Asia-Pacific B2B Payments Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD11090

December 2024

86

About the Report

Asia-Pacific B2B Payments Market Overview

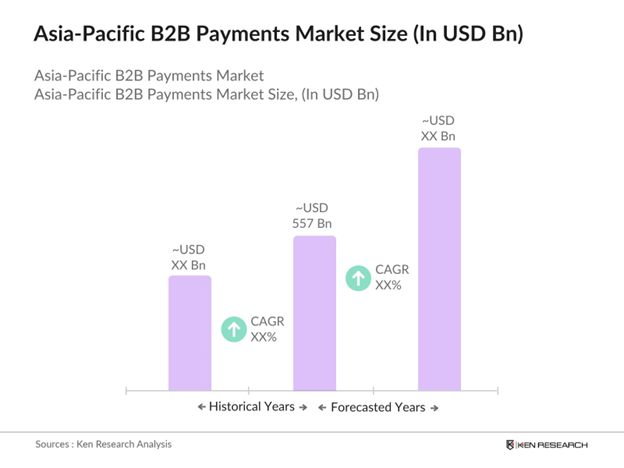

- The Asia-Pacific B2B payments market is valued at USD 557 billion, based on a five-year historical analysis. This substantial market size is driven by the rapid digitalization of payment processes, the expansion of cross-border trade, and the increasing adoption of fintech solutions across the region. Government initiatives promoting cashless transactions further bolster this growth.

- China and India are the dominant countries in the Asia-Pacific B2B payments market. China's dominance is attributed to its large-scale manufacturing sector and extensive export activities, while India's rapidly growing economy and increasing digital payment adoption contribute to its significant market presence.

- Singapore's Personal Data Protection Act (PDPA) mandates organizations to obtain consent before collecting, using, or disclosing personal data, with penalties reaching up to USD 755 million for non-compliance. ThePrivacy Act 1988in Australia has undergone significant amendments recently. Previously, the maximum penalty for serious or repeated privacy breaches wasUSD 1.45 million. However, following the passage of thePrivacy Legislation Amendment (Enforcement and Other Measures) Bill 2022, this maximum penalty has been increased to the greater of USD 34 million.

Asia-Pacific B2B Payments Market Segmentation

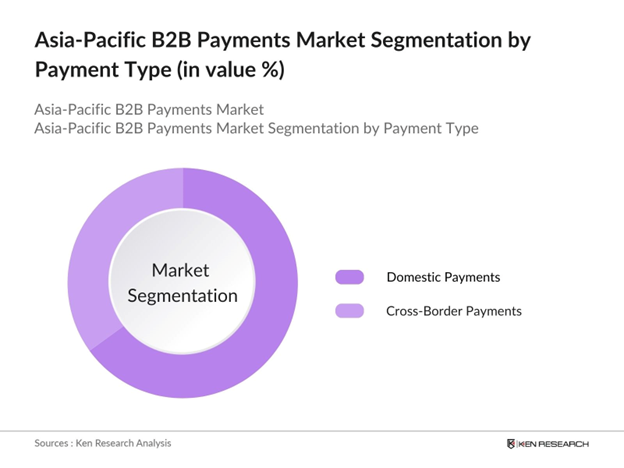

By Payment Type: The Asia-Pacific B2B payments market is segmented by payment type into domestic payments and cross-border payments. Domestic payments hold a dominant market share due to the high volume of transactions within countries, driven by local trade activities and established banking infrastructures that facilitate efficient domestic transactions.

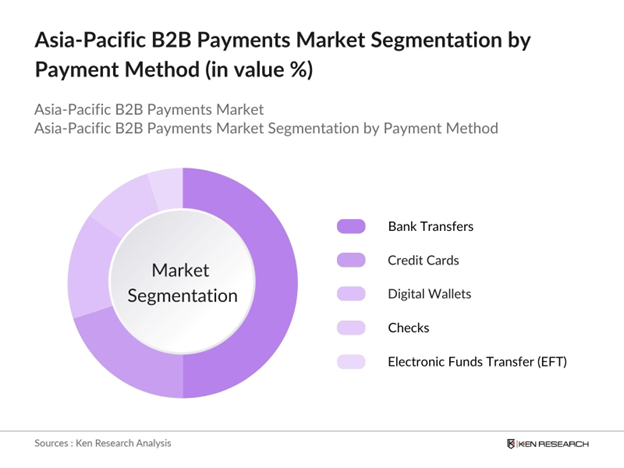

By Payment Method: The market is further segmented by payment method into bank transfers, credit cards, digital wallets, checks, and electronic funds transfer (EFT). Bank transfers dominate this segment, as businesses prefer them for their reliability, security, and ability to handle large transaction volumes, making them a preferred choice for B2B transactions.

Asia-Pacific B2B Payments Market Competitive Landscape

The Asia-Pacific B2B payments market is characterized by the presence of major global and regional players, including Visa Inc., Mastercard Incorporated, PayPal Holdings Inc., American Express Company, and Ant Financial Services Group. These companies have established strong market positions through extensive networks, technological innovations, and strategic partnerships.

Asia-Pacific B2B Payments Market Analysis

Growth Drivers

- Digitalization of Payment Processes: The Asia-Pacific region has witnessed a significant shift towards digital payment methods, with over 2.5 billion internet users and approximately 1.5 billion smartphone users as of 2024. This widespread connectivity has facilitated the adoption of digital payment platforms, enhancing transaction efficiency and security. For instance, in India, the Unified Payments Interface (UPI) processed over 8 billion transactions in January 2024 alone, indicating a robust digital payment ecosystem.

- Adoption of FinTech Solutions: The Asia-Pacific region is home to over 6,000 FinTech startups as of 2024, reflecting a dynamic ecosystem fostering innovation in financial services. Countries like Singapore have established regulatory sandboxes, encouraging the development and deployment of FinTech solutions that enhance B2B payment systems. This environment has led to the creation of platforms offering real-time payments, automated invoicing, and enhanced security features, catering to the evolving needs of businesses.

- Government Initiatives Promoting Cashless Transactions: Governments across Asia-Pacific are actively promoting cashless economies to enhance transparency and reduce transaction costs. In 2024, the Reserve Bank of India reported a 30% increase in digital transactions, attributing this growth to initiatives like Digital India. Similarly, Thailand's National e-Payment Master Plan aims to reduce cash usage by promoting electronic payments, thereby fostering a conducive environment for B2B payment solutions.

Challenges

- Security Concerns and Fraud Risks: The increasing reliance on digital payment systems has heightened vulnerabilities, leading to significant financial losses for businesses. For instance, a major data breach in 2023 resulted in losses exceeding $100 million for affected companies, highlighting the critical need for robust security measures in B2B payment systems.

- Regulatory Compliance Complexities: The Asia-Pacific region comprises diverse regulatory frameworks, with over 40 countries each having distinct financial regulations. This diversity poses challenges for businesses operating across borders, as they must navigate varying compliance requirements. For example, differing anti-money laundering (AML) standards necessitate tailored compliance strategies, increasing operational complexities and costs for companies engaged in cross-border B2B transactions.

Asia-Pacific B2B Payments Market Future Outlook

Over the next five years, the Asia-Pacific B2B payments market is expected to experience significant growth, driven by continuous advancements in payment technologies, increasing adoption of digital payment methods by businesses, and supportive government policies promoting cashless economies. The integration of blockchain technology and the development of real-time payment systems are anticipated to further enhance the efficiency and security of B2B transactions in the region.

Market Opportunities

- Integration of Blockchain Technology: Blockchain technology offers the potential to streamline B2B payments by providing transparent, secure, and immutable transaction records. In 2024, over 60% of financial institutions in Asia-Pacific are exploring blockchain applications to enhance payment processes. For example, the Hong Kong Monetary Authority launched a blockchain-based trade finance platform, facilitating faster and more secure cross-border transactions for businesses.

- Growth in SME Sector: Small and medium-sized enterprises (SMEs) constitute approximately 98% of businesses in Asia-Pacific, employing over 50% of the workforce. The digital transformation of SMEs presents a significant opportunity for B2B payment providers to offer tailored solutions that enhance operational efficiency. For instance, digital invoicing and payment platforms can reduce processing times from weeks to days, improving cash flow for SMEs and fostering economic growth.

Scope of the Report

|

Segment |

Sub-Segments |

|

Payment Type |

Domestic Payments |

|

Payment Method |

Bank Transfers |

|

Enterprise Size |

Large Enterprises |

|

Industry Vertical |

Manufacturing |

|

Country |

China |

Products

Key Target Audience

Financial Institutions (e.g., banks, credit unions)

Payment Service Providers

Large Enterprises

Small and Medium-Sized Enterprises (SMEs)

E-commerce Platforms

Technology Solution Providers

Government and Regulatory Bodies (e.g., Reserve Bank of India, Monetary Authority of Singapore)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Visa Inc.

Mastercard Incorporated

PayPal Holdings Inc.

American Express Company

Ant Financial Services Group

Tencent Holdings Limited

Payoneer Inc.

Western Union Company

TransferWise Ltd.

Earthport PLC

Table of Contents

1. Asia-Pacific B2B Payments Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific B2B Payments Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific B2B Payments Market Analysis

3.1. Growth Drivers

3.1.1. Digitalization of Payment Processes

3.1.2. Expansion of Cross-Border Trade

3.1.3. Adoption of FinTech Solutions

3.1.4. Government Initiatives Promoting Cashless Transactions

3.2. Market Challenges

3.2.1. Security Concerns and Fraud Risks

3.2.2. Regulatory Compliance Complexities

3.2.3. High Transaction Costs

3.3. Opportunities

3.3.1. Integration of Blockchain Technology

3.3.2. Growth in SME Sector

3.3.3. Development of Real-Time Payment Systems

3.4. Trends

3.4.1. Rise of Mobile Payment Platforms

3.4.2. Increasing Use of Artificial Intelligence in Payment Processing

3.4.3. Shift Towards Cloud-Based Payment Solutions

3.5. Government Regulations

3.5.1. Data Protection Laws

3.5.2. Anti-Money Laundering (AML) Policies

3.5.3. Cross-Border Payment Regulations

3.5.4. Digital Payment Promotion Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia-Pacific B2B Payments Market Segmentation

4.1. By Payment Type (In Value %)

4.1.1. Domestic Payments

4.1.2. Cross-Border Payments

4.2. By Payment Method (In Value %)

4.2.1. Bank Transfers

4.2.2. Credit Cards

4.2.3. Digital Wallets

4.2.4. Checks

4.2.5. Electronic Funds Transfer (EFT)

4.3. By Enterprise Size (In Value %)

4.3.1. Large Enterprises

4.3.2. Medium-Sized Enterprises

4.3.3. Small-Sized Enterprises

4.4. By Industry Vertical (In Value %)

4.4.1. Manufacturing

4.4.2. Information Technology and Telecom

4.4.3. Metals and Mining

4.4.4. Energy and Utilities

4.4.5. Banking, Financial Services, and Insurance (BFSI)

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. South Korea

4.5.6. Rest of Asia-Pacific

5. Asia-Pacific B2B Payments Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Visa Inc.

5.1.2. Mastercard Incorporated

5.1.3. PayPal Holdings Inc.

5.1.4. American Express Company

5.1.5. Ant Financial Services Group

5.1.6. Tencent Holdings Limited

5.1.7. Payoneer Inc.

5.1.8. Western Union Company

5.1.9. TransferWise Ltd.

5.1.10. Earthport PLC

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Key Services Offered, Regional Presence, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Asia-Pacific B2B Payments Market Regulatory Framework

6.1. Compliance Requirements

6.2. Certification Processes

6.3. International Payment Standards

7. Asia-Pacific B2B Payments Future Market Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific B2B Payments Future Market Segmentation

8.1. By Payment Type (In Value %)

8.2. By Payment Method (In Value %)

8.3. By Enterprise Size (In Value %)

8.4. By Industry Vertical (In Value %)

8.5. By Country (In Value %)

9. Asia-Pacific B2B Payments Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia-Pacific B2B Payments Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Asia-Pacific B2B Payments Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple payment service providers to acquire detailed insights into product segments, transaction volumes, customer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia-Pacific B2B Payments market.

Frequently Asked Questions

01. How big is the Asia-Pacific B2B Payments Market?

The Asia-Pacific B2B payments market is valued at USD 557 billion, based on a five-year historical analysis, driven by the rapid digitalization of payment processes, the expansion of cross-border trade, and the increasing adoption of fintech solutions across the region.

02. What are the challenges in the Asia-Pacific B2B Payments Market?

Challenges in Asia-Pacific B2B payments market include security concerns and fraud risks, regulatory compliance complexities, and high transaction costs, which can hinder the seamless execution of B2B transactions in the region.

03. Who are the major players in the Asia-Pacific B2B Payments Market?

Key players in Asia-Pacific B2B payments market include Visa Inc., Mastercard Incorporated, PayPal Holdings Inc., American Express Company, and Ant Financial Services Group, among others.

04. What are the growth drivers of the Asia-Pacific B2B Payments Market?

Asia-Pacific B2B payments market is propelled by factors such as the digitalization of payment processes, expansion of cross-border trade, adoption of fintech solutions, and government initiatives promoting cashless transactions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.