Asia Pacific Brain Computer Interface Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD2911

December 2024

93

About the Report

Asia Pacific Brain Computer Interface Market Overview

- The Asia Pacific Brain-Computer Interface (BCI) market is valued at USD 394 million, based on a five-year historical analysis. This market's growth is primarily driven by advancements in neurotechnology and increasing applications across healthcare, communication, and gaming industries. The rising prevalence of neurodegenerative disorders and the integration of artificial intelligence in BCI devices further accelerate market demand. As industries focus on enhancing human-computer interaction, BCIs are increasingly recognized as a transformative technology, especially in sectors like neurorehabilitation, assistive communication, and immersive gaming experiences.

- Within the Asia Pacific region, countries such as China, Japan, and South Korea are leading the BCI market. China's dominance is due to substantial investments in research and development, coupled with government initiatives supporting neurotechnology advancements. Japan's strong healthcare infrastructure and technological innovation contribute to its significant market share. South Korea's focus on integrating BCI in gaming and entertainment sectors further bolsters its position in the market.

- National policies in the Asia-Pacific region are increasingly focusing on neurotechnology. In 2024, China's State Council issued guidelines to promote the development of brain science and neurotechnology, emphasizing ethical standards and innovation. Similarly, Japan's Ministry of Health, Labour and Welfare established a framework in 2023 to regulate BCI devices, ensuring safety and efficacy. These policies aim to balance innovation with ethical considerations in the neurotechnology sector.

Asia Pacific Brain Computer Interface Market Segmentation

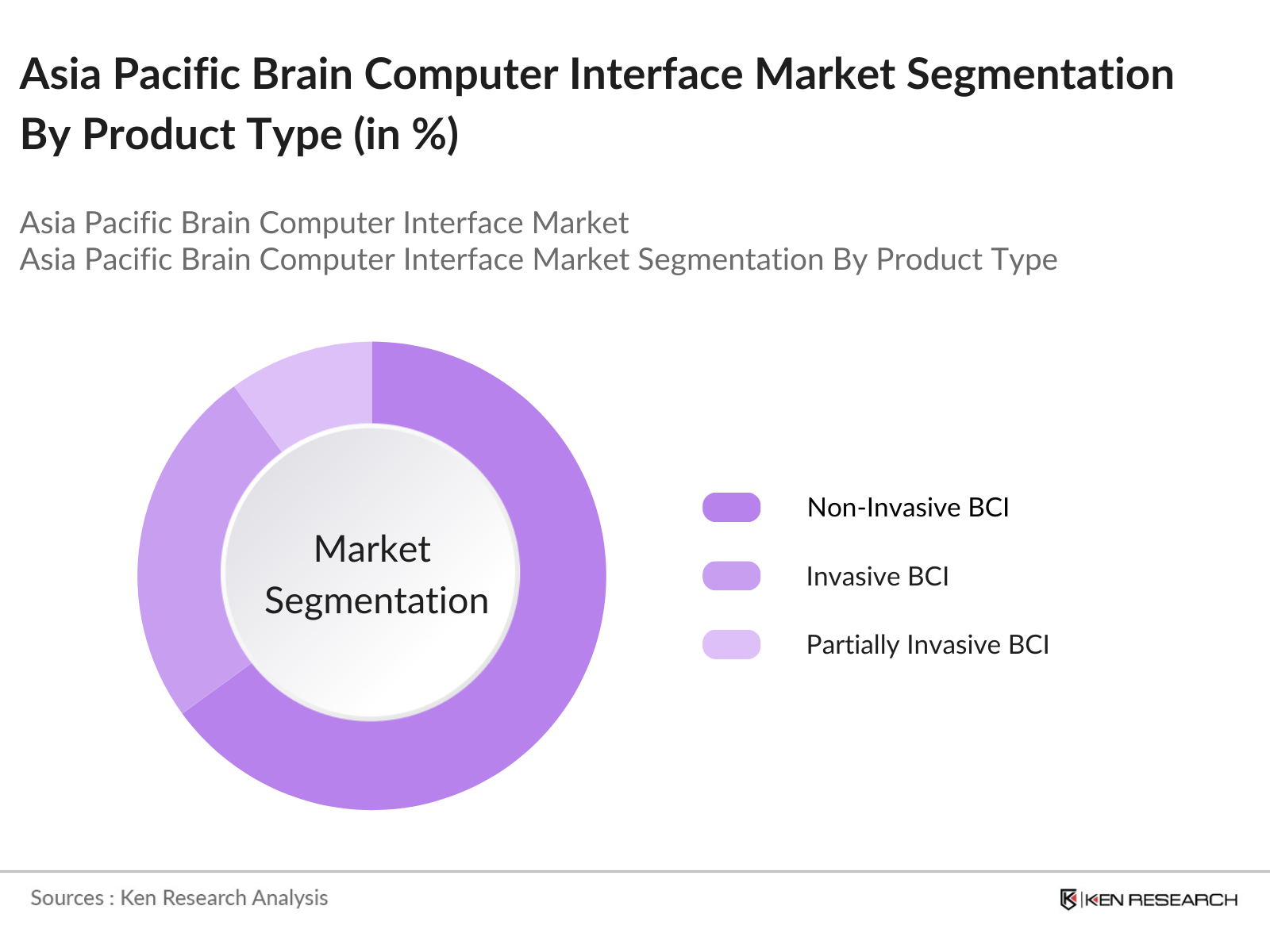

By Product Type: The market is segmented by product type into invasive, non-invasive, and partially invasive BCIs. Non-invasive BCIs hold a dominant market share due to their ease of use and safety profile, eliminating the need for surgical procedures. These devices are widely adopted in applications such as gaming, communication, and rehabilitation, making them more accessible to a broader user base.

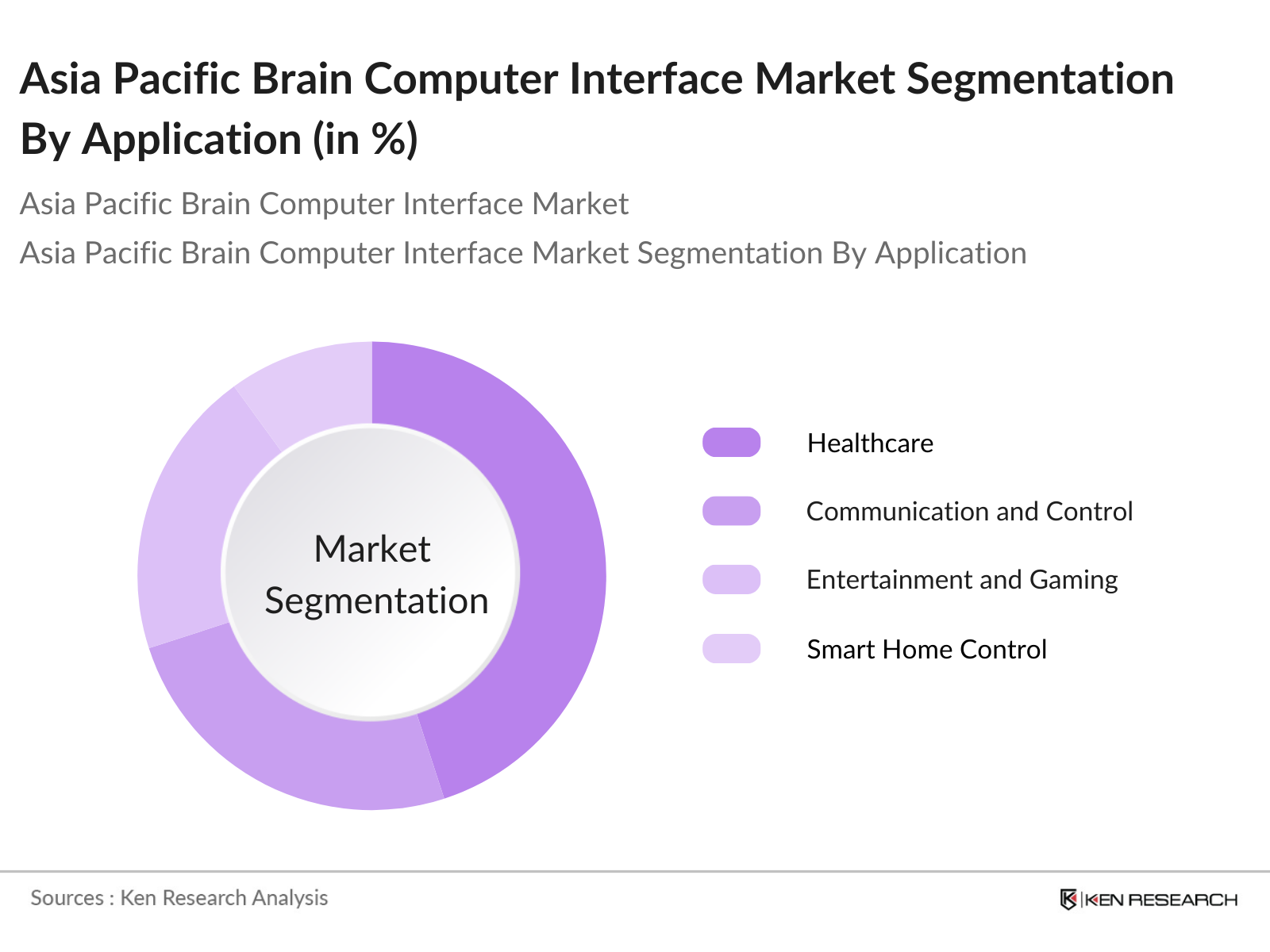

By Application: In terms of application, the market is divided into healthcare, communication and control, entertainment and gaming, smart home control, and others. The healthcare segment leads the market, driven by the increasing use of BCIs in neurorehabilitation and assistive technologies for patients with neurological disorders. The ability of BCIs to restore communication and mobility functions in patients has significantly contributed to their adoption in the medical field.

Asia Pacific Brain Computer Interface Market Competitive Landscape

The Asia Pacific BCI market is characterized by the presence of both established companies and emerging startups, fostering a competitive environment. Key players are focusing on technological advancements, strategic partnerships, and expanding their product portfolios to strengthen their market positions.

Asia Pacific Brain Computer Interface Industry Analysis

Growth Drivers

- Increasing Prevalence of Neurodegenerative Disorders: The Asia-Pacific region is experiencing a significant rise in neurodegenerative disorders. For instance, in 2023, Japan reported approximately 4.6 million individuals diagnosed with dementia, a figure projected to increase due to its aging population. Similarly, China had over 10 million Alzheimer's patients in 2022, with expectations of a substantial rise in the coming years. This surge underscores the urgent need for advanced medical technologies, including Brain-Computer Interfaces (BCIs), to assist in diagnosis and therapy.

- Advancements in Neurotechnology: The Asia-Pacific region is witnessing rapid advancements in neurotechnology. In 2023, China's NeuCyber NeuroTech developed a BCI system enabling a monkey to control a robotic arm via thought, showcasing significant progress in neural interfaces. Additionally, Japan's RIKEN Center for Brain Science introduced a non-invasive BCI in 2024, enhancing communication for individuals with mobility impairments. These developments highlight the region's commitment to pioneering neurotechnological innovations.

- Rising Investments in Research and Development: Investment in neurotechnology R&D is escalating across Asia-Pacific. In 2023, the Chinese government allocated approximately $1.5 billion to its Brain Science and Brain-Inspired Intelligence Project, aiming to position China at the forefront of global neuroscience research. Similarly, Japan's Moonshot Research and Development Program invested around $100 million in 2024 to advance brain-machine interface technologies. These substantial investments are propelling the development and application of BCIs in the region.

Market Challenges

- High Costs of BCI Systems: The high costs associated with BCI systems pose a significant challenge in the Asia-Pacific market. For instance, in 2023, the average cost of a non-invasive BCI device in Japan was approximately $20,000, limiting accessibility for many healthcare providers and patients. Similarly, in India, the cost of BCI systems remains prohibitive for widespread adoption in clinical settings. These financial barriers hinder the broader implementation of BCI technologies across the region.

- Ethical and Privacy Concerns: The deployment of BCIs raises ethical and privacy issues in the Asia-Pacific region. In 2024, China's Ministry of Science and Technology introduced guidelines addressing concerns over data security and the potential misuse of neural data. Similarly, Japan's Council for Science, Technology, and Innovation emphasized the need for ethical standards in neurotechnology research. These concerns necessitate the development of robust regulatory frameworks to ensure responsible use of BCI technologies.

Asia Pacific Brain Computer Interface Market Future Outlook

Over the next five years, the Asia Pacific BCI market is expected to witness substantial growth, driven by continuous technological advancements, increasing applications in healthcare and entertainment, and supportive government policies. The integration of artificial intelligence with BCI technologies and the development of non-invasive devices are anticipated to open new avenues for market expansion.

Market Opportunities

- Emerging Markets in Asia-Pacific: Emerging markets in Asia-Pacific, such as India and Southeast Asian nations, offer significant growth opportunities for BCI technologies. In 2023, India's healthcare sector expanded by 15%, increasing demand for advanced medical devices, including BCIs. Similarly, Indonesia's gaming industry grew by 20% in 2024, presenting a lucrative market for BCI-enabled gaming applications. These emerging markets provide fertile ground for the expansion of BCI technologies.

- Integration with Artificial Intelligence: Integrating BCIs with artificial intelligence (AI) presents substantial opportunities in the Asia-Pacific region. In 2024, China's Tencent AI Lab developed an AI-driven BCI system that improved neural signal interpretation accuracy by 30%. Additionally, Australia's CSIRO introduced an AI-enhanced BCI for neurorehabilitation, reducing patient recovery times by 25%. These integrations enhance the functionality and efficiency of BCI systems, driving their adoption across various sectors.

Scope of the Report

|

Product Type |

Invasive BCI |

|

Application |

Healthcare |

|

Component |

Hardware |

|

End-User |

Medical |

|

Country |

China |

Products

Key Target Audience

Medical Device Manufacturers

Healthcare Providers

Neurotechnology Researchers

Gaming and Entertainment Companies

Rehabilitation Centers

Government and Regulatory Bodies (e.g., National Medical Products Administration, Ministry of Health)

Investment and Venture Capitalist Firms

Academic and Research Institutions

Companies

Players Mentioned in the Report

Neuralink Corporation

Emotiv Inc.

G.tec Medical Engineering GmbH

BrainCo Inc.

MindMaze SA

Advanced Brain Monitoring, Inc.

NeuroSky

OpenBCI

Natus Medical Incorporated

Compumedics Neuroscan

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Neurodegenerative Disorders

3.1.2 Advancements in Neurotechnology

3.1.3 Rising Investments in Research and Development

3.1.4 Expanding Applications in Healthcare and Gaming

3.2 Market Challenges

3.2.1 High Costs of BCI Systems

3.2.2 Ethical and Privacy Concerns

3.2.3 Technical Complexities and Integration Issues

3.3 Opportunities

3.3.1 Emerging Markets in Asia Pacific

3.3.2 Integration with Artificial Intelligence

3.3.3 Development of Non-Invasive BCI Technologies

3.4 Trends

3.4.1 Adoption of Wearable BCI Devices

3.4.2 Collaboration Between Tech Firms and Healthcare Providers

3.4.3 Government Initiatives Supporting Neurotechnology

3.5 Government Regulations

3.5.1 National Policies on Neurotechnology

3.5.2 Compliance Standards for BCI Devices

3.5.3 Funding Programs for BCI Research

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Product Type (Value %)

4.1.1 Invasive BCI

4.1.2 Non-Invasive BCI

4.1.3 Partially Invasive BCI

4.2 By Application (Value %)

4.2.1 Healthcare

4.2.2 Communication and Control

4.2.3 Entertainment and Gaming

4.2.4 Smart Home Control

4.2.5 Others

4.3 By Component (Value %)

4.3.1 Hardware

4.3.2 Software

4.4 By End-User (Value %)

4.4.1 Medical

4.4.2 Military

4.4.3 Manufacturing

4.4.4 Education and Research

4.4.5 Others

4.5 By Country (Value %)

4.5.1 China

4.5.2 Japan

4.5.3 India

4.5.4 South Korea

4.5.5 Australia

4.5.6 Rest of Asia Pacific

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Medtronic

5.1.2 g.tec medical engineering GmbH

5.1.3 Natus Medical Incorporated

5.1.4 Compumedics Neuroscan

5.1.5 Brain Products GmbH

5.1.6 Integra LifeSciences Corporation

5.1.7 Advanced Brain Monitoring, Inc.

5.1.8 EMOTIV

5.1.9 NeuroSky

5.1.10 ANT Neuro

5.1.11 NIRx Medical Technologies, LLC

5.1.12 Ripple Neuro

5.1.13 Neuroelectrics

5.1.14 OpenBCI

5.1.15 COGNIONICS, INC. (CGX)

5.2 Cross-Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Regional Presence, R&D Investment, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Regulatory Framework

6.1 Standards for BCI Devices

6.2 Certification Processes

6.3 Compliance Requirements

7. Future Market Size (USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Product Type (Value %)

8.2 By Application (Value %)

8.3 By Component (Value %)

8.4 By End-User (Value %)

8.5 By Country (Value %)

9. Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Brain-Computer Interface Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific Brain-Computer Interface Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple BCI manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Brain-Computer Interface market.

Frequently Asked Questions

1. How big is the Asia Pacific Brain-Computer Interface Market?

The Asia Pacific Brain-Computer Interface (BCI) market is valued at USD 394 million, based on a five-year historical analysis. This market's growth is primarily driven by advancements in neurotechnology and increasing applications across healthcare, communication, and gaming industries.

2. What are the challenges in the Asia Pacific Brain-Computer Interface Market?

Challenges include high costs of BCI systems, ethical and privacy concerns, and technical complexities related to device integration and usability. Additionally, there is a need for skilled professionals to handle and interpret BCI data effectively.

3. Who are the major players in the Asia Pacific Brain-Computer Interface Market?

The major players in this market include Neuralink Corporation, Emotiv Inc., G.tec Medical Engineering GmbH, BrainCo Inc., and MindMaze SA. These companies are leading due to their robust R&D investments, innovative product offerings, and strategic collaborations within the region.

4. What are the growth drivers of the Asia Pacific Brain-Computer Interface Market?

The market growth is driven by increasing adoption of BCIs in healthcare and rehabilitation, advancements in neurotechnology, and the rising prevalence of neurodegenerative disorders. Additionally, government support and growing demand for non-invasive BCI solutions are accelerating market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.