Asia Pacific Carboxymethyl Cellulose (CMC) Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD5570

December 2024

86

About the Report

Asia Pacific Carboxymethyl Cellulose Market Overview

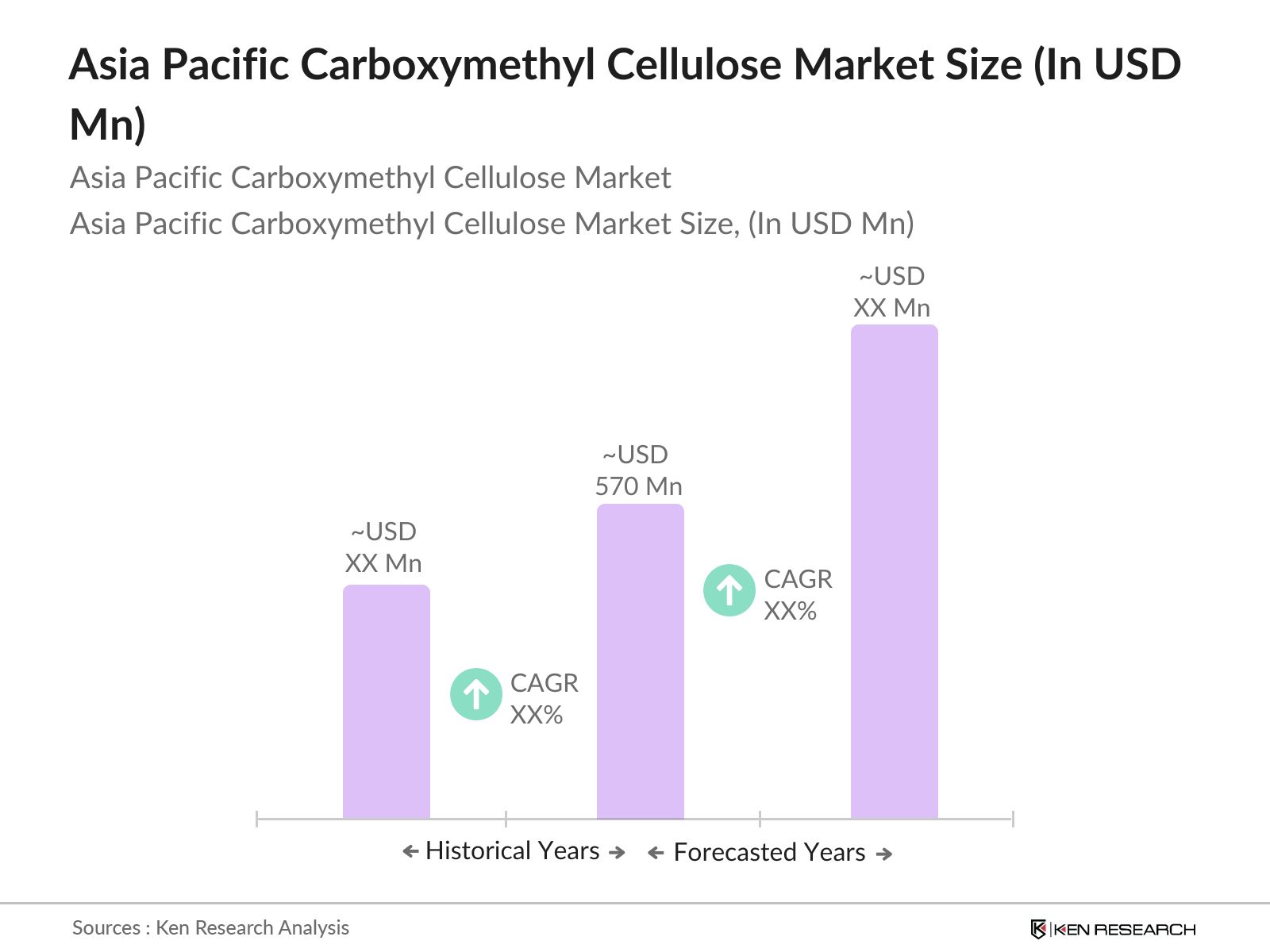

- The Asia Pacific Carboxymethyl Cellulose (CMC) market is valued at USD 570 million, based on a five-year historical analysis. This market is driven by the rising demand for CMC in various sectors, such as food and beverages, pharmaceuticals, and oil drilling. The market benefits from the materials cost-effectiveness, biodegradable nature, and its ability to act as a thickening, emulsifying, and stabilizing agent. The increasing application of CMC in these industries has propelled the market's growth, making it a critical component in manufacturing processes.

- Countries like China and India dominate the Asia Pacific Carboxymethyl Cellulose market. China is a key producer due to its massive manufacturing base and access to abundant raw materials like cotton and wood pulp. India, with its expanding pharmaceutical and food industries, is also a major player. Both countries benefit from lower production costs, well-established supply chains, and growing domestic demand for CMC in sectors such as food processing and personal care, allowing them to lead the market.

- Asia Pacific's regulatory landscape for CMC is governed by stringent standards, particularly in food and pharmaceutical applications. The Food and Drug Administration of Thailand (FDA) and the Food Safety and Standards Authority of India (FSSAI) enforce rigorous quality controls, requiring CMC used in consumable products to meet high purity levels. In 2024, these standards were tightened to ensure the safety and efficacy of food-grade CMC, with audits conducted regularly to ensure compliance. These frameworks are critical in shaping the market for CMC in the region.

Asia Pacific Carboxymethyl Cellulose Market Segmentation

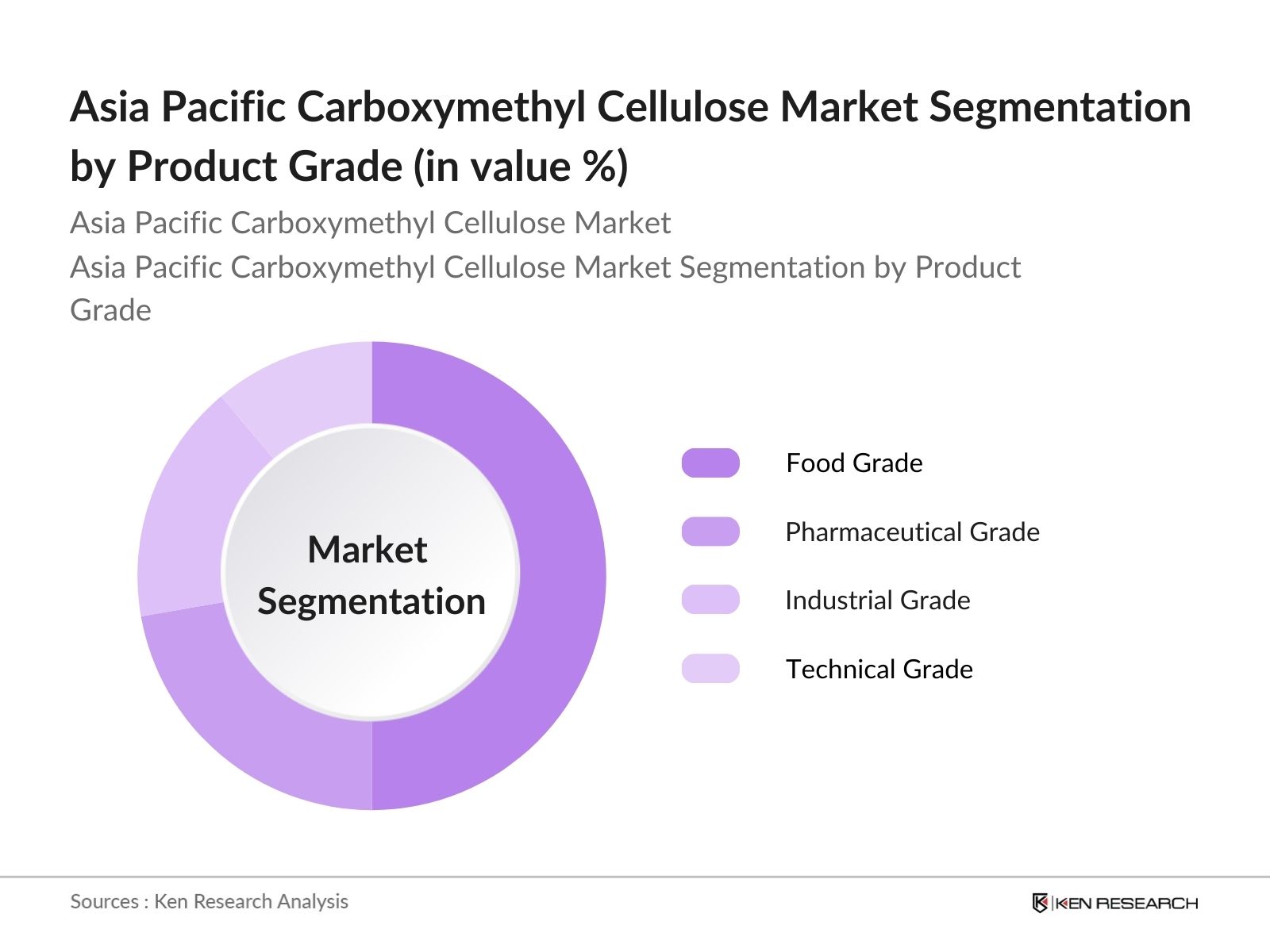

- By Product Grade: The Asia Pacific Carboxymethyl Cellulose market is segmented by product grade into food grade, pharmaceutical grade, industrial grade, and technical grade. Food grade CMC dominates the market, primarily due to the increasing consumption of processed foods in the region. The demand for food-grade CMC is driven by its widespread application as a thickening agent and stabilizer in baked goods, beverages, and dairy products. Its role in improving texture and shelf life is highly valued by manufacturers in the food and beverage industry.

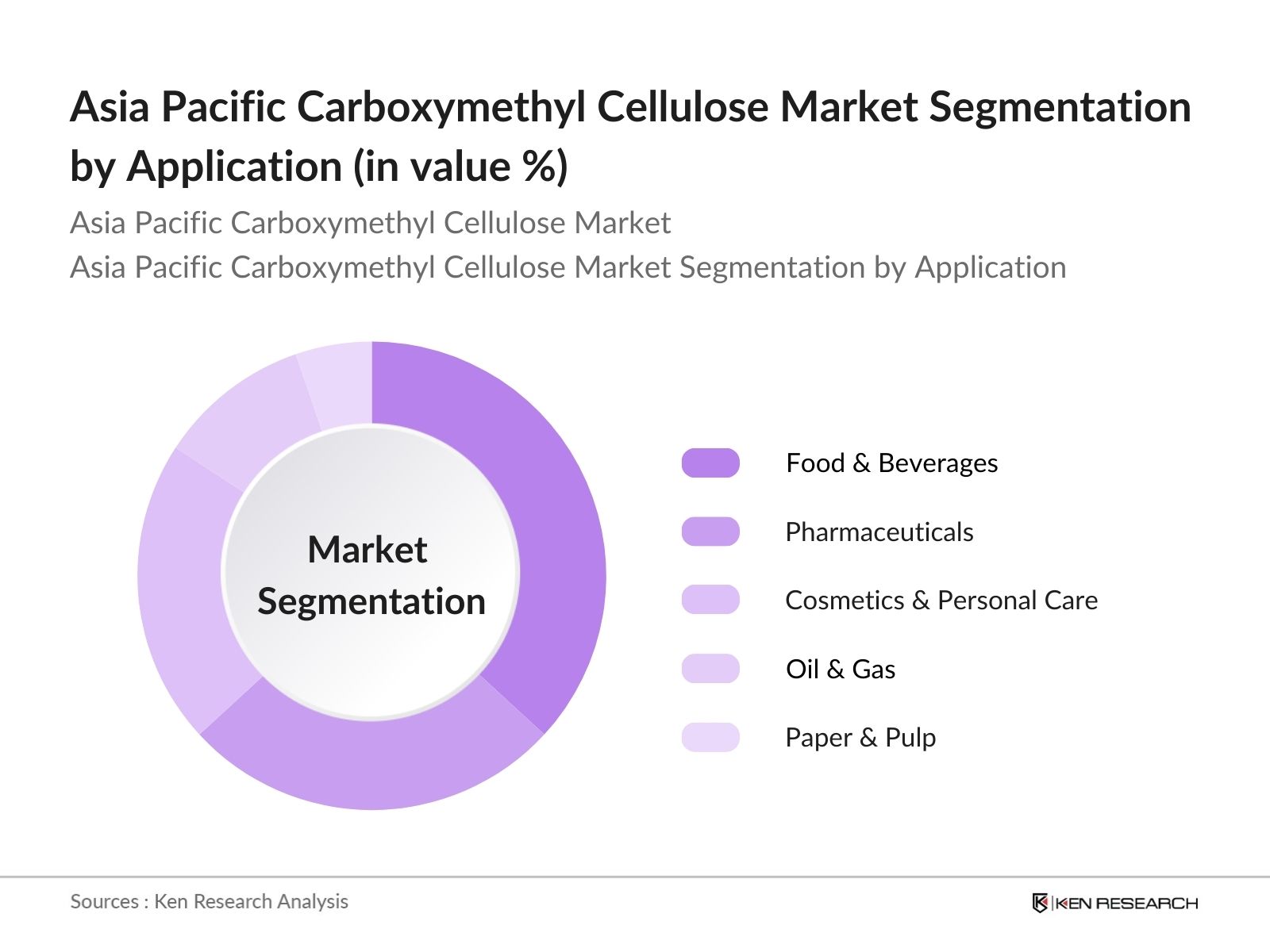

- By Application: The market is further segmented by application into food and beverages, pharmaceuticals, cosmetics and personal care, oil and gas, and paper and pulp. The food and beverage segment holds the dominant market share, driven by the increasing demand for low-fat and gluten-free products that require CMC as a thickener and emulsifier. The pharmaceutical industry follows closely, utilizing CMC in drug formulations and as a binder in tablets.

Asia Pacific Carboxymethyl Cellulose Market Competitive Landscape

The Asia Pacific Carboxymethyl Cellulose market is characterized by the presence of both global and regional players, including leading chemical manufacturers. The market is consolidated, with a few major companies dominating due to their extensive production capabilities and strong supply chains.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

Revenue (USD Mn) |

Innovation Index |

Product Portfolio |

Sustainability Initiatives |

R&D Spending |

Geographical Presence |

|

CP Kelco |

1934 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Ashland Global Holdings |

1924 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

The Dow Chemical Company |

1897 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Nippon Paper Industries |

1949 |

Japan |

- |

- |

- |

- |

- |

- |

- |

|

Akzo Nobel N.V. |

1646 |

Netherlands |

- |

- |

- |

- |

- |

- |

- |

Asia Pacific Carboxymethyl Cellulose Market Analysis

Asia Pacific Carboxymethyl Cellulose Market Growth Drivers

- Rising Demand for Processed Food: The Asia Pacific region has experienced growth in the processed food sector, driven by urbanization and changing consumer preferences. According to the World Bank, urban populations in the region have increased by over 50 million people from 2022 to 2024, which has heightened demand for ready-to-eat and convenience foods. Carboxymethyl cellulose (CMC) plays a crucial role as a stabilizer and thickener in processed foods, supporting shelf-life extension and texture enhancement. Additionally, the food processing industry in India and China alone employed over 20 million workers in 2023, further supporting the robust demand for CMC in this sector.

- Growth in Pharmaceutical and Cosmetic Sectors: The pharmaceutical and cosmetic industries in Asia Pacific have witnessed exponential growth. According to the International Monetary Fund (IMF), the pharmaceutical industry in the region recorded a gross output of USD 650 billion in 2023. CMC is extensively used in pharmaceutical formulations as a binder and disintegrant. In cosmetics, its application as a thickener for lotions and creams has surged, with South Korea leading the market with an output increase of 10 million units of cosmetic products in 2023. These industries are key drivers for CMC demand across the region.

- Increasing Application in Oil & Gas Industry: The application of CMC in the oil & gas industry, particularly in drilling fluids, has expanded due to the rise in drilling activities in Southeast Asia. Countries like Indonesia and Malaysia saw a combined crude oil production of 1.75 million barrels per day in 2023, necessitating advanced drilling fluids that use CMC to maintain stability in high-pressure environments. The increased exploration of natural gas, driven by rising energy demands, has also boosted the consumption of CMC-based additives in the sector.

Asia Pacific Carboxymethyl Cellulose Market Challenges

- Price Fluctuation of Raw Materials: The price volatility of raw materials used in CMC production, such as wood pulp and cotton, remains a major challenge. According to the World Bank Commodity Prices Data, the price of wood pulp fluctuated between USD 750 to USD 920 per metric ton from 2022 to 2024 due to supply chain disruptions and increased global demand. These fluctuations directly impact the manufacturing cost of CMC and create uncertainty for producers and end-users across industries.

- Regulatory Stringency on Synthetic Additives: Regulatory bodies across Asia Pacific have tightened their stance on synthetic additives in the food and pharmaceutical industries. The Food Safety and Standards Authority of India (FSSAI) and China's National Medical Products Administration (NMPA) have introduced stricter regulations that limit the use of non-organic or synthetic additives. This has led to an increased demand for organic CMC alternatives, but the regulatory complexity continues to challenge manufacturers looking to meet compliance without compromising production costs.

Asia Pacific Carboxymethyl Cellulose Market Future Outlook

Over the next five years, the Asia Pacific Carboxymethyl Cellulose market is expected to witness growth, driven by the increasing demand in food processing, pharmaceutical applications, and the personal care industry. Additionally, the push for sustainable and biodegradable ingredients in cosmetics and personal care products is likely to fuel CMC consumption. Government regulations promoting the use of biodegradable and eco-friendly materials will further support market growth, especially in developed economies within the region.

Asia Pacific Carboxymethyl Cellulose Market Opportunities

- Expansion of Application in Food and Beverage Industry: The food and beverage industry in Asia Pacific is undergoing rapid growth, and CMC is increasingly being used in processed foods, beverages, and dairy products as a thickening and stabilizing agent. In 2023, the industry was valued at USD 2.3 trillion, with CMC usage seeing notable increases in dairy alternatives and plant-based products. Countries like India and China, with a combined population of over 2.7 billion people, are prime markets for such innovations, offering immense opportunities for CMC producers to expand their footprint in the sector.

- Emerging Markets for CMC in Asia: Emerging economies such as Vietnam, Indonesia, and Thailand have shown a strong demand for CMC, particularly in sectors such as textiles, food processing, and pharmaceuticals. According to the Asian Development Bank, these countries have a combined GDP growth rate of 6.5% in 2024, with manufacturing and processing industries accounting for a substantial portion of this growth. The rapid industrialization in these countries presents a lucrative opportunity for CMC manufacturers to tap into new markets.

Scope of the Report

|

Product Grade |

Food Grade Pharmaceutical Grade Industrial Grade Technical Grade |

|

Application |

Food & Beverages Pharmaceuticals Cosmetics & Personal Care Oil & Gas Paper & Pulp |

|

Function |

Thickener Stabilizer Emulsifier Binder |

|

Source Type |

Synthetic Natural (Wood, Cotton, etc.) |

|

Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience

Food and Beverage Manufacturers

Pharmaceutical Companies

Banks and Financial Institutions

Cosmetic and Personal Care Product Manufacturers

Oil and Gas Companies

Paper and Pulp Producers

Government and Regulatory Bodies (e.g., Food and Drug Administration)

Investors and Venture Capitalist Firms

Environmental Agencies (e.g., Ministry of Environmental Protection)

Companies

Players Mentioned in the Report

CP Kelco

Ashland Global Holdings Inc.

The Dow Chemical Company

Nippon Paper Industries Co., Ltd.

Akzo Nobel N.V.

Quimica Amtex

Lamberti S.p.A.

Daicel Corporation

DKS Co. Ltd.

Ugur Seluloz Kimya A.S.

Table of Contents

1. Asia Pacific Carboxymethyl Cellulose Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Asia Pacific Carboxymethyl Cellulose Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Asia Pacific Carboxymethyl Cellulose Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Processed Food

3.1.2 Growth in Pharmaceutical and Cosmetic Sectors

3.1.3 Increasing Application in Oil & Gas Industry

3.1.4 Strong Demand for Sustainable and Biodegradable Additives

3.2 Market Challenges

3.2.1 Price Fluctuation of Raw Materials

3.2.2 Regulatory Stringency on Synthetic Additives

3.2.3 Limited Availability of High-Purity Grades

3.3 Opportunities

3.3.1 Expansion of Application in Food and Beverage Industry

3.3.2 Emerging Markets for CMC in Asia

3.3.3 Development of Non-Synthetic, Plant-Based CMC Variants

3.4 Trends

3.4.1 Shift Towards Organic and Sustainable Additives

3.4.2 Increasing Investment in R&D for Enhanced CMC Properties

3.4.3 Adoption of CMC in High-Performance Drilling Fluids

3.5 Regulatory Framework

3.5.1 Food and Pharmaceutical Grade Standards

3.5.2 Environmental Impact and Compliance Regulations

3.5.3 Patent Landscape and Intellectual Property

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. Asia Pacific Carboxymethyl Cellulose Market Segmentation

4.1 By Product Grade (In Value %)

4.1.1 Food Grade

4.1.2 Pharmaceutical Grade

4.1.3 Industrial Grade

4.1.4 Technical Grade

4.2 By Application (In Value %)

4.2.1 Food & Beverages

4.2.2 Pharmaceuticals

4.2.3 Cosmetics & Personal Care

4.2.4 Oil & Gas

4.2.5 Paper & Pulp

4.3 By Function (In Value %)

4.3.1 Thickener

4.3.2 Stabilizer

4.3.3 Emulsifier

4.3.4 Binder

4.4 By Source Type (In Value %)

4.4.1 Synthetic

4.4.2 Natural (Wood, Cotton, etc.)

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Australia

4.5.5 Southeast Asia

5. Asia Pacific Carboxymethyl Cellulose Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 CP Kelco

5.1.2 Ashland Global Holdings Inc.

5.1.3 The DOW Chemical Company

5.1.4 Nippon Paper Industries Co., Ltd.

5.1.5 Akzo Nobel N.V.

5.1.6 Quimica Amtex

5.1.7 Lamberti S.p.A.

5.1.8 Daicel Corporation

5.1.9 DKS Co. Ltd.

5.1.10 Ugur Seluloz Kimya A.S.

5.1.11 Sinocmc Co., Ltd.

5.1.12 Patel Industries

5.1.13 Phoenix Chemical Inc.

5.1.14 Qingdao Sinocmc Chemical Co. Ltd.

5.1.15 Zhonglan Industry Co., Ltd.

5.2 Cross Comparison Parameters (Production Capacity, Revenue, Market Share, Geographical Presence, R&D Spending, Innovation Index, Product Portfolio, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Incentives and Tax Benefits

5.8 Export-Import Dynamics

6. Asia Pacific Carboxymethyl Cellulose Market Regulatory Framework

6.1 Food and Pharmaceutical Compliance (E.g., FDA, WHO Standards)

6.2 Labeling and Certification (Organic Certification, Non-GMO Certification)

6.3 Environmental Regulations

7. Asia Pacific Carboxymethyl Cellulose Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Carboxymethyl Cellulose Future Market Segmentation

8.1 By Product Grade (In Value %)

8.2 By Application (In Value %)

8.3 By Function (In Value %)

8.4 By Source Type (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Carboxymethyl Cellulose Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Strategic Partnerships and Collaborations

9.3 Market Penetration Strategies

9.4 White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves the construction of an ecosystem map, encompassing all major stakeholders within the Asia Pacific Carboxymethyl Cellulose market. Through extensive desk research, utilizing both secondary sources and proprietary databases, the research team gathers comprehensive data on the industry. The objective is to identify the critical variables driving market dynamics, such as demand trends and supply chain disruptions.

Step 2: Market Analysis and Construction

The second phase involves the compilation of historical data for the Asia Pacific Carboxymethyl Cellulose market. This data includes industry-specific parameters such as CMC production volumes, raw material availability, and end-user industry penetration rates. Additionally, revenue estimates are calculated by analyzing sales figures and growth trends across various application sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated based on the collected data and validated through interviews with industry experts from key CMC producers and suppliers. This process involves computer-assisted telephone interviews (CATIs) and email-based surveys, ensuring the data's reliability and accuracy.

Step 4: Research Synthesis and Final Output

The final phase of the research involves synthesizing the gathered data and cross-referencing it with information from leading manufacturers and industry stakeholders. This step ensures that the final report offers a comprehensive and validated analysis of the Asia Pacific Carboxymethyl Cellulose market, reflecting both macroeconomic trends and specific industry developments.

Frequently Asked Questions

01. How big is the Asia Pacific Carboxymethyl Cellulose Market?

The Asia Pacific Carboxymethyl Cellulose market was valued at USD 570 million in 2023, driven by demand from various sectors like food, pharmaceuticals, and personal care.

02. What are the challenges in the Asia Pacific Carboxymethyl Cellulose Market?

Challenges include raw material price fluctuations, regulatory barriers, and limited availability of high-purity grades, which can hinder growth and profitability for manufacturers.

03. Who are the major players in the Asia Pacific Carboxymethyl Cellulose Market?

Key players include CP Kelco, Ashland Global Holdings Inc., The Dow Chemical Company, Nippon Paper Industries, and Akzo Nobel N.V., who dominate through their established production capacities and extensive product portfolios.

04. What are the growth drivers of the Asia Pacific Carboxymethyl Cellulose Market?

The market is driven by rising demand for processed foods, increased application in pharmaceutical formulations, and growing use in sustainable and biodegradable cosmetics and personal care products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.