Asia-Pacific Chemical Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD10143

November 2024

100

About the Report

Asia-Pacific Chemical Market Overview

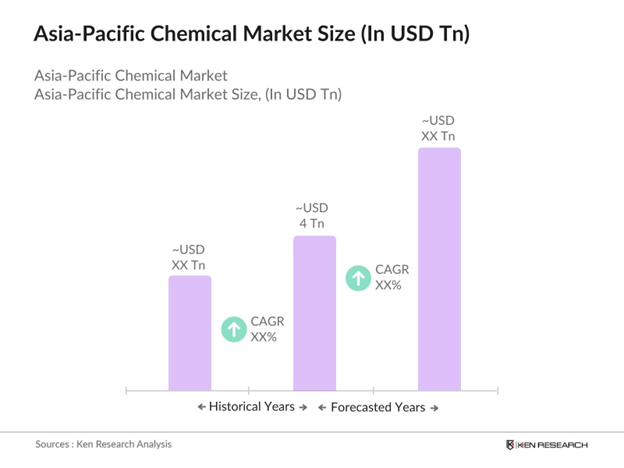

- Asia-Pacific chemical market is valued at USD 4 trillion in 2023, driven by rapid industrialization, rising consumer demand, and government incentives promoting sustainable chemical production. The region's strong infrastructure for production and the increasing focus on specialty chemicals for diverse industrial applications further enhance market growth. The integration of advanced technologies like artificial intelligence and IoT in production processes has also contributed significantly to the sector's dynamism.

- China, India, and Japan dominate the Asia-Pacific chemical market due to their well-established production capacities, abundant raw material availability, and large domestic consumption. China's dominance is bolstered by its vast industrial base and strategic investments in R&D. Indias rapid industrial growth and demand for specialty chemicals position it as a key player, while Japans innovation-driven chemical industry ensures its competitiveness.

- Governments in the Asia-Pacific region have enforced stringent environmental protection laws to mitigate the ecological impact of chemical manufacturing. In 2023, China launched the "Zero Pollution Action Plan," mandating a 10% reduction in industrial emissions, including those from chemical plants. Japan also introduced tighter regulations on hazardous waste disposal, requiring companies to invest in cleaner technologies. These laws have resulted in an estimated $3 billion investment in sustainable infrastructure by chemical companies in the region.

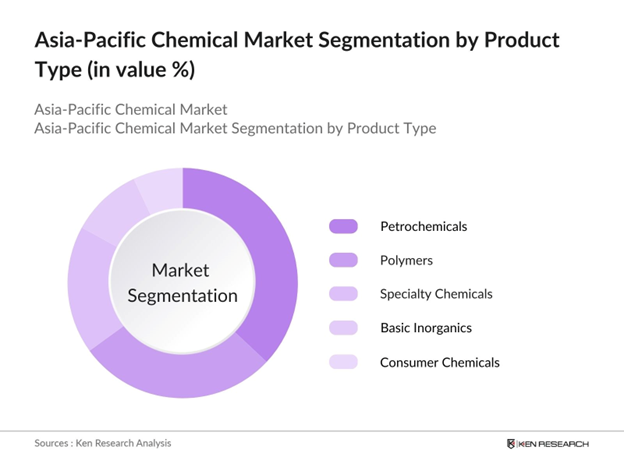

Asia-Pacific Chemical Market Segmentation

By Product Type: The Asia-Pacific chemical market is segmented by product type into petrochemicals, polymers, specialty chemicals, basic inorganics, and consumer chemicals. Among these, petrochemicals hold a dominant market share in the region. This is primarily due to their extensive application across industries such as automotive, packaging, and construction, along with significant investments in refining and chemical integration in countries like China and South Korea.

By Application: The market is segmented by application into agriculture, automotive, construction, electronics, and healthcare. The construction segment dominates due to the region's rapid urbanization and infrastructure development projects, particularly in India and Southeast Asia. Chemicals such as adhesives, sealants, and coatings are critical in construction processes, driving demand in this segment.

Asia-Pacific Chemical Market Competitive Landscape

The Asia-Pacific chemical market is dominated by a few major players, including BASF SE, Mitsubishi Chemical Holdings Corporation, and Reliance Industries Ltd. These companies leverage their extensive production capabilities, advanced R&D initiatives, and strong regional presence to maintain competitive advantage.

Asia-Pacific Chemical Market Analysis

Growth Drivers

- Rapid Industrialization: The Asia-Pacific region has experienced significant industrial growth, with manufacturing output reaching $12.5 trillion in 2023, accounting for 45% of global manufacturing value-added. This surge is driven by countries like China and India, which have expanded their industrial bases to meet both domestic and international demand. For instance, China's industrial production increased by 6.3% in the first half of 2023, contributing to the region's robust manufacturing sector.

- Urbanization Trends: Urbanization in the Asia-Pacific region has accelerated, with an estimated 2.3 billion people residing in urban areas by 2023. This urban growth has led to increased demand for infrastructure, housing, and consumer goods, thereby boosting the chemical industry's production of construction materials, plastics, and consumer chemicals. For example, India's urban population grew by 34 million between 2020 and 2023, driving up the need for chemical products in construction and consumer markets.

- Government Policies and Incentives: Governments across the Asia-Pacific region have implemented policies to support industrial growth. In 2023, China announced a $1.5 trillion investment plan to modernize its manufacturing sector, including the chemical industry. Similarly, India's Production Linked Incentive (PLI) scheme allocated $2 billion to the chemical sector to enhance domestic production and reduce import dependence. These initiatives aim to strengthen the chemical industry's competitiveness and capacity.

Challenges

- Environmental Regulations: Stringent environmental regulations have posed challenges for the chemical industry in the Asia-Pacific region. In 2023, countries like South Korea and Japan implemented stricter emission standards, requiring chemical manufacturers to invest in cleaner technologies. Compliance costs have increased, with South Korean chemical companies spending an estimated $1.2 billion on environmental upgrades in 2023 to meet new regulatory requirements.

- Fluctuating Raw Material Prices: The chemical industry has faced volatility in raw material prices. In 2023, the price of crude oil, a key feedstock, fluctuated between $70 and $90 per barrel, impacting production costs. For example, the cost of naphtha, a primary input for petrochemicals, increased by 15% in the first quarter of 2023, leading to higher expenses for chemical manufacturers in the region.

Asia-Pacific Chemical Market Future Outlook

Over the next five years, the Asia-Pacific chemical market is expected to witness robust growth due to increasing demand for specialty and green chemicals, coupled with technological advancements and sustainable manufacturing practices. The region's large-scale urbanization, along with investments in research and innovation, will continue to drive growth.

Market Opportunities

- Expansion into Emerging Markets: Emerging markets in Southeast Asia present significant growth opportunities for the chemical industry. In 2023, Vietnam's chemical imports increased by 12%, indicating a growing demand for chemical products. Similarly, Indonesia's chemical market expanded, with imports reaching $15 billion, driven by the automotive and construction sectors. These markets offer avenues for chemical companies to expand their footprint and cater to rising industrial needs.

- Green and Sustainable Chemistry: The shift towards sustainability has opened new avenues in green chemistry. In 2023, the Asia-Pacific region saw a 20% increase in the production of bio-based chemicals, reflecting a move towards environmentally friendly products. For instance, Malaysia invested $300 million in bio-refineries to produce sustainable chemicals from palm oil residues, aligning with global sustainability goals and catering to eco-conscious consumers.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Petrochemicals |

|

By Application |

Agriculture |

|

By End-User Industry |

Manufacturing |

|

By Country |

China |

Products

Key Target Audience

Chemical Manufacturing Companies

Raw Material Suppliers

End-User Industries (Automotive, Construction, etc.)

Exporters and Importers of Chemicals

Specialty Chemical Distributors

Industry-Specific R&D Organizations

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology, Environmental Protection Agencies)

Companies

Players Mentioned in the Report

BASF SE

Mitsubishi Chemical Holdings Corporation

Reliance Industries Ltd.

LG Chem Ltd.

SABIC

Toray Industries, Inc.

PTT Global Chemical Public Company Limited

China Petroleum & Chemical Corporation (Sinopec)

Formosa Plastics Corporation

Sumitomo Chemical Co., Ltd.

Table of Contents

1. Asia-Pacific Chemical Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia-Pacific Chemical Market Size (In USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia-Pacific Chemical Market Analysis

3.1. Growth Drivers

3.1.1. Rapid Industrialization

3.1.2. Urbanization Trends

3.1.3. Government Policies and Incentives

3.1.4. Technological Advancements

3.2. Market Challenges

3.2.1. Environmental Regulations

3.2.2. Fluctuating Raw Material Prices

3.2.3. Trade Tariffs and Barriers

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Green and Sustainable Chemistry

3.3.3. Digital Transformation in Manufacturing

3.4. Trends

3.4.1. Shift Towards Specialty Chemicals

3.4.2. Integration of Circular Economy Practices

3.4.3. Increased Mergers and Acquisitions

3.5. Government Regulations

3.5.1. Environmental Protection Laws

3.5.2. Safety Standards and Compliance

3.5.3. Trade Agreements and Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter's Five Forces Analysis

3.9. Competitive Landscape

4. Asia-Pacific Chemical Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Petrochemicals

4.1.2. Basic Inorganics

4.1.3. Polymers

4.1.4. Specialty Chemicals

4.1.5. Consumer Chemicals

4.2. By Application (In Value %)

4.2.1. Agriculture

4.2.2. Automotive

4.2.3. Construction

4.2.4. Electronics

4.2.5. Healthcare

4.3. By End-User Industry (In Value %)

4.3.1. Manufacturing

4.3.2. Pharmaceuticals

4.3.3. Food and Beverage

4.3.4. Textiles

4.3.5. Energy

4.4. By Country (In Value %)

4.4.1. China

4.4.2. India

4.4.3. Japan

4.4.4. South Korea

4.4.5. Rest of Asia-Pacific

5. Asia-Pacific Chemical Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. China Petroleum & Chemical Corporation (Sinopec)

5.1.3. Mitsubishi Chemical Holdings Corporation

5.1.4. Sumitomo Chemical Co., Ltd.

5.1.5. LG Chem Ltd.

5.1.6. Reliance Industries Ltd.

5.1.7. Formosa Plastics Corporation

5.1.8. PTT Global Chemical Public Company Limited

5.1.9. Toray Industries, Inc.

5.1.10. SABIC

5.2. Cross Comparison Parameters

(Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, R&D Expenditure, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Asia-Pacific Chemical Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia-Pacific Chemical Market Future Size (In USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia-Pacific Chemical Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Country (In Value %)

9. Asia-Pacific Chemical Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research began by mapping the ecosystem of the Asia-Pacific chemical market, identifying major stakeholders, market drivers, and trends. Primary and secondary data sources, including company annual reports and government publications, were reviewed to define key variables.

Step 2: Market Analysis and Construction

Historical data on market dynamics were analyzed to identify trends and growth patterns. This phase also involved studying the relationship between market drivers like industrialization and demand for end-user applications.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through structured interviews with industry experts and representatives from leading chemical companies. Insights on operational efficiency, supply chain challenges, and innovation trends were gathered

Step 4: Research Synthesis and Final Output

The final analysis integrated insights from both bottom-up and top-down approaches, ensuring a holistic view of the market. This phase also included validation of data through triangulation techniques.

Frequently Asked Questions

01. How big is the Asia-Pacific Chemical Market?

The Asia-Pacific chemical market is valued at USD 4 trillion in 2023, driven by industrialization and demand for specialty chemicals.

02. What are the challenges in the Asia-Pacific Chemical Market?

Challenges in Asia-Pacific chemical market include stringent environmental regulations, fluctuating raw material prices, and trade barriers affecting profitability. Stringent environmental regulations have posed challenges for the chemical industry in the Asia-Pacific region

03. Who are the major players in the Asia-Pacific Chemical Market?

Key players in Asia-Pacific chemical market include BASF SE, Mitsubishi Chemical Holdings Corporation, Reliance Industries Ltd., and SABIC, known for their extensive production capacities and technological advancements.

04. What are the growth drivers of the Asia-Pacific Chemical Market?

Growth in Asia-Pacific chemical market is fueled by rapid urbanization, advancements in specialty chemicals, and integration of sustainable manufacturing processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.