Asia Pacific Car Air Purifier Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD9532

December 2024

87

About the Report

Asia Pacific Car Air Purifier Market Overview

- The Asia Pacific Car Air Purifier Market is valued at USD 0.5 billion, driven by increased air pollution levels and growing consumer awareness about respiratory health. Rising air quality concerns in urban areas, coupled with government regulations mandating emission control, have significantly boosted the demand for car air purifiers. Major cities in countries like China, India, and Japan face high levels of vehicular pollution, further encouraging the adoption of air purification systems in automobiles.

- Countries such as China, Japan, and India dominate the Asia Pacific car air purifier market due to their high levels of urbanization and vehicular pollution. China, being the largest automotive market globally, drives demand for in-car air purifiers due to deteriorating air quality in metropolitan cities like Beijing and Shanghai. Similarly, Japans strong technological ecosystem and India's rapid urbanization in cities like Delhi and Mumbai have accelerated the adoption of these devices.

- Countries across Asia-Pacific are setting ambitious emission reduction targets to combat pollution. For instance, in 2023, China registered approximately 8.1 million new electric car registrations, marking a 35% increase compared to 2022. These initiatives directly impact the demand for car air purifiers as governments push for cleaner air, incentivizing consumers to adopt air purification technologies as part of broader efforts to meet emission reduction goals.

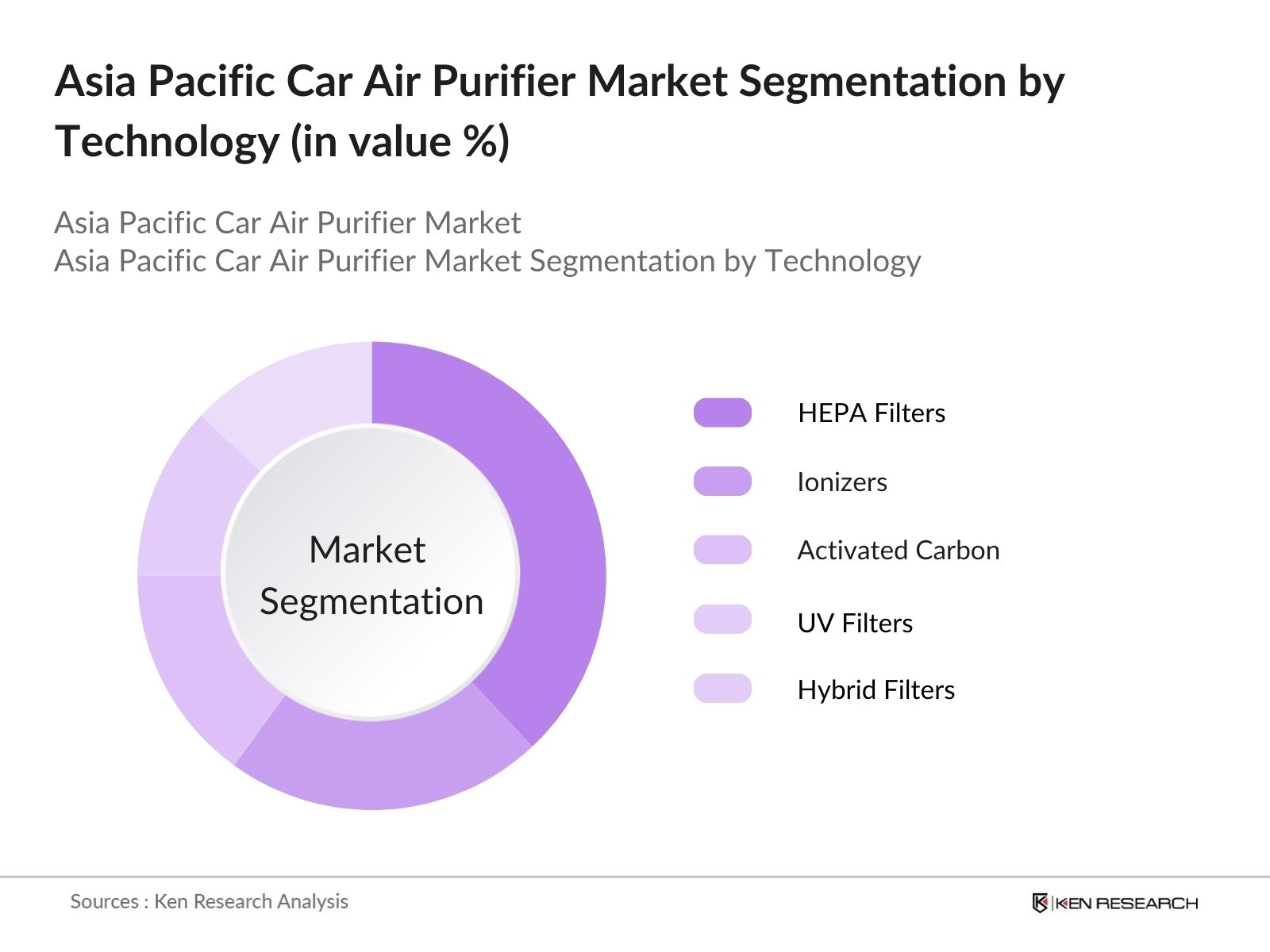

Asia Pacific Car Air Purifier Market Segmentation

By Technology: The Asia Pacific car air purifier market is segmented by technology into HEPA filters, ionizers, activated carbon filters, UV filters, and hybrid filters. HEPA Filters are currently the dominant technology in this segment, owing to their proven efficacy in removing particulate matter like PM2.5 and PM10 from the air. These filters are widely recognized for their ability to trap airborne pollutants and allergens, making them a preferred choice for health-conscious consumers. Furthermore, automotive companies frequently incorporate HEPA filters due to their durability and superior air purification capabilities.

By Application: The market is segmented by application into passenger cars and commercial vehicles. The Passenger Cars hold a dominant market share within this segment, primarily due to their larger base of consumers. As private car ownership rises in developing countries like China and India, so does the demand for premium features like air purification systems. Increasing health consciousness among individuals and families, especially in polluted urban areas, has made car air purifiers a must-have accessory in personal vehicles.

Asia Pacific Car Air Purifier Market Competitive Landscape

The market is highly competitive, with key players utilizing innovation and partnerships to maintain market share. International brands such as Xiaomi and Panasonic dominate the market, supported by local competitors specializing in affordable and advanced technologies. These major players drive competition through constant product innovation and technological advancements, such as smart and portable car air purifiers.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Product Innovation |

Market Reach |

Revenue (USD) |

Key Partnerships |

Technology Patents |

|

Xiaomi Corporation |

2010 |

Beijing, China |

||||||

|

Panasonic Corporation |

1918 |

Osaka, Japan |

||||||

|

Honeywell International |

1906 |

Charlotte, USA |

||||||

|

LG Electronics Inc. |

1958 |

Seoul, South Korea |

||||||

|

Sharp Corporation |

1912 |

Osaka, Japan |

Asia Pacific Car Air Purifier Industry Analysis

Growth Drivers

- Increasing Air Pollution (Urban Air Quality Metrics, Vehicle Emissions): Air pollution continues to be a significant issue in Asia-Pacific, with urban areas such as Delhi, Beijing, and Jakarta facing air quality index (AQI) levels indicating unhealthy levels of pollution. Air pollution is responsible for approximately 6.5 million deaths annually, with 70% of these occurring in the Asia-Pacific region. The demand for car air purifiers is driven by the need to mitigate exposure to pollutants, particularly in congested urban zones where vehicular emissions are most concentrated.

- Rising Health Concerns (Respiratory Disease Incidence): The prevalence of respiratory diseases is increasing in Asia-Pacific, cases of asthma and chronic obstructive pulmonary disease (COPD) reported in 2024 alone. For instance, projections indicated that East Asia had around 136 million COPD cases by 2020, with expectations for continued increases in prevalence through 2050. The growing concern about the adverse health effects of prolonged exposure to polluted air has escalated demand for in-car air purifiers, which are viewed as a preventive health measure for drivers and passengers alike.

- Regulatory Support (Emission Control Standards, Environmental Regulations): Governments in Asia-Pacific are implementing stricter vehicle emission standards, such as Euro 6 equivalents, to combat air pollution. Programs like Indias National Clean Air Programme aim to reduce particulate matter, encouraging the adoption of technologies like car air purifiers. These regulations promote the use of in-car air purification systems as essential tools for meeting cleaner air targets and improving urban air quality, driving market demand.

Market Challenges

- High Product Cost (Price Elasticity, Consumer Spending Power): A significant challenge in the Asia-Pacific car air purifier market is the high cost of premium devices, making them a luxury product in many developing nations. In regions where consumer spending power is lower, these products may be perceived as non-essential, limiting their market penetration. This price sensitivity makes it difficult for manufacturers to attract consumers in areas with lower disposable incomes, hindering widespread adoption of air purifiers.

- Lack of Awareness (Penetration Rates, Consumer Education): Despite increasing air pollution, many consumers in the Asia-Pacific region remain unaware of the health benefits of car air purifiers. Low penetration rates, particularly in countries like Indonesia, Thailand, and the Philippines, highlight the need for greater consumer education. In rural and semi-urban areas, limited awareness campaigns and insufficient marketing efforts further contribute to the slow adoption of in-car air purification systems.

Asia Pacific Car Air Purifier Market Future Outlook

The Asia Pacific car air purifier market is expected to show continued growth in the coming years, driven by rising air pollution, increased health awareness, and government initiatives aimed at reducing emissions. Major cities across the region, particularly in China and India, are seeing heightened demand for car air purifiers due to worsening air quality levels. Additionally, technological advancements such as the integration of smart features, such as app-controlled air purifiers, are likely to further boost market expansion.

Market Opportunities

- Rising Disposable Income in Developing Economies (Consumer Income Brackets, Market Penetration): Increasing disposable incomes across Asia-Pacifics developing economies, such as Vietnam, Malaysia, and Thailand, offer substantial opportunities for market growth. As consumers gain greater purchasing power, there is a growing focus on health and lifestyle improvements, driving demand for car air purifiers. These emerging markets are becoming key areas for premium product adoption, as rising income levels enable more consumers to invest in technologies that enhance their overall quality of life.

- Expansion into Rural Areas (Rural Penetration, Untapped Regions): While urban areas have been the primary focus for car air purifier manufacturers, rural regions present untapped potential. Growing vehicle ownership and improved infrastructure in these areas create new opportunities for affordable air purifiers. Targeting rural markets with cost-effective products, along with focused awareness campaigns, could drive significant demand. As rural economies continue to develop, these areas are likely to contribute to the overall growth of the car air purifier market.

Scope of the Report

|

By Technology |

HEPA Filters Ionizers Activated Carbon Filters UV Filters Hybrid Filters |

|

By Application |

Passenger Cars Commercial Vehicles |

|

By Distribution Channel |

Online Channels Offline Retail Specialty Automotive Stores |

|

By End-User |

Individual Users Fleet Owners Car Rental Companies |

|

By Country |

China Japan India South Korea Australia |

Products

Key Target Audience

Automotive Manufacturers (OEMs)

Air Purifier Component Manufacturers

Health and Wellness Companies

Luxury Car Manufacturers

Corporate Fleet Management Companies

Government and Regulatory Bodies (Japans Ministry of Land, Infrastructure, Transport and Tourism)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Xiaomi Corporation

Honeywell International Inc.

Panasonic Corporation

Sharp Corporation

LG Electronics Inc.

Bosch Group

Dyson Ltd.

3M Company

Philips N.V.

IQAir AG

Table of Contents

1. Asia Pacific Car Air Purifier Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Car Air Purifier Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Car Air Purifier Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Air Pollution (Urban Air Quality Metrics, Vehicle Emissions)

3.1.2. Rising Health Concerns (Respiratory Disease Incidence)

3.1.3. Regulatory Support (Emission Control Standards, Environmental Regulations)

3.1.4. Technological Advancements (HEPA, Activated Carbon, Ionizers)

3.2. Market Challenges

3.2.1. High Product Cost (Price Elasticity, Consumer Spending Power)

3.2.2. Lack of Awareness (Penetration Rates, Consumer Education)

3.2.3. Competition from OEM Air Filters (Substitution Effect)

3.3. Opportunities

3.3.1. Rising Disposable Income in Developing Economies (Consumer Income Brackets, Market Penetration)

3.3.2. Expansion into Rural Areas (Rural Penetration, Untapped Regions)

3.3.3. Collaboration with Automotive OEMs (Partnership Models)

3.4. Trends

3.4.1. Smart Air Purifiers with IoT Connectivity (Smart Vehicle Integration, Mobile App Control)

3.4.2. Customizable Air Purifier Units (Personalization, Modular Components)

3.4.3. Energy-Efficient Technologies (Sustainability, Low Energy Consumption Metrics)

3.5. Government Regulations

3.5.1. Emission Reduction Targets (Government Initiatives)

3.5.2. Air Quality Standards (AQI Guidelines, Compliance Regulations)

3.5.3. Clean Air Acts (Regional Policies, Support Programs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, OEMs, Distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Car Air Purifier Market Segmentation

4.1. By Technology (In Value %)

4.1.1. HEPA Filters

4.1.2. Ionizers

4.1.3. Activated Carbon Filters

4.1.4. UV Filters

4.1.5. Hybrid Filters

4.2. By Application (In Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.3. By Distribution Channel (In Value %)

4.3.1. Online Channels

4.3.2. Offline Retail

4.3.3. Specialty Automotive Stores

4.4. By End-User (In Value %)

4.4.1. Individual Users

4.4.2. Fleet Owners

4.4.3. Car Rental Companies

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

5. Asia Pacific Car Air Purifier Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Xiaomi Corporation

5.1.2. Honeywell International Inc.

5.1.3. Koninklijke Philips N.V.

5.1.4. Sharp Corporation

5.1.5. Panasonic Corporation

5.1.6. 3M Company

5.1.7. Blueair AB

5.1.8. LG Electronics Inc.

5.1.9. Bosch Group

5.1.10. IQAir AG

5.1.11. Dyson Ltd.

5.1.12. Coway Co., Ltd.

5.1.13. Kent RO Systems Ltd.

5.1.14. Eureka Forbes

5.1.15. Daikin Industries, Ltd.

5.2. Cross Comparison Parameters (No. of Employees, Revenue, R&D Investment, Product Innovation, Global Presence, Manufacturing Capacity, Key Partnerships, Technology Patents)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Car Air Purifier Market Regulatory Framework

6.1. Environmental Standards (Emission Control Standards, AQI Compliance)

6.2. Certification Processes (ISO Certifications, Government Approvals)

6.3. Compliance Requirements

7. Asia Pacific Car Air Purifier Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Car Air Purifier Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Country (In Value %)

9. Asia Pacific Car Air Purifier Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

We initiated the research by identifying critical variables that drive the Asia Pacific Car Air Purifier Market. These variables include air pollution levels, consumer demand, regulatory mandates, and technological advancements. Secondary research and proprietary databases were utilized to map these key market dynamics.

Step 2: Market Analysis and Construction

Historical data was compiled to assess market growth rates, consumer adoption, and regulatory compliance within key countries. A comprehensive review of market penetration by technology and application was conducted, ensuring that our data was both accurate and representative of industry trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were tested through interviews with industry experts and stakeholders. This consultation allowed for the refinement of our data, ensuring that our findings were both reliable and actionable.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from multiple sources, including market participants and regulatory bodies, to provide a well-rounded and accurate market report. The output was validated through cross-referencing with external data sets to guarantee its reliability.

Frequently Asked Questions

01. How big is the Asia Pacific Car Air Purifier Market?

The Asia Pacific Car Air Purifier Market is valued at USD 0.5 billion, driven by rising air pollution levels and increasing demand for health-conscious consumer products.

02. What are the challenges in the Asia Pacific Car Air Purifier Market?

Challenges in Asia Pacific Car Air Purifier Market include high product costs, lack of awareness among consumers in developing regions, and competition from OEM-installed air filters, which often serve as a substitute for aftermarket purifiers.

03. Who are the major players in the Asia Pacific Car Air Purifier Market?

Major players in Asia Pacific Car Air Purifier Market include Xiaomi Corporation, Honeywell International Inc., Panasonic Corporation, and LG Electronics Inc., which dominate due to their extensive product portfolios and strong R&D investments.

04. What are the growth drivers of the Asia Pacific Car Air Purifier Market?

The Asia Pacific Car Air Purifier Market growth drivers include increasing levels of air pollution in urban areas, consumer awareness of respiratory health, and government regulations pushing for stricter emission controls.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.