Asia-Pacific All-Terrain Vehicle (ATV) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4445

October 2024

95

About the Report

Asia-Pacific All-Terrain Vehicle Market Overview

- The Asia-Pacific All-Terrain Vehicle (ATV) market is experiencing steady growth, driven by increasing demand from sectors such as agriculture, sports, and defence. The market is valued at USD 567 million, based on a five-year historical analysis. The driving factors behind this market's expansion include the rising popularity of off-road recreational activities and the utility of ATVs in challenging terrains for agricultural and military purposes. Additionally, increasing investments in adventure tourism and technological advancements in electric and hybrid ATVs contribute to market growth.

- Countries such as China, Japan, and Australia dominate the Asia-Pacific ATV market. China leads due to its large-scale ATV manufacturing capabilities and growing use in the agricultural sector. Japan's dominance is attributed to its strong technological base and innovation in electric-powered ATVs. Australia stands out because of its widespread use of ATVs in agriculture and recreation. The dominance of these nations is driven by the availability of advanced infrastructure, investment in outdoor activities, and technological development.

- Governments across Asia-Pacific have introduced stringent safety standards for the manufacturing and use of ATVs. In Australia, for example, the government mandated the inclusion of roll-over protection structures (ROPS) in all new ATVs from 2024, a regulation aimed at reducing fatalities caused by vehicle rollovers. The World Bank indicates that these safety measures have already led to a decline in off-road vehicle accidents by 15% across the region. Such regulations are reshaping the market, forcing manufacturers to comply with higher safety benchmarks.

Asia-Pacific All-Terrain Vehicle Market Segmentation

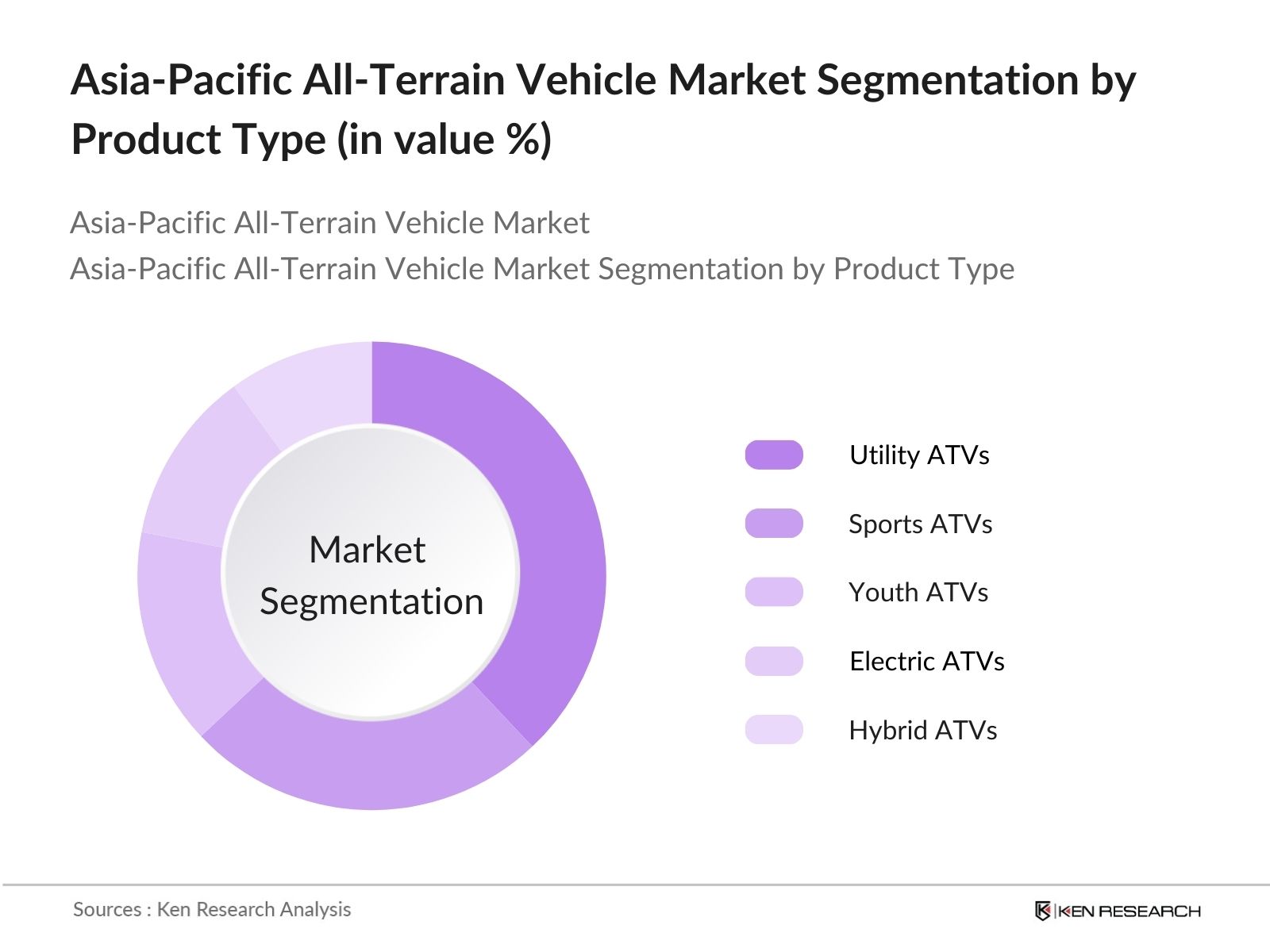

- By Product Type: The Asia-Pacific ATV market is segmented by product type into utility ATVs, sports ATVs, youth ATVs, electric ATVs, and hybrid ATVs. Utility ATVs hold a dominant market share in this category due to their widespread use in agriculture, forestry, and ranching. Their ability to navigate rough terrain and perform various tasks, from transportation to hauling, makes them highly versatile for both commercial and personal use. Additionally, their growing adoption in rural areas for farming and utility tasks strengthens their market position.

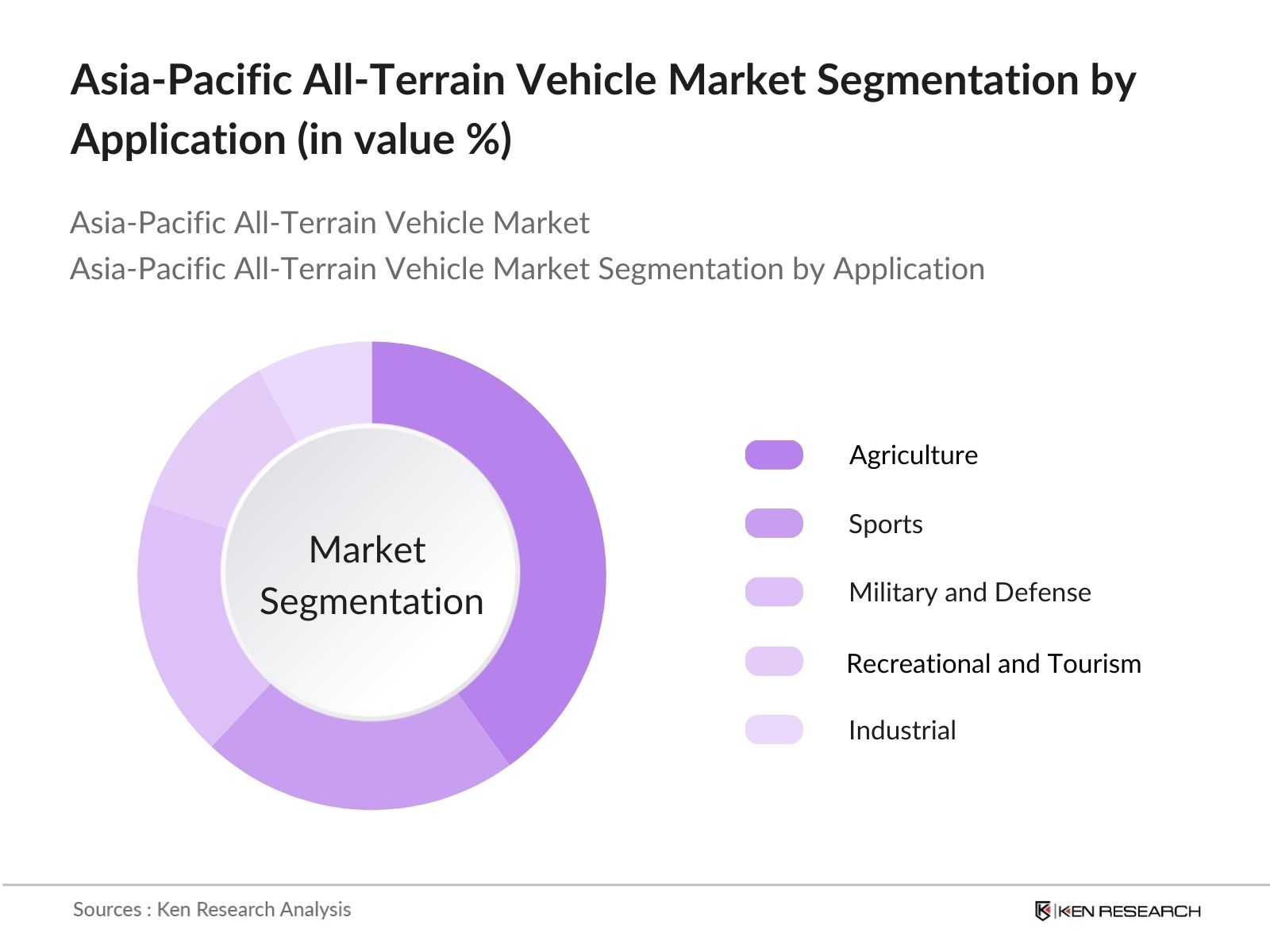

- By Application: The market is also segmented by application into agriculture, sports, military and defence, recreational and tourism, and industrial use. Agriculture dominates this segment, as ATVs are increasingly used in farm operations for quick transportation, herding animals, and managing crops. The versatility and efficiency of ATVs in these environments make them indispensable tools, especially in rural areas where large farming operations require vehicles capable of navigating uneven terrains.

Asia-Pacific All-Terrain Vehicle Market Competitive Landscape

The Asia-Pacific ATV market is characterized by a few key players that dominate the industry through technological advancements, diverse product offerings, and strategic partnerships. These companies invest heavily in R&D to stay ahead of the competition and cater to the evolving needs of customers. The market is led by renowned brands such as Polaris, Honda, and Yamaha, which have established strong distribution networks across the region. These companies dominate by delivering high-quality, innovative products tailored to both recreational users and professionals in agriculture and defense.

| Company | Establish ment Year |

Head quarters |

Product Range | Global Presence | Technolo gical Innovation |

Partner ships |

Patents | Revenue | Emplo yees |

|---|---|---|---|---|---|---|---|---|---|

| Polaris Industries | 1954 | Minnesota, USA | |||||||

| Honda Motor Co., Ltd. | 1948 | Tokyo, Japan | |||||||

| Yamaha Motor Co., Ltd. | 1955 | Iwata, Japan | |||||||

| Kawasaki Heavy Industries | 1896 | Tokyo, Japan | |||||||

| BRP (Bombardier) | 2003 | Quebec, Canada |

Asia-Pacific All-Terrain Vehicle Market Analysis

Asia-Pacific All-Terrain Vehicle Market Growth Drivers

- Increasing Use in Agriculture: The agricultural sector in the Asia-Pacific region is witnessing modernization, with ATVs becoming crucial for increasing operational efficiency in remote and challenging terrains. In countries like India, which has over 157 million hectares of agricultural land, ATVs are being used for transporting equipment, inspecting large farms, and accessing remote areas. The World Bank estimates that agricultural output in Asia-Pacific contributes around 10% to the regional GDP in 2024, providing a solid foundation for ATV adoption. The ability of ATVs to traverse rugged terrain enhances accessibility in remote farming areas, further driving demand.

- Growing Popularity of Off-Road Sports: Off-road sports, driven by the popularity of events such as the Asia-Pacific Rally Championship, have spurred demand for ATVs across the region. In Japan alone, adventure tourism has grown by 13 million participants in 2024, reflecting the increasing consumer interest in outdoor recreational activities. This surge in interest has created a vibrant market for ATVs, which are essential for these sports. The off-road sports industry, generating billions annually, is positioning the Asia-Pacific as a hotspot for ATV purchases, particularly in countries like Australia and New Zealand, where adventure tourism plays a major role in the economy.

- Rising Demand from Defense Sector: The Asia-Pacific region's defence expenditure has seen a marked increase, with China, India, and Australia being among the top spenders. The International Monetary Fund (IMF) reports that defence budgets in the region reached over $500 billion in 2024. ATVs have become integral to military operations for tactical mobility, particularly in mountainous and rough terrains, as they offer high versatility in off-road missions. With military modernization programs in countries like India and Japan, ATV adoption for defence purposes is expected to rise, helping armies to navigate and operate efficiently in diverse terrains.

Asia-Pacific All-Terrain Vehicle Market Challenges

- High Ownership and Maintenance Costs: The ownership and maintenance costs of ATVs in the Asia-Pacific region remain a hurdle, particularly in emerging economies. For instance, in India, the average maintenance cost of ATVs is approximately USD 1,200 per annum, a substantial expenditure for rural consumers. Despite technological advancements, the high initial purchase price and regular servicing requirements deter widespread adoption in low-income markets. Furthermore, the World Bank indicates that the average GDP per capita across several Asia-Pacific nations remains under USD 3,500 in 2024, making the affordability of ATVs a persistent challenge.

- Stringent Emission Regulations (Regulatory Barriers and Compliance Costs): Governments in the Asia-Pacific region have tightened emission regulations to curb environmental degradation, directly impacting ATV manufacturers. For example, China's 2024 National Environmental Standards mandate a 20% reduction in emissions for off-road vehicles, compelling ATV manufacturers to invest heavily in cleaner technologies. These stringent regulations increase production costs and place compliance burdens on manufacturers. According to the World Bank’s Environmental Performance Index, Asia-Pacific nations are intensifying their environmental policies, raising the regulatory costs associated with ATV production.

Asia-Pacific All-Terrain Vehicle Market Future Outlook

The Asia-Pacific All-Terrain Vehicle market is poised for growth over the coming years, driven by the expansion of adventure tourism, technological advancements in electric and hybrid ATVs, and increasing demand from sectors such as agriculture and defence. Governments across the region are also implementing policies to support the use of eco-friendly vehicles, providing incentives for electric ATV manufacturers. These factors, coupled with growing consumer awareness about the utility of ATVs in various applications, will drive market expansion.

Asia-Pacific All-Terrain Vehicle Market Opportunities

- Expansion into Rural and Adventure Tourism Markets: Rural regions in the Asia-Pacific are witnessing a growing interest in adventure tourism, with an influx of tourists exploring off-beat paths. India alone attracted 18 million adventure tourists in 2024, many of whom are drawn to off-road experiences that require ATVs. This expansion presents a lucrative opportunity for ATV manufacturers to target rural areas with high tourism potential, especially as infrastructure development accelerates. As per the World Bank, the rural population in Asia-Pacific stands at over 1.8 billion, indicating a vast market for ATV adoption in these emerging tourism hotspots.

- Development of Environmentally Friendly ATVs: With a substantial shift towards environmentally conscious transportation, the demand for electric and hybrid ATVs in the Asia-Pacific is on the rise. China's aggressive push for electric mobility in 2024 has increased over 10 million electric vehicle sales, encouraging ATV manufacturers to develop eco-friendly alternatives. Furthermore, several governments in the region, including South Korea and Japan, are offering tax incentives for consumers opting for electric and hybrid vehicles, fueling market growth. This trend reflects the growing market opportunity for sustainable ATVs in Asia-Pacific.

Scope of the Report

| By Product Type |

Utility ATVs Sports ATVs Youth ATVs Electric ATVs Hybrid ATVs |

| By Application |

Agriculture, Sports Military and Defense Recreational and Tourism Industrial |

| By Engine Capacity |

Below 400cc 400cc to 800cc Above 800cc |

| By Propulsion Type |

Gasoline-Powered ATVs Electric-Powered ATVs Hybrid-Powered ATVs |

| By Country |

China Japan South Korea Australia India |

Products

Key Target Audience

Government and Regulatory Bodies (Ministry of Transport, Environmental Protection Agencies)

Agriculture Equipment Manufacturers

Defense Ministries

Banks and Financial Institutions

Adventure Tourism Operators

Outdoor Recreational Equipment Suppliers

Investment and Venture Capitalist Firms

ATV Component Suppliers

Off-Road Racing Organizations

Companies

Polaris Industries

Honda Motor Co., Ltd.

Yamaha Motor Co., Ltd.

Kawasaki Heavy Industries

BRP Inc. (Bombardier Recreational Products)

Arctic Cat Inc.

CFMoto Powersports

Hisun Motors Corp.

Textron Inc.

Kymco

Suzuki Motor Corporation

KTM AG

TGB Motor Co. Ltd.

Taiwan Golden Bee Co.

Linhai Group

Table of Contents

1. Asia-Pacific ATV Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Influence of Government Policies, Consumer Preferences, and Economic Stability)

1.4. Market Segmentation Overview

2. Asia-Pacific ATV Market Size (In USD Mn)

2.1. Historical Market Size (Impact of Key Market Drivers: Tourism, Agriculture, Sports, and Military Applications)

2.2. Year-On-Year Growth Analysis (Emergence of Off-Road Sports and Expanding Tourism Sector)

2.3. Key Market Developments and Milestones (New Product Launches, Expanding Distribution Networks, Strategic Partnerships)

3. Asia-Pacific ATV Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Use in Agriculture (Agricultural Efficiency and Remote Area Accessibility)

3.1.2. Growing Popularity of Off-Road Sports (Influence of Sports Events and Adventure Tourism)

3.1.3. Rising Demand from Defense Sector (Military Adoption for Tactical Mobility)

3.1.4. Technological Advancements (Integration of Electric ATVs and AI-Based Safety Features)

3.2. Market Challenges

3.2.1. High Ownership and Maintenance Costs (Pricing Impact on Market Penetration)

3.2.2. Stringent Emission Regulations (Regulatory Barriers and Compliance Costs)

3.2.3. Limited Aftermarket Services (Servicing Availability in Remote Areas)

3.3. Opportunities

3.3.1. Expansion into Rural and Adventure Tourism Markets (Emerging Markets with High Adventure Tourism Potential)

3.3.2. Development of Environmentally Friendly ATVs (Electric and Hybrid Models for Eco-Conscious Consumers)

3.3.3. Rising Interest in Racing Events (Growth in ATV Racing Clubs and Sports Tourism)

3.4. Trends

3.4.1. Shift Towards Electric and Hybrid ATVs (Eco-Friendly Technologies and Energy Efficiency)

3.4.2. Increased Customization for Off-Road Use (Demand for Specialized Performance Upgrades)

3.4.3. Integration with GPS and Smart Technologies (Enhanced Navigation and Safety Features)

3.5. Government Regulations

3.5.1. Safety Standards for ATV Manufacturing and Usage

3.5.2. Emission Norms and Environmental Regulations

3.5.3. Import and Export Policies Impacting ATV Trade

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces (Competitive Landscape, Barriers to Entry, and Supplier Power)

3.9. Competition Ecosystem (New Entrants, Substitute Products, Supplier Influence)

4. Asia-Pacific ATV Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Utility ATVs

4.1.2. Sports ATVs

4.1.3. Youth ATVs

4.1.4. Electric ATVs

4.1.5. Hybrid ATVs

4.2. By Application (In Value %)

4.2.1. Agriculture

4.2.2. Sports

4.2.3. Military and Defense

4.2.4. Recreational and Tourism

4.2.5. Industrial

4.3. By Engine Capacity (In Value %)

4.3.1. Below 400cc

4.3.2. 400cc to 800cc

4.3.3. Above 800cc

4.4. By Propulsion Type (In Value %)

4.4.1. Gasoline-Powered ATVs

4.4.2. Electric-Powered ATVs

4.4.3. Hybrid-Powered ATVs

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Australia

4.5.5. India

5. Asia-Pacific ATV Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Polaris Industries Inc.

5.1.2. Honda Motor Co., Ltd.

5.1.3. Yamaha Motor Co., Ltd.

5.1.4. Kawasaki Heavy Industries, Ltd.

5.1.5. Suzuki Motor Corporation

5.1.6. BRP Inc. (Bombardier Recreational Products)

5.1.7. Arctic Cat Inc.

5.1.8. KTM AG

5.1.9. CFMoto Powersports Inc.

5.1.10. Hisun Motors Corp.

5.1.11. Textron Inc.

5.1.12. Kymco

5.1.13. TGB Motor Co. Ltd.

5.1.14. Taiwan Golden Bee Co.

5.1.15. Linhai Group

5.2. Cross Comparison Parameters (Revenue, Headquarters, Global Presence, Product Range, Technological Innovation, Number of Patents, Partnerships, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Acquisitions, Joint Ventures, Strategic Alliances)

5.5. Investment Analysis

5.6. Government Grants and Subsidies

5.7. Private Equity Investments

6. Asia-Pacific ATV Market Regulatory Framework

6.1. Safety and Emission Regulations

6.2. Certification Standards

6.3. Environmental Compliance

7. Asia-Pacific ATV Future Market Size (In USD Mn)

7.1. Market Size Projections

7.2. Key Factors Driving Future Growth (Focus on Electric and Hybrid ATVs, Expanding Adventure Tourism)

8. Asia-Pacific ATV Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Engine Capacity (In Value %)

8.4. By Propulsion Type (In Value %)

8.5. By Country (In Value %)

9. Asia-Pacific ATV Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Analysis (Agricultural, Sports Enthusiasts, Military Procurement, Tourism)

9.3. White Space Opportunity Identification

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ATV market's key stakeholders, from manufacturers to end-users, through comprehensive desk research. Proprietary databases and secondary research sources are used to gather market-specific data, focusing on economic drivers and technological advancements.

Step 2: Market Analysis and Construction

This phase includes compiling historical data on ATV adoption, sector penetration, and revenue generation. We also evaluate user adoption trends in agriculture, tourism, and defence to derive accurate market estimates.

Step 3: Hypothesis Validation and Expert Consultation

We conduct interviews with industry experts from leading ATV manufacturers and dealers to validate hypotheses. Insights gathered are cross-referenced with secondary data to ensure reliability.

Step 4: Research Synthesis and Final Output

This final step involves synthesizing all the gathered data to create a comprehensive, validated analysis. Direct engagement with key manufacturers ensures detailed insights into product segments and consumer behaviour.

Frequently Asked Questions

01. How big is the Asia-Pacific ATV Market?

The Asia-Pacific ATV market is valued at USD 567 million, driven by rising demand from the agriculture, tourism, and defence sectors.

02. What are the challenges in the Asia-Pacific ATV Market?

Challenges in the Asia-Pacific ATV market include stringent emission regulations, high ownership costs, and a limited aftermarket network, which could impact the market's penetration in certain regions.

03. Who are the major players in the Asia-Pacific ATV Market?

Asia-Pacific ATV market major players include Polaris, Honda, Yamaha, Kawasaki, and BRP, all known for their technological innovations and extensive product offerings.

04. What are the growth drivers of the Asia-Pacific ATV Market?

Key Asia-Pacific ATV market growth drivers include the rise of adventure tourism, technological advancements in electric and hybrid ATVs, and increased demand for ATVs in agricultural and military applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.