Asia-Pacific Capsule Hotel Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD4151

October 2024

93

About the Report

Asia-Pacific Capsule Hotel Market Overview

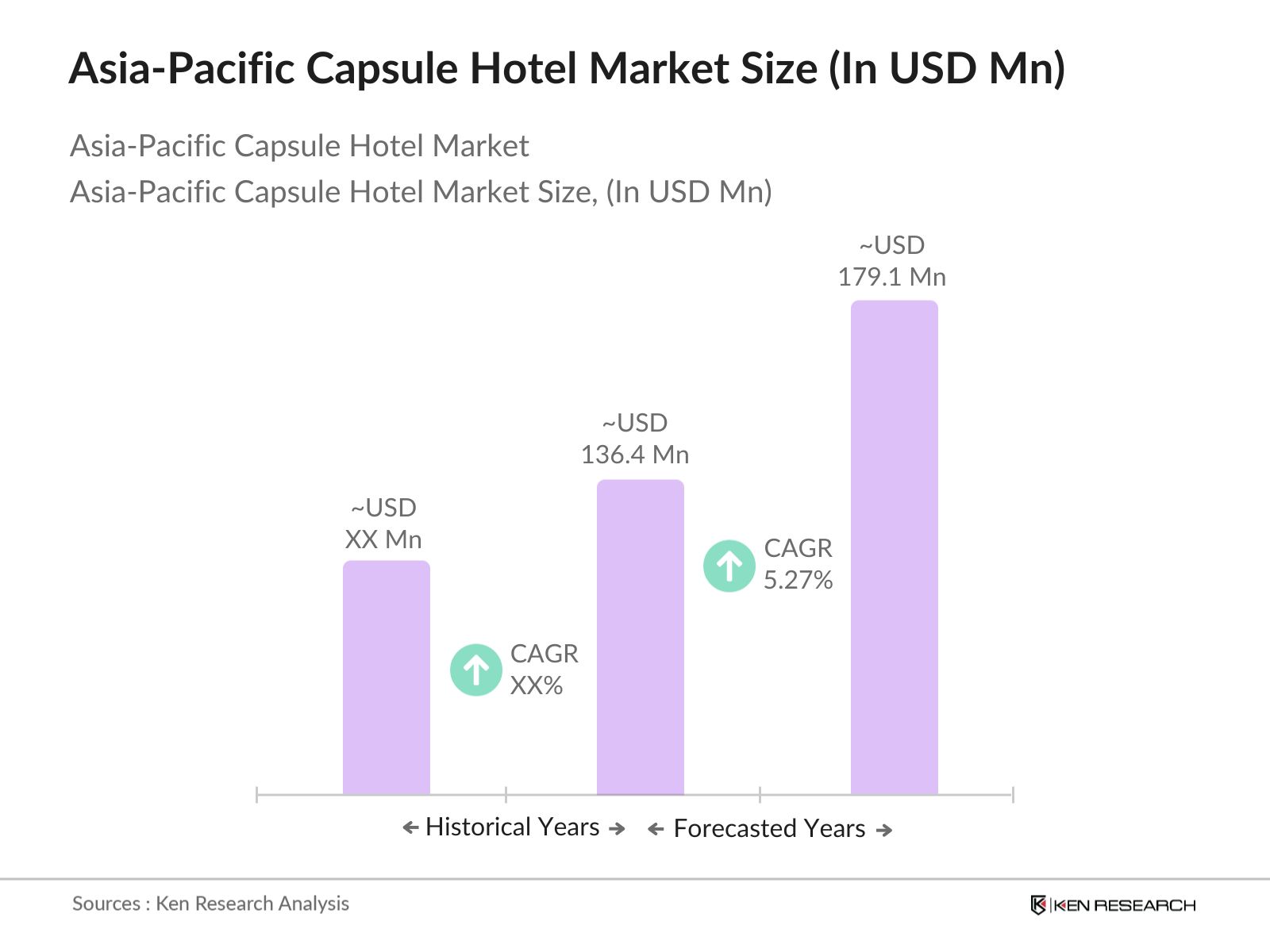

- The Asia-Pacific Capsule Hotel market is valued at USD 136.4 million, based on a five-year historical analysis. The market is driven by several factors, including the growing demand for affordable accommodations, particularly among solo travellers and budget-conscious tourists. Additionally, technological innovations, such as capsule designs with smart features, contribute to enhancing guest experiences, further pushing market growth. In key urban centres, capsule hotels are especially popular due to space constraints and the need for affordable, convenient lodging solutions.

- Key cities and countries that dominate the market include Japan, South Korea, and Singapore. Japan, as the birthplace of the capsule hotel concept, remains at the forefront due to its innovative designs and high demand from both domestic and international travellers. Singapore and South Korea are following suit, driven by increasing tourism, limited land space, and an expanding market of digital nomads. Their advanced infrastructure and support for tourism continue to solidify their leadership positions in the Asia-Pacific market.

- Tourism promotion policies in countries like Japan, Thailand, and Singapore directly influence the growth of the capsule hotel market. For example, Japan's "Go To Travel" campaign, launched in 2020 and extended into 2022, significantly boosted domestic tourism, leading to a 15% increase in capsule hotel bookings, according to data from the Japan Tourism Agency. These policies, aimed at stimulating both domestic and international travel, provide an opportunity for capsule hotels to attract a larger customer base by offering affordable and accessible lodging options.

Asia-Pacific Capsule Hotel Market Segmentation

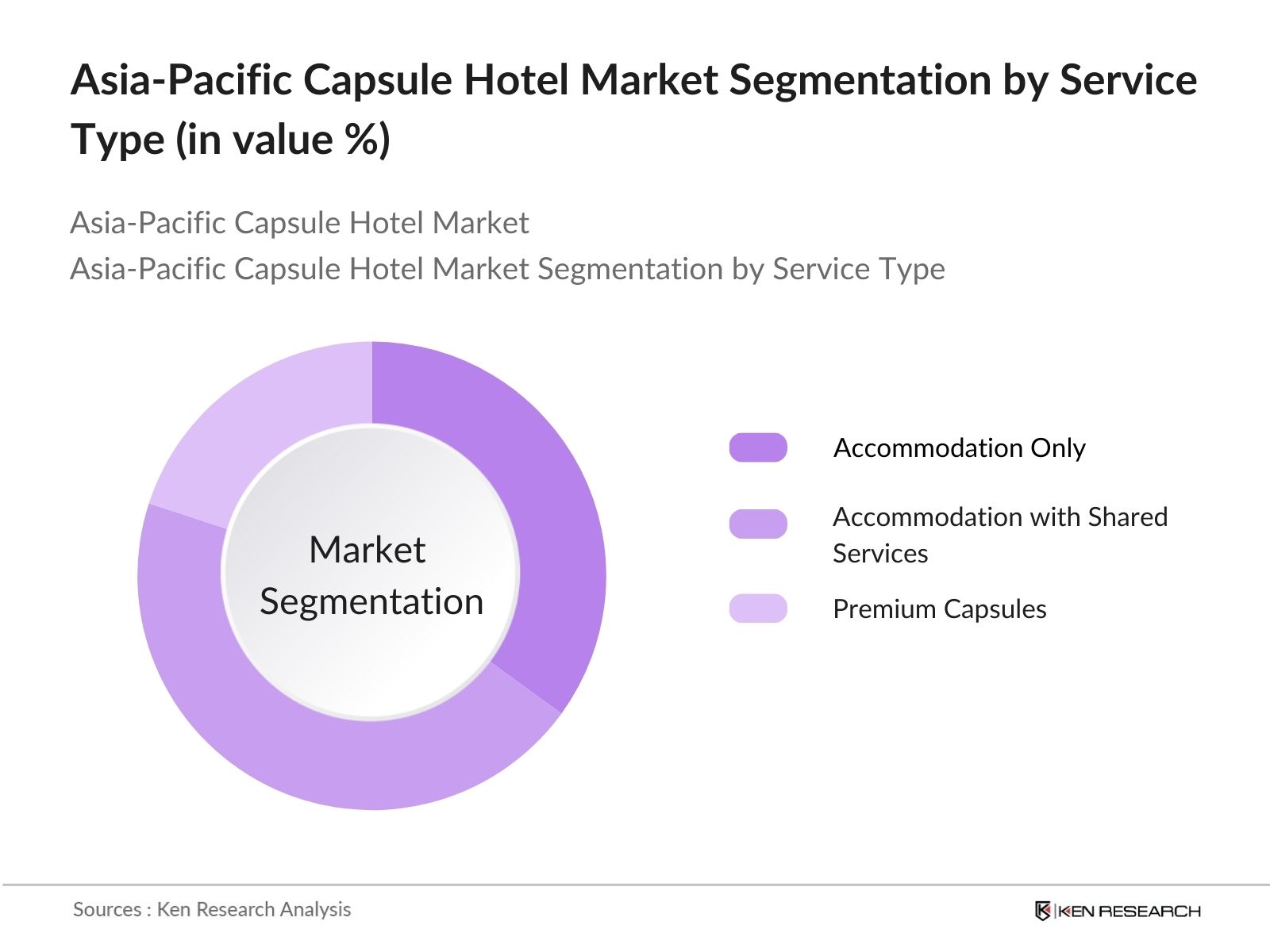

- By Service Type: The Asia-Pacific Capsule Hotel market is segmented by service type into Accommodation Only, Accommodation with Shared Services, and Premium Capsules. Recently, Accommodation with Shared Services has been dominating market share in the region due to its cost-effectiveness and value-added services, which appeal to both budget travellers and tourists seeking a community-oriented experience. These shared spaces often feature lounges, co-working areas, and communal kitchens, enhancing the overall guest experience, especially for longer stays.

- By End User: The market is further segmented by end users into Solo Travelers, Business Travelers, and Tourist Groups. The Solo Travelers sub-segment holds the dominant market share due to the capsule hotels’ appeal to individual tourists seeking affordable, private spaces in high-density cities. Solo travellers are primarily driven by convenience, minimalism, and lower cost compared to traditional hotel options, making capsule hotels an ideal choice for backpackers, digital nomads, and short-term visitors.

Asia-Pacific Capsule Hotel Market Competitive Landscape

The Asia-Pacific Capsule Hotel market is highly competitive, with several players leading the market across different regions. This consolidation highlights the influence of both domestic and international brands. Major companies continue to expand their operations by investing in smart technologies and customizable experiences, contributing to their market dominance. Below is a competitive analysis of five major players:

| Company | Year of Establishment | Headquarters | No. of Capsules | Revenue (USD Bn) | Global Presence | Technological Innovation | Sustainability Initiatives | Customer Reviews | Expansion Plans |

|---|---|---|---|---|---|---|---|---|---|

| Nine Hours | 2009 | Japan | |||||||

| First Cabin | 2006 | Japan | |||||||

| Urbanpod | 2016 | India | |||||||

| Pangea Pod Hotel | 2018 | Canada | |||||||

| The Millennials Shibuya | 2016 | Japan |

Asia-Pacific Capsule Hotel Market Analysis

Asia-Pacific Capsule Hotel Market Growth Drivers

- Increasing Tourism: Tourism across the Asia-Pacific region is witnessing a significant boom, driven by the rebound in international travel post-COVID-19. In 2023, tourist arrivals in countries like Japan surged to over 20 million, driven by high demand from countries like China and South Korea, according to data from the Japan National Tourism Organization. Additionally, Malaysia received over 16 million tourists in 2022. The tourism sector is essential for the expansion of capsule hotels, particularly as these establishments offer affordable and convenient options for budget-conscious travellers. Capsule hotels in Japan, for example, have been expanding in tandem with the tourism sector.

- Affordable Accommodation Demand: The demand for affordable accommodation is soaring in Asia-Pacific, particularly in high-tourism areas like Japan, Thailand, and South Korea. Capsule hotels provide cost-effective alternatives to traditional hotels, making them increasingly popular among budget travellers. In 2022, the average hotel stay in Tokyo costs around $200 per night, compared to capsule hotels, which provide rooms at $30–$50 per night. This growing preference for affordable lodging aligns with the rising cost of living and increasing demand for budget-friendly options among millennials and Gen Z travellers across major urban centres.

- Rise in Solo Travel: The Asia-Pacific region is experiencing a rapid rise in solo travel. Data from the Japan Tourism Agency indicates that around 30% of international travellers to Japan in 2023 were solo travellers, a segment that particularly favours capsule hotels due to their affordability and practicality. Solo travellers prefer capsule hotels because they offer privacy at a lower cost. The growth in solo travellers also reflects broader societal shifts, such as increased independence and digital nomadism, which have significantly boosted the demand for compact, individual-centric accommodations like capsule hotels.

Asia-Pacific Capsule Hotel Market Challenges

- Limited Space and Comfort: Despite their cost-effectiveness, capsule hotels face challenges regarding space and comfort. Capsule spaces typically measure around 2 meters in length and 1 meter in width, which can feel confining for guests seeking more comfortable lodging. A survey conducted by the Ministry of Land, Infrastructure, and Transport in Japan found that 40% of guests preferred larger hotel rooms for longer stays, indicating a major drawback of capsule hotels. This limitation primarily affects older travellers or those on extended visits, making capsules more suitable for short stays and transient travellers.

- Regulatory Compliance: Stringent regulatory requirements regarding safety and zoning laws have posed challenges for the expansion of capsule hotels in various Asia-Pacific countries. For instance, Japan's Building Standards Act requires hotels, including capsule hotels, to adhere to specific fire safety regulations, which can be costly to implement in older or smaller buildings. Furthermore, capsule hotels need to meet local zoning laws, which can vary significantly across different regions, making it difficult to open new establishments in densely populated urban areas.

Asia-Pacific Capsule Hotel Market Future Outlook

Over the next five years, the Asia-Pacific Capsule Hotel market is expected to witness significant growth driven by rising tourism, increased adoption of smart technologies, and the growing demand for affordable, efficient lodging. Expanding into secondary cities, tapping into the business traveller market, and enhancing capsule designs with sustainability features are key growth strategies for industry players. Market players are also focusing on strengthening their digital presence and partnering with online travel agencies to attract a broader customer base.

Asia-Pacific Capsule Hotel Market Opportunities

- Expansion in Tier 2 Cities: Tier 2 cities in countries like India, China, and Indonesia present significant opportunities for the expansion of capsule hotels. With urbanization on the rise, cities like Hyderabad and Chengdu are experiencing growing middle-class populations, increased business travel, and more tourist arrivals. These cities offer untapped markets for capsule hotels, particularly as accommodation demand outpaces supply. For example, Hyderabad saw over 3 million business travellers in 2022, according to data from the Indian Ministry of Tourism, indicating a growing market for budget accommodations in these rapidly developing urban areas.

- Partnerships with Travel Agencies: Forming strategic partnerships with travel agencies is an opportunity for capsule hotels to reach a wider customer base. Travel agencies can bundle capsule hotel bookings with flights and tours, offering customers affordable and convenient travel packages. In 2023, over 60% of tourists in Japan booked travel packages through agencies, according to the Japan National Tourism Organization, making these partnerships crucial for market penetration. Additionally, collaborations with online travel platforms like Agoda and Booking.com help capsule hotels to maintain consistent occupancy rates throughout the year.

Scope of the Report

| By Service Type |

Accommodation Only Accommodation with Shared Services Premium Capsules |

| By Ownership |

Standalone Capsule Hotels Capsule Hotel Chains Franchise Models |

| By End User |

Solo Travelers Business Travelers Tourist Groups |

| By Region |

East Asia Southeast Asia Oceania |

| By Capsule Type |

Standard Capsules Luxury Capsules |

Products

Key Target Audience

Hospitality Management Companies

Tourism Boards (Asia-Pacific Tourism Promotion Council)

Capsule Hotel Operators

Banks and Financial Institutions

Real Estate Developers

Investments and Venture Capital Firms

Government and Regulatory Bodies (Japan Ministry of Tourism, Singapore Tourism Board)

Online Travel Agencies (Expedia, Agoda)

Smart Technology Providers (AI and automation solutions for hotels)

Companies

Nine Hours

First Cabin

Urbanpod

Pangea Pod Hotel

The Millennials Shibuya

Capsule Inn Osaka

Yotel

Book and Bed Tokyo

Sleepbox Hotel Moscow

The Capsule Hotel Sydney

Zzz Hostel Bangkok

InBox Capsule Hotel

Urbany Hostels

Hostelling International

Kapsule Rooms

Table of Contents

1. Asia-Pacific Capsule Hotel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Capsule Hotel Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Capsule Hotel Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Tourism

3.1.2. Affordable Accommodation Demand

3.1.3. Rise in Solo Travel

3.1.4. Technological Integration

3.2. Market Challenges

3.2.1. Limited Space and Comfort

3.2.2. Regulatory Compliance

3.2.3. Competition from Budget Hotels

3.3. Opportunities

3.3.1. Expansion in Tier 2 Cities

3.3.2. Partnerships with Travel Agencies

3.3.3. Customizable Capsule Spaces

3.4. Trends

3.4.1. Smart Capsule Features (AI Integration, Automation)

3.4.2. Sustainability Initiatives (Energy-Efficient Design)

3.4.3. Co-Working and Capsule Spaces

3.5. Government Regulation

3.5.1. Local Zoning and Safety Standards

3.5.2. Tourism Promotion Policies

3.5.3. Capsule Hotel Certifications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Ecosystem

4. Asia-Pacific Capsule Hotel Market Segmentation (In Value %)

4.1. By Service Type

4.1.1. Accommodation Only

4.1.2. Accommodation with Shared Services

4.1.3. Premium Capsules

4.2. By Ownership

4.2.1. Standalone Capsule Hotels

4.2.2. Capsule Hotel Chains

4.2.3. Franchise Models

4.3. By End User

4.3.1. Solo Travelers

4.3.2. Business Travelers

4.3.3. Tourist Groups

4.4. By Region

4.4.1. East Asia

4.4.2. Southeast Asia

4.4.3. Oceania

4.5. By Capsule Type

4.5.1. Standard Capsules

4.5.2. Luxury Capsules

5. Asia-Pacific Capsule Hotel Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nine Hours

5.1.2. Capsule Inn Osaka

5.1.3. Pod Hotel

5.1.4. Yotel

5.1.5. Book and Bed Tokyo

5.1.6. First Cabin

5.1.7. The Millennials Shibuya

5.1.8. Urbanpod

5.1.9. Pangea Pod Hotel

5.1.10. InBox Capsule Hotel

5.1.11. The Capsule Hotel Sydney

5.1.12. Zzz Hostel Bangkok

5.1.13. Sleepbox Hotel Moscow

5.1.14. Hostelworld

5.1.15. Urbany Hostels

5.2. Cross Comparison Parameters (No. of Employees, Inception Year, Revenue, Global Presence, Customer Reviews, Sustainability Initiatives, Innovation Index, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Asia-Pacific Capsule Hotel Market Regulatory Framework

6.1. Accommodation Standards

6.2. Capsule Safety Certifications

6.3. Tourism Licensing Requirements

7. Asia-Pacific Capsule Hotel Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Capsule Hotel Future Market Segmentation (In Value %)

8.1. By Service Type

8.2. By Ownership

8.3. By End User

8.4. By Region

8.5. By Capsule Type

9. Asia-Pacific Capsule Hotel Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Persona Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involved identifying the key variables influencing the Asia-Pacific Capsule Hotel market, such as urbanization rates, tourism flows, and technological innovations. This step was supported by comprehensive desk research, leveraging secondary databases, industry reports, and proprietary data.

Step 2: Market Analysis and Construction

The second phase included historical data compilation and market construction for the Asia-Pacific Capsule Hotel market. We analyzed key market trends, competitive landscape data, and industry growth patterns to develop a complete view of the market dynamics and size.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with industry experts, market hypotheses were tested and validated. Key insights from operators, hotel owners, and technology providers helped to confirm market trends and forecast projections.

Step 4: Research Synthesis and Final Output

Finally, direct interviews with capsule hotel operators and industry stakeholders helped to refine and validate market assumptions. These interactions ensured that the report provides accurate, data-driven insights into the Asia-Pacific Capsule Hotel market.

Frequently Asked Questions

01. How big is the Asia-Pacific Capsule Hotel Market?

The Asia-Pacific Capsule Hotel market is valued at USD 136.4 million, driven by increasing demand for affordable, space-efficient accommodations in urban areas across the region.

02. What are the key growth drivers of the Asia-Pacific Capsule Hotel market?

The Asia-Pacific Capsule Hotel market is driven by factors such as rising tourism, the increasing popularity of solo travel, and innovations in capsule designs that offer smart features and improved guest experiences.

03. Who are the major players in the Asia-Pacific Capsule Hotel market?

Key players in the Asia-Pacific Capsule Hotel market include Nine Hours, First Cabin, Urbanpod, Pangea Pod Hotel, and The Millennials Shibuya, all of which dominate due to their innovative offerings and regional presence.

04. What challenges does the Asia-Pacific Capsule Hotel market face?

Challenges in the Asia-Pacific Capsule Hotel market include regulatory compliance in different countries, competition from budget hotels and hostels, and maintaining customer satisfaction in small, shared spaces.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.