Asia Pacific Acrylonitrile Butadiene Styrene Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD4590

December 2024

90

About the Report

Asia Pacific Acrylonitrile Butadiene Styrene (ABS) Market Overview

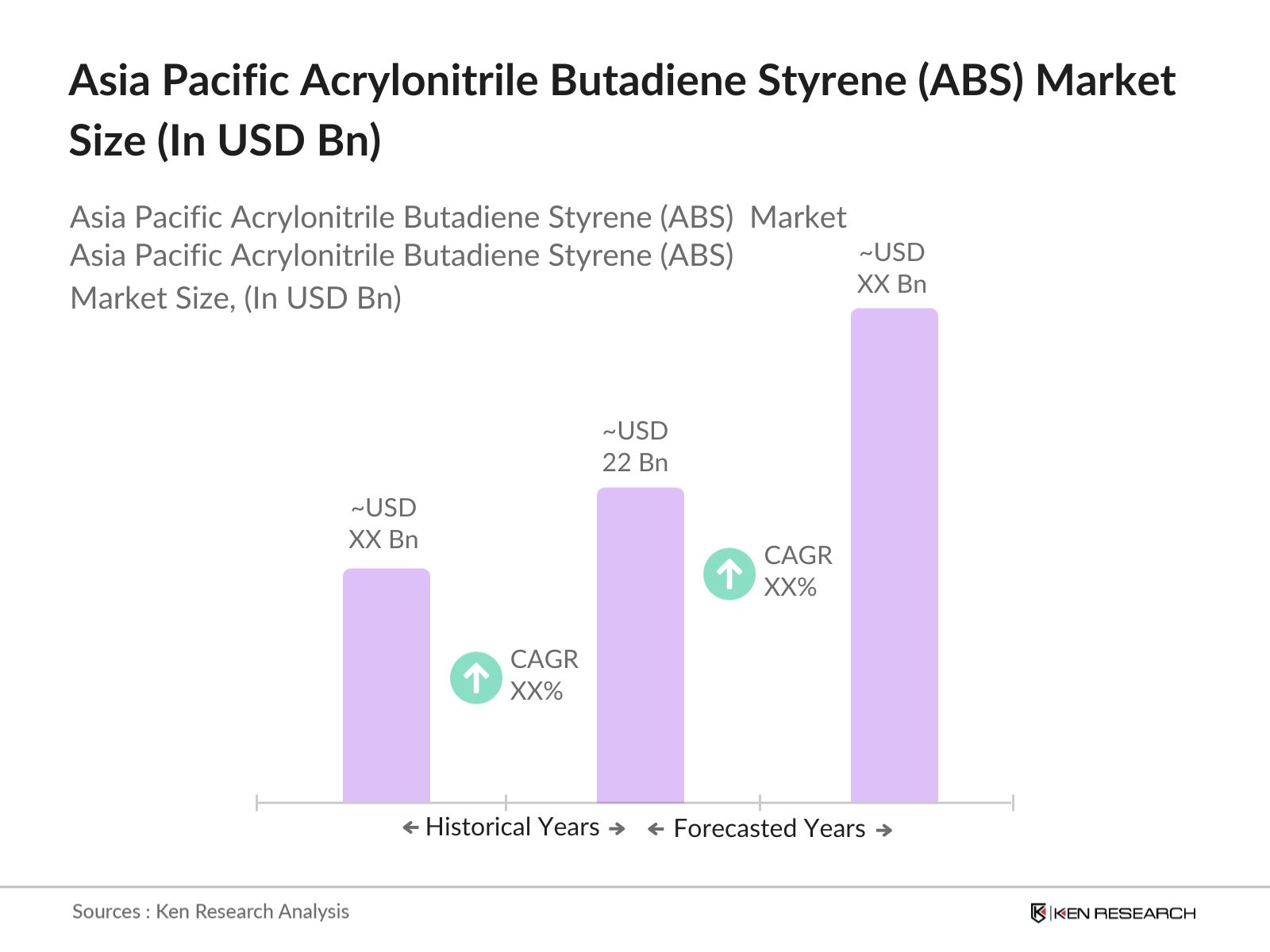

- Asia Pacific Acrylonitrile Butadiene Styrene (ABS) market is valued at USD 22 billion, driven primarily by its applications in the automotive, electronics, and construction industries. ABSs strong mechanical properties and ease of processing make it a preferred choice in these sectors. The rising demand for lightweight, durable materials in automotive manufacturing and the increased use of electronic devices have contributed to the consistent growth of this market, based on a five-year historical analysis of ABS demand across key industries.

- China, Japan, and South Korea dominate the ABS market in the region due to their advanced manufacturing sectors and well-established automotive and electronics industries. China's massive production capacity and extensive infrastructure projects also play a significant role in maintaining its market dominance.

- Recycling mandates enforced by governments in Asia Pacific are pushing industries to adopt sustainable materials and processes, creating challenges and opportunities for ABS manufacturers. Chinas 2024 mandate requires plastic producers to recycle at least 50% of their output, incentivizing companies to develop recyclable ABS. Japan is also focusing on stringent recycling policies, with its government aiming for a 25% increase in plastic recycling by 2024. These mandates are fostering the growth of recyclable ABS materials, as companies strive to meet the new environmental standards imposed by regulatory bodies.

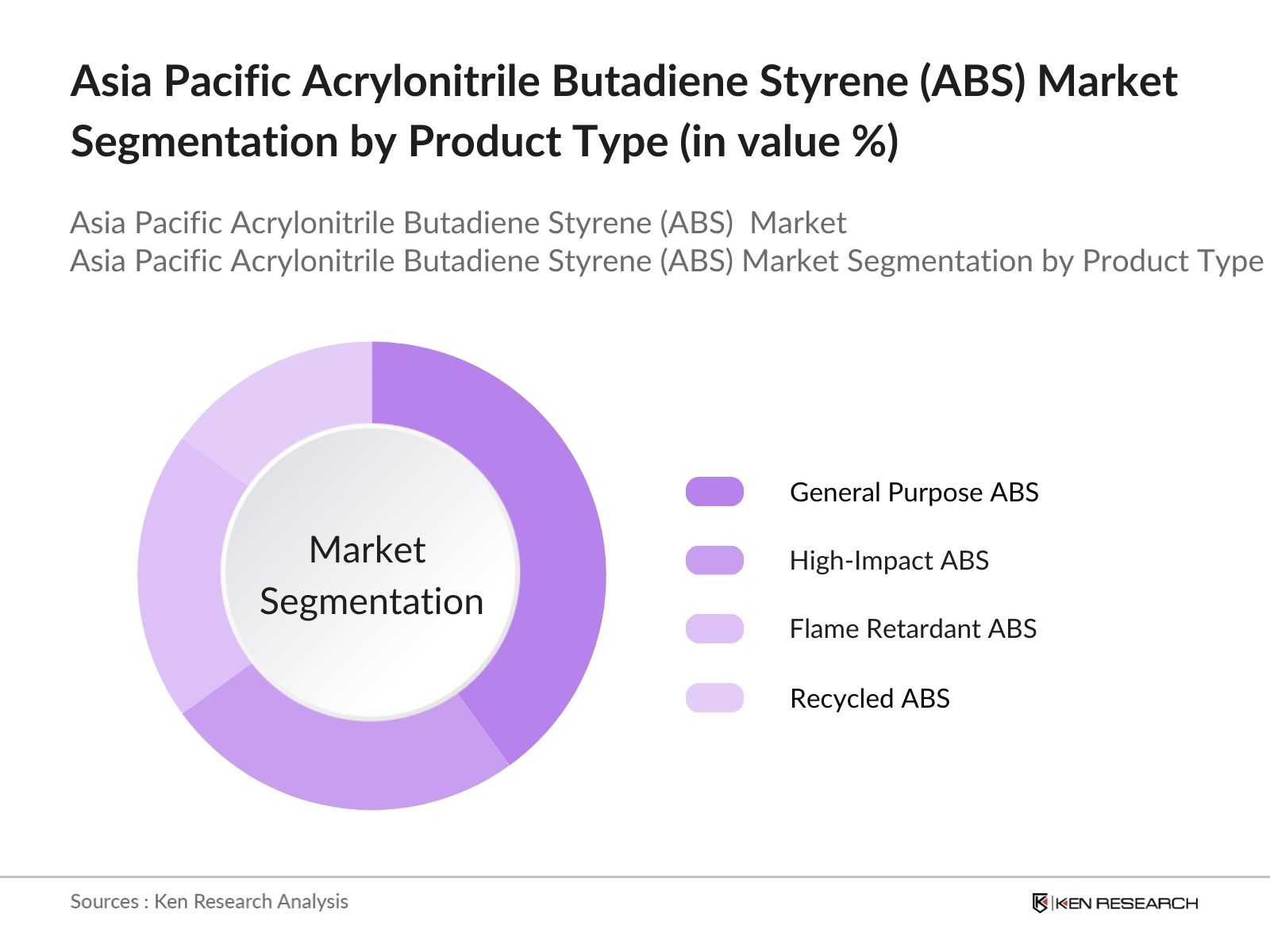

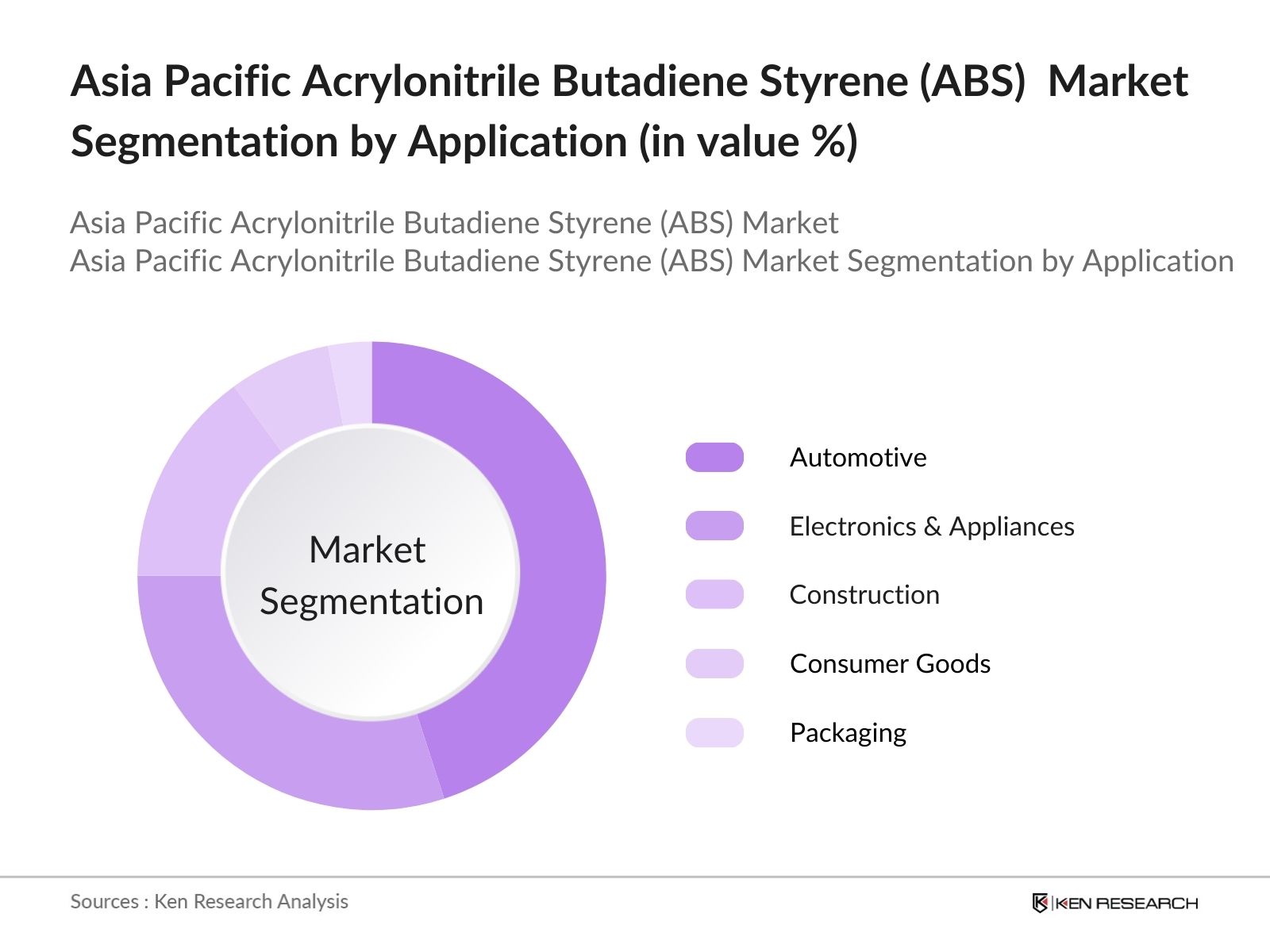

Asia Pacific Acrylonitrile Butadiene Styrene (ABS) Market Segmentation

By Product Type: The Asia Pacific ABS market is segmented by product type into General Purpose ABS, High-Impact ABS, Flame Retardant ABS, and Recycled ABS. General Purpose ABS holds a dominant market share due to its versatile applications across industries, particularly in automotive and consumer goods manufacturing. Its favorable balance of toughness and cost-effectiveness makes it highly sought after by manufacturers, particularly in regions like China, where automotive production continues to rise rapidly.

By Application: The ABS market is further segmented by application into Automotive, Electronics & Appliances, Construction, Consumer Goods, and Packaging. The automotive sector dominates the ABS market, primarily due to the increasing focus on lightweight materials to improve fuel efficiency and reduce emissions. The growth of electric vehicles in the region, especially in China, has led to increased demand for ABS in various automotive components, including interior parts and electrical insulation.

Asia Pacific Acrylonitrile Butadiene Styrene (ABS) Market Competitive Landscape

The Asia Pacific ABS market is highly competitive, with several key players operating in the region. The competitive landscape in the ABS market is characterized by a mix of regional and global players, including major firms like LG Chem and Chi Mei Corporation. These companies dominate due to their extensive production capacities, strong research and development capabilities, and well-established customer bases in the automotive and electronics sectors.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

R&D Expenditure |

Geographical Presence |

Product Innovation |

Sustainability Initiatives |

|

LG Chem |

1947 |

South Korea |

- |

- |

- |

- |

- |

|

Chi Mei Corporation |

1960 |

Taiwan |

- |

- |

- |

- |

- |

|

SABIC |

1976 |

Saudi Arabia |

- |

- |

- |

- |

- |

|

INEOS Styrolution |

2011 |

Germany |

- |

- |

- |

- |

- |

|

Formosa Plastics |

1954 |

Taiwan |

- |

- |

- |

- |

- |

Asia Pacific Acrylonitrile Butadiene Styrene (ABS) Market Analysis

Growth Drivers

- Demand in Automotive Sector: The Asia Pacific region has seen a rapid increase in vehicle production, particularly in countries like China, India, and Japan. In 2024, automotive production in China is projected to reach over 28 million units, making it the largest global producer. Additionally, India's automotive industry is expected to manufacture nearly 5 million vehicles this year, pushing further demand for ABS. These numbers reflect the strong influence of the automotive sector on ABS demand in the region.

- Rising Applications in Electronics: The increasing production of consumer electronics in Asia Pacific, including smartphones, laptops, and home appliances, is a key growth driver for ABS. China alone is responsible for the production of 1.4 billion smartphones annually, while India has surged as an emerging electronics hub, producing millions of units. ABS is used in manufacturing protective casings for electronics, which has bolstered its demand.

- Shifting Focus on Sustainable ABS Materials: Governments are pushing stricter environmental regulations, prompting industries to adopt sustainable practices. By 2024, the region aims to reduce plastic waste substantially, driving research into more sustainable ABS alternatives. The Chinese governments push for recycling more than 50 million tons of waste plastic has boosted the development of recyclable ABS. This trend is supported by government-backed policies to reduce carbon footprints, increasing the demand for greener ABS solutions.

Market Challenges

- Fluctuating Raw Material Prices: ABS production is heavily dependent on raw materials derived from crude oil, which makes it vulnerable to fluctuations in global oil prices. In 2024, oil prices are expected to hover around $80 per barrel, creating cost volatility for ABS manufacturers. Countries like India, which imports more than 85% of its crude oil, are particularly affected. Such price fluctuations have a direct impact on the cost of production for ABS manufacturers in Asia Pacific, complicating supply chain management and creating challenges in maintaining stable pricing structures.

- Increasing Environmental Regulations: Chinas 2024 policy aims to cut single-use plastic waste by 30%, which could restrict ABS usage in packaging and single-use items. Additionally, Indias policy on Extended Producer Responsibility (EPR) for plastics mandates companies to take responsibility for recycling their products, further complicating ABS usage in non-recyclable products. These regulatory frameworks pose significant challenges for ABS manufacturers.

Asia Pacific Acrylonitrile Butadiene Styrene (ABS) Market Future Outlook

The Asia Pacific ABS market is expected to experience continued growth, driven by increasing demand in key end-user industries such as automotive, construction, and electronics. The rising trend toward electric vehicles and the need for lightweight materials to improve energy efficiency are projected to be key drivers of market expansion. Furthermore, advancements in ABS production technology, including bio-based and recycled ABS, are expected to play a crucial role in shaping the future market landscape.

Market Opportunities

- Growth in Electric Vehicles: The Asia Pacific electric vehicle (EV) market is set for exponential growth, which presents significant opportunities for ABS manufacturers. With China producing over 5 million electric vehicles in 2024, the demand for lightweight, durable materials like ABS is increasing, especially in components such as dashboards, door panels, and battery casings. As governments continue to push for cleaner energy solutions, the growth of the EV market directly correlates to an uptick in ABS demand across the region. India and South Korea are also expanding their EV infrastructure, further boosting the market for ABS.

- Technological Advancements in ABS Production: Advancements in manufacturing techniques, such as 3D printing and injection molding, are revolutionizing ABS production in the Asia Pacific region. In 2024, major investments in Industry 4.0 and automation in countries like Japan and South Korea are driving innovation in ABS processing, allowing manufacturers to produce high-performance ABS materials more efficiently.

Scope of the Report

|

By Product Type |

General Purpose ABS High-Impact ABS Flame Retardant ABS Recycled ABS |

|

By Application |

Automotive Electronics & Appliances Construction Consumer Goods Packaging |

|

By Manufacturing Process |

Extrusion Injection Molding Blow Molding |

|

By End-User |

OEMs Suppliers Distributors |

|

By Region |

China Japan India South Korea Australia |

Products

Key Target Audience

Automotive Manufacturers

Electronics & Appliances Producers

Construction Companies

Consumer Goods Manufacturers

Packaging Industries

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agencies, Trade Ministries)

Companies

Players Mentioned in the Report

LG Chem

Chi Mei Corporation

SABIC

INEOS Styrolution

Formosa Plastics

Trinseo

Covestro

Kumho Petrochemical

Toray Industries

Lotte Chemical

Table of Contents

1. Asia Pacific ABS Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific ABS Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific ABS Market Analysis

3.1. Growth Drivers

3.1.1. Demand in Automotive Sector (Automotive Growth Impact)

3.1.2. Rising Applications in Electronics (Consumer Electronics)

3.1.3. Shifting Focus on Sustainable ABS Materials (Sustainability Initiatives)

3.1.4. Expanding Infrastructure Projects (Construction Sector Growth)

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices (Crude Oil Dependency)

3.2.2. Increasing Environmental Regulations (Plastic Waste Management)

3.2.3. Competition from Biodegradable Alternatives (Emerging Bio-plastics)

3.2.4. Volatility in Global Trade (Trade Tariffs and Duties)

3.3. Opportunities

3.3.1. Growth in Electric Vehicles (EV Market Boost)

3.3.2. Technological Advancements in ABS Production (Advanced Manufacturing Techniques)

3.3.3. Expansion into Untapped Emerging Markets (Emerging Economies)

3.3.4. Development of Recyclable ABS (Circular Economy Trends)

3.4. Trends

3.4.1. Increased Usage of Bio-based ABS (Sustainability Focus)

3.4.2. Lightweight Material Innovation in Automotive (Vehicle Efficiency Standards)

3.4.3. Rising Investments in Smart Manufacturing (Industry 4.0 Adoption)

3.4.4. Growing Preference for Custom ABS Grades (Tailored Product Development)

3.5. Government Regulation

3.5.1. Regional Environmental Policies (Plastic Ban Initiatives)

3.5.2. Recycling Mandates (Governmental Recycling Programs)

3.5.3. Industry Standards for Automotive Grade ABS (Automotive Regulatory Bodies)

3.5.4. Import/Export Tariffs on ABS (Trade and Tariff Policies)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific ABS Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. General Purpose ABS

4.1.2. High-Impact ABS

4.1.3. Flame Retardant ABS

4.1.4. Recycled ABS

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Electronics & Appliances

4.2.3. Construction

4.2.4. Consumer Goods

4.2.5. Packaging

4.3. By Manufacturing Process (In Value %)

4.3.1. Extrusion

4.3.2. Injection Molding

4.3.3. Blow Molding

4.4. By End-User (In Value %)

4.4.1. OEMs

4.4.2. Suppliers

4.4.3. Distributors

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific ABS Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. LG Chem

5.1.2. Chi Mei Corporation

5.1.3. SABIC

5.1.4. INEOS Styrolution

5.1.5. Formosa Plastics

5.1.6. Trinseo

5.1.7. Covestro

5.1.8. Kumho Petrochemical

5.1.9. Toray Industries

5.1.10. Lotte Chemical

5.2. Cross Comparison Parameters (Production Capacity, Product Innovation, Market Reach, Revenue, Geographical Presence, Partnerships, M&A Activity, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific ABS Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific ABS Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific ABS Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Manufacturing Process (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific ABS Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key variables influencing the ABS market, focusing on the automotive, electronics, and construction sectors. We rely on industry reports and government data sources to outline key market dynamics.

Step 2: Market Analysis and Construction

Next, a comprehensive analysis of historical market trends, production capacities, and revenue generation is conducted. This involves aggregating data from regional trade associations, production statistics, and company financial reports to ensure a thorough market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth and challenges are validated through consultations with industry professionals and executives in leading ABS-producing firms. This phase involves direct feedback from stakeholders to fine-tune the market insights.

Step 4: Research Synthesis and Final Output

The final stage of research involves synthesizing data from both primary and secondary sources to deliver a cohesive report. Final validation is performed by cross-referencing production data with end-user demand forecasts, ensuring an accurate depiction of the ABS markets trajectory.

Frequently Asked Questions

01 How big is the Asia Pacific ABS Market?

The Asia Pacific ABS market is valued at USD 22 billion, driven by increasing demand in automotive, electronics, and construction sectors, as well as innovations in recyclable ABS materials.

02 What are the challenges in the Asia Pacific ABS Market?

Challenges of Asia Pacific ABS market include fluctuating raw material prices, increasing environmental regulations, and competition from biodegradable alternatives like bio-plastics, which present a growing threat to traditional ABS production.

03 Who are the major players in the Asia Pacific ABS Market?

Key players of Asia Pacific ABS market include LG Chem, Chi Mei Corporation, SABIC, INEOS Styrolution, and Formosa Plastics, known for their extensive production capacities and strong presence in automotive and electronics industries.

04 What are the growth drivers of the Asia Pacific ABS Market?

Growth of Asia Pacific ABS market is driven by demand for lightweight materials in automotive production, increased use of electronic devices, and innovations in bio-based and recyclable ABS. Expanding infrastructure projects also fuel the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.