Asia Pacific Aprotic Solvent Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD5528

December 2024

82

About the Report

Asia Pacific Aprotic Solvent Market Overview

- The Asia Pacific Aprotic Solvent Market is valued at USD 20 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for aprotic solvents in the pharmaceutical and electronics industries. The pharmaceutical industry uses aprotic solvents extensively as reaction mediums and in the manufacturing of APIs (Active Pharmaceutical Ingredients), while the electronics sector employs these solvents in lithium-ion battery production. These factors contribute to the growth of the market, with both industries demonstrating strong potential for future expansion.

- China and Japan are the dominant countries in the Asia Pacific Aprotic Solvent Market. China leads due to its vast chemical manufacturing base and rising demand for aprotic solvents in the production of pharmaceuticals and electric vehicle batteries. Japan, with its advanced electronics and automotive industries, follows closely behind. These countries benefit from their well-established industrial sectors and strong government support for innovation and sustainability.

- Compliance with the European Unions REACH regulation is a major factor affecting the aprotic solvent market in Asia Pacific. In 2022, several Asian companies exporting to the EU had to undergo rigorous testing and registration procedures, impacting their production timelines. Japan's Ministry of Economy, Trade, and Industry reported that over 200 chemical firms were affected by REACH compliance, requiring additional investments in testing and certification to meet European standards. This compliance pressure is reshaping the supply chain for aprotic solvents.

Asia Pacific Aprotic Solvent Market Segmentation

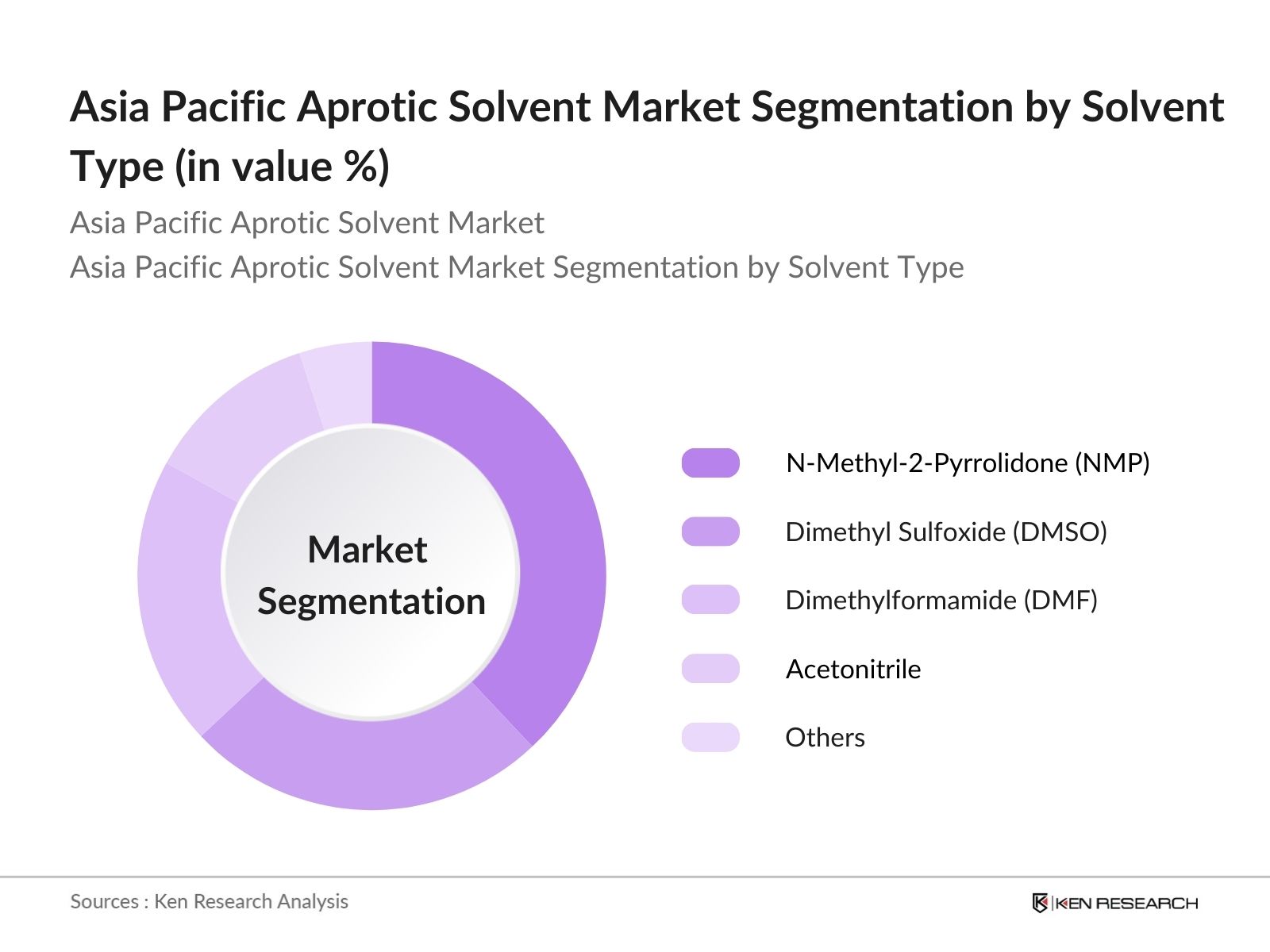

- By Solvent Type: The Asia Pacific Aprotic Solvent Market is segmented by solvent type into N-Methyl-2-Pyrrolidone (NMP), Dimethyl Sulfoxide (DMSO), Dimethylformamide (DMF), Acetonitrile, and others. Among these, NMP holds a dominant share due to its extensive use in the electronics industry, particularly for lithium-ion batteries. NMP is a key solvent in battery production, given its exceptional properties such as high polarity and ability to dissolve a wide range of materials. The demand for electric vehicles is rapidly increasing, thereby bolstering the growth of this sub-segment.

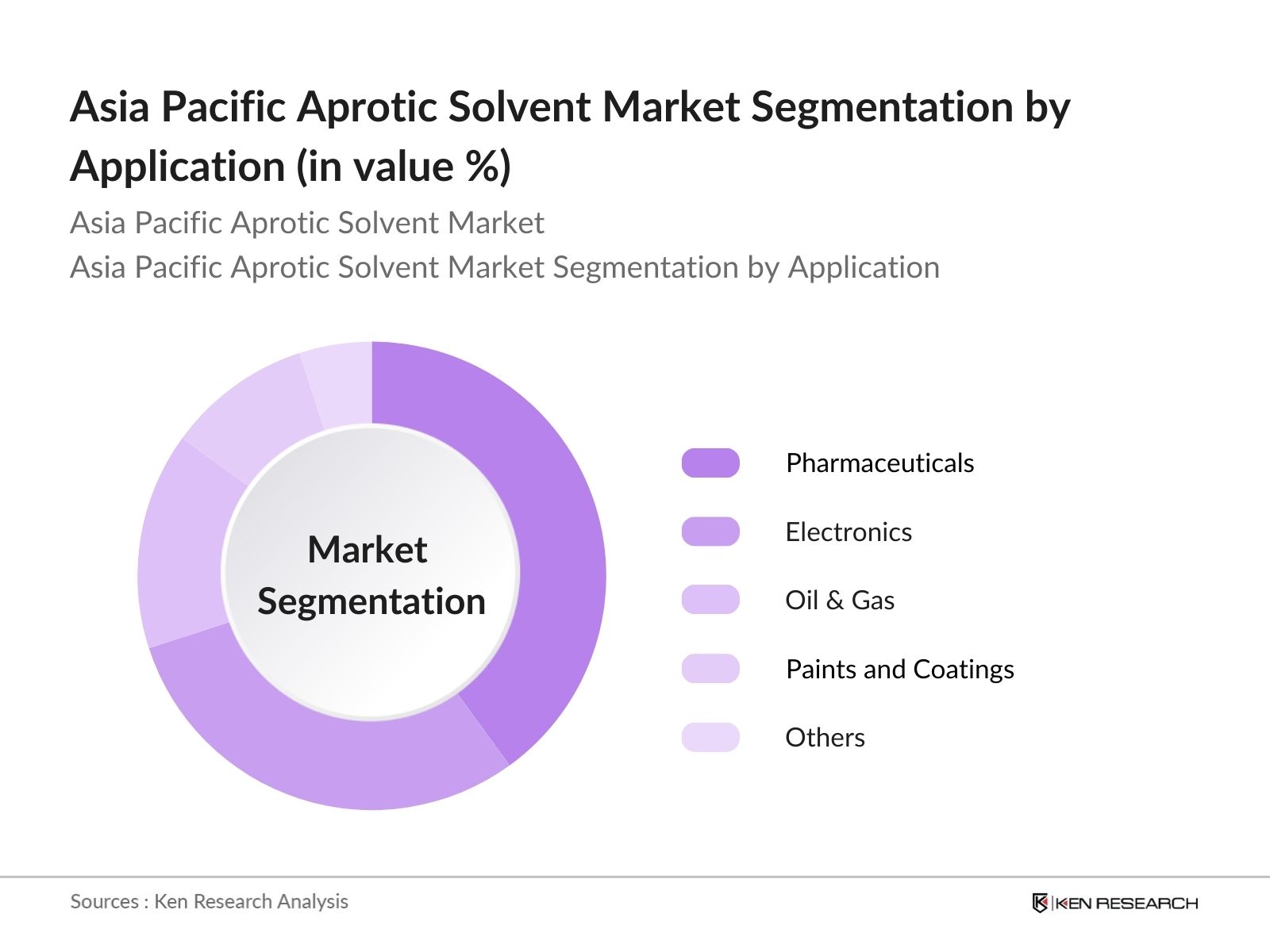

- By Application: The market is further segmented by application into Pharmaceuticals, Electronics, Oil & Gas, Paints and Coatings, and Others. Pharmaceuticals dominate this segmentation due to the increasing use of aprotic solvents in drug formulation and synthesis. Aprotic solvents are indispensable in the manufacturing of pharmaceuticals as they aid in the dissolution and reaction processes for producing APIs. The growing pharmaceutical industry in countries like China and India drives this segments market share.

Asia Pacific Aprotic Solvent Market Competitive Landscape

The Asia Pacific Aprotic Solvent Market is dominated by key global and regional players who have established a strong presence through robust production capacities and extensive research and development activities. These companies continuously strive to innovate and meet the growing demand for advanced solvents in various industrial applications. The competitive landscape is primarily shaped by innovations in green solvents and collaborations with local manufacturers.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment |

Manufacturing Capacity |

Market Reach |

Sustainability Initiatives |

Certifications |

Number of Employees |

|

Eastman Chemical Company |

1920 |

Tennessee, USA |

- |

- |

- |

- |

- |

- |

- |

|

BASF SE |

1865 |

Ludwigshafen, GER |

- |

- |

- |

- |

- |

- |

- |

|

Mitsubishi Chemical Holdings Corp |

2005 |

Tokyo, Japan |

- |

- |

- |

- |

- |

- |

- |

|

LyondellBasell Industries Holdings B.V. |

2009 |

Rotterdam, NLD |

- |

- |

- |

- |

- |

- |

- |

|

Solvay S.A. |

1863 |

Brussels, BEL |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Aprotic Solvent Market Analysis

Asia Pacific Aprotic Solvent Market Growth Drivers

- Rising Demand in Pharmaceuticals: The Asia Pacific aprotic solvent market is witnessing a demand surge driven by the expanding pharmaceutical industry, which is growing rapidly, especially in countries like India and China. The pharmaceutical sector is expected to reach a value of USD 485 billion by 2025 due to increased investment and development of new drugs. Aprotic solvents play a crucial role in the formulation and synthesis of pharmaceutical compounds, especially in the production of APIs (Active Pharmaceutical Ingredients). Government data from Chinas Ministry of Industry and Information Technology showed that pharmaceutical output grew by over 12% in 2023.

- Expanding Electronics Sector: The rapid expansion of the electronics sector in the Asia Pacific region is one of the leading factors boosting the demand for aprotic solvents. These solvents are vital in the production of lithium-ion batteries, especially as electric vehicles (EVs) gain market share. The region saw electric vehicle production increase to 3.1 million units in 2022, with China accounting for over 2.5 million of those units. Governments in the region, such as Chinas and South Koreas, have set ambitious targets for EV adoption, further driving the use of aprotic solvents in the electronics and battery manufacturing sectors.

- Industrialization and Urbanization: The ongoing industrialization and urbanization in Asia Pacific, particularly in countries like India, Vietnam, and Indonesia, have been instrumental in driving growth in the chemical industries. In 2023, over 60% of the population in Asia Pacific lived in urban areas, compared to just 42% two decades ago, and this rapid urban growth is creating a robust demand for chemicals, including aprotic solvents, which are used extensively in various industrial processes. India alone saw a growth of 10% in its industrial output in 2022, according to the Indian Ministry of Statistics.

Asia Pacific Aprotic Solvent Market Challenges

- Environmental and Regulatory Restrictions: Stringent environmental regulations in the Asia Pacific region are increasingly impacting the production and use of aprotic solvents. The Chinese government implemented new environmental protection regulations in 2022 that have led to the closure of over 500 chemical plants. Additionally, the increased enforcement of REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) compliance has affected the supply chain, leading to delays and reduced production capacities in major countries like Japan and South Korea. These regulations are aimed at reducing emissions and ensuring safe chemical handling, which poses a challenge for solvent manufacturers.

- High Production Costs: The production of aprotic solvents faces challenges due to the rising cost of raw materials and energy. In 2022, the cost of petrochemical raw materials rose by over 15% in key countries like China, India, and Japan due to supply chain disruptions and rising crude oil prices, according to data from the International Energy Agency (IEA). Energy costs, which account for a major portion of production expenses, have also increased by around 10% annually in some Asia Pacific nations, further adding to the cost burden.

Asia Pacific Aprotic Solvent Market Future Outlook

Over the next five years, the Asia Pacific Aprotic Solvent Market is expected to show robust growth driven by continued expansion in the pharmaceutical and electronics sectors. The increasing adoption of electric vehicles, especially in China, Japan, and South Korea, will further drive the demand for aprotic solvents such as NMP. Additionally, stringent regulations and a shift towards more sustainable chemical production methods will encourage innovation in green solvents. The market will likely witness a wave of mergers, acquisitions, and strategic partnerships as companies aim to strengthen their positions.

Asia Pacific Aprotic Solvent Market Opportunities

- Innovation in Green Solvents: There is growing interest in the development of bio-based aprotic solvents as industries shift toward sustainability. In 2022, Japans Ministry of the Environment launched a USD 2.5 billion fund to support green technologies, including the development of bio-based solvents. This shift is in response to increased consumer demand for environmentally friendly products and tighter government regulations. Bio-based solvents are being researched as alternatives to traditional aprotic solvents, and early tests have shown they can reduce toxic emissions by up to 50%, according to government reports.

- Strategic Collaborations: Strategic collaborations, joint ventures, and partnerships are providing lucrative opportunities for market players to expand their operations in Asia Pacific. In 2023, South Korean chemical companies formed over 30 joint ventures with foreign firms, aimed at expanding aprotic solvent production capacity. These collaborations not only bring in foreign investments but also facilitate technology transfers, helping to improve production efficiency. According to the South Korean Ministry of Trade, Industry, and Energy, foreign direct investment (FDI) in the chemicals sector rose by 18% in 2022.

Scope of the Report

|

Solvent Type |

NMP DMSO DMF Acetonitrile Others |

|

Application |

Pharmaceuticals Electronics Oil & Gas Paints, Others |

|

End-User Industry |

Chemical Processing Healthcare Automotive Energy, Others |

|

Function |

Solvent Chemical Reagent Extraction Agent Others |

|

Region |

China Japan India Australia Rest of Asia Pacific |

Products

Key Target Audience

Pharmaceutical Manufacturers

Chemical Processing Companies

Electronics Manufacturers

Automotive Battery Manufacturers

Oil & Gas Companies

Banks and Financial Institutions

Paints and Coatings Companies

Government and Regulatory Bodies (APAC Environmental Regulations Authority)

Investors and Venture Capitalist Firms

Memory updated

Companies

Players Mentioned in the Report

Eastman Chemical Company

BASF SE

Dupont

Mitsubishi Chemical Holdings Corporation

Ineos Group

Ashland Global Holdings Inc.

LyondellBasell Industries Holdings B.V.

Celanese Corporation

Shandong Qingyun Changxin Chemical Science-Tech Co., Ltd.

AlzChem Group AG

Table of Contents

1. Asia Pacific Aprotic Solvent Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Aprotic Solvent Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Aprotic Solvent Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand in Pharmaceuticals (Growth in pharmaceutical solvents)

3.1.2 Expanding Electronics Sector (Increased use in lithium-ion batteries)

3.1.3 Industrialization and Urbanization (Growth in chemical industries)

3.2 Market Challenges

3.2.1 Environmental and Regulatory Restrictions (Stringent environmental regulations)

3.2.2 High Production Costs (Cost of raw materials)

3.2.3 Safety and Toxicity Concerns (Health and safety regulations)

3.3 Opportunities

3.3.1 Innovation in Green Solvents (Development of bio-based aprotic solvents)

3.3.2 Strategic Collaborations (Joint ventures and partnerships)

3.3.3 Growing Demand in Emerging Markets (Expansion into Southeast Asia)

3.4 Trends

3.4.1 Adoption of Sustainable Practices (Shift towards eco-friendly alternatives)

3.4.2 Technological Advancements (Automation in production processes)

3.4.3 Increased Focus on Safety and Compliance (Improvement in safety measures)

3.5 Government Regulations

3.5.1 REACH Compliance (European Unions REACH regulation impacts)

3.5.2 APAC Regulatory Framework (Country-specific regulatory policies)

3.5.3 Environmental Protection Standards (Emission and disposal standards)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Asia Pacific Aprotic Solvent Market Segmentation

4.1 By Solvent Type (In Value %)

4.1.1 N-Methyl-2-Pyrrolidone (NMP)

4.1.2 Dimethyl Sulfoxide (DMSO)

4.1.3 Dimethylformamide (DMF)

4.1.4 Acetonitrile

4.1.5 Others (pyridines, etc.)

4.2 By Application (In Value %)

4.2.1 Pharmaceuticals

4.2.2 Electronics (Semiconductors, batteries)

4.2.3 Oil & Gas

4.2.4 Paints and Coatings

4.2.5 Others (Agrochemicals, etc.)

4.3 By End-User Industry (In Value %)

4.3.1 Chemical Processing

4.3.2 Healthcare

4.3.3 Automotive

4.3.4 Energy

4.3.5 Others (Laboratories, etc.)

4.4 By Function (In Value %)

4.4.1 Solvent (Dissolution capabilities)

4.4.2 Chemical Reagent (Reaction medium)

4.4.3 Extraction Agent (Purification of compounds)

4.4.4 Others

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Australia

4.5.5 Rest of Asia Pacific

5. Asia Pacific Aprotic Solvent Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Eastman Chemical Company

5.1.2 BASF SE

5.1.3 Dupont

5.1.4 Mitsubishi Chemical Holdings Corporation

5.1.5 Ineos Group

5.1.6 Ashland Global Holdings Inc.

5.1.7 LyondellBasell Industries Holdings B.V.

5.1.8 Celanese Corporation

5.1.9 Shandong Qingyun Changxin Chemical Science-Tech Co., Ltd.

5.1.10 AlzChem Group AG

5.1.11 Arkema S.A.

5.1.12 Honeywell International Inc.

5.1.13 Huntsman Corporation

5.1.14 Merck KGaA

5.1.15 Solvay S.A.

5.2 Cross Comparison Parameters (Product Portfolio, R&D Investment, Geographic Presence, Market Share, Revenue, Sustainability Initiatives, Manufacturing Capacity, Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Asia Pacific Aprotic Solvent Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Asia Pacific Aprotic Solvent Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Aprotic Solvent Future Market Segmentation

8.1 By Solvent Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Function (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Aprotic Solvent Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves identifying the primary drivers and stakeholders in the Asia Pacific Aprotic Solvent Market. Desk research will be conducted using secondary databases and proprietary sources to map the ecosystem of manufacturers, suppliers, and end-users.

Step 2: Market Analysis and Construction

Historical data on market performance will be compiled to assess growth trends, regional market penetration, and industry-specific revenue generation. This will include a detailed review of key applications such as pharmaceuticals and electronics.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including professionals from chemical and pharmaceutical companies, will be consulted to validate market hypotheses. These consultations will be carried out via structured interviews to gather qualitative insights on market dynamics.

Step 4: Research Synthesis and Final Output

The final research output will synthesize data from multiple sources, ensuring accuracy through triangulation with industry participants. This includes a comprehensive market analysis backed by quantitative and qualitative findings.

Frequently Asked Questions

01. How big is the Asia Pacific Aprotic Solvent Market?

The Asia Pacific Aprotic Solvent Market is valued at USD 20 billion, driven by increasing demand from pharmaceutical and electronics industries.

02. What are the major challenges in the Asia Pacific Aprotic Solvent Market?

Key challenges in the Asia Pacific Aprotic Solvent Market include stringent environmental regulations and high production costs, particularly for solvents like NMP and DMF, which have safety and toxicity concerns.

03. Who are the major players in the Asia Pacific Aprotic Solvent Market?

Major players in the Asia Pacific Aprotic Solvent Market include Eastman Chemical Company, BASF SE, Dupont, Mitsubishi Chemical Holdings Corporation, and Solvay S.A. These companies dominate due to their vast product portfolios and advanced R&D capabilities.

04. What are the growth drivers for the Asia Pacific Aprotic Solvent Market?

The growth of the Asia Pacific Aprotic Solvent market is driven by increasing demand for lithium-ion batteries in electric vehicles and the pharmaceutical industry's reliance on aprotic solvents for drug manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.