Asia Pacific Bakery Products Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD11092

November 2024

84

About the Report

Asia Pacific Bakery Products Market Overview

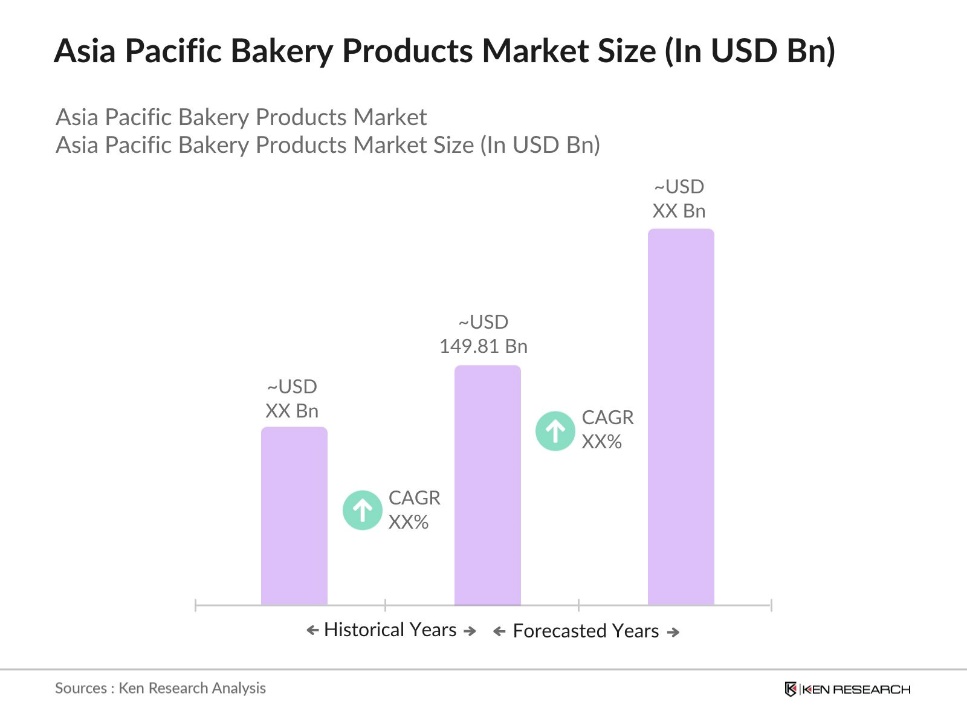

- The Asia Pacific bakery products market, valued at USD 149.81 billion, reflects strong growth, driven by the region's urbanization, rising incomes, and a shift towards convenience foods. This consumer shift has created significant demand for on-the-go bakery items like packaged bread, cakes, and biscuits. The demand for healthier options like gluten-free, organic, and low-sugar products also reflects a shift in consumer preference toward health and wellness, which major market players are leveraging through product innovations and extensive distribution networks, particularly in urban centers.

- Countries like China, Japan, and India dominate the Bakery Products Market in the Asia Pacific region due to their large populations, evolving lifestyles, and increasing disposable incomes. China stands out with robust domestic consumption and investment in modern bakeries, while Japan's demand for premium and high-quality bakery goods drives its market. India, with its growing urbanization and adoption of Western dietary habits, has seen a rise in demand for a wide range of bakery products across metropolitan and tier-1 cities.

- Strict food safety standards are enforced across the Asia Pacific bakery industry, ensuring compliance with hygiene and quality control measures. In 2024, Japans regulatory body conducted over 2,300 inspections in the food sector, which includes bakery production facilities, to ensure adherence to food safety laws. These regulations mandate stringent quality control processes for bakery items, protecting consumers and maintaining product integrity across the supply chain.

Asia Pacific Bakery Products Market Segmentation

By Product Type: The market is segmented by product type into bread, cakes & pastries, cookies & biscuits, rolls & buns, and savory items. Among these, bread holds a dominant position due to its staple status and daily consumption across diverse cultures within the region. The convenience of pre-packaged bread, coupled with affordability and high nutritional value, contributes to its extensive adoption in countries like China, India, and Japan.

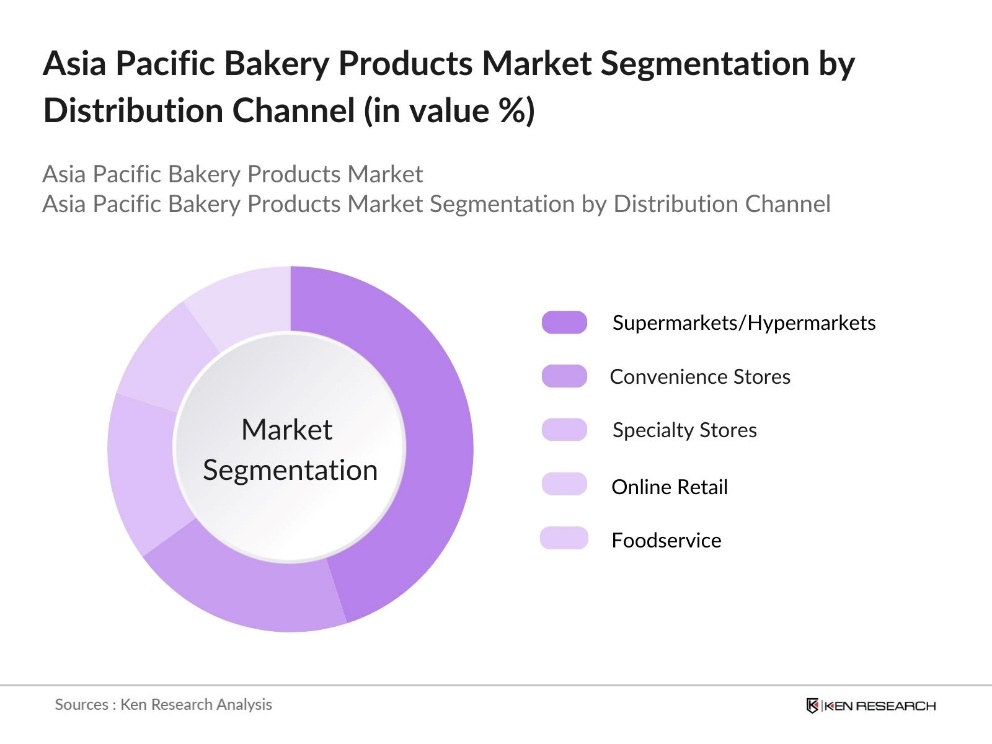

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and foodservice channels. Supermarkets and hypermarkets dominate the distribution channels, benefiting from their accessibility, variety, and growing presence in urban and suburban areas. These outlets cater to diverse consumer preferences, providing a range of both traditional and specialized bakery products, which enhances their market share in the bakery segment.

Asia Pacific Bakery Products Market Competitive Landscape

The market is dominated by prominent players like Mondelez International, Yamazaki Baking Co., and Britannia Industries Ltd., showcasing substantial influence in terms of product innovation and regional expansion. These companies competitive edge lies in their established brand equity, extensive distribution networks, and responsiveness to consumer trends, particularly the demand for healthier and premium bakery products.

Asia Pacific Bakery Industry Analysis

Growth Drivers

- Urbanization and Rising Disposable Income: Rapid urbanization and an increase in disposable incomes are accelerating the demand for bakery products in the Asia Pacific region. The countries such as China and India have experienced growth in disposable income per capita, supporting higher expenditure on convenient foods like bakery products. For example, Chinas per capita disposable income was recorded at 39,218 yuan (0.0054 million USD) in 2023, driving consumer spending on processed foods, including baked goods. The urbanized populations in these regions contribute to increased demand due to their faster lifestyles and preference for ready-to-eat options.

- Shift Towards Convenience Foods: Convenience foods, including packaged and pre-prepared bakery items, have surged in popularity, supported by the working-age populations demand for quick meal solutions. Asia Pacific, with around 2.3 billion individuals in the workforce, is seeing a high demand for products such as pastries, sandwiches, and ready-to-eat baked goods. Consumers are increasingly opting for bakery products that save time without compromising on taste or quality.

- Increasing Demand for Healthy Bakery Options: The Asia Pacific region is experiencing a rise in demand for healthier bakery alternatives, especially in markets like Japan and South Korea. Consumers are increasingly opting for whole-grain, low-sugar, and fortified products that offer added health benefits. Government initiatives supporting healthy eating further drive this trend, making functional, health-oriented bakery products a growing segment across the region.

Market Challenges

- Price Sensitivity and High Competition: The Asia Pacific bakery market faces challenges from high price sensitivity among consumers and intense competition from numerous local and international brands. Smaller, local bakeries in countries like India and Indonesia create a highly competitive landscape, with consumers prioritizing affordability. This environment pressures larger players to balance competitive pricing with quality, which can be difficult to maintain without impacting profitability.

- Stringent Health and Safety Regulations: Health and safety regulations across Asia Pacific impose strict standards on bakery products, especially concerning additives and preservatives. These regulations require manufacturers to frequently update product formulations to meet evolving standards, increasing operational costs. As governments prioritize consumer health protection, bakery producers face substantial compliance requirements, which can complicate production and add to overall operational complexity in the market.

Asia Pacific Bakery Products Market Future Outlook

The Asia Pacific Bakery Products Market is expected to grow steadily in the coming years, driven by the region's continued urbanization, rising incomes, and demand for healthier and premium bakery products. Companies are expected to invest in product diversification and expansion of distribution channels, particularly in emerging economies within the region. Additionally, technological advancements in packaging and production are likely to streamline processes, reduce costs, and enhance product quality, which will support the growth trajectory of the market.

Market Opportunities

- Product Innovation (Plant-based, Gluten-Free, Organic): Growing demand for plant-based, gluten-free, and organic bakery options is driving product innovation across Asia Pacific. Consumers in countries like Australia and South Korea are increasingly seeking specialty bakery products that align with lifestyle and health choices, creating opportunities for brands to diversify with ingredients that cater to these preferences. This shift in dietary habits has bolstered the appeal of bakery items tailored to specific dietary requirements.

- Expansion into Emerging Markets (Rural Penetration): Emerging rural markets in Asia Pacific offer significant growth potential for bakery brands as infrastructure and income levels improve. With enhanced distribution networks and rising consumer purchasing power in rural areas, bakery consumption is on the rise. Brands that introduce affordable bakery products in these regions stand to benefit from increased market penetration, as access and availability continue to expand.

Scope of the Report

|

Product Type |

Bread Cakes & Pastries Cookies & Biscuits Rolls & Buns Savory Items |

|

Ingredient |

Flour Sugar Fats and Oils Additives & Preservatives Fillings & Toppings |

|

Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Specialty Stores Online Retail Foodservice (Restaurants, Cafes) |

|

Specialty Type |

Gluten-Free Organic Vegan Sugar-Free Low-Fat |

|

Region |

China Japan India Southeast Asia Australia & New Zealand |

Products

Key Target Audience

E-commerce Platforms

Foodservice Industry

Specialty Bakery Companies

Sustainable Packaging Companies

Investors and venture capital Firms

Government and Regulatory Bodies (Food Safety and Standards Authority of India, China Food and Drug Administration)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Mondelez International

Yamazaki Baking Co.

Parle Products Pvt. Ltd.

Britannia Industries Ltd.

Grupo Bimbo

Nestl S.A.

Associated British Foods Plc

Finsbury Food Group

Lotte Confectionery Co.

Orion Corporation

Table of Contents

1. Asia Pacific Bakery Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Bakery Products Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Bakery Products Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Rising Disposable Income

3.1.2. Shift Towards Convenience Foods

3.1.3. Increasing Demand for Healthy Bakery Options

3.1.4. Expanding Distribution Networks (Supermarkets, Online Channels)

3.2. Market Challenges

3.2.1. Price Sensitivity and High Competition

3.2.2. Stringent Health and Safety Regulations

3.2.3. Supply Chain Complexities (Raw Material Sourcing)

3.3. Opportunities

3.3.1. Product Innovation (Plant-based, Gluten-Free, Organic)

3.3.2. Expansion into Emerging Markets (Rural Penetration)

3.3.3. Growth in Premium and Artisan Bakery Products

3.4. Trends

3.4.1. Growing Demand for Functional Ingredients (Protein, Fiber)

3.4.2. Rise of On-the-Go Snack Items

3.4.3. Emphasis on Sustainable Packaging

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Labeling Requirements

3.5.3. Import and Export Tariffs

3.5.4. Environmental Regulations (Waste Management)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape and Market Ecosystem

4. Asia Pacific Bakery Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Bread

4.1.2. Cakes & Pastries

4.1.3. Cookies & Biscuits

4.1.4. Rolls & Buns

4.1.5. Savory Items

4.2. By Ingredient (In Value %)

4.2.1. Flour

4.2.2. Sugar

4.2.3. Fats and Oils

4.2.4. Additives & Preservatives

4.2.5. Fillings & Toppings

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Convenience Stores

4.3.3. Specialty Stores

4.3.4. Online Retail

4.3.5. Foodservice (Restaurants, Cafes)

4.4. By Specialty Type (In Value %)

4.4.1. Gluten-Free

4.4.2. Organic

4.4.3. Vegan

4.4.4. Sugar-Free

4.4.5. Low-Fat

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Southeast Asia

4.5.5. Australia & New Zealand

5. Asia Pacific Bakery Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mondelez International

5.1.2. Yamazaki Baking Co.

5.1.3. Parle Products Pvt. Ltd.

5.1.4. Britannia Industries Ltd.

5.1.5. Grupo Bimbo

5.1.6. Nestl S.A.

5.1.7. Associated British Foods Plc

5.1.8. Finsbury Food Group

5.1.9. Lotte Confectionery Co.

5.1.10. Orion Corporation

5.1.11. Regal Bakery

5.1.12. Super Group Ltd.

5.1.13. Rich Products Corporation

5.1.14. ITC Limited

5.1.15. Bauli Group

5.2. Cross Comparison Parameters (Market Reach, Product Portfolio Diversity, R&D Expenditure, Supply Chain Efficiency, Sustainability Initiatives, Brand Equity, Market Share, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Venture Capital Involvement

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Asia Pacific Bakery Products Market Regulatory Framework

6.1. Food Safety Standards and Compliance

6.2. Certification and Quality Control

6.3. Export and Import Regulations

7. Asia Pacific Bakery Products Market Future Outlook (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Bakery Products Mining Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Ingredient (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Specialty Type (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Bakery Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation and Buying Behavior Analysis

9.3. Marketing Strategies

9.4. Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

An extensive review of the Bakery Products Market in Asia Pacific was conducted, identifying critical variables impacting the market such as product diversity, distribution channels, and consumer health preferences. Secondary databases and proprietary resources were utilized to gather comprehensive data.

Step 2: Market Analysis and Construction

Historical data analysis was performed to assess market growth trends, market penetration, and consumer buying behaviors. This included evaluating distribution efficiency and the impact of product segmentation on revenue generation across countries.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through consultations with industry experts from bakery production and distribution sectors. Insights from these interviews offered operational perspectives, aligning with observed market trends and refining the collected data.

Step 4: Research Synthesis and Final Output

Primary interactions with key bakery product manufacturers were undertaken to gain insights on sales performance, consumer demand, and product innovations. This information was cross-referenced with secondary data to ensure a comprehensive analysis of the Asia Pacific bakery products market.

Frequently Asked Questions

01. How big is the Asia Pacific Bakery products market?

The Asia Pacific Bakery Products Market is valued at USD 149.81 billion, driven by urbanization, increasing incomes, and a shift towards convenience foods.

02. What are the major challenges in the Asia Pacific Bakery products market?

Challenges in Asia Pacific Bakery Products Market include stringent health and safety regulations, supply chain complexities, and high competition from local brands.

03. Who are the leading players in the Asia Pacific Bakery products market?

Major players in Asia Pacific Bakery Products Market include Mondelez International, Yamazaki Baking Co., Parle Products Pvt. Ltd., and Grupo Bimbo, among others.

04. What drives the growth of the Bakery Products Market in Asia Pacific?

The Asia Pacific Bakery Products Market growth drivers include rising consumer demand for convenience foods, increased disposable incomes, and expanding distribution channels in urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.