturing processes, influencing the demand for acrylic polymers that meet these environmental standards

Asia-Pacific Acrylic Polymer Market Segmentation

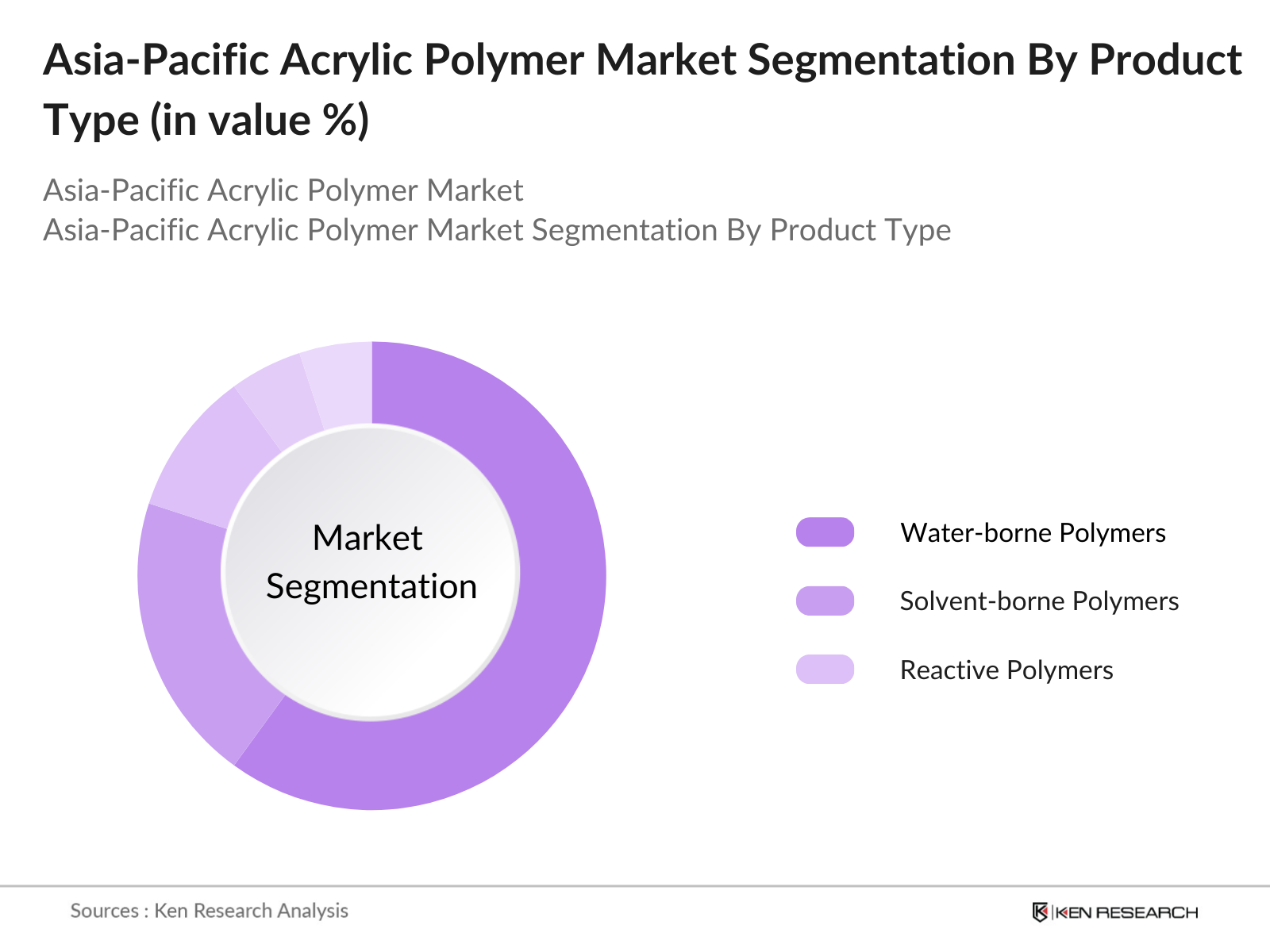

By Product Type: The Asia-Pacific Acrylic Polymer market is segmented by product type into water-borne polymers, solvent-borne polymers, and reactive polymers. Water-borne polymers have the largest market share due to their eco-friendly properties, regulatory compliance, and high adaptability across industries. Companies and consumers prefer water-borne variants for their low VOC (Volatile Organic Compounds) content, making them suitable for applications where environmental standards are stringent, such as in residential and automotive coatings.

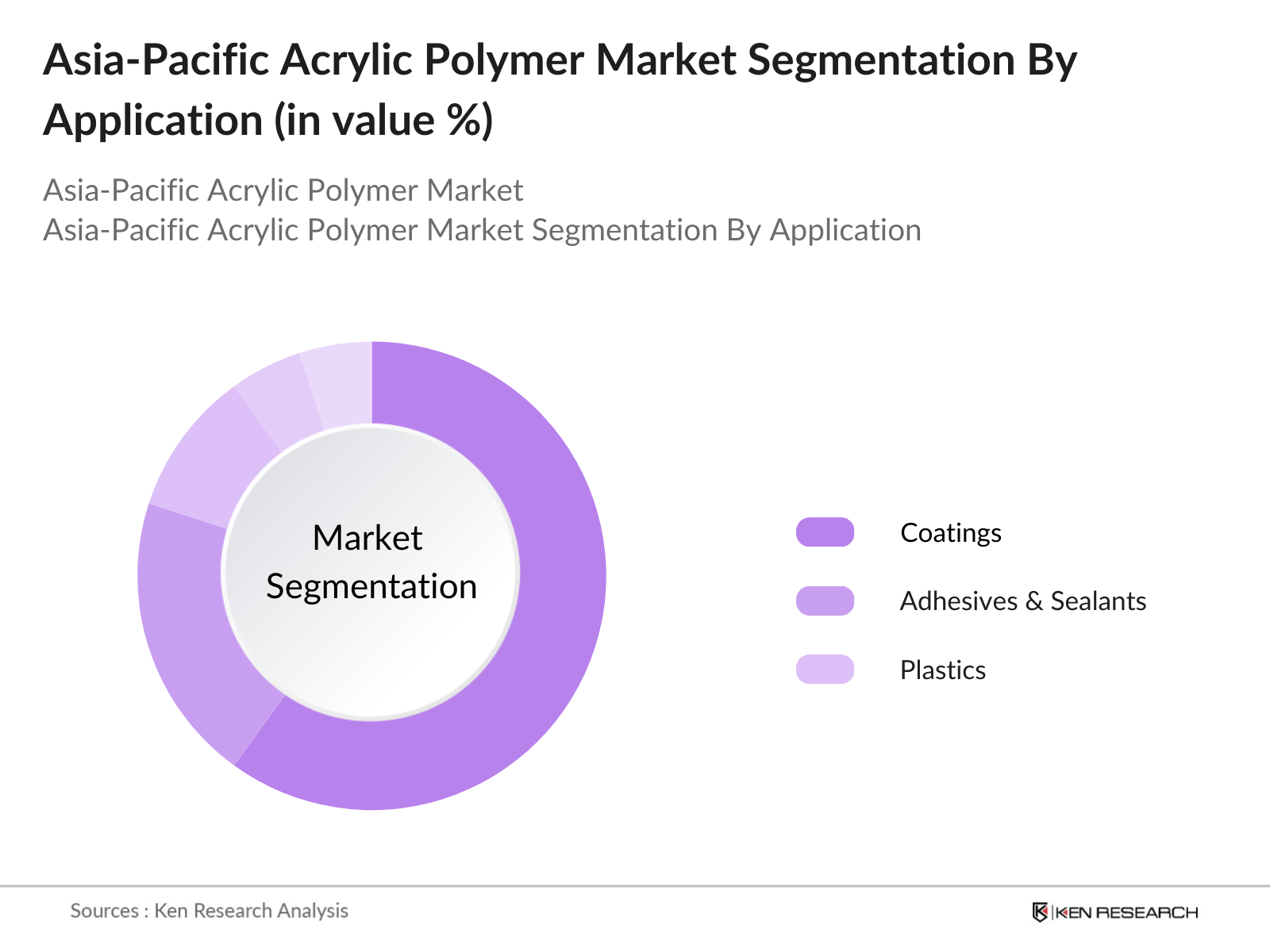

By Application: The market segmentation by application includes coatings, adhesives & sealants, and plastics. Coatings lead the market due to the extensive use of acrylic polymers in paint and coatings for automotive, infrastructure, and consumer goods. Acrylic-based coatings offer high durability and resistance to weather and corrosion, making them a popular choice in rapidly urbanizing regions. This segments dominance is reinforced by increased construction and renovation projects across Asia-Pacific.

Asia-Pacific Acrylic Polymer Competitive Landscape

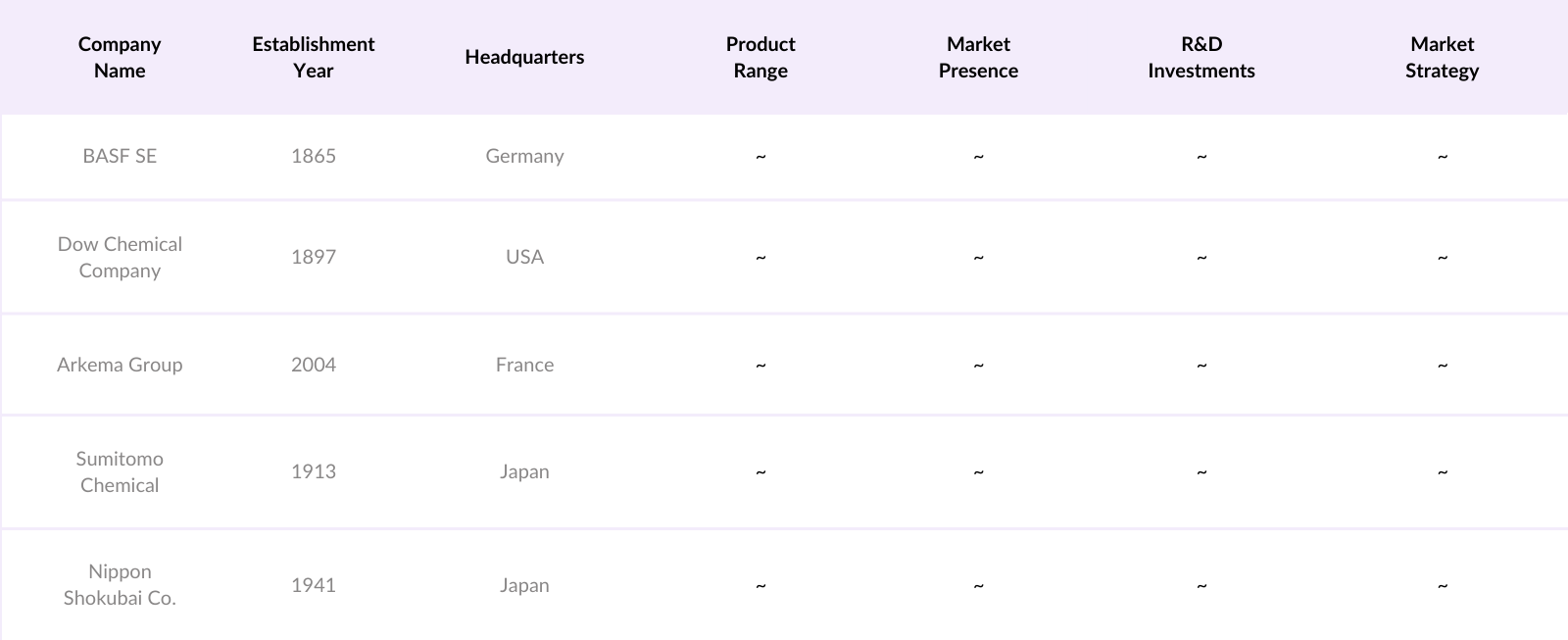

The Asia-Pacific Acrylic Polymer market is consolidated, with major players dominating due to their extensive production capacities, innovative product portfolios, and strategic partnerships.

The market is led by prominent international players, with BASF and Dow Chemical spearheading global expansion, while Arkema and Nippon Shokubai maintain strong regional focuses. This consolidation shows the influence of well-established brands in innovation and production capabilities, making it challenging for new entrants.

Asia-Pacific Acrylic Polymer Market Analysis

Growth Drivers

- Increasing Demand from the Paints and Coatings Industry: The paints and coatings industry in the Asia-Pacific region is projected to reach $178 billion by 2025, driven by a resurgence in construction activities and automotive manufacturing. This sector is a major consumer of acrylic polymers, which enhance durability, gloss, and resistance to environmental conditions. The robust growth in urban infrastructure development, alongside government initiatives to promote sustainable practices, further fuels the demand for high-performance acrylic polymer-based coatings.

- Expansion of the Automotive Sector: The Asia-Pacific automotive market is expected to grow at a rate of 5% annually, reaching approximately $890 billion by 2025. This growth is linked to rising disposable incomes, increasing vehicle ownership, and technological advancements in automotive manufacturing. Acrylic polymers play a critical role in producing lightweight and durable components, contributing to fuel efficiency and compliance with stringent emission standards. This trend will continue to bolster the demand for acrylic polymers in automotive applications.

- Growing Construction Activities: The Asia-Pacific construction industry is projected to exceed $6 trillion by 2025, supported by infrastructure projects and housing development across key countries like India and China. This growth translates to a significant rise in demand for acrylic polymers, utilized in sealants and adhesives, enhancing the performance of construction materials. The government's focus on smart city projects and affordable housing schemes is likely to further escalate the requirement for high-quality acrylic polymers in construction applications.

Challenges

- Volatility in Raw Material Prices: The acrylic polymer market is significantly impacted by the fluctuating prices of raw materials, such as ethylene and propylene, which are derived from crude oil. The recent geopolitical tensions and supply chain disruptions have led to a 20% increase in raw material costs in the past year. Such volatility poses challenges for manufacturers, forcing them to optimize production processes and consider alternative materials, which may impact profit margins and pricing strategies.

- Stringent Environmental Regulations: Regulatory frameworks across the Asia-Pacific region have tightened, focusing on the environmental impact of polymer production. For instance, in 2023, several countries introduced stricter guidelines on VOC emissions from paints and coatings

Asia-Pacific Acrylic Polymer Future Outlook

The Asia-Pacific Acrylic Polymer market is projected to experience steady growth, driven by the expanding industrial applications, rising infrastructural investments, and the transition to environmentally sustainable polymers. Rising demand in construction, automotive, and consumer goods industries will continue propelling market growth. Additionally, regulatory support for low-VOC and sustainable products will incentivize further development in eco-friendly polymer technologies. This trend highlights a promising future for companies focusing on sustainable and innovative acrylic polymer solutions.

Opportunities

- Rise in Demand for Eco-friendly Products: The Asia-Pacific region is witnessing a significant shift towards sustainable and environmentally friendly products. Governments and consumers are increasingly prioritizing eco-friendly solutions, creating a substantial market opportunity for acrylic polymers that are bio-based or have low volatile organic compound (VOC) emissions. This trend is evident in the growing adoption of waterborne acrylic polymers in paints and coatings, driven by their reduced environmental impact.

- Technological Innovations in Polymer Production: Advancements in polymerization techniques and the development of new catalysts have enhanced the efficiency and performance of acrylic polymers. These innovations enable the production of polymers with tailored properties, such as improved durability and resistance, expanding their applicability across various industries, including automotive, construction, and healthcare.

Scope of the Report

|

Segment |

Sub-segments |

|---|---|

|

Product Type |

Emulsion Polymers |

|

Solution Polymers |

|

|

Powder Polymers |

|

|

Application |

Paints and Coatings |

|

Adhesives and Sealants |

|

|

Textiles |

|

|

Construction |

|

|

End-user Industry |

Automotive |

|

Construction |

|

|

Healthcare |

|

|

Region |

China |

|

India |

|

|

Japan |

|

|

Australia |

|

|

South Korea |

Products

Key Target Audience

Acrylic Polymer Manufacturers

Automotive Component Manufacturers

Construction Material Suppliers

Electronics Manufacturers

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology - China)

Investor and Venture Capitalist Firms

Environmental Compliance Agencies

R&D and Innovation Centers in Polymers

Companies

Players mentioned in the report

BASF SE

Dow Chemical Company

Arkema Group

Sumitomo Chemical

Nippon Shokubai Co.

Mitsubishi Chemical Holdings

LG Chem Ltd.

Mitsubishi Rayon Co.

Sibelco

Toagosei Co. Ltd.

Kaneka Corporation

Evonik Industries

Formosa Plastics

Hexion Inc.

Sinopec Shanghai Petrochemical Co.

Table of Contents

1. Asia-Pacific Acrylic Polymer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Acrylic Polymer Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Acrylic Polymer Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand from the Paints and Coatings Industry (Market Demand)

3.1.2. Expansion of the Automotive Sector (Sector Growth)

3.1.3. Growing Construction Activities (Infrastructure Investment)

3.1.4. Advancements in Adhesives and Sealants (Technological Innovation)

3.2. Market Challenges

3.2.1. Volatility in Raw Material Prices (Market Risk)

3.2.2. Stringent Environmental Regulations (Compliance Pressure)

3.2.3. Competition from Alternative Polymers (Market Competition)

3.3. Opportunities

3.3.1. Rise in Demand for Eco-friendly Products (Sustainable Development)

3.3.2. Technological Innovations in Polymer Production (Innovation Potential)

3.3.3. Growth of the E-commerce Sector (Market Accessibility)

3.4. Trends

3.4.1. Shift Towards Bio-based Acrylic Polymers (Sustainability Trend)

3.4.2. Integration of Smart Coatings in Industries (Technological Advancement)

3.4.3. Increased Use of Acrylic Polymers in Medical Applications (Healthcare Expansion)

3.5. Government Regulations

3.5.1. National Environmental Policies (Regulatory Framework)

3.5.2. Standards for Polymer Production and Safety (Compliance Guidelines)

3.5.3. Incentives for Green Manufacturing Practices (Support Programs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia-Pacific Acrylic Polymer Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Emulsion Polymers

4.1.2. Solution Polymers

4.1.3. Powder Polymers

4.2. By Application (In Value %)

4.2.1. Paints and Coatings

4.2.2. Adhesives and Sealants

4.2.3. Textiles

4.2.4. Construction

4.3. By End-user Industry (In Value %)

4.3.1. Automotive

4.3.2. Construction

4.3.3. Healthcare

4.4. By Region (In Value %)

4.4.1. China

4.4.2. India

4.4.3. Japan

4.4.4. Australia

4.4.5. South Korea

5. Asia-Pacific Acrylic Polymer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Dow Inc.

5.1.3. AkzoNobel N.V.

5.1.4. Covestro AG

5.1.5. Nippon Paint Holdings Co., Ltd.

5.1.6. Arkema S.A.

5.1.7. Wacker Chemie AG

5.1.8. DSM Coating Resins

5.1.9. Solvay S.A.

5.1.10. Jushi Group Co., Ltd.

5.1.11. Ems-Chemie Holding AG

5.1.12. Huntsman Corporation

5.1.13. Eastman Chemical Company

5.1.14. Mitsubishi Chemical Corporation

5.1.15. LG Chem Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia-Pacific Acrylic Polymer Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia-Pacific Acrylic Polymer Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Acrylic Polymer Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-user Industry (In Value %)

8.4. By Region (In Value %)

8.5. By Technology (In Value %)

9. Asia-Pacific Acrylic Polymer Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We constructed an industry ecosystem map encompassing all significant stakeholders in the Asia-Pacific Acrylic Polymer market. Utilizing proprietary and secondary databases, we identified key variables influencing the market, such as market dynamics, demand-supply trends, and price elasticity.

Step 2: Market Analysis and Construction

Data collection included historical records and market penetration metrics, enabling us to analyze and map revenue distribution and industry statistics. Quality assessments were performed to validate the data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

To verify data points, we conducted CATI interviews with industry experts, gathering firsthand operational insights, which refined our dataset and informed revenue projections and market shares.

Step 4: Research Synthesis and Final Output

Our final stage involved synthesizing findings from direct interactions with market stakeholders, which corroborated data accuracy. This step ensured that the insights and forecasts align with industry standards and emerging trends.

Frequently Asked Questions

-

How big is the Asia-Pacific Acrylic Polymer Market?

The Asia-Pacific Acrylic Polymer Market is valued at USD 12.5 billion, largely due to robust industrial demand and advancements in sustainable polymers. -

What are the challenges in the Asia-Pacific Acrylic Polymer Market?

The market faces challenges including volatile raw material prices, stringent environmental regulations, and competition from alternative materials. -

Who are the major players in the Asia-Pacific Acrylic Polymer Market?

Key players include BASF SE, Dow Chemical Company, Arkema Group, Sumitomo Chemical, and Nippon Shokubai Co., known for their innovative products and expansive distribution networks. -

What are the growth drivers of the Asia-Pacific Acrylic Polymer Market?

Major growth drivers include increased demand from the construction and automotive sectors, coupled with advancements in polymer technologies and a shift toward eco-friendly materials. -

Which region dominates the Asia-Pacific Acrylic Polymer Market?

China dominates due to its substantial manufacturing capacity, while India shows promising growth fueled by infrastructural projects and industrial expansions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.