Asia Pacific Card and Board Games Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD9723

December 2024

93

About the Report

Asia Pacific Card and Board Games Market Overview

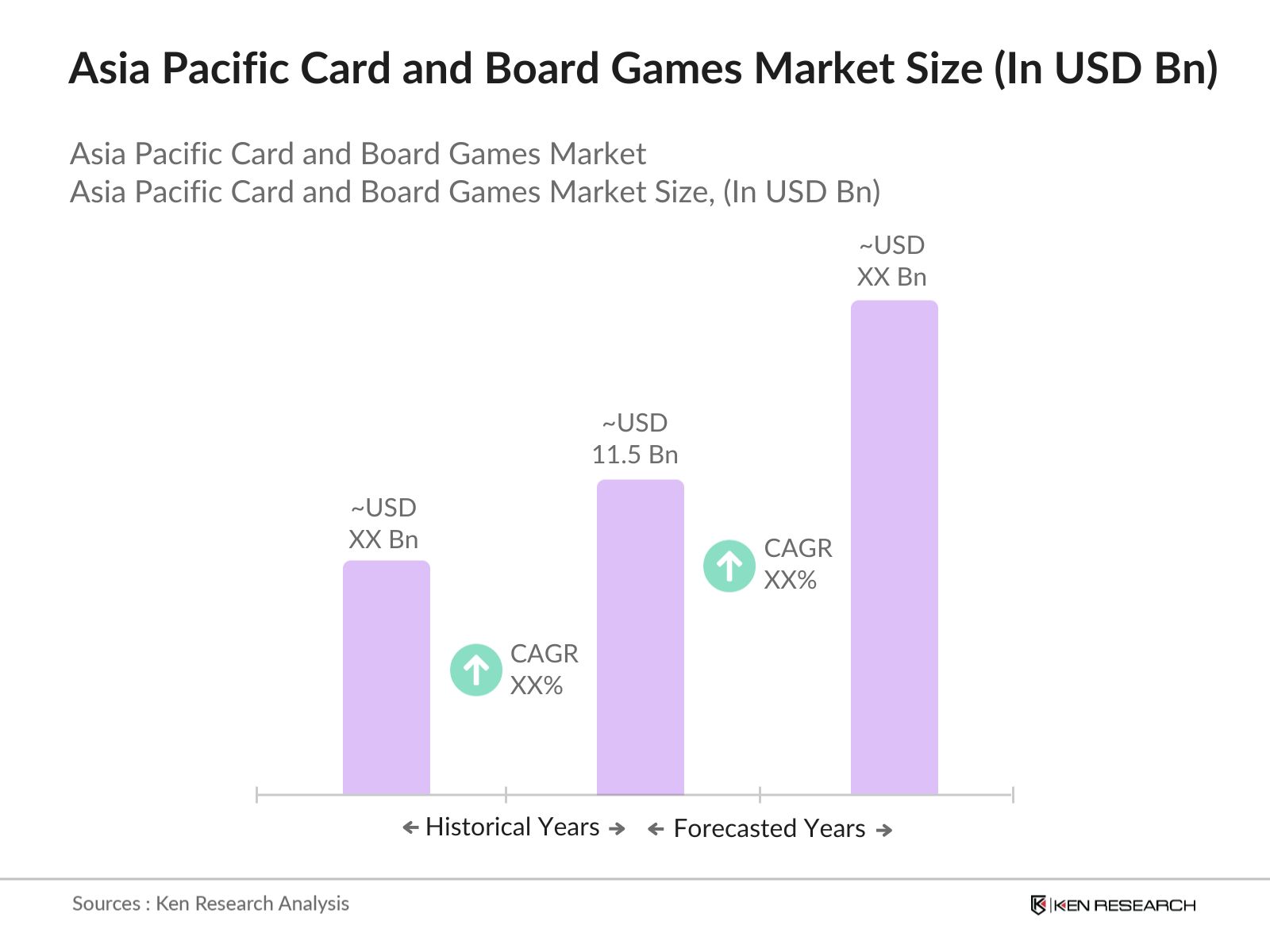

- The Asia Pacific Card and Board Games market is valued at USD 11.5 billion, driven by rising disposable incomes, increased interest in social gaming experiences, and the regions cultural inclination towards interactive games. The markets growth is also fueled by the adoption of digital versions of popular games and the influence of millennial consumers who seek nostalgia and offline recreational options. Furthermore, pandemic-driven demand for home entertainment has elevated the relevance of board games, pushing market growth significantly.

- China, Japan, and South Korea lead the Asia Pacific market, primarily due to their well-established gaming cultures, high spending power, and consumer interest in both traditional and modern games. These countries also benefit from a robust gaming infrastructure, strong retail networks, and extensive local production capabilities, enabling them to support a wide array of games in physical and digital formats, thereby maintaining a competitive advantage within the region.

- Licensing requirements are becoming stricter, as governments in Asia-Pacific, including China and South Korea, impose regulations on game production. Data from Chinas National Press and Publication Administration reveals that 90% of games produced domestically undergo a rigorous licensing process to ensure compliance with regional standards, a critical factor for manufacturers.

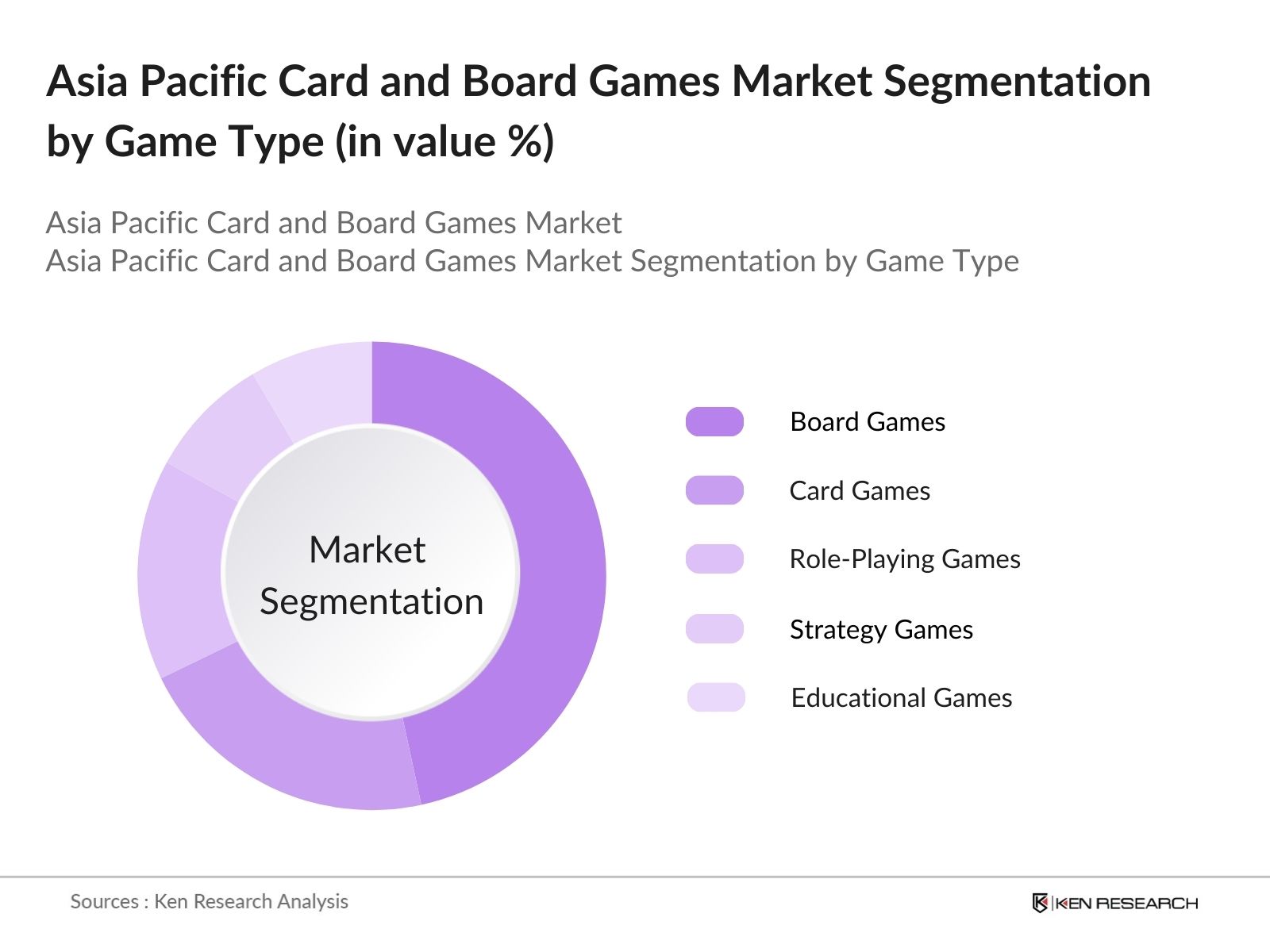

Asia Pacific Card and Board Games Market Segmentation

By Game Type: The Asia Pacific Card and Board Games market is segmented by game type into card games, board games, role-playing games, strategy games, and educational games. Board games currently hold a dominant market share within this segmentation, due to their appeal across age groups, adaptability to digital formats, and their ability to bring people together in social settings. Popular titles like Monopoly, Scrabble, and Catan have established strong demand, creating sustained interest in board games for family entertainment.

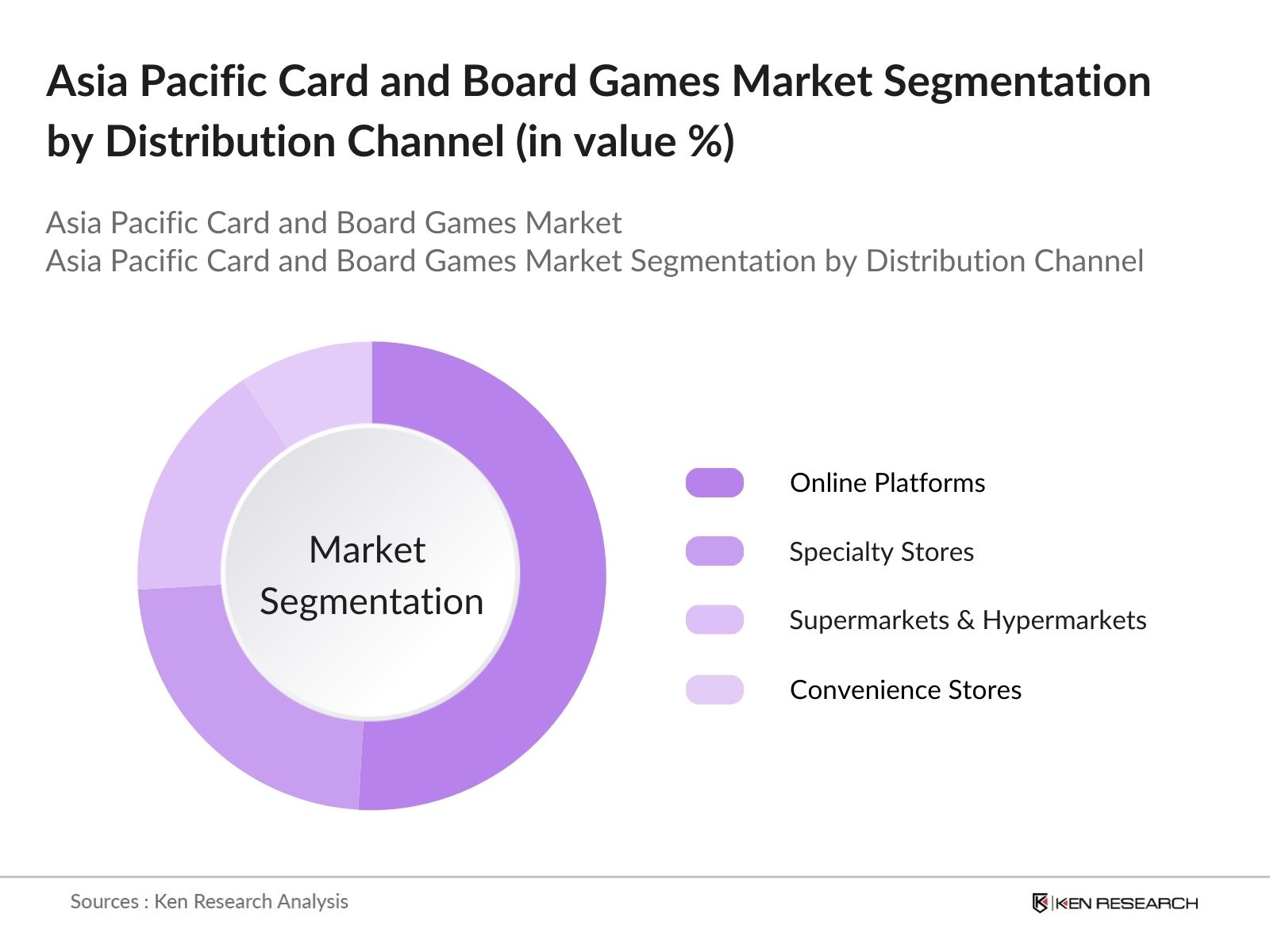

By Distribution Channel: The market is further segmented by distribution channels, including online platforms, specialty stores, supermarkets & hypermarkets, and convenience stores. Online platforms have captured a dominant market share in recent years due to the convenience of home delivery, extensive availability of international titles, and exclusive online promotions. E-commerce giants like Amazon and Flipkart have played a crucial role in reshaping consumer access to a variety of games, increasing the popularity of online purchasing.

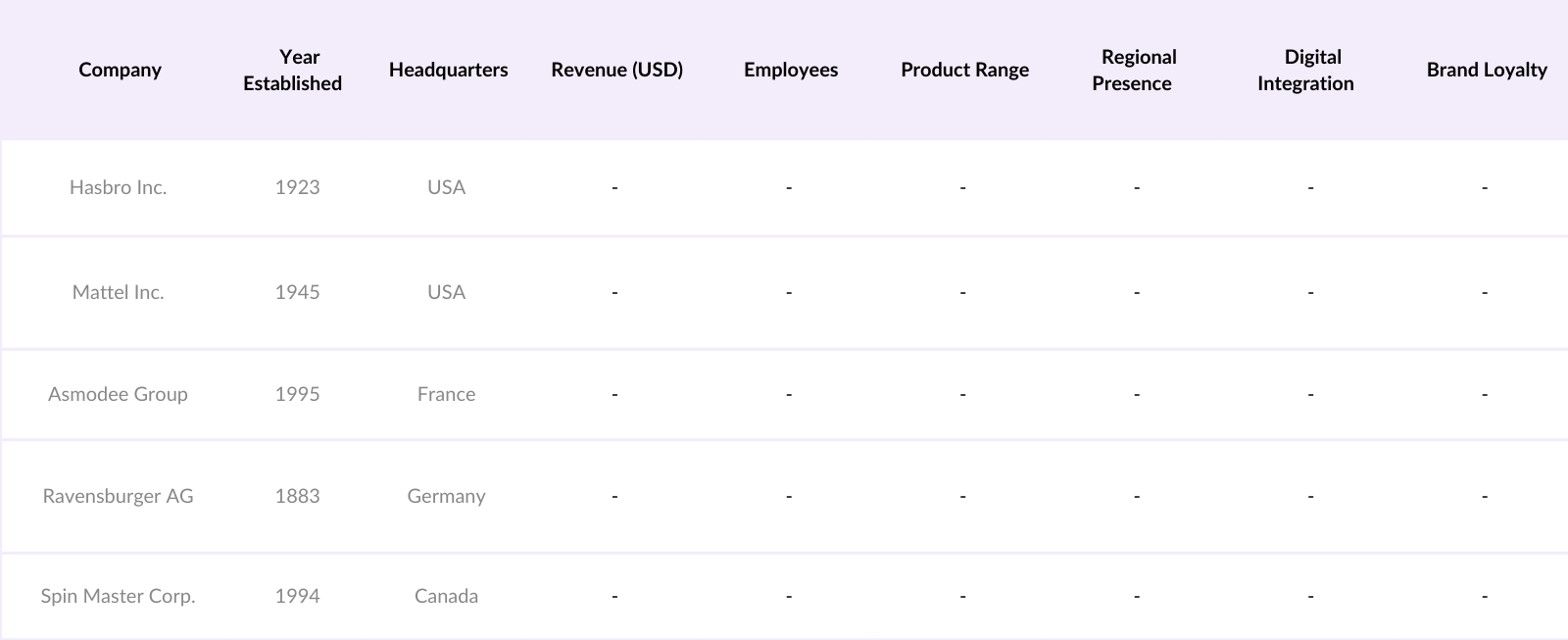

Asia Pacific Card and Board Games Market Competitive Landscape

The Asia Pacific Card and Board Games market is dominated by several established players, each leveraging strong brand portfolios, innovative game titles, and strategic distribution networks. Major companies have invested heavily in product diversity and regional expansion to maintain market dominance.

Asia Pacific Card and Board Games Market Analysis

Growth Drivers

- Digital Integration (Online Platforms, App-Based Gaming): Digital integration has significantly influenced the card and board games market in Asia-Pacific, with millions of people turning to online platforms for gameplay. In 2024, the region saw over 1.2 billion mobile and internet users, reflecting a 15 million increase since 2023, which is driving app-based gaming adoption. South Korea, Japan, and China are at the forefront, with government data indicating a rise in digital content consumption as nearly 60% of consumers report engaging in online gaming. Government reports confirm this rise, especially among youth aged 15-30.

- Cultural Revival (Regional Influence, Traditional Game Resurgence): Cultural revival has brought traditional games back into prominence, supported by national heritage initiatives across Asia-Pacific. In 2024, Japan and China observed a 40% rise in domestic sales of traditional games such as Go and Mahjong, backed by government programs encouraging cultural preservation. India reported similar growth, with the reintroduction of games like Pachisi into mainstream educational curricula. This shift aligns with increased tourism and a local product emphasis in national policies, driving demand for culturally significant games.

- Social Interaction Demand (Family, Community Game Nights): With a reported 30% rise in social gatherings in 2024, the demand for social interaction-focused games has surged. Government-supported community programs across Japan, Australia, and South Korea have promoted family and community game nights, which have led to an increase in game purchases. Data from national family associations indicate that 50% of families with children under 18 participate in board games at least twice a month, reflecting a strong preference for offline interaction.

Market Challenges

- Piracy and Copyright Issues: Piracy and copyright infringement are prominent challenges, with losses estimated at 15 billion USD in 2024 across Asia-Pacific, particularly in countries with high levels of unlicensed content, such as China, India, and Indonesia. Government crackdowns have led to a 20% decrease in pirated game distributions in China alone, according to national intellectual property bodies. Efforts are ongoing to enforce stricter copyright laws across the region, but the high prevalence of pirated materials remains a significant market barrier.

- High Production and Distribution Costs: Production and distribution costs have seen a considerable rise, as manufacturing costs increased by approximately 10% in 2024 due to inflation and supply chain disruptions in countries like Vietnam and Malaysia. Data from the Asia-Pacific Trade Council shows that these expenses have impacted retail prices, with the average game cost rising to $30 in key markets. This escalation affects both creators and consumers, constraining growth in price-sensitive segments.

Asia Pacific Card and Board Games Market Future Outlook

Over the next five years, the Asia Pacific Card and Board Games market is anticipated to continue its growth trajectory. This expansion is expected to be driven by the increasing adoption of hybrid board games that combine physical and digital elements, the rising popularity of localized game content, and partnerships with pop culture franchises to attract younger demographics. Additionally, as e-commerce continues to gain traction, online platforms will likely play a crucial role in expanding market reach, particularly in emerging markets across Southeast Asia.

Market Opportunities

- Increasing Penetration in Emerging Markets (Tier-2 & Tier-3 Cities): Emerging markets in Asia-Pacific, particularly in India and Southeast Asia, show growing interest in board games. According to Indias National Statistical Office, there was a 35% increase in the availability of board games in Tier-2 and Tier-3 cities in 2024. Educational institutions and family associations in these regions are actively promoting such games for skill development and social interaction, representing a promising growth avenue.

- Collaboration with Educational Institutions (Educational Games): Collaborations with educational institutions provide growth potential, as over 50% of primary schools in Japan and South Korea introduced board games in classrooms in 2024. These games focus on cognitive and social skill development. The Ministry of Education in South Korea notes that over 5,000 schools now use board games as part of their curriculum, underlining the opportunity for educational game makers to penetrate this sector.

Scope of the Report

|

By Game Type |

Card Games Board Games Educational Games Strategy Games Fantasy Role-Playing Games |

|

By Distribution Channel |

Online Platforms Specialty Stores Mass Merchandisers Supermarkets & Hypermarkets Convenience Stores |

|

By Player Type |

Single-Player Multiplayer Team-Based |

|

By Age Group |

Kids (Under 12 Years) Teenagers (13-17 Years) Adults (18-35 Years) Older Adults (Above 35 Years) |

|

By Region |

China Japan South Korea Australia India |

Products

Key Target Audience

Manufacturers and Producers

Retailers and Wholesalers

Distributors

E-commerce Platforms

Marketing Agencies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Trade and Industry, Ministry of Culture)

International Board Game Conventions and Organizers

Companies

Players Mentioned in the Report:

Hasbro Inc.

Mattel Inc.

Asmodee Group

Ravensburger AG

Spin Master Corp.

Funskool Ltd.

Goliath Games

CMON Limited

IELLO Games

HABA

Table of Contents

1. Asia Pacific Card and Board Games Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Card and Board Games Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Card and Board Games Market Analysis

3.1. Growth Drivers

3.1.1. Digital Integration (Online Platforms, App-Based Gaming)

3.1.2. Cultural Revival (Regional Influence, Traditional Game Resurgence)

3.1.3. Social Interaction Demand (Family, Community Game Nights)

3.1.4. Innovative Game Mechanics (Role-Playing, Strategy-Based, Hybrid Formats)

3.2. Market Challenges

3.2.1. Piracy and Copyright Issues

3.2.2. High Production and Distribution Costs

3.2.3. Competitive Digital Alternatives (Video Games, Mobile Apps)

3.3. Opportunities

3.3.1. Increasing Penetration in Emerging Markets (Tier-2 & Tier-3 Cities)

3.3.2. Collaboration with Educational Institutions (Educational Games)

3.3.3. Partnerships with Entertainment Franchises (Movie & Series Tie-ins)

3.4. Trends

3.4.1. Subscription-Based Models

3.4.2. Eco-Friendly Materials

3.4.3. Limited-Edition and Collector's Sets

3.4.4. Augmented Reality (AR) & Virtual Reality (VR) Integration

3.5. Government and Regulatory Influences

3.5.1. Licensing Requirements

3.5.2. Intellectual Property Rights (IPR) Compliance

3.5.3. Safety and Age-Appropriate Content Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Asia Pacific Card and Board Games Market Segmentation

4.1. By Game Type (In Value %)

4.1.1. Card Games

4.1.2. Board Games

4.1.3. Educational Games

4.1.4. Strategy Games

4.1.5. Fantasy Role-Playing Games

4.2. By Distribution Channel (In Value %)

4.2.1. Online Platforms

4.2.2. Specialty Stores

4.2.3. Mass Merchandisers

4.2.4. Supermarkets & Hypermarkets

4.2.5. Convenience Stores

4.3. By Player Type (In Value %)

4.3.1. Single-Player

4.3.2. Multiplayer

4.3.3. Team-Based

4.4. By Age Group (In Value %)

4.4.1. Kids (Under 12 Years)

4.4.2. Teenagers (13-17 Years)

4.4.3. Adults (18-35 Years)

4.4.4. Older Adults (Above 35 Years)

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Australia

4.5.5. India

5. Asia Pacific Card and Board Games Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Hasbro Inc.

5.1.2. Mattel Inc.

5.1.3. Asmodee Group

5.1.4. Ravensburger AG

5.1.5. Funskool Ltd.

5.1.6. Goliath Games

5.1.7. Spin Master Corp.

5.1.8. Grand Prix International

5.1.9. CMON Limited

5.1.10. IELLO Games

5.1.11. HABA

5.1.12. The Walt Disney Company (Games Division)

5.1.13. Oriental Trading Company

5.1.14. WizKids Games

5.1.15. Plaid Hat Games

5.2. Cross Comparison Parameters (Revenue, Regional Market Presence, Game Portfolio Diversity, Brand Partnerships, Digital Integration Capabilities, Licensing Deals, Environmental Initiatives, Production Facilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Card and Board Games Market Regulatory Framework

6.1. Import-Export Restrictions

6.2. Product Safety and Age Restrictions

6.3. Certification Processes

7. Asia Pacific Card and Board Games Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Card and Board Games Future Market Segmentation

8.1. By Game Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Player Type (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Card and Board Games Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved constructing an ecosystem map for the Asia Pacific Card and Board Games Market. This included extensive desk research, drawing on primary and secondary sources to determine the significant variables influencing market trends.

Step 2: Market Analysis and Construction

The historical market data were assessed to construct a reliable forecast. This included evaluating distribution channels, popular game genres, and the impact of digital sales channels, which provided a comprehensive understanding of the current market structure.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding key growth drivers, consumer preferences, and dominant segments were tested through expert interviews with manufacturers, distributors, and regional market players. These interviews offered invaluable insights into market nuances and verified the collected data.

Step 4: Research Synthesis and Final Output

The final step included synthesizing research findings into a validated report, incorporating cross-sectional data from various market segments. By aligning with key players' strategies and considering consumer shifts, the report provides a well-rounded analysis of the market landscape.

Frequently Asked Questions

01. How big is the Asia Pacific Card and Board Games Market?

The Asia Pacific Card and Board Games market is valued at USD 11.5 billion, driven by the growth of social gaming experiences and the increased popularity of digital adaptations of traditional games.

02. What are the challenges in the Asia Pacific Card and Board Games Market?

Key challenges in the Asia Pacific Card and Board Games market include piracy and copyright infringement, high production costs, and competition from digital games, which can detract from physical game sales in the region.

03. Who are the major players in the Asia Pacific Card and Board Games Market?

Notable players in the Asia Pacific Card and Board Games market include Hasbro, Mattel, Asmodee Group, Ravensburger, and Spin Master, all of which have significant market presence due to their diverse product ranges and established distribution networks.

04. What are the growth drivers of the Asia Pacific Card and Board Games Market?

Growth drivers in Asia Pacific Card and Board Games market include the rising disposable income across Asia, the cultural preference for interactive games, and the proliferation of online sales channels that offer a wide variety of gaming options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.