Asia Pacific Artificial Intelligence Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD1971

November 2024

84

About the Report

Asia Pacific Artificial Intelligence Market Overview

The Asia Pacific Artificial Intelligence (AI) market is valued at USD 36 billion based on a five-year historical analysis. This market is driven by the rapid digital transformation across industries, increased adoption of AI technologies in sectors such as healthcare, finance, and manufacturing, and rising investments in AI-driven solutions. The availability of large datasets and advancements in computing power have enabled AI systems to offer more sophisticated applications, fueling market growth.

In terms of geographical dominance, China and Japan lead the market, primarily due to significant government investments in AI infrastructure and R&D, along with strong industrial applications of AI in manufacturing and autonomous systems. Chinas focus on becoming a global leader in AI, through its ambitious AI national strategy, and Japans integration of AI into robotics and automation in industries, are key reasons for their dominance.

Governments in the Asia Pacific region is providing substantial funding and incentives for AI research and development. In 2023, South Korea committed $5 billion to AI R&D, with a focus on AI innovation in healthcare and autonomous systems (Korean Ministry of Trade, Industry, and Energy). Similarly, the Japanese government has allocated $2 billion for AI research, targeting key industries such as manufacturing and defense. These funding initiatives are essential for fostering AI growth and encouraging public and private sector collaboration in AI technology development.

Asia Pacific Artificial Intelligence Market Segmentation

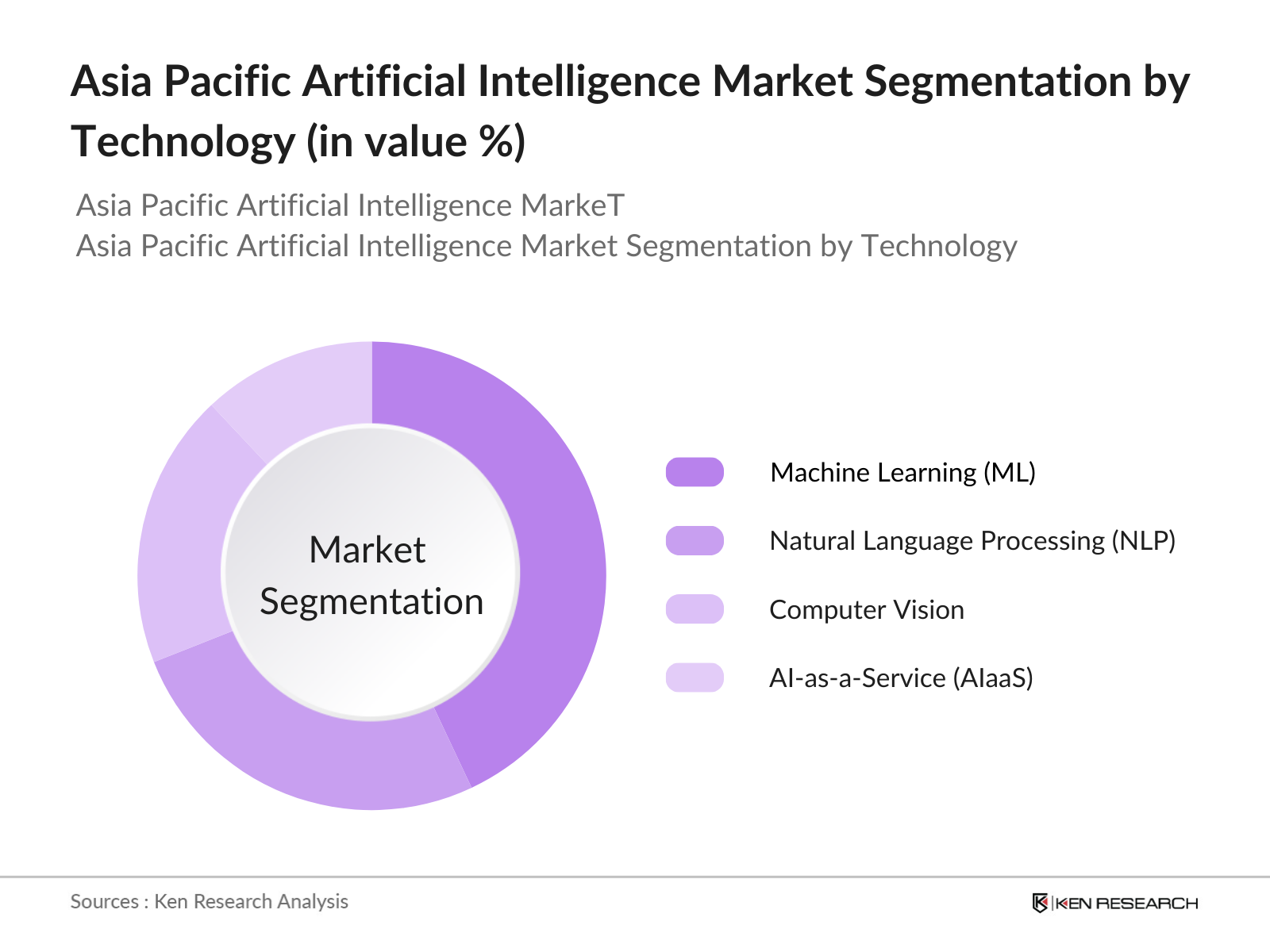

- By Technology: The market is segmented by Machine Learning (ML), Natural Language Processing (NLP), Computer Vision, and AI-as-a-Service (AIaaS). Among these, Machine Learning holds a dominant share in the market. This is due to its wide range of applications in predictive analytics, personalization of services, and decision-making tools across sectors such as healthcare, finance, and e-commerce. Companies are increasingly integrating ML to optimize business operations, automate repetitive tasks, and deliver enhanced customer experiences.

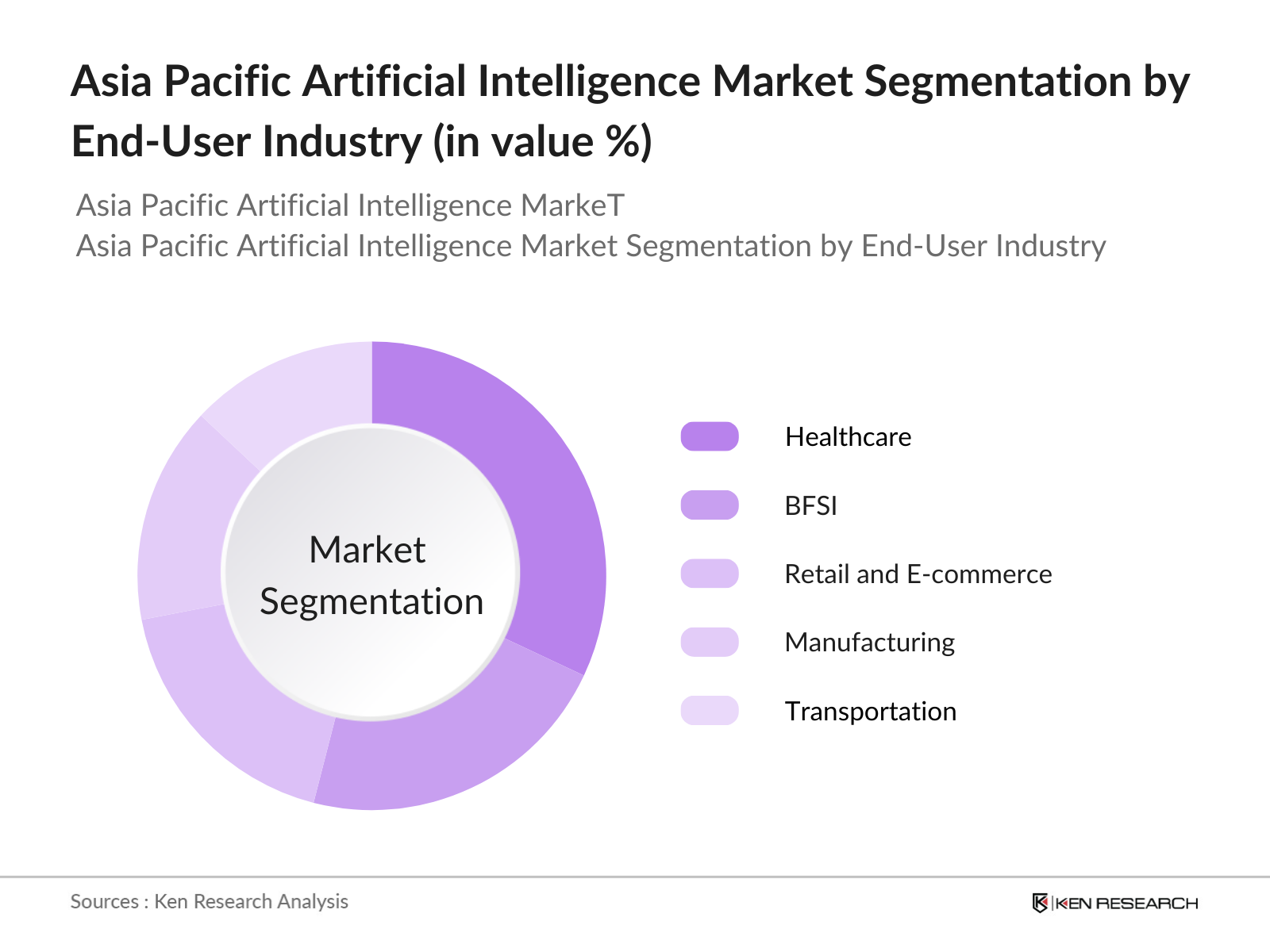

- By End-User Industry: The market is further segmented into Healthcare, BFSI (Banking, Financial Services, and Insurance), Retail and E-commerce, Manufacturing, and Transportation. The healthcare sector dominates the end-user industry segment, as AI is increasingly used in diagnostic tools, personalized medicine, and robotic surgery. The rising need for automation in hospital operations, coupled with AI's role in predictive analytics for health conditions, makes it a significant player in AI adoption.

Asia Pacific Artificial Intelligence Market Competitive Landscape

The Asia Pacific AI market is highly competitive, with a mix of local and global players leading the space. Major companies dominate the landscape due to their strong product portfolios, strategic partnerships, and investments in AI R&D. The competitive environment is shaped by these players' continuous efforts to improve AI technologies, expand their global presence, and form collaborations with local AI firms and research institutions.

|

Company Name |

Establishment Year |

Headquarters |

No. of Employees |

AI R&D Budget (USD) |

AI Product Portfolio |

Global Reach |

Strategic Partnerships |

Patents Filed |

Revenue from AI Solutions |

|---|---|---|---|---|---|---|---|---|---|

|

Google LLC |

1998 |

California, USA |

|||||||

|

Microsoft Corporation |

1975 |

Washington, USA |

|||||||

|

Alibaba Group |

1999 |

Hangzhou, China |

|||||||

|

Baidu Inc. |

2000 |

Beijing, China |

|||||||

|

NVIDIA Corporation |

1993 |

California, USA |

Asia Pacific Artificial Intelligence Market Analysis

Growth Drivers

- Increasing Demand for Automation: The Asia Pacific AI market is experiencing rapid growth due to the increasing need for automation across sectors such as manufacturing, logistics, and customer service. For example, Japan, total orders for industrial robots from Japanese manufacturers reached a record955.8 billion yen, contributing significantly to industrial output (World Bank). The Chinese government has also promoted AI automation in its "Made in China 2025" initiative, which encourages the use of AI to improve manufacturing efficiency. This push towards automation is expected to drive the AI market further, as industries increasingly rely on AI to streamline processes.

- Surge in AI-driven Enterprise Solutions: There is a marked increase in AI adoption by enterprises across the Asia Pacific region, especially in countries like Singapore and Australia. In Singapore, over 70% of businesses have integrated some form of AI-driven solution by 2023 (Ministry of Trade and Industry, Singapore). AI-powered customer service chatbots, predictive maintenance tools in manufacturing, and personalized recommendations in e-commerce are some notable examples of AI enterprise applications. Additionally, in 2024, the number of AI startups in Southeast Asia alone surged to over 3,000, underscoring the role of AI in business transformation.

- AI Adoption in Sectors like Healthcare, Finance, and Retail: Healthcare, finance, and retail sectors in the Asia Pacific region have seen an exponential rise in AI adoption. In 2022, China's AI-enabled healthcare applications reached over 10,000 hospitals, assisting in diagnostics and telemedicine (National Health Commission of China). In India, AI solutions are revolutionizing retail, with over 60% of large retailers utilizing AI for inventory management and customer personalization. Furthermore, in the finance sector, AI-based fraud detection systems are now operational in 95% of top banks across the Asia Pacific, driven by increasing digitization in 2024.

Market Challenges

- Talent Shortage in AI Fields: One of the biggest challenges in the Asia Pacific AI market is the shortage of AI talent. According to a 2024 report from UNESCO, the region requires an additional 500,000 skilled AI professionals to meet demand in the coming years. Countries like Japan and South Korea are experiencing an AI skills gap, with only 20,000 certified AI professionals available for approximately 100,000 AI-related job openings in 2023 (Japan Ministry of Education). This shortage is slowing down AI adoption in sectors requiring complex AI models, such as autonomous driving and healthcare.

- High Costs of AI Implementation and Infrastructure: The high cost of AI infrastructure remains a barrier to widespread adoption. In countries like Australia, setting up AI infrastructure can cost businesses up to $5 million annually, depending on the complexity of the system (Australian Department of Industry, Science, Energy and Resources). Moreover, cloud-based AI platforms come with a significant operational cost, making it difficult for small and medium enterprises (SMEs) to invest in AI technologies. As a result, many companies struggle to scale their AI projects due to financial constraints.

Asia Pacific Artificial Intelligence Market Future Outlook

Over the next five years, the Asia Pacific AI market is expected to experience growth due to technological advancements, increased adoption in key industries like healthcare and finance, and continuous government support through AI national strategies. The growth will also be driven by the rising demand for AI-powered automation in manufacturing and logistics, further fueling the expansion of AI across various sectors in the region.

Future Market Opportunities

- Expanding AI Use Cases in Smart Cities and Autonomous Systems: Smart cities are a key driver for AI growth in the Asia Pacific region. In 2024, China alone allocated USD 14 billion towards smart city development, with AI playing a critical role in urban management, transportation, and environmental monitoring (Chinese Ministry of Housing and Urban-Rural Development). South Koreas Busan and Singapore are also incorporating AI into public infrastructure, utilizing autonomous systems for traffic management and public safety. These projects open up significant opportunities for AI applications, particularly in urban planning, transportation, and sustainability.

- Cross-industry Collaborations for AI Innovation: Collaborations between industries, research institutions, and government bodies are accelerating AI innovation across the region. In 2023, over 1,500 cross-industry AI partnerships were formed in countries like Australia, Japan, and India (World Economic Forum). These collaborations focus on areas such as AI-driven drug discovery, manufacturing automation, and autonomous transportation systems. Public-private partnerships are further promoting AI-based innovation, with governments offering funding and research incentives to foster AI development. Such initiatives present opportunities for enhanced AI-driven innovation in various sectors.

Scope of the Report

|

By Technology |

Machine Learning (ML) |

|

By Application |

Healthcare |

|

By End-User Industry |

Enterprise |

|

By Deployment Model |

Cloud-based |

|

By Region |

China |

Products

Key Target Audience

AI Solution Providers

AI Hardware Manufacturers

Venture Capitalists and Investment Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology (MIIT), National AI Council)

Banks and Financial Institutes

End-User Enterprises (Healthcare, BFSI, Retail)

Cloud Service Providers

Autonomous Systems Developers

Research & Development Institutes

Companies

Major Players

Google LLC

Microsoft Corporation

Alibaba Group

Baidu Inc.

NVIDIA Corporation

IBM Corporation

Tencent Holdings Ltd.

Fujitsu Limited

NEC Corporation

SAP SE

SenseTime

H2O.ai

DataRobot

Appier Inc.

Samsung Electronics Co.

Table of Contents

1. Asia Pacific Artificial Intelligence Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (in terms of AI adoption rate, industry vertical integration, and digital transformation)

1.4. Market Segmentation Overview

2. Asia Pacific Artificial Intelligence Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (notable AI innovation, government initiatives, private sector AI investments)

3. Asia Pacific Artificial Intelligence Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for automation

3.1.2. Surge in AI-driven enterprise solutions

3.1.3. AI adoption in sectors like healthcare, finance, and retail

3.1.4. Government digitalization initiatives

3.2. Market Challenges

3.2.1. Talent shortage in AI fields

3.2.2. High costs of AI implementation and infrastructure

3.2.3. Data privacy and regulatory constraints

3.2.4. Limited understanding of AI applications among SMEs

3.3. Opportunities

3.3.1. AI as a Service (AIaaS) adoption in small businesses

3.3.2. Increased AI penetration in emerging economies

3.3.3. Expanding AI use cases in smart cities and autonomous systems

3.3.4. Cross-industry collaborations for AI innovation

3.4. Trends

3.4.1. Rise in explainable AI (XAI)

3.4.2. AI-driven edge computing

3.4.3. AI in human-machine interfaces (HMIs)

3.4.4. AIs role in predictive analytics and big data

3.5. Government Regulation

3.5.1. National AI policies and regulatory frameworks (AI ethics guidelines, data sovereignty)

3.5.2. AI-specific funding and incentives

3.5.3. Public-private partnerships to foster AI development

3.5.4. Regulations concerning AI-driven technologies (e.g., autonomous vehicles, AI in healthcare)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem (AI platforms, AI service providers, AI R&D institutions)

4. Asia Pacific Artificial Intelligence Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Machine Learning (ML)

4.1.2. Natural Language Processing (NLP)

4.1.3. Computer Vision

4.1.4. Speech Recognition

4.1.5. AI-as-a-Service (AIaaS)

4.2. By Application (In Value %)

4.2.1. Healthcare

4.2.2. BFSI (Banking, Financial Services, and Insurance)

4.2.3. Retail and E-commerce

4.2.4. Manufacturing

4.2.5. Transportation and Logistics

4.3. By End-User Industry (In Value %)

4.3.1. Enterprise

4.3.2. Government

4.3.3. Education

4.3.4. IT & Telecom

4.3.5. Defense

4.4. By Deployment Model (In Value %)

4.4.1. Cloud-based

4.4.2. On-premise

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. ASEAN Countries

5. Asia Pacific Artificial Intelligence Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Google LLC

5.1.2. Microsoft Corporation

5.1.3. IBM Corporation

5.1.4. Alibaba Group

5.1.5. Tencent Holdings Ltd.

5.1.6. Baidu Inc.

5.1.7. Amazon Web Services (AWS)

5.1.8. NVIDIA Corporation

5.1.9. Fujitsu Limited

5.1.10. NEC Corporation

5.1.11. SAP SE

5.1.12. SenseTime

5.1.13. H2O.ai

5.1.14. DataRobot

5.1.15. Appier Inc.

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. AI R&D Investment

5.2.3. Revenue from AI Solutions

5.2.4. Number of Patents

5.2.5. Headquarters

5.2.6. Partnership Ecosystem

5.2.7. AI Product Portfolio

5.2.8. Inception Year

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Artificial Intelligence Market Regulatory Framework

6.1. AI Ethics and Compliance Standards

6.2. Data Privacy Regulations

6.3. Certification and Approval Processes

7. Asia Pacific Artificial Intelligence Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (advancements in AI technologies, rising AI adoption in industries, and government support)

8. Asia Pacific Artificial Intelligence Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Deployment Model (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Artificial Intelligence Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involved mapping the Asia Pacific AI ecosystem, identifying the major stakeholders, and conducting extensive desk research through secondary and proprietary databases. This step helped in identifying the core variables influencing the market dynamics, such as AI adoption rates, investment trends, and industry vertical applications.

Step 2: Market Analysis and Construction

This phase compiled historical data on AI technology adoption, end-user industry performance, and revenue generation from AI solutions. Analysis of AIs penetration in sectors like healthcare and BFSI was conducted to assess future market trends.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were developed concerning AI technology trends and market drivers. These were validated through computer-assisted interviews (CATI) with industry experts, providing insights into AI developments, strategic partnerships, and investment patterns.

Step 4: Research Synthesis and Final Output

In this final step, data was cross-verified with AI solution providers, ensuring a comprehensive and validated analysis of the Asia Pacific AI market. The bottom-up approach was used to complement the gathered statistics, confirming market trends and future outlook.

Frequently Asked Questions

01. How big is the Asia Pacific Artificial Intelligence Market?

The Asia Pacific Artificial Intelligence market is valued at USD 36 billion, driven by rapid advancements in AI technologies and increased adoption in key industries like healthcare, BFSI, and manufacturing.

02. What are the challenges in the Asia Pacific Artificial Intelligence Market?

Challenges include a shortage of skilled AI professionals, high costs of AI infrastructure, and complex regulatory frameworks concerning data privacy and AI ethics. These factors may slow down AI adoption in smaller enterprises.

03. Who are the major players in the Asia Pacific Artificial Intelligence Market?

Key players include Google LLC, Microsoft Corporation, Alibaba Group, Baidu Inc., and NVIDIA Corporation. These companies lead due to their strong AI product portfolios, strategic partnerships, and significant R&D investments.

04. What are the growth drivers of the Asia Pacific Artificial Intelligence Market?

The market is driven by technological advancements in AI, growing adoption in industries such as healthcare and finance, and supportive government policies across major countries like China and Japan.

05. Which sectors are adopting AI the fastest in the Asia Pacific region?

The healthcare and BFSI sectors are the fastest adopters of AI technologies, leveraging AI for diagnostic tools, robotic surgery, personalized healthcare, and fraud detection in financial services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.