Asia Pacific Active Pharmaceutical Ingredients Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10906

November 2024

81

About the Report

Asia Pacific Active Pharmaceutical Ingredients Market Overview

- The Asia Pacific Active Pharmaceutical Ingredients (API) market, based on a comprehensive five-year analysis, reached a valuation of USD 78 billion. This growth is primarily driven by the expansion of the pharmaceutical manufacturing industry across key regions, including China and India. Increasing demand for generic drugs and the rising prevalence of chronic diseases, such as cancer and cardiovascular disorders, have also spurred API demand.

- China and India dominate the Asia Pacific API market due to their established infrastructure and cost-effective production capabilities. These countries benefit from substantial government support, favorable policies, and a well-developed supply chain network. China has a particularly robust capacity for manufacturing chemical APIs, while India is recognized globally for producing generic APIs.

- Import and exports for APIs are tightening across Asia Pacific to address quality and safety concerns. Indias Directorate General of Foreign Trade mandated stricter quality checks on API imports in 2023, delaying imports by an average of 10 days ure aligns with the regions goal of bolstering domestic API production while ensuring imported products meet established quality standards. Such regulations encourage local API manufacturing to meet rising demand.

Asia Pacific Active Pharmaceutical Ingredients Market Segmentation

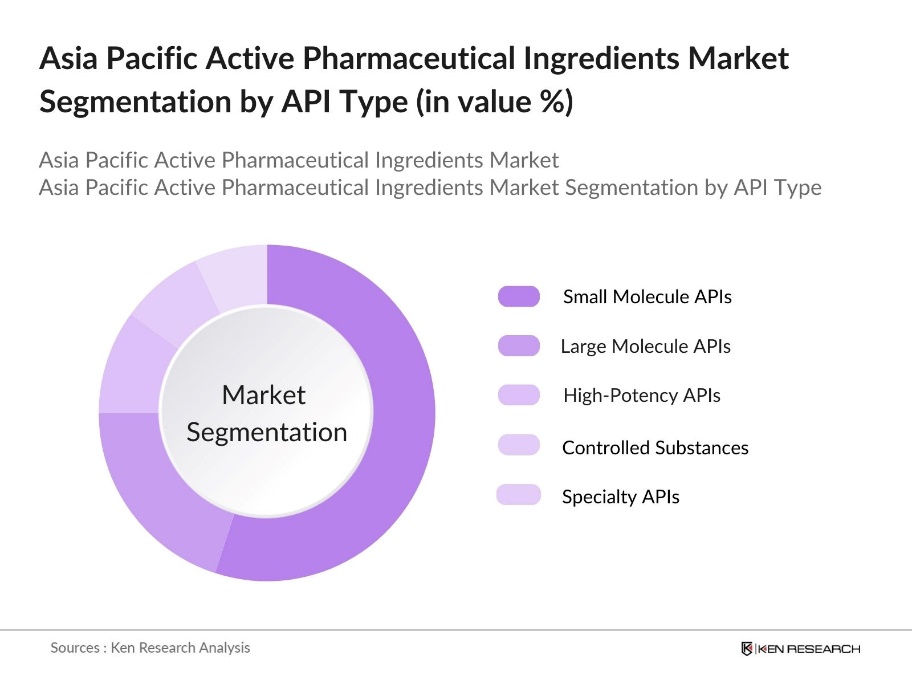

By API Type: The Asia Pacific API market is segmented by API Type into Small Molecule APIs, Large Molecule APIs, High-Potency APIs, Controlled Substances, and Specialty APIs. Recently, Small Molecule APIs have dominated the market under this segmentation due to their widespread application in generic medications. This dominance stems from their well-understood chemical synthesis, lower production costs, and extensive use in treating chronic and infectious diseases, leading to high adoption rates across healthcare systems in the region.

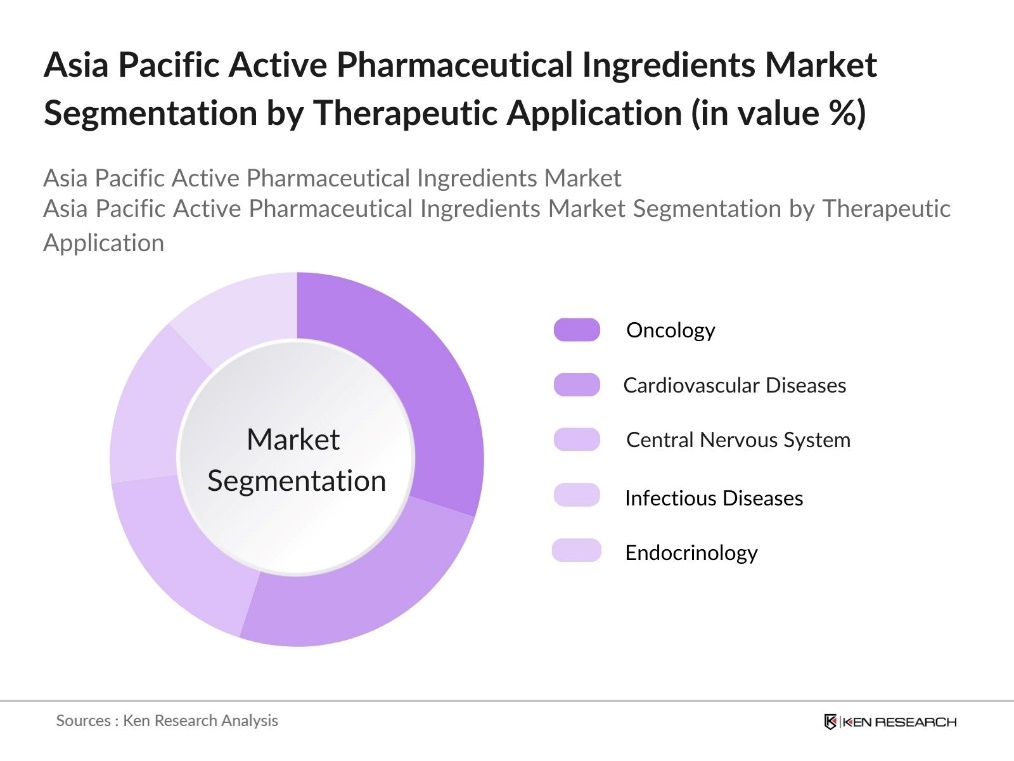

By Therapeutic Application: The market is segmented by Therapeutic Application into Oncology, Cardiovascular Diseases, Central Nervous System, Infectious Diseases, and Endocrinology. Within this category, Oncology APIs dominate due to the rising incidence of cancer across the Asia Pacific. With the growing awareness of cancer treatments and an increase in healthcare expenditure, oncology APIs are increasingly demanded for advanced therapies, making it the leading segment under therapeutic applications.

Asia Pacific Active Pharmaceutical Ingredients Market Competitive Landscape

The Asia Pacific API market is characterized by the presence of several dominant players, both local and multinational. Companies such as Sun Pharmaceutical Industries and Dr. Reddy's Laboratories from India, alongside international firms like Pfizer Inc. and Novartis AG, have a substantial influence due to their extensive distribution networks and production capabilities.

Asia Pacific Active Pharmaceutical Ingredients Industry Analysis

Growth Drivers

- Expansion of Biopharmaceutical Manufacturing: The Asia Pacific region is witnessing substantial growth in biopharmaceutical manufacturing, driven by advancements in biotechnology and increased demand for personalized medicine. The investment in South Korea's bio-health sector is projected to reach approximately $9 billion (10 trillion) by 2023, driven by major companies like Samsung Biologics and Celltrion. This expansion gher production volumes of biopharmaceutical APIs, supporting the treatment of complex diseases such as cancer and autoimmune disorders, aligning with regional healthcare priorities.

- R&D Advancements in API Synthesis: R&D efforts in API synthesis are leading to more efficient production processes, specifically in nations like Japan and South Korea. In 2023, total reported R&D spending in the pharmaceutical sector increased from $139.2 billion in 2022 to $145.5 billion. Newer technologies, such as continuous manufacturing and prethesis, are improving yield and reducing waste, contributing to increased API availability. Additionally, Japans investment in green chemistry for API production reduces environmental impact, promoting sustainable practices in API manufacturing.

- Rising Demand for Generic Pharmaceuticals: The Asia Pacific region is witnessing increased demand for generic pharmaceuticals due to expanding healthcare coverage and the need for affordable treatments in countries like India and China. Boosts in domestic production of essential medicines support this trend, reducing reliance on imports and making healthcare more accessible. This shift strengthens the region's generic pharmaceutical sector and broadens access to cost-effective healthcare options.

Market Challenges

- Supply Chain Disruptions: Supply chain disruptions have significantly affected API availability, with challenges intensified by the pandemic. The reliance on specific raw materials from a limited number of suppliers, often concentrated in certain countries, makes the supply chain susceptible to geopolitical and logistical issues. This situation highlights the need for diversifying supply chains across the Asia Pacific region to ensure consistent API availability and minimize vulnerabilities.

- Stringent Regulatory Compliance: The Asia Pacific API market faces strict regulatory requirements that can extend approval times and raise operational costs. Standards enforced by agencies in countries like Japan and China require thorough quality and safety checks. While these stringent regulations are vital for public health, they pose a considerable barrier to API manufacturers, particularly smaller players, due to high compliance expenses and complex approval processes.

Asia Pacific Active Pharmaceutical Ingredients Market Future Outlook

The Asia Pacific API market is anticipated to see continued growth due to rising healthcare investments, a growing pharmaceutical manufacturing base, and increasing demand for complex APIs. The region's supportive regulatory environment and initiatives toward self-reliance in healthcare will likely drive market expansion. The growth of contract manufacturing for APIs is also expected to add momentum as countries in Asia Pacific emerge as major players in the global pharmaceutical supply chain.

Market Opportunities

- Growth of Contract Manufacturing in APIs: Contract manufacturing has become an effective solution for pharmaceutical companies seeking to reduce costs and enhance production capabilities. By partnering with contract manufacturing organizations (CMOs) in regions like India and China, pharmaceutical firms can leverage scalable facilities to meet rising demand. This trend supports the growth of local API production, fosters collaborations between international and regional companies, and strengthens the API supply chain in the Asia Pacific.

- Increasing API Production in Emerging Markets: API production in emerging Asia Pacific markets, such as Vietnam and Indonesia, is expanding due to supportive government initiatives and incentives. These programs attract international manufacturers, boost local economies, and promote self-sufficiency in API production. Increased API output in these markets enhances regional availability and reduces reliance on imports from more established economies, strengthening the local pharmaceutical industry.

Scope of the Report

|

By API Type |

Small Molecule APIs Large Molecule APIs High-Potency APIs Controlled Substances Specialty APIs |

|

By Manufacturing Process |

Captive API Manufacturing Contract API Manufacturing |

|

By Drug Type |

Generic APIs Innovative APIs |

|

By Therapeutic Application |

Oncology Cardiovascular Diseases Central Nervous System Infectious Diseases Endocrinology |

|

By Region |

China India Japan South Korea Southeast Asia |

Products

Key Target Audience

Pharmaceutical Manufacturing Firms

API Contract Manufacturers

Research and Development Organizations

Biopharmaceutical Companies

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., National Medical Products Administration - NMPA, Pharmaceuticals and Medical Devices Agency - PMDA)

Companies

Players Mentioned in the Report

Pfizer Inc.

Sun Pharmaceutical Industries

Dr. Reddys Laboratories

Novartis AG

Teva Pharmaceutical Industries Ltd.

Aurobindo Pharma

Cipla Ltd.

AbbVie Inc.

GlaxoSmithKline plc

Johnson & Johnson

Table of Contents

1. Asia Pacific Active Pharmaceutical Ingredients Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate and Trends

1.4 Market Segmentation Overview

1.5 Industry Value Chain Analysis

2. Asia Pacific Active Pharmaceutical Ingredients Market Size (in USD Mn)

2.1 Historical Market Size Analysis

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Active Pharmaceutical Ingredients Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Generic Pharmaceuticals

3.1.2 Expansion of Biopharmaceutical Manufacturing

3.1.3 Government Initiatives for Healthcare Access

3.1.4 R&D Advancements in API Synthesis

3.2 Market Challenges

3.2.1 Supply Chain Disruptions

3.2.2 Stringent Regulatory Compliance

3.2.3 High Production Costs

3.3 Opportunities

3.3.1 Growth of Contract Manufacturing in APIs

3.3.2 Increasing API Production in Emerging Markets

3.3.3 Expansion of High-Potency APIs (HPAPIs)

3.4 Market Trends

3.4.1 Adoption of Green Chemistry in API Production

3.4.2 Shift towards Continuous Manufacturing

3.4.3 Increasing Collaboration for Drug Development

3.5 Government Regulation

3.5.1 Regulatory Standards for API Quality

3.5.2 Compliance with Environmental Guidelines

3.5.3 Regional API Approval Procedures

3.5.4 Import and Export Control Regulations

3.6 SWOT Analysis

3.7 Porters Five Forces Analysis

3.8 Value Chain Analysis

3.9 Industry Stakeholder Ecosystem

4. Asia Pacific Active Pharmaceutical Ingredients Market Segmentation

4.1 By API Type (in Value %)

4.1.1 Small Molecule APIs

4.1.2 Large Molecule APIs

4.1.3 High-Potency APIs

4.1.4 Controlled Substances

4.1.5 Specialty APIs

4.2 By Manufacturing Process (in Value %)

4.2.1 Captive API Manufacturing

4.2.2 Contract API Manufacturing

4.3 By Drug Type (in Value %)

4.3.1 Generic APIs

4.3.2 Innovative APIs

4.4 By Therapeutic Application (in Value %)

4.4.1 Oncology

4.4.2 Cardiovascular Diseases

4.4.3 Central Nervous System

4.4.4 Infectious Diseases

4.4.5 Endocrinology

4.5 By Region (in Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 South Korea

4.5.5 Southeast Asia

5. Asia Pacific Active Pharmaceutical Ingredients Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Pfizer Inc.

5.1.2 Novartis International AG

5.1.3 Teva Pharmaceutical Industries Ltd.

5.1.4 Sun Pharmaceutical Industries Ltd.

5.1.5 Aurobindo Pharma

5.1.6 Cipla Ltd.

5.1.7 Dr. Reddy's Laboratories Ltd.

5.1.8 Sanofi

5.1.9 AbbVie Inc.

5.1.10 Lupin Ltd.

5.1.11 Bristol-Myers Squibb

5.1.12 GlaxoSmithKline plc

5.1.13 Johnson & Johnson

5.1.14 Mylan N.V.

5.1.15 Merck & Co., Inc.

5.2 Cross Comparison Parameters (API Portfolio Range, Manufacturing Capacity, Compliance Standards, API Patents, Revenue, Employee Count, Headquarters, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Subsidies

5.9 Private Equity Investments

6. Asia Pacific Active Pharmaceutical Ingredients Market Regulatory Framework

6.1 Quality Control and Compliance Standards

6.2 Regional API Certification Requirements

6.3 Environmental Regulations for API Production

6.4 Import and Export Controls on APIs

7. Asia Pacific Active Pharmaceutical Ingredients Market Future Size (in USD Mn)

7.1 Market Forecast Analysis

7.2 Key Drivers Influencing Future Growth

8. Asia Pacific Active Pharmaceutical Ingredients Market Future Segmentation

8.1 By API Type (in Value %)

8.2 By Manufacturing Process (in Value %)

8.3 By Drug Type (in Value %)

8.4 By Therapeutic Application (in Value %)

8.5 By Region (in Value %)

9. Asia Pacific Active Pharmaceutical Ingredients Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Investment Opportunities

9.3 Competitive Positioning

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves mapping key stakeholders in the Asia Pacific API market through extensive desk research, using secondary and proprietary databases to gather comprehensive industry-level data. The primary objective is to define critical variables influencing the API market.

Step 2: Market Analysis and Construction

Historical data on API production, import-export dynamics, and regulatory impacts are analyzed. Metrics such as regional distribution and therapeutic application shares are evaluated to ensure accurate market representation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through interviews with industry experts representing top API manufacturers. These discussions provide insights into production trends, market dynamics, and R&D investments.

Step 4: Research Synthesis and Final Output

The final phase consolidates data from multiple sources, including manufacturers and regulatory bodies, to validate market estimates. This results in a comprehensive, verified analysis of the Asia Pacific API market.

Frequently Asked Questions

01. How big is the Asia Pacific Active Pharmaceutical Ingredients Market?

The Asia Pacific API market was valued at USD 78 billion, driven by increased demand for pharmaceutical manufacturing and chronic disease treatments.

02. What are the challenges in the Asia Pacific API market?

Challenges in Asia Pacific API market include stringent regulatory compliance, high production costs, and supply chain disruptions impacting raw material availability.

03. Who are the major players in the Asia Pacific API market?

Major players in Asia Pacific API market include Pfizer Inc., Sun Pharmaceutical Industries, Dr. Reddy's Laboratories, Novartis AG, and Teva Pharmaceutical Industries, owing to their extensive production capacities and strong market reach.

04. What are the growth drivers of the Asia Pacific API market?

Growth drivers in Asia Pacific API market include the expanding pharmaceutical industry, rising chronic disease prevalence, and increasing demand for generic drugs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.