Asia-Pacific AI Chip Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD2727

November 2024

90

About the Report

Asia-Pacific AI Chip Market Overview

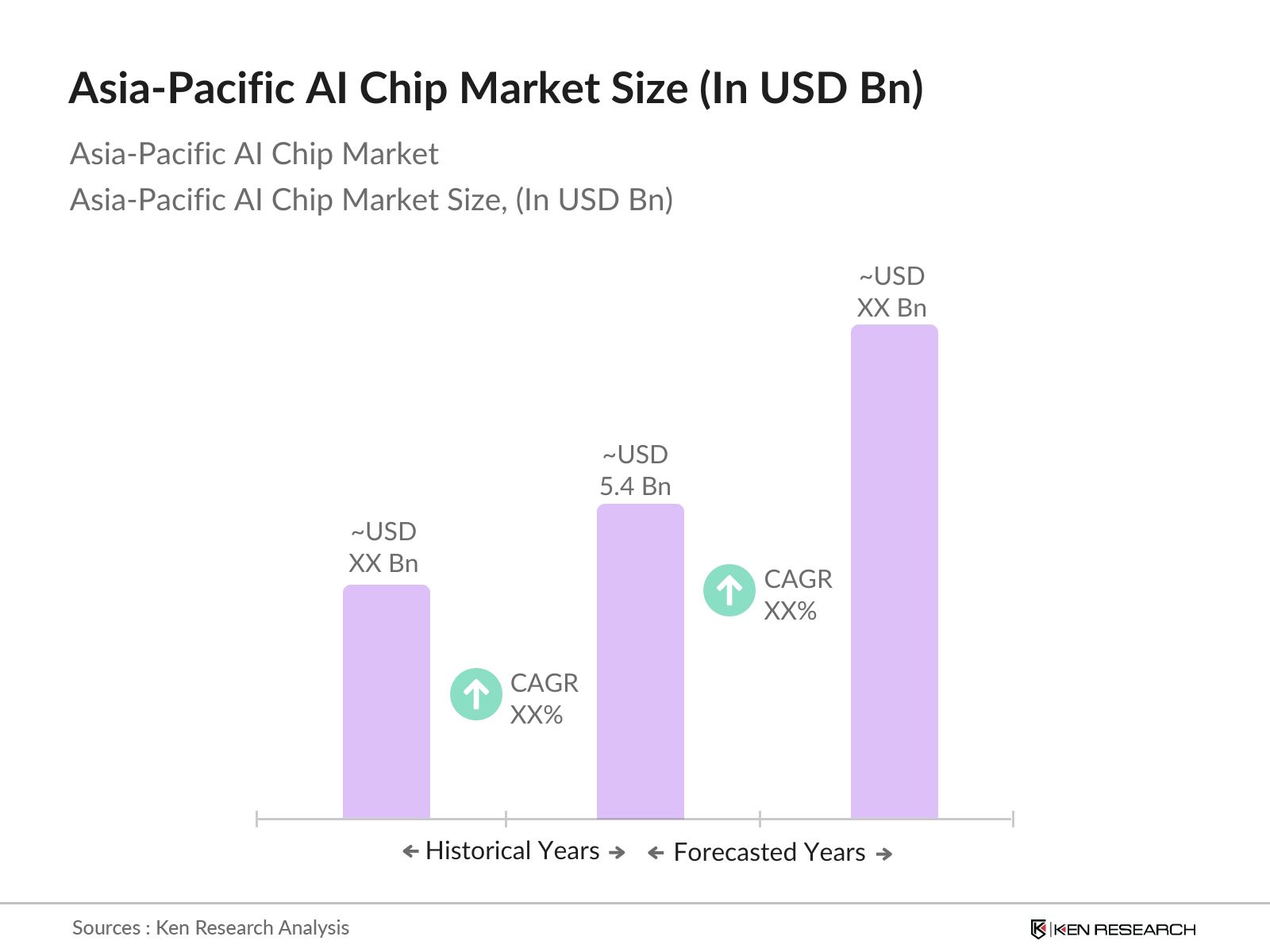

- The Asia-Pacific AI Chip Market is valued at USD 5.4 billion. The market's growth is driven by the increasing adoption of AI technologies across various sectors, such as healthcare, automotive, and financial services. Additionally, government initiatives promoting AI innovation, coupled with the rise in AI-powered applications, are boosting the demand for AI chips in the region.

- Key players in the Asia-Pacific AI Chip Market include NVIDIA Corporation, Intel Corporation, Qualcomm Technologies Inc., Huawei Technologies Co., Ltd., and MediaTek Inc. These companies focus on developing cutting-edge AI chips to enhance computing power, energy efficiency, and edge computing capabilities.

- Nvidia is reportedly set to launch a new AI chip, potentially named B20, for the Chinese market, with mass production starting later this year. However, concerns remain over U.S. export controls, which could impact its availability and shipment timelines.

- In 2023, China led the Asia-Pacific AI Chip Market, driven by its large-scale AI investments and robust semiconductor industry. Japan and South Korea followed closely, leveraging their technological expertise and strong industrial base in AI-related applications.

Asia-Pacific AI Chip Market Segmentation

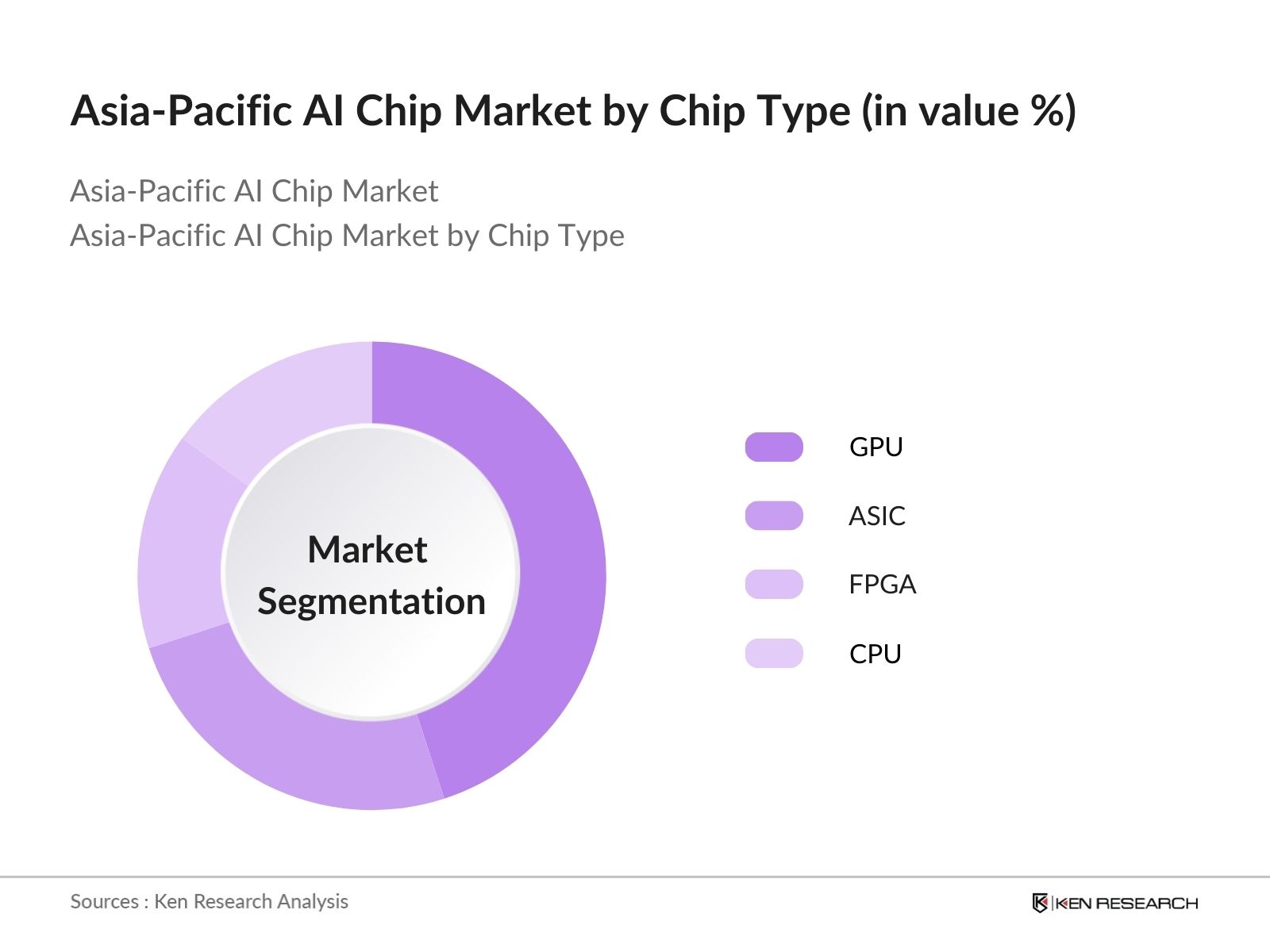

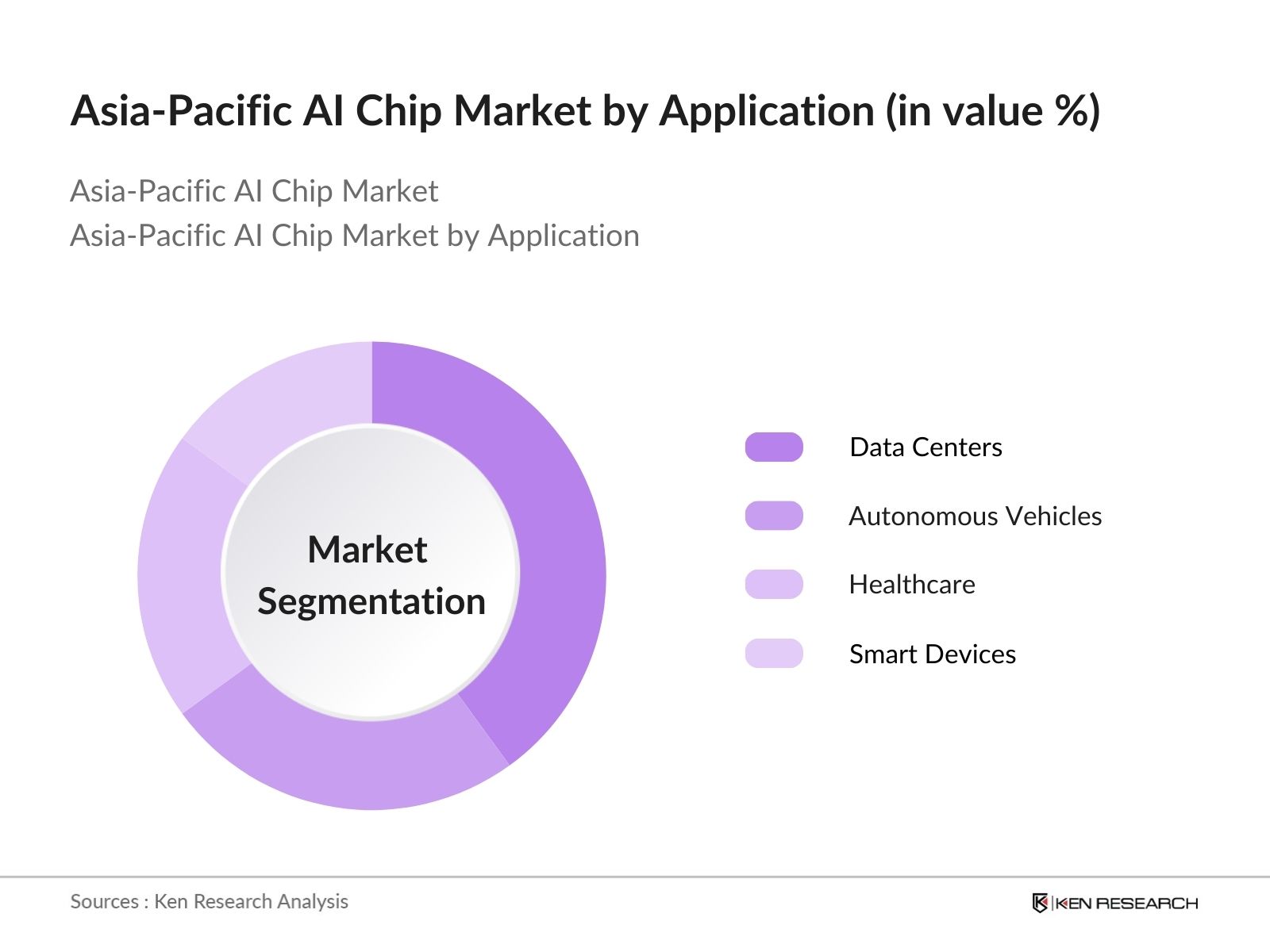

The Asia-Pacific AI Chip Market is segmented by chip type, application, and region.

- By Chip Type: The market is segmented into GPU, ASIC, FPGA, and CPU. In 2023, GPU dominated the market due to its advanced parallel processing capabilities, crucial for AI workloads.

- By Application: The market is segmented into data centers, autonomous vehicles, healthcare, and smart devices. The data center segment held the largest market share in 2023, attributed to the growing demand for AI-driven cloud computing services.

- By Region: The market is segmented into China, Japan, South Korea, India, Australia, and the Rest of APAC. China accounted for the highest market share in 2023, driven by rapid AI advancements and supportive government policies.

Asia-Pacific AI Chip Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

NVIDIA Corporation |

1993 |

Santa Clara, USA |

|

Intel Corporation |

1968 |

Santa Clara, USA |

|

Qualcomm Technologies Inc. |

1985 |

San Diego, USA |

|

Huawei Technologies Co., Ltd. |

1987 |

Shenzhen, China |

|

MediaTek Inc. |

1997 |

Hsinchu, Taiwan |

- Intel Corporation: Intel is carving out India as a separate geographic region, betting big on the country's growth potential driven by AI and the 'Siliconomy'. The company aims to provide AI-enabled processors for up to 100 million PCs by 2025 to democratize access to innovative machines.

- Qualcomm Technologies Inc.: Qualcomm has landed projects with Toyota and FAW's Hongqi for its Snapdragon Ride autonomous driving chip, highlighting its cost-effectiveness amid competition from Nvidia and Horizon Robotics. Mass production may begin by late 2024 for Hongqi and 2025 for Toyota

Asia-Pacific AI Chip Market Analysis

Asia-Pacific AI Chip Market Growth Drivers:

- Rising AI Adoption: Increasing deployment of AI technologies in sectors such as healthcare, automotive, and manufacturing is driving demand for AI chips. China sold over 5 million AI-powered devices in 2023, showcasing the growing adoption.

- Expansion of AI Infrastructure: Governments in the Asia-Pacific region are heavily investing in AI research and infrastructure, which enhances market growth. In 2023, South Korea allocated over USD 500 million to AI infrastructure, reflecting a strategic commitment to fostering innovation and supporting the burgeoning AI ecosystem.

- Edge Computing and AI Chips: As AI applications move towards edge computing, demand for AI chips with low-latency processing and energy-efficient features is rising. In 2023, AI chips for edge computing accounted for 25% of the market.

Asia-Pacific AI Chip Market Challenges:

- High Manufacturing Costs: Developing advanced AI chips is capital-intensive, with research and design costs soaring from around $28 million at the 65 nm node to about $540 million at the 5 nm node. Additionally, fab construction costs increased from $400 million to $5.4 billion for the same nodes.

- Data Privacy Concerns: As AI chips process vast amounts of sensitive data, the risk of data breaches rises. In regions like Japan and South Korea, stringent regulations require companies to implement robust data security measures, with 79% of organizations citing data privacy as a substantial concern when adopting AI technologies.

Asia-Pacific AI Chip Market Government Initiatives:

- Chinas AI Development Plan: As part of its national strategy, China aims to become the world leader in AI by 2030. The governments plan involves substantial investments in AI chips and related technologies, with over USD 2 billion allocated for AI R&D in 2023.

- Japans AI Innovation Strategy: Japans government is promoting AI through its AI Society 5.0 initiative, this initiative includes a goal to train 250,000 AI specialists by 2025, ensuring that Japan has the necessary talent to support its ambitious AI integration and development plans, enhancing its competitive edge in the market.

Asia-Pacific AI Chip Future Market Outlook

The Asia-Pacific AI Chip Market is expected to grow steadily over the next five years, driven by the continued adoption of AI and cloud computing technologies. SaaS is predicted to dominate the market, with companies increasingly opting for subscription-based AI chip services. The rise of edge computing, 5G, and the Internet of Things (IoT) will further propel market growth.

Asia-Pacific AI Chip Future Market Trends:

- Increased Adoption of AI in Autonomous Vehicles: In the next five years, AI chips designed for autonomous vehicles will see substantial growth, with expectations that they will account for a substantial portion of the market. This trend reflects the automotive industry's increasing reliance on AI technologies for enhancing vehicle safety and operational efficiency.

- Advancements in Quantum Computing: Over the next five years, quantum AI chips will emerge as a substantial trend, particularly in countries like China and Japan. These chips will offer faster computing power for complex AI models, enabling advancements in AI applications and aligning with national strategies to develop high-efficiency computing technologies for future innovations.

Scope of the Report

|

By Chip Type |

GPU ASIC FPGA CPU |

|

By Application |

Data Centers Autonomous Vehicles Healthcare Smart Devices |

|

By Region |

China Japan South Korea India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Data Center Companies

Automotive Manufacturers

Semiconductor Manufacturers

AI Solution Providing Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

NVIDIA Corporation

Intel Corporation

Qualcomm Technologies Inc.

Huawei Technologies Co., Ltd.

MediaTek Inc.

AMD (Advanced Micro Devices, Inc.)

Samsung Electronics Co., Ltd.

Xilinx Inc. (Acquired by AMD)

Graphcore

Cerebras Systems

Cambricon Technologies Corporation

Baidu Inc.

Alibaba Group Holding Ltd. (T-Head)

Fujitsu Limited

Renesas Electronics Corporation

Table of Contents

1. Asia-Pacific AI Chip Market Overview

1.1 Definition and Scope of the Asia-Pacific AI Chip Market

1.2 Market Taxonomy (Chip Type, Application, Region)

1.3 Market Growth Rate and Trends

1.4 Market Drivers (Rising AI Adoption, Government Initiatives, Expansion of AI Infrastructure)

1.5 Market Restraints (High Manufacturing Costs, Data Privacy Concerns)

2. Asia-Pacific AI Chip Market Size (in USD Billion)

2.1 Historical Market Size Analysis (2018-2023)

2.2 Year-on-Year Growth Analysis

2.3 Forecast Market Size and Growth Projections (2023-2028)

2.4 Key Market Milestones and Developments

3. Asia-Pacific AI Chip Market Analysis

3.1 Growth Drivers

3.1.1 Increasing AI Adoption Across Sectors

3.1.2 Expansion of AI Infrastructure and Government Support

3.1.3 Demand for Edge Computing and AI Chips

3.2 Market Challenges

3.2.1 High Costs of AI Chip Development and Manufacturing

3.2.2 Data Privacy and Security Concerns

3.3 Opportunities

3.3.1 Expansion in Autonomous Vehicles

3.3.2 Development of AI Chips for Healthcare Applications

3.4 Market Trends

3.4.1 Adoption of AI Chips for Edge Computing

3.4.2 Advancements in Quantum AI Chips

4. Asia-Pacific AI Chip Market Segmentation

4.1 By Chip Type (in Value %)

4.1.1 GPU (Graphics Processing Units)

4.1.2 ASIC (Application-Specific Integrated Circuit)

4.1.3 FPGA (Field-Programmable Gate Array)

4.1.4 CPU (Central Processing Unit)

4.2 By Application (in Value %)

4.2.1 Data Centers

4.2.2 Autonomous Vehicles

4.2.3 Healthcare

4.2.4 Smart Devices

4.3 By Region (in Value %)

4.3.1 China

4.3.2 Japan

4.3.3 South Korea

4.3.4 India

4.3.5 Australia

4.3.6 Rest of APAC

5. Asia-Pacific AI Chip Market Competitive Landscape

5.1 Competitive Market Share Analysis

5.2 Company Profiles

5.2.1 NVIDIA Corporation (Established 1993, Headquarters: Santa Clara, USA)

5.2.2 Intel Corporation (Established 1968, Headquarters: Santa Clara, USA)

5.2.3 Qualcomm Technologies Inc. (Established 1985, Headquarters: San Diego, USA)

5.2.4 Huawei Technologies Co., Ltd. (Established 1987, Headquarters: Shenzhen, China)

5.2.5 MediaTek Inc. (Established 1997, Headquarters: Hsinchu, Taiwan)

5.2.6 AMD (Advanced Micro Devices, Inc.)

5.2.7 Samsung Electronics Co., Ltd.

5.2.8 Xilinx Inc. (Acquired by AMD)

5.2.9 Graphcore

5.2.10 Cerebras Systems

5.2.11 Cambricon Technologies Corporation

5.2.12 Baidu Inc.

5.2.13 Alibaba Group Holding Ltd. (T-Head)

5.2.14 Fujitsu Limited

5.2.15 Renesas Electronics Corporation

5.3 Strategic Initiatives and Investments

5.4 Recent Mergers and Acquisitions

5.5 Technological Innovations and R&D Investments

6. Asia-Pacific AI Chip Market Government Regulations and Initiatives

6.1 Chinas AI Development Plan for AI Chip Industry

6.2 Japans AI Innovation Strategy (AI Society 5.0)

6.3 South Koreas AI Infrastructure Investment Plans

6.4 Indias AI Policy and Innovation Support

7. Asia-Pacific AI Chip Market Future Market Size and Segmentation

7.1 Market Segmentation by Chip Type (2023-2028)

7.2 Market Segmentation by Application (2023-2028)

7.3 Market Segmentation by Region (2023-2028)

7.4 Future Market Trends (Edge Computing, Quantum Computing, Autonomous Vehicles)

8. Asia-Pacific AI Chip Market Technological Advancements

8.1 Advancements in High-Efficiency AI Chips for Edge Computing

8.2 Development of AI Chips for Autonomous Vehicles

8.3 Innovations in Quantum AI Chip Technology

9. Asia-Pacific AI Chip Market Investment and Funding Landscape

9.1 Key Investments in AI Chip Manufacturing Facilities

9.2 Mergers and Acquisitions in the AI Chip Market

9.3 Government Grants and Funding for AI Infrastructure

9.4 Private Equity and Venture Capital Funding in AI Chip Startups

10. Asia-Pacific AI Chip Market SWOT Analysis

10.1 Strengths (High Demand in Key Sectors, Government Support for AI Infrastructure)

10.2 Weaknesses (High Manufacturing Costs, Data Privacy Concerns)

10.3 Opportunities (Expansion in Autonomous Vehicles and Smart Devices, Advancements in AI Chip Technology)

10.4 Threats (Global Supply Chain Disruptions, Competitive Market Dynamics)

11. Analysts Recommendations

11.1 Strategic Market Entry and Expansion Opportunities

11.2 Collaboration with AI and Semiconductor Companies

11.3 Innovative Product Development (Advanced AI Chips for Edge Computing and Quantum Computing)

11.4 Market Positioning Strategies for Key Players

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the Asia-Pacific AI Chip Market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple AI Chip manufacturers to understand product segments, sales trends, consumer preferences, and other parameters. This approach supports us in validating the statistics derived from the bottom-up approach of these AI Chip manufacturers.

Frequently Asked Questions

01. How big is the Asia-Pacific AI Chip Market?

The Asia-Pacific AI Chip Market was valued at USD 5.4 billion, driven by the increasing adoption of AI across industries and substantial investments in AI infrastructure.

02. Who are the major players in the Asia-Pacific AI Chip Market?

Major players in the Asia-Pacific AI Chip Market include NVIDIA Corporation, Intel Corporation, Qualcomm Technologies Inc., Huawei Technologies Co., Ltd., and MediaTek Inc., focusing on AI chip innovation and performance enhancement.

03. What are the growth drivers of the Asia-Pacific AI Chip Market?

Key growth drivers in the Asia-Pacific AI Chip Market include rising adoption of AI across sectors, government support for AI innovation, and advancements in AI chip technologies for edge computing.

04. What are the Asia-Pacific AI Chip Market challenges?

Challenges in the Asia-Pacific AI Chip Market include high manufacturing costs of AI chips and data privacy concerns, particularly in highly regulated markets like Japan and South Korea.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.