Asia Pacific Barley Tea Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9651

November 2024

88

About the Report

Asia Pacific Barley Tea Market Overview

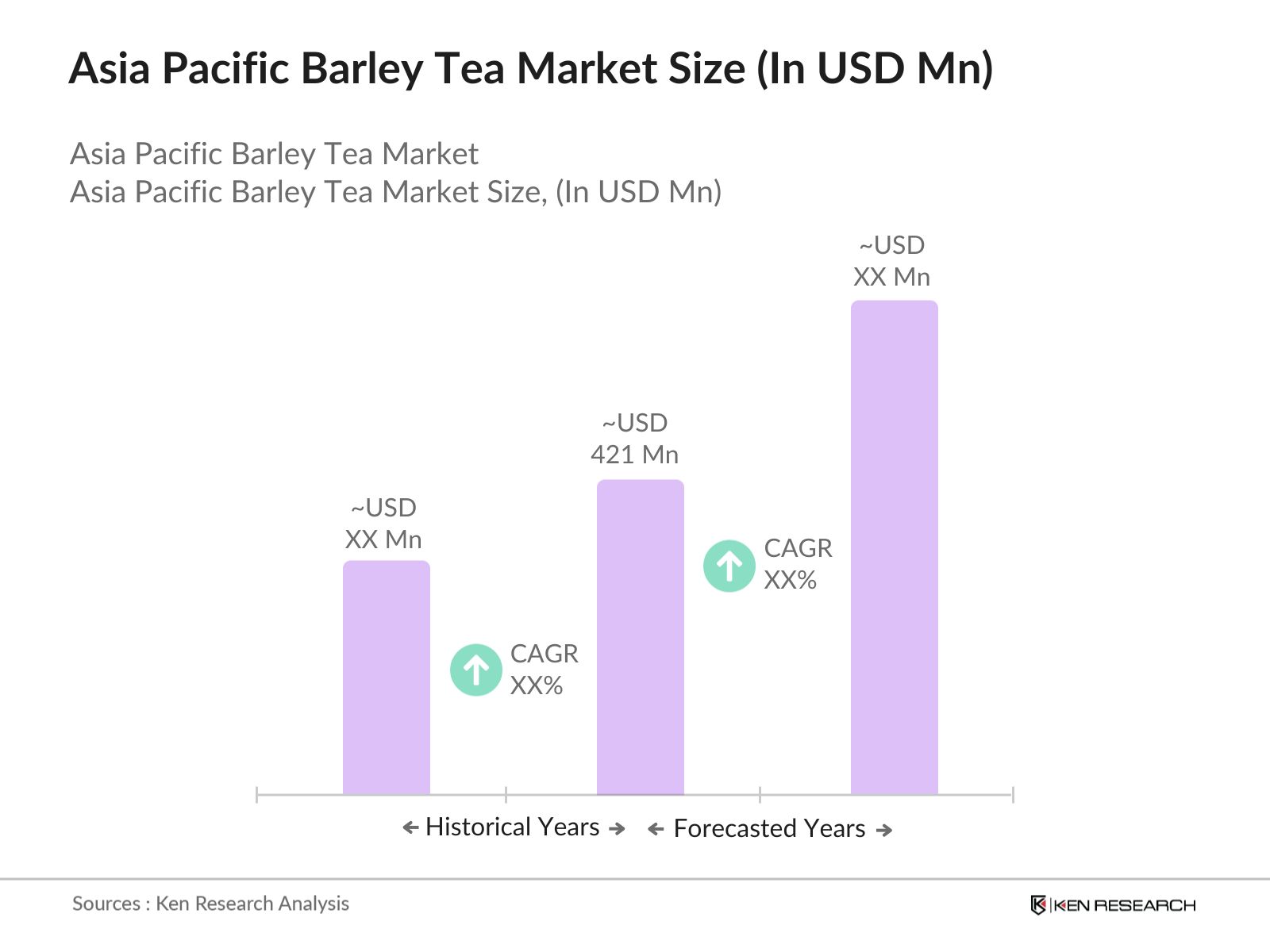

- The Asia Pacific Barley Tea Market is valued at USD 421 million based on a comprehensive analysis of the past five years. The market's growth is driven by increasing health consciousness among consumers and the beverages appeal as a non-caffeinated, functional drink. Expanding distribution channels and rising demand for organic and natural products have further fueled the market's expansion.

- Countries such as Japan, South Korea, and China lead in the Asia Pacific Barley Tea Market due to cultural acceptance of barley tea as a staple beverage, especially in households and foodservice sectors. This dominance is further supported by these nations well-established tea industries and a strong focus on health-promoting beverages among their populations.

- Governments in Japan and South Korea have introduced subsidies to support local barley production, incentivizing sustainable agriculture. In 2024, Japan allocated $120 million towards sustainable farming initiatives, encouraging the cultivation of barley to support the functional beverage market, including barley tea. Such initiatives help stabilize the raw material supply, benefiting local producers and fostering industry growth.

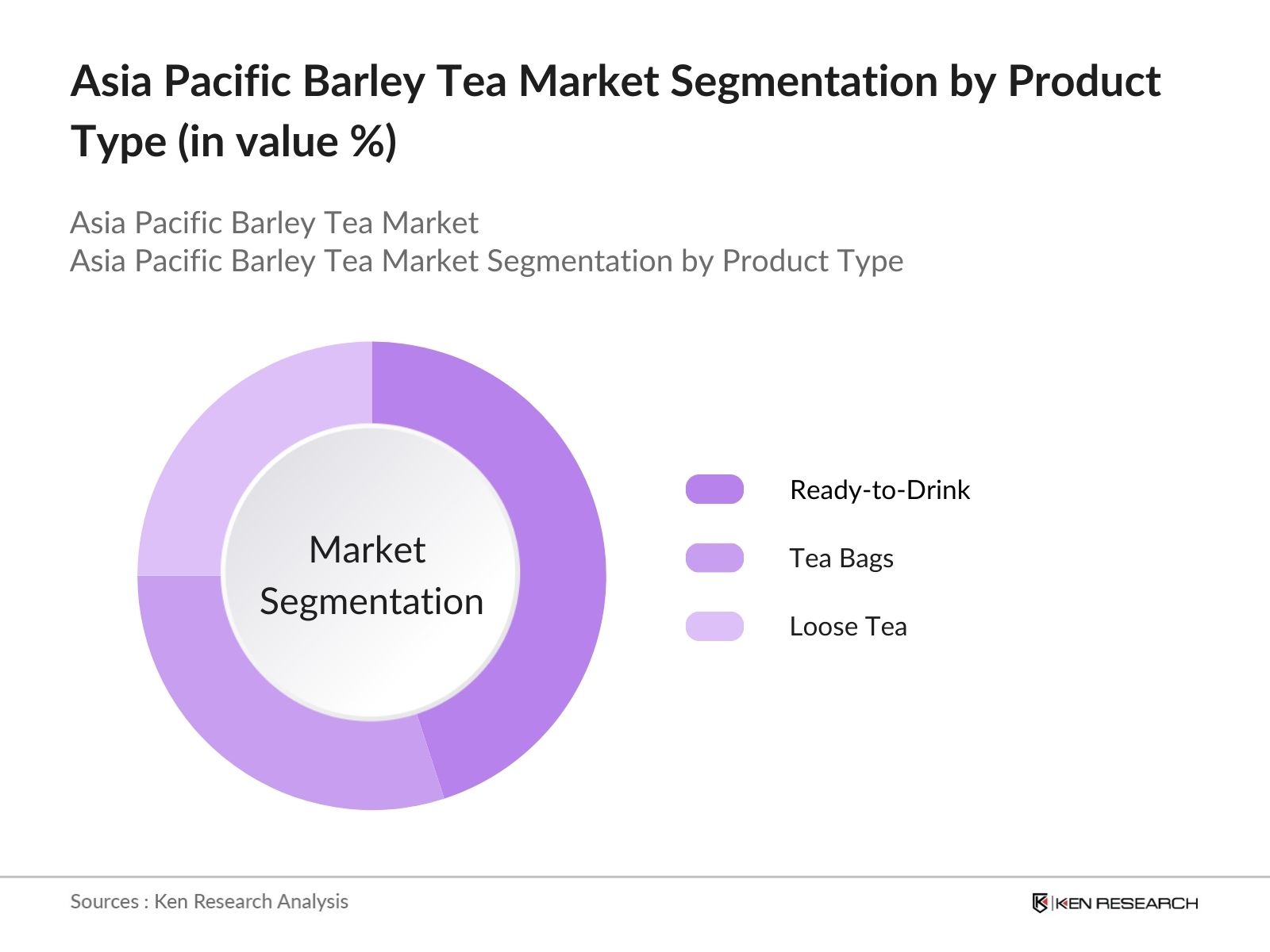

Asia Pacific Barley Tea Market Segmentation

By Product Type: The Asia Pacific Barley Tea Market is segmented by product type into loose tea, tea bags, and ready-to-drink formats. Recently, ready-to-drink barley tea holds a significant share, attributed to the convenience it offers to on-the-go consumers, especially urban dwellers. The growth of ready-to-drink formats aligns with increasing demand for instant beverages in countries like Japan and South Korea, where such products are a regular part of daily routines.

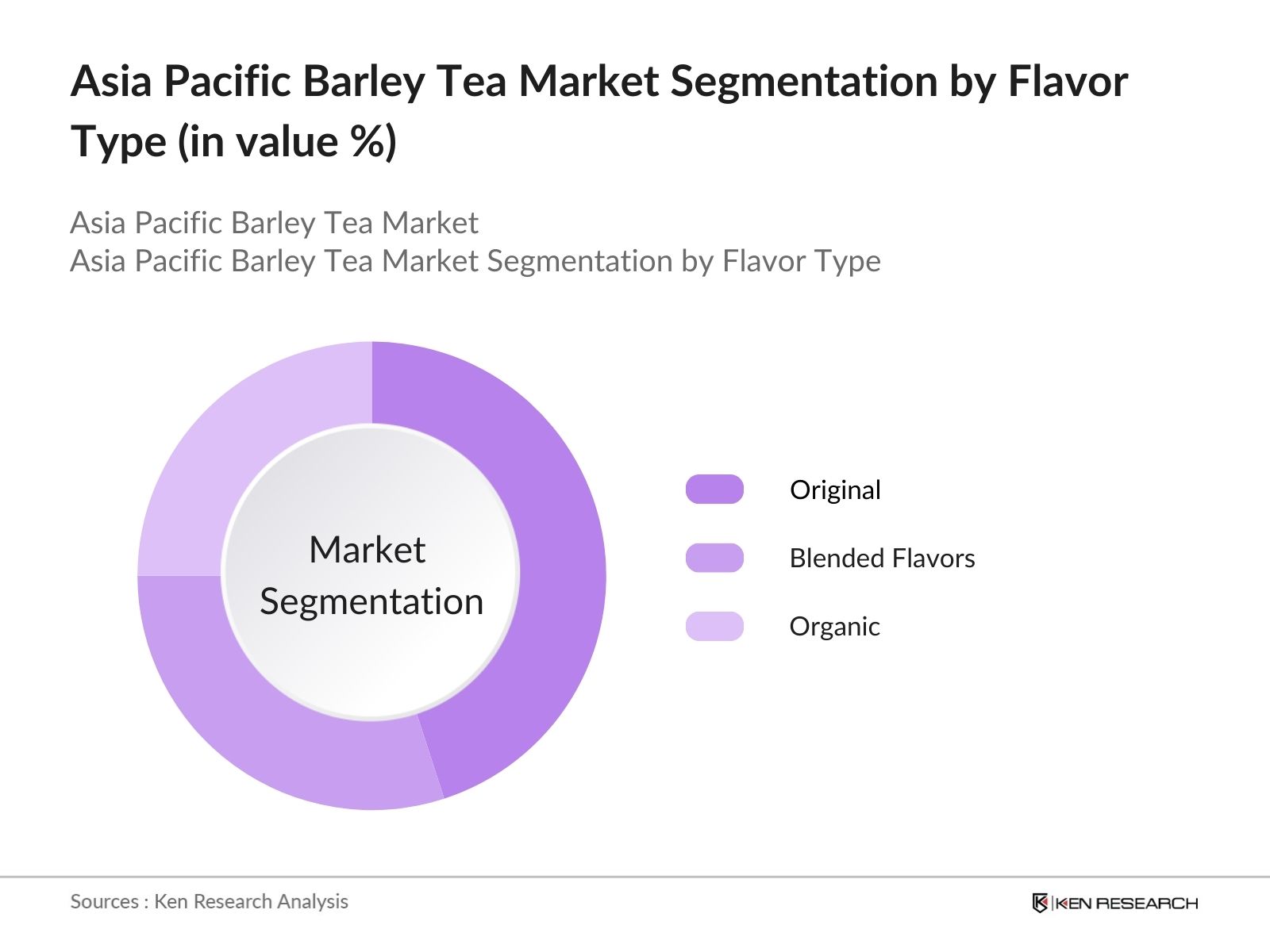

By Flavor Type: The market is also segmented by flavor type, including original, blended flavors (such as lemon and mint), and organic variants. Original flavors dominate, largely due to their longstanding cultural acceptance and simplicity in traditional diets across the Asia Pacific. Additionally, the preference for authentic, unaltered flavors in Japan and China has reinforced the market position of original-flavored barley tea.

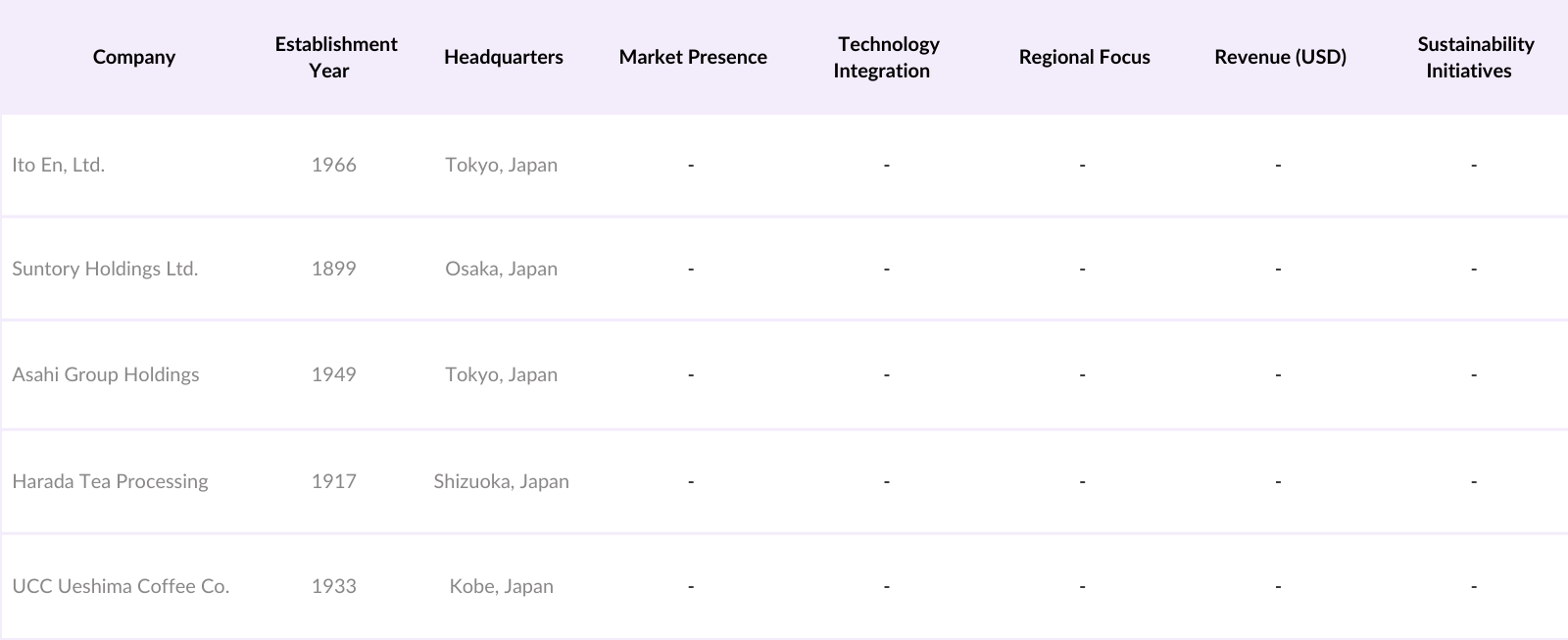

Asia Pacific Barley Tea Market Competitive Landscape

The Asia Pacific Barley Tea Market is characterized by the presence of several key players, both domestic and international. Major companies dominate through strong distribution networks and focus on product innovation tailored to regional tastes.

Asia Pacific Barley Tea Market Analysis

Growth Drivers

- Rising Health Awareness: Health consciousness among consumers in Asia Pacific has accelerated demand for barley tea, renowned for its digestive benefits and antioxidants. In 2024, health-oriented beverage consumption surged across markets like Japan and South Korea, where consumer data showed an increase in wellness-based purchases by 27 million people, focusing on beverages known to improve digestion and promote a balanced diet. These trends are driven by rising incidences of gastrointestinal issues reported by over 120 million individuals across the region, showcasing a significant shift toward dietary choices that enhance overall health.

- Increasing Adoption of Functional Beverages: The shift toward functional beverages with unique health benefits has positioned barley tea as a favored option due to its properties that aid in reducing inflammation and blood sugar levels. In 2024, over 63 million liters of barley-based beverages were consumed in the region, underscoring an increase in preference for drinks with health-boosting ingredients. Nations like China have observed an influx of brands offering functional teas, aligning with consumer demands and further reinforcing barley teas relevance.

- Cultural Acceptance and Preferences: Barley tea holds traditional significance in many Asia Pacific countries, including Japan and South Korea, where it is commonly consumed as an everyday drink. Approximately 80% of households in these countries reported regular consumption of barley tea in 2024, supported by the deep-rooted cultural preference for non-caffeinated, mild-flavored beverages. This cultural acceptance is reinforced by a robust consumer base in urban centers, increasing domestic and regional market demand.

Market Challenges

- Limited Shelf Stability: Barley teas natural composition presents challenges regarding shelf life, with oxidation and degradation issues reducing its market viability in some regions. In 2024, companies reported average product life to be less than 12 months without added preservatives, constraining the products distribution reach, especially in rural and tropical regions where temperature control is limited. This limitation has led to an approximate loss of $35 million in potential market revenues for producers.

- Lack of Consumer Awareness in Rural Areas: Despite rising popularity in urban areas, rural segments remain largely unaware of barley teas health benefits and availability, especially in emerging markets. Data from 2024 indicates that barley tea penetration in rural Asia Pacific areas was below 15 million households, compared to 68 million in urban centers, reflecting a significant disparity. This challenge limits market expansion and highlights the need for targeted awareness campaigns.

Asia Pacific Barley Tea Market Future Outlook

The Asia Pacific Barley Tea Market is poised for sustained growth, driven by consumer health trends and expanding retail channels across urban and rural areas. Efforts toward sustainable packaging and increasing consumer awareness about barley tea's health benefits are expected to influence product preferences and expand market reach.

Market Opportunities

- Expansion of Online Retail Channels: Online retail channels are expanding rapidly, providing barley tea producers with broader market reach. In 2024, the Asia Pacific e-commerce market added over 60 million new users, with a marked interest in specialty and health-based products like barley tea. This trend enables manufacturers to directly target health-conscious consumers, particularly in regions without established physical distribution channels.

- Product Diversification (e.g., Flavored Barley Tea): Companies are exploring product diversification through flavored barley teas to cater to varied consumer tastes. In 2024, flavors such as honey and lemon witnessed an uptake, attracting approximately 25 million consumers across South Korea and Japan, where consumers demonstrated a growing interest in value-added, taste-enhanced products. Such diversification aligns with rising demand for unique tea flavors, creating opportunities to increase market share.

Scope of the Report

|

By Product Type |

Loose Tea Tea Bags Ready-to-Drink |

|

By Flavor Type |

Original Blended Flavors (e.g., Lemon, Mint) Organic |

|

By Distribution Channel |

Supermarkets & Hypermarkets Online Retail Specialty Stores Convenience Stores |

|

By End-User |

Household Food Service Sector (Hotels, Cafes) |

|

By Region |

China Japan South Korea Southeast Asia Oceania |

Products

Key Target Audience

Manufacturers and Suppliers of Barley Tea Products

Retail and Distribution Channels

Food and Beverage Industry Associations

Health and Wellness Product Distributors

Investors and Venture Capitalist Firms

Research and Development (R&D) Teams

Government and Regulatory Bodies (e.g., Japanese Food and Drug Safety Agency, Ministry of Agriculture, Forestry, and Fisheries - Japan)

Online and E-commerce Retailers

Companies

Players Mentioned in the Report:

Ito En, Ltd.

Suntory Holdings Ltd.

Asahi Group Holdings

Harada Tea Processing

UCC Ueshima Coffee Co., Ltd.

Coca-Cola Bottlers Japan Inc.

Pokka Sapporo Food & Beverage Ltd.

Kirin Beverage Company

Daiohs Corporation

Marutomo Co., Ltd.

Table of Contents

1. Asia Pacific Barley Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Barley Tea Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Barley Tea Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Awareness

3.1.2. Increasing Adoption of Functional Beverages

3.1.3. Cultural Acceptance and Preferences

3.1.4. Growing Demand for Non-Caffeinated Beverages

3.2. Market Challenges

3.2.1. Limited Shelf Stability

3.2.2. Lack of Consumer Awareness in Rural Areas

3.2.3. Competition from Established Herbal Teas

3.3. Opportunities

3.3.1. Expansion of Online Retail Channels

3.3.2. Product Diversification (e.g., Flavored Barley Tea)

3.3.3. Increased Penetration into Emerging Economies

3.4. Trends

3.4.1. Organic and Natural Labeling

3.4.2. Enhanced Packaging Solutions

3.4.3. Adoption of Ready-to-Drink (RTD) Formats

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Import and Export Regulations

3.5.3. Labeling Requirements for Health Beverages

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Barley Tea Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Loose Tea

4.1.2. Tea Bags

4.1.3. Ready-to-Drink

4.2. By Flavor Type (In Value %)

4.2.1. Original

4.2.2. Blended Flavors (e.g., Mint, Lemon)

4.2.3. Organic

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets & Hypermarkets

4.3.2. Online Retail

4.3.3. Specialty Stores

4.3.4. Convenience Stores

4.4. By End-User (In Value %)

4.4.1. Household

4.4.2. Food Service Sector (Hotels, Cafes)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Southeast Asia

4.5.5. Oceania

5. Asia Pacific Barley Tea Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ito En, Ltd.

5.1.2. Harada Tea Processing Co., Ltd.

5.1.3. Suntory Holdings Limited

5.1.4. Oi Ocha

5.1.5. UCC Ueshima Coffee Co., Ltd.

5.1.6. Asahi Group Holdings, Ltd.

5.1.7. Daiohs Corporation

5.1.8. Marubeni Corporation

5.1.9. Kirin Beverage Company

5.1.10. Coca-Cola Bottlers Japan Inc.

5.1.11. Pokka Sapporo Food & Beverage Ltd.

5.1.12. Sanyo Foods Co., Ltd.

5.1.13. Tassei Co., Ltd.

5.1.14. Yamamotoyama Tea Company

5.1.15. Marutomo Co., Ltd.

5.2. Cross Comparison Parameters (Product Range, Market Presence, Distribution Networks, Revenue, Product Pricing, Innovation Rate, Sustainability Initiatives, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Subsidies for Export

5.8. Partnership with Local Distributors

5.9. Private Equity Investments

6. Asia Pacific Barley Tea Market Regulatory Framework

6.1. Quality Standards Compliance

6.2. Certification Requirements for Organic Labeling

6.3. Import Tariffs and Trade Agreements

7. Asia Pacific Barley Tea Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Market Expansion

8. Asia Pacific Barley Tea Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Barley Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Portfolio Enhancement

9.3. Regional Expansion Strategy

9.4. Consumer Engagement Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

An initial ecosystem map was created to identify all major stakeholders, including industry players and regulatory authorities, in the Asia Pacific Barley Tea Market. This step involved extensive desk research using proprietary and public databases to determine critical variables affecting the market.

Step 2: Market Analysis and Construction

Historical data was analyzed to construct a comprehensive market view, focusing on consumer demand and distribution networks. Data from these analyses were instrumental in understanding the current market dynamics and consumer trends.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through consultations with key industry experts via computer-assisted telephone interviews (CATIs), providing insights on competitive positioning, challenges, and growth opportunities.

Step 4: Research Synthesis and Final Output

The final phase incorporated feedback from major barley tea manufacturers, consolidating findings to ensure an accurate, data-backed market report aligned with industry insights.

Frequently Asked Questions

1. How big is the Asia Pacific Barley Tea Market?

The Asia Pacific Barley Tea Market, valued at USD 421 million based on the latest data, is driven by rising health awareness and an increase in demand for non-caffeinated beverages.

2. What are the main challenges in the Asia Pacific Barley Tea Market?

Key challenges include limited shelf stability and the low awareness in certain rural regions, posing barriers to widespread adoption.

3. Who are the major players in the Asia Pacific Barley Tea Market?

Major players include Ito En, Ltd., Suntory Holdings Ltd., and Asahi Group Holdings, which dominate due to extensive distribution networks and strong brand recognition.

4. What factors drive the growth of the Asia Pacific Barley Tea Market?

The market is primarily driven by increasing demand for functional beverages, consumer health consciousness, and the popularity of barley tea as a staple drink in East Asian countries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.