Asia Pacific Barium Fluoride Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9621

November 2024

92

About the Report

Asia Pacific Barium Fluoride Market Overview

- The Asia Pacific Barium Fluoride Market is valued at USD 405 million, primarily driven by significant demand across optical materials, defense, and electronics sectors. The markets growth stems from the material's unique optical properties, making it essential for applications in spectroscopic instruments and radiation detection. Barium fluoride's demand is further accelerated by technological advancements and increased government focus on enhancing local manufacturing capacities in the optics and defense industries.

- China and Japan are key players in the Asia Pacific Barium Fluoride market due to their strong industrial base, government support for research and development, and established mining infrastructure. China's dominance is due to its extensive manufacturing sector and advancements in spectroscopic applications. Japans substantial market share is attributed to its leading-edge technology in electronics and defense, requiring high-grade optical materials like barium fluoride.

- Japanese researchers announced the development of high-purity barium fluoride in 2024, setting a new standard for material quality. The project, with funding support exceeding 80 million USD, seeks to enhance performance in spectroscopic applications, contributing to improved device accuracy in sensitive industries like pharmaceuticals.

Asia Pacific Barium Fluoride Market Segmentation

By Application: The Asia Pacific Barium Fluoride market is segmented by application into optical materials, defense and aerospace, semiconductor and electronics, and other industrial applications. The optical materials segment holds a leading market share due to barium fluoride's widespread use in lenses, windows, and spectroscopic applications. This dominance is attributed to the growing demand in the defense sector and the need for high-purity materials in spectrometry.

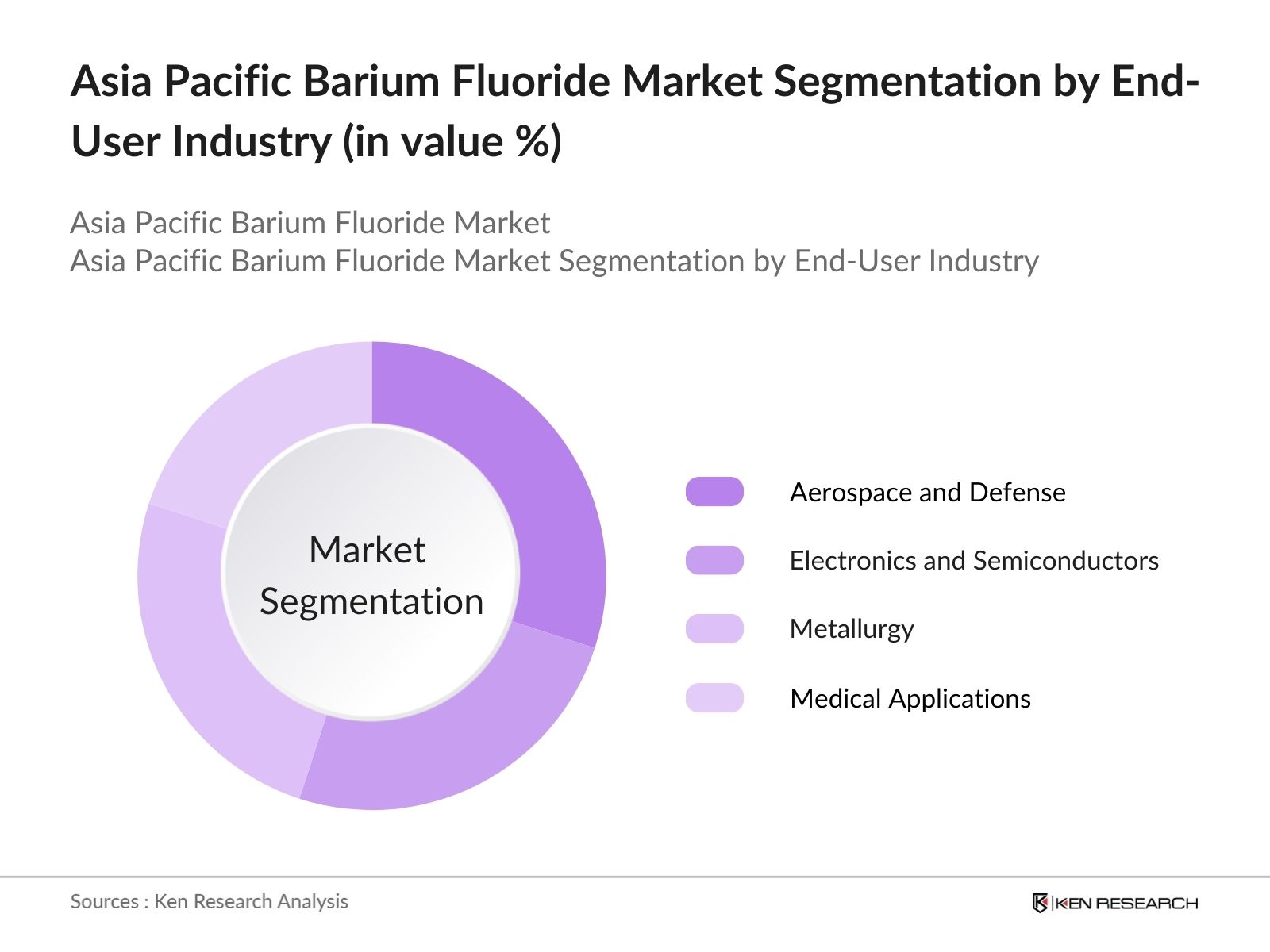

By End-Use Industry: The Asia Pacific Barium Fluoride market is segmented by end-use industry into aerospace and defense, electronics and semiconductors, metallurgy, and medical applications. The aerospace and defense sector commands the largest market share, driven by substantial investments and a high demand for precision optics and radiation detection devices in national defense programs.

Asia Pacific Barium Fluoride Market Competitive Landscape

The Asia Pacific Barium Fluoride market is characterized by a few major players dominating the market, thanks to their extensive product portfolios and technological expertise. These companies are critical to the supply chain for sectors like optics, electronics, and defense.

Asia Pacific Barium Fluoride Market Analysis

Growth Drivers

- Rising demand for optical materials in the aerospace sector: With the Asia Pacific aerospace industry projected to experience significant demand for high-quality optical components, the use of barium fluoride in high-performance optics is anticipated to grow. In 2024, regional aerospace manufacturing output reached approximately 5,200 units, showing an increased reliance on advanced materials like barium fluoride for enhanced optical clarity and resistance to radiation, essential in space-based and high-altitude applications.

- Technological advancements in spectroscopic application: Barium fluoride's utility in spectroscopic analysis, particularly in the infrared spectrum, has led to its increased adoption. The semiconductor industry in APAC is turning to barium fluoride in advanced spectroscopic equipment to facilitate material analysis in manufacturing. This demand is expected to drive further market adoption of barium fluoride.

- Government initiatives supporting local mining and manufacturing: Several APAC governments have launched programs supporting the mining and local production of high-value minerals, including fluorides. In 2024, China and Australia, prominent fluorite-producing countries, invested 1 billion USD in fluoride extraction and refinement technology improvements, aimed at reducing reliance on imported fluoride compounds and promoting local barium fluoride production.

Market Challenges

- High extraction and processing costs: Barium fluoride extraction and processing require substantial energy and advanced refinement processes, contributing to high operational costs. Estimated costs for setting up a moderate-scale fluoride extraction plant in APAC are around 200 million USD, which poses a barrier to new entrants in the market and limits expansion capabilities for existing players.

- Environmental concerns regarding mining operations: Mining activities, particularly for fluoride compounds, raise concerns about environmental impact due to waste and contamination. In 2024, APAC nations collectively spent over 3 billion USD on remediation of mining-related environmental damages, which has led to stricter regulations, making the process more costly and challenging for companies involved in barium fluoride extraction.

Asia Pacific Barium Fluoride Market Future Outlook

Over the next five years, the Asia Pacific Barium Fluoride market is anticipated to witness sustained growth. Key drivers include increased adoption of advanced optical materials in the defense and electronics sectors, growing investment in barium fluoride mining, and regulatory support for eco-friendly mining practices.

Market Opportunities

- Increasing applications in semiconductor and electronics industries: The APAC semiconductor sector, with production output valued at over 600 billion USD in 2024, is driving demand for barium fluoride in advanced photolithography processes. Barium fluoride's durability under intense conditions has positioned it as a material of choice for precision manufacturing in semiconductor facilities across Japan, South Korea, and Taiwan.

- Growing usage in radiation detection technology: Barium fluorides suitability in scintillation detectors for radiation monitoring is becoming increasingly relevant across the APAC region. Japan, which has invested approximately 300 million USD in nuclear safety technology in 2024, is a prime market for barium fluoride-based radiation detection, presenting a significant growth avenue for manufacturers.

Scope of the Report

|

By Application |

Optical materials Metallurgical industry Semiconductor and electronics Defense and aerospace Others |

|

By End-Use Industry |

Aerospace and Defense Electronics Metallurgical Medical Others |

|

By Form |

Powder Granules Solid Crystals |

|

By Distribution Channel |

Direct Sales Distributors Online Platforms |

|

By Region |

China Japan India South Korea Rest of APAC |

Products

Key Target Audience

Optics Manufacturers

Defense Contractors

Electronics Manufacturers

Mining Companies

Material Science Research Institutes

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology, National Development and Reform Commission)

Radiation Detection Device Manufacturers

Companies

Players Mentioned in the Report:

Solvay SA

Alfa Aesar

Merck KGaA

Thermo Fisher Scientific

Shandong Dongyue Group

Fluorochem Ltd.

International Crystal Laboratories

American Elements

Barium & Chemicals, Inc.

Sigma-Aldrich

Table of Contents

1. Asia Pacific Barium Fluoride Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Barium Fluoride Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Barium Fluoride Market Analysis

3.1. Growth Drivers

3.1.1. Rising demand for optical materials in the aerospace sector

3.1.2. Technological advancements in spectroscopic applications

3.1.3. Government initiatives supporting local mining and manufacturing

3.1.4. Expansion of the defense industry

3.2. Market Challenges

3.2.1. High extraction and processing costs

3.2.2. Environmental concerns regarding mining operations

3.2.3. Dependence on import of raw materials

3.2.4. Availability of alternative materials

3.3. Opportunities

3.3.1. Increasing applications in semiconductor and electronics industries

3.3.2. Growing usage in radiation detection technology

3.3.3. Investment in research and development of fluoride materials

3.3.4. Untapped potential in emerging APAC markets

3.4. Trends

3.4.1. Integration with advanced coating technologies

3.4.2. Development of eco-friendly processing techniques

3.4.3. Increased focus on sustainability and regulatory compliance

3.4.4. Partnerships between manufacturers and research institutes

3.5. Government Regulations

3.5.1. Local mining laws and export restrictions

3.5.2. Environmental regulations on barium fluoride mining

3.5.3. Import-export tariffs on fluoride-based compounds

3.5.4. Subsidies and incentives for clean mining operations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Barium Fluoride Market Segmentation

4.1. By Application (In Value %)

4.1.1. Optical materials (lenses, windows)

4.1.2. Metallurgical industry

4.1.3. Semiconductor and electronics

4.1.4. Defense and aerospace

4.1.5. Others (radiation detection, specialty coatings)

4.2. By End-Use Industry (In Value %)

4.2.1. Aerospace and Defense

4.2.2. Electronics and Semiconductors

4.2.3. Metallurgical Applications

4.2.4. Medical Applications

4.2.5. Others (Research, Industrial Applications)

4.3. By Form (In Value %)

4.3.1. Powder

4.3.2. Granules

4.3.3. Solid Crystals

4.4. By Distribution Channel (In Value %)

4.4.1. Direct Sales

4.4.2. Distributors

4.4.3. Online Platforms

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Rest of APAC

5. Asia Pacific Barium Fluoride Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Solvay SA

5.1.2. Alfa Aesar

5.1.3. American Elements

5.1.4. Merck KGaA

5.1.5. Crystran Ltd.

5.1.6. Barium & Chemicals, Inc.

5.1.7. Shanghai DiBo Chemical Technology

5.1.8. Fluorochem Ltd

5.1.9. International Crystal Laboratories

5.1.10. All-Chemie, Ltd.

5.1.11. Sigma-Aldrich

5.1.12. Shandong Dongyue Group

5.1.13. Hunan Nonferrous Metals Holding Group

5.1.14. Thermo Fisher Scientific

5.1.15. Fujian Minqiang Barium Fluoride

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Annual Revenue, Market Share, Global Reach, R&D Investment, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. Asia Pacific Barium Fluoride Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Barium Fluoride Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Barium Fluoride Future Market Segmentation

8.1. By Application (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Form (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Barium Fluoride Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, an ecosystem map was created to include all stakeholders within the Asia Pacific Barium Fluoride Market. Desk research and secondary databases were used to identify variables affecting market dynamics.

Step 2: Market Analysis and Construction

Historical data on market penetration and service ratios were analyzed, along with sector-specific statistics. This data served as the foundation for revenue and service quality estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from various companies provided feedback on market hypotheses through computer-assisted telephone interviews (CATIs), ensuring operational and financial insights were accurately represented.

Step 4: Research Synthesis and Final Output

Conversations with manufacturers of barium fluoride products and other stakeholders helped confirm and complement bottom-up derived statistics, resulting in a validated report on the Asia Pacific Barium Fluoride market.

Frequently Asked Questions

1. How big is the Asia Pacific Barium Fluoride Market?

The Asia Pacific Barium Fluoride Market is valued at USD 405 million, driven by demand from optics and defense industries, and supported by advancements in spectrometry technology.

2. What are the challenges in the Asia Pacific Barium Fluoride Market?

The Asia Pacific Barium Fluoride Market faces challenges such as high production costs, strict environmental regulations on mining, and a limited supply chain, affecting scalability and profitability.

3. Who are the major players in the Asia Pacific Barium Fluoride Market?

Key players in the Asia Pacific Barium Fluoride Market include Solvay SA, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, and Shandong Dongyue Group, distinguished by their technological expertise and global reach.

4. What drives growth in the Asia Pacific Barium Fluoride Market?

Growth of the Asia Pacific Barium Fluoride Market is driven by an expanding defense industry, increasing demand for high-quality optical materials, and government initiatives aimed at fostering local production capabilities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.