Asia Pacific Body-Worn Camera Market Outlook to 2030

Region:Asia

Author(s):Shambhavi Awasthi

Product Code:KROD9724

November 2024

89

About the Report

Asia Pacific Body-Worn Camera Market Overview

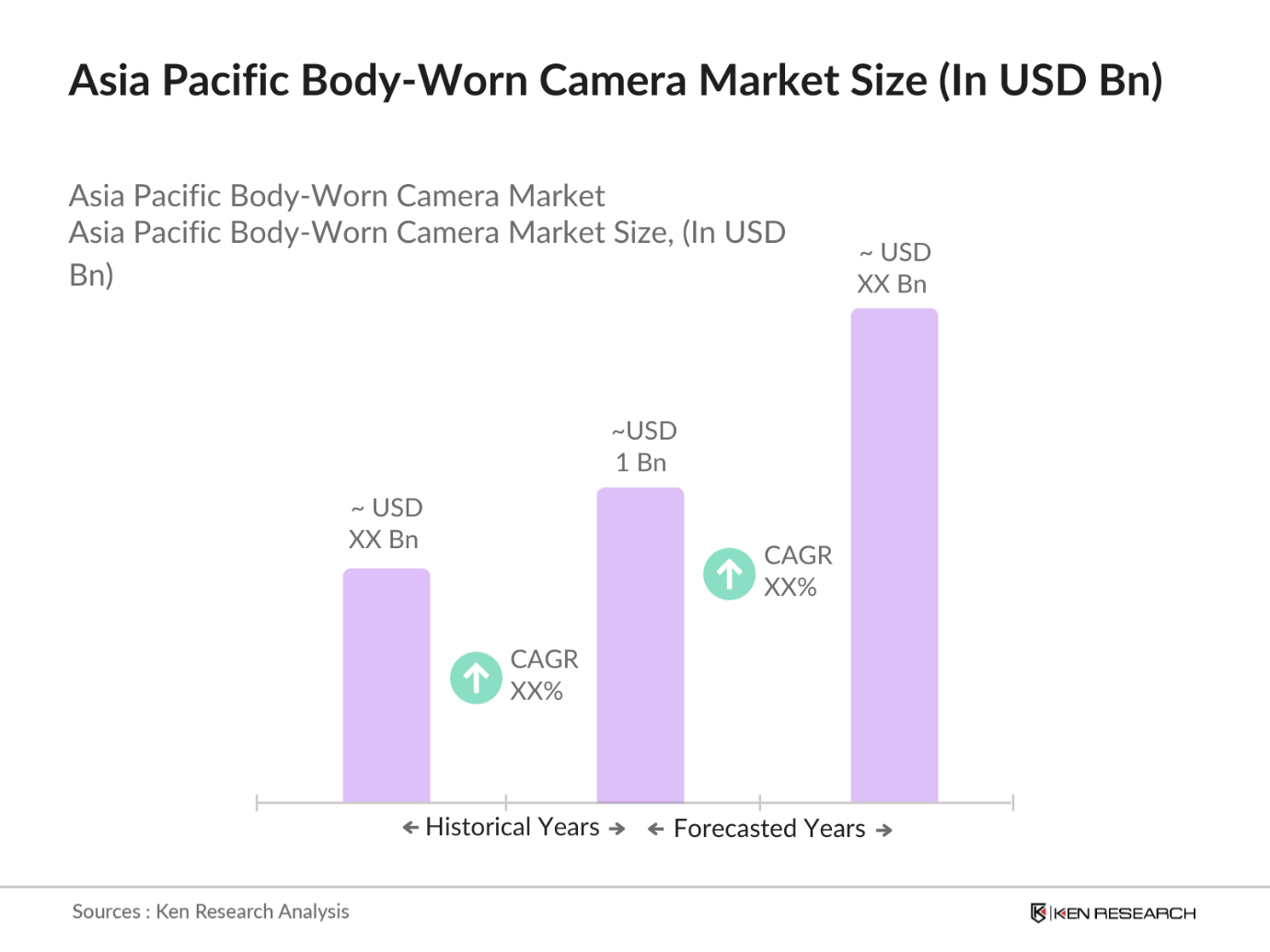

- The Asia Pacific Body-Worn Camera market is currently valued at USD 1 billion, based on a comprehensive five-year historical analysis, driven by its expanding use in law enforcement, military, and security applications. Body-worn cameras have become integral in these sectors due to the demand for transparency, accountability, and crime prevention. The technology has also seen an uptake in private sectors, including healthcare and transport, where real-time surveillance is a necessity. Increased government mandates and technological advancements further strengthen market expansion.

- Countries like China, Japan, and India dominate the Asia Pacific Body-Worn Camera market due to their extensive investments in public safety and defense sectors. China leads in technological production, enabling rapid development and deployment of body-worn cameras in law enforcement. Japan, with a focus on safety and surveillance in densely populated cities, drives demand for this technology, while Indias recent public safety initiatives have amplified its adoption. The security emphasis in these nations has catalyzed a strong body-worn camera market presence.

- Various Asia Pacific countries have introduced mandatory policies for body-worn camera implementation in law enforcement, requiring substantial public funding. In 2024, Singapore mandated BWCs for all law enforcement officers, with $180 million allocated to ensure deployment and adherence to guidelines. Australia has followed suit with regulations emphasizing transparency, dedicating $200 million to mandate and implement BWCs across its police forces, reflecting the regions commitment to enforceable public security regulations.

Asia Pacific Body-Worn Camera Market Segmentation

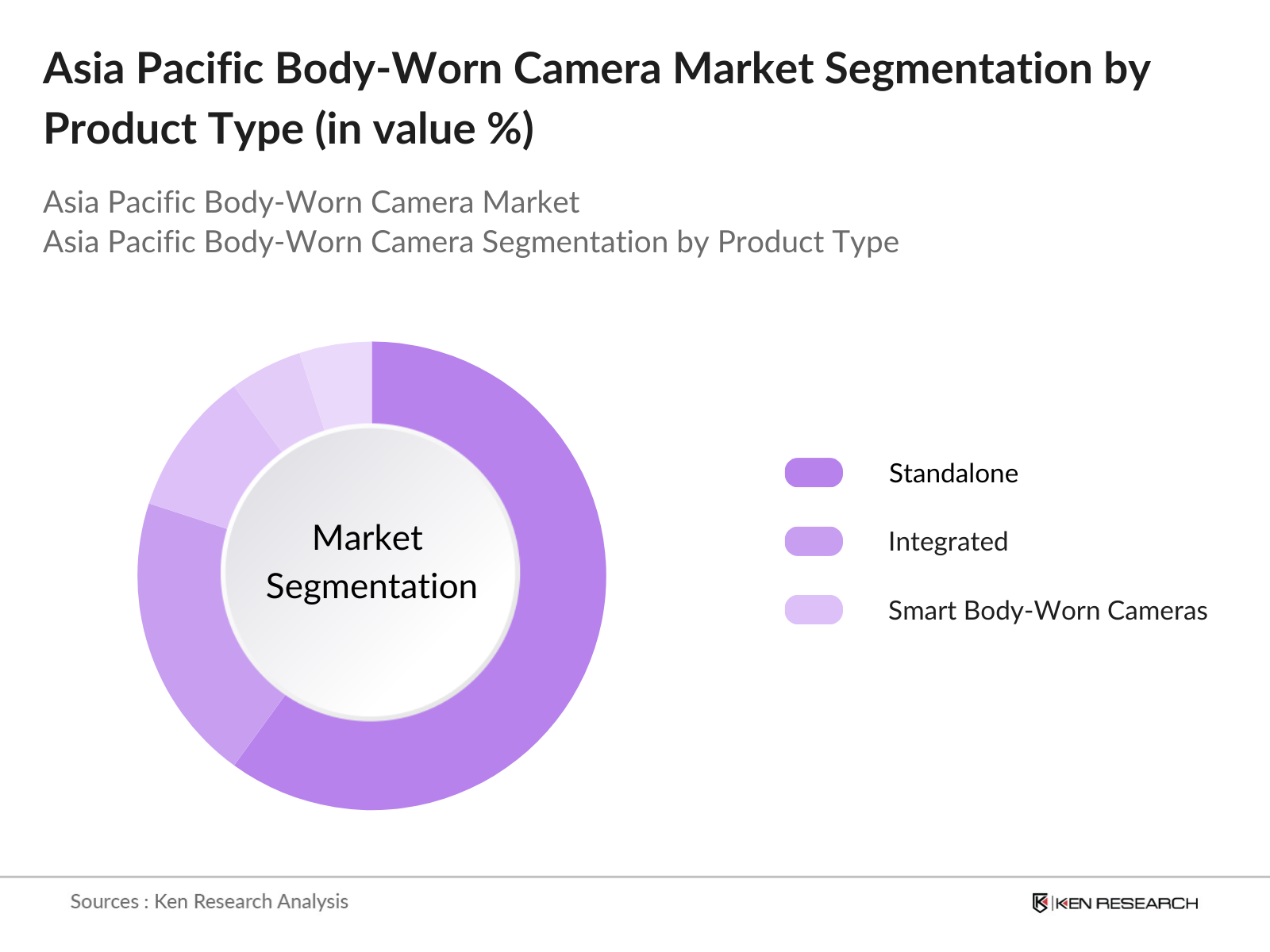

- By Product Type: The Asia Pacific Body-Worn Camera market is segmented by product type into Standalone, Integrated, and Smart Body-Worn Cameras. Standalone cameras hold the dominant market share due to their simplicity and reliability, making them highly preferred for law enforcement purposes. Law enforcement agencies favor standalone models for their durability and straightforward functionality, which are essential for daily operations in rigorous environments. The dominance of this sub-segment is bolstered by manufacturers like Axon and Digital Ally, who provide ruggedized solutions tailored for field use.

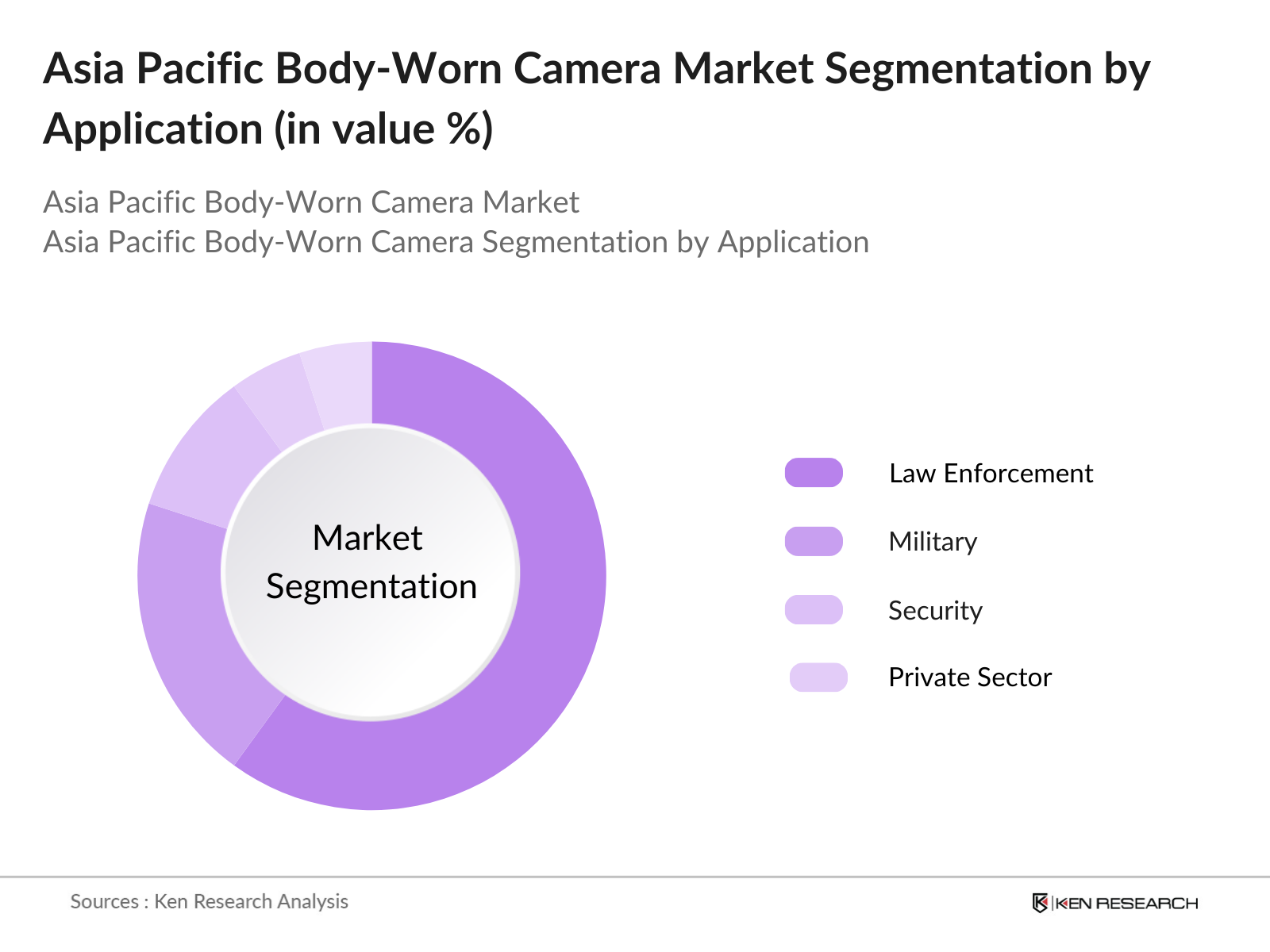

- By Application: The market is further segmented by application into Law Enforcement, Military, Security, and Private Sector. Law enforcement leads this segment due to its wide implementation across police departments to enhance accountability and evidence collection. The trust in body-worn cameras for these purposes has grown, especially in countries where public safety has seen reforms in transparency and monitoring. Notably, the increasing demand for these devices in policing and security sectors highlights their relevance in deterring misconduct and recording encounters.

Asia Pacific Body-Worn Camera Market Competitive Landscape

The Asia Pacific Body-Worn Camera market is dominated by several prominent players who are leading in technology, strategic partnerships, and innovation. Global brands such as Axon and Motorola Solutions compete with regional players, further consolidating their market hold.

Asia Pacific Body-Worn Camera Industry Analysis

Growth Drivers

- Increasing Law Enforcement Adoption: Law enforcement agencies in the Asia Pacific region are progressively adopting body-worn cameras (BWCs) to improve accountability and transparency. For instance, Indias Ministry of Home Affairs allocated approximately $200 million in 2023 to enhance police monitoring technologies, which included body-worn cameras for over 100,000 police personnel across metropolitan areas. Similarly, the New South Wales Police Force in Australia reported increased funding allocations by $150 million for advanced surveillance equipment, including BWCs for public safety enhancement, reflecting the regions commitment to transparent policing practices.

- Rising Public Demand for Transparency: Public demand for greater transparency in law enforcement is prompting governments to adopt body-worn cameras extensively. A 2024 survey by Japans Ministry of Justice revealed that 75% of citizens favored the use of BWCs for improving police accountability. Furthermore, in South Korea, a government mandate requiring BWCs during public interactions boosted funding by $120 million to ensure law enforcement officers nationwide are equipped with this technology, reflecting public and governmental consensus on enhancing transparency.

- Expansion in Adventure Tourism: As Asia Pacific's adventure tourism grows, body-worn cameras are gaining popularity among tourists for immersive recording experiences. According to the World Tourism Organization, adventure tourism in Asia grew by 15% in visitor numbers from 2022 to 2024. Australias tourism department allocated $90 million for digital enhancements, including BWCs for safety and documentation purposes, promoting safer and documented adventure tourism experiences. Such measures showcase the industrys confidence in using BWCs for personal recording and safety, enhancing tourists experiences across Asia Pacific.

Market Challenges

- High Initial Investment Costs: The high cost of body-worn camera technology remains a significant barrier for broader implementation in Asia Pacific, especially among smaller security firms and rural law enforcement. The World Banks 2024 report indicated that an estimated 40% of Asia Pacific police departments face budget constraints in adopting BWCs, often requiring up to $2,000 per unit, including software integration. Governmental subsidies and grants have only partially alleviated this burden, underscoring the need for cost-effective solutions to bridge budgetary limitations for broader adoption.

- Data Privacy Concerns: Rising data privacy concerns are challenging the integration of BWCs, with governments focusing on strict data protection laws. According to the Asia Pacific Privacy Framework, 60% of surveyed residents in Japan, South Korea, and Australia express concerns about potential misuse of recorded data. Recent policies in South Korea require data encryption and limited access protocols for recorded footage, with an estimated $130 million invested in compliance technologies for BWCs in 2023, highlighting the push for privacy-protective measures across the region.

Asia Pacific Body-Worn Camera Market Future Outlook

Over the next five years, the Asia Pacific Body-Worn Camera market is projected to experience significant growth, driven by ongoing advancements in camera technology, rising demand for transparency, and governmental emphasis on public safety. The shift toward enhanced image resolution, AI-integrated features, and cloud storage will further augment the markets expansion. An increase in regulatory mandates across Asia Pacific, coupled with increased adoption in private sectors, is likely to create substantial growth opportunities for market participants.

Market Opportunities

- Integration with Smart City Initiatives: The rise of smart cities across Asia Pacific presents growth opportunities for BWC integration in urban security systems. Chinas Ministry of Urban Development allocated $500 million for smart city technology, including BWCs integrated with surveillance networks for real-time crime detection. Similarly, Japan invested $200 million in its smart city projects, emphasizing the adoption of BWCs for enhanced safety and surveillance, highlighting the role of urban digitalization in promoting BWC usage across the region.

- Expansion into Private Security Sectors: BWCs are increasingly being adopted by private security firms, given their value in evidence documentation and real-time monitoring. In India, over 1,000 private security firms adopted BWCs in 2024, according to data from the Private Security Sector Association, with $20 million in equipment purchases and tech training. This trend reflects the growing reliance on BWCs beyond law enforcement, with private firms recognizing their utility in risk management and accountability enhancement.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Standalone Cameras |

|

Operation |

Recording Only |

|

Resolution |

Full HD |

|

End User |

Law Enforcement |

|

Country |

China |

Products

Key Target Audience

Government and regulatory bodies (e.g., Ministry of Public Security)

Law enforcement agencies

Private security firms

Military organizations

Healthcare institutions

Retail chains with security needs

Investors and venture capital firms

Technology integrators and consultants

Companies

Players Mentioned in the report:

Axon

Motorola Solutions

Digital Ally

Hikvision

GoPro

Panasonic

Wolfcom

Reveal Media

Veho

Transcend Information

Safe Fleet

Pannin Technologies

Pinnacle Response

B-Cam

Table of Contents

1. Asia Pacific Body-Worn Camera Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Body-Worn Camera Market Size (in USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Body-Worn Camera Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Law Enforcement Adoption

3.1.2 Technological Advancements

3.1.3 Rising Public Demand for Transparency

3.1.4 Expansion in Adventure Tourism

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Data Privacy Concerns

3.2.3 Technical Limitations

3.3 Opportunities

3.3.1 Integration with Smart City Initiatives

3.3.2 Expansion into Private Security Sectors

3.3.3 Development of Cost-Effective Solutions

3.4 Trends

3.4.1 Adoption of Cloud-Based Storage

3.4.2 Integration with Artificial Intelligence

3.4.3 Miniaturization and Design Improvements

3.5 Government Regulations

3.5.1 Mandatory Implementation Policies

3.5.2 Data Storage and Retention Laws

3.5.3 Privacy and Consent Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. Asia Pacific Body-Worn Camera Market Segmentation

4.1 By Product Type

4.1.1 Standalone Cameras

4.1.2 Integrated Systems

4.2 By Operation

4.2.1 Recording Only

4.2.2 Recording and Live Streaming

4.3 By Resolution

4.3.1 Full HD

4.3.2 HD

4.3.3 4K

4.3.4 Others

4.4 By End User

4.4.1 Law Enforcement

4.4.2 Military

4.4.3 Transportation

4.4.4 Sports and Leisure

4.4.5 Others

4.5 By Country

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Australia

4.5.5 South Korea

4.5.6 Rest of Asia Pacific

5. Asia Pacific Body-Worn Camera Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Axon Enterprise, Inc.

5.1.2 Panasonic Corporation

5.1.3 Motorola Solutions, Inc.

5.1.4 GoPro, Inc.

5.1.5 Transcend Information, Inc.

5.1.6 Reveal Media Ltd.

5.1.7 Digital Ally, Inc.

5.1.8 Safety Vision LLC

5.1.9 Pinnacle Response Ltd.

5.1.10 PRO-VISION Video Systems

5.1.11 Shenzhen AEE Technology Co., Ltd.

5.1.12 Wolfcom Enterprises

5.1.13 Veho (MUVI)

5.1.14 10-8 Video Systems LLC

5.1.15 Pannin Technologies

5.2 Cross Comparison Parameters

5.2.1 Number of Employees

5.2.2 Headquarters Location

5.2.3 Year of Establishment

5.2.4 Revenue

5.2.5 Product Portfolio

5.2.6 Market Presence

5.2.7 Recent Developments

5.2.8 Strategic Initiatives

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Asia Pacific Body-Worn Camera Regulatory Framework

6.1 Regional Compliance Standards

6.2 Certification Processes

6.3 Data Protection Laws

7. Asia Pacific Body-Worn Camera Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Body-Worn Camera Future Market Segmentation

8.1 By Product Type

8.2 By Operation

8.3 By Resolution

8.4 By End User

8.5 By Country

9. Asia Pacific Body-Worn Camera Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the Asia Pacific Body-Worn Camera market ecosystem, identifying critical stakeholders, and using secondary and proprietary databases for comprehensive industry information to recognize influential market variables.

Step 2: Market Analysis and Construction

Historical data collection was central to this phase, assessing body-worn camera adoption across various sectors, and segmenting by application to understand revenue generation and key drivers.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were verified via CATI with industry specialists across the body-worn camera ecosystem, providing insights on operational dynamics and influencing data accuracy.

Step 4: Research Synthesis and Final Output

Engagement with manufacturers validated the data, offering insights into sales and consumer preferences, ensuring a reliable, bottom-up analysis of the Asia Pacific Body-Worn Camera market.

Frequently Asked Questions

01. How big is the Asia Pacific Body-Worn Camera Market?

The Asia Pacific Body-Worn Camera Market is valued at USD 1 billion, driven by high demand in law enforcement, military, and security applications.

02. What are the challenges in the Asia Pacific Body-Worn Camera Market?

Key challenges include high competition, data privacy concerns, and budget constraints among potential buyers, which may impact growth.

03. Who are the major players in the Asia Pacific Body-Worn Camera Market?

Major players include Axon, Motorola Solutions, Digital Ally, Hikvision, and GoPro, dominating due to advanced technology and strong partnerships with public safety agencies.

04. What are the growth drivers of the Asia Pacific Body-Worn Camera Market?

Growth drivers include the increasing adoption of body-worn cameras in law enforcement, advancements in camera technology, and regulatory support for transparency.

05. What role does technology play in the Asia Pacific Body-Worn Camera Market?

Technological advancements, such as AI integration and real-time data streaming, play a crucial role in enhancing functionality and increasing adoption rates in the market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.