Asia Pacific Bone and Joint Health Supplements Market Outlook to 2030

Region:Global

Author(s):Abhinav

Product Code:KROD5338

December 2024

84

About the Report

Asia Pacific Bone and Joint Health Supplements Market Overview

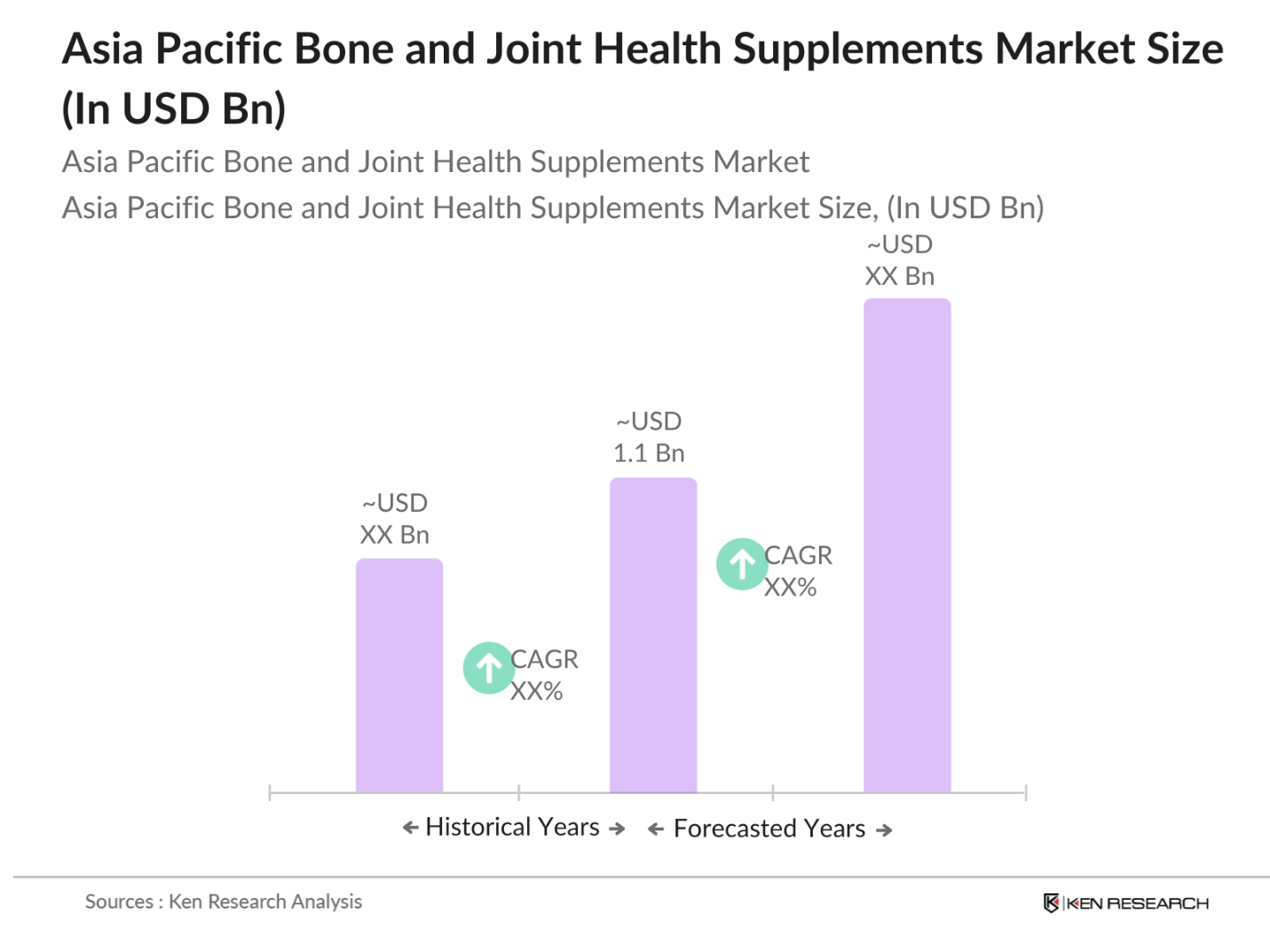

- The Asia Pacific bone and joint health supplements market is valued at USD 1.1 billion, based on a five-year historical analysis. The markets growth is driven by increasing awareness about preventive healthcare among the aging population, as well as the rising prevalence of bone and joint disorders such as arthritis and osteoporosis. Additionally, factors such as higher disposable incomes, advancements in healthcare infrastructure, and innovations in supplement formulations have accelerated the demand for bone and joint health supplements across key regions in the Asia Pacific.

- Countries like Japan, China, and India dominate the market due to their large aging populations and rising healthcare expenditure. Japan, with its significant elderly population, has a high demand for bone and joint health supplements, while Chinas growth is attributed to increasing urbanization and consumer awareness. Indias market dominance stems from a growing middle class and rising healthcare spending on wellness and preventive treatments.

- Consumers in Asia-Pacific are increasingly favoring plant-based and vegan supplements for bone and joint health, driven by environmental and health concerns. In 2023, over 10% of Japans population reported preferring plant-based products, with turmeric and Boswellia gaining popularity due to their anti-inflammatory properties. This shift is further bolstered by government initiatives promoting plant-based diets in countries like Australia and India, driving demand for supplements that align with these preferences.

Asia Pacific Bone and Joint Health Supplements Market Segmentation

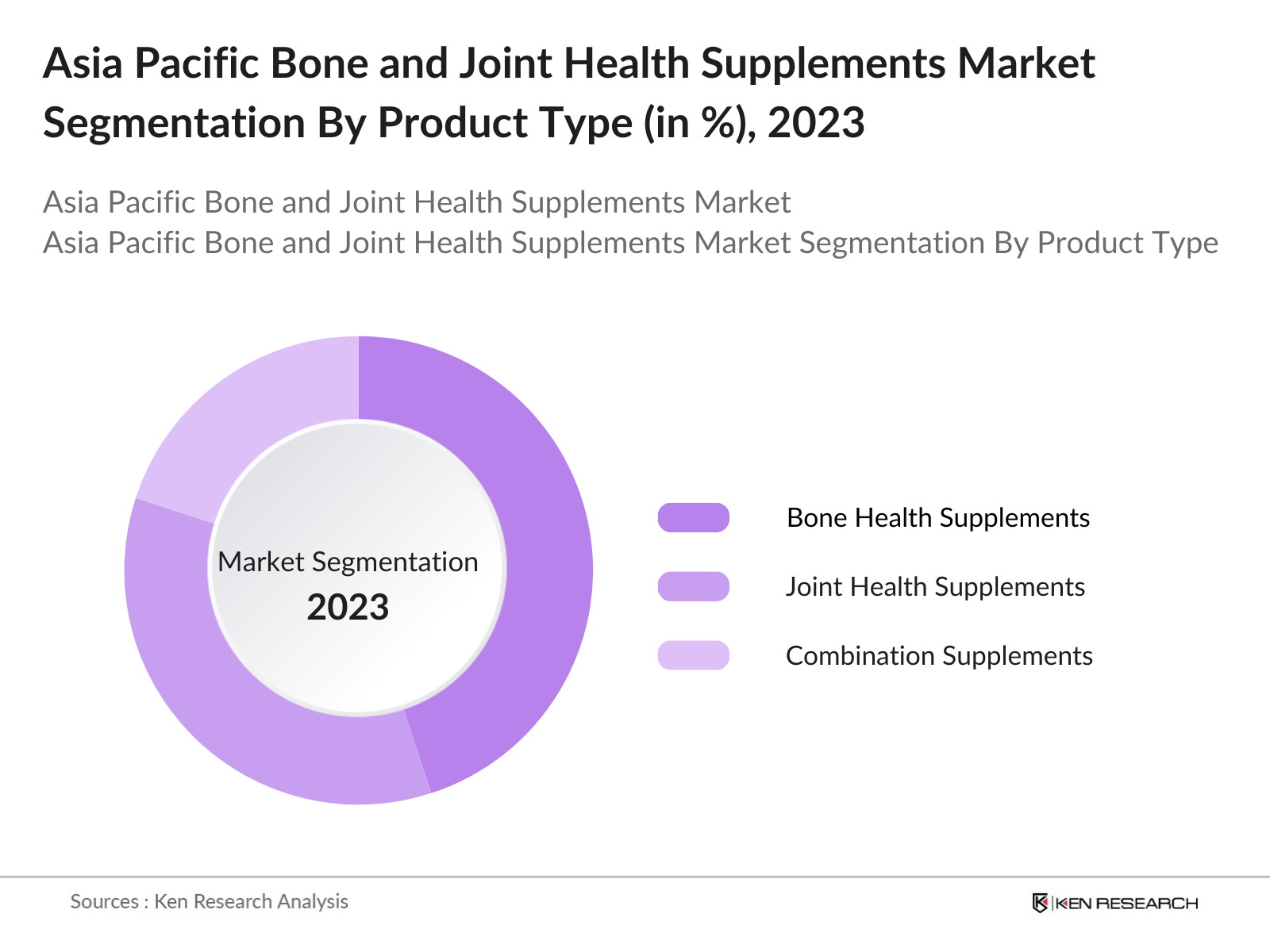

By Product Type: The Asia Pacific bone and joint health supplements market is segmented by product type into bone health supplements, joint health supplements, and combination supplements. Bone health supplements hold a dominant market share due to the growing aging population and the rising incidence of osteoporosis in key markets like Japan and China. Calcium and Vitamin D supplements are particularly popular as they are essential in maintaining bone density and preventing fractures, which are more common among elderly individuals. The increasing focus on preventive healthcare, alongside clinical recommendations for such supplements, has further bolstered this segments dominance.

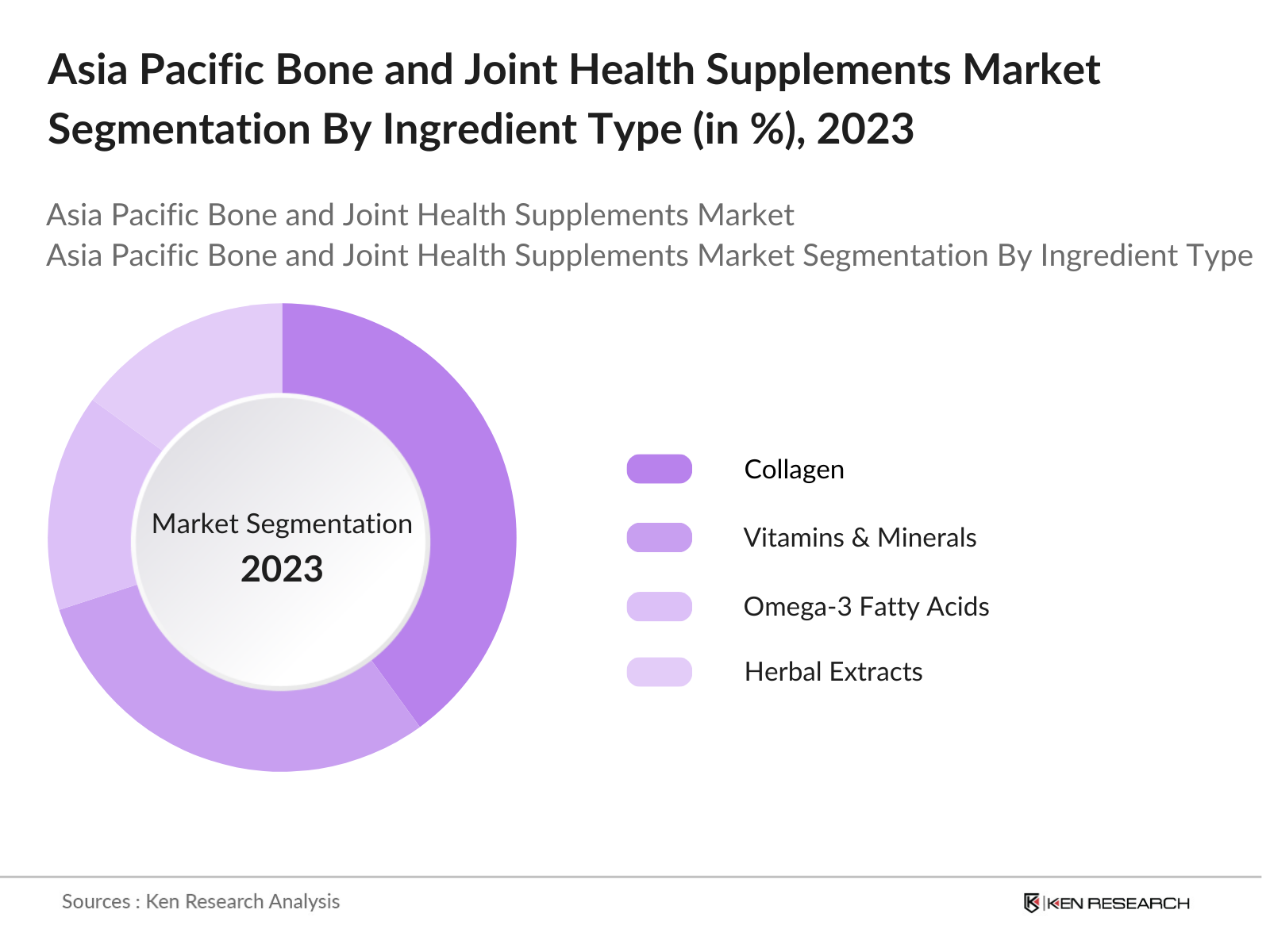

By Ingredient Type: The market is also segmented by ingredient type, including vitamins & minerals, collagen, omega-3 fatty acids, and herbal extracts. Collagen-based supplements lead the market under this segmentation. Collagen, particularly types I and II, has gained traction due to its benefits for joint lubrication, cartilage repair, and skin health. Collagens growing popularity in markets like South Korea, Australia, and China is also due to its widespread use in beauty and joint care products, supported by clinical evidence of its effectiveness. Additionally, collagen supplements have become a preferred choice for younger consumers seeking preventive measures for joint and bone health.

Asia Pacific Bone and Joint Health Supplements Market Competitive Landscape

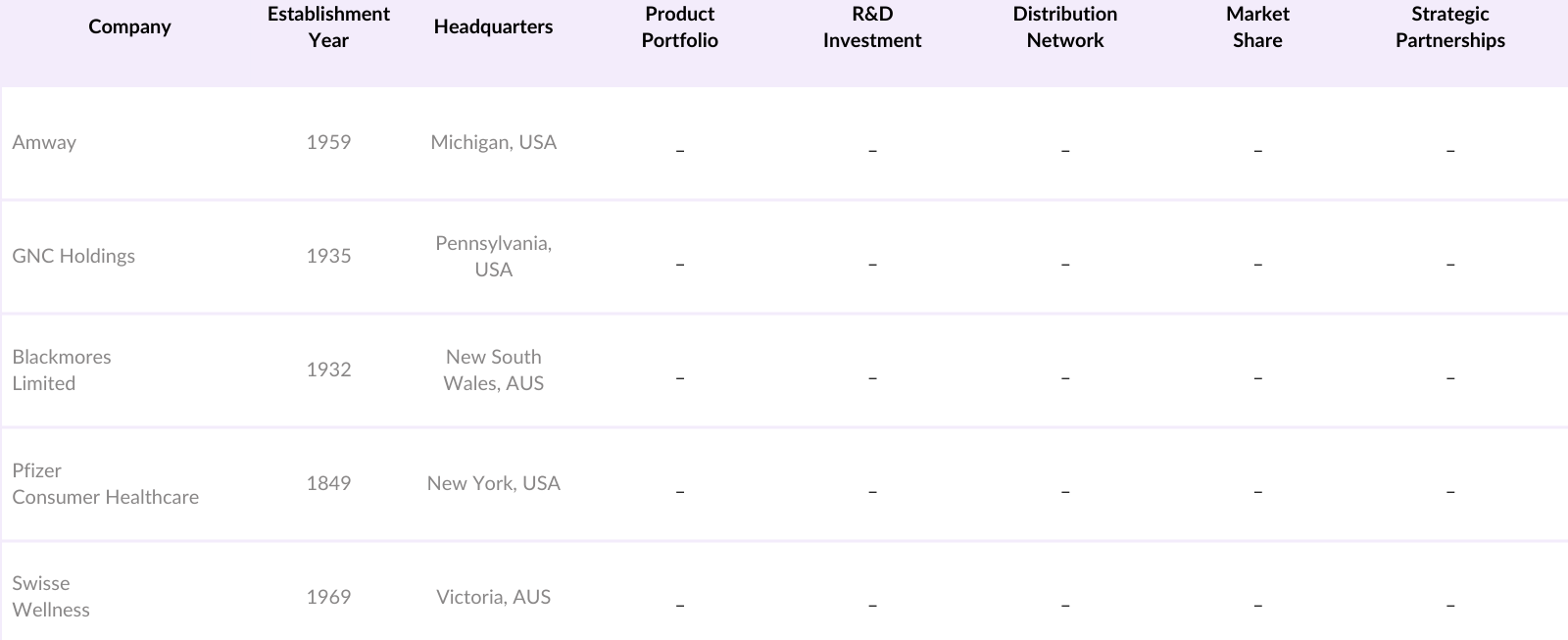

The Asia Pacific bone and joint health supplements market is highly competitive, with key players focusing on product innovation, geographic expansion, and strategic partnerships to maintain a competitive edge. The market is dominated by both global players and regional companies that have established strong distribution networks and consumer trust. The competitive landscape in the market is shaped by several global and regional players such as Amway, GNC Holdings, Blackmores Limited, Pfizer Consumer Healthcare, and Swisse Wellness. These companies benefit from established brand recognition and trusted product lines in the bone and joint health category. Many of these firms are increasingly leveraging digital platforms and e-commerce to expand their reach, while also focusing on research and innovation to cater to a growing consumer demand for premium and scientifically-backed supplements.

Asia Pacific Bone and Joint Health Supplements Industry Analysis

Growth Drivers

- Aging Population: Japan and Australia have experienced significant growth in their elderly populations, contributing to increased demand for bone and joint health supplements. In 2023, Japans population aged 65 and older reached 36.2 million, representing a growing need for healthcare solutions, especially those aimed at bone health. In Australia, the number of individuals aged 65 and above is now over 4.4 million. This aging population is particularly prone to bone-related issues such as arthritis and osteoporosis, further driving the market for health supplements targeting bone and joint well-being.

- Rising Prevalence of Bone and Joint Disorders: With an increase in sedentary lifestyles and poor dietary habits, bone and joint disorders have become more prevalent in Asia-Pacific. In 2022, over 7 million people in Japan suffered from osteoporosis, with arthritis affecting nearly 10 million people across the region. These rising cases are directly linked to the growing consumption of bone and joint health supplements, as patients seek preventive measures. With increasing awareness and diagnoses, the need for such supplements has escalated. Countries like India and China are witnessing similar trends in bone health issues.

- Growing Awareness of Preventive Health: There is a notable increase in consumer awareness about preventive healthcare across the Asia-Pacific region, particularly regarding bone and joint health. With over 60% of adults in urban centers in Australia and Japan reported to engage in physical activities to maintain health in 2024, dietary supplements are becoming essential for enhancing joint mobility and bone strength. This shift towards health consciousness is coupled with the increasing popularity of fitness and wellness routines, propelling the market for joint and bone health supplements.

Market Challenges

- Regulatory Hurdles: Health supplement markets in Asia-Pacific face significant regulatory challenges, particularly in countries like Japan and South Korea. Japans Ministry of Health, Labour and Welfare enforces strict approval processes for supplements, requiring comprehensive clinical evidence for efficacy claims. Similarly, Chinas regulatory framework mandates stringent testing and certification processes for health supplements. These regulatory requirements increase time-to-market for new products and create barriers for international companies attempting to enter these markets, leading to higher costs and delayed product launches.

- High Product Development Costs: Developing bone and joint health supplements is associated with significant research and development expenses. Clinical trials, which are crucial for product validation, can cost anywhere from $500,000 to $5 million depending on the scope and region. Companies must navigate these high costs, particularly in regions like Japan and Australia where stringent regulatory standards demand rigorous testing. This adds to the overall product development time and expense, making it challenging for smaller companies to compete in the market.

Asia Pacific Bone and Joint Health Supplements Market Future Outlook

Over the next five years, the Asia Pacific bone and joint health supplements market is expected to experience sustained growth driven by factors such as the increasing geriatric population, rising awareness about preventive healthcare, and the integration of technology in supplement development.

Opportunities

- Rising Demand for Natural Ingredients: The demand for natural ingredients in bone and joint health supplements is growing rapidly in Asia-Pacific, particularly in markets like Japan, Australia, and South Korea. In 2023, global collagen production exceeded 120,000 metric tons, with significant demand coming from these regions. Similarly, glucosamine and chondroitin supplements are becoming increasingly popular as consumers shift towards natural, non-pharmaceutical solutions. This trend presents an opportunity for companies focusing on plant-based and natural ingredient formulations, especially as awareness around their benefits grows.

- Expansion in Emerging Markets: Emerging markets such as China, India, and Vietnam present a significant growth opportunity for bone and joint health supplements. In China, urbanization is rapidly increasing, with over 900 million people living in urban areas as of 2023. India has over 400 million urban dwellers, while Vietnam is experiencing a similar surge. These countries also have rising incidences of bone and joint disorders due to lifestyle changes, further bolstering the demand for health supplements. Companies expanding into these markets can capitalize on the increasing health awareness and growing middle class.

Scope of the Report

|

By Product Type |

Bone Health Supplements Joint Health Supplements Combination Supplements |

|

By Ingredient Type |

Vitamins & Minerals Collagen Omega-3 Fatty Acids Herbal Extracts |

|

By Form |

Tablets & Capsules Powders Gummies & Chewables Liquid Formulations |

|

By Distribution Channel |

Pharmacy & Drug Stores Supermarkets/Hypermarkets Online Stores Specialty Stores |

|

By Region |

China Japan India Australia Southeast Asia |

Products

Key Target Audience:

Manufacturers of Bone and Joint Health Supplement Companies

Healthcare Providers and Practitioner Companies

Pharmaceutical Companies

Retail Chains and Pharmacies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., TGA, China FDA, FSSAI)

E-commerce Platforms and Distributor Industries

Private Label Supplement Manufacturing Companies

Companies

Players Mentioned in the Report

Amway

GNC Holdings

Herbalife Nutrition

Blackmores Limited

Swisse Wellness

Natures Bounty

BioCeuticals

NOW Foods

VitaHealth

Pfizer Consumer Healthcare

Table of Contents

01. Asia Pacific Bone and Joint Health Supplements Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Bone density supplements, joint health improvement solutions, region-specific growth)

1.4 Market Segmentation Overview (Product type, application, ingredient, form, region)

02. Asia Pacific Bone and Joint Health Supplements Market Size (In USD Mn)

2.1 Historical Market Size (Market share by country, top product types)

2.2 Year-On-Year Growth Analysis (Growth rates of key segments, penetration rates in different regions)

2.3 Key Market Developments and Milestones (Notable product launches, partnerships, clinical trials)

03. Asia Pacific Bone and Joint Health Supplements Market Analysis

3.1 Growth Drivers

3.1.1 Aging Population

3.1.2 Rising Prevalence of Bone and Joint Disorders

3.1.3 Growing Awareness of Preventive Health

3.1.4 Increased Healthcare Expenditure

3.2 Market Challenges

3.2.1 Regulatory Hurdles

3.2.2 High Product Development Costs

3.2.3 Skepticism Among Consumers

3.3 Opportunities

3.3.1 Rising Demand for Natural Ingredients

3.3.2 Expansion in Emerging Markets

3.3.3 E-commerce Penetration

3.4 Trends

3.4.1 Preference for Plant-Based and Vegan Supplements

3.4.2 Personalized Nutrition

3.4.3 Probiotic and Omega-3 Supplement Integration

3.5 Government Regulations

3.5.1 Supplement Labeling Standards

3.5.2 Health Claim Regulations

3.5.3 Import and Export Restrictions

3.6 SWOT Analysis

3.6.1 Strengths

3.6.2 Weaknesses

3.6.3 Opportunities

3.6.4 Threats

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

04. Asia Pacific Bone and Joint Health Supplements Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Bone Health Supplements (Calcium, Vitamin D, Magnesium)

4.1.2 Joint Health Supplements (Glucosamine, Chondroitin, MSM)

4.1.3 Combination Supplements (Bone & joint health solutions)

4.2 By Ingredient Type (In Value %)

4.2.1 Vitamins & Minerals (Calcium, Vitamin K2)

4.2.2 Collagen (Marine, Bovine)

4.2.3 Omega-3 Fatty Acids

4.2.4 Herbal Extracts (Turmeric, Boswellia)

4.3 By Form (In Value %)

4.3.1 Tablets & Capsules

4.3.2 Powders

4.3.3 Gummies & Chewables

4.3.4 Liquid Formulations

4.4 By Distribution Channel (In Value %)

4.4.1 Pharmacy & Drug Stores

4.4.2 Supermarkets/Hypermarkets

4.4.3 Online Stores

4.4.4 Specialty Stores

4.5 By Region (In Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 Australia

4.5.5 Southeast Asia (Malaysia, Singapore, Thailand)

05. Asia Pacific Bone and Joint Health Supplements Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Amway

5.1.2. GNC Holdings

5.1.3. Herbalife Nutrition

5.1.4. Blackmores Limited

5.1.5. Swisse Wellness

5.1.6. Natures Bounty

5.1.7. BioCeuticals

5.1.8. NOW Foods

5.1.9. VitaHealth

5.1.10. Pfizer Consumer Healthcare

5.1.11. Nutralife Health & Fitness

5.1.12. Ostelin

5.1.13. GlaxoSmithKline

5.1.14. Bayer AG

5.1.15. Nutricore

5.2 Cross Comparison Parameters (Revenue, R&D investment, product innovation, market presence, acquisition strategies, distribution network, market share by region, strategic partnerships)

5.3 Market Share Analysis (Top five players, market consolidation)

5.4 Strategic Initiatives (Product innovation, market expansion)

5.5 Mergers and Acquisitions (Recent deals, impacts on the market)

5.6 Investment Analysis (Venture capital inflows, private equity funding)

5.7 Government Grants (Subsidies for domestic production)

5.8 Private Equity Investments (Key players, recent deals)

06. Asia Pacific Bone and Joint Health Supplements Market Regulatory Framework

6.1 Supplement Manufacturing Standards (Good Manufacturing Practices, ISO certifications)

6.2 Ingredient Approvals (Regulatory bodies: TGA, China FDA, FSSAI)

6.3 Compliance Requirements (Mandatory product testing, safety requirements)

6.4 Advertising Guidelines (Health claims, promotional restrictions)

07. Asia Pacific Bone and Joint Health Supplements Future Market Size (In USD Mn)

7.1 Future Market Size Projections (Based on key market drivers and trends)

7.2 Key Factors Driving Future Market Growth (Aging population, preventive health focus)

08. Asia Pacific Bone and Joint Health Supplements Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Ingredient Type (In Value %)

8.3 By Form (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

09. Asia Pacific Bone and Joint Health Supplements Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2 Consumer Cohort Analysis (Age group targeting, income level, health conditions)

9.3 Marketing Initiatives (Digital strategies, influencer marketing, customer engagement)

9.4 White Space Opportunity Analysis (Untapped regions, product gaps)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Bone and Joint Health Supplements Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Asia Pacific bone and joint health supplements market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple supplement manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific bone and joint health supplements market.

Frequently Asked Questions

01. How big is the Asia Pacific Bone and Joint Health Supplements Market?

The Asia Pacific bone and joint health supplements market is valued at USD 1.1 billion, driven by rising consumer awareness and the growing prevalence of joint and bone-related health issues.

02. What are the challenges in the Asia Pacific Bone and Joint Health Supplements Market?

Key challenges include stringent regulations governing health supplements in different countries and the high development costs of premium products. Furthermore, the market is highly competitive, with several global players vying for dominance.

03. Who are the major players in the Asia Pacific Bone and Joint Health Supplements Market?

Leading players in the market include Amway, GNC Holdings, Herbalife Nutrition, Blackmores Limited, and Swisse Wellness. These companies dominate due to their extensive product portfolios and strong distribution networks across the region.

04. What are the growth drivers of the Asia Pacific Bone and Joint Health Supplements Market?

The market is propelled by an aging population, rising consumer focus on preventive healthcare, and the increasing incidence of osteoporosis and arthritis, particularly in countries like Japan and China.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.