Asia Pacific Autonomous Mobile Robot (AMR) Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD4144

November 2024

96

About the Report

Asia Pacific Autonomous Mobile Robot (AMR) Market Overview

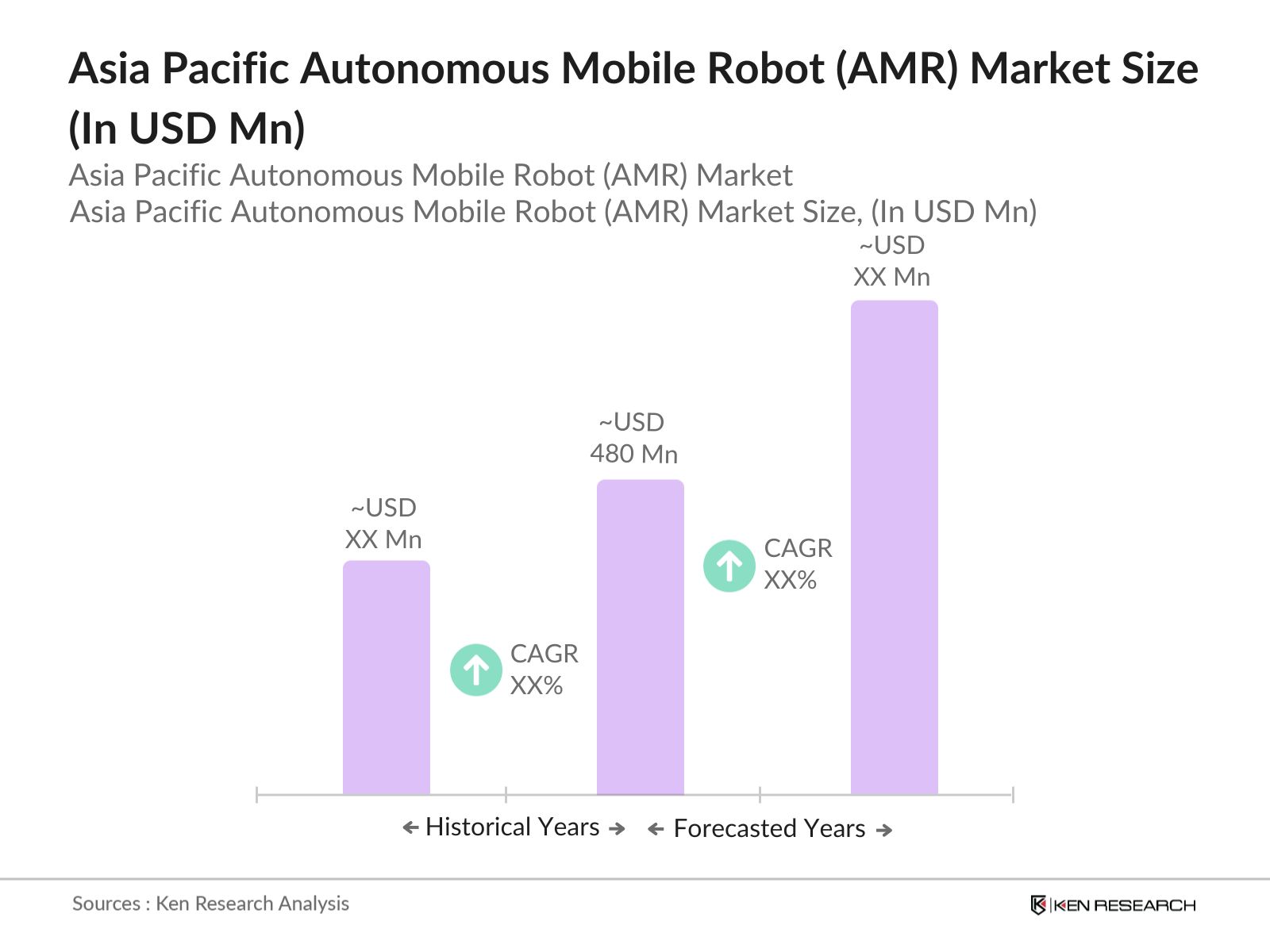

- The Asia Pacific Autonomous Mobile Robot (AMR) market is currently valued at USD 480 million, driven by the increasing need for automation in warehouses and industrial sectors. The adoption of AMRs has been further propelled by the boom in e-commerce, which necessitates faster order fulfillment and efficient logistics solutions. This market has witnessed strong growth due to the efficiency improvements that AMRs bring to inventory management, material handling, and overall operational productivity. Government initiatives to encourage Industry 4.0 and smart manufacturing have also contributed significantly to the adoption of AMRs, creating a favorable environment for market expansion.

- The dominant countries in this market include China, Japan, and South Korea, which have established a significant presence due to their advanced robotics industries, strong industrial bases, and widespread adoption of automation technologies. China leads the region with its massive industrial production and logistics networks, where AMRs are utilized to manage complex operations. Japan and South Korea are also at the forefront of adopting AMRs due to their high levels of technological innovation, with leading companies and research institutions driving continuous improvements in robotics capabilities.

- Governments in the Asia-Pacific region is actively promoting Industry 4.0 initiatives to support the adoption of AMRs. In 2023, South Korea launched a USD 1 billion investment fund to boost the implementation of smart manufacturing technologies, including AMRs, across its industrial sectors. Similarly, Japan's "Society 5.0" initiative focuses on integrating digital technologies into various industries, fostering the development of intelligent robots for warehouses and manufacturing. These government-backed initiatives are creating a favorable environment for the growth of the AMR market in the region.

Asia Pacific Autonomous Mobile Robot (AMR) Market Segmentation

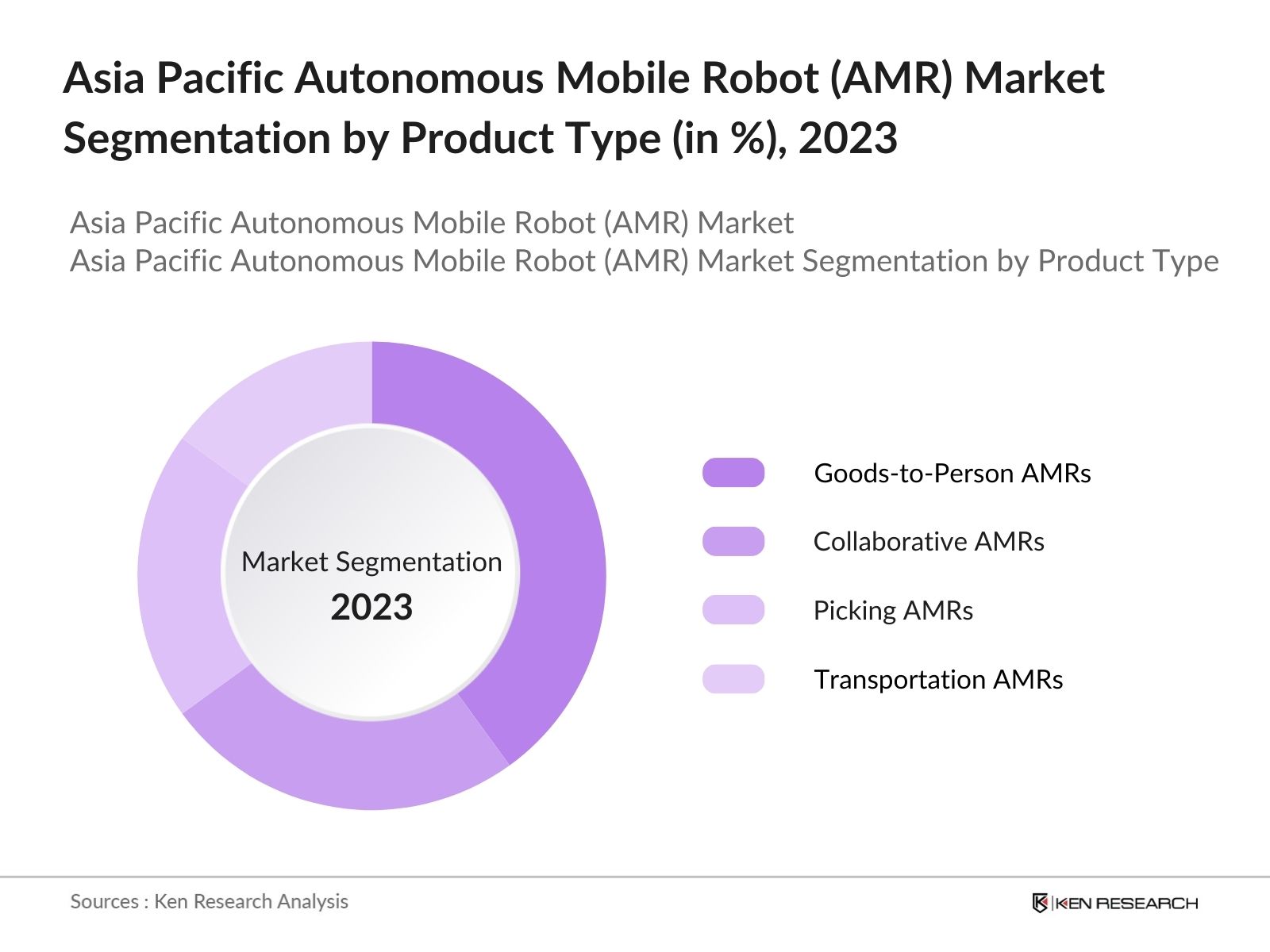

By Product Type: The market is segmented by product type into Goods-to-Person AMRs, Collaborative AMRs, Picking AMRs, and Transportation AMRs. Among these, Goods-to-Person AMRs currently dominate the market. This dominance is attributed to the rapid expansion of e-commerce, where these robots are used to optimize warehouse picking processes. The efficiency of Goods-to-Person AMRs in reducing human intervention and accelerating order fulfillment has made them a preferred choice for large-scale fulfillment centers and logistics operators.

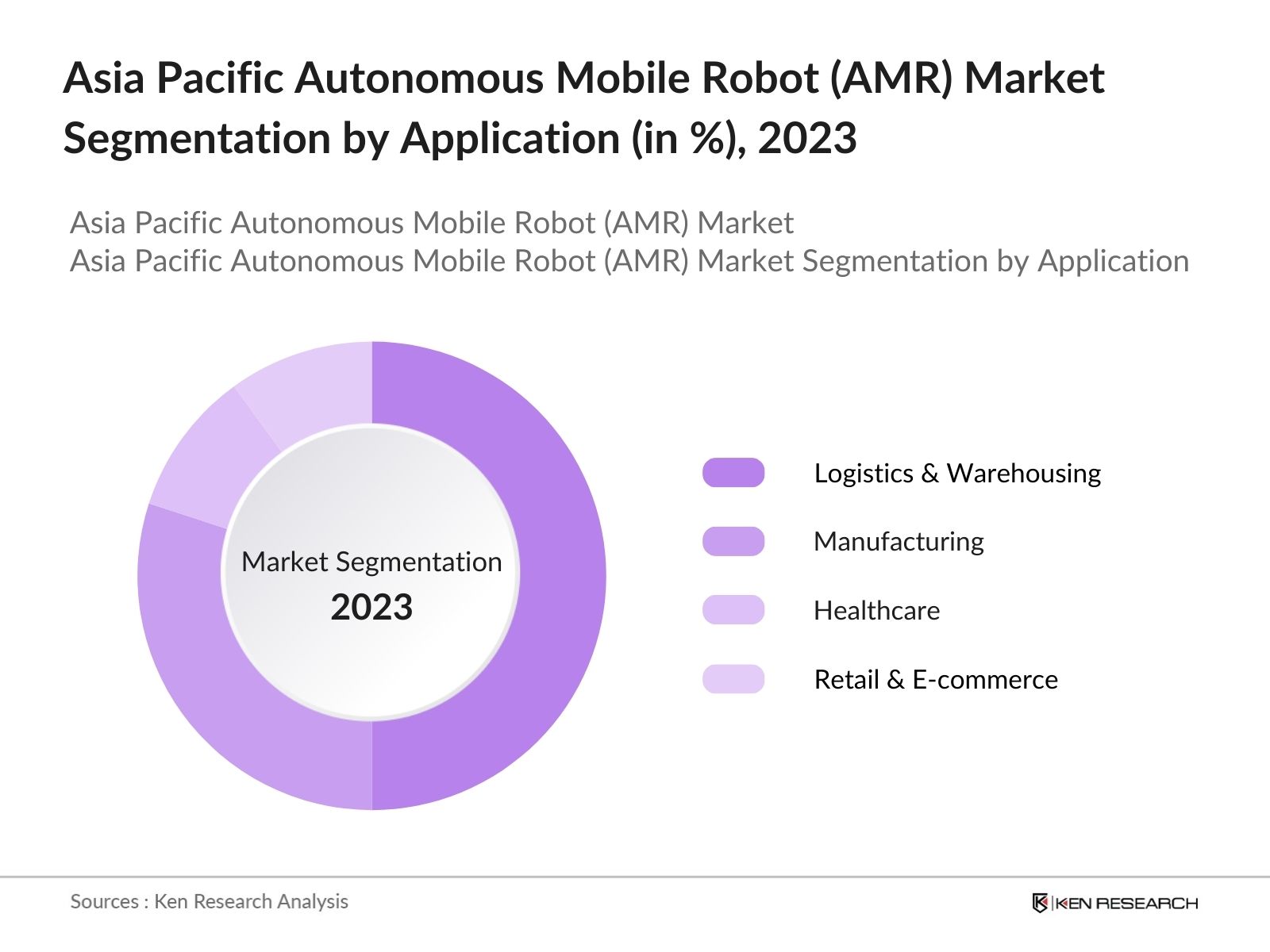

By Application: The market is segmented by application into Logistics & Warehousing, Manufacturing, Healthcare, and Retail & E-commerce. Logistics & Warehousing holds the largest market share, driven by the rapid growth of the e-commerce industry in Asia Pacific. The increasing demand for faster delivery times and efficient warehouse operations has pushed logistics providers to adopt AMRs to streamline material handling and inventory management. Companies in this sector are leveraging AMRs to reduce labor costs, improve warehouse space utilization, and enhance scalability during peak seasons.

Asia Pacific Autonomous Mobile Robot (AMR) Market Competitive Landscape

The Asia Pacific AMR market is dominated by several key players who are driving innovation and shaping the market's competitive environment. These companies are focusing on advanced technologies such as AI, machine learning, and IoT integration to enhance the capabilities of AMRs. The competitive landscape is characterized by continuous investment in R&D, strategic partnerships, and mergers and acquisitions.

|

Company |

Established |

Headquarters |

No. of Employees |

Revenue (USD Mn) |

Key Technologies |

Product Portfolio |

Global Presence |

Strategic Partnerships |

|

Geek+ |

2015 |

China |

||||||

|

Fetch Robotics |

2014 |

USA |

||||||

|

Mobile Industrial Robots |

2013 |

Denmark |

||||||

|

GreyOrange |

2011 |

India |

||||||

|

Locus Robotics |

2014 |

USA |

Asia Pacific Autonomous Mobile Robot Industry Analysis

Growth Drivers

- Demand for Automation in Warehousing: The Asia-Pacific region has seen a sharp increase in demand for warehouse automation as a result of expanding logistics and supply chain activities. In 2024, the logistics sector across APAC handled approximately 46 billion tons of freight annually, which has created an enormous demand for more efficient automated solutions like autonomous mobile robots (AMRs). These robots have become vital to optimize warehouse operations and meet the need for speed and accuracy in order fulfillment processes. Countries such as China and India have been key contributors to this trend, accounting for over 50% of logistics activity in the region.

- Rising E-commerce and Online Retail: The growth of e-commerce in APAC is driving the adoption of AMRs in warehouse operations. In 2023, the region recorded over 6.1 billion online shoppers, with significant growth in China, Japan, and Southeast Asia. The increasing volume of e-commerce transactions requires efficient solutions for order picking, packing, and distribution, which AMRs provide. By integrating AMRs into retail and e-commerce warehouses, companies are improving delivery times and reducing errors, allowing them to keep pace with rising consumer demand. The region's e-commerce transactions crossed USD 2 trillion in 2023, making AMRs indispensable in scaling operations.

- Technological Advancements in Robotics: The integration of artificial intelligence (AI) and machine learning (ML) into AMRs has revolutionized robotic efficiency in warehouses. By 2024, AI-enabled AMRs in Asia-Pacific have enhanced warehouse operations through real-time data analysis and predictive maintenance, allowing robots to adapt to changing environments and tasks. China leads the region with the deployment of over 100,000 AI-powered robots in logistics centers. The continuous development in machine learning algorithms has improved the robots' navigation, object recognition, and decision-making capabilities, allowing them to operate alongside human workers more effectively.

Market Challenges

- High Initial Deployment Costs: The initial deployment cost for AMRs remains a significant barrier for small to medium-sized enterprises (SMEs) in the Asia-Pacific region. The average cost for deploying a fleet of AMRs in a single warehouse is estimated to be USD 500,000 as of 2024, which includes hardware, software, and infrastructure upgrades. This high capital investment can be challenging, particularly for businesses in developing economies like Vietnam and Indonesia, where profit margins are slim, and investment capabilities are limited. Government grants and subsidies in certain APAC countries have helped mitigate these costs, but financial barriers persist.

- Technical Integration with Legacy Systems: Integrating AMRs with existing warehouse management systems (WMS) remains a challenge in APAC. Many warehouses in the region, particularly in developing economies, still use outdated systems that lack compatibility with modern robotic software. In 2023, over 40% of warehouses in Southeast Asia were found to be operating on legacy WMS platforms that require significant upgrading before AMRs can be implemented. The lack of standardization across platforms further complicates the integration process, driving up the time and cost required to fully implement AMR systems across logistics and manufacturing sectors.

Asia Pacific Autonomous Mobile Robot (AMR) Market Future Outlook

Over the next five years, the Asia Pacific AMR market is poised to experience robust growth. This will be driven by the rising adoption of automation technologies across various industries such as logistics, manufacturing, and healthcare. The increasing demand for efficient and scalable material handling solutions in large fulfillment centers and the integration of AI and IoT technologies in AMRs will propel market growth. Moreover, government support for smart manufacturing and Industry 4.0 initiatives in countries like China and Japan will further accelerate the adoption of AMRs across the region.

Future Market Opportunities

- Expansion into New Industrial Sectors: Beyond logistics, the adoption of AMRs is expanding into other sectors, such as manufacturing and healthcare. In 2023, APACs manufacturing sector accounted for 30% of the global manufacturing output, driving the demand for automation technologies, including AMRs, in production lines and material handling. Additionally, the healthcare sector in countries like Japan and South Korea is adopting AMRs for tasks such as medication delivery and patient transport in hospitals. This cross-industry expansion offers considerable growth opportunities for AMR providers in the Asia-Pacific region.

- Increasing Demand for AMRs in APACs Emerging Markets: The growing industrialization in emerging markets like China, India, and Southeast Asia is boosting the demand for AMRs. In 2023, China produced over 6 million industrial robots, with significant portions dedicated to warehouse automation. Similarly, India is investing in automation to meet its warehousing and logistics needs, particularly as its e-commerce sector rapidly expands. The increasing industrial activity in these emerging markets presents a lucrative opportunity for AMR manufacturers to scale their operations and cater to growing demand.

Scope of the Report

|

Product Type |

Goods-to-Person AMRs Collaborative AMRs Picking AMRs Transportation AMRs |

|

Application |

Logistics & Warehousing Manufacturing Healthcare Retail & E-commerce |

|

Navigation Technology |

LIDAR-Based AMRs Vision-Based AMRs SLAM AMRs |

|

End-User Industry |

Automotive Food & Beverage Pharmaceuticals Electronics & Electrical |

|

Region |

China Japan India South Korea Southeast Asia |

Products

Key Target Audience

Autonomous Mobile Robot Manufacturers

Logistics & Warehouse Operators

Retail and E-commerce Companies

Healthcare Industry Stakeholders

Banks and Financial Institutes

Manufacturing Companies

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry and Information Technology - China, Ministry of Economy, Trade, and Industry - Japan)

Technology Integrators

Companies

Major Players in the Market

Geek+

Fetch Robotics

Mobile Industrial Robots (MiR)

GreyOrange

Locus Robotics

Clearpath Robotics

IAM Robotics

OMRON Corporation

Swisslog

SICK AG

Vecna Robotics

JBT Corporation

KION Group AG

Aethon Inc.

Seegrid

Table of Contents

1. Asia Pacific Autonomous Mobile Robot Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Autonomous Mobile Robot Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Autonomous Mobile Robot Market Analysis

3.1. Growth Drivers

3.1.1. Demand for Automation in Warehousing (Logistics & Supply Chain Automation)

3.1.2. Rising E-commerce and Online Retail (Retail & E-commerce Integration)

3.1.3. Labor Shortages (Warehouse Labor & Workforce Optimization)

3.1.4. Technological Advancements in Robotics (AI & Machine Learning in AMR)

3.2. Market Challenges

3.2.1. High Initial Deployment Costs (Capital Investment Requirements)

3.2.2. Technical Integration with Legacy Systems (Warehouse Management Systems)

3.2.3. Regulatory Framework for Autonomous Operations (Compliance with Safety & Operation Standards)

3.3. Opportunities

3.3.1. Integration with IoT and 5G (Real-Time Communication & Connectivity)

3.3.2. Expansion into New Industrial Sectors (Manufacturing, Healthcare)

3.3.3. Increasing Demand for AMRs in APACs Emerging Markets (China, India, Southeast Asia)

3.4. Trends

3.4.1. Adoption of Hybrid AMR Fleets (Combining Automated Guided Vehicles & AMRs)

3.4.2. Enhanced Battery Life and Charging Solutions (Lithium-ion Batteries & Fast Charging)

3.4.3. Collaboration between AMRs and Human Operators (Human-Robot Collaboration in Warehouses)

3.5. Government Regulations

3.5.1. Compliance with Robotics Safety Standards (ISO 3691-4 & Other APAC-Specific Regulations)

3.5.2. Data Security and Privacy Laws (APAC Data Protection Policies)

3.5.3. Government Initiatives for Industry 4.0 (Smart Manufacturing Policies in APAC)

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Software Providers, System Integrators, End-Users)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Autonomous Mobile Robot Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Goods-to-Person AMRs

4.1.2. Collaborative AMRs

4.1.3. Picking AMRs

4.1.4. Transportation AMRs

4.2. By Application (In Value %)

4.2.1. Logistics & Warehousing

4.2.2. Manufacturing

4.2.3. Healthcare

4.2.4. Retail & E-commerce

4.3. By Navigation Technology (In Value %)

4.3.1. LIDAR-Based AMRs

4.3.2. Vision-Based AMRs

4.3.3. SLAM (Simultaneous Localization and Mapping) AMRs

4.4. By End-User Industry (In Value %)

4.4.1. Automotive

4.4.2. Food & Beverage

4.4.3. Pharmaceuticals

4.4.4. Electronics & Electrical

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Southeast Asia (Malaysia, Thailand, Vietnam, Indonesia)

5. Asia Pacific Autonomous Mobile Robot Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Geek+

5.1.2. Fetch Robotics

5.1.3. Mobile Industrial Robots (MiR)

5.1.4. GreyOrange

5.1.5. KION Group AG

5.1.6. Clearpath Robotics

5.1.7. IAM Robotics

5.1.8. Seegrid

5.1.9. Locus Robotics

5.1.10. Swisslog

5.1.11. OMRON Corporation

5.1.12. JBT Corporation

5.1.13. SICK AG

5.1.14. Vecna Robotics

5.1.15. Aethon Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Key Technologies, Product Offerings, Market Share, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Autonomous Mobile Robot Market Regulatory Framework

6.1. Safety and Operational Guidelines

6.2. Data Protection & Privacy Regulations

6.3. Robotics Certification & Standardization (ISO, APAC-specific) Compliance

7. Asia Pacific Autonomous Mobile Robot Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Autonomous Mobile Robot Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Navigation Technology (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Autonomous Mobile Robot Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Penetration Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying the key factors influencing the Asia Pacific AMR market, including product type, application, and technology. Extensive desk research was conducted to collect industry-level information and map the market ecosystem.

Step 2: Market Analysis and Construction

Historical data from reputable sources were analyzed to determine market trends, product penetration, and revenue generation in the Asia Pacific region. The competitive landscape and technological advancements were also evaluated.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses were validated through expert interviews with industry professionals, which provided insights into market growth drivers, challenges, and outlook.

Step 4: Research Synthesis and Final Output

The data was synthesized to develop a comprehensive market report, ensuring accuracy and relevance. The final output was validated through direct engagement with AMR manufacturers and logistics providers.

Frequently Asked Questions

01. How big is the Asia Pacific AMR Market?

The Asia Pacific AMR market is valued at USD 480 million, driven by the increasing demand for automation in logistics, warehousing, and manufacturing sectors.

02. What are the challenges in the Asia Pacific AMR Market?

Key challenges in the Asia Pacific AMR market include high initial deployment costs, technical integration with legacy systems, and compliance with stringent safety and operational regulations across the region.

03. Who are the major players in the Asia Pacific AMR Market?

Major players in the Asia Pacific AMR market include Geek+, Fetch Robotics, Mobile Industrial Robots (MiR), GreyOrange, and Locus Robotics. These companies are driving innovation and expanding their presence across Asia Pacific.

04. What are the growth drivers of the Asia Pacific AMR Market?

The Asia Pacific AMR market is driven by increasing e-commerce activities, labor shortages in the logistics industry, advancements in robotics technology, and government initiatives supporting smart manufacturing and automation.

05. What are the dominant product types in the Asia Pacific AMR Market?

Goods-to-Person AMRs currently dominate the market, particularly in large e-commerce fulfillment centers where efficient order picking is critical in the Asia Pacific AMR market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.