Asia-Pacific AI in Computer Vision Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD1625

November 2024

90

About the Report

Asia-Pacific AI in Computer Vision Market Overview

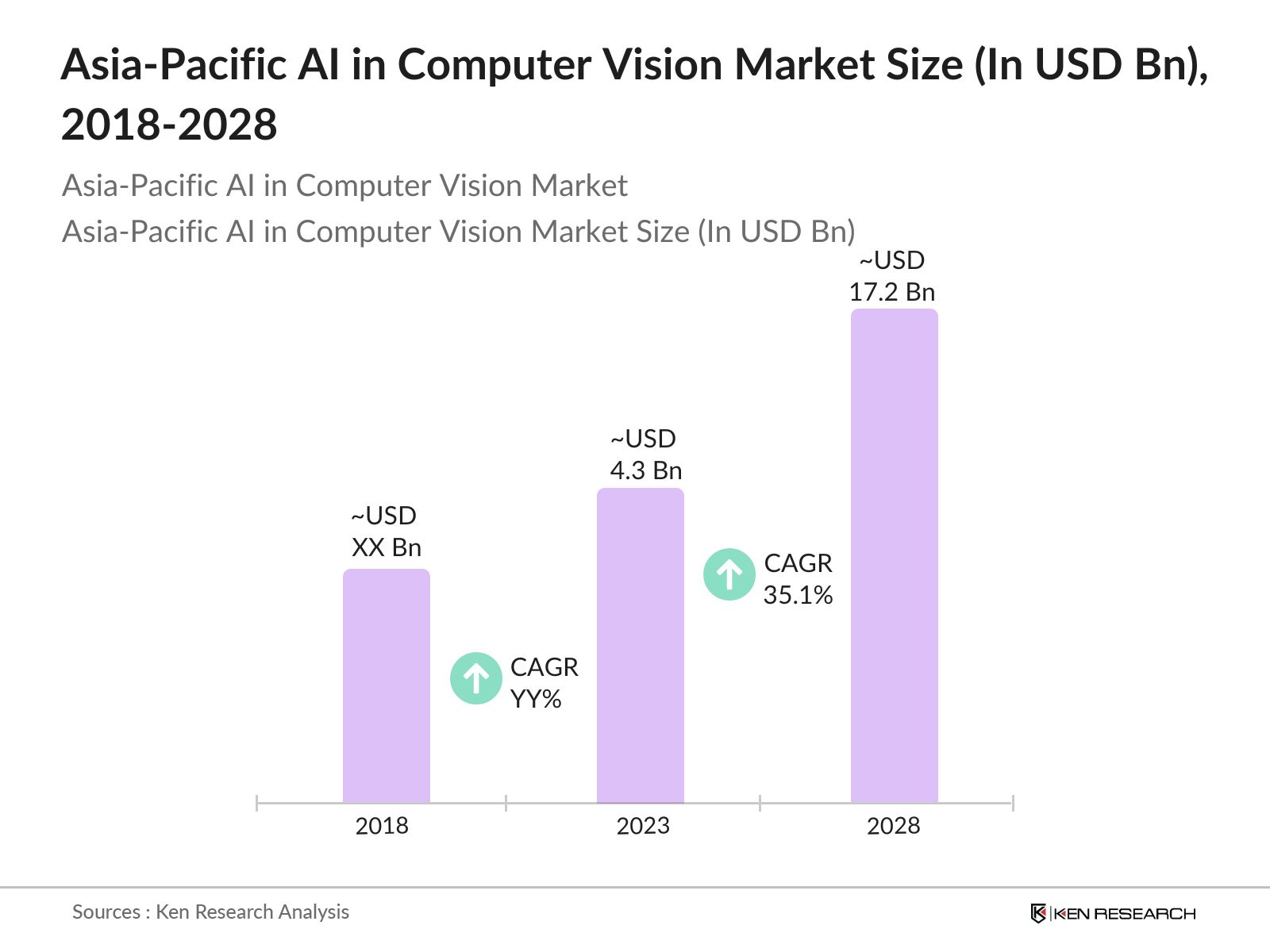

- The Asia-Pacific AI in Computer Vision market was valued at USD 4.3 billion in 2023. This market's growth is driven by the rising adoption of AI-driven vision systems in various sectors, including automotive, healthcare, and consumer electronics.

- Major players in the market include Intel Corporation, NVIDIA Corporation, IBM Corporation, Qualcomm Technologies, and Google LLC. These companies dominate the market due to their extensive R&D investments, innovative AI-driven solutions for various industries, and strategic partnerships with local and Asia-Pacific tech companies.

- NVIDIA announced the Blackwell platform on March 18, 2024, designed for real-time generative AI applications. It supports trillion-parameter models while reducing operational costs and energy consumption by up to 25 times compared to its predecessors. The platform is expected to be widely adopted by major tech companies and cloud providers.

- Beijing, Seoul, and Tokyo are the dominant cities in the Asia-Pacific AI in Computer Vision market. Beijing leads with extensive AI research facilities and a strong government push for AI adoption.

Asia-Pacific AI in Computer Vision Market Segmentation

The Asia-Pacific AI in Computer Vision market is segmented by application, Software Type, and region.

- By Application: The market is segmented by application into Automotive, Healthcare, Consumer Electronics, and Industrial. In 2023, Automotive holds the dominant market share, driven by the rapid integration of AI in driver assistance systems and autonomous vehicles, particularly in China and Japan.

- By Software Type: The market is segmented by Software Type into Hardware, Software, and Services. In 2023, Software leads this segment with the highest market share. This dominance is attributed to the growing demand for AI algorithms and platforms that enhance the performance of computer vision systems.

- By Region: The market is segmented by region into China, South Korea, Japan, India, Australia, and the rest of APAC. East Asia, particularly China and Japan, holds the largest market share due to the presence of major tech companies, robust R&D infrastructure, and strong government support for AI technology development.

Asia-Pacific AI in Computer Vision Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Intel Corporation |

1968 |

Santa Clara, USA |

|

NVIDIA Corporation |

1993 |

Santa Clara, USA |

|

IBM Corporation |

1911 |

Armonk, USA |

|

Qualcomm Technologies |

1985 |

San Diego, USA |

|

Google LLC |

1998 |

Mountain View, USA |

- Qualcomm Technologies: Qualcomm Technologies unveiled the Snapdragon Dev Kit for Windows, a compact PC powered by Snapdragon X Elite, designed for developers creating AI PC apps. The kit features a 12-core Qualcomm Oryon CPU, 45 TOPS NPU, and supports up to three UHD screens, allowing developers to optimize next-gen AI experiences.

- Google LLC: In March 2024, Google announced a collaboration with the University of Tokyo to launch an initiative using generative AI to address challenges faced by local communities in Japan, such as employment mismatches and issues on remote islands.

Asia-Pacific AI in Computer Vision Market Analysis

Asia-Pacific AI in Computer Vision Market Growth Drivers:

- Increasing Demand for AI-Driven Automation: The automotive sector is rapidly adopting AI-driven automation, with about 40% of manufacturers integrating AI-powered vision systems to enhance vehicle safety and performance in 2023. This trend is driven by the need for improved operational efficiency and the growing focus on autonomous driving technologies, which rely heavily on advanced computer vision.

- Expansion of AI Research and Development: In 2023, China's investment in AI research surpassed USD 10 billion, boosting advancements in computer vision technology. This investment supports the development of innovative solutions tailored to local needs, positioning China as a leader in AI innovation and fostering collaboration among tech companies and research institutions.

- Growing Applications in Consumer Electronics: The consumer electronics sector increasingly employs AI-driven computer vision, accounting for nearly 25% of the AI in Computer Vision market in the Asia-Pacific region in 2023. Applications such as facial recognition and gesture control are becoming standard in smart devices, enhancing user experiences and driving demand for advanced vision technologies.

Asia-Pacific AI in Computer Vision Market Challenges:

- High Costs of AI Hardware: The high costs associated with AI hardware, including GPUs and specialized sensors, pose a major challenge for small and medium-sized enterprises in the Asia-Pacific region. In 2023, high-end AI GPUs exceeded USD 3,000 per unit, contributing to over 47% of total AI spending, which limits adoption in cost-sensitive markets.

- Data Privacy and Security Concerns: Regulatory hurdles and compliance issues related to data privacy and security create barriers to AI in the Computer Vision market. In 2023, variations in data protection laws across countries slowed AI deployment, as 78% of organizations reported challenges in navigating complex regulations, complicating compliance for companies.

Asia-Pacific AI in Computer Vision Market Government Initiatives:

- China's AI Development Plan: China's "New Generation Artificial Intelligence Development Plan" aims for global AI leadership by 2030, with a focus on computer vision. The plan includes a target of establishing multiple AI technology innovation centers and achieving a core AI industry scale exceeding 1 trillion RMB. In 2022, China ranked second globally in AI-related patents and publications.

- Japan's Society 5.0 Initiative: Japan's "Society 5.0" initiative integrates AI into society, aiming to enhance the quality of life and productivity. The government plans to invest around USD 2 billion annually to support AI technologies, including computer vision. In 2023, Japan ranked third globally in AI research output, reflecting its commitment to technological advancement.

Asia-Pacific AI in Computer Vision Market Future Market Outlook

The Asia-Pacific AI in Computer Vision Market is expected to reach USD 17.2 billion in 2028, driven by increasing demand for AI-driven automation, expanding applications across various industries, and supportive government initiatives.

Asia-Pacific AI in Computer Vision Market Future Market Trends:

- Growth in AI-Driven Autonomous Systems: By 2028, the integration of AI in autonomous systems is expected to drive growth in the market. Governments are investing in smart city projects, with Japan allocating USD 5 billion towards urban development. In 2023, 83% of organizations reported increased adoption of AI technologies in autonomous applications, reflecting a strong trend toward automation in various sectors.

- Expansion of Healthcare Applications: The deployment of AI in healthcare applications is anticipated to become widespread across major cities in Asia-Pacific by 2028. AI-driven computer vision is projected to be integral in diagnostics and treatment planning, particularly in China, Japan, and South Korea. In 2023, 26.6% of banks in the region reported increased investment in AI solutions, highlighting the growing reliance on AI for improving healthcare outcomes.

Scope of the Report

|

By Software Type |

Hardware Software Services |

|

By Application |

Automotive Healthcare Consumer Electronics Industrial |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Automotive Manufacturers

Healthcare Companies

Consumer Electronics Manufacturers

AI Technology Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Table of Contents

1. Asia-Pacific AI in Computer Vision Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific AI in Computer Vision Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific AI in Computer Vision Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for AI-Driven Automation

3.1.2. Expansion of AI Research and Development

3.1.3. Growing Applications in Consumer Electronics

3.2. Restraints

3.2.1. High Costs of AI Hardware

3.2.2. Data Privacy and Security Concerns

3.3. Opportunities

3.3.1. Growth in AI-Driven Autonomous Systems

3.3.2. Expansion of Healthcare Applications

3.4. Trends

3.4.1. Adoption of AI in Smart Cities

3.4.2. Innovations in AI and Computer Vision Technologies

3.4.3. Increased Integration of AI in Consumer Electronics

3.5. Government Regulation

3.5.1. Chinas AI Development Plan

3.5.2. Japans Society 5.0 Initiative

3.5.3. Regulatory and Compliance Landscape

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Asia-Pacific AI in Computer Vision Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Automotive

4.1.2. Healthcare

4.1.3. Consumer Electronics

4.1.4. Industrial

4.2. By Software Type (in Value %)

4.2.1. Hardware

4.2.2. Software

4.2.3. Services

4.3. By Region (in Value %)

4.3.1. China

4.3.2. South Korea

4.3.3. Japan

4.3.4. India

4.3.5. Australia

4.3.6. Rest of APAC

5. Asia-Pacific AI in Computer Vision Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Intel Corporation

5.1.2. NVIDIA Corporation

5.1.3. IBM Corporation

5.1.4. Qualcomm Technologies

5.1.5. Google LLC

5.1.6. Samsung Electronics

5.1.7. Sony Corporation

5.1.8. Huawei Technologies Co., Ltd.

5.1.9. Panasonic Corporation

5.1.10. Toshiba Corporation

5.1.11. Fujitsu Limited

5.1.12. NEC Corporation

5.1.13. LG Electronics

5.1.14. Hitachi, Ltd.

5.1.15. Canon Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Asia-Pacific AI in Computer Vision Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Asia-Pacific AI in Computer Vision Market Regulatory Framework

7.1. Data Privacy Regulations

7.2. AI Ethics and Compliance Requirements

7.3. Certification Processes and Standards

8. Asia-Pacific AI in Computer Vision Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Asia-Pacific AI in Computer Vision Market Future Market Segmentation, 2028

9.1. By Application (in Value %)

9.2. By Software Type (in Value %)

9.3. By Region (in Value %)

10. Asia-Pacific AI in Computer Vision Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the Asia-Pacific AI in Computer Vision market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple essential AI in Computer Vision companies and understand the nature of product segments and sales, consumer preferences, and other parameters, which will support us in validating statistics derived through a bottom-up approach from AI in Computer Vision companies.

Frequently Asked Questions

01. How big is the Asia-Pacific AI in the Computer Vision Market?

The Asia-Pacific AI in Computer Vision market was valued at USD 4.3 billion in 2023. The market is primarily driven by the demand for AI-driven automation in automotive, healthcare, and consumer electronics, alongside some investments in AI research and development, particularly in countries like China, Japan, and South Korea.

02. Who are the major players in the Asia-Pacific AI in Computer Vision market?

Key players in the Asia-Pacific AI in Computer Vision market include Intel Corporation, NVIDIA Corporation, IBM Corporation, Qualcomm Technologies, and Google LLC. These companies lead the market through extensive R&D investments, strategic partnerships, and advancements in AI-driven technologies.

03. What are the growth drivers of the Asia-Pacific AI in Computer Vision market?

The Asia-Pacific AI in Computer Vision market is driven by the rapid adoption of AI-driven automation across various industries, substantial government funding for AI research, and the expansion of AI capabilities in consumer electronics, healthcare, and automotive sectors.

04. What are the Asia-Pacific AI in Computer Vision market challenges?

Challenges include in the Asia-Pacific AI in Computer Vision market the high costs of AI hardware, data privacy and security concerns, and regulatory hurdles across different countries, which can slow down the deployment and adoption of AI-driven computer vision technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.