Asia Pacific Automotive Plastic Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD3259

December 2024

97

About the Report

Asia Pacific Automotive Plastic Market Overview

- Asia Pacific Automotive Plastic Market is valued at USD 14.5 billion, primarily driven by the increased adoption of lightweight plastic materials in vehicle manufacturing. Lightweighting initiatives by automotive manufacturers to improve fuel efficiency, along with stringent government regulations on emission standards, are major drivers propelling the growth of this market. The rising demand for electric vehicles (EVs) has further boosted the need for automotive plastics, especially in electric vehicle battery housings and other under-the-hood applications.

- The dominance of countries like China, Japan, and India in this market is attributed to their large-scale automotive production, government incentives for EV manufacturing, and substantial investments in automotive research and development. China, being the largest automobile producer, benefits from a highly developed supply chain and significant government support for electric vehicles. Japan's dominance is driven by its strong automotive heritage and its focus on integrating innovative materials in vehicle manufacturing, while India benefits from a rapidly growing domestic automotive industry and rising consumer demand for lighter, more fuel-efficient vehicles.

- Asia Pacific governments are enforcing stringent recycling policies to manage automotive plastic waste. In 2024, Japan's End-of-Life Vehicle (ELV) law mandated the recycling of 95% of vehicle materials, including plastics. Similarly, Chinas Circular Economy Promotion Law encourages the use of recycled materials in automotive manufacturing. This regulatory environment supports the integration of recycled plastics into new vehicle production, contributing to the circular economy.

Asia Pacific Automotive Plastic Market Segmentation

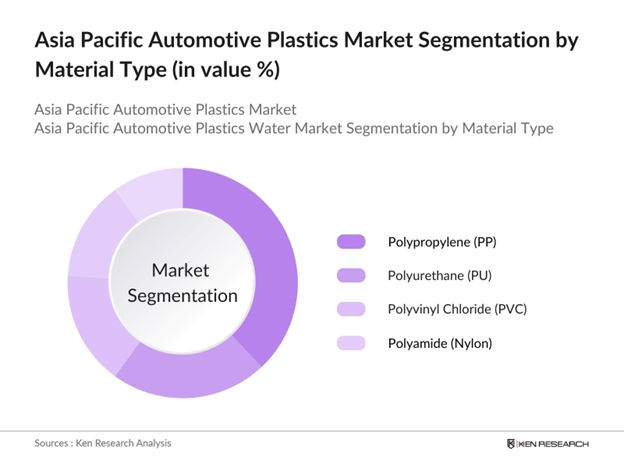

By Material Type: The Asia Pacific Automotive Plastic Market is segmented by material type into Polypropylene (PP), Polyurethane (PU), Polyvinyl Chloride (PVC), Acrylonitrile Butadiene Styrene (ABS), and Polyamide (Nylon). Polypropylene (PP) holds a dominant market share under the material type segmentation due to its wide usage in both interior and exterior automotive parts. Its affordability, durability, and lightweight characteristics make it highly preferred for applications like bumpers, door panels, and dashboards. The extensive availability of polypropylene in the Asia Pacific region, combined with its versatility in automotive manufacturing, reinforces its market dominance.

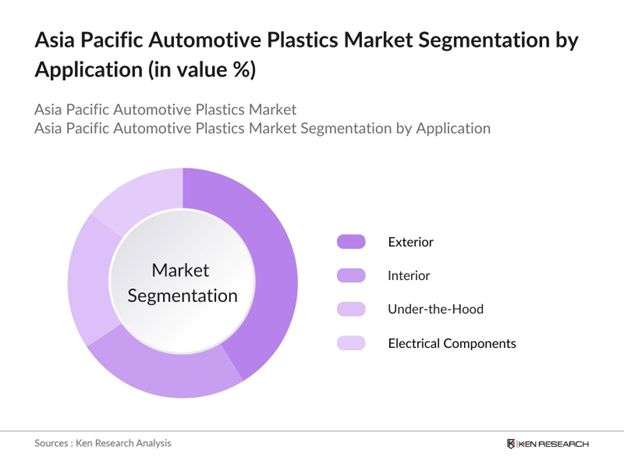

By Application: The market is segmented by application into Exterior, Interior, Under-the-Hood, and Electrical Components. Exterior applications, including bumpers, grills, and headlamps, dominate the market due to the high volume of plastic used in the exterior parts of vehicles. These components require durable, lightweight materials to meet performance standards, and plastics like PP and ABS are heavily employed for such purposes. The dominance of exterior applications is reinforced by the continued demand for fuel-efficient and aesthetically pleasing vehicle designs, where plastics offer a balance of strength, flexibility, and cost-effectiveness.

Asia Pacific Automotive Plastic Market Competitive Landscape

The Asia Pacific Automotive Plastic Market is characterized by the presence of a few dominant players, each holding substantial market shares. The major players include international giants like BASF SE and Covestro AG, which lead the market with their innovation in advanced plastics and sustainability initiatives. Companies like SABIC and LyondellBasell also play a crucial role in the market due to their vast production capabilities and involvement in automotive plastic innovation. Furthermore, regional players such as LG Chem and Mitsubishi Chemical Corporation are strengthening their positions through strategic alliances and R&D investments.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

R&D Expenditure |

Sustainability Initiatives |

Product Portfolio Diversification |

Automotive Market Penetration |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

- |

- |

- |

- |

- |

|

Covestro AG |

2015 |

Leverkusen, Germany |

- |

- |

- |

- |

- |

|

SABIC |

1976 |

Riyadh, Saudi Arabia |

- |

- |

- |

- |

- |

|

LyondellBasell Industries Holdings B.V. |

2007 |

Rotterdam, Netherlands |

- |

- |

- |

- |

- |

|

LG Chem Ltd. |

1947 |

Seoul, South Korea |

- |

- |

- |

- |

- |

Asia Pacific Automotive Plastic Market Analysis

Growth Drivers

- Vehicle Lightweighting Initiatives: The automotive industry in the Asia Pacific region is undergoing a transformation driven by vehicle lightweighting initiatives. According to the World Bank, the Asia Pacific automotive sector employed over 65 million workers in 2023, with an increasing focus on reducing vehicle weight to enhance fuel efficiency and meet emission standards. These efforts are integral to achieving sustainability goals, as lighter vehicles consume less fuel, aligning with macroeconomic targets like the reduction of CO2 emissions, which stood at 5.7 billion metric tons in 2022 in the region.

- Increased Production of Electric Vehicles: Electric vehicle (EV) production in Asia Pacific is accelerating, driven by government incentives and the rising demand for sustainable transport. In 2024, China alone accounted for 28 million vehicles on the road, of which 15% were electric vehicles. The shift towards EVs demands advanced automotive plastics for components like battery casings and interiors, contributing to weight reduction and enhanced vehicle performance.

- Demand for Enhanced Fuel Efficiency: Asia Pacifics automotive sector is increasingly focused on enhancing fuel efficiency to reduce costs and meet regulatory standards. In 2022, Japans average fuel consumption for light vehicles was recorded at 24.3 km per liter, with new models aiming to achieve even higher efficiency. Plastic components play a critical role in this process by reducing vehicle weight and enhancing aerodynamics, accelerating the adoption of advanced plastics in automotive design and manufacturing.

Challenges

- High Production Costs: The production costs associated with automotive plastics remain a challenge, particularly due to fluctuations in raw material prices. In 2024, the price of crude oil, a key component in plastic production, stood at $74 per barrel, which directly impacts the cost of plastic resins. This has created economic pressure on manufacturers in emerging markets like India and Vietnam, where automotive production costs are already elevated.

- Environmental Concerns: Environmental concerns surrounding plastic waste management are significant challenges for the automotive plastic market. In 2023, the Asia Pacific region generated 142 million tons of plastic waste, with only 22% being recycled, according to the UN Environment Programme (UNEP). The automotive sector contributes to this issue through the disposal of non-recyclable plastic components. Governments across the region, particularly in countries like Indonesia and Malaysia, have begun implementing strict regulations to reduce plastic waste.

Asia Pacific Automotive Plastic Market Future Outlook

Asia Pacific Automotive Plastic Market is expected to experience substantial growth. This growth is largely driven by the increasing production of electric vehicles, continuous innovation in advanced plastic materials, and heightened government efforts to promote eco-friendly transportation solutions. Rising investments in lightweight and durable materials will further augment market expansion, particularly in countries like China and Japan, which are at the forefront of automotive advancements. The growing preference for fuel-efficient vehicles, along with stringent environmental regulations, will continue to propel the demand for automotive plastics in the region.

Market Opportunities

- Advanced Material Innovation: The innovation of high-performance plastics presents a significant growth opportunity for the Asia Pacific automotive market. These materials offer superior durability, heat resistance, and chemical stability, making them ideal for use in electric vehicle battery components and autonomous vehicle systems. In 2024, advanced polymers such as polycarbonate and polyamide are seeing increased application in high-performance areas like automotive lighting and interior components.

- Growth in Autonomous Vehicle Segment: Autonomous vehicle technology is gaining traction across Asia Pacific, creating new opportunities for automotive plastics. As of early 2022, South Korea had conducted tests with a fleet of approximately 200-250 autonomous vehicles, accumulating around 720,000 kilometers of driving data. Automotive plastics are integral to this trend, offering lightweight solutions that can house sophisticated electronics and sensors required for autonomous driving systems.

Scope of the Report

|

Material Type |

Polypropylene (PP) Polyurethane (PU) Polyvinyl Chloride (PVC) Acrylonitrile Butadiene Styrene (ABS) Polyamide (Nylon) |

|

Application |

Exterior Interior Under-the-Hood Electrical Components |

|

Manufacturing Process |

Injection Molding Blow Molding Extrusion Thermoforming |

|

Vehicle Type |

Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles |

|

Region |

China India Japan South Korea Australia |

Products

Key Target Audience

Automotive Manufacturers

Electric Vehicle (EV) Manufacturers

Telecommunications Companies

Game Development Companies

Media and Entertainment Companies

Content Delivery Network (CDN) Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology, China)

Companies

Major Players

BASF SE

Covestro AG

SABIC

LyondellBasell Industries Holdings B.V.

LG Chem Ltd.

Teijin Limited

Solvay S.A.

Borealis AG

Mitsubishi Chemical Corporation

Hanwha Total Petrochemical Co. Ltd.

RTP Company

UBE Industries, Ltd.

Toray Industries, Inc.

Evonik Industries AG

ExxonMobil Chemical

Table of Contents

1. Asia Pacific Automotive Plastic Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Automotive Plastic Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Automotive Plastic Market Analysis

3.1. Growth Drivers

3.1.1. Vehicle Lightweighting Initiatives (Automotive Weight Reduction)

3.1.2. Increased Production of Electric Vehicles (EV Market Penetration)

3.1.3. Regulatory Mandates for Emission Reduction (Emission Standards Compliance)

3.1.4. Demand for Enhanced Fuel Efficiency (Fuel Efficiency Improvements)

3.2. Market Challenges

3.2.1. High Production Costs (Raw Material Costs)

3.2.2. Environmental Concerns (Plastic Waste Management)

3.2.3. Availability of Substitutes (Bioplastics, Metal Alternatives)

3.3. Opportunities

3.3.1. Advanced Material Innovation (High-Performance Plastics Development)

3.3.2. Growth in Autonomous Vehicle Segment (Technological Integration)

3.3.3. Expanding Aftermarket for Automotive Plastics (Aftermarket Growth Potential)

3.4. Trends

3.4.1. Usage of Recycled Automotive Plastics (Circular Economy Approach)

3.4.2. Adoption of 3D Printing Technologies (Additive Manufacturing)

3.4.3. Integration of Plastics in Autonomous Driving Systems (Smart Vehicle Design)

3.5. Government Regulation

3.5.1. Emission Control Norms (Euro 6/VI Standards)

3.5.2. Plastic Recycling Policies (Automotive Recycling Directives)

3.5.3. Safety Standards for Plastics (Crashworthiness Standards)

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Suppliers, Distributors)

3.8. Porter’s Five Forces (Bargaining Power, Supplier Influence, New Entrants, etc.)

3.9. Competition Ecosystem

4. Asia Pacific Automotive Plastic Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Polypropylene (PP)

4.1.2. Polyurethane (PU)

4.1.3. Polyvinyl Chloride (PVC)

4.1.4. Acrylonitrile Butadiene Styrene (ABS)

4.1.5. Polyamide (Nylon)

4.2. By Application (In Value %)

4.2.1. Exterior (Bumpers, Grills, Headlamps)

4.2.2. Interior (Dashboard, Door Panels, Seats)

4.2.3. Under-the-Hood (Engine Covers, Air Intake Manifolds)

4.2.4. Electrical Components (Battery Housings, Connectors)

4.3. By Manufacturing Process (In Value %)

4.3.1. Injection Molding

4.3.2. Blow Molding

4.3.3. Extrusion

4.3.4. Thermoforming

4.4. By Vehicle Type (In Value %)

4.4.1. Passenger Vehicles

4.4.2. Light Commercial Vehicles (LCVs)

4.4.3. Heavy Commercial Vehicles (HCVs)

4.4.4. Electric Vehicles (EVs)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Automotive Plastic Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Covestro AG

5.1.3. LyondellBasell Industries Holdings B.V.

5.1.4. SABIC

5.1.5. Borealis AG

5.1.6. Solvay S.A.

5.1.7. Teijin Limited

5.1.8. Evonik Industries AG

5.1.9. Mitsubishi Chemical Corporation

5.1.10. LG Chem Ltd.

5.1.11. UBE Industries, Ltd.

5.1.12. Toray Industries, Inc.

5.1.13. RTP Company

5.1.14. ExxonMobil Chemical

5.1.15. Hanwha Total Petrochemical Co. Ltd.

5.2. Cross Comparison Parameters (Revenue, Automotive Market Penetration, R&D Expenditure, Number of Patents, Sustainability Initiatives, Headquarters, Production Capacities, Market Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Partnerships

5.8. Government Funding

5.9. Research and Development Focus

6. Asia Pacific Automotive Plastic Market Regulatory Framework

6.1. Environmental Standards

6.2. Emission Standards and Compliance

6.3. Certification and Labeling Requirements

7. Asia Pacific Automotive Plastic Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Automotive Plastic Market Future Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By Manufacturing Process (In Value %)

8.4. By Vehicle Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Automotive Plastic Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Analysis

9.3. Product Positioning and Differentiation Strategies

9.4. White Space Opportunity Identification

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying the key variables within the Asia Pacific Automotive Plastic Market. This involves constructing an ecosystem map of major stakeholders, including manufacturers, suppliers, and automotive OEMs. Comprehensive desk research is conducted using secondary and proprietary databases to define the factors influencing market growth.

Step 2: Market Analysis and Construction

Historical data pertaining to the Asia Pacific Automotive Plastic Market is compiled and analyzed, including production volumes, usage of specific plastic types, and trends in automotive manufacturing. A thorough evaluation of the supply-demand dynamics is conducted to assess the market's current landscape.

Step 3: Hypothesis Validation and Expert Consultation

To validate market assumptions, interviews are conducted with key industry players, including executives from automotive OEMs, plastic manufacturers, and sustainability experts. These insights help refine the market data and ensure the accuracy of the revenue estimates.

Step 4: Research Synthesis and Final Output

This final phase synthesizes all the gathered data, cross-referencing the insights from stakeholders with bottom-up analysis. The report provides a comprehensive, validated outlook of the Asia Pacific Automotive Plastic Market, including future projections and key growth opportunities.

Frequently Asked Questions

01. How big is the Asia Pacific Automotive Plastic Market?

The Asia Pacific Automotive Plastic Market is valued at USD 14.5 billion, driven by rising demand for lightweight and durable materials in automotive manufacturing, particularly in electric vehicles.

02. What are the challenges in the Asia Pacific Automotive Plastic Market?

Key challenges include the high costs of raw materials, concerns around plastic waste management, and competition from alternative materials like bioplastics and metals, which can impact market growth.

03. Who are the major players in the Asia Pacific Automotive Plastic Market?

Major players in the market include BASF SE, Covestro AG, SABIC, LyondellBasell, and LG Chem Ltd. These companies are dominant due to their production capacity, innovation in material development, and strong market presence.

04. What drives the Asia Pacific Automotive Plastic Market?

The market is driven by the increasing demand for lightweight materials to enhance fuel efficiency, the rapid growth of electric vehicles, and the need to comply with stringent emission regulations across the Asia Pacific region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.