Asia Pacific Blockchain Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD2261

December 2024

87

About the Report

Asia Pacific Blockchain Market Overview

- The Asia Pacific blockchain market was valued at USD 2 billion in 2023. The market's growth is fueled by the widespread adoption of blockchain technology in sectors like finance, supply chain, and healthcare. Key drivers include the increasing use of blockchain for digital currencies and cross-border payments, as well as significant investments in blockchain infrastructure by governments and enterprises across the region. Major countries contributing to this growth include China, Japan, Singapore, and South Korea, where blockchain is being integrated into various applications.

- Leading players in the Asia Pacific blockchain market include IBM Corporation, Tencent Holdings, Alibaba Group, Hyperledger, and ConsenSys. These companies dominate the market due to their extensive blockchain platforms, which cater to industries such as finance, healthcare, and supply chain. Their ability to continuously innovate with blockchain-as-a-service (BaaS) models and develop decentralized applications strengthens their market position.

- A key development in 2023 was the partnership between Tencent and the People's Bank of China (PBOC) to enhance Chinas Central Bank Digital Currency (CBDC) initiative. The collaboration aims to scale the use of digital yuan across different sectors, positioning China as a leader in blockchain-based financial systems. The PBOC reports that digital yuan transactions reached over $13 billion in Q2 2023, highlighting the growing importance of blockchain in financial innovation.

- Key cities driving the blockchain market in Asia Pacific include Beijing, Tokyo, and Singapore. Beijing's leadership is fueled by China's aggressive push toward digital currency and blockchain integration in its financial system. Tokyo is a hub for blockchain startups, supported by government regulations that encourage blockchain development, especially in finance and cybersecurity. Singapore dominates the blockchain market due to its progressive regulatory framework and position as a fintech hub, attracting global blockchain projects.

Asia Pacific Blockchain Market Segmentation

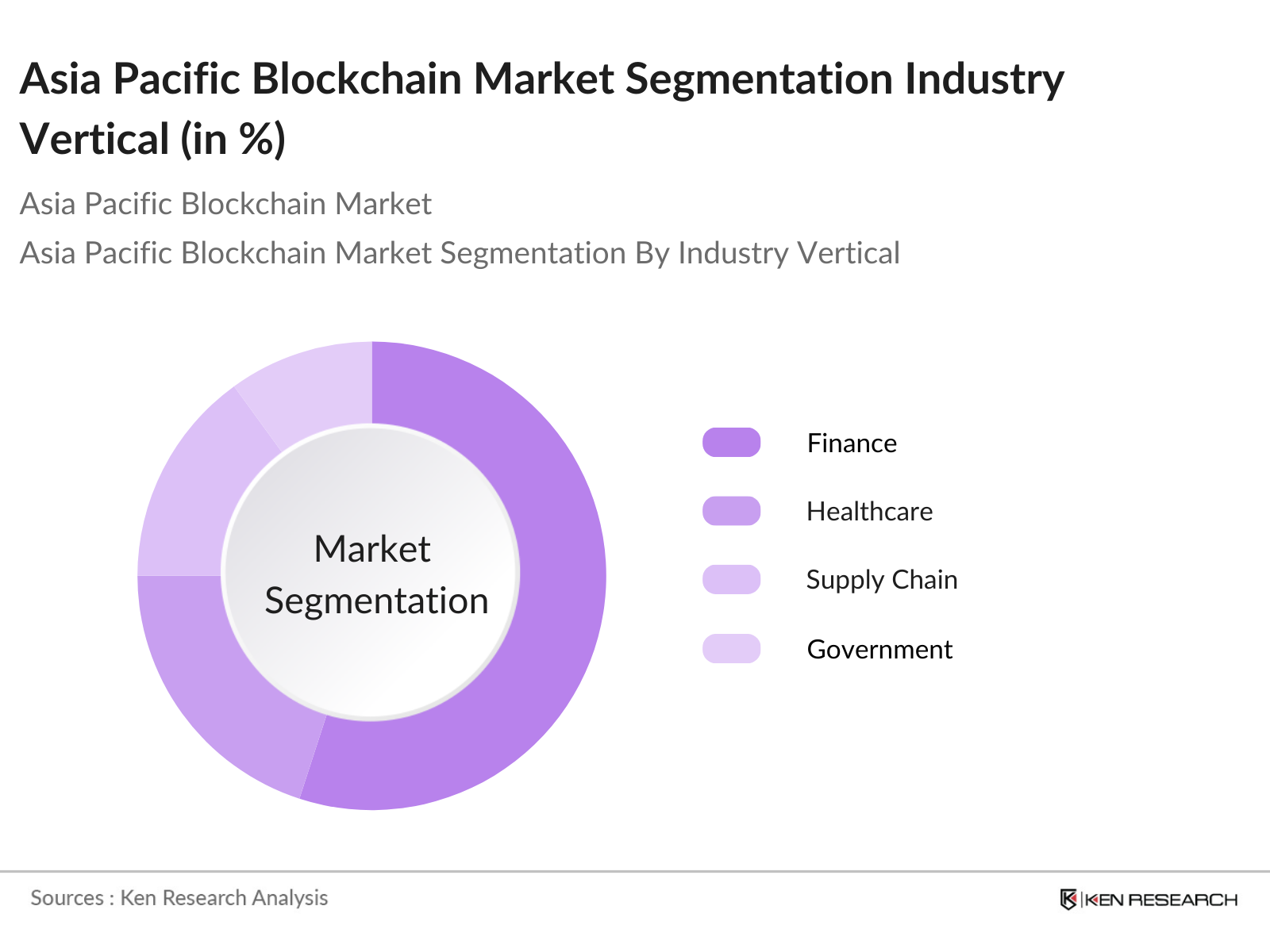

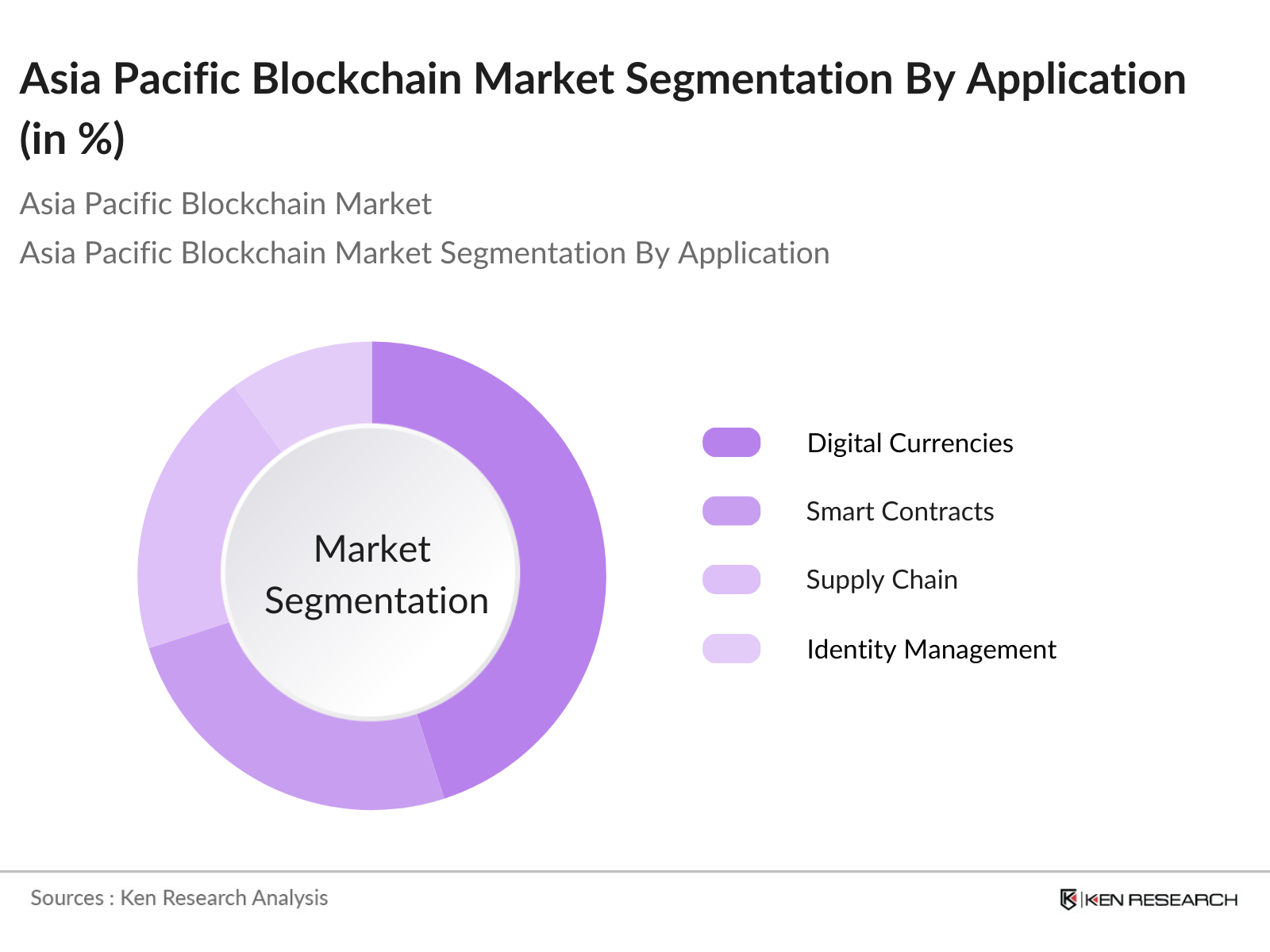

The Asia Pacific blockchain market can be segmented based on Industry Vertical, Application, and Region.

- By Industry Vertical: The market is segmented by industry vertical into Finance, Healthcare, Supply Chain, and Government. In 2023, the finance sector held the largest market share due to the widespread adoption of blockchain in cryptocurrency trading and decentralized finance (DeFi) applications. The finance sector leverages blockchain for secure financial transactions, digital currency management, and real-time settlement of cross-border payments.

- By Application: Blockchain applications in the Asia Pacific region are categorized into Digital Currencies, Smart Contracts, Supply Chain Management, and Identity Management. In 2023, digital currencies dominated the market with the largest share due to the increasing acceptance of cryptocurrencies like Bitcoin, Ethereum, and Chinas digital yuan.

By Region: Geographically, the market is segmented into North Asia, South Asia, East Asia, and West Asia. In 2023, East Asia held the largest market share due to China's leadership in blockchain initiatives, including its Blockchain Service Network (BSN) and digital yuan. Japan and South Korea are also key contributors to East Asia's dominance, with both countries investing heavily in blockchain innovation.

Asia Pacific Blockchain Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

IBM Corporation |

1911 |

New York, USA |

|

Tencent Holdings |

1998 |

Shenzhen, China |

|

Alibaba Group |

1999 |

Hangzhou, China |

|

Hyperledger |

2015 |

San Francisco, USA |

|

ConsenSys |

2014 |

Brooklyn, USA |

- IBM Corporation: In 2024, IBM partnered with Mitsubishi UFJ Financial Group to implement a blockchain-based payment platform for its institutional clients in Japan. This initiative is expected to streamline transaction processing and improve security. IBM also expanded its blockchain solutions for food traceability in Asia Pacific, signing deals with major retailers in 2023 to enhance supply chain transparency.

- Alibaba Groups Blockchain Expansion: In 2023, Alibaba's AntChain expanded into Southeast Asia, offering blockchain-based solutions for supply chain management and financial services. By the end of 2023, over 500 companies in the region were using AntChain's blockchain platform.

Asia Pacific Blockchain Market Analysis

Market Growth Drivers

- Increasing Blockchain Startups and Funding: Asia Pacific witnessed a massive rise in blockchain-focused startups in 2023, particularly in regions like Southeast Asia and India. These startups received substantial funding in 2023, with Singapore-based blockchain startups alone securing $2.2 billion in investments, an increase from $1.4 billion in 2022. In 2024, the South Korean government announced $50 million in funding to support blockchain-based supply chain and identity management solutions, aiming to integrate blockchain into critical sectors like logistics and e-governance.

- Blockchain in Cross-Border Payments: Blockchain has increasingly penetrated cross-border payment systems in the region. In 2023, the cross-border remittance market in Southeast Asia alone reached $130 billion, of which $4 billion was processed through blockchain platforms, particularly in Indonesia, the Philippines, and Vietnam. Blockchain's ability to reduce transaction costs and enhance transparency is being embraced by the regions remittance-dependent economies, and this trend is expected to accelerate in 2024 as blockchain adoption continues to rise.

- Rising Blockchain Startups and Investments: Asia Pacific is witnessing a surge in blockchain startups, particularly in countries like India and Singapore. In 2023, Singapore-based blockchain startups raised $2.2 billion in funding, while South Koreas government pledged $50 million in 2024 to support blockchain projects focused on supply chain and healthcare applications.

Asia Pacific Blockchain Market Challenges

- Regulatory Uncertainty Across the Region: Despite several blockchain-friendly nations in Asia Pacific, regulatory uncertainty remains a major barrier to widespread adoption. For example, in 2023, India's Reserve Bank imposed restrictions on cryptocurrency trading platforms, making it difficult for businesses to leverage blockchain technologies for digital assets. The unclear stance of governments like Indonesia and Malaysia on digital currencies is slowing blockchain adoption across sectors. As of 2024, over 30% of blockchain projects in Asia Pacific are stalled due to regulatory challenges.

- Cybersecurity Concerns in Blockchain Adoption Although blockchain is known for its security, the Asia Pacific region has witnessed significant cybersecurity challenges, especially in decentralized finance (DeFi) platforms. In 2023, DeFi hacks in Asia amounted to $2.3 billion in stolen funds, with a majority of the attacks targeting smart contracts in Japan and South Korea. In 2024, South Korea's Financial Services Commission mandated stricter cybersecurity measures for blockchain-based platforms to address these risks, but challenges in implementation remain a concern.

Asia Pacific Blockchain Market Government Initiatives

- IndiaChain Initiative (2023): Indias government launched the IndiaChain initiative, a blockchain infrastructure designed to enhance transparency and reduce corruption in public services. By 2023, this platform had onboarded over 2 million transactions related to land records, public distribution, and health data. In 2024, IndiaChain will expand to 5 additional states, further solidifying its role in driving blockchain adoption in public sectors.

- Singapores Blockchain for Trade and Finance (BTF): In 2024, Singapore introduced a Blockchain for Trade and Finance (BTF) initiative in collaboration with the Monetary Authority of Singapore (MAS). This program aims to streamline international trade by enabling businesses to secure real-time trade financing using blockchain technology. By mid-2024, over $20 billion worth of trade transactions were processed using blockchain under this initiative, positioning Singapore as a leader in blockchain-based trade solutions in the Asia Pacific region.

Asia Pacific Blockchain Future Market Outlook

The Asia Pacific blockchain market is set to experience significant growth by 2028, driven by the expansion of blockchain in finance, supply chain, and government applications. The integration of blockchain with digital currencies, decentralized identity, and energy trading platforms will transform key industries across the region.

Future Market Trends

- Expansion of Central Bank Digital Currencies (CBDCs): By 2028, several Asia Pacific countries, including China, Japan, and Singapore, will fully implement central bank digital currencies (CBDCs), with government-backed initiatives driving the integration of CBDCs into retail payments and cross-border trade. In 2024, Japan plans to test its CBDC in retail payments, following Chinas success with the digital yuan. These efforts will significantly enhance the blockchain infrastructure across the region, making blockchain an essential technology for financial systems.

- Growth of Blockchain in Decentralized Identity (DID): Decentralized Identity (DID) solutions will gain momentum in the Asia Pacific blockchain market by 2028, as governments and corporations aim to provide secure, verifiable digital identities. In 2024, South Korea launched a $15 million initiative to develop blockchain-based identity verification systems. By 2028, DID will be a crucial part of the regions digital infrastructure, offering secure and decentralized identification solutions across industries like healthcare, finance, and public services. (Source: Ministry of Science and ICT, South Korea, 2024)

Scope of the Report

|

By Application |

Digital Currencies Smart Contracts Supply Chain Identity Management |

|

By Industry Vertical |

Finance Healthcare Supply Chain Government Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Financial Institutions and Banks

Blockchain Startups

Government and Regulatory Bodies (e.g., Monetary Authority of Singapore)

Technology Providers and Developers

Cryptocurrency Exchanges

Healthcare Providers

Supply Chain Companies

Telecommunications Firms

Venture Capital Firms

Energy Companies

Insurance Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report

IBM Corporation

Tencent Holdings

Alibaba Group

Hyperledger

ConsenSys

Ripple Labs

AntChain

VeChain

OneConnect Financial Technology

Table of Contents

1. Asia Pacific Blockchain Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Blockchain Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Blockchain Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Digital Currencies and Central Bank Digital Currencies (CBDCs)

3.1.2. Expansion of Blockchain in Supply Chain Management

3.1.3. Government Initiatives and Investments in Blockchain Infrastructure

3.2. Restraints

3.2.1. Regulatory Uncertainty Across Different Countries

3.2.2. Cybersecurity and Privacy Concerns

3.2.3. Lack of Interoperability Between Blockchain Networks

3.3. Opportunities

3.3.1. Blockchain Integration in Decentralized Finance (DeFi)

3.3.2. Rise of Decentralized Identity and Authentication Solutions

3.3.3. Adoption of Blockchain in Healthcare and Public Services

3.4. Trends

3.4.1. Growth of NFT Adoption in Entertainment and Media

3.4.2. Increasing Use of Blockchain for Cross-Border Payments

3.4.3. Expansion of Blockchain-as-a-Service (BaaS) Platforms

3.5. Government Regulations

3.5.1. Chinas Blockchain Service Network (BSN) Regulations

3.5.2. Indias Cryptocurrency and Blockchain Regulations

3.5.3. Japans Digital Asset Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Asia Pacific Blockchain Market Segmentation, 2023

4.1. By Industry Vertical (in Value %)

4.1.1. Finance

4.1.2. Healthcare

4.1.3. Supply Chain

4.1.4. Government

4.2. By Application (in Value %)

4.2.1. Digital Currencies

4.2.2. Smart Contracts

4.2.3. Identity Management

4.2.4. Supply Chain Tracking

4.3. By Region (in Value %)

4.3.1. East Asia

4.3.2. South Asia

4.3.3. North Asia

4.3.4. West Asia

5. Asia Pacific Blockchain Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. IBM Corporation

5.1.2. Tencent Holdings

5.1.3. Alibaba Group

5.1.4. Hyperledger

5.1.5. ConsenSys

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Asia Pacific Blockchain Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Asia Pacific Blockchain Market Regulatory Framework

7.1. Chinas Blockchain Regulatory Environment

7.2. Indias Blockchain Policy and Guidelines

7.3. Japans Blockchain and Cryptocurrency Licensing Requirements

8. Asia Pacific Blockchain Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Asia Pacific Blockchain Market Future Segmentation, 2028

9.1. By Industry Vertical (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. Asia Pacific Blockchain Market Analysts' Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Strategic Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Establishing an ecosystem for key entities in the Asia Pacific Blockchain Market, referencing secondary and proprietary databases. This step involves collecting industry-level data, identifying key market trends, and understanding the competitive landscape for a thorough analysis.

Step 2: Market Building

Aggregating data on the Asia Pacific Blockchain Market, analyzing market penetration across segments, and evaluating the performance of major players. Production capacities, market shares, and transaction data are reviewed to accurately determine revenue within the market. Quality assurance measures ensure data reliability.

Step 3: Validating and Finalizing

Formulating market hypotheses and conducting Computer-Assisted Telephone Interviews (CATIs) with industry experts and stakeholders from key blockchain companies. These interviews validate the gathered data, refine forecasts, and provide operational insights directly from industry leaders.

Step 4: Research Output

Collaborating with blockchain industry leaders to assess product segmentation, customer needs, and sales patterns. A bottom-up approach is used to verify data accuracy, ensuring that the final statistics and insights reflect real market conditions and inform strategic decisions.

Frequently Asked Questions

1. How big is the Asia Pacific Blockchain Market?

The Asia Pacific blockchain market was valued at USD 2 billion in 2023. The market's growth is fueled by the widespread adoption of blockchain technology in sectors like finance, supply chain, and healthcare.

2. What are the challenges in the Asia Pacific Blockchain Market?

Challenges in the Asia Pacific blockchain market include regulatory uncertainty, cybersecurity risks, and interoperability issues between blockchain platforms. These factors are hindering widespread adoption, especially in sectors like decentralized finance and cross-border payments.

3. Who are the major players in the Asia Pacific Blockchain Market?

Key players in the Asia Pacific blockchain market include IBM Corporation, Tencent Holdings, Alibaba Group, Hyperledger, and ConsenSys. These companies lead the market through innovative blockchain solutions and strong partnerships with financial and governmental institutions.

4. What are the growth drivers of the Asia Pacific Blockchain Market?

Growth drivers include government-backed initiatives, such as Chinas Blockchain Service Network, and increasing demand for blockchain in cross-border payments and digital currencies. The rise of blockchain-based startups and funding is also accelerating market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.