Asia Pacific Business Process Outsourcing (BPO) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD6312

December 2024

82

About the Report

Asia Pacific BPO Market Overview

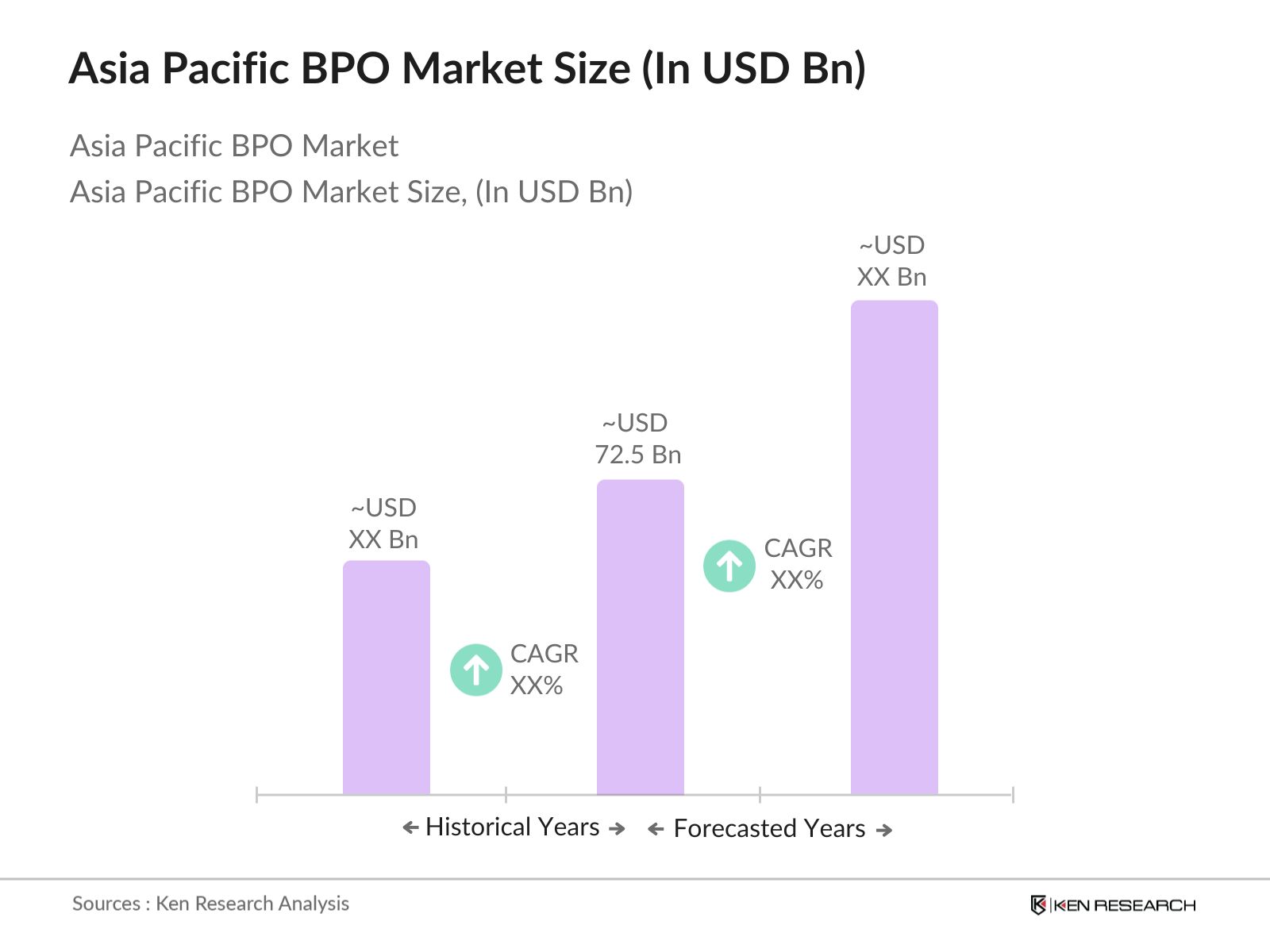

- The Asia Pacific Business Process Outsourcing (BPO) market is valued at USD 72.5 billion, based on a five-year historical analysis. This valuation is driven by the increasing demand for cost-effective solutions and the ability of companies to streamline non-core processes, enabling businesses to focus on their core competencies. The region's extensive talent pool and technological advancements, such as AI and automation, have further contributed to the market's growth.

- India, the Philippines, and China dominate the Asia Pacific BPO market due to their well-established outsourcing infrastructure and cost advantages. India, with its vast English-speaking workforce and mature BPO sector, is a leader, while the Philippines benefits from strong government support and a highly skilled labor force in customer service. Chinas dominance, particularly in knowledge process outsourcing (KPO), is due to its rapid technological innovation and growing demand for complex services like data analytics and IT outsourcing.

- Governments in Asia Pacific continue to implement policies to encourage outsourcing. In 2024, the Philippines PEZA (Philippine Economic Zone Authority) offers fiscal incentives, including tax holidays and reduced tax rates, attracting BPO investments that contributed nearly 14% to the country's GDP in 2023, according to the IMF. Similarly, India's Software Technology Parks (STPI) scheme provides duty-free imports and export incentives, boosting the country's BPO sector by creating around 1.5 million new jobs in 2024.

Asia Pacific BPO Market Segmentation

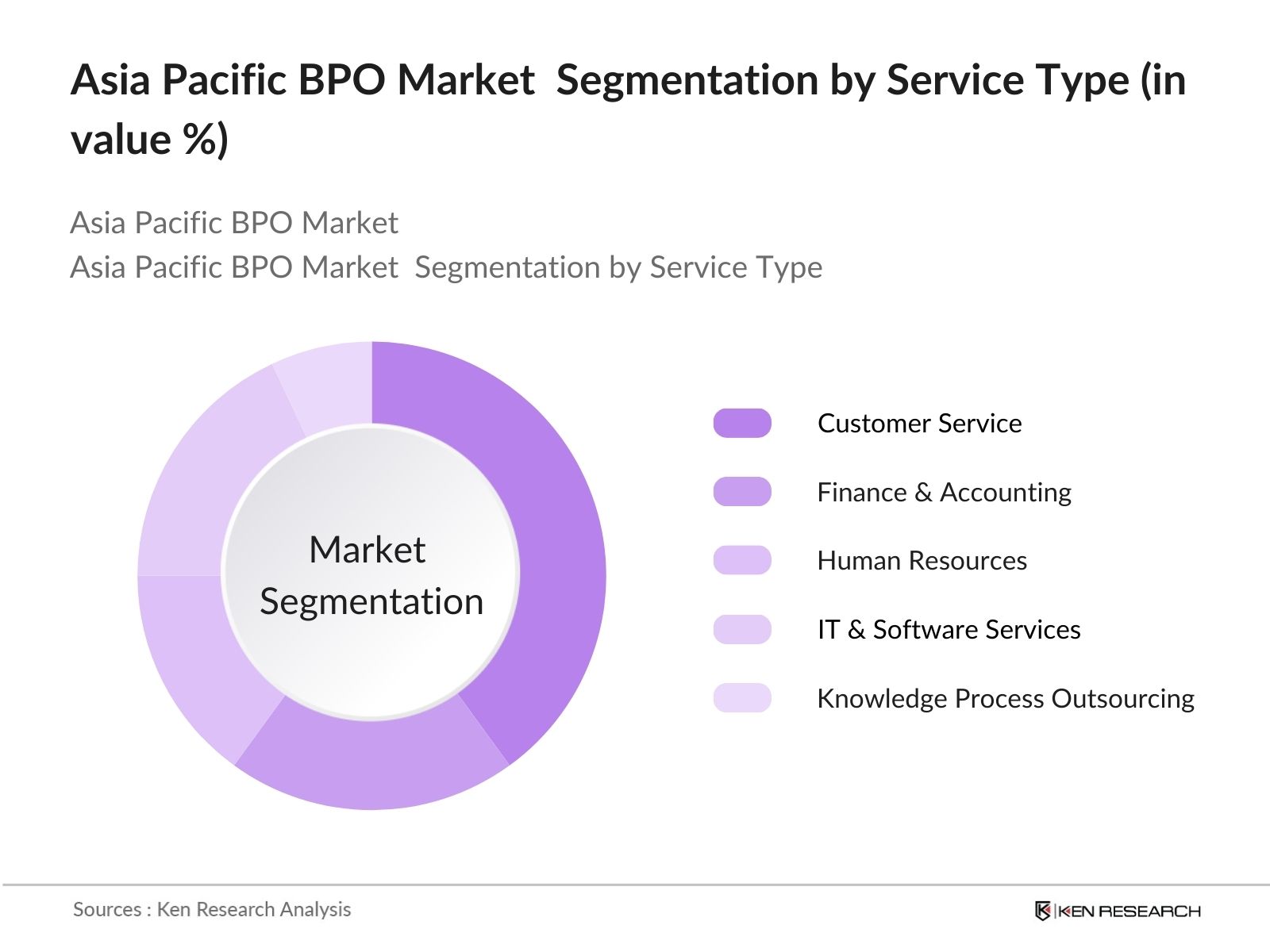

- By Service Type: The market is segmented by service type into customer service, finance & accounting, human resources, IT & software services, and knowledge process outsourcing (KPO). Customer service holds the largest market share under this segmentation due to the regions ability to offer 24/7 multilingual support at competitive costs. Major global companies from sectors such as telecommunications, retail, and e-commerce are increasingly outsourcing their customer service operations to countries like the Philippines and India, making this segment a key driver of market growth.

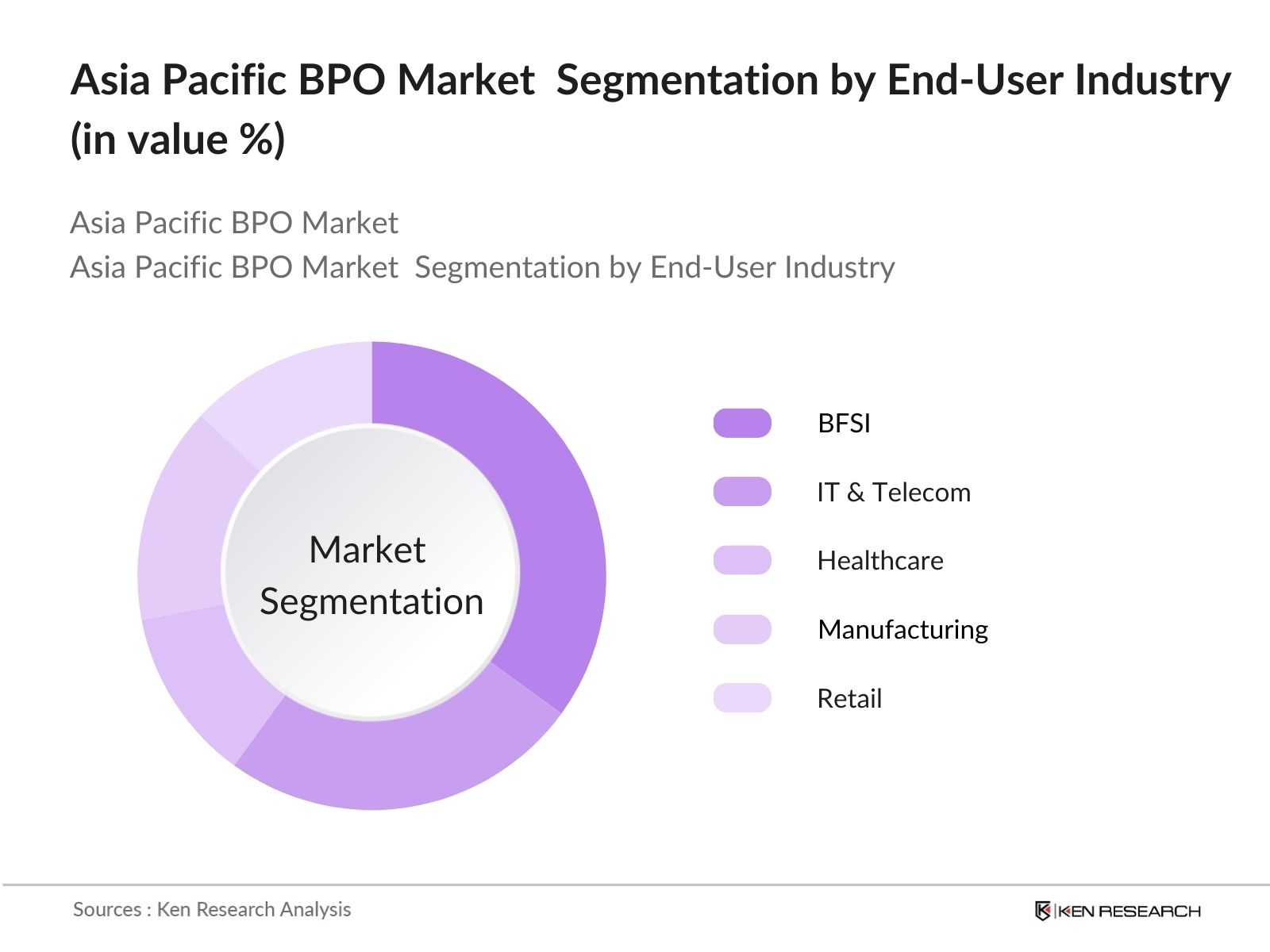

- By End-User Industry: The market is also segmented by end-user industry, including BFSI, IT & Telecom, Healthcare, Manufacturing, and Retail. The BFSI sector dominates this segmentation due to the industry's heavy reliance on outsourcing for back-office operations such as data processing, customer relationship management, and regulatory compliance. Additionally, the continuous digital transformation of financial services and the need for cost-effective solutions have driven the BFSI sector's demand for BPO services in the region.

Asia Pacific BPO Market Competitive Landscape

The Asia Pacific BPO market is highly competitive, with several global and regional players holding shares. These companies dominate due to their extensive service portfolios, strong technological integration, and cost-effective solutions. The market is characterized by strategic partnerships, mergers, and acquisitions as companies seek to enhance their capabilities and expand their presence in emerging sectors such as Knowledge Process Outsourcing (KPO) and IT outsourcing.

|

Company |

Year of Establishment |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Technological Capabilities |

Client Base |

Regions Covered |

Service Offerings |

Employee Turnover Rate (%) |

|

Accenture |

1989 |

Dublin, Ireland |

- |

- |

- |

- |

- |

- |

- |

|

Tata Consultancy Services (TCS) |

1968 |

Mumbai, India |

- |

- |

- |

- |

- |

- |

- |

|

Concentrix |

2006 |

Fremont, US |

- |

- |

- |

- |

- |

- |

- |

|

Wipro |

1945 |

Bengaluru, India |

- |

- |

- |

- |

- |

- |

- |

|

Genpact |

1997 |

New York, US |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific BPO Market Analysis

Asia Pacific BPO Market Growth Drivers

- Increased Demand for Cost Efficiency: Asia Pacific countries have been experiencing cost pressures due to inflationary trends, prompting businesses to look for ways to optimize operational expenses. BPO has been a preferred choice for companies aiming to reduce overhead costs. In 2024, labor costs in the region are estimated to be about 30-60% lower compared to developed countries like the United States and Japan, according to the International Labour Organization (ILO). Additionally, countries such as India and the Philippines offer wage rates below those of Western nations, making them attractive hubs for outsourcing.

- Technological Integration: Technological advancements are driving the BPO sector towards efficiency improvements. In 2024, AI and automation technologies have enabled BPO firms to handle a wider range of services while cutting response times by 25%, according to data from the World Bank. Nations like Singapore and Malaysia are heavily investing in AI-driven BPO, enhancing the regions competitiveness. With the International Monetary Fund (IMF) reporting that emerging economies in Asia-Pacific are investing billions in digital infrastructure, this shift towards tech-driven outsourcing is growing rapidly.

- Availability of Skilled Workforce: The Asia Pacific region boasts a large pool of skilled professionals, with over 750 million workers participating in the service sector, according to ILO data for 2024. The region's highly educated workforce, especially in countries like India and the Philippines, continues to provide ample talent for BPO services. Governments are implementing national education programs to boost technical and soft skills, with India's National Skill Development Corporation (NSDC) targeting training for an additional 150 million workers by 2025. This growing labor force contributes to the sector's scalability and cost-efficiency.

Asia Pacific BPO Market Challenges

- Data Security and Privacy Concerns: Data breaches and privacy violations have become an issue for companies outsourcing to the Asia Pacific region. According to a 2024 report from the World Bank, cyberattacks have surged by 45% across APAC countries, leading to increased scrutiny on data protection policies. Nations like Singapore have implemented stringent data protection laws such as the Personal Data Protection Act (PDPA), but countries with less robust frameworks face compliance challenges. These inconsistencies make data security a major concern for companies outsourcing to the region.

- High Employee Turnover Rates: One of the major challenges for the BPO sector in Asia Pacific is the high employee attrition rate. In 2024, attrition rates in countries like India and the Philippines stand between 35% and 45%, higher than the global average. This trend can be attributed to the competitive job market and better opportunities in tech-driven sectors. High turnover increases costs related to recruitment and training, impacting overall operational efficiency.

Asia Pacific BPO Market Future Outlook

Over the next five years, the Asia Pacific BPO market is expected to witness growth driven by technological advancements, the increasing demand for Knowledge Process Outsourcing (KPO), and the shift toward digital transformation. As more industries adopt automation and AI-powered solutions, the demand for high-value outsourcing services will continue to rise. Additionally, the expansion of BPO services into emerging sectors such as healthcare, legal services, and analytics is expected to contribute to the markets growth.

Asia Pacific BPO Market Opportunities

- Digital Transformation: Asia Pacific is at the forefront of digital transformation, with government and private sector investments in cloud computing, AI, and big data expected to improve the region's BPO capabilities. As of 2024, the World Bank reports that over 70% of companies in countries like Singapore and Japan have already adopted cloud-based solutions to streamline operations, opening up opportunities for BPO providers to offer new digital services. The rise of e-commerce and fintech in the region further enhances the demand for digitally skilled BPO services.

- Expansion into Emerging Markets: Emerging markets within the Asia Pacific region, particularly in healthcare and SMEs, present growth opportunities for BPO providers. The IMF has reported that the healthcare market in Asia Pacific is expected to grow by 6-7% annually due to aging populations and rising healthcare expenditure. With nearly 98 million SMEs registered across the region as of 2024, there is strong demand for outsourced back-office and customer support services, creating untapped potential for BPO expansion.

Scope of the Report

|

Service Type |

Customer Service Finance & Accounting Human Resources IT & Software Services Knowledge Process Outsourcing (KPO) |

|

End-User Industry |

BFSI IT & Telecom Healthcare Manufacturing Retail |

|

Outsourcing Type |

Onshore Offshore Nearshore |

|

Deployment Model |

Cloud-Based On-Premises |

|

Region |

China India Philippines Australia Rest of Asia Pacific |

Products

Key Target Audience

BPO Service Providers

Technology Providers (AI, Automation)

BFSI Industry Stakeholders

IT & Telecom Companies

Healthcare Industry Stakeholders

Manufacturing Industry Players

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Information Technology, Philippines, and NASSCOM, India)

Companies

Players Mentioned in the Report

Accenture

Tata Consultancy Services (TCS)

Concentrix

Wipro

Genpact

IBM

Infosys

HCL Technologies

Teleperformance

Cognizant

Table of Contents

1. Asia Pacific BPO Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific BPO Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific BPO Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for Cost Efficiency

3.1.2. Technological Integration (Automation, AI)

3.1.3. Availability of Skilled Workforce

3.1.4. Government Initiatives and Incentives

3.2. Market Challenges

3.2.1. Data Security and Privacy Concerns

3.2.2. High Employee Turnover Rates

3.2.3. Compliance with Regional Regulations

3.3. Opportunities

3.3.1. Digital Transformation

3.3.2. Expansion into Emerging Markets (SMEs, Healthcare)

3.3.3. Growth in Multilingual Support

3.4. Trends

3.4.1. Shift Towards Knowledge Process Outsourcing (KPO)

3.4.2. Hybrid Delivery Models (Onshore/Offshore)

3.4.3. Increase in Remote BPO Services

3.5. Government Regulation

3.5.1. Outsourcing Policies and Incentives

3.5.2. Data Protection Laws

3.5.3. Regulatory Requirements in Key Markets (India, Philippines)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Clients, Vendors, Government Bodies)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific BPO Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Customer Service

4.1.2. Finance & Accounting

4.1.3. Human Resources

4.1.4. IT & Software Services

4.1.5. Knowledge Process Outsourcing (KPO)

4.2. By End-User Industry (In Value %)

4.2.1. BFSI

4.2.2. IT & Telecom

4.2.3. Healthcare

4.2.4. Manufacturing

4.2.5. Retail

4.3. By Outsourcing Type (In Value %)

4.3.1. Onshore Outsourcing

4.3.2. Offshore Outsourcing

4.3.3. Nearshore Outsourcing

4.4. By Deployment Model (In Value %)

4.4.1. Cloud-Based

4.4.2. On-Premises

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Philippines

4.5.4. Australia

4.5.5. Rest of Asia Pacific

5. Asia Pacific BPO Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Accenture

5.1.2. Tata Consultancy Services (TCS)

5.1.3. Wipro

5.1.4. Infosys

5.1.5. Concentrix

5.1.6. Genpact

5.1.7. Teleperformance

5.1.8. Sykes Enterprises

5.1.9. HCL Technologies

5.1.10. Tech Mahindra

5.1.11. EXL Service

5.1.12. IBM

5.1.13. Cognizant

5.1.14. Capgemini

5.1.15. Aegis Limited

5.2. Cross Comparison Parameters

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers, Acquisitions, Partnerships)

5.5. Investment Analysis (VC, PE, Govt. Grants)

5.6. Venture Capital Funding

5.7. Mergers and Acquisitions

6. Asia Pacific BPO Market Regulatory Framework

6.1. Data Security and Compliance Standards

6.2. Labor Laws and Workforce Regulations

6.3. Outsourcing Contract Requirements

7. Asia Pacific BPO Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific BPO Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Outsourcing Type (In Value %)

8.4. By Deployment Model (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific BPO Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves constructing a stakeholder ecosystem map of the Asia Pacific BPO Market, gathering comprehensive industry-level data from proprietary databases and secondary research sources. The aim is to identify the critical variables that influence market dynamics, such as technological trends, workforce dynamics, and regulatory policies.

Step 2: Market Analysis and Construction

We analyze historical data to assess market penetration rates, revenue generation, and the adoption of outsourcing models in key sectors. This phase also includes evaluating the quality-of-service delivery to ensure that the revenue estimates and market projections are accurate and reliable.

Step 3: Hypothesis Validation and Expert Consultation

We conduct interviews with key industry experts to validate our market hypotheses. These consultations offer valuable operational and financial insights into the BPO sector, aiding in the refinement of market data.

Step 4: Research Synthesis and Final Output

The final stage involves direct engagement with major BPO service providers and their clients to gather detailed insights on service performance, consumer preferences, and operational efficiency. These interactions help ensure that our analysis is accurate and reflects the latest market trends.

Frequently Asked Questions

01. How big is the Asia Pacific Business Process Outsourcing (BPO) Market?

The Asia Pacific BPO market is valued at USD 72.5 billion, driven by the increasing demand for cost efficiency and advanced technology integration in industries such as BFSI, IT, and Healthcare.

02. What are the challenges in the Asia Pacific BPO Market?

Challenges in the Asia Pacific BPO market include rising labor costs in key markets, data security concerns, and regulatory compliance issues across different countries. Moreover, high employee turnover rates also affect operational efficiencies.

03. Who are the major players in the Asia Pacific BPO Market?

Key players in the Asia Pacific BPO market include Accenture, Tata Consultancy Services (TCS), Concentrix, Wipro, and Genpact. These companies dominate the market due to their global reach, technological capabilities, and extensive service portfolios.

04. What are the growth drivers of the Asia Pacific BPO Market?

Growth in the Asia Pacific BPO market is driven by the demand for cost-effective outsourcing solutions, the rise in digital transformation, and technological advancements in automation, AI, and data analytics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.