Asia Pacific Biopharmaceuticals Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10912

November 2024

90

About the Report

Asia Pacific Biopharmaceuticals Market Overview

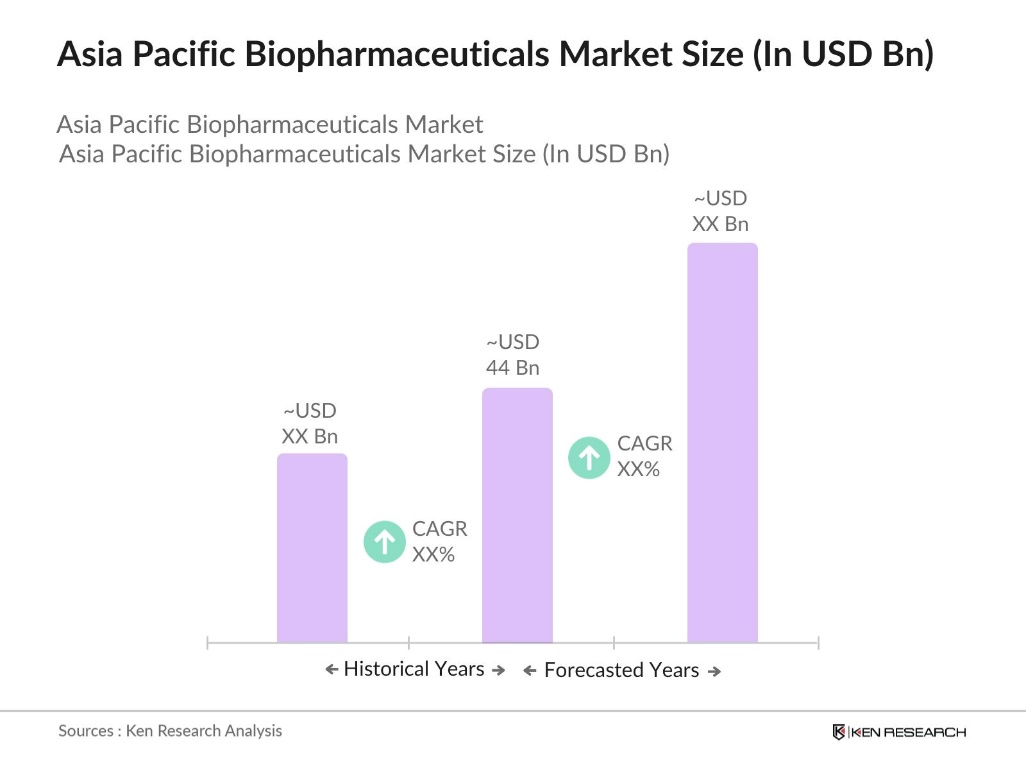

- The Asia Pacific biopharmaceuticals market is valued at USD 44 billion, fueled by substantial investment in biopharmaceutical innovation and increased adoption of biologics and biosimilars across therapeutic applications. The market benefits from rising healthcare expenditures and a growing preference for targeted therapies, which address specific patient needs more effectively than traditional pharmaceuticals.

- The dominant countries in this market include China, Japan, and South Korea. China leads due to its extensive manufacturing capabilities and focus on R&D investments. Japan follows, benefiting from a highly developed pharmaceutical infrastructure and supportive regulatory environment that encourages innovation. South Koreas advanced bioprocessing technologies and government-backed research initiatives contribute to its dominance, positioning these countries as pivotal players within the Asia Pacific biopharmaceutical landscape.

- Governments across Asia Pacific have implemented pricing policies to make biosimilars more accessible to patients. For example, South Korea enforced a pricing cap on biosimilars in 2023, limiting costs to increase affordability. The shift reflects a regional focus on balancing innovation with accessibility.

Asia Pacific Biopharmaceuticals Market Segmentation

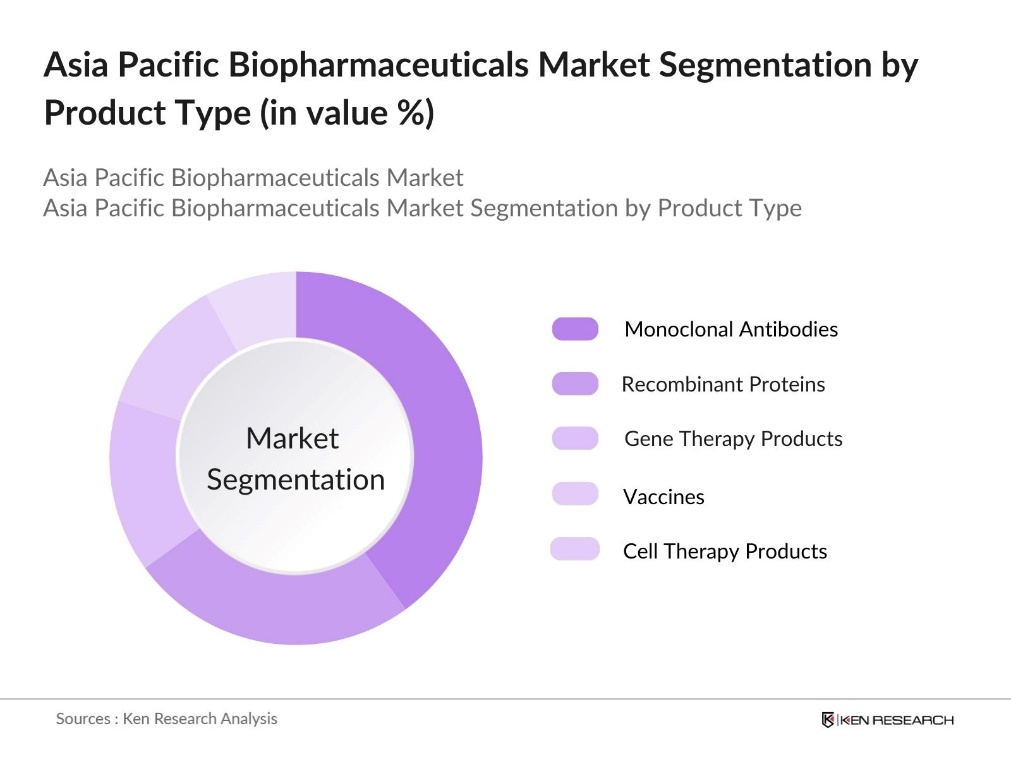

By Product Type: The market is segmented by product type into monoclonal antibodies, recombinant proteins, gene therapy products, vaccines, and cell therapy products. Monoclonal antibodies currently hold a dominant position in the product type segmentation due to their effectiveness in targeted treatments, particularly in oncology and autoimmune diseases. This segments growth is bolstered by a surge in demand for cancer therapeutics and an increasing number of research and development initiatives, making it a key area of focus for both established and emerging biopharma companies.

By Application: Within the Asia Pacific biopharmaceutical market, applications are segmented into oncology, neurology, cardiology, infectious diseases, and immunology. Oncology holds a significant market share due to the high prevalence of cancer and increasing reliance on biopharmaceutical solutions for targeted treatment. This segments dominance is driven by ongoing research, a rising incidence of cancer cases, and the strategic focus of companies on developing innovative biologic treatments to meet the growing demand in the oncology field.

Asia Pacific Biopharmaceuticals Market Competitive Landscape

The Asia Pacific biopharmaceutical market is primarily dominated by both regional and global players. Major companies such as Roche Holding AG, Pfizer Inc., and Amgen Inc. are leading the market, leveraging their strong R&D capabilities, extensive biomanufacturing networks, and strategic partnerships. Regional players like Biocon and Innovent Biologics are also gaining prominence, focusing on cost-effective biosimilars and capturing a substantial market share across developing regions.

Asia Pacific Biopharmaceuticals Industry Analysis

Growth Drivers

- Expansion in Cancer Therapeutics: In the Asia Pacific region, cancer therapeutics has seen significant expansion due to the rising prevalence of cancer, with 8.7 million cases reported in the region in 2020. Governments across countries like Japan and South Korea have prioritized biopharmaceuticals for cancer, particularly monoclonal antibodies and targeted therapies, to manage this health burden. This budgetary support is complemented by hospital investments in biopharmaceuticals that focus on oncology.

- Rising Demand for Gene Therapy: Gene therapy demand has surged, particularly in China and India, where there is a high incidence of genetic disorders and inherited diseases. Chinas National Health. In 2023, China approved a total of 87 novel drugs, with 67.8% of these being targeted drugs, which include gene therapies among other categories. This demand has created a thriving gene therapy market as facilities continue to upgrade to meet demand.

- Increased Prevalence of Chronic Diseases: The Asia Pacific region faces a growing prevalence of chronic diseases, especially diabetes and cardiovascular conditions, spurring demand for biopharmaceuticals focused on long-term care. Governments are responding with expanded healthcare initiatives to address these conditions, particularly in countries like India, where theres an increased emphasis on innovative treatments. This shift highlights the urgent need for advanced biopharmaceutical solutions tailored to chronic disease management across the region.

Market Challenges

- Stringent Approval Timelines: Approval timelines for biopharmaceuticals in Asia Pacific remain lengthy and complex, often creating delays in market entry. Although some countries have initiated reforms to streamline processes, strict regulatory criteriaespecially for high-risk drugscontinue to slow approvals. These extended timelines pose challenges for timely access to new treatments, impacting the availability of essential biopharmaceuticals across the regions markets.

- Manufacturing Complexity and Cost: Biopharmaceutical manufacturing in Asia Pacific faces significant complexities, primarily due to the need for advanced infrastructure and specialized expertise. Establishing production facilities requires substantial capital investment and skilled labor, both of which are limited in availability. Additionally, high costs of raw materials add further financial strain, impacting profit margins for biopharmaceutical companies operating in the region.

Asia Pacific Biopharmaceuticals Market Future Outlook

The Asia Pacific biopharmaceuticals market is expected to continue on a growth trajectory due to advancements in bioprocessing technologies, increasing demand for biologics, and supportive regulatory frameworks that ease the approval process for new drugs. Government investments in healthcare and emerging innovations in gene and cell therapy are likely to shape the market. Major companies are expected to focus on expanding their presence across the Asia Pacific through local partnerships and targeted investments in high-growth countries.

Market Opportunities

- Advanced Bioprocessing Technologies: The adoption of advanced bioprocessing technologies is creating new opportunities in Asia Pacific by enhancing production efficiency and scalability for biopharmaceuticals. Innovations like continuous manufacturing and single-use systems streamline operations, enabling faster production cycles and reducing lead times for critical therapies. These advancements are increasingly popular as facilities seek to improve cost-effectiveness and respond more efficiently to market demands.

- Partnerships for Drug Development: Collaborative partnerships are becoming a key driver for biopharmaceutical development in Asia Pacific. Through joint research agreements, countries are pooling resources and expertise to address shared health challenges. These partnerships help reduce R&D costs and accelerate the introduction of new treatments, allowing countries to tackle common disease burdens more effectively and make advanced therapies more accessible to the region's population.

Scope of the Report

|

Product Type |

Monoclonal Antibodies Recombinant Proteins Gene Therapy Products Vaccines Cell Therapy Products |

|

Application |

Oncology Neurology Cardiology Infectious Diseases Immunology |

|

Manufacturing Process |

Upstream Processing Downstream Processing Quality Control |

|

End User |

Hospitals Clinics Research Institutions Contract Manufacturing Organizations (CMOs) |

|

Country |

China Japan India South Korea Australia |

Products

Key Target Audience

Pharmaceutical Manufacturers

Biotechnology Companies

Pharmaceutical Companies

Government and Regulatory Bodies (e.g., China Food and Drug Administration, Pharmaceuticals and Medical Devices Agency Japan)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Roche Holding AG

Pfizer Inc.

Amgen Inc.

AbbVie Inc.

Novartis AG

Johnson & Johnson

Bristol-Myers Squibb

Gilead Sciences

AstraZeneca

Takeda Pharmaceuticals

Table of Contents

1. Asia Pacific Biopharmaceuticals Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Biopharmaceuticals Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Biopharmaceuticals Market Analysis

3.1 Growth Drivers (Therapeutic Advancements, Regulatory Approvals, R&D Investment, Population Aging)

3.1.1 Expansion in Cancer Therapeutics

3.1.2 Rising Demand for Gene Therapy

3.1.3 Government Support for Biologics

3.1.4 Increased Prevalence of Chronic Diseases

3.2 Market Challenges (Complex Production Processes, Regulatory Hurdles, High R&D Costs)

3.2.1 Stringent Approval Timelines

3.2.2 Manufacturing Complexity and Cost

3.2.3 Market Access Barriers in Emerging Regions

3.3 Opportunities (Technological Innovations, Collaborations, Emerging Markets)

3.3.1 Advanced Bioprocessing Technologies

3.3.2 Partnerships for Drug Development

3.3.3 Entry Opportunities in Rural Markets

3.4 Trends (Personalized Medicine, Biosimilars Adoption, Digital Biopharma)

3.4.1 Growth of Precision Biologics

3.4.2 Rising Market for Biosimilars

3.4.3 Integration of AI in Drug Discovery

3.5 Government Regulation (Health Authority Guidelines, Drug Pricing, Import/Export Controls)

3.5.1 Biologics Registration and Licensing

3.5.2 Pricing Policies for Biosimilars

3.5.3 Export Regulations and Trade Agreements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Biotech Startups, Research Institutions, CROs, Regulatory Agencies)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Asia Pacific Biopharmaceuticals Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Monoclonal Antibodies

4.1.2 Recombinant Proteins

4.1.3 Gene Therapy Products

4.1.4 Vaccines

4.1.5 Cell Therapy Products

4.2 By Application (In Value %)

4.2.1 Oncology

4.2.2 Neurology

4.2.3 Cardiology

4.2.4 Infectious Diseases

4.2.5 Immunology

4.3 By Manufacturing Process (In Value %)

4.3.1 Upstream Processing

4.3.2 Downstream Processing

4.3.3 Quality Control

4.4 By End User (In Value %)

4.4.1 Hospitals

4.4.2 Clinics

4.4.3 Research Institutions

4.4.4 Contract Manufacturing Organizations (CMOs)

4.5 By Country (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 South Korea

4.5.5 Australia

5. Asia Pacific Biopharmaceuticals Market Competitive Analysis

5.1 Detailed Profiles of Major Companies (R&D Spending, Manufacturing Facilities, Market Reach, Strategic Collaborations, Revenue Contribution, Patent Holdings, Growth Strategies)

5.1.1 Roche Holding AG

5.1.2 Pfizer Inc.

5.1.3 Amgen Inc.

5.1.4 AbbVie Inc.

5.1.5 Novartis AG

5.1.6 Johnson & Johnson

5.1.7 Bristol-Myers Squibb

5.1.8 Gilead Sciences

5.1.9 AstraZeneca

5.1.10 Takeda Pharmaceuticals

5.1.11 Merck & Co.

5.1.12 CSL Limited

5.1.13 Biocon

5.1.14 Innovent Biologics

5.1.15 Samsung Biologics

5.2 Cross Comparison Parameters (R&D Focus, Product Portfolio Diversification, Geographical Presence, Manufacturing Scale, Revenue Generation, Strategic Partnerships, Regulatory Approvals, Patented Innovations)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Licensing, Joint Ventures)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Incentives

5.8 Venture Capital Funding

5.9 Private Equity Investments

6. Asia Pacific Biopharmaceuticals Market Regulatory Framework

6.1 Drug Approval Process

6.2 Compliance Requirements

6.3 Certification and Licensing Standards

7. Asia Pacific Biopharmaceuticals Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Biopharmaceuticals Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Manufacturing Process (In Value %)

8.4 By End User (In Value %)

8.5 By Country (In Value %)

9. Asia Pacific Biopharmaceuticals Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the stakeholder ecosystem within the Asia Pacific biopharmaceutical market. Extensive desk research is conducted, sourcing information from primary and secondary databases, to define the critical variables impacting market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on the biopharmaceutical market is compiled and analyzed. This includes assessing market penetration rates and the ratio of regional to global companies to generate accurate revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through CATI (Computer-Assisted Telephone Interviews) with industry experts and stakeholders. These consultations yield valuable insights into operational and financial aspects, supporting the accuracy of the data.

Step 4: Research Synthesis and Final Output

The final stage involves direct interaction with biopharmaceutical manufacturers to gather insights on product segments, consumer trends, and sales performance. This ensures comprehensive, reliable analysis through a bottom-up approach, finalizing the report with a validated market overview.

Frequently Asked Questions

01. How big is the Asia Pacific Biopharmaceuticals Market?

The Asia Pacific biopharmaceuticals market is valued at USD 44 billion, driven by rapid growth in biologics and an expanding patient base for targeted therapies across key markets.

02. What are the challenges in the Asia Pacific Biopharmaceuticals Market?

Challenges in Asia Pacific biopharmaceuticals market include high R&D costs, regulatory hurdles, and complex manufacturing processes, which can delay drug approvals and impact profitability.

03. Who are the major players in the Asia Pacific Biopharmaceuticals Market?

Key players in Asia Pacific biopharmaceuticals market include Roche Holding AG, Pfizer Inc., Amgen Inc., AbbVie Inc., and Novartis AG, which dominate through extensive product portfolios, strong R&D investment, and regional manufacturing facilities.

04. What factors are driving the Asia Pacific Biopharmaceuticals Market?

Growth drivers in Asia Pacific biopharmaceuticals market include advancements in therapeutic technology, increasing prevalence of chronic diseases, and supportive government policies that facilitate drug approval and R&D.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.