Asia Pacific Canned Food Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6071

December 2024

85

About the Report

Asia Pacific Canned Food Market Overview

- The Asia Pacific canned food market is valued at USD 121.24 billion, driven by an increasing demand for convenient and long-lasting food options among consumers. With the busy lifestyles prevalent across major urban centers, canned food offers a practical solution for meal preparation and storage. Key factors propelling this market include urbanization, rising disposable incomes, and an expanding e-commerce network that makes canned goods more accessible to consumers across various socioeconomic segments.

- Dominant countries in the Asia Pacific canned food market include China, Japan, and Australia, primarily due to their large urban populations and high purchasing power. These countries have well-developed food processing industries and significant consumer demand for ready-to-eat products. Additionally, Japan's focus on food safety and high-quality standards in canned goods has established a robust domestic and export market, reinforcing its leading position.

- Asia Pacific countries enforce strict food safety standards, with Japan, Australia, and South Korea leading in regulatory compliance. In 2024, Japan invested JPY 75 billion in enhancing food safety infrastructure, mandating compliance for all imported and domestically produced canned foods. These standards are designed to protect consumers and ensure the quality and safety of food products.

Asia Pacific Canned Food Market Segmentation

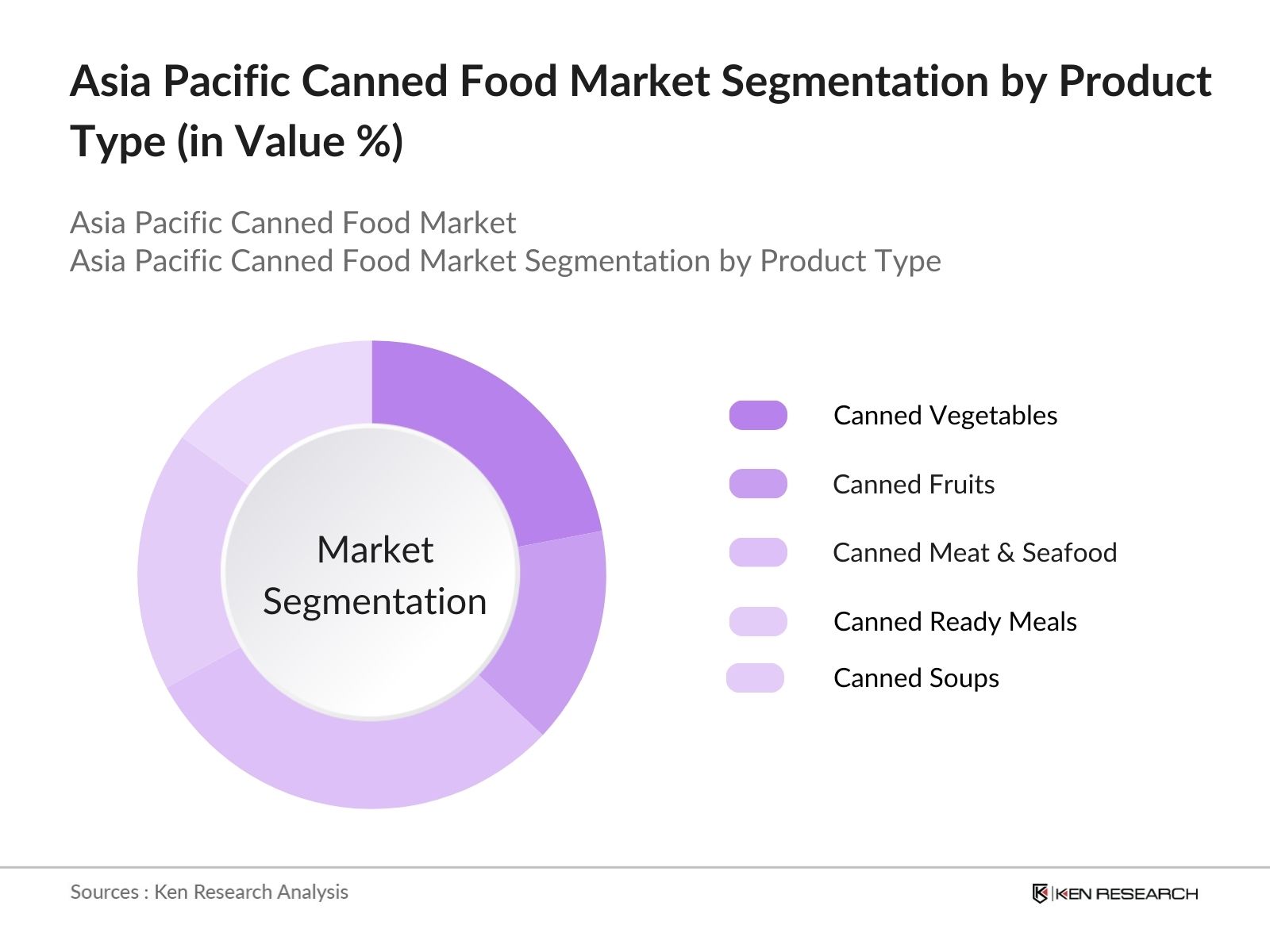

By Product Type: The Asia Pacific canned food market is segmented by product type into canned vegetables, canned fruits, canned meat & seafood, canned ready meals, and canned soups. Canned meat & seafood currently holds a dominant market share due to high demand for protein-rich, shelf-stable foods across the region. The popularity of canned tuna, sardines, and other seafood items reflects the established consumption of seafood in many Asia Pacific diets, combined with a growing preference for convenient meal options among consumers.

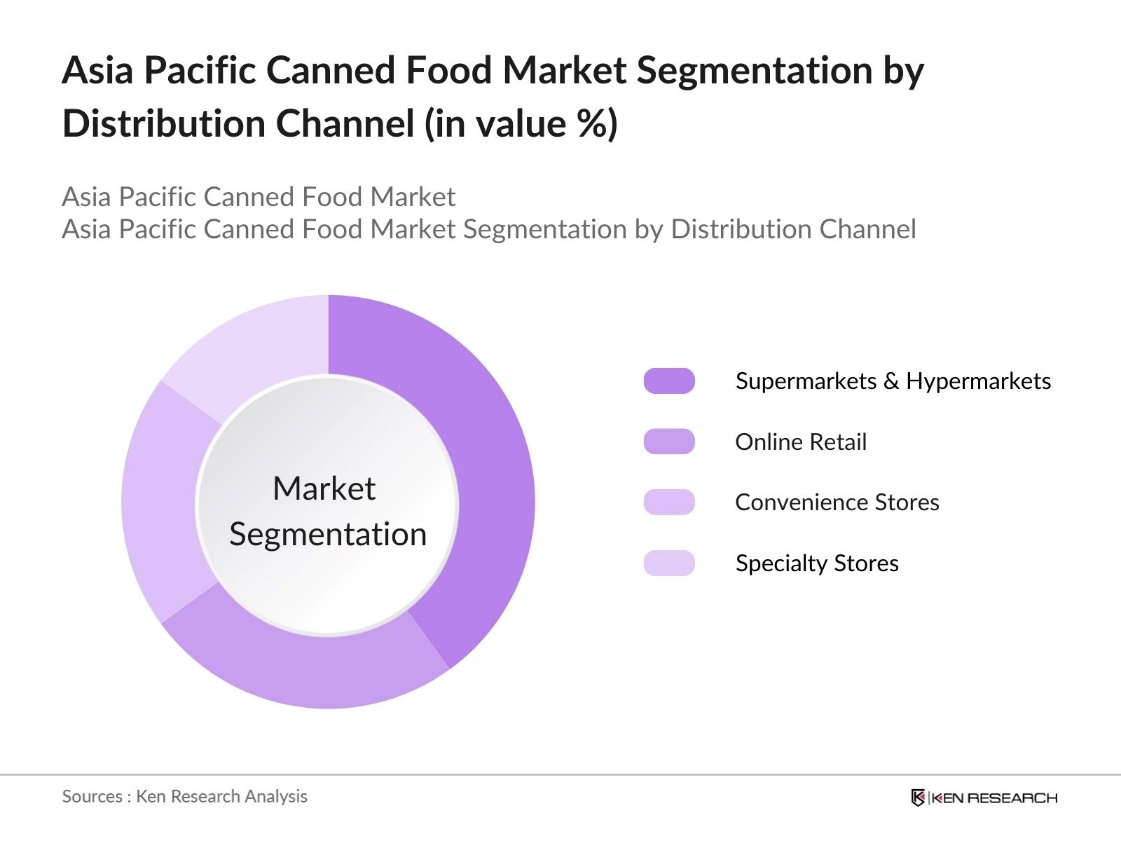

By Distribution Channel: Distribution channels in the Asia Pacific canned food market include supermarkets & hypermarkets, online retail, convenience stores, and specialty stores. Supermarkets and hypermarkets dominate this segment, as they provide a comprehensive range of products under one roof, enabling consumers to choose from various brands and types. Their dominance is further driven by strategic partnerships with canned food manufacturers, leading to a well-stocked and convenient shopping experience.

Asia Pacific Canned Food Market Competitive Landscape

The Asia Pacific canned food market is dominated by a few prominent players, with both regional and international brands having a significant market presence. The market sees strong competition due to established brand loyalty and continued innovations in product offerings, such as organic canned goods and low-sodium options.

Asia Pacific Canned Food Industry Analysis

Growth Drivers

- Urban Population Expansion (Population in Key Urban Areas): The urban population across Asia Pacific has experienced a significant increase, driven by migration to major cities. In 2024, urban centers like Tokyo, Mumbai, and Jakarta have expanded, with urban populations in and the tokyo reaching 37.1 million. This concentration of population in urban areas intensifies demand for convenient and durable food products such as canned food, as it fits the lifestyle of busy city residents who seek quick meal options. The United Nations notes this trend is particularly strong in Asia, as urbanization drives up demand for shelf-stable foods.

- Rising Disposable Income (Household Income Levels): Household disposable incomes across Asia Pacific, particularly in China and India, continue to rise. The study by Home Credit India (HCIN) shows that on average, the personal monthly income of lower-middle-class individuals is around Rs 33,000, while monthly expenses stand at Rs 19,000 in 2024. This growth in income levels allows consumers to afford a wider variety of canned foods, fostering market growth.

- Increasing Convenience Demand (Lifestyle Preferences): In Asia Pacific, busier lifestyles and dense urban environments have led to a rising demand for convenient food options, making canned foods increasingly popular. With limited time for meal preparation, consumers value ready-to-eat solutions that fit into fast-paced routines. Canned food offers a practical choice, catering to those seeking quality, nutrition, and ease without sacrificing flavor or flexibility in their daily lives.

Market Challenges

- High Raw Material Costs (Price Volatility in Metal and Glass): The canned food market in Asia Pacific faces significant challenges due to fluctuations in raw material costs, particularly for metals and glass used in packaging. This volatility affects manufacturers' cost structures, as they must absorb higher expenses associated with these essential materials. Such cost variations can strain profit margins, especially for companies already operating on tight budgets within competitive markets.

- Stringent Food Safety Regulations (Compliance Requirements): Strict food safety regulations across Asia Pacific, particularly in countries like Japan, Australia, and South Korea, require high standards for canned food production and sale. These regulations mandate rigorous hygiene and quality checks, adding operational complexities for companies. Compliance can be particularly challenging for smaller players in the market, as adhering to these stringent standards demands considerable investment in quality control processes.

Asia Pacific Canned Food Market Future Outlook

The Asia Pacific canned food market is expected to witness significant growth over the next five years, driven by the region's increasing urban population, evolving consumer preferences towards convenient and long-lasting food options, and an expanding e-commerce network. Rising awareness of food preservation technology and growing investment in sustainable and eco-friendly packaging options are anticipated to further accelerate market growth.

Market Opportunities

- Innovations in Packaging Technology (Sustainable Canning Solutions): The Asia Pacific canned food market holds growth opportunities through advancements in sustainable packaging. Innovations like BPA-free linings and biodegradable materials are becoming popular, aligning with shifting consumer preferences toward eco-friendly solutions. These sustainable options not only meet regulatory expectations but also enhance brand image, fostering consumer loyalty as environmental consciousness grows among customers and companies alike.

- Market Penetration in Rural Areas (Regional Demand Analysis): Rural areas across Asia Pacific present untapped potential for the canned food market, as demand increases where access to fresh produce is limited. Improved distribution networks are making canned foods more accessible in these regions, offering significant growth prospects for producers. Expanding into rural markets allows companies to cater to a larger, underserved customer base and strengthen their regional presence.

Scope of the Report

|

Product Type |

Canned Vegetables Canned Fruits Canned Meat & Seafood Canned Ready Meals Canned Soups |

|

Distribution Channel |

Supermarkets & Hypermarkets Online Retail Convenience Stores Specialty Stores |

|

End-User |

Household Foodservice Industry |

|

Packaging Type |

Tins Jars Pouches |

|

Region |

China Japan India Australia Southeast Asia |

Products

Key Target Audience

Canned Food Manufacturers

Packaging Industry

Export-Import Industry

E-commerce Platforms

Government and Regulatory Bodies (Food Standards Australia New Zealand, Food Safety and Standards Authority of India)

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Del Monte Foods

Ayam Brand

Nestl

Thai Union Group

Bonduelle

Conagra Brands

ADF Foods

H.J. Heinz Company

Bumble Bee Foods

La Doria

Table of Contents

1. Asia Pacific Canned Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Canned Food Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Canned Food Market Analysis

3.1. Growth Drivers

3.1.1. Urban Population Expansion (Population in Key Urban Areas)

3.1.2. Rising Disposable Income (Household Income Levels)

3.1.3. Food Security Initiatives (Government Policies on Food Preservation)

3.1.4. Increasing Convenience Demand (Lifestyle Preferences)

3.2. Market Challenges

3.2.1. High Raw Material Costs (Price Volatility in Metal and Glass)

3.2.2. Stringent Food Safety Regulations (Compliance Requirements)

3.2.3. Environmental Impact (Sustainable Packaging Requirements)

3.3. Opportunities

3.3.1. Innovations in Packaging Technology (Sustainable Canning Solutions)

3.3.2. Market Penetration in Rural Areas (Regional Demand Analysis)

3.3.3. Rising Demand for Organic and Preservative-Free Canned Food

3.4. Trends

3.4.1. Premiumization of Canned Food (Product Quality Enhancements)

3.4.2. Introduction of Smart Canning Technologies

3.4.3. Expansion of E-commerce Platforms

3.5. Government Regulation

3.5.1. Regulatory Standards for Food Safety (Asia Pacific Compliance)

3.5.2. Import Tariffs and Trade Policies (Regional Trade Agreements)

3.5.3. Packaging Waste Reduction Programs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Canned Food Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Canned Vegetables

4.1.2. Canned Fruits

4.1.3. Canned Meat & Seafood

4.1.4. Canned Ready Meals

4.1.5. Canned Soups

4.2. By Distribution Channel (in Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Online Retail

4.2.3. Convenience Stores

4.2.4. Specialty Stores

4.3. By End-User (in Value %)

4.3.1. Household

4.3.2. Foodservice Industry

4.4. By Packaging Type (in Value %)

4.4.1. Tins

4.4.2. Jars

4.4.3. Pouches

4.5. By Region (in Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia Pacific Canned Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Del Monte Foods

5.1.2. Campbell Soup Company

5.1.3. Ayam Brand

5.1.4. Nestl

5.1.5. Conagra Brands

5.1.6. Thai Union Group

5.1.7. Bonduelle

5.1.8. ADF Foods

5.1.9. H.J. Heinz Company

5.1.10. Bumble Bee Foods

5.1.11. La Doria

5.1.12. StarKist

5.1.13. Century Pacific Food, Inc.

5.1.14. Rhodes Food Group

5.1.15. S&W Fine Foods

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Market Presence, Product Portfolio, Sustainability Initiatives, Supply Chain Partnerships, R&D Investment, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Canned Food Market Regulatory Framework

6.1. Food Safety and Standards

6.2. Labeling and Nutritional Information Regulations

6.3. Import and Export Regulations

6.4. Environmental Compliance for Packaging

7. Asia Pacific Canned Food Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Canned Food Future Market Segmentation

8.1. By Product Type (in Value %)

8.2. By Distribution Channel (in Value %)

8.3. By End-User (in Value %)

8.4. By Packaging Type (in Value %)

8.5. By Region (in Value %)

9. Asia Pacific Canned Food Market Analysts Recommendations

9.1. Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves the mapping of industry stakeholders in the Asia Pacific canned food market. Data is collected from primary sources and proprietary databases to identify critical variables influencing market trends.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to understand market penetration, consumer preferences, and product adoption. This helps in deriving reliable estimates for the canned food market revenue across various segments.

Step 3: Hypothesis Validation and Expert Consultation

Market insights and hypotheses are validated through interviews with industry experts and key market players. This helps in gathering insights related to market operations, trends, and challenges from stakeholders.

Step 4: Research Synthesis and Final Output

The final synthesis involves a detailed review of collected data to ensure accuracy. Engagements with industry representatives further refine data points, resulting in a validated market analysis that provides actionable insights for stakeholders.

Frequently Asked Questions

01 How big is the Asia Pacific Canned Food Market?

The Asia Pacific canned food market is valued at USD 121.24 billion, driven by urbanization, increased consumer demand for convenient foods, and a robust e-commerce network across the region.

02 What are the key challenges in the Asia Pacific Canned Food Market?

Key challenges in Asia Pacific canned food market include increasing consumer preference for fresh and minimally processed foods, fluctuating raw material costs, and regulatory compliance related to food safety standards.

03 Who are the major players in the Asia Pacific Canned Food Market?

Prominent players in this Asia Pacific canned food market include Del Monte Foods, Nestl, Ayam Brand, Thai Union Group, and Bonduelle, who are known for their strong product portfolios and distribution networks.

04 What are the growth drivers of the Asia Pacific Canned Food Market?

Growth drivers in Asia Pacific canned food market include urbanization, the rising demand for long-shelf-life foods, expansion of e-commerce channels, and growing investments in sustainable and innovative packaging solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.