Asia Pacific Biomass Boiler Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD4908

November 2024

80

About the Report

Asia Pacific Biomass Boiler Market Overview

- The Asia Pacific Biomass Boiler Market is valued at USD 2.9 billion, driven by the growing emphasis on sustainable energy solutions and stringent governmental regulations aimed at reducing carbon emissions. Industrial sectors such as power generation, district heating, and the paper industry have increasingly adopted biomass boilers as an alternative to traditional fossil fuel systems.

- China, India, and Japan are the leading countries in the Asia Pacific Biomass Boiler Market. China dominates due to its high industrial energy consumption and aggressive governmental policies promoting renewable energy. The large-scale agricultural residue and industrial waste in China make it an ideal feedstock for biomass energy generation.

- Carbon trading schemes in the Asia Pacific are also fostering biomass energy adoption. Chinas national carbon market, launched in 2021, allows companies to trade carbon credits, which has led to a surge in biomass energy projects. These carbon markets offer financial incentives for industries that adopt biomass boilers, aligning with broader environmental objectives.

Asia Pacific Biomass Boiler Market Segmentation

By Feedstock Type: The market is segmented by feedstock type into wood biomass, agricultural residue, industrial waste, and municipal waste. Among these, wood biomass held the dominant market share in 2023, driven by its widespread availability and established supply chains. The preference for wood as a primary feedstock is due to its high calorific value and ease of processing, making it a cost-effective and reliable source of fuel for biomass boilers. Countries like China and India have robust wood supply systems, which, coupled with government support for forest management, contribute to this segment's dominance.

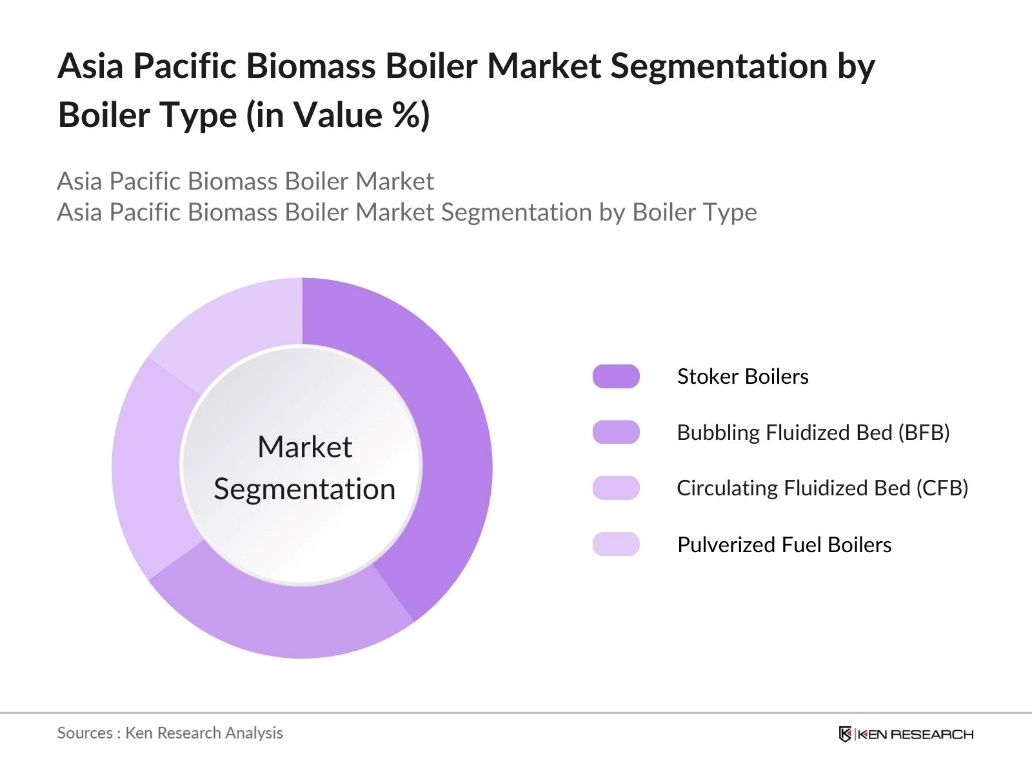

By Boiler Type: In terms of boiler type, the market is divided into stoker boilers, bubbling fluidized bed (BFB) boilers, circulating fluidized bed (CFB) boilers, and pulverized fuel boilers. Stoker boilers dominated the market in 2023, primarily due to their simpler design and lower capital costs. These boilers are extensively used in small to medium-scale industries where initial cost considerations play a significant role in adoption. Furthermore, stoker boilers are well-suited for lower-grade fuels such as agricultural residue, which is abundant in many Asia Pacific countries.

Asia Pacific Biomass Boiler Market Competitive Landscape

The Asia Pacific Biomass Boiler Market is highly competitive, with key players investing heavily in technological advancements and expanding their market presence. The market is dominated by a few global and regional players, with strong market positions in feedstock processing and boiler manufacturing. These companies leverage partnerships and acquisitions to enhance their market reach and technological capabilities.

Asia Pacific Biomass Boiler Industry Analysis

Growth Drivers

- Government Initiatives for Renewable Energy: Governments in the Asia Pacific region have been implementing aggressive renewable energy policies to promote the adoption of biomass boilers. For instance, Japan's Sixth Strategic Energy Plan, released in October 2021, indeed sets a target for renewable energy to account for 36-38% of the national energy mix by 2030, which is an increase from the previous figures of around 26% in 2022. Countries like India and China have also introduced incentives for biomass energy projects.

- Stringent Emission Regulations: Countries across the Asia Pacific are tightening emission standards, pushing industries toward cleaner energy sources like biomass. The State Administration for Market Regulation (SAMR) has implemented Chinas National Emission Standards Phase VI (B), tightening emission limits for light and heavy-duty vehicles starting July 1, 2023. Many automotive products must obtain CCC, CCAP, or CQC certification for compliance in China. Japan and South Korea have also introduced stricter air quality standards, promoting biomass boilers as they have lower emissions compared to coal or natural gas boilers.

- Growing Awareness for Sustainable Energy: Awareness of sustainable energy is rising across the Asia Pacific, driven by increased public and corporate interest in greener alternatives. Governments are promoting biomass boilers through campaigns that highlight their role in reducing greenhouse gas emissions and supporting energy independence. This shift is making biomass an appealing option for industries and communities aiming to transition to cleaner energy sources.

Market Challenges

- High Installation and Maintenance Costs: Biomass boilers generally come with higher upfront installation costs compared to traditional fossil fuel boilers. Additionally, maintaining these systems is more complex due to the need for regular feedstock management, which further increases operational expenses. These high costs, both in terms of installation and ongoing maintenance, can pose significant financial challenges, particularly for small and medium-sized enterprises (SMEs) in developing regions of the Asia Pacific.

- Limited Biomass Supply Chains in Remote Areas: In remote areas of the Asia Pacific, biomass supply chains are often underdeveloped. While countries like Indonesia and Vietnam have considerable biomass potential, they frequently lack the infrastructure necessary to efficiently harvest and transport biomass fuels. This makes biomass boilers less feasible in these regions, pushing industries to depend on more readily available energy sources such as coal or natural gas.

Asia Pacific Biomass Boiler Market Future Outlook

Over the coming years, the Asia Pacific Biomass Boiler Market is expected to grow significantly, driven by the increasing demand for sustainable and renewable energy solutions. Governments across the region are reinforcing their commitment to carbon neutrality by offering subsidies and favorable policies to promote biomass energy. The expansion of the agricultural sector, particularly in Southeast Asia, is expected to enhance the availability of biomass feedstock.

Market Opportunities

- Technological Innovations in Biomass Conversion: Recent advancements in biomass conversion technologies are creating new opportunities in the Asia Pacific market. Innovations such as advanced gasification systems have significantly improved the efficiency of converting biomass into energy. These developments help reduce the carbon footprint of biomass boilers, making them more competitive with other renewable energy solutions and offering industries a cleaner, more efficient energy source.

- Expansion of Biomass Boiler Usage in District Heating: Biomass boilers are increasingly being used in district heating systems, particularly in colder regions of the Asia Pacific. This trend is helping to reduce reliance on coal and offering scalable, sustainable heating solutions for densely populated urban areas. The growing use of biomass boilers in district heating presents new growth opportunities for manufacturers and supports regional energy sustainability goals.

Scope of the Report

|

Feedstock Type |

Wood Biomass, Agricultural Residue, Industrial Waste, Municipal Waste |

|

Boiler Type |

Stoker Boilers, BFB Boilers, CFB Boilers, Pulverized Fuel Boilers |

|

Application |

Power Generation, Industrial Heating, Residential Heating, District Heating |

|

End-User Industry |

Pulp and Paper, Food and Beverage, Chemical and Petrochemical, Energy and Utilities |

|

Region |

China, India, Japan, South Korea, Southeast Asia (Indonesia, Thailand, Vietnam) |

Products

Key Target Audience

Industrial and Commercial Biomass Boiler Operators

Energy and Utilities Companies

Boiler Technology Companies

Government and Regulatory Bodies (Ministry of New and Renewable Energy, China National Energy Administration)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

General Electric Company

Mitsubishi Heavy Industries Ltd.

Siemens AG

Valmet Corporation

Thermax Ltd.

Babcock & Wilcox Enterprises Inc.

ANDRITZ AG

Hurst Boiler & Welding Company Inc.

Alstom SA

JFE Engineering Corporation

Table of Contents

1. Asia Pacific Biomass Boiler Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Biomass Boiler Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Biomass Boiler Market Analysis

3.1. Growth Drivers

3.1.1. Rising Energy Demand in Industrial Applications

3.1.2. Government Initiatives for Renewable Energy

3.1.3. Stringent Emission Regulations

3.1.4. Growing Awareness for Sustainable Energy

3.2. Market Challenges

3.2.1. High Installation and Maintenance Costs

3.2.2. Limited Biomass Supply Chains in Remote Areas

3.2.3. Competition from Other Renewable Energy Sources

3.3. Opportunities

3.3.1. Technological Innovations in Biomass Conversion

3.3.2. Expansion of Biomass Boiler Usage in District Heating

3.3.3. Cross-Regional Collaboration for Biomass Infrastructure Development

3.4. Trends

3.4.1. Use of Hybrid Biomass Boilers (Biomass and Fossil Fuels)

3.4.2. Automation in Biomass Boiler Systems

3.4.3. Adoption of Advanced Emission Control Technologies

3.5. Government Regulations

3.5.1. Renewable Energy Standards (RES) in the Asia Pacific

3.5.2. National Policies on Biomass Usage

3.5.3. Incentives for Biomass Energy Projects

3.5.4. Carbon Trading Schemes and Their Impact

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Biomass Suppliers

3.7.2. Boiler Manufacturers

3.7.3. Industrial End-Users

3.7.4. Policy Makers

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Biomass Boiler Market Segmentation

4.1. By Feedstock Type (In Value %)

4.1.1. Wood Biomass

4.1.2. Agricultural Residue

4.1.3. Industrial Waste

4.1.4. Municipal Waste

4.2. By Boiler Type (In Value %)

4.2.1. Stoker Boilers

4.2.2. Bubbling Fluidized Bed (BFB) Boilers

4.2.3. Circulating Fluidized Bed (CFB) Boilers

4.2.4. Pulverized Fuel Boilers

4.3. By Application (In Value %)

4.3.1. Power Generation

4.3.2. Industrial Heating

4.3.3. Residential Heating

4.3.4. District Heating

4.4. By End-User Industry (In Value %)

4.4.1. Pulp and Paper

4.4.2. Food and Beverage

4.4.3. Chemical and Petrochemical

4.4.4. Energy and Utilities

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Southeast Asia (Indonesia, Thailand, Vietnam)

5. Asia Pacific Biomass Boiler Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. General Electric Company

5.1.2. Siemens AG

5.1.3. Thermax Ltd.

5.1.4. Mitsubishi Heavy Industries Ltd.

5.1.5. Babcock & Wilcox Enterprises Inc.

5.1.6. Valmet Corporation

5.1.7. Amec Foster Wheeler Plc

5.1.8. Alstom SA

5.1.9. Hurst Boiler & Welding Company Inc.

5.1.10. ANDRITZ AG

5.1.11. JFE Engineering Corporation

5.1.12. Doosan Heavy Industries & Construction Co., Ltd.

5.1.13. Harbin Electric Corporation

5.1.14. Hangzhou Boiler Group Co., Ltd.

5.1.15. AET Biomass Boiler Systems

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Feedstock Specialization, Regional Presence, Revenue, Technology Focus, Partnerships, Production Capacity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. Asia Pacific Biomass Boiler Market Regulatory Framework

6.1. Renewable Energy Standards (RES)

6.2. Biomass Boiler Certification Processes

6.3. Emission Compliance Guidelines

6.4. Feedstock Sustainability Requirements

6.5. Energy Efficiency Standards

7. Asia Pacific Biomass Boiler Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Biomass Boiler Future Market Segmentation

8.1. By Feedstock Type (In Value %)

8.2. By Boiler Type (In Value %)

8.3. By Application (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Biomass Boiler Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Expansion Strategy Insights

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves creating a detailed ecosystem map of all stakeholders in the Asia Pacific Biomass Boiler Market. Extensive secondary research is conducted using government databases and proprietary resources to identify the main market variables, including feedstock availability, technology adoption, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, historical data on biomass boiler adoption, operational performance, and feedstock supply chains are analyzed. Market penetration, competitive dynamics, and revenue generation are assessed, with a focus on industry-specific metrics. An in-depth examination of regional market developments ensures accuracy in revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through expert consultations and interviews with industry stakeholders. These insights are critical in corroborating the data and refining the market model. Computer-assisted telephone interviews (CATI) with key players across the supply chain provide additional validation.

Step 4: Research Synthesis and Final Output

In the final stage, primary and secondary data are synthesized to produce a comprehensive market report. Direct engagement with key biomass boiler manufacturers ensures the accuracy and reliability of the final output, resulting in a validated market forecast.

Frequently Asked Questions

01. How big is the Asia Pacific Biomass Boiler Market?

The Asia Pacific Biomass Boiler Market was valued at USD 2.9 billion, driven by the increasing demand for renewable energy and government regulations aimed at reducing carbon emissions.

02. What are the major challenges in the Asia Pacific Biomass Boiler Market?

Challenges in Asia Pacific Biomass Boiler Market include high installation costs, limited feedstock supply in remote areas, and competition from other renewable energy sources such as solar and wind.

03. Who are the major players in the Asia Pacific Biomass Boiler Market?

Key players in Asia Pacific Biomass Boiler Market include General Electric Company, Mitsubishi Heavy Industries, Siemens AG, Valmet Corporation, and Thermax Ltd. These companies have established strong market positions due to their advanced technologies and extensive distribution networks.

04. What drives the growth of the Asia Pacific Biomass Boiler Market?

The Asia Pacific Biomass Boiler Market is driven by increasing industrial energy demands, government incentives for renewable energy, and advancements in biomass boiler technologies that enhance efficiency and reduce emissions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.