Asia Pacific Carbomer Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD9806

December 2024

99

About the Report

Asia Pacific Carbomer Market Overview

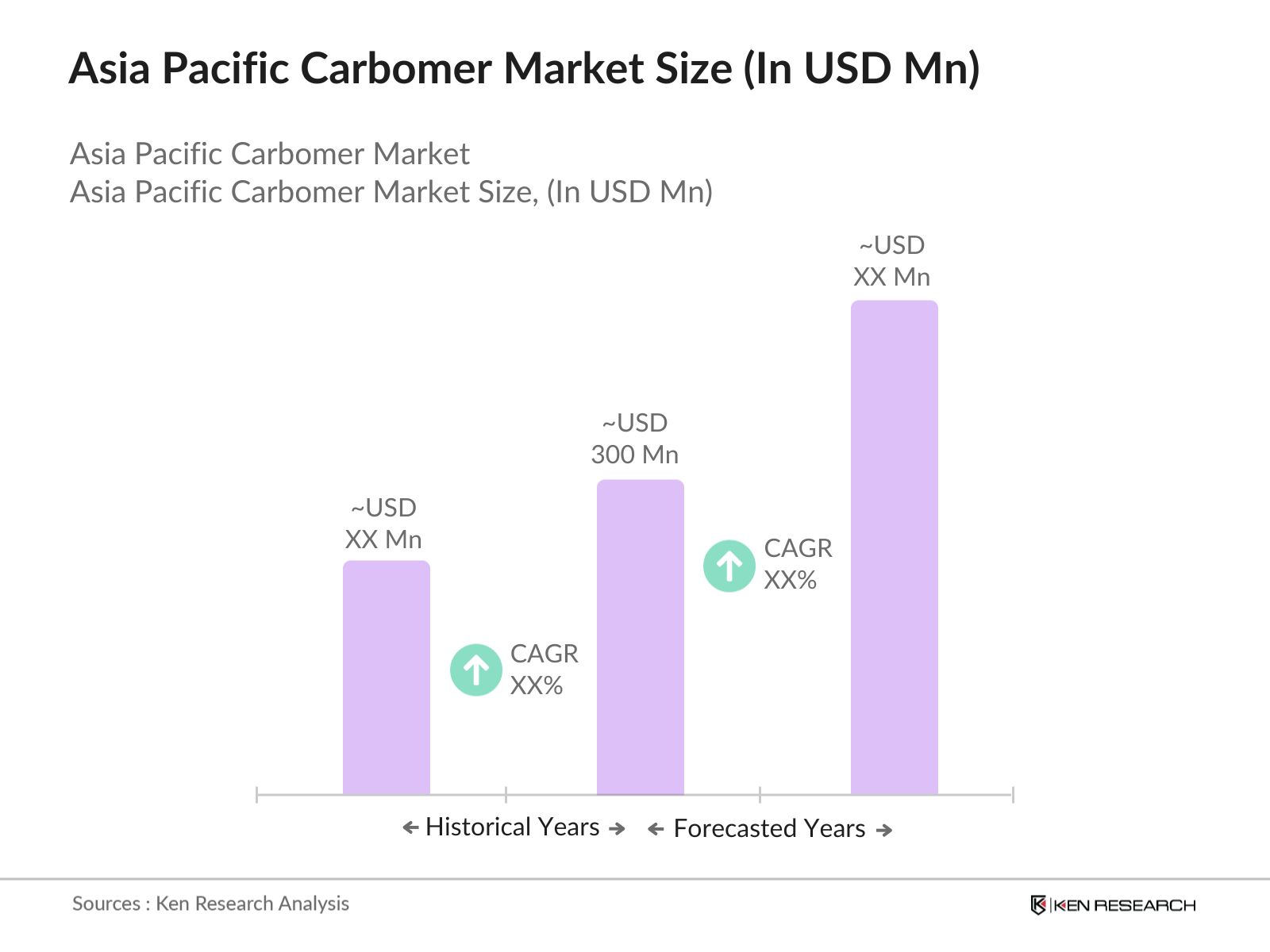

- The Asia Pacific Carbomer market is valued at USD 300 million, based on a five-year historical analysis. This market is primarily driven by the increasing demand for carbomer in the personal care and pharmaceutical sectors. Carbomers, widely used as thickeners and stabilizers, have found growing applications in moisturizers, gels, and lotions, making them essential for the formulation of personal care products. In the pharmaceutical industry, carbomers play a vital role as excipients in various drug formulations. This demand has been bolstered by technological advancements in production processes, which have improved the quality and versatility of carbomers.

- China and Japan dominate the Asia Pacific Carbomer market due to their well-established cosmetic and pharmaceutical industries. Chinas large consumer base, combined with its robust manufacturing infrastructure, has made it a leading producer and consumer of carbomers. Japan's dominance is attributed to its strong presence in the personal care sector, with local brands producing high-quality skincare and cosmetic products. Additionally, the pharmaceutical sector in both countries is highly developed, contributing to the high demand for carbomers in medical formulations.

- The regulatory framework for cosmetic ingredients in the Asia Pacific region is stringent, with countries like Japan, South Korea, and China implementing specific guidelines for carbomer usage. In 2023, the China National Medical Products Administration (NMPA) mandated that all cosmetic products containing carbomer undergo safety testing for skin irritation and environmental impact. These regulations are designed to ensure consumer safety and environmental sustainability, posing compliance challenges for manufacturers but also pushing them to innovate and improve product safety.

Asia Pacific Carbomer Market Segmentation

By Product Type: The market is segmented by product type into Carbomer 940, Carbomer 934, Carbomer 980, and other variants. Recently, Carbomer 940 has a dominant market share under this segmentation. Its popularity stems from its superior thickening and gelling properties, making it a preferred choice for formulating personal care products like moisturizers, shampoos, and cleansers. Furthermore, Carbomer 940's compatibility with a wide range of ingredients enhances its demand across diverse applications in the cosmetics and pharmaceutical industries.

By Application: The market is also segmented by application into personal care and cosmetics, pharmaceuticals, home care, and industrial applications. The personal care and cosmetics segment holds the largest market share in the Asia Pacific Carbomer market. This is largely due to the growing consumer demand for skincare and hair care products, particularly in urban areas where rising disposable incomes have spurred increased spending on premium cosmetic products. Moreover, the expanding e-commerce platforms have contributed significantly to the availability and popularity of these products.

Asia Pacific Carbomer Market Competitive Landscape

The Asia Pacific Carbomer market is highly competitive, with both global and regional players vying for market dominance. Key companies are focusing on product innovation and strategic partnerships to strengthen their market position. The market is dominated by a few major players, including Lubrizol Corporation, SNF S.A.S., and Sumitomo Seika Chemicals Co., Ltd., among others. These companies have a significant influence on market trends due to their established distribution networks, advanced production capabilities, and strong focus on research and development.

|

Company Name |

Establishment Year |

Headquarters |

R&D Expenditure |

Production Capacity |

Geographical Reach |

Strategic Partnerships |

Sustainability Initiatives |

Innovation Patents |

|

Lubrizol Corporation |

1928 |

Wickliffe, Ohio, USA |

||||||

|

SNF S.A.S |

1978 |

Andrzieux, France |

||||||

|

Evonik Industries AG |

2007 |

Essen, Germany |

||||||

|

Guangzhou Tinci Materials Technology Co. |

2000 |

Guangzhou, China |

||||||

|

Anhui Newman Fine Chemicals Co., Ltd. |

2004 |

Anhui, China |

Asia Pacific Carbomer Industry Analysis

Growth Drivers

- Growing Demand in Cosmetics and Personal Care Industry: Carbomer, a key ingredient in personal care formulations such as gels, creams, and lotions, has witnessed rising demand due to its thickening, stabilizing, and emulsifying properties. In 2023, the Asia Pacific region's personal care market exceeded $125 billion, significantly contributing to the increased demand for carbomers in skincare and hair care products. Countries like China and Japan have seen substantial growth in premium personal care products, which include carbomer-based formulations. This trend is further supported by rising disposable incomes and increasing consumer awareness of high-quality skincare products.

- Expansion in Pharmaceutical Applications: Carbomer is widely used as an excipient in the pharmaceutical industry due to its excellent bioadhesive properties, making it essential in drug delivery systems, gels, and creams. In 2024, pharmaceutical revenue in Asia Pacific countries such as India and South Korea surpassed $1 trillion, largely driven by increased demand for over-the-counter (OTC) products and topical formulations. As the region's healthcare industry continues to expand, carbomer-based products are expected to see increased usage in pharmaceuticals, particularly in the production of bioadhesive gels and ophthalmic formulations.

- Technological Advancements in Production: Technological innovations in carbomer synthesis have led to improved formulations that enhance product stability and reduce production costs. In 2023, the manufacturing sector in Asia Pacific, particularly in China and India, invested over $200 billion in research and development, focusing on chemical and pharmaceutical advancements. These improvements have resulted in more efficient carbomer production techniques, such as new polymerization methods, which offer better control over polymer properties and molecular weight distribution, making carbomer formulations more adaptable for various industrial applications. IMF, 2023.

Market Challenges

- Volatile Raw Material Prices: Carbomers are primarily synthesized from acrylic acid, whose price volatility poses a significant challenge for manufacturers. In 2023, the price of acrylic acid fluctuated between $1,800 and $2,100 per ton due to supply chain disruptions and rising crude oil prices. This instability impacts the production costs of carbomers, forcing manufacturers to either absorb the additional costs or pass them on to consumers. These fluctuations are primarily driven by the global energy market and environmental regulations affecting chemical production, especially in key producing countries like China and India. IMF, 2023.

- Complex Regulatory Framework: The regulatory landscape for carbomers is intricate, with each country in the Asia Pacific region having its own set of compliance standards, particularly for pharmaceutical and cosmetic products. For instance, Chinas National Medical Products Administration (NMPA) and Japans Pharmaceuticals and Medical Devices Agency (PMDA) have stringent guidelines that manufacturers must adhere to. In 2023, over 70% of new cosmetic and pharmaceutical product launches in these markets faced delays due to compliance issues. The need to meet varying safety and environmental standards across multiple markets increases the complexity and cost of bringing carbomer-based products to market.

Asia Pacific Carbomer Market Future Outlook

Over the next five years, the Asia Pacific Carbomer market is expected to show significant growth, driven by rising consumer demand for high-performance personal care products and the increasing use of carbomers in pharmaceutical formulations. Additionally, the expansion of e-commerce platforms and the growing preference for premium skincare products are expected to boost market growth. Furthermore, technological advancements in the production of eco-friendly and sustainable carbomers are anticipated to open new growth opportunities in the market. Key players are likely to focus on product innovation, sustainability, and expanding their geographic reach to capture larger market shares.

Future Market Opportunities

- Surge in Demand for Eco-Friendly Carbomers: The increasing consumer preference for sustainable and biodegradable products presents a significant opportunity for carbomer manufacturers. In 2023, eco-friendly beauty and personal care products accounted for nearly 35% of total sales in key markets such as Australia, South Korea, and Japan. Governments are also incentivizing the production of environmentally friendly chemicals through tax breaks and grants, further boosting the demand for biodegradable carbomer alternatives. Companies that invest in the development of such products are well-positioned to capitalize on this growing demand.

- Rising Use in Advanced Drug Delivery Systems: Carbomers are increasingly being used in innovative drug delivery systems due to their bioadhesive properties. With pharmaceutical R&D spending in Asia Pacific reaching over $100 billion in 2023, there is a growing focus on developing advanced drug formulations that improve patient compliance and efficacy. Carbomers are key in these developments, particularly in topical and ophthalmic formulations, where controlled release and bioadhesion are critical. This expanding use of carbomers in advanced drug delivery systems offers significant growth potential for manufacturers.

Scope of the Report

|

Product Type |

Carbomer 940 Carbomer 934 Carbomer 980 Others |

|

Application |

Personal Care and Cosmetics Pharmaceuticals Home Care Others |

|

Formulation Type |

Gels Creams Lotions Powders |

|

End-Use Industry |

Cosmetics and Personal Care Pharmaceuticals Home Care Industrial |

|

Region |

China Japan South Korea India Southeast Asia |

Products

Key Target Audience

Carbomer Manufacturers

Personal Care & Cosmetics Brands

Pharmaceutical Companies

Home Care Product Manufacturers

Industrial Chemical Companies

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, Ministry of Health)

E-commerce Retailers

Companies

Major Players

Lubrizol Corporation

SNF S.A.S.

Sumitomo Seika Chemicals Co., Ltd.

Anhui Newman Fine Chemicals

Ashland Global Holdings Inc.

Guangzhou Tinci Materials Technology Co., Ltd.

Corel Pharma Chem

Evonik Industries AG

Boai NKY Pharmaceuticals Ltd.

Zhejiang Dongda Chemical Group Co., Ltd.

Maruti Chemicals

BF Goodrich Performance Materials

BASF SE

Jiangsu KND Polymer Material Co., Ltd.

Haihang Industry Co., Ltd.

Table of Contents

Asia Pacific Carbomer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Asia Pacific Carbomer Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Asia Pacific Carbomer Market Analysis

3.1. Growth Drivers

3.1.1. Growing Demand in Cosmetics and Personal Care Industry (Carbomer usage in personal care formulations)

3.1.2. Expansion in Pharmaceutical Applications (Carbomer's role as an excipient)

3.1.3. Technological Advancements in Production (Improved synthesis techniques)

3.1.4. Rising Investments in Healthcare and Bioadhesives (Medical gels and bioadhesive formulations)

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices (Fluctuations in acrylic acid)

3.2.2. Complex Regulatory Framework (Compliance with regional pharmaceutical and cosmetic regulations)

3.2.3. Limited Awareness in Emerging Markets (Low market penetration in rural areas)

3.3. Opportunities

3.3.1. Surge in Demand for Eco-Friendly Carbomers (Sustainable and biodegradable formulations)

3.3.2. Rising Use in Advanced Drug Delivery Systems (Enhanced carbomer formulations)

3.3.3. Expansion in E-commerce and Online Sales (Increasing demand from online skincare products)

3.4. Trends

3.4.1. Shift towards Organic and Natural Carbomer Alternatives (Consumer preference for natural ingredients)

3.4.2. Increased Focus on Anti-pollution Formulations (Incorporation of carbomers in skincare products targeting pollution)

3.4.3. Growth in Customizable and Multifunctional Polymers (Carbomers with multiple applications)

3.5. Government Regulations

3.5.1. Asia Pacific Cosmetic Ingredient Regulations (Mandatory compliance for carbomer use in cosmetics)

3.5.2. Pharmaceutical Safety Standards (FDA and local health regulations for carbomers in medical use)

3.5.3. Environmental Protection Regulations (Guidelines on carbomer waste management)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

Asia Pacific Carbomer Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Carbomer 940

4.1.2. Carbomer 934

4.1.3. Carbomer 980

4.1.4. Other Variants

4.2. By Application (In Value %)

4.2.1. Personal Care and Cosmetics (Moisturizers, Gels, Lotions)

4.2.2. Pharmaceuticals (Oral, Topical, Ophthalmic Formulations)

4.2.3. Home Care (Household Cleaning Products)

4.2.4. Others (Industrial Applications)

4.3. By Formulation Type (In Value %)

4.3.1. Gels

4.3.2. Creams

4.3.3. Lotions

4.3.4. Powders

4.4. By End-Use Industry (In Value %)

4.4.1. Cosmetics and Personal Care

4.4.2. Pharmaceuticals

4.4.3. Home Care

4.4.4. Industrial

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. India

4.5.5. Southeast Asia

Asia Pacific Carbomer Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Lubrizol Corporation

5.1.2. SNF S.A.S

5.1.3. Sumitomo Seika Chemicals Co., Ltd.

5.1.4. Anhui Newman Fine Chemicals

5.1.5. Corel Pharma Chem

5.1.6. Guangzhou Tinci Materials Technology Co., Ltd.

5.1.7. Evonik Industries AG

5.1.8. Ashland Global Holdings Inc.

5.1.9. Maruti Chemicals

5.1.10. Boai NKY Pharmaceuticals Ltd.

5.1.11. Zhejiang Dongda Chemical Group Co., Ltd.

5.1.12. Jiangsu KND Polymer Material Co., Ltd.

5.1.13. Haihang Industry Co., Ltd.

5.1.14. BF Goodrich Performance Materials

5.1.15. BASF SE

5.2. Cross Comparison Parameters (Revenue, R&D Expenditure, Geographical Presence, Production Capacity, Strategic Partnerships, Sustainability Initiatives, Product Innovations, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Asia Pacific Carbomer Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

Asia Pacific Carbomer Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Asia Pacific Carbomer Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Formulation Type (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

Asia Pacific Carbomer Market Analyst Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Carbomer Market. This step was underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective was to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compiled and analyzed historical data pertaining to the Asia Pacific Carbomer Market. This included assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics was conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provided valuable operational and financial insights directly from industry practitioners, which were instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple carbomer manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction served to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Carbomer market.

Frequently Asked Questions

01. How big is the Asia Pacific Carbomer Market?

The Asia Pacific Carbomer market is valued at USD 300 million, driven by increasing demand in personal care and pharmaceutical applications. Growth is attributed to the rising consumer preference for premium skincare products and technological advancements in pharmaceutical formulations.

02. What are the challenges in the Asia Pacific Carbomer Market?

Challenges in the Asia Pacific Carbomer market include fluctuating raw material prices, complex regulatory frameworks, and limited awareness in emerging markets. Additionally, the lack of skilled labor and technological expertise in some regions hinders growth.

03. Who are the major players in the Asia Pacific Carbomer Market?

Key players in the Asia Pacific Carbomer market include Lubrizol Corporation, SNF S.A.S., Sumitomo Seika Chemicals Co., Ltd., Ashland Global Holdings Inc., and Guangzhou Tinci Materials Technology Co., Ltd. These companies dominate due to their extensive product portfolios, technological innovation, and global reach.

04. What are the growth drivers of the Asia Pacific Carbomer Market?

The Asia Pacific Carbomer market is driven by rising consumer demand for personal care products, increasing pharmaceutical applications, and growing investments in bioadhesive technologies. Additionally, the expansion of e-commerce platforms is boosting sales of cosmetic and personal care products containing carbomers.

05. What are the trends in the Asia Pacific Carbomer Market?

Key trends in the Asia Pacific Carbomer market include the shift towards eco-friendly carbomers, the use of carbomers in anti-pollution skincare products, and the increasing demand for multifunctional polymers that offer greater versatility in product formulation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.