Asia Pacific CBD Pouches Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD7983

December 2024

90

About the Report

Asia Pacific CBD Pouches Market Overview

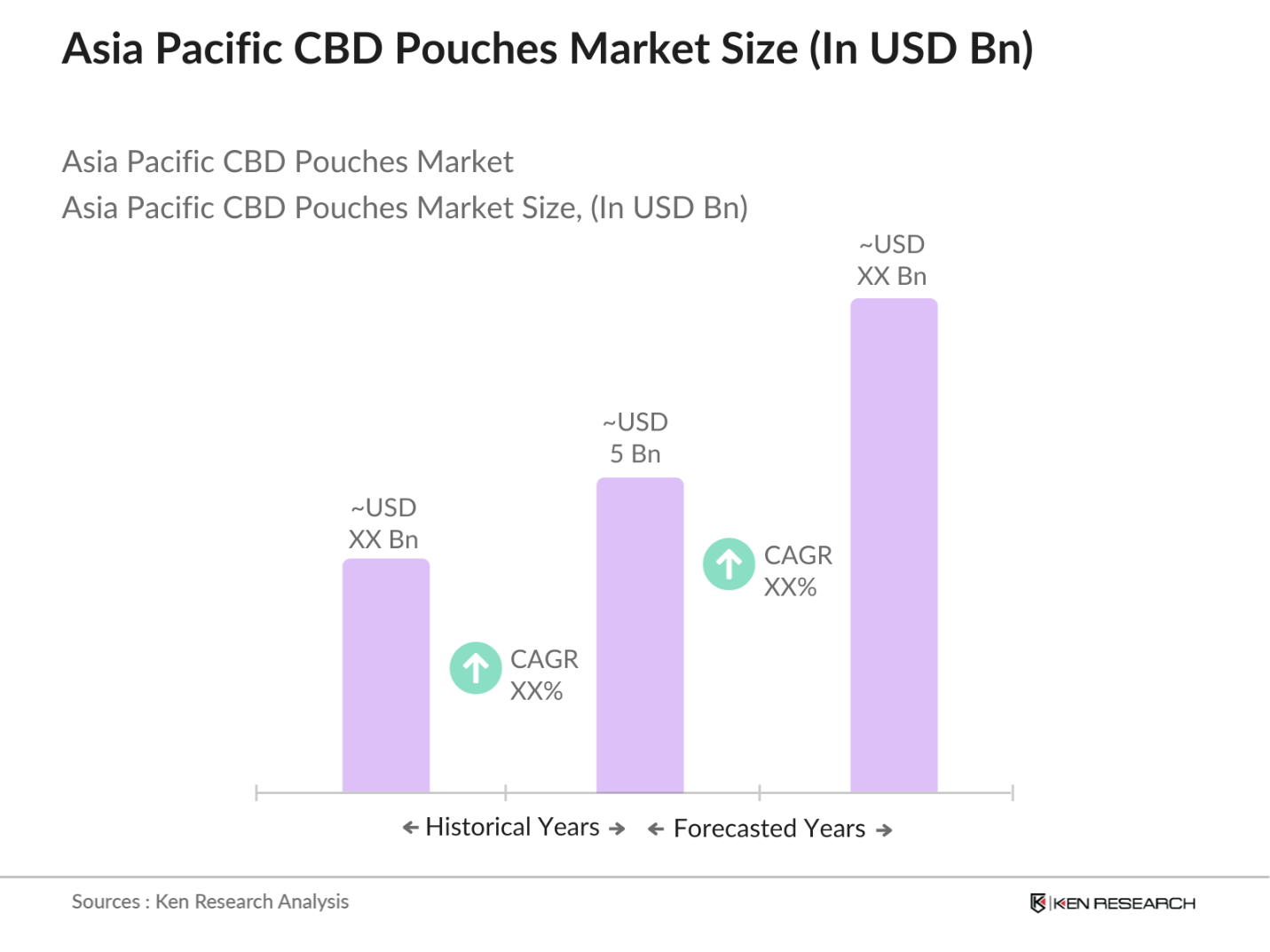

- The Asia Pacific CBD pouches market is valued at approximately USD 5 billion, driven by rising consumer interest in health and wellness products. With growing awareness about the benefits of CBD, the demand for alternative methods of consumption, such as CBD pouches, is increasing significantly. The market's expansion is supported by regulatory reforms in countries such as Australia and New Zealand, which are gradually legalizing the sale of cannabis-derived products for therapeutic use.

- Key markets in the Asia Pacific region, including Australia and Japan, are leading due to progressive regulatory frameworks and a strong base of health-conscious consumers. Australia, in particular, is emerging as a hub for CBD innovation, driven by investments in research and development and a robust demand for wellness products. Meanwhile, Japan is a critical player due to its growing interest in alternative medicine and strong purchasing power among consumers.

- With the growing demand for more effective CBD products, bioavailability-enhancing technologies like water-soluble CBD and nano-emulsification are becoming popular. Companies in South Korea and Japan are focusing on improving product efficacy, supported by government grants for CBD research. In 2024, South Korea allocated $20 million toward CBD product development, targeting innovations that improve absorption rates. This shift towards advanced formulations is expected to create a competitive advantage for brands offering scientifically superior products.

Asia Pacific CBD Pouches Market Segmentation

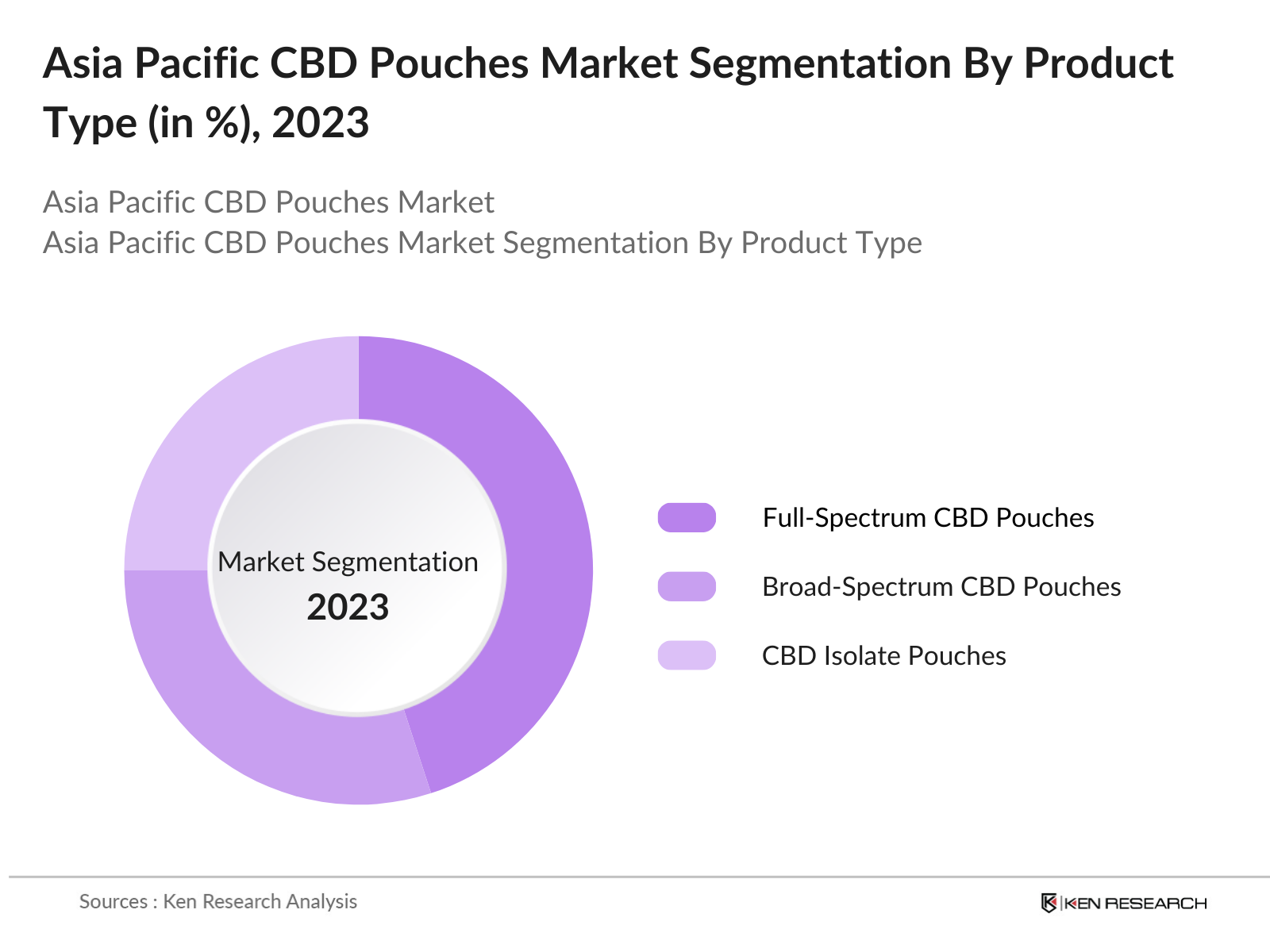

By Product Type: The Asia Pacific CBD pouches market is segmented by product type into full-spectrum CBD pouches, broad-spectrum CBD pouches, and CBD isolate pouches.

Recently, full-spectrum CBD pouches have captured a dominant market share due to their perceived therapeutic efficacy. Full-spectrum pouches contain a broader range of cannabinoids and terpenes, enhancing their overall effectiveness, also known as the "entourage effect." Consumers in markets such as Australia and South Korea are increasingly drawn to these products for their comprehensive health benefits, further bolstering the segment's growth.

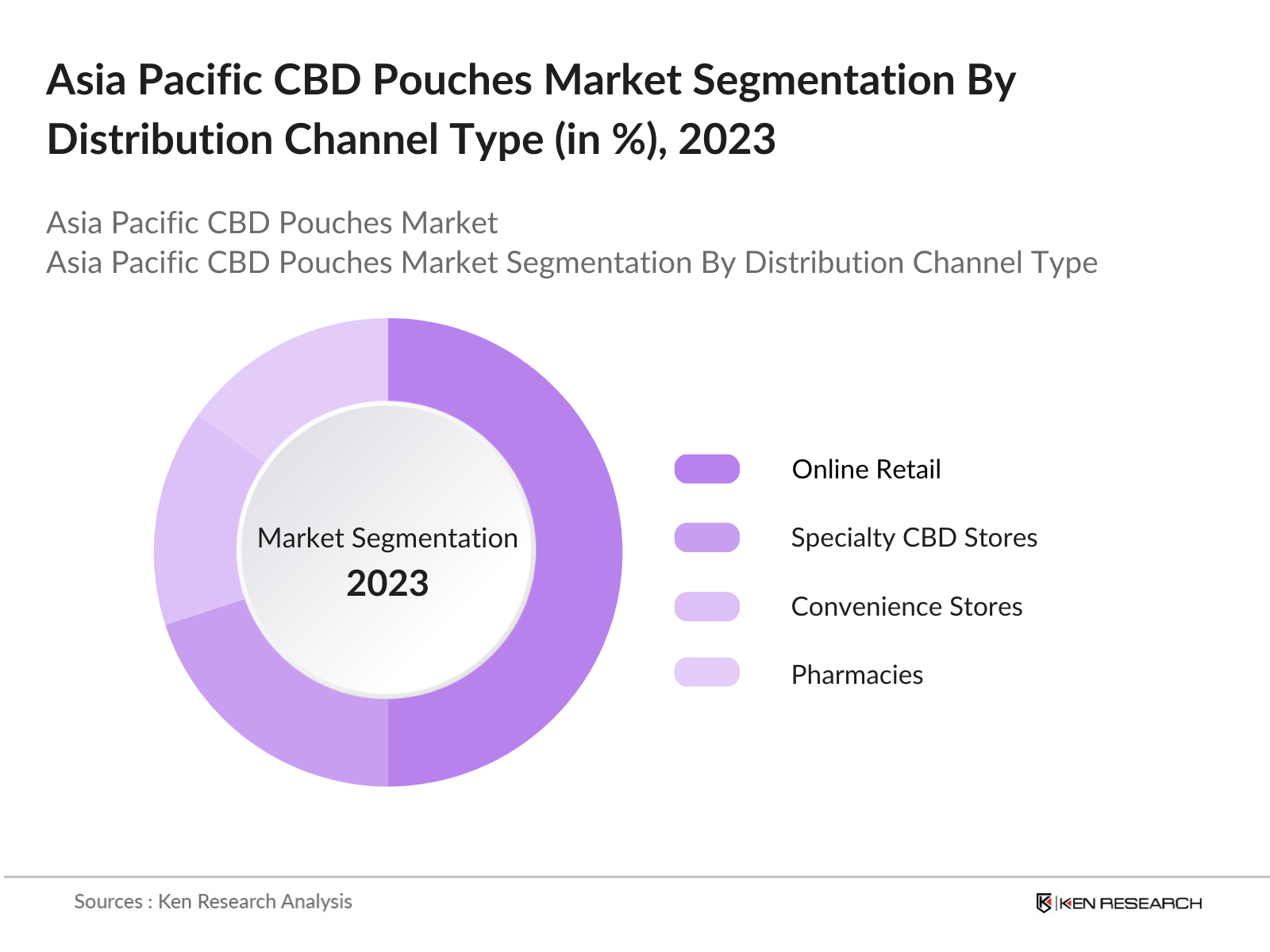

By Distribution Channel: The market is also segmented by distribution channel into online retail, specialty CBD stores, convenience stores, and pharmacies.Online retail channels dominate the market, with a market share of 50% in 2023, driven by the increasing popularity of e-commerce platforms and consumer demand for discreet purchasing options. This trend is particularly evident in countries like Japan and South Korea, where digital shopping is well-established, and consumers seek access to a wide variety of CBD pouch brands and formulations online.

Asia Pacific CBD Pouches Market Competitive Landscape

The Asia Pacific CBD pouches market is characterized by a mix of international and local players, with a few key companies dominating the competitive landscape. The competition is driven by product differentiation, branding, and compliance with regional regulations. The Asia Pacific CBD pouches market is highly competitive, with a few dominant players such as Altria Group, British American Tobacco, and Canopy Growth Corporation leading the market. These companies have an edge due to their established distribution networks and product innovation capabilities.

|

Company Name |

Establishment Year |

Headquarters |

CBD Product Range |

Regional Presence |

Revenue (USD Mn) |

Strategic Partnerships |

Hemp Source (Domestic/Imported) |

|

Altria Group, Inc. |

1985 |

Virginia, USA |

_ |

_ |

_ |

_ |

_ |

|

British American Tobacco |

1902 |

London, UK |

_ |

_ |

_ |

_ |

_ |

|

Canopy Growth Corporation |

2013 |

Ontario, Canada |

_ |

_ |

_ |

_ |

_ |

|

Curaleaf Holdings, Inc. |

2010 |

Massachusetts, USA |

_ |

_ |

_ |

_ |

_ |

|

Cronos Group Inc. |

2012 |

Toronto, Canada |

_ |

_ |

_ |

_ |

_ |

Asia Pacific CBD Pouches Industry Analysis

Growth Drivers

- Regulatory Reforms Supporting CBD Usage: The Asia Pacific region is experiencing a significant shift in regulatory frameworks concerning CBD products. Countries like Thailand have legalized medical cannabis use, which has opened avenues for CBD pouches to enter the market. This is reinforced by macroeconomic data showing Thailands GDP growth of 2.8% in 2024, indicating a conducive environment for new product categories. Additionally, the expanding middle class in Southeast Asia, with over 150 million people entering this income bracket between 2022-2025, provides a lucrative customer base for CBD products.

- Growing Consumer Awareness Regarding CBD Health Benefits: Consumer awareness of CBD's potential health benefits is growing due to increased education campaigns and scientific publications. For instance, South Korea's wellness industry, valued at $100 billion in 2024, has started embracing CBD products in holistic health regimes. Rising disposable incomes across Asia Pacific, such as an annual increase of $1,500 in household income in urban China, further fuel the demand for non-traditional health solutions like CBD pouches. This growing awareness creates a favorable environment for CBD products to flourish.

- Expansion of Legalized Markets for Cannabis-Derived Products: In 2024, Japan and South Korea have started exploring CBD use for medical purposes, while Australia has fully legalized CBD for over-the-counter sale. In Australia, more than 1.1 million consumers are projected to be using medicinal cannabis by the end of 2024. This expanding legal framework across key markets is expected to boost the availability and accessibility of CBD pouches, supporting broader product adoption across the region. Regulatory changes are set to further accelerate market penetration as consumer markets open up.

Market Challenges

- Regulatory Uncertainty in Key Markets: Despite progress, regulatory uncertainty remains a major obstacle in the Asia Pacific CBD pouches market. For example, in 2024, countries like Indonesia and India still maintain strict regulations against CBD usage, limiting market expansion. The absence of a uniform regional policy framework makes it difficult for producers to scale operations efficiently. This is especially challenging in markets where the legal status of CBD is under review, causing disruption in supply chains and consumer outreach.

- Misconceptions About CBD Products: Widespread misconceptions regarding the psychoactive properties of CBD continue to challenge market growth. For instance, a 2023 survey in Japan found that 40% of respondents still associate CBD with marijuanas intoxicating effects. This lack of consumer knowledge creates hurdles in expanding the market, even as scientific evidence grows to support the health benefits of CBD. Efforts to educate the public and dispel these misconceptions will be essential to overcoming resistance in more conservative markets.

Asia Pacific CBD Pouches Market Future Outlook

Over the next five years, the Asia Pacific CBD pouches market is expected to witness significant growth driven by several key factors. Regulatory changes across countries such as Australia, New Zealand, and Thailand are expected to expand the legal use of CBD products, which will provide a conducive environment for market growth. Additionally, growing consumer demand for wellness products, coupled with increasing research on the health benefits of CBD, will likely drive further expansion. As more consumers shift toward smoke-free CBD options, pouches will continue to gain traction.

Opportunities

- Increasing Adoption of CBD in Wellness and Cosmetics: CBDs integration into wellness and cosmetic products is gaining momentum across Asia Pacific. For instance, South Koreas cosmetic industry, valued at $45 billion in 2024, is increasingly adopting CBD-infused products for skincare routines. The wellness market in Thailand and Japan is also embracing CBD for stress relief and anti-aging treatments. This growing adoption provides a significant opportunity for CBD pouch producers to diversify into related sectors, tapping into a broader consumer base seeking holistic health solutions.

- Investment in Sustainable and Organic Hemp Production: Sustainability is becoming a key driver of growth in the Asia Pacific CBD market. Investment in organic hemp farming is expanding, with countries like Australia and Thailand leading the way in sustainable cultivation. In 2024, Australia's government announced $50 million in grants to support eco-friendly hemp farming practices. Such investments are likely to reduce supply chain inefficiencies while promoting environmentally sustainable production methods, which align with consumer demand for ethically sourced products.

Scope of the Report

|

Product Type |

Full-Spectrum CBD Pouches |

|

Broad-Spectrum CBD Pouches |

|

|

CBD Isolate Pouches |

|

|

Flavor Type |

Mint Citrus Berry Unflavored |

|

Distribution Channel |

Online Retail |

|

Specialty CBD Stores |

|

|

Convenience Stores |

|

|

Pharmacies |

|

|

Application |

Wellness and Lifestyle Pain Management Anxiety and Stress Relief Sleep Support |

|

Region |

Australia Japan South Korea China Rest of Asia Pacific |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

CBD Product Manufacturing Companies

Wellness and Health Brand Companies

Government and Regulatory Bodies (e.g., TGA - Therapeutic Goods Administration, Australian Government Department of Health)

Investors and Venture Capitalist Firms

E-commerce Platform Companies

Medical and Pharmaceutical Companies

Organic and Natural Product Companies

Companies

Players Mentioned in the Report

Altria Group, Inc.

British American Tobacco

Canopy Growth Corporation

Curaleaf Holdings, Inc.

Cronos Group Inc.

KushCo Holdings, Inc.

Aurora Cannabis Inc.

Organigram Holdings Inc.

Tilray, Inc.

Aphria Inc.

Table of Contents

1. Asia Pacific CBD Pouches Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific CBD Pouches Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific CBD Pouches Market Analysis

3.1. Growth Drivers

3.1.1. Regulatory Reforms Supporting CBD Usage

3.1.2. Growing Consumer Awareness Regarding CBD Health Benefits

3.1.3. Expansion of Legalized Markets for Cannabis-Derived Products

3.1.4. Rising Demand for Non-Smokable CBD Products

3.2. Market Challenges

3.2.1. Regulatory Uncertainty in Key Markets

3.2.2. Misconceptions About CBD Products

3.2.3. Limited Clinical Research on Long-Term Benefits

3.2.4. Supply Chain and Sourcing Challenges

3.3. Opportunities

3.3.1. Increasing Adoption of CBD in Wellness and Cosmetics

3.3.2. Investment in Sustainable and Organic Hemp Production

3.3.3. Rising Popularity of CBD Pouches in Sports and Fitness

3.3.4. Innovations in CBD Product Formulation and Delivery Systems

3.4. Trends

3.4.1. Shift Towards Bioavailability-Enhancing Formulations

3.4.2. Growth of Online and Direct-to-Consumer (D2C) Sales Channels

3.4.3. Increased Collaboration Between CBD Producers and Tobacco Companies

3.4.4. Focus on Product Differentiation and Flavors

3.5. Government Regulations

3.5.1. Legalization Status Across Asia Pacific Countries

3.5.2. Import and Export Regulations for Hemp and CBD Products

3.5.3. Labeling and Marketing Compliance Requirements

3.5.4. Restrictions on CBD Dosage and Composition

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Asia Pacific CBD Pouches Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Full-Spectrum CBD Pouches

4.1.2. Broad-Spectrum CBD Pouches

4.1.3. CBD Isolate Pouches

4.2. By Flavor Type (In Value %)

4.2.1. Mint

4.2.2. Citrus

4.2.3. Berry

4.2.4. Unflavored

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retail

4.3.2. Specialty CBD Stores

4.3.3. Convenience Stores

4.3.4. Pharmacies

4.4. By Application (In Value %)

4.4.1. Wellness and Lifestyle

4.4.2. Pain Management

4.4.3. Anxiety and Stress Relief

4.4.4. Sleep Support

4.5. By Region (In Value %)

4.5.1. Australia

4.5.2. Japan

4.5.3. South Korea

4.5.4. China

4.5.5. Rest of Asia Pacific

5. Asia Pacific CBD Pouches Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Altria Group, Inc.

5.1.2. British American Tobacco

5.1.3. Canopy Growth Corporation

5.1.4. Cronos Group Inc.

5.1.5. Curaleaf Holdings, Inc.

5.1.6. Imperial Brands

5.1.7. KushCo Holdings, Inc.

5.1.8. Aurora Cannabis Inc.

5.1.9. Organigram Holdings Inc.

5.1.10. Tilray, Inc.

5.1.11. Aphria Inc.

5.1.12. Charlottes Web Holdings, Inc.

5.1.13. Medterra

5.1.14. Green Roads

5.1.15. Endoca

5.2 Cross Comparison Parameters (Revenue, Market Presence, Product Range, Production Capacity, CBD Source, Legal Status, Strategic Partnerships, R&D Investment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Private Equity Investments

6. Asia Pacific CBD Pouches Market Regulatory Framework

6.1. Legalization Policies in the Asia Pacific Region

6.2. Compliance Requirements and Product Approval

6.3. Certification Processes for CBD Products

7. Asia Pacific CBD Pouches Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific CBD Pouches Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Flavor Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific CBD Pouches Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step focuses on creating an ecosystem map of key stakeholders in the Asia Pacific CBD Pouches Market. Comprehensive desk research using secondary and proprietary databases helps identify critical variables influencing market dynamics such as regulatory frameworks, consumer preferences, and competitive forces.

Step 2: Market Analysis and Construction

This phase involves a thorough analysis of historical market data to assess market penetration rates, product availability, and revenue generation. Market share data is then compiled and evaluated to create an accurate depiction of the market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested and validated through consultations with industry experts, including CBD product manufacturers and regulatory authorities. These discussions offer practical insights that help to refine the market projections and validate our data.

Step 4: Research Synthesis and Final Output

In this final phase, data collected from primary research is corroborated with secondary sources to ensure consistency and reliability. The final report is then synthesized, incorporating expert opinions and validated data to provide an in-depth analysis of the market.

Frequently Asked Questions

01. How big is the Asia Pacific CBD Pouches Market?

The Asia Pacific CBD pouches market is valued at approximately USD 5 billion, with rising demand driven by consumer interest in health and wellness products.

02. What are the key challenges in the Asia Pacific CBD Pouches Market?

The market faces regulatory challenges, particularly regarding the legalization and sale of CBD products in certain countries, as well as issues related to supply chain management and quality control.

03. Who are the major players in the Asia Pacific CBD Pouches Market?

Key players include Altria Group, British American Tobacco, Canopy Growth Corporation, Curaleaf Holdings, and Cronos Group, each of which benefits from strong brand recognition and distribution networks.

04. What are the growth drivers in the Asia Pacific CBD Pouches Market?

The market is primarily driven by consumer interest in non-smokable forms of CBD, regulatory reforms, and increasing awareness about the therapeutic benefits of CBD.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.