Asia Pacific Air Defense Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD10073

November 2024

88

About the Report

Asia-Pacific Air Defense Systems Market Overview

- The Asia-Pacific Air Defense Systems market is valued at USD 14.5 billion, driven by increasing geopolitical tensions and advancements in defense technology. The demand for robust air defense systems is propelled by rising security concerns across borders and increased government expenditure on military modernization. These systems play a crucial role in ensuring national security, which is a priority for most countries in the region.

- The market is dominated by China, India, and Japan due to their significant defense budgets, technological advancements, and the presence of major defense manufacturing companies. China leads the region with its large-scale production capabilities and indigenous development of advanced systems. India, on the other hand, focuses on modernizing its military infrastructure, while Japan leverages its technological expertise to strengthen its defense network.

- Several Asia-Pacific countries have revised their defense procurement policies to expedite the acquisition of advanced air defense systems. For example, Japan's Three Principles on Transfer of Defense Equipment and Technology have been updated to allow the export of defense technologies to strategic partners. This policy shift is expected to streamline procurement processes and enhance regional cooperation in defense capabilities. Additionally, Indias Defence Procurement Procedure (DPP) 2024 emphasizes fast-track procurement for urgent operational requirements, reflecting a shift toward efficiency in defense spending.

Asia-Pacific Air Defense Systems Market Segmentation

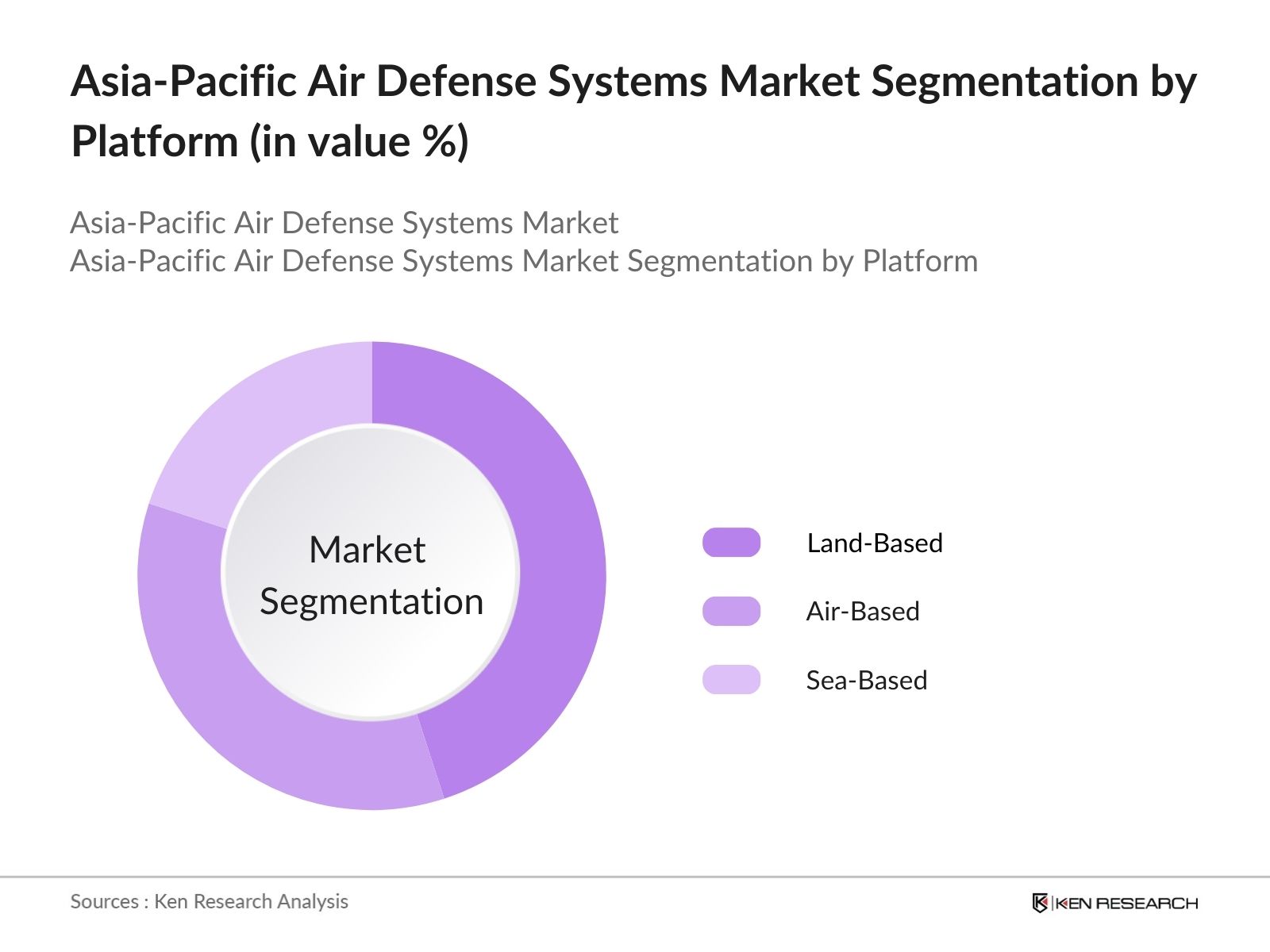

By Platform: The Asia-Pacific Air Defense Systems market is segmented by platform into land-based, air-based, and sea-based systems. Land-based systems hold a dominant market share due to their established presence and flexibility in deploying short- and long-range defense capabilities. For instance, missile systems like the S-400 and indigenous platforms contribute significantly to the demand for land-based solutions.

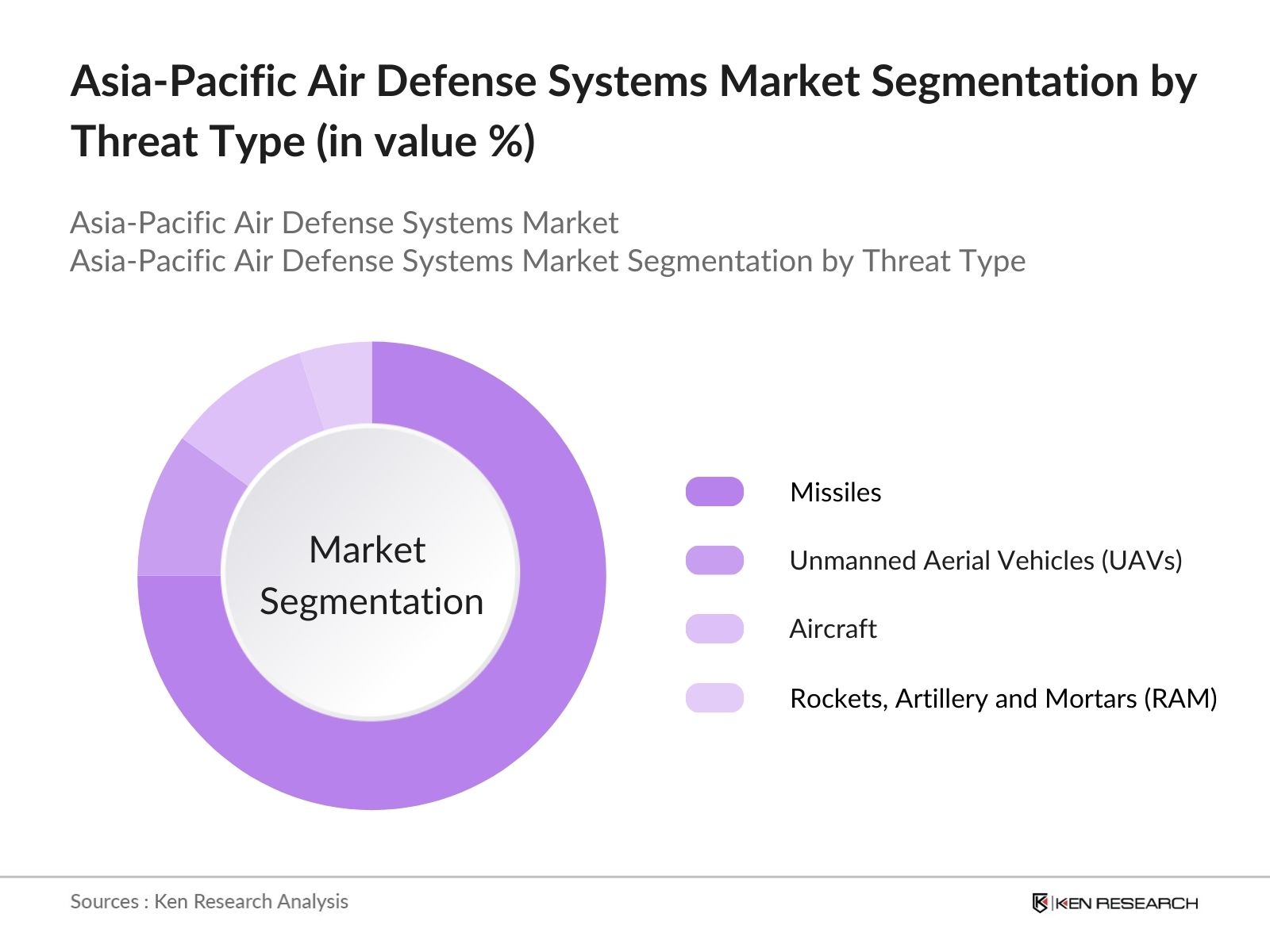

By Threat Type: The market is further segmented by threat type into missiles (ballistic and cruise), Unmanned Aerial Vehicles (UAVs), aircraft, and Rockets, Artillery and Mortars (RAM). Missile defense systems dominate the market due to the increased prevalence of long-range missile threats. Advanced systems such as hypersonic interceptors and anti-ballistic missiles drive this segment's growth.

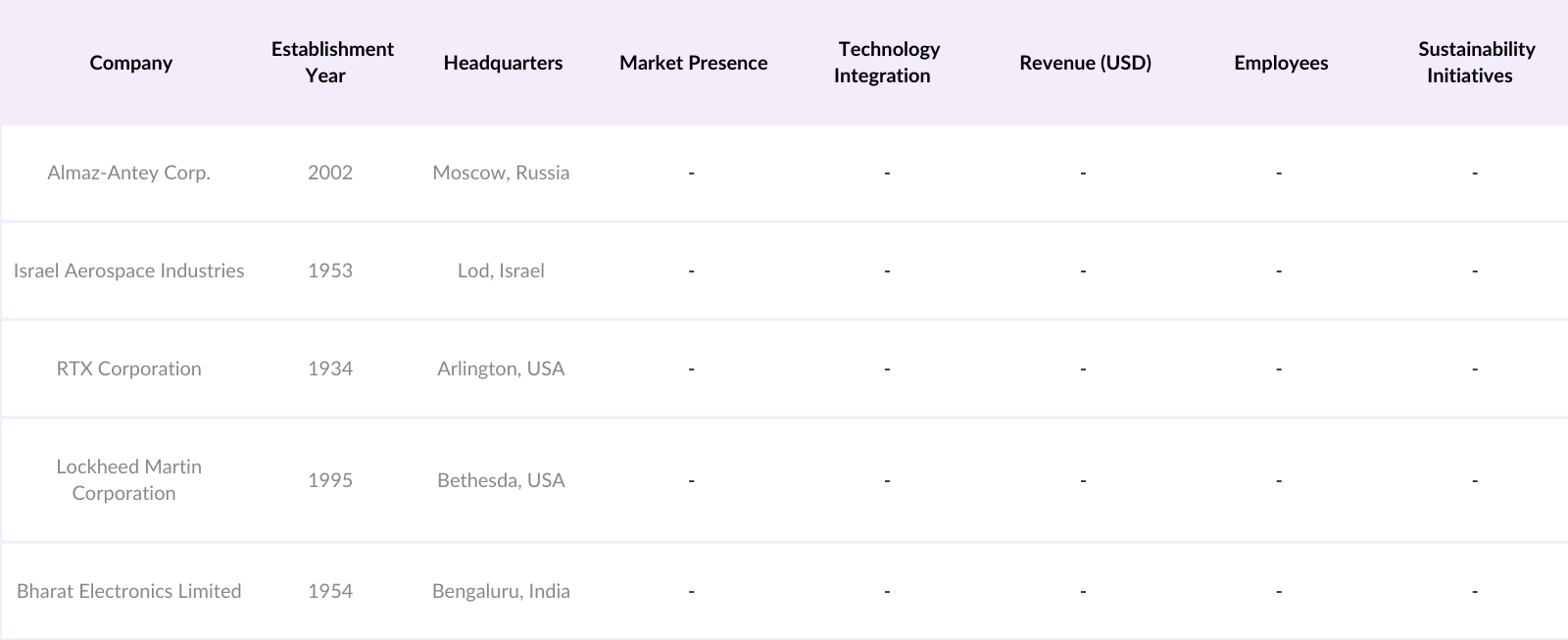

Asia-Pacific Air Defense Systems Market Competitive Landscape

The Asia-Pacific Air Defense Systems market is dominated by a mix of regional and global players, showcasing high competitiveness in technology integration, manufacturing capabilities, and strategic collaborations. The leading players emphasize R&D investment and regional partnerships to expand their market presence.

Asia-Pacific Air Defense Systems Market Analysis

Growth Drivers

- Geopolitical Tensions: The Asia-Pacific region has experienced escalating geopolitical tensions, notably between China and neighboring countries over territorial disputes in the South China Sea. For instance, China's defense budget reached approximately $236 billion in 2024, accounting for 46% of the region's total defense spending. This significant investment underscores the country's focus on enhancing its military capabilities. In response, neighboring nations have increased their defense expenditures to bolster air defense systems and maintain regional stability.

- Technological Advancements: Technological innovations have significantly influenced the Asia-Pacific air defense systems market. The development of hypersonic missiles and advanced unmanned aerial vehicles (UAVs) has necessitated the adoption of sophisticated defense mechanisms. For example, Japan's defense budget for 2024 includes substantial investments in upgrading military capabilities, such as the expedited deployment of long-range missiles capable of targeting China and North Korea. This strategic move aims to counter emerging threats and enhance national security.

- Defense Budget Allocations: Several Asia-Pacific countries have significantly increased their defense budgets to strengthen air defense capabilities. Japan's defense budget for 2024 is set at 7.95 trillion yen (approximately $56 billion), marking a 16% increase from the previous year. Similarly, Australia announced a record defense budget of AU$55.7 billion (around $37 billion) for the next fiscal year, reflecting a 6.3% increase. These substantial allocations underscore a regional commitment to enhancing military readiness and air defense systems.

Challenges

- High Development and Procurement Costs: The development and acquisition of advanced air defense systems involve substantial financial investments. For instance, Australia's plan to acquire nuclear-powered submarines through the AUKUS partnership is projected to cost up to USD 235.52 billion over the next few decades. Such high costs can strain national budgets and pose challenges for sustained investment in air defense capabilities.

- Regulatory and Compliance Issues: In December 2023, Japan's government revised these policies, allowing for the export of lethal weapons and defense equipment manufactured under foreign licenses. This change is part of a broader strategy to enhance Japan's role in global security and defense cooperation, particularly in light of rising regional tensions. However, navigating these regulatory frameworks can be complex and may delay the deployment of critical defense systems.

Asia-Pacific Air Defense Systems Market Future Outlook

Over the next five years, the Asia-Pacific Air Defense Systems market is poised for substantial growth, fueled by increased investments in defense modernization, the integration of cutting-edge technologies like AI, and the rising need to counter evolving threats such as hypersonic missiles and UAVs. Regional collaborations and government policies supporting indigenization are expected to create new growth opportunities.

Market Opportunities

- Indigenous Defense Manufacturing Initiatives: Several Asia-Pacific countries are investing in domestic defense manufacturing to reduce reliance on foreign suppliers. India, for example, has launched the "Make in India" initiative, encouraging local production of defense equipment. The Foreign Direct Investment (FDI) policy has been liberalized to allow up to 74% FDI under the automatic route for defense manufacturing. This strategy aims to enhance self-reliance and stimulate economic growth through the development of indigenous defense technologies.

- Collaborations and Joint Ventures: Collaborative efforts among nations and defense companies are fostering innovation and resource sharing. Australia's partnership with the United States and the United Kingdom under the AUKUS agreement in 2021 exemplifies such collaboration, focusing on the development of nuclear-powered submarines and advanced defense technologies. These alliances enhance collective security and technological advancement.

Scope of the Report

|

Segment |

Sub-Segments |

|

Platform |

- Land-Based |

|

Range |

- Short-Range |

|

Threat Type |

- Missiles (Ballistic and Cruise) |

|

Component |

- Weapon Systems |

|

Country |

- China |

Products

Key Target Audience

Defense Ministries and Agencies (e.g., Ministry of Defense, Japan; Ministry of Defense, India)

Defense Equipment Manufacturers

Unmanned Aerial Systems (UAS) Developers

Command and Control System Providers

Surveillance and Detection Technology Firms

Investors and Venture Capitalist Firms

Regional Government and Regulatory Bodies (e.g., People's Liberation Army, China; Indian Armed Forces)

Technological R&D Institutes Specializing in Defense Applications

Companies

Players Mentioned in the Report

Almaz-Antey Corp.

Israel Aerospace Industries

RTX Corporation

Lockheed Martin Corporation

Bharat Electronics Limited (BEL)

Mitsubishi Heavy Industries

BAE Systems plc

Northrop Grumman Corporation

Hanwha Systems

Leonardo S.p.A.

Table of Contents

1. Asia-Pacific Air Defense Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Air Defense Systems Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Air Defense Systems Market Analysis

3.1. Growth Drivers

3.1.1. Geopolitical Tensions

3.1.2. Technological Advancements

3.1.3. Defense Budget Allocations

3.1.4. Emergence of Unmanned Aerial Threats

3.2. Market Challenges

3.2.1. High Development and Procurement Costs

3.2.2. Regulatory and Compliance Issues

3.2.3. Technological Integration Complexities

3.3. Opportunities

3.3.1. Indigenous Defense Manufacturing Initiatives

3.3.2. Collaborations and Joint Ventures

3.3.3. Modernization of Existing Defense Infrastructure

3.4. Trends

3.4.1. Adoption of AI and Machine Learning in Defense Systems

3.4.2. Integration of Cybersecurity Measures

3.4.3. Development of Hypersonic Defense Capabilities

3.5. Government Regulations

3.5.1. Defense Procurement Policies

3.5.2. Export Control Regulations

3.5.3. Offset Agreements

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia-Pacific Air Defense Systems Market Segmentation

4.1. By Platform (In Value %)

4.1.1. Land-Based

4.1.2. Air-Based

4.1.3. Sea-Based

4.2. By Range (In Value %)

4.2.1. Short-Range

4.2.2. Medium-Range

4.2.3. Long-Range

4.3. By Threat Type (In Value %)

4.3.1. Missiles (Ballistic and Cruise)

4.3.2. Unmanned Aerial Vehicles (UAVs)

4.3.3. Aircraft

4.3.4. Rockets, Artillery, and Mortars (RAM)

4.4. By Component (In Value %)

4.4.1. Weapon Systems

4.4.2. Fire Control Systems

4.4.3. Command and Control Systems

4.4.4. Surveillance and Detection Systems

4.5. By Country (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

4.5.6. Rest of Asia-Pacific

5. Asia-Pacific Air Defense Systems Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Almaz-Antey Corp.

5.1.2. Israel Aerospace Industries (IAI)

5.1.3. RTX Corporation

5.1.4. Leonardo S.p.A.

5.1.5. Hanwha Systems

5.1.6. Lockheed Martin Corporation

5.1.7. BAE Systems plc

5.1.8. Northrop Grumman Corporation

5.1.9. Mitsubishi Heavy Industries

5.1.10. Bharat Electronics Limited (BEL)

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Product Portfolio

5.2.6. Regional Presence

5.2.7. R&D Investment

5.2.8. Strategic Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Asia-Pacific Air Defense Systems Market Regulatory Framework

6.1. Defense Procurement Policies

6.2. Export Control Regulations

6.3. Certification Processes

6.4. Compliance Requirements

7. Asia-Pacific Air Defense Systems Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Air Defense Systems Future Market Segmentation

8.1. By Platform (In Value %)

8.2. By Range (In Value %)

8.3. By Threat Type (In Value %)

8.4. By Component (In Value %)

8.5. By Country (In Value %)

9. Asia-Pacific Air Defense Systems Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

An ecosystem map was developed, encompassing all major stakeholders in the Asia-Pacific Air Defense Systems market. Comprehensive desk research was conducted using proprietary and secondary databases to define critical variables influencing market trends.

Step 2: Market Analysis and Construction

Historical data for the market was analyzed, focusing on penetration levels, platform utilization, and revenue generation. Advanced statistical methods were used to ensure the accuracy of revenue projections and trend analysis.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through structured interviews with industry experts. This step included discussions with defense manufacturers and government procurement agencies for precise insights.

Step 4: Research Synthesis and Final Output

Insights from stakeholders were synthesized to develop a comprehensive report that provides a balanced analysis. Bottom-up approaches were used to validate market segmentation, size, and competitive intelligence.

Frequently Asked Questions

01. How big is the Asia-Pacific Air Defense Systems market?

The Asia-Pacific Air Defense Systems market is valued at USD 14.5 billion, driven by rising geopolitical tensions and increased investments in military modernization.

02. What are the challenges in the Asia-Pacific Air Defense Systems market?

Challenges in Asia-Pacific Air Defense Systems market include high development and procurement costs, integration complexities, and regulatory hurdles that can delay system deployments.

03. Who are the major players in the Asia-Pacific Air Defense Systems market?

Key players in Asia-Pacific Air Defense Systems market include Almaz-Antey Corp., Israel Aerospace Industries, RTX Corporation, Lockheed Martin Corporation, and Bharat Electronics Limited (BEL).

04. What are the growth drivers of the Asia-Pacific Air Defense Systems market?

Asia-Pacific Air Defense Systems market is driven by advancements in defense technologies, rising security concerns, and the growing prevalence of UAVs and hypersonic threats.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.