Asia Pacific Battery Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD10960

November 2024

90

About the Report

Asia Pacific Battery Market Overview

- The Asia Pacific Battery Market, with a valuation of USD 70.26 billion, has demonstrated robust growth due to the rapid adoption of electric vehicles (EVs), expansion in renewable energy storage applications, and substantial government backing across the region. China and South Korea play a significant role in shaping the market, fueled by extensive industrial capacity and technology advancements that ensure regional production meets rising demand for batteries.

- China, South Korea, and Japan lead the Asia Pacific battery market, attributed to their strong manufacturing bases, supportive government policies, and high consumer demand for electric mobility. In particular, Chinese cities like Shenzhen and Shanghai and South Koreas capital, Seoul, have become production and research hubs, hosting leading battery manufacturers that benefit from government incentives and well-established supply chains.

- Asia Pacific countries are enhancing recycling standards to manage battery waste, promoting environmental sustainability. In 2023, South Korea implemented stringent battery recycling guidelines, requiring manufacturers to establish take-back systems, which support circular economy practices. Japan also introduced policies in 2023 mandating proper disposal and recycling of used batteries to minimize environmental impact, a move expected to encourage sustainable practices across the industry.

Asia Pacific Battery Market Segmentation

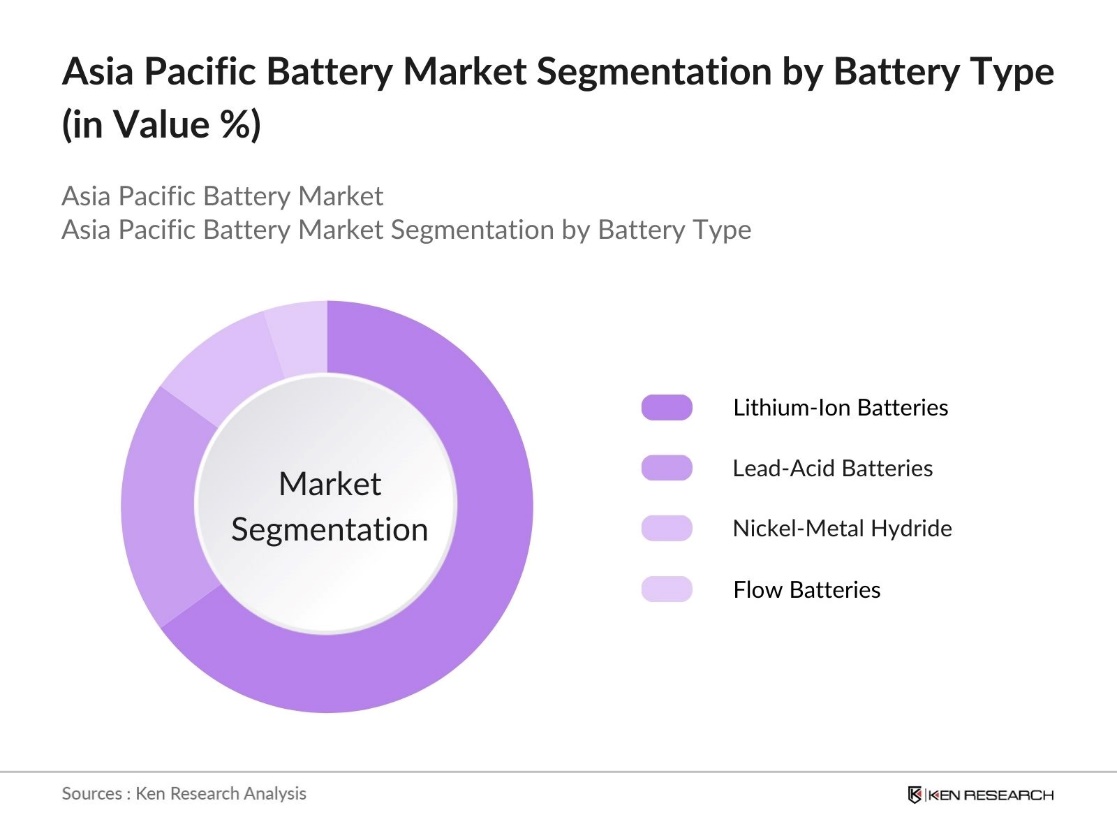

- By Battery Type: The market is segmented by battery type into Lithium-Ion Batteries, Lead-Acid Batteries, Nickel-Metal Hydride Batteries, and Flow Batteries. Recently, lithium-ion batteries have maintained a dominant market share in the Asia Pacific under the battery type segmentation. This is due to their widespread application across EVs, portable electronics, and grid energy storage solutions. Their energy density, lifespan, and decreasing production costs have positioned lithium-ion batteries as the preferred choice for manufacturers looking to meet the growing demand for efficient, long-lasting batteries.

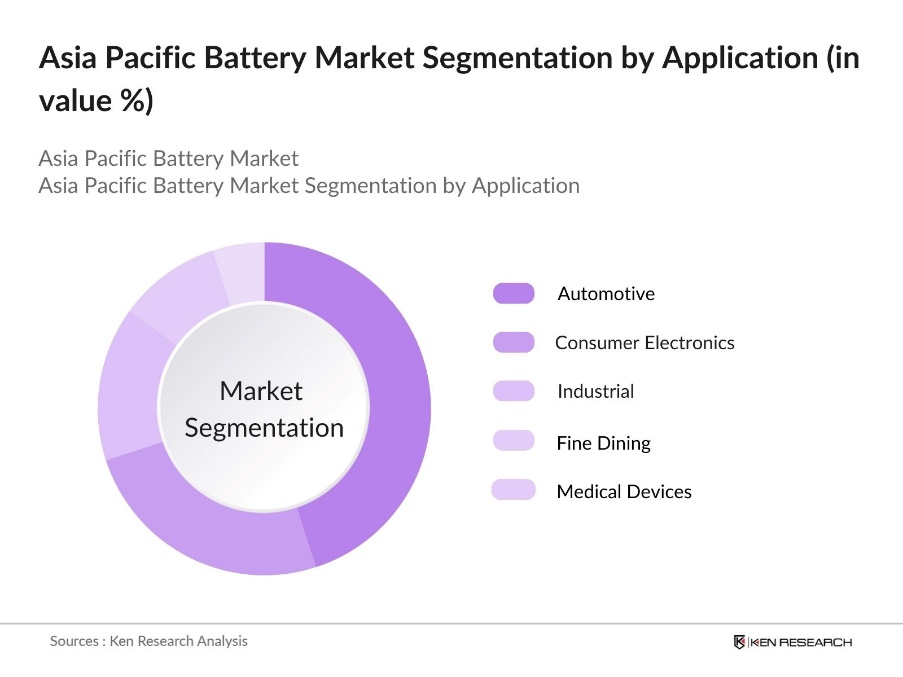

- By Application: The market is segmented by application into Automotive, Consumer Electronics, Industrial, Energy Storage Systems, and Medical Devices. Within this segmentation, automotive applications, driven by the rapid increase in electric vehicle (EV) production, hold the leading market share. Rising EV adoption, supported by policy incentives and the focus on emission reduction, is leading automakers to increasingly invest in battery technology, boosting the automotive segments share of the battery market.

Asia Pacific Battery Market Competitive Landscape

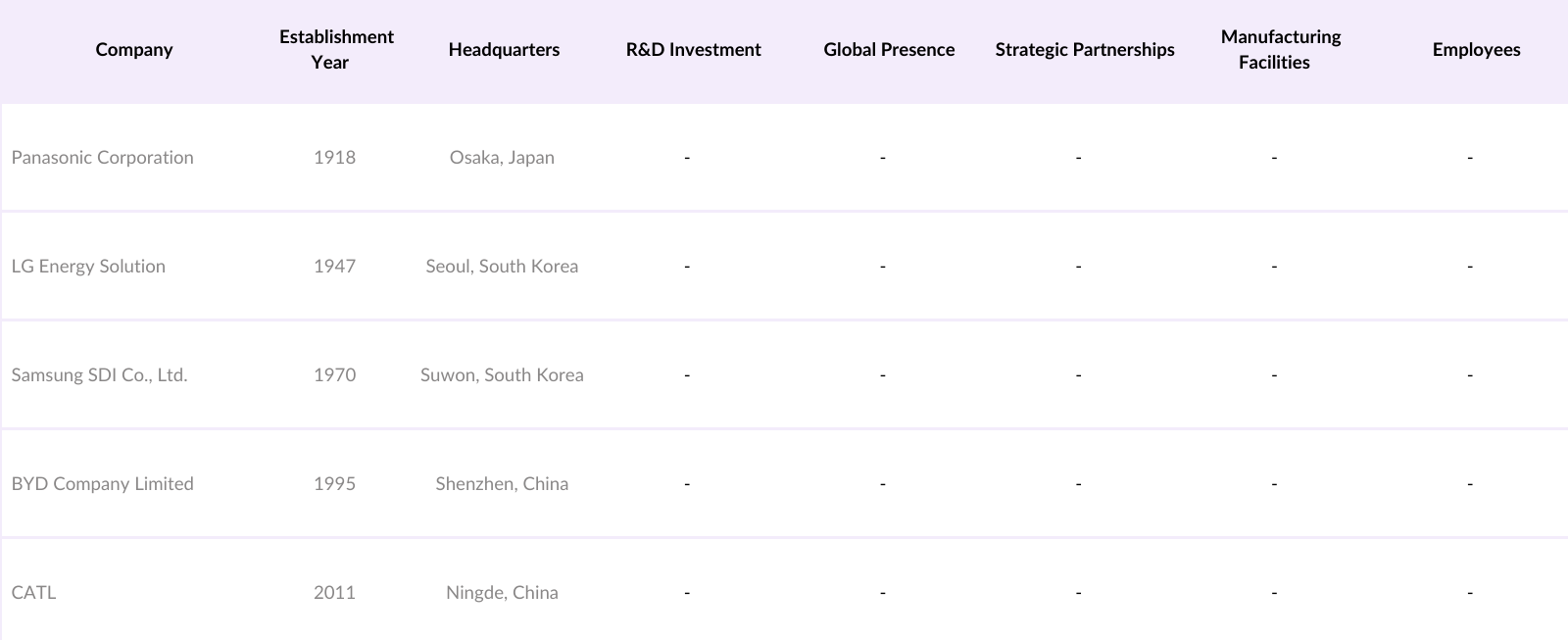

The Asia Pacific Battery Market is highly competitive, with both regional giants and global players striving for market share. The market is dominated by major companies like Panasonic, LG Energy Solution, and Samsung SDI, whose strong R&D capabilities and extensive product lines provide significant competitive advantages. Other key players, such as CATL and BYD, are expanding their production capacities to cater to the rising demand in EV and energy storage sectors, further solidifying the competitive landscape.

Asia Pacific Battery Industry Analysis

Growth Drivers

- Energy Transition Initiatives: Energy transition initiatives in the Asia Pacific region are significantly driving battery demand, particularly due to the regions aggressive shift toward renewable energy sources. In 2023, China indeed made significant investments in clean energy projects, totaling approximately USD 890 billion (6.3 trillion yuan), which marked a substantial increase from the previous year. This shift toward low-carbon energy directly propels battery market growth as it necessitates substantial energy storage capabilities to balance renewable energy intermittency.

- Rising EV Adoption: The Asia Pacific regions electric vehicle (EV) market has seen rapid adoption, in 2023, China accounted for nearly 60% of global EV sales, with over 8.1 million new electric car registrations, marking a 35% increase from 2022. This surge fuels the demand for advanced battery technologies to power these vehicles. South Korea and India, with increasing governmental support and infrastructure investments, thereby significantly boosting demand for lithium-ion and emerging solid-state batteries essential for sustainable vehicle electrification.

- Advancements in Battery Technology: Technological advancements in the Asia Pacific battery market are driving the development of high-density batteries. Japan and South Korea are focusing on solid-state and lithium-metal technologies, respectively, to enhance safety, capacity, and efficiency. These innovations are essential for applications in electric vehicles and grid energy storage, supporting the regions growing demand for reliable energy solutions and facilitating sustainable energy transitions.

Market Challenges

- Raw Material Supply Constraints: The Asia Pacific battery market faces significant challenges in securing essential raw materials like lithium and cobalt, which are crucial for battery production. Demand for these materials often surpasses supply, creating persistent supply risks that impact production stability. Countries reliant on imports encounter added costs and logistical hurdles, underscoring the need for diversified sources and sustainable supply chains to mitigate potential shortages.

- High Production Costs: Battery production costs pose a major challenge in the Asia Pacific region, especially in countries with limited local supplies of lithium-ion components. High production expenses, driven by the reliance on imported materials and energy costs, create barriers for smaller manufacturers. These cost pressures hinder broader adoption of battery storage solutions and slow down the progress of renewable energy initiatives across the region.

Asia Pacific Battery Market Future Outlook

The Asia Pacific Battery Market is poised for strong growth over the coming years, propelled by rising EV adoption, increased investment in energy storage solutions, and supportive government policies aimed at sustainability and clean energy. As battery technology advances, such as solid-state and lithium-sulfur batteries, the market is likely to witness even greater adoption across various applications. The outlook remains positive as environmental regulations tighten and demand for green technologies continues to accelerate.

Market Opportunities

- Demand for Energy Storage Systems (ESS): The increasing demand for energy storage systems (ESS) to support renewable energy grids offers significant opportunities for battery manufacturers. ESS solutions play a crucial role in stabilizing grid performance, especially as more renewable sources are integrated into power networks. This demand emphasizes the essential role of batteries in ensuring grid stability and meeting the growing energy storage needs across the Asia Pacific region.

- Expansion in Emerging Markets: Emerging markets in Southeast Asia are prioritizing battery technology to support their energy storage and security goals. Countries in the region are investing in battery solutions to enhance grid stability and improve energy reliability. This focus on energy storage represents considerable growth potential for the battery industry, as these markets work to secure sustainable power solutions to meet increasing energy demands.

Scope of the Report

|

By Battery Type |

Lithium-Ion Batteries Lead-Acid Batteries Nickel-Metal Hydride Batteries Flow Batteries Other Battery Types |

|

By Application |

Automotive Consumer Electronics Industrial Energy Storage Systems Medical Devices |

|

By Capacity Range |

Below 1000mAh 1000mAh to 5000mAh 5000mAh to 10000mAh Above 10000mAh |

|

By End-User Sector |

Residential Commercial Industrial Utility-Scale |

|

By Region |

China Japan South Korea India ASEAN Countries |

Products

Key Target Audience

Battery Manufacturers

Electric Vehicle Manufacturers

Renewable Energy Developers

Industrial Equipment Manufacturers

Utility Companies

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Industry, Ministry of New and Renewable Energy)

Companies

Players Mentioned in the Report

anasonic Corporation

LG Energy Solution

Samsung SDI Co., Ltd.

BYD Company Limited

Contemporary Amperex Technology Co. Ltd. (CATL)

Toshiba Corporation

GS Yuasa Corporation

Envision AESC Group Ltd.

Hitachi Chemical Co., Ltd.

Amara Raja Batteries Ltd.

Table of Contents

1. Asia Pacific Battery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Growth Rate (Volume and Value)

1.4. Market Segmentation Overview

1.5. Demand Dynamics (Grid Storage, Automotive, Consumer Electronics)

2. Asia Pacific Battery Market Size (In USD Mn)

2.1. Historical Market Size Analysis

2.2. Year-On-Year Growth Analysis (YoY %)

2.3. Key Market Developments and Milestones

3. Asia Pacific Battery Market Analysis

3.1. Growth Drivers

3.1.1. Energy Transition Initiatives

3.1.2. Rising EV Adoption

3.1.3. Government Support and Incentives

3.1.4. Advancements in Battery Technology

3.2. Market Challenges

3.2.1. Raw Material Supply Constraints

3.2.2. High Production Costs

3.2.3. Environmental and Disposal Concerns

3.3. Opportunities

3.3.1. Demand for Energy Storage Systems (ESS)

3.3.2. Expansion in Emerging Markets

3.3.3. Recycling and Sustainable Solutions

3.4. Trends

3.4.1. Solid-State Battery Innovations

3.4.2. Integration with Renewable Energy

3.4.3. High-Capacity Battery Development

3.5. Government Regulations

3.5.1. Emission Reduction Policies

3.5.2. Import-Export Tariffs

3.5.3. Recycling Standards and Guidelines

3.5.4. Battery Safety Standards

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Ecosystem

4. Asia Pacific Battery Market Segmentation

4.1. By Battery Type (In Value %)

4.1.1. Lithium-Ion Batteries

4.1.2. Lead-Acid Batteries

4.1.3. Nickel-Metal Hydride Batteries

4.1.4. Flow Batteries

4.1.5. Other Battery Types

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Consumer Electronics

4.2.3. Industrial

4.2.4. Energy Storage Systems

4.2.5. Medical Devices

4.3. By Capacity Range (In Value %)

4.3.1. Below 1000mAh

4.3.2. 1000mAh to 5000mAh

4.3.3. 5000mAh to 10000mAh

4.3.4. Above 10000mAh

4.4. By End-User Sector (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.4.4. Utility-Scale

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. India

4.5.5. ASEAN Countries

5. Asia Pacific Battery Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Panasonic Corporation

5.1.2. Samsung SDI Co., Ltd.

5.1.3. LG Energy Solution

5.1.4. BYD Company Limited

5.1.5. Contemporary Amperex Technology Co. Ltd (CATL)

5.1.6. Toshiba Corporation

5.1.7. GS Yuasa Corporation

5.1.8. Envision AESC Group Ltd.

5.1.9. Hitachi Chemical Co., Ltd.

5.1.10. Amara Raja Batteries Ltd.

5.1.11. Exide Industries Ltd.

5.1.12. Luminous Power Technologies Pvt. Ltd.

5.1.13. Shenzen BAK Battery Co., Ltd.

5.1.14. Microvast Holdings, Inc.

5.1.15. Narada Power Source Co., Ltd.

5.2. Cross Comparison Parameters (Production Capacity, R&D Investment, Revenue, Global Presence, Product Portfolio Depth, Strategic Partnerships, Manufacturing Facilities, Number of Employees)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Battery Market Regulatory Framework

6.1. Environmental Standards and Emission Controls

6.2. Compliance and Certification Requirements

6.3. Safety and Hazardous Material Regulations

7. Asia Pacific Battery Future Market Size (In USD Mn)

7.1. Projected Future Market Size

7.2. Key Drivers for Future Market Growth

8. Asia Pacific Battery Market Future Segmentation

8.1. By Battery Type (In Value %)

8.2. By Application (In Value %)

8.3. By Capacity Range (In Value %)

8.4. By End-User Sector (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Battery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Distribution Strategies

9.4. Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves establishing a comprehensive ecosystem map of the Asia Pacific Battery Market. Extensive desk research and proprietary databases were used to identify critical market variables and stakeholders influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data was compiled to analyze market trends and revenue streams across the Asia Pacific Battery Market. This phase evaluated battery penetration in EV and energy storage applications to gauge the overall market structure.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through consultations with industry experts from leading battery manufacturing firms. Computer-assisted telephone interviews (CATIs) were conducted to capture in-depth financial and operational insights directly from professionals.

Step 4: Research Synthesis and Final Output

In the final stage, direct engagements with battery manufacturers provided insights into product segments, manufacturing capacity, and supply chain dynamics, ensuring the accuracy of revenue estimates through a bottom-up approach.

Frequently Asked Questions

01. How big is the Asia Pacific Battery Market?

The Asia Pacific Battery Market is valued at USD 70.26 billion, driven by the surging adoption of EVs and energy storage systems within the region.

02. What are the key challenges in the Asia Pacific Battery Market?

Challenges in Asia Pacific Battery Market include high production costs, stringent environmental regulations, and raw material supply constraints, which impact both pricing and profitability.

03. Who are the leading players in the Asia Pacific Battery Market?

Leading companies in Asia Pacific Battery Market include Panasonic Corporation, LG Energy Solution, Samsung SDI, CATL, and BYD, which maintain dominance through their extensive production capacities and R&D capabilities.

04. What factors drive growth in the Asia Pacific Battery Market?

The Asia Pacific Battery Market growth is driven by the adoption of electric vehicles, renewable energy integration, and supportive policies aimed at reducing carbon emissions across the region.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.