Asia Pacific Autonomous Material Handling Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD2732

November 2024

81

About the Report

Asia Pacific Autonomous Material Market Overview

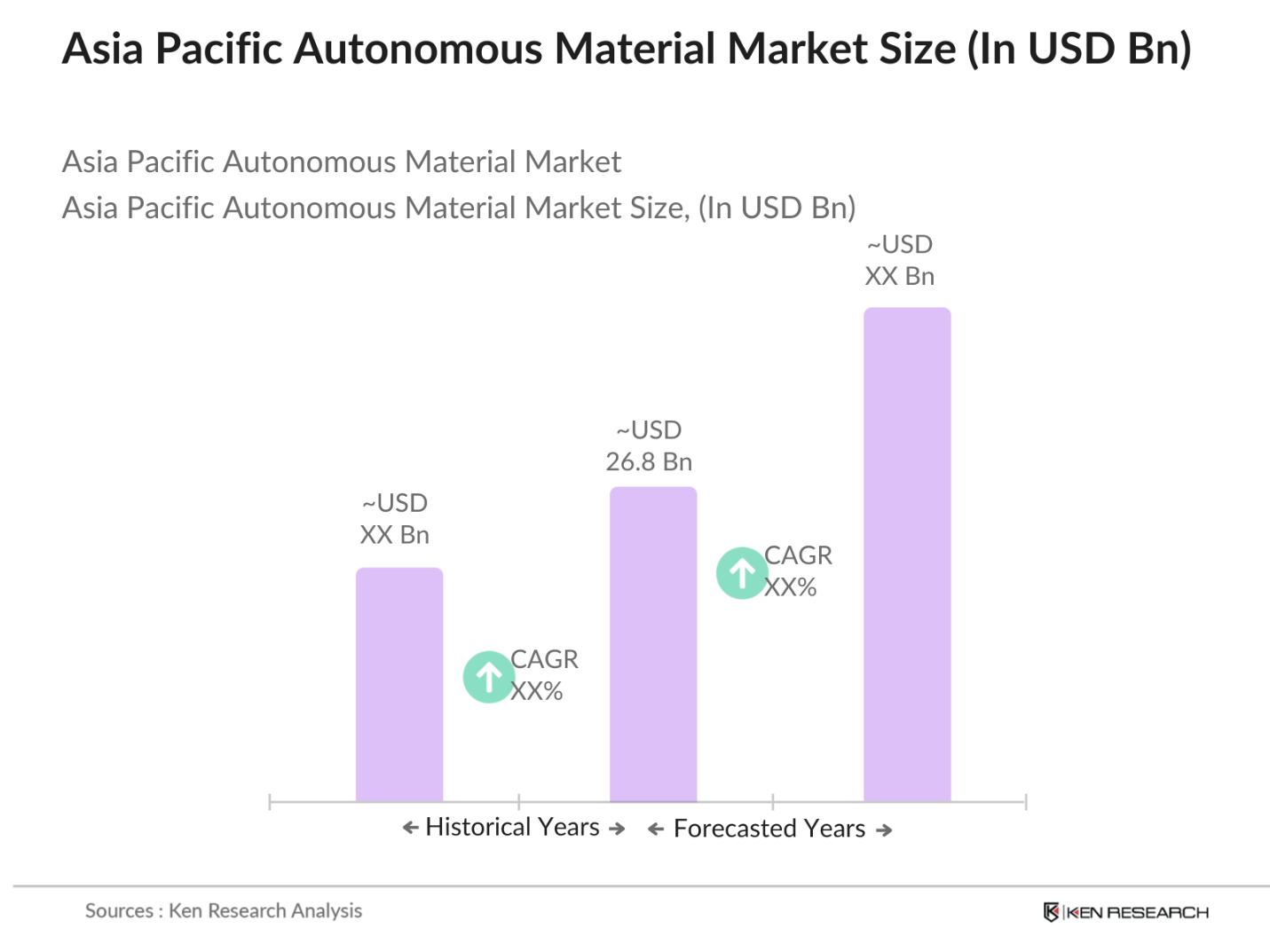

- The Asia Pacific autonomous material handling market has experienced significant growth, reaching a valuation of USD 26.8 billion. This expansion is primarily driven by rapid industrialization, the proliferation of e-commerce, and the increasing adoption of automation technologies across various industries. The demand for efficient and cost-effective material handling solutions has led to widespread implementation of autonomous systems in manufacturing, warehousing, and logistics sectors.

- China and Japan are the dominant players in this market. China's dominance stems from its extensive manufacturing base and substantial investments in automation to enhance productivity and reduce labor costs. Japan's leadership is attributed to its advanced technological infrastructure and early adoption of robotics and automation in industrial processes, positioning it at the forefront of autonomous material handling innovations.

- The integration of the Internet of Things (IoT) and Industry 4.0 principles is transforming material handling operations. In 2022, the number of IoT-connected devices in the Asia-Pacific region reached approximately 8.6 billion, facilitating real-time data exchange and process optimization. This connectivity enables predictive maintenance and enhances the efficiency of autonomous material handling systems.

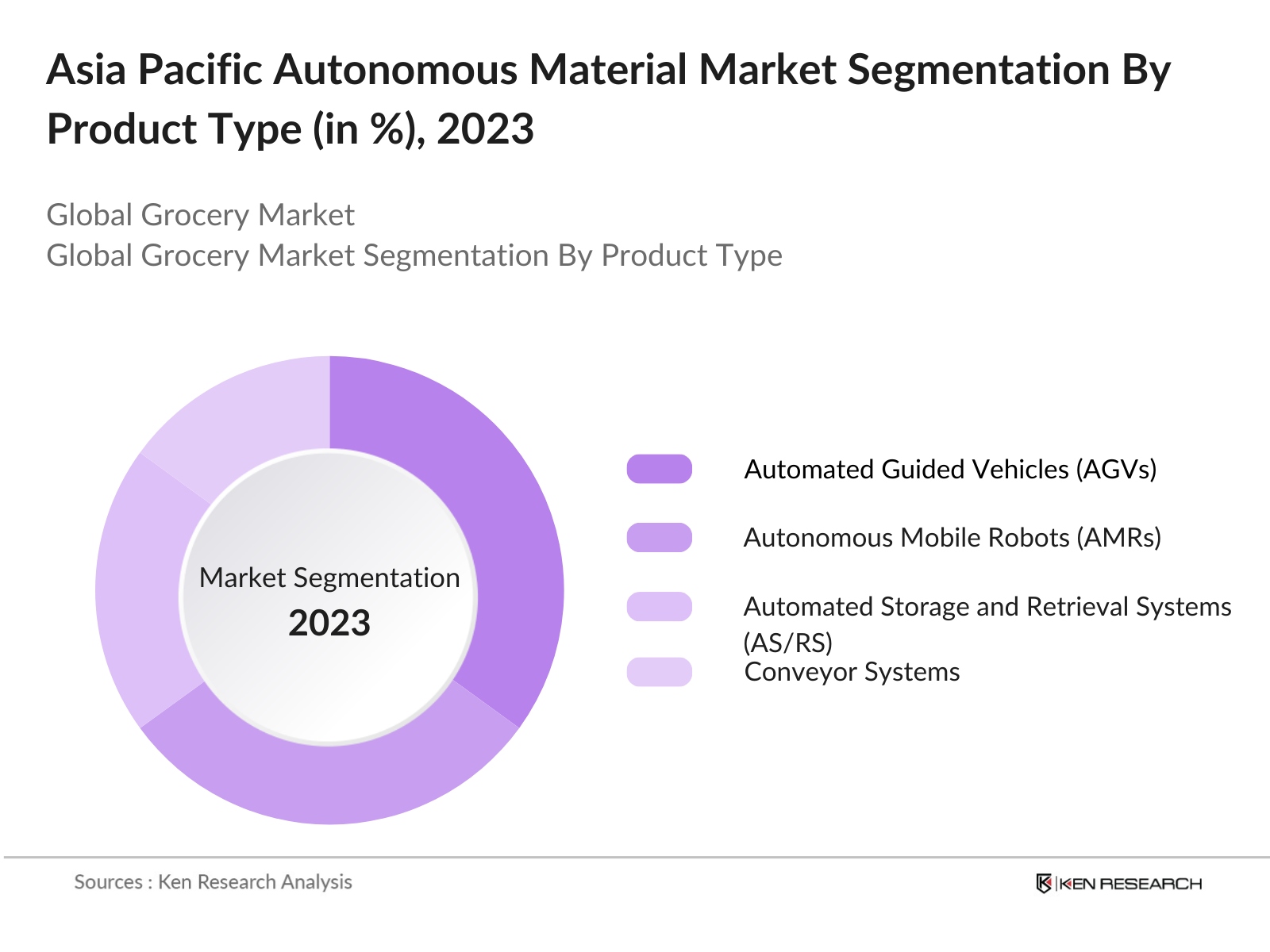

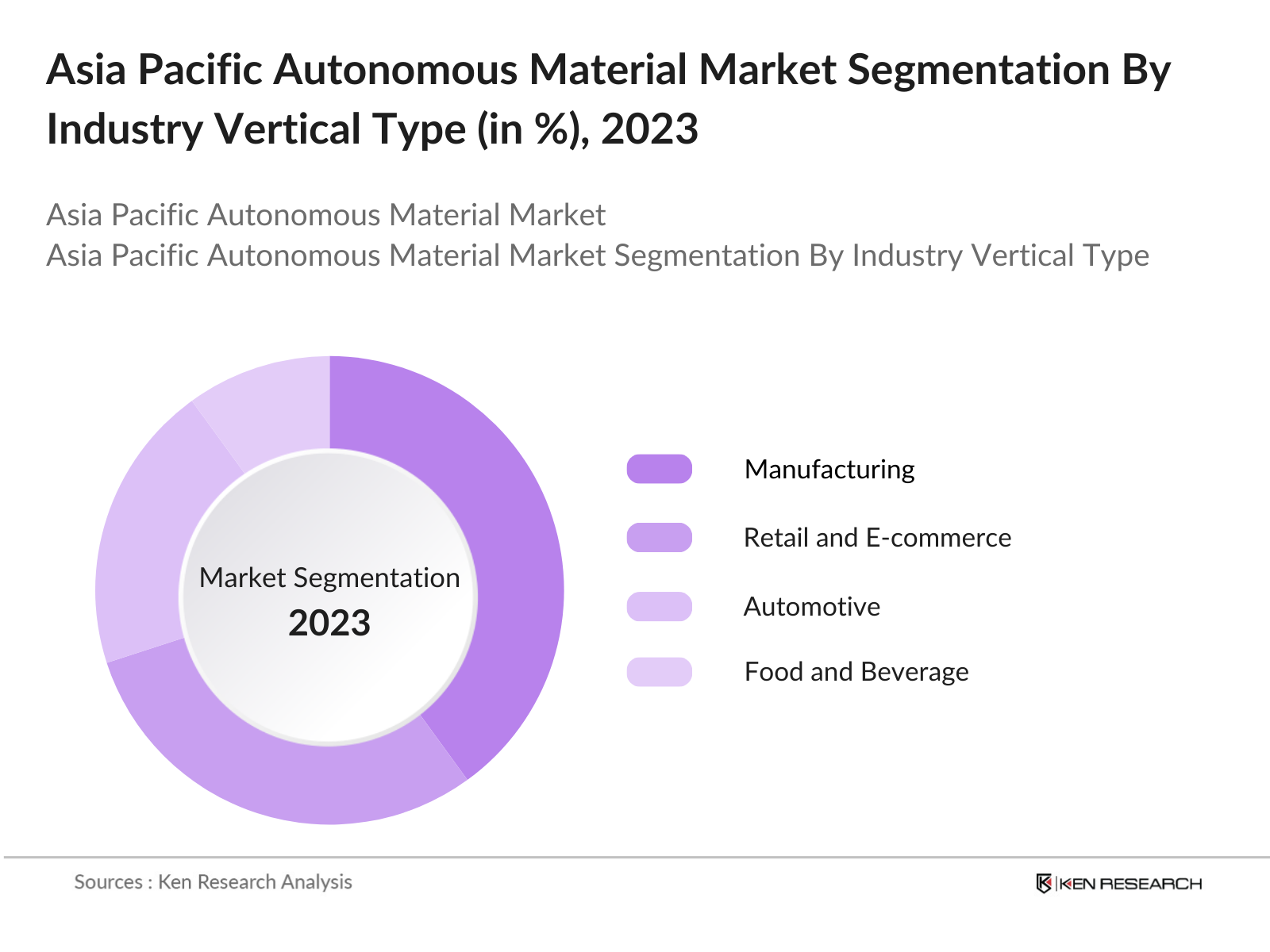

Asia Pacific Autonomous Material Market Segmentation

By Product Type: The Asia Pacific autonomous material handling market is segmented by product type into Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, and Palletizers. Among these, AGVs hold a dominant market share due to their versatility and efficiency in transporting materials within warehouses and manufacturing facilities. Their ability to operate in diverse environments and handle various payloads makes them a preferred choice for industries aiming to enhance operational efficiency.

By Industry Vertical: The market is further segmented by industry vertical into Manufacturing, Retail and E-commerce, Automotive, Food and Beverage, and Pharmaceuticals. The Manufacturing sector leads in market share, driven by the need for streamlined operations and reduced labor costs. The integration of autonomous material handling systems in manufacturing processes has resulted in increased productivity and minimized human intervention, thereby enhancing overall operational efficiency.

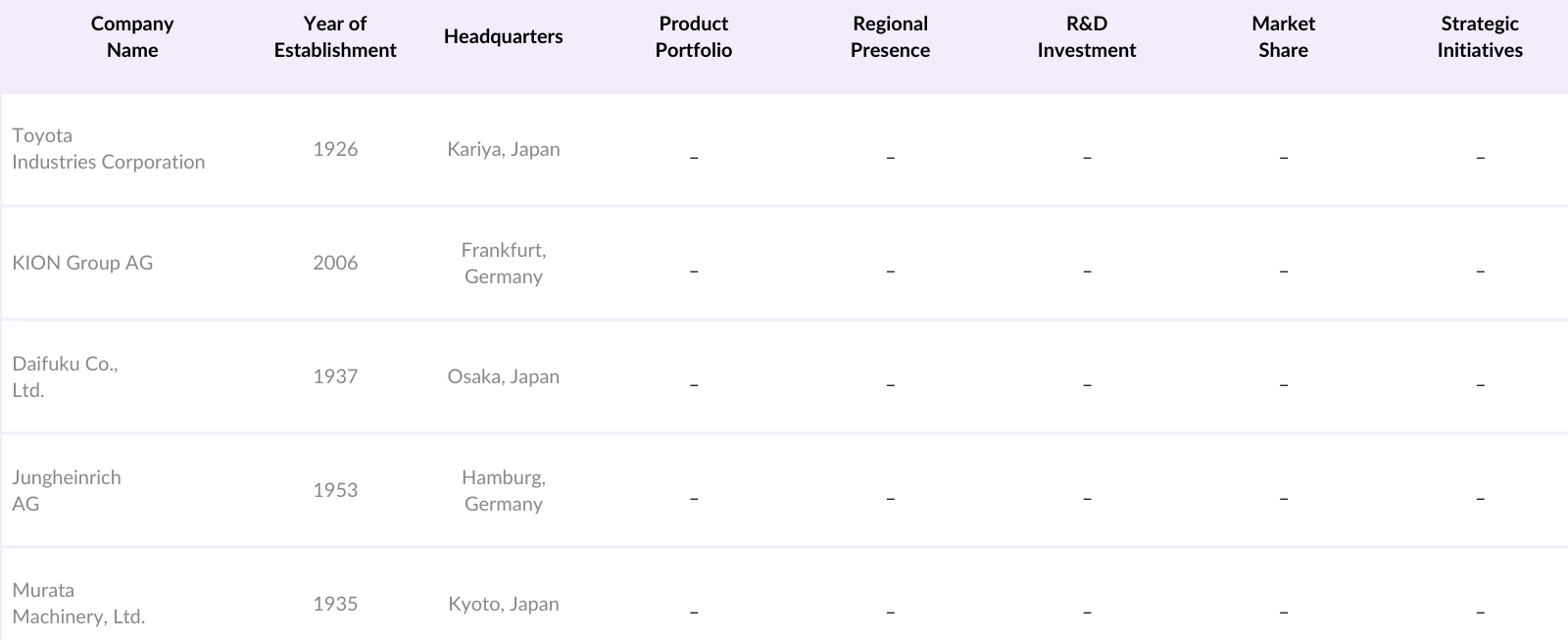

Asia Pacific Autonomous Material Market Competitive Landscape

The Asia Pacific autonomous material handling market is characterized by the presence of several key players who contribute to its dynamic and competitive nature. These companies are at the forefront of innovation, offering a range of products and solutions tailored to meet the diverse needs of industries across the region.

Asia Pacific Autonomous Material Industry Analysis

Growth Drivers

- Advancements in Robotics and AI: The Asia-Pacific region has witnessed significant advancements in robotics and artificial intelligence (AI), leading to increased adoption of autonomous material handling systems. In 2022, China produced approximately 270,000 industrial robots, accounting for over 50% of global production, indicating a robust manufacturing capability in robotics. Additionally, Japan's industrial robot exports reached 136,069 units in 2022, reflecting a strong presence in the robotics market. These developments have enhanced the efficiency and capabilities of material handling systems across various industries.

- Expansion of E-commerce and Retail Sectors: The rapid growth of e-commerce in the Asia-Pacific region has significantly increased the demand for efficient material handling solutions. In 2022, China's online retail sales reached approximately 13.1 trillion yuan, highlighting the scale of e-commerce activities. Similarly, India's e-commerce market was valued at around $50 billion in 2022, with projections indicating continued growth. This surge necessitates advanced material handling systems to manage the increased volume of goods efficiently.

- Labor Cost Optimization: Rising labor costs in the Asia-Pacific region have prompted industries to seek automation solutions. For instance, China's average annual wage in the manufacturing sector increased to approximately 82,783 yuan in 2022, reflecting a steady rise in labor expenses. Similarly, in South Korea, the average monthly wage in manufacturing was about 3.5 million KRW in 2022. Implementing autonomous material handling systems helps companies optimize labor costs and maintain competitiveness.

Market Challenges

- High Initial Investment Costs: The deployment of autonomous material handling systems involves substantial initial investments. For example, the cost of implementing automated guided vehicles (AGVs) can range from $100,000 to $150,000 per unit, depending on specifications. Additionally, integrating these systems with existing infrastructure may require further financial commitments, posing challenges for small and medium-sized enterprises (SMEs) with limited budgets.

- Integration with Existing Systems: Integrating autonomous material handling systems with existing operations can be complex. Legacy systems may lack compatibility with modern automation technologies, necessitating significant modifications. For instance, a survey by the International Federation of Robotics indicated that 30% of companies faced challenges in integrating new robotic systems with their existing processes, highlighting the need for comprehensive planning and technical expertise.

Asia Pacific Autonomous Material Market Future Outlook

Over the next five years, the Asia Pacific autonomous material handling market is poised for substantial growth. This trajectory is fueled by continuous advancements in automation technologies, increasing investments in infrastructure development, and the rising demand for efficient supply chain solutions. The integration of artificial intelligence and machine learning into autonomous systems is expected to further enhance operational capabilities, driving the market forward.

Opportunities

- Technological Innovations in Autonomous Systems: Continuous technological advancements present significant opportunities for the autonomous material handling market. Developments in machine learning and sensor technologies have led to the creation of more efficient and adaptable autonomous systems. For instance, the integration of LiDAR sensors has enhanced the navigation capabilities of autonomous vehicles, enabling them to operate effectively in complex environments.

- Emerging Markets in Southeast Asia: Southeast Asian countries are experiencing rapid industrialization and urbanization, creating new markets for autonomous material handling solutions. For example, Vietnam's manufacturing sector grew by 8.7% in 2022, indicating a robust industrial expansion. Similarly, Indonesia's manufacturing Purchasing Managers' Index (PMI) reached 53.7 in 2022, reflecting strong manufacturing activity. These developments present opportunities for deploying advanced material handling systems to meet increasing industrial demands.

Scope of the Report

|

Product Type |

Automated Guided Vehicles (AGVs) |

|

Industry Vertical |

Manufacturing |

|

Function |

Transportation |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Manufacturing Companies

Logistics and Warehousing Companies

E-commerce Companies

Automotive Manufacturing Industries

Food and Beverage Production Industries

Pharmaceutical Companies

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Toyota Industries Corporation

KION Group AG

Daifuku Co., Ltd.

Jungheinrich AG

Murata Machinery, Ltd.

Crown Equipment Corporation

Mitsubishi Logisnext Co., Ltd.

SSI Schaefer AG

Honeywell Intelligrated

BEUMER Group GmbH & Co. KG

Table of Contents

1. Asia Pacific Autonomous Material Handling Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Autonomous Material Handling Market Size (USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Autonomous Material Handling Market Analysis

3.1 Growth Drivers

3.1.1 Rapid Industrialization

3.1.2 Expansion of E-commerce

3.1.3 Technological Advancements in Automation

3.1.4 Labor Cost Optimization

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Integration Complexities

3.2.3 Skilled Workforce Shortage

3.3 Opportunities

3.3.1 Adoption of Industry 4.0

3.3.2 Government Initiatives Supporting Automation

3.3.3 Emerging Markets in Southeast Asia

3.4 Trends

3.4.1 Integration of AI and Machine Learning

3.4.2 Development of Autonomous Mobile Robots (AMRs)

3.4.3 Shift Towards Smart Warehousing Solutions

3.5 Government Regulations

3.5.1 Safety Standards for Autonomous Systems

3.5.2 Import and Export Policies

3.5.3 Incentives for Automation Adoption

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Asia Pacific Autonomous Material Handling Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Automated Guided Vehicles (AGVs)

4.1.2 Autonomous Mobile Robots (AMRs)

4.1.3 Automated Storage and Retrieval Systems (AS/RS)

4.1.4 Conveyor Systems

4.1.5 Palletizers

4.2 By Industry Vertical (Value %)

4.2.1 Manufacturing

4.2.2 Retail and E-commerce

4.2.3 Automotive

4.2.4 Food and Beverage

4.2.5 Pharmaceuticals

4.3 By Function (Value %)

4.3.1 Transportation

4.3.2 Storage

4.3.3 Assembly

4.3.4 Packaging

4.3.5 Distribution

4.4 By Technology (Value %)

4.4.1 Laser Guidance

4.4.2 Vision Guidance

4.4.3 Magnetic Guidance

4.4.4 Natural Navigation

4.5 By Country (Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 South Korea

4.5.5 Australia

5. Asia Pacific Autonomous Material Handling Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Toyota Industries Corporation

5.1.2 KION Group AG

5.1.3 Jungheinrich AG

5.1.4 Mitsubishi Logisnext Co., Ltd.

5.1.5 Hyster-Yale Materials Handling, Inc.

5.1.6 Crown Equipment Corporation

5.1.7 Daifuku Co., Ltd.

5.1.8 SSI Schaefer AG

5.1.9 Murata Machinery, Ltd.

5.1.10 Dematic

5.1.11 Honeywell Intelligrated

5.1.12 BEUMER Group GmbH & Co. KG

5.1.13 Fives Group

5.1.14 Vanderlande Industries

5.1.15 Swisslog Holding AG

5.2 Cross Comparison Parameters

5.2.1 Number of Employees

5.2.2 Headquarters Location

5.2.3 Year of Establishment

5.2.4 Revenue

5.2.5 Product Portfolio

5.2.6 Regional Presence

5.2.7 R&D Investment

5.2.8 Market Share

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Asia Pacific Autonomous Material Handling Regulatory Framework

6.1 Safety and Compliance Standards

6.2 Certification Processes

6.3 Environmental Regulations

7. Asia Pacific Autonomous Material Handling Future Market Size (USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Autonomous Material Handling Future Market Segmentation

8.1 By Product Type (Value %)

8.2 By Industry Vertical (Value %)

8.3 By Function (Value %)

8.4 By Technology (Value %)

8.5 By Country (Value %)

9. Asia Pacific Autonomous Material Handling Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Segmentation Analysis

9.3 Strategic Marketing Initiatives

9.4 Identification of Market Gaps and Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Autonomous Material Handling Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific Autonomous Material Handling Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple autonomous material handling system manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Autonomous Material Handling market.

Frequently Asked Questions

01. How big is the Asia Pacific Autonomous Material Handling Market?

The Asia Pacific autonomous material handling market is valued at USD 26.8 billion, driven by rapid industrialization and the increasing adoption of automation technologies across various industries.

02. What are the challenges in the Asia Pacific Autonomous Material Handling Market?

Challenges include high initial investment costs, integration complexities, and a shortage of skilled workforce capable of managing and maintaining advanced autonomous systems.

03. Who are the major players in the Asia Pacific Autonomous Material Handling Market?

Key players in the market include Toyota Industries Corporation, KION Group AG, Daifuku Co., Ltd., Jungheinrich AG, and Murata Machinery, Ltd., among others.

04. What are the growth drivers of the Asia Pacific Autonomous Material Handling Market?

The market is propelled by factors such as rapid industrialization, expansion of e-commerce, technological advancements in automation, and the need for labor cost optimization.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.