Asia Pacific Biostimulants Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD3524

December 2024

86

About the Report

Asia Pacific Biostimulants Market Overview

- The Asia Pacific biostimulants market is valued at USD 750 million, based on a comprehensive five-year historical analysis. This market has seen consistent growth, driven primarily by increasing demand for sustainable agriculture practices and the adoption of organic farming techniques. Rising awareness of the negative environmental impacts of chemical fertilizers has further encouraged the shift towards biostimulants, which enhance plant growth and soil health without compromising the ecosystem.

- Countries like China, India, and Australia dominate the Asia Pacific biostimulants market due to their large agricultural base and government incentives promoting sustainable farming practices. China leads the market owing to its extensive agricultural sector and strong regulatory support for organic farming. Indias dominance is driven by a growing population that demands higher crop yields and increased investments in advanced agricultural inputs. Australia, on the other hand, is capitalizing on the growing demand for environmentally-friendly farming practices.

- The biostimulants market in Asia Pacific faces stringent country-specific regulations regarding product registration and labeling. In 2023, India introduced new labeling rules under its Fertilizer Control Order (FCO), mandating detailed ingredient disclosure for biostimulants. Similarly, Japans regulatory authorities require thorough testing and documentation for biostimulants before they can be sold. These country-specific requirements present challenges for manufacturers looking to expand across multiple markets in the region.

Asia Pacific Biostimulants Market Segmentation

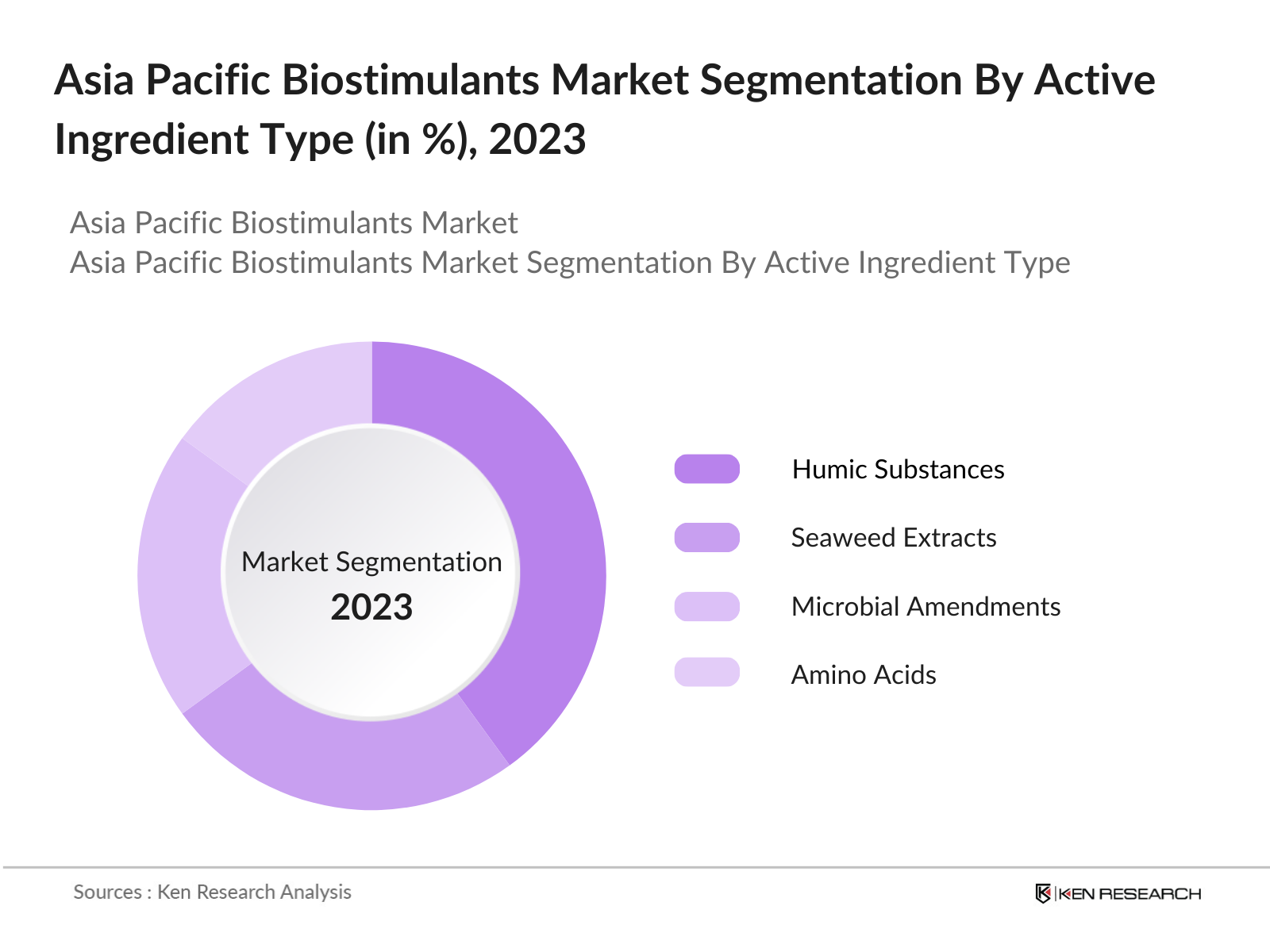

By Active Ingredient: The Asia Pacific biostimulants market is segmented by active ingredient into humic substances, seaweed extracts, microbial amendments, amino acids, and others (including protein hydrolysates, chitin, etc.). Recently, humic substances have been the dominant sub-segment under active ingredients due to their wide-ranging benefits in improving soil structure, enhancing nutrient uptake, and promoting plant resilience. Their versatility in application across different types of crops makes them a popular choice among farmers, driving their dominance in the biostimulants market.

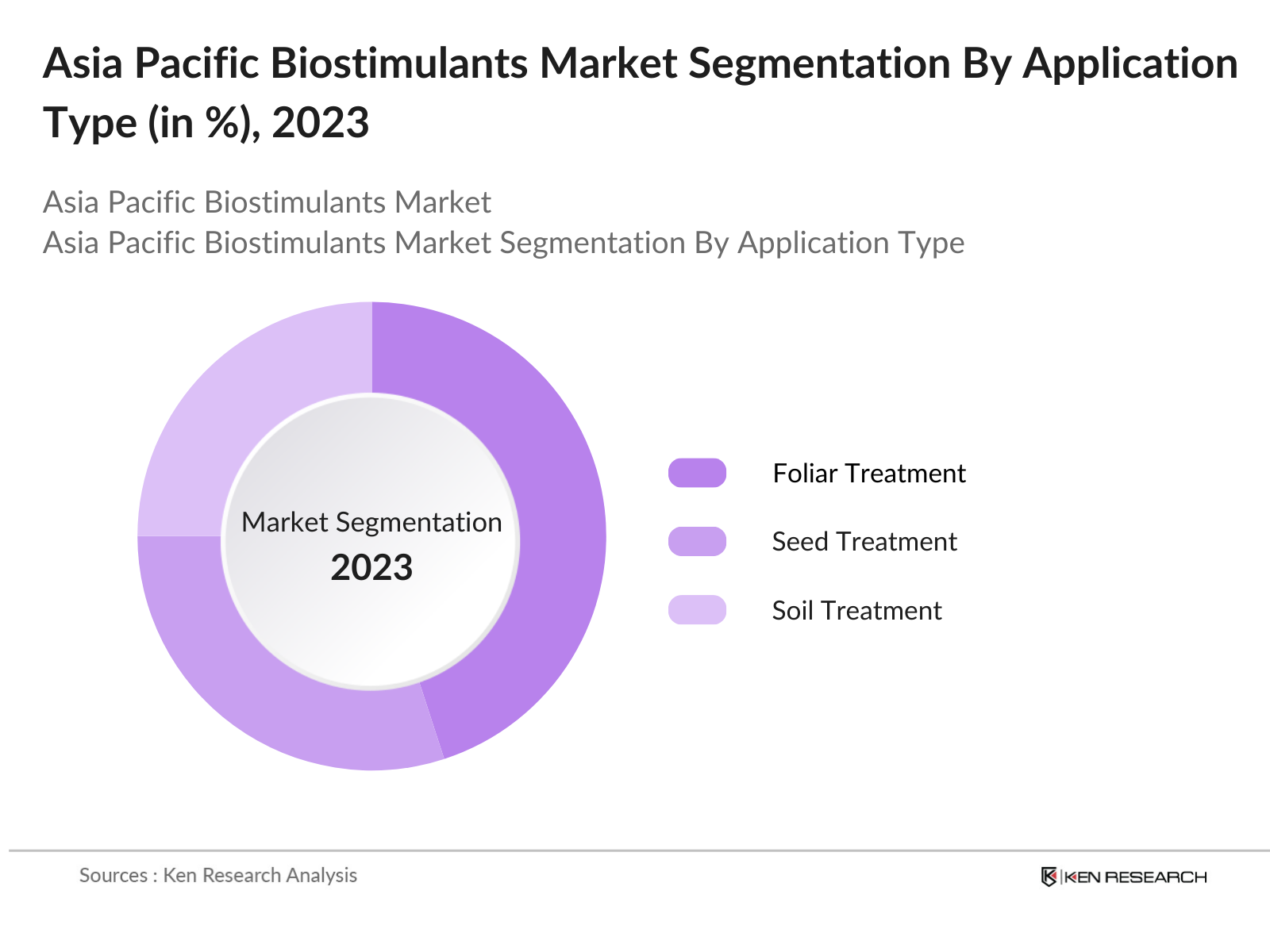

By Application: The market is also segmented by application into foliar treatment, seed treatment, and soil treatment. Foliar treatment has gained a dominant market share in recent years due to its direct and rapid effect on plant growth. This method ensures the efficient absorption of nutrients and biostimulants through the leaves, making it a cost-effective solution for enhancing crop productivity. Farmers in the Asia Pacific region increasingly prefer foliar treatments, particularly for high-value horticultural crops, due to the immediate visible results on plant health.

Asia Pacific Biostimulants Market Competitive Landscape

The Asia Pacific biostimulants market is dominated by a few major global and regional players, focusing on innovation and sustainability. These companies leverage strategic partnerships and acquisitions to expand their market share. For instance, companies like BASF and Bayer AG lead the market with their extensive R&D and strong distribution networks across the Asia Pacific region. Local players such as UPL Limited and Valagro SpA are also crucial competitors, providing localized solutions to meet the specific needs of the market.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

Number of Patents |

Distribution Channels |

R&D Expenditure |

Product Portfolio |

Market Share (2023) |

Strategic Initiatives |

|

BASF SE |

1865 |

Germany |

- |

- |

- |

- |

- |

- |

- |

|

Bayer AG |

1863 |

Germany |

- |

- |

- |

- |

- |

- |

- |

|

UPL Limited |

1969 |

India |

- |

- |

- |

- |

- |

- |

- |

|

Valagro SpA |

1980 |

Italy |

- |

- |

- |

- |

- |

- |

- |

|

Syngenta AG |

2000 |

Switzerland |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Biostimulants Industry Analysis

Growth Drivers

- Rising Demand for Organic Farming: The global shift towards organic farming is significantly influencing the biostimulants market, especially in the Asia Pacific. Organic farming land across the region has been expanding, driven by consumer preferences for chemical-free produce. In 2022, the organic farming area in Asia totaled over 6 million hectares, with India and China among the top contributors (World Bank). This push for sustainable agriculture practices has boosted demand for biostimulants, as they are vital in improving crop health and reducing dependency on chemical fertilizers. Governments in the region, such as India, have allocated funds for organic farming, further driving growth.

- Government Support for Sustainable Agriculture: Governments in Asia Pacific have been actively promoting biostimulants through subsidies and supportive regulations. For example, Indias National Mission on Sustainable Agriculture (NMSA) allocated over USD 150 million in 2023 for projects promoting organic inputs, including biostimulants. Similarly, in China, agricultural policies under the 2023 Zero Growth Action Plan for chemical fertilizers have encouraged the use of biostimulants to boost productivity without relying on synthetic inputs. These financial and regulatory frameworks are accelerating the adoption of biostimulants in the region.

- Increasing Crop Yield Demand: As the population in Asia Pacific grows, projected to reach 4.75 billion by 2025 (UN Data), there is a mounting demand for higher crop yields to ensure food security. Biostimulants play a key role in enhancing crop performance, especially under stress conditions, thereby enabling farmers to achieve higher yields. For instance, India's crop production grew by 3% annually between 2020-2023 due to improved agricultural practices, including biostimulant applicationSource: FAO, 2024. This trend is pushing both large-scale and smallholder farmers towards adopting biostimulants to meet rising food demands.

Market Challenges

- Lack of Awareness among Farmers: Despite the potential benefits, a significant challenge in the Asia Pacific biostimulants market is the lack of awareness among small-scale farmers. In 2023, around 60% of farmers in rural areas of Southeast Asia were unfamiliar with the use of biostimulants. Many farmers still rely heavily on conventional fertilizers, unaware of how biostimulants can improve their yields and reduce dependency on chemical inputs. This gap in knowledge limits the widespread adoption of biostimulants, especially in regions where agricultural education and access to new technologies are limited.

- Variability in Regulatory Frameworks: The biostimulants market in the Asia Pacific faces regulatory challenges due to diverse country-specific laws. For instance, in 2023, regulations in India required manufacturers to undergo complex registration processes, resulting in delays in product launches. Meanwhile, in China, stricter environmental regulations have slowed the introduction of foreign biostimulant products into the market. These inconsistent frameworks create hurdles for companies looking to scale across the region, limiting the availability of biostimulants to farmers.

Asia Pacific Biostimulants Market Future Outlook

Over the next five years, the Asia Pacific biostimulants market is expected to experience significant growth driven by increased investments in sustainable agriculture, government support for organic farming, and technological advancements in crop enhancement products. The market is likely to witness further consolidation as key players focus on strategic mergers and acquisitions to expand their geographical reach and product portfolios. Continuous innovation in biostimulant formulations is also expected to play a crucial role in meeting the rising demand for eco-friendly agricultural solutions.

Opportunities

- Expansion into Emerging Markets: Unexplored regions in the Asia Pacific, particularly in Southeast Asia and Oceania, present substantial opportunities for biostimulant manufacturers. For instance, Indonesia, with a population of over 277 million in 2024, is seeing rapid growth in agricultural practices. Currently, only about 10% of farmers in the country use biostimulants, leaving a large market untapped. By targeting these emerging markets, biostimulant producers can significantly expand their reach and influence within the region's agricultural sector.

- Strategic Collaborations: Collaborations between biostimulant manufacturers and agricultural institutions can help overcome barriers to entry and boost adoption rates. In 2023, the Indian government partnered with several biostimulant producers to promote sustainable farming practices under the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY). Similar initiatives in other countries, including partnerships with cooperatives and research bodies, are expected to increase biostimulant penetration, especially in rural areas. These collaborations also foster knowledge transfer and innovation, enabling local farmers to adopt advanced biostimulant formulations.

Scope of the Report

|

Active Ingredient |

Humic Substances Seaweed Extracts Microbial Amendments Amino Acids Others (Protein Hydrolysates, Chitin) |

|

Application |

Foliar Treatment Seed Treatment Soil Treatment |

|

Crop Type |

Row Crops Horticultural Crops Turf and Ornamentals |

|

Formulation |

Liquid Biostimulants Dry Biostimulants |

|

Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Agricultural Equipment Manufacturing Companies

Biostimulant Manufacturers and Industry

Agricultural Cooperatives Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministries of Agriculture in Asia Pacific Countries)

Horticultural Industries

Companies

Players Mentioned in the Report:

BASF SE

Bayer AG

UPL Limited

Valagro SpA

Syngenta AG

Biolchim S.p.A.

Tradecorp International

Arysta Lifescience

Italpollina SpA

Lallemand Inc.

Futureco Bioscience

Novozymes A/S

Koppert Biological Systems

AgriLife

Isagro S.p.A

Table of Contents

1. Asia Pacific Biostimulants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Biostimulants Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Biostimulants Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Organic Farming

3.1.2. Government Support for Sustainable Agriculture

3.1.3. Increasing Crop Yield Demand

3.1.4. Expansion of the Horticulture Sector

3.2. Market Challenges

3.2.1. Lack of Awareness among Farmers

3.2.2. Variability in Regulatory Frameworks

3.2.3. High Product Pricing Compared to Conventional Fertilizers

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Strategic Collaborations

3.3.3. Development of Advanced Formulations

3.4. Trends

3.4.1. Increased Use of Seaweed Extracts

3.4.2. Adoption of Precision Agriculture

3.4.3. Growing Demand for Liquid Biostimulants

3.5. Government Regulations

3.5.1. Country-Specific Registration and Labeling Requirements

3.5.2. Biostimulant Standards

3.5.3. Government Incentives for Biostimulant Usage

3.5.4. Environmental Impact Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Biostimulants Market Segmentation

4.1. By Active Ingredient (In Value %)

4.1.1. Humic Substances

4.1.2. Seaweed Extracts

4.1.3. Microbial Amendments

4.1.4. Amino Acids

4.1.5. Others (Protein Hydrolysates, Chitin, etc.)

4.2. By Application (In Value %)

4.2.1. Foliar Treatment

4.2.2. Seed Treatment

4.2.3. Soil Treatment

4.3. By Crop Type (In Value %)

4.3.1. Row Crops

4.3.2. Horticultural Crops

4.3.3. Turf and Ornamentals

4.4. By Formulation (In Value %)

4.4.1. Liquid Biostimulants

4.4.2. Dry Biostimulants

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia Pacific Biostimulants Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bayer AG

5.1.2. BASF SE

5.1.3. Valagro SpA

5.1.4. Biolchim S.p.A.

5.1.5. Koppert Biological Systems

5.1.6. Syngenta AG

5.1.7. Arysta Lifescience

5.1.8. UPL Limited

5.1.9. Italpollina SpA

5.1.10. Isagro S.p.A

5.1.11. Tradecorp International

5.1.12. AgriLife

5.1.13. Lallemand Inc.

5.1.14. Novozymes A/S

5.1.15. Futureco Bioscience

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Global Presence, Product Portfolio, Market Share, Patents, Distribution Channels, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Biostimulants Market Regulatory Framework

6.1. Compliance Requirements for Product Registration

6.2. Certification Processes for Organic Standards

6.3. Environmental and Safety Regulations

7. Asia Pacific Biostimulants Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Biostimulants Future Market Segmentation

8.1. By Active Ingredient (In Value %)

8.2. By Application (In Value %)

8.3. By Crop Type (In Value %)

8.4. By Formulation (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Biostimulants Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved mapping out all major stakeholders within the Asia Pacific Biostimulants Market. This process was underpinned by secondary research using proprietary databases and public sources to gather detailed industry-level information. Key variables influencing market dynamics were identified and defined.

Step 2: Market Analysis and Construction

We compiled and analyzed historical market data for the Asia Pacific Biostimulants Market, including market penetration and revenue generation. This analysis helped in assessing the ratio of biostimulant products to conventional agricultural inputs and provided insight into revenue drivers.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were developed regarding market growth drivers and were validated through expert consultations. These consultations were conducted using computer-assisted telephone interviews (CATIs) with key industry practitioners, providing operational insights.

Step 4: Research Synthesis and Final Output

The final stage involved directly engaging with biostimulant manufacturers and key agricultural stakeholders to collect detailed insights into product segments, sales performance, and consumer preferences. This validated the data collected through bottom-up approaches, ensuring comprehensive analysis of the market.

Frequently Asked Questions

01. How big is the Asia Pacific Biostimulants Market?

The Asia Pacific Biostimulants market is valued at USD 750 million, driven by increasing demand for sustainable and eco-friendly agricultural practices across major farming countries like China and India.

02. What are the challenges in the Asia Pacific Biostimulants Market?

The market faces challenges such as high product costs and lack of awareness among small-scale farmers, especially in emerging markets. Additionally, inconsistent regulatory frameworks across countries create barriers to market expansion.

03. Who are the major players in the Asia Pacific Biostimulants Market?

Key players in the market include BASF SE, Bayer AG, UPL Limited, Valagro SpA, and Syngenta AG, which dominate due to their extensive product portfolios, strong R&D, and regional distribution networks.

04. What are the growth drivers of the Asia Pacific Biostimulants Market?

The market is propelled by factors such as rising consumer awareness regarding organic farming, government incentives for sustainable agriculture, and the increasing demand for higher crop yields amidst rapid population growth.

05. What are the key trends in the Asia Pacific Biostimulants Market?

Notable trends include the increased adoption of precision farming techniques and the rising use of liquid biostimulants due to their efficiency in nutrient absorption and ease of application.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.