Asia Pacific Alternative Milk Products Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD1116

October 2024

95

About the Report

Asia Pacific Alternative Milk Products Market Overview

- The Asia Pacific Alternative Milk Products Market was valued at USD 8.89 billion in 2023. This growth is primarily driven by increasing consumer awareness of plant-based diets, lactose intolerance, the environmental concerns related to traditional dairy farming have encouraged consumers to switch to plant-based alternatives, further boosting market growth.

- Major players in the market include companies like Danone, Nestlé, Oatly, Vitasoy, and Blue Diamond Growers. These companies have established strong distribution networks and are investing in product innovation to cater to the diverse consumer base in the region. Their dominance in the market is supported by strategic mergers, acquisitions, and extensive marketing campaigns.

- In 2023, Oatly, a leading brand in the alternative milk industry, expanded its production facility in Singapore to meet the growing demand in the Asia Pacific region. This expansion is expected to increase their production capacity, enabling them to serve a larger market. This move highlights the increasing demand for oat milk in the region, driven by its health benefits and environmental sustainability.

- In the Asia Pacific region, China dominates the alternative milk products market share in 2023. This dominance is due to the large population base, rising disposable incomes, and increasing health awareness. The Chinese government’s focus on promoting plant-based diets as part of its national health strategy has also contributed to the market’s growth. Additionally, the growing vegan population in urban areas of China has driven the demand for plant-based milk products.

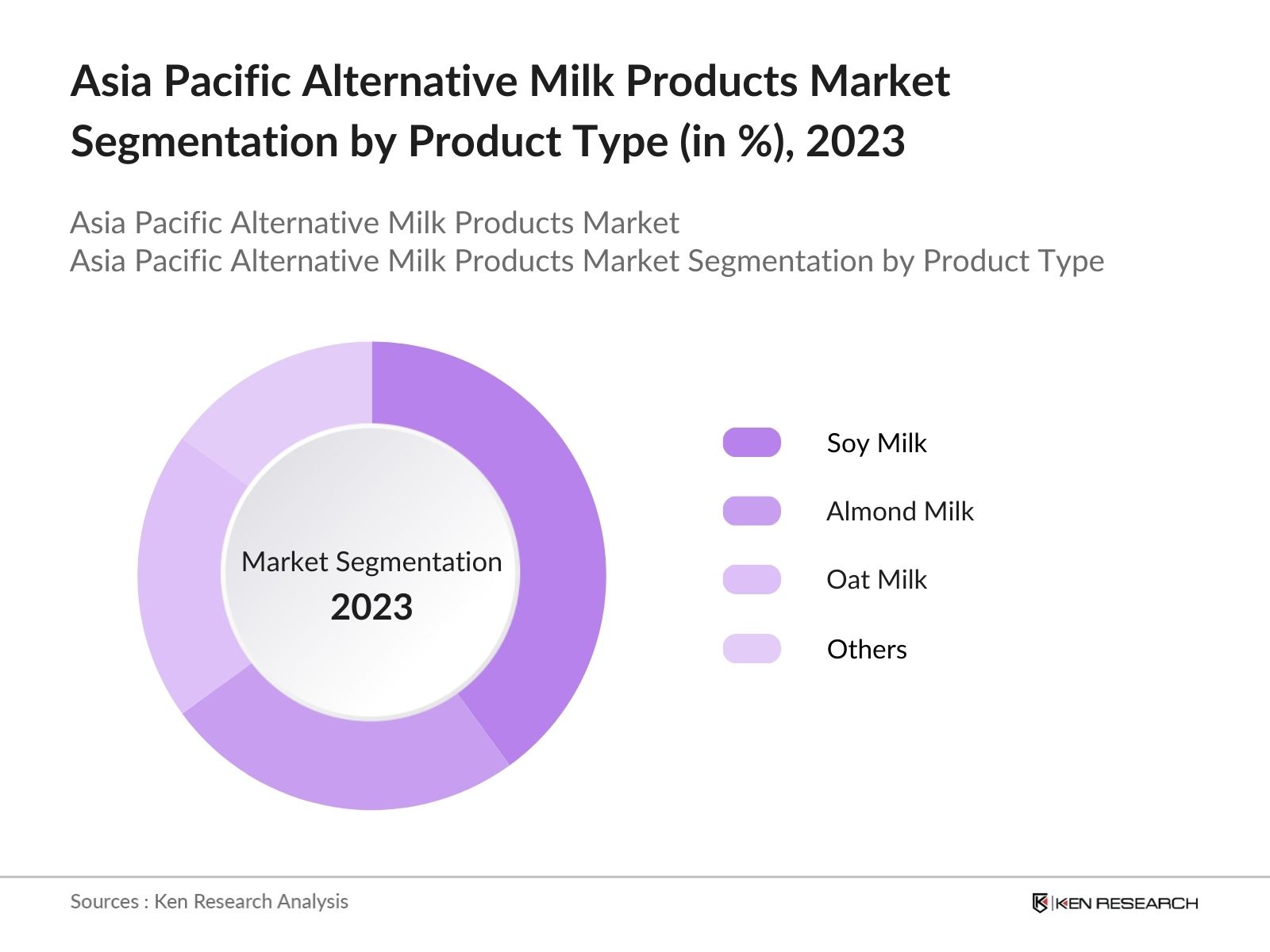

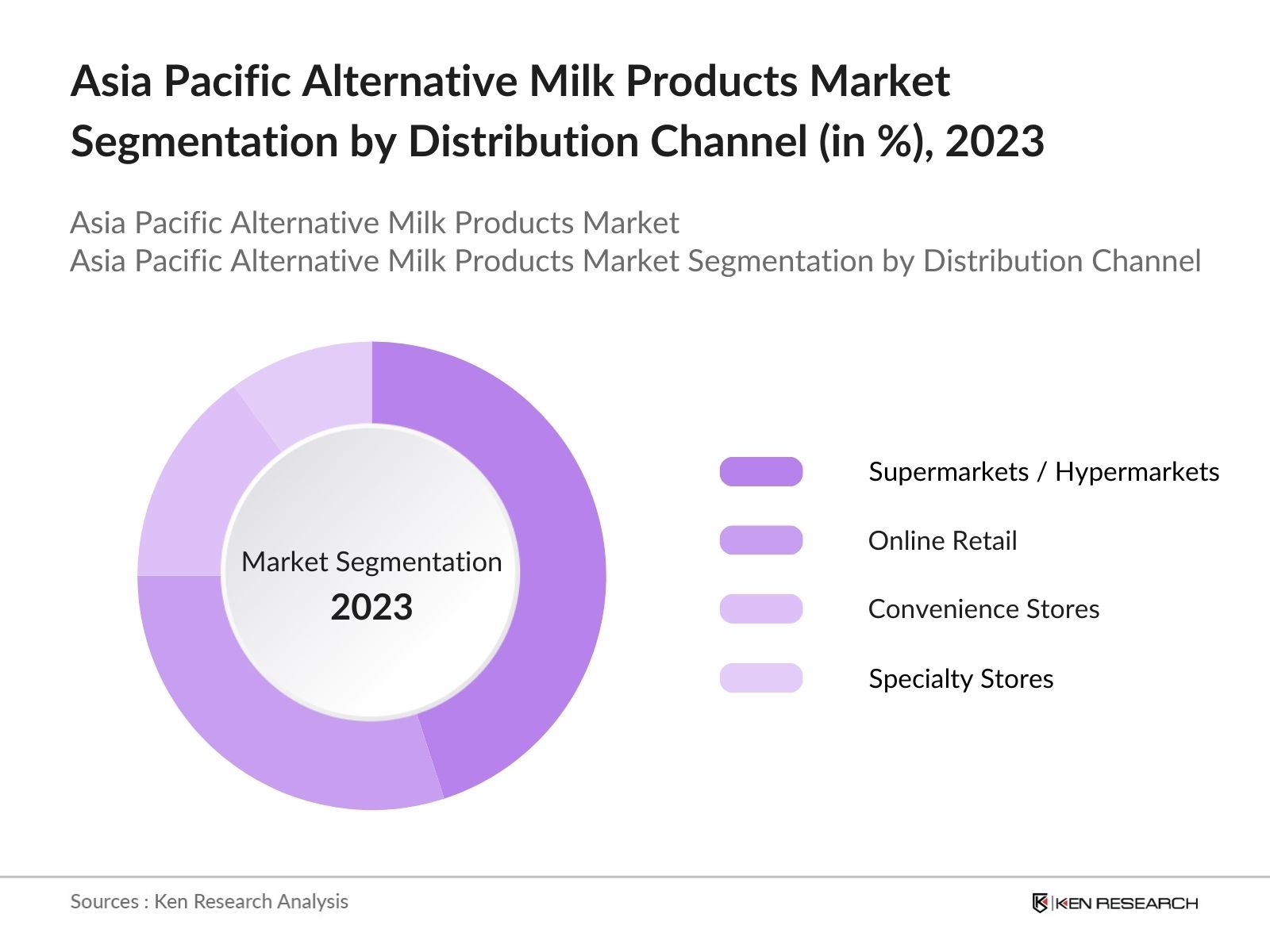

Asia Pacific Alternative Milk Products Market Segmentation

The Asia Pacific Alternative Milk Product market is segmented by various factors like Product Type, Distribution Channel and region etc.

By Product Type: The market is segmented by product type into soy milk, almond milk, oat milk, and others (Coconut milk, cashew mil etc.). In 2023, soy milk had a dominant market share. This dominance is attributed to its high protein content and affordability compared to other plant-based milk options. Soy milk has been a staple in many Asian diets for decades, which has contributed to its widespread acceptance.

By Distribution Channel: The market is also segmented by distribution channels into supermarkets/hypermarkets, online retail, convenience stores, and specialty stores. In 2023, supermarkets/hypermarkets held the largest market share. This dominance is due to the widespread availability and accessibility of these retail outlets across the Asia Pacific region.

By Region: The market is further segmented by region into China, Japan, Australia, South Korea, India and Rest of APAC. In 2023, China dominates the Asia Pacific Alternative Milk Products Market due to its large population, rising health consciousness, and increasing lactose intolerance. The growing middle class and urbanization further drive demand for plant-based milk alternatives, making China the leading market in the region.

Asia Pacific Alternative Milk Products Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Danone |

1919 |

Paris, France |

|

Nestlé |

1867 |

Vevey, Switzerland |

|

Oatly |

1994 |

Malmö, Sweden |

|

Vitasoy |

1940 |

Hong Kong, China |

|

Blue Diamond Growers |

1910 |

Sacramento, USA |

- Nestlé’s Introduction of Pea-based Milk: Nestlé launched a new pea-based milk product in 2024, targeting health-conscious consumers in the Asia Pacific region. The product, which contains 8 grams of protein per serving, is positioned as a high-protein alternative to both dairy and other plant-based milks. Nestlé’s pea-based milk has already garnered attention in Japan and South Korea, where the company expects to achieve sales of over 50 million liters by the end of 2024.

- Danone’s Acquisition of Local Brands: In 2024, Danone acquired two local plant-based milk brands in India and Vietnam to strengthen its market position in the Asia Pacific region. The acquisition is expected to increase Danone’s production capacity. This move allows Danone to leverage the established brand recognition and distribution networks of the acquired companies, helping to boost its market share in these rapidly growing markets.

Asia Pacific Alternative Milk Products Industry Analysis

Growth Drivers

- Increasing Consumer Health Consciousness: The number of individuals diagnosed with lactose intolerance in China alone exceeded 440 million. The health benefits associated with plant-based milk, such as lower cholesterol levels and the absence of lactose, have made it a preferred choice for health-conscious consumers. As a result, the market has seen an increase in demand for products like almond milk and oat milk.

- Growing Vegan and Flexitarian Population: The rise of veganism and flexitarian diets in Asia Pacific has contributed to the growing demand for alternative milk products. In 2024, the vegan population in Asia was recorded at over 70 million, with an additional 300 million people identifying as flexitarians. These dietary preferences have led to an increase in the demand for plant-based milk products.

- Innovation in Product Offerings: Fortified almond milk with added vitamins and minerals has seen 1.5 times increase in demand, reaching an annual sales volume of over 450 million liters. Additionally, the introduction of functional beverages with added probiotics or protein has captured the interest of health-conscious consumers, driving further market growth.

Challenges

- High Cost of Alternative Milk Products: In 2024, the average price of alternative milk was 60 INR per liter higher than dairy milk, making it less accessible to low-income consumers in countries like India. This price difference is primarily due to the higher cost of raw materials and production processes for plant-based milk. The challenge of affordability may limit market penetration in price-sensitive markets, where traditional dairy milk remains the dominant choice for consumers.

- Consumer Perception and Acceptance: Despite the growing popularity of plant-based milk, consumer skepticism about the taste, texture, and nutritional value of these products remains a challenge. Additionally, the perception that plant-based milk is a niche product for vegans rather than a mainstream alternative has slowed adoption rates in some parts of Asia. Addressing these consumer perceptions through education and product innovation is crucial for the market’s growth.

Government Initiatives

- Australia’s Plant-Based Food Initiative: In 2024, the Australian government launched a Plant-Based Food Initiative aimed at promoting the production and consumption of plant-based foods, including alternative milk. The initiative included subsidies for plant-based milk production, resulting in an increase in annual production capacity by 200 million liters. This initiative also included public awareness campaigns that reached Australians, promoting the environmental and health benefits of plant-based diets.

- Singapore’s Sustainable Food Strategy: As part of its Sustainable Food Strategy, the Singaporean government announced plans in 2024 to support the development of the alternative protein sector, including plant-based milk. The strategy includes funding of SGD 100 million for research and development in alternative protein products, with a focus on improving the taste and nutritional profile of plant-based milk.

Asia Pacific Alternative Milk Products Industry Future Outlook

The Asia Pacific Alternative Milk Products Market will grow exponentially primarily driven by increasing consumer awareness of plant-based diets, lactose intolerance, the environmental concerns related to traditional dairy farming have encouraged consumers to switch to plant-based alternatives, further boosting market growth.

Future Trends

- Adoption of Sustainable Packaging Solutions: Sustainability will continue to be a key focus in the alternative milk market, with companies adopting more environmentally friendly packaging solutions. This shift will be supported by consumer demand for sustainable products and government regulations aimed at reducing plastic waste.

- Growth of Online Retail Channels: The online retail channel for alternative milk products will see substantial growth over the next five years, driven by the increasing adoption of e-commerce in the Asia Pacific region. The convenience of online shopping, combined with the growing preference for home delivery services, will drive this trend.

Scope of the Report

|

By Product Type |

Soy Milk Almond Milk Oat Milk Others |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores |

|

By Region |

China Japan Australia South Korea India Rest of APAC |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Food and Beverage Manufacturers

Supermarkets/Hypermarkets Chains

Health and Wellness Brands

Vegan and Vegetarian Product Distributors

Nutritional Supplement Companies

Organic Food Producers

Dairy Alternatives Associations

Investors and VC Firms

Ministries of Health and Nutrition

Ministry of Agriculture

Banks and Financial Institutions

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Danone

Nestlé

Oatly

Vitasoy

Blue Diamond Growers

Alpro

Califia Farms

Ripple Foods

The Hain Celestial Group

Daiya Foods Inc.

Pacific Foods of Oregon

SunOpta Inc.

Tofutti Brands Inc.

Earth’s Own Food Company Inc.

Miyoko’s Creamery

Table of Contents

1. Asia-Pacific Alternative Milk Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Plant-Based Milk, Nut Milk, Soy Milk, Oat Milk, Rice Milk)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Alternative Milk Products Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Alternative Milk Products Market Analysis

3.1. Growth Drivers

3.1.1. Rising Vegan Population

3.1.2. Increasing Lactose Intolerance Rates

3.1.3. Health and Wellness Trends

3.1.4. Sustainability and Environmental Impact

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Limited Consumer Awareness in Developing Markets

3.2.3. Supply Chain Complexities for Raw Ingredients

3.3. Opportunities

3.3.1. Expansion in Emerging Markets (APAC)

3.3.2. Product Innovation and Flavor Development

3.3.3. Strategic Collaborations with Retailers

3.4. Trends

3.4.1. Fortification of Alternative Milks with Nutrients

3.4.2. Growth of E-commerce Channels for Distribution

3.4.3. Increased Adoption in the Foodservice Industry

3.5. Government Regulations

3.5.1. Food Labeling Standards (Dairy vs. Non-Dairy)

3.5.2. Sustainability Certifications (Organic, Non-GMO)

3.5.3. Subsidies and Incentives for Sustainable Agriculture

3.6. SWOT Analysis (For Key Market Segments)

3.7. Stakeholder Ecosystem (Dairy Industry, Retailers, Producers, Regulatory Bodies)

3.8. Porter’s Five Forces Analysis

3.9. Competitive Landscape and Ecosystem

4. Asia-Pacific Alternative Milk Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Almond Milk

4.1.2. Soy Milk

4.1.3. Oat Milk

4.1.4. Coconut Milk

4.1.5. Rice Milk

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. E-commerce

4.2.4. Specialty Stores

4.3. By Source (In Value %)

4.3.1. Plant-based

4.3.2. Grain-based

4.3.3. Nut-based

4.4. By End-Use (In Value %)

4.4.1. Beverages

4.4.2. Dairy Alternatives

4.4.3. Infant Formula

4.4.4. Functional Foods

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. South Korea

5. Asia-Pacific Alternative Milk Products Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Danone SA

5.1.2. Oatly Group AB

5.1.3. Nestle S.A.

5.1.4. Blue Diamond Growers

5.1.5. Califia Farms

5.1.6. Vitasoy International Holdings

5.1.7. SunOpta Inc.

5.1.8. Ripple Foods

5.1.9. Pacific Foods of Oregon

5.1.10. Elmhurst 1925

5.1.11. Daiya Foods Inc.

5.1.12. Hain Celestial Group

5.1.13. Earth’s Own Food Company Inc.

5.1.14. Kite Hill

5.1.15. Nutpods

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Headquarters, Product Portfolio, Market Reach, R&D Focus, Sustainability Initiatives, Certifications)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government Grants

5.9. Expansion Plans and New Product Launches

6. Asia-Pacific Alternative Milk Products Market Regulatory Framework

6.1. Food Safety and Standards (Plant-Based Labeling, Additive Restrictions)

6.2. Import and Export Regulations (Tariff Policies)

6.3. Certification Processes (Non-GMO, Organic Certifications)

6.4. Compliance with International Quality Standards

7. Asia-Pacific Alternative Milk Products Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Alternative Milk Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Source (In Value %)

8.4. By End-Use (In Value %)

8.5. By Region (In Value %)

9. Asia-Pacific Alternative Milk Products Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Advertising Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Asia Pacific Alternative milk products industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different alternative milk products companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple alternative milk products companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such alternative milk product companies.

Frequently Asked Questions

01 How big is the Asia Pacific Alternative Milk Products Market?

The Asia Pacific Alternative Milk Products Market was valued at USD 8.89 billion in 2023, driven by increasing consumer health consciousness, environmental sustainability concerns, and the growing vegan and flexitarian population.

02 What are the challenges in the Asia Pacific Alternative Milk Products Market?

Challenges in the Asia Pacific Alternative Milk Products Market include the high cost of alternative milk products, consumer skepticism regarding taste and nutritional value, supply chain disruptions, and regulatory hurdles related to labeling and marketing.

03 Who are the major players in the Asia Pacific Alternative Milk Products Market?

Key players in the Asia Pacific Alternative Milk Products Market include Danone, Nestlé, Oatly, Vitasoy, and Blue Diamond Growers. These companies lead the market due to their strong distribution networks, innovative product offerings, and strategic acquisitions.

04 What are the growth drivers of the Asia Pacific Alternative Milk Products Market?

The Asia Pacific Alternative Milk Products Market is driven by factors such as increasing consumer health consciousness, concerns over environmental sustainability, the rise of vegan and flexitarian diets, and continuous innovation in plant-based milk product offerings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.