Asia Pacific Bio-Based Coating Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD10456

November 2024

97

About the Report

Asia Pacific Bio-Based Coating Market Overview

- The Asia Pacific Bio-Based Coating Market is valued at USD 3 billion based on a five-year historical analysis. The market is driven by increased consumer awareness of sustainability, strict government regulations on environmental protection, and growing demand from key end-use industries such as construction and automotive. Bio-based coatings, derived from renewable sources such as vegetable oils and natural resins, offer low volatile organic compounds (VOCs) emissions, driving their demand across various industries.

- The market is dominated by countries such as China, India, Japan, and Australia due to their massive manufacturing and construction sectors. China and India, with their booming construction activities and growing industrial output, have led the demand for bio-based coatings. In Japan, stringent environmental regulations have encouraged the adoption of eco-friendly alternatives, while Australia's focus on sustainability in both manufacturing and building practices continues to push market demand.

- Several countries in the Asia Pacific region have implemented policies that directly support the adoption of green coatings. In 2023, India launched its Green India Mission, which includes incentives for industries adopting eco-friendly practices, such as the use of bio-based coatings. Japans 2050 Carbon Neutrality Policy also encourages the use of green technologies, including coatings, in various sectors. These national policies not only provide financial incentives but also create a favorable regulatory environment for the adoption of bio-based coatings, accelerating their integration into the market.

Asia Pacific Bio-Based Coating Market Segmentation

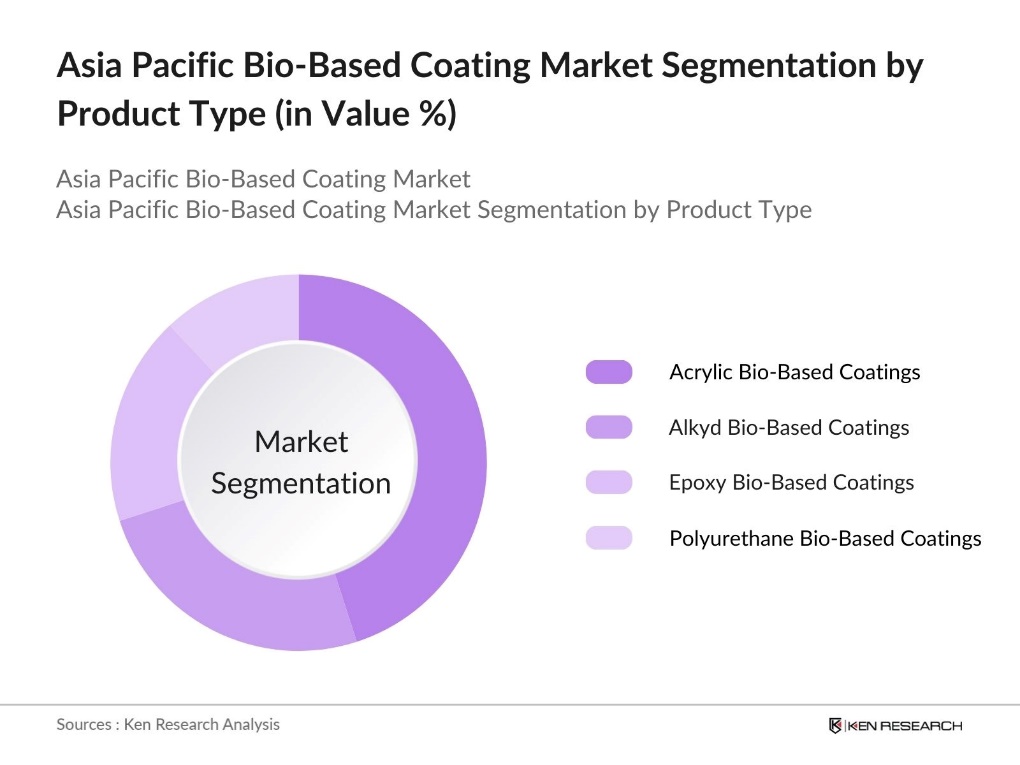

By Product Type: The Asia Pacific Bio-Based Coating market is segmented by product type into Acrylic Bio-Based Coatings, Alkyd Bio-Based Coatings, Epoxy Bio-Based Coatings, and Polyurethane Bio-Based Coatings. Recently, Acrylic Bio-Based Coatings have taken a dominant market share within this segmentation. Their popularity can be attributed to their versatility and durability, making them highly preferred in the construction and automotive industries. Their low cost compared to other bio-based alternatives and the ease of application have also contributed to their dominance in the region.

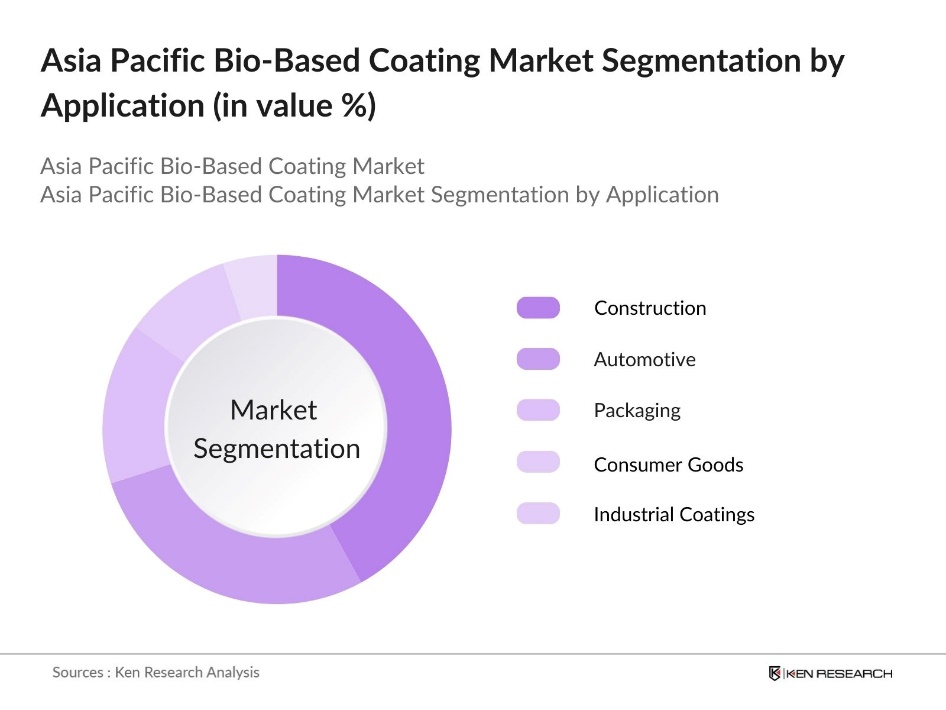

By Application: The Asia Pacific Bio-Based Coating market is also segmented by application into Construction, Automotive, Packaging, Consumer Goods, and Industrial Coatings. Construction is the leading sub-segment in terms of market share. The growth of green buildings and sustainability initiatives across various Asia Pacific nations has propelled the demand for eco-friendly coatings in the construction sector. Governments have incentivized using bio-based materials, resulting in a surge in bio-based coating adoption in residential, commercial, and infrastructure projects.

Asia Pacific Bio-Based Coating Market Competitive Landscape

The market is dominated by several key players, including both regional and international companies. These players focus on expanding their product portfolios, increasing production capacity, and investing in research and development to innovate bio-based technologies. The market is moderately consolidated, with a few companies holding a significant share, driven by their ability to scale production and meet growing demand from end-user industries.

|

Company |

Established Year |

Headquarters |

No. of Employees |

R&D Expenditure (USD Mn) |

Global Presence |

Sustainability Initiatives |

Major Products |

Revenue (USD Mn) |

|

AkzoNobel N.V. |

1792 |

Netherlands |

||||||

|

BASF SE |

1865 |

Germany |

||||||

|

PPG Industries |

1883 |

United States |

||||||

|

Sherwin-Williams Company |

1866 |

United States |

||||||

|

Nippon Paint Holdings Co., Ltd. |

1881 |

Japan |

Asia Pacific Bio-Based Coating Industry Analysis

Growth Drivers

- Rising Demand for Sustainable Coatings (Sustainability): The demand for sustainable coatings in the Asia Pacific market is increasing as countries shift toward eco-friendly manufacturing. In 2023, countries like Japan and Australia implemented stricter regulations, pushing industries to adopt bio-based alternatives. For instance, Chinas Ministry of Ecology and Environment promotes the use of bio-based coatings to reduce VOC emissions, aligning with the countrys carbon neutrality goals by 2060. The regional construction industry also benefits, as green building materials are in high demand. Bio-based coatings provide a lower environmental impact, boosting their adoption in construction, automotive, and industrial applications.

- Increased Use of Bio-Based Raw Materials (Raw Material Supply Chain): The supply chain for bio-based raw materials is expanding in the Asia Pacific region, with large-scale investments in sustainable agriculture and biorefineries. In 2023, Thailand increased its production of bio-based feedstocks like palm oil and soybeans, which are critical for manufacturing bio-based coatings. Australias development of bio-based chemical refineries supports local supply chains, reducing reliance on imports. This regional self-sufficiency minimizes risks associated with supply disruptions, making bio-based coatings a viable and accessible solution for multiple industries. The rise of bio-economies across Southeast Asia further contributes to the supply chain's resilience.

- Growth in Construction and Automotive Industries (End-Use Sectors): The construction and automotive industries in Asia Pacific are pivotal for bio-based coatings adoption. As sustainability gains traction, these sectors are turning to eco-friendly coatings to meet strict environmental standards. Construction projects increasingly use bio-based coatings for green building initiatives, while the automotive sector integrates them to reduce emissions and comply with regulations, fostering sustainable industry practices.

Market Challenges

- High Production Costs of Bio-Based Materials (Cost Dynamics): The high production costs of bio-based materials present a significant challenge for manufacturers. Extracting and processing bio-based resins, such as those from soy or linseed oil, is more expensive compared to petrochemical alternatives. This cost disparity limits the widespread adoption of bio-based coatings, especially in regions where cheaper synthetic options are available. However, advancements in technology and potential government support may help reduce production costs over time.

- Limited Availability of Raw Materials (Supply Chain Bottlenecks): The availability of raw materials for bio-based coatings is another challenge in the Asia Pacific market. Natural feedstocks, essential for bio-resin production, can be affected by seasonal changes and supply disruptions, impacting production consistency. This limitation in the supply chain hinders manufacturers' ability to meet growing demand for bio-based coatings, adding complexity to scaling up production efforts in the region.

Asia Pacific Bio-Based Coating Market Future Outlook

Over the next five years, the Asia Pacific Bio-Based Coating market is expected to show significant growth driven by increasing consumer awareness of eco-friendly products, government incentives for reducing VOC emissions, and technological advancements in bio-based materials. As more industries transition towards sustainable alternatives, bio-based coatings will play a crucial role in reducing environmental impact across sectors like automotive, packaging, and construction. The expansion of green building certifications and the rise in sustainable packaging trends are expected to further boost the demand for bio-based coatings.

Market Opportunities

- Advances in Bio-Based Resin Technologies (Technological Innovation): Technological innovations in bio-based resin technologies are opening significant opportunities for the market. Improved formulations of bio-based resins, such as polyurethane and epoxy, are now offering comparable performance to traditional petrochemical-based materials. These advancements are enabling industries to adopt bio-based coatings in various sectors, including automotive, aerospace, and consumer electronics. As production scales up, these innovations are making bio-based coatings more competitive and accessible, paving the way for broader market penetration.

- Expanding Application in Packaging and Consumer Goods (New Market Applications): The increasing demand for sustainable packaging and consumer goods is driving the use of bio-based coatings. These coatings are being adopted for packaging solutions and products like furniture, electronics, and home appliances due to their environmentally friendly properties. As sustainability regulations tighten, more industries are turning to bio-based coatings to meet eco-friendly standards, demonstrating the versatility of these materials across diverse applications.

Scope of the Report

|

By Product Type |

Acrylic Bio-Based Coatings Alkyd Bio-Based Coatings Epoxy Bio-Based Coating Polyurethane |

|

By Application |

Construction Automotive Packaging Consumer Goods Industrial Coatings |

|

By Technology |

Solvent-Based Bio Coatings Waterborne Bio Coatings Powder Coatings High-Solid Coatings |

|

By Raw Material |

Soybean Oil Castor Oil Tall Oil Corn Starch Others |

|

By Region |

China Japan India Australia South Korea |

Products

Key Target Audience

Automotive manufacturers

Construction companies

Packaging firms

Consumer goods manufacturers

Government and regulatory bodies (e.g., Ministry of Environment, Forest and Climate Change)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

AkzoNobel N.V.

BASF SE

PPG Industries

Sherwin-Williams Company

Nippon Paint Holdings Co., Ltd.

Kansai Paint Co., Ltd.

Axalta Coating Systems

Arkema S.A.

DSM Coating Resins

Evonik Industries AG

Table of Contents

1. Asia Pacific Bio-Based Coating Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Bio-Based Coating Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Bio-Based Coating Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Sustainable Coatings (Sustainability)

3.1.2. Government Support for Eco-Friendly Solutions (Government Initiatives)

3.1.3. Increased Use of Bio-Based Raw Materials (Raw Material Supply Chain)

3.1.4. Growth in Construction and Automotive Industries (End-Use Sectors)

3.2. Market Challenges

3.2.1. High Production Costs of Bio-Based Materials (Cost Dynamics)

3.2.2. Limited Availability of Raw Materials (Supply Chain Bottlenecks)

3.2.3. Technical Performance Issues Compared to Synthetic Coatings (Performance Metrics)

3.3. Opportunities

3.3.1. Advances in Bio-Based Resin Technologies (Technological Innovation)

3.3.2. Expanding Application in Packaging and Consumer Goods (New Market Applications)

3.3.3. Growth in Green Building Certifications (Regulatory Compliance)

3.4. Trends

3.4.1. Rising Popularity of Waterborne Bio-Based Coatings (Technology Shifts)

3.4.2. Development of Hybrid Bio-Based Coatings (Product Innovation)

3.4.3. Increasing Consumer Preference for Sustainable Products (Consumer Preferences)

3.5. Government Regulations

3.5.1. Bio-Based Product Certification Programs (Regulatory Framework)

3.5.2. Emission Standards for Coating Industries (Regulatory Compliance)

3.5.3. National Policies on Green Coating Adoption (Policy Initiatives)

3.5.4. Public-Private Partnerships for Sustainable Solutions (Collaborative Frameworks)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia Pacific Bio-Based Coating Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Acrylic Bio-Based Coatings

4.1.2. Alkyd Bio-Based Coatings

4.1.3. Epoxy Bio-Based Coatings

4.1.4. Polyurethane Bio-Based Coatings

4.2. By Application (In Value %)

4.2.1. Construction

4.2.2. Automotive

4.2.3. Packaging

4.2.4. Consumer Goods

4.2.5. Industrial Coatings

4.3. By Technology (In Value %)

4.3.1. Solvent-Based Bio Coatings

4.3.2. Waterborne Bio Coatings

4.3.3. Powder Coatings

4.3.4. High-Solid Coatings

4.4. By Raw Material Source (In Value %)

4.4.1. Soybean Oil

4.4.2. Castor Oil

4.4.3. Tall Oil

4.4.4. Corn Starch

4.4.5. Others

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. South Korea

5. Asia Pacific Bio-Based Coating Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. AkzoNobel N.V.

5.1.2. BASF SE

5.1.3. PPG Industries

5.1.4. The Sherwin-Williams Company

5.1.5. Axalta Coating Systems

5.1.6. Nippon Paint Holdings Co., Ltd.

5.1.7. Kansai Paint Co., Ltd.

5.1.8. Arkema S.A.

5.1.9. DSM Coating Resins

5.1.10. Evonik Industries AG

5.1.11. Covestro AG

5.1.12. Corbion N.V.

5.1.13. Allnex Group

5.1.14. Wacker Chemie AG

5.1.15. NatureWorks LLC

5.2. Cross Comparison Parameters (Bio-Based Material Adoption, Environmental Compliance, No. of Employees, Headquarters, R&D Investment, Revenue, Product Innovation, Global Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Bio-Based Coating Market Regulatory Framework

6.1. Environmental Standards for Bio-Based Coatings

6.2. Compliance with Bio-Based Certification Requirements

6.3. Industry-Specific Green Building Certifications

7. Asia Pacific Bio-Based Coating Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Bio-Based Coating Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Raw Material Source (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Bio-Based Coating Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Marketing Initiatives

9.3. Customer Cohort Analysis

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Bio-Based Coating Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Asia Pacific Bio-Based Coating Market. This includes assessing market penetration, the ratio of bio-based coatings to conventional coatings, and the resultant revenue generation. Furthermore, an evaluation of coating performance statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple bio-based coating manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Bio-Based Coating market.

Frequently Asked Questions

01. How big is the Asia Pacific Bio-Based Coating Market?

The Asia Pacific Bio-Based Coating Market is valued at USD 3 billion, based on a five-year historical analysis. It is driven by stringent government regulations and growing demand for sustainable solutions across various sectors.

02. What are the challenges in the Asia Pacific Bio-Based Coating Market?

Challenges in Asia Pacific Bio-Based Coating Market include high production costs of bio-based materials and technical performance issues compared to synthetic coatings. Limited availability of raw materials also hampers market growth.

03. Who are the major players in the Asia Pacific Bio-Based Coating Market?

Key players in the Asia Pacific Bio-Based Coating Market include AkzoNobel N.V., BASF SE, PPG Industries, Sherwin-Williams Company, and Nippon Paint Holdings Co., Ltd. These companies dominate due to their global presence and investment in bio-based technologies.

04. What are the growth drivers of the Asia Pacific Bio-Based Coating Market?

The Asia Pacific Bio-Based Coating Market is propelled by growing environmental awareness, stringent regulations on VOC emissions, and advancements in bio-based resin technologies. The demand for eco-friendly construction materials also contributes to market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.