Asia Pacific chemical vapor deposition Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD5577

October 2024

84

About the Report

Asia Pacific chemical vapor deposition Market Overview

- The Asia Pacific Chemical Vapor Deposition (CVD) market is valued at USD 11.5 billionbased on a five-year historical analysis, driven primarily by the semiconductor and electronics industries. The robust demand for high-performance electronic components, especially in countries like China and South Korea, fuels the market. Additionally, the growing adoption of CVD technology for thin-film coatings in solar cells and medical devices further boosts market growth, as manufacturers seek more efficient and scalable solutions.

- China and South Korea are the dominant players in the Asia Pacific CVD market due to their established semiconductor manufacturing infrastructure. Chinas extensive investments in semiconductor fabrication and South Koreas strong electronics sector, driven by leading firms like Samsung and SK Hynix, have solidified their dominance. These countries benefit from government support and a skilled workforce, which allows for innovation and development in CVD technologies.

- Semiconductor manufacturing is highly regulated in the Asia Pacific, particularly in South Korea and Japan. In 2023, South Koreas government provided tax incentives worth USD 8 billion to semiconductor manufacturers to encourage investments in advanced fabrication techniques like CVD. Japan introduced new standards for semiconductor cleanliness in 2023, requiring manufacturers to adopt more efficient CVD processes to meet strict particle contamination levels.

Asia Pacific chemical vapor deposition Market Segmentation

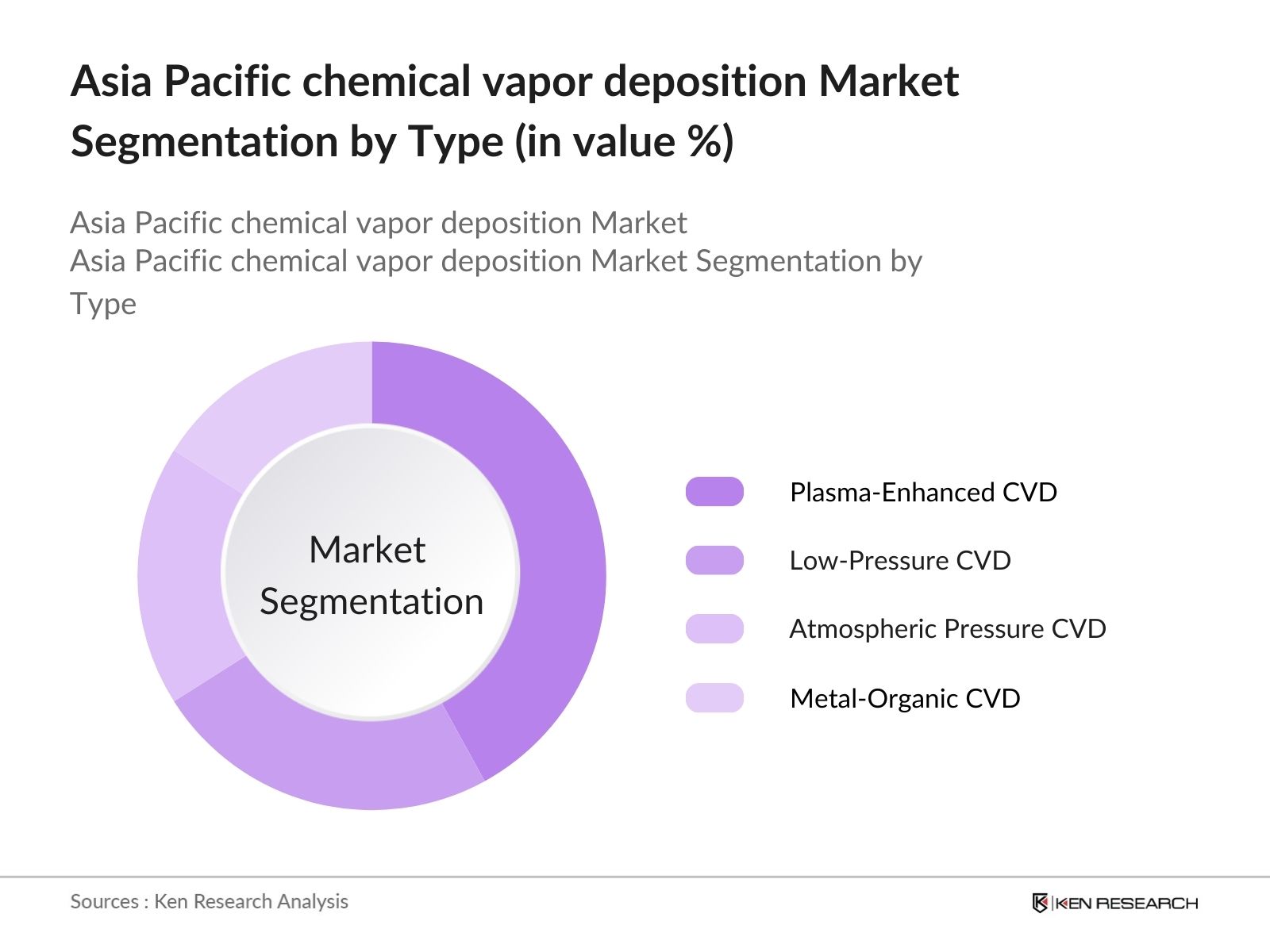

- By Type: The Asia Pacific CVD market is segmented by type into Atmospheric Pressure CVD (APCVD), Low-Pressure CVD (LPCVD), Plasma-Enhanced CVD (PECVD), and Metal-Organic CVD (MOCVD). Plasma-Enhanced CVD (PECVD) holds a dominant market share in 2023, accounting for 42% of the total market. The growing use of PECVD in semiconductor fabrication, owing to its ability to deposit high-quality thin films at lower temperatures, has made it the preferred technology for manufacturers. PECVD is also favored for its applications in solar cells and LEDs, where precise control over film thickness and material properties is critical.

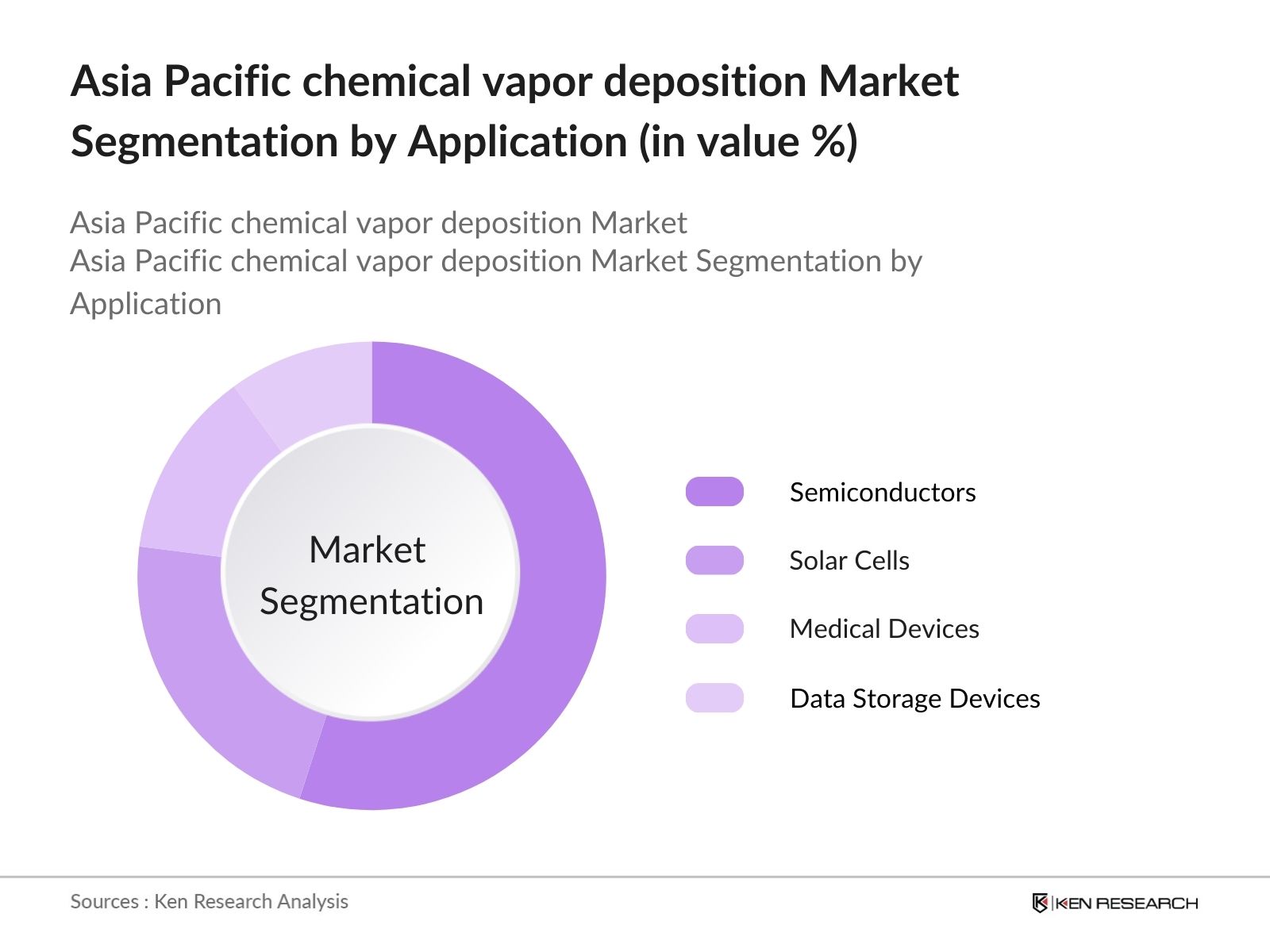

- By Application: The CVD market is segmented by application into semiconductors, solar cells, medical devices, and data storage devices. Semiconductors are the largest application segment, holding around 55% of the market share in 2023. This dominance is driven by the exponential growth in demand for consumer electronics, 5G technology, and the Internet of Things (IoT). Semiconductor manufacturers rely heavily on CVD processes to create advanced microchips and integrated circuits that are smaller, faster, and more energy-efficient, further fueling the need for CVD technology.

Asia Pacific chemical vapor deposition Market Competitive Landscape

The Asia Pacific CVD market is dominated by a few major players, including large multinational corporations and local manufacturers with a focus on innovation and strategic partnerships. These key players leverage advanced R&D capabilities, mergers, and acquisitions to maintain their competitive edge.

|

Company |

Established Year |

Headquarters |

Revenue (2023) |

Employees |

R&D Expenditure |

Product Portfolio |

Recent Developments |

Market Presence |

|

Applied Materials, Inc. |

1967 |

Santa Clara, USA |

||||||

|

ASM International N.V. |

1968 |

Almere, Netherlands |

||||||

|

Tokyo Electron Limited |

1963 |

Tokyo, Japan |

||||||

|

Lam Research Corporation |

1980 |

Fremont, USA |

||||||

|

Veeco Instruments Inc. |

1945 |

Plainview, USA |

Asia Pacific chemical vapor deposition Industry Analysis

Growth Drivers

- Semiconductor Manufacturing Expansion: The semiconductor manufacturing industry in the Asia Pacific region has seen a significant boost, driven by rising demand from industries such as automotive and consumer electronics. In 2023, countries like Taiwan and South Korea are leading the global semiconductor production, with Taiwan producing nearly 65% of the world's chips. South Korea remains a major player, with semiconductor exports worth USD 99 billion in 2023, as reported by the Korea International Trade Association. This expansion is creating a direct demand for Chemical Vapor Deposition (CVD) systems, used in the production of thin films essential in semiconductors.

- Growing Demand in Solar PV Applications: Solar power generation is expanding rapidly across the Asia Pacific region, with China at the forefront. In 2023, China added over 98 GW of new solar capacity, which requires advanced thin-film technologies facilitated by CVD processes. India is also ramping up its solar photovoltaic (PV) installations, targeting an additional 30 GW of capacity by 2024, according to the Ministry of New and Renewable Energy (MNRE). This surge in solar PV installations demands high-quality coatings enabled by CVD, especially in regions like China and India that are emphasizing clean energy initiatives.

- Advancements in Thin-Film Coatings: The thin-film coating market, integral to the CVD process, is advancing with increased applications in electronics, optics, and protective layers. In 2024, South Korea and Japan have been pioneering advancements in this field, specifically for OLED displays and semiconductor devices. Japan alone invested over USD 2.5 billion in thin-film R&D in 2023, as per the Ministry of Economy, Trade, and Industry (METI). The continuous development in thin-film technology is enhancing the precision and performance of CVD applications, making it a pivotal factor for growth in the Asia Pacific.

Market Restraints

- Complex Process Control and Monitoring: The precision required in CVD processes adds to operational complexity. Monitoring parameters such as temperature and gas flow in a CVD system is critical, and any deviations can lead to significant product defects. According to data from the Japan Semiconductor Manufacturing Association, error rates in CVD processing can lead to losses of USD 500,000 annually per facility, affecting the profitability of manufacturers. This challenge is magnified in countries like Vietnam and Indonesia, where technical expertise in semiconductor manufacturing is still developing.

- Environmental and Regulatory Pressures: Stringent environmental regulations in the Asia Pacific are putting pressure on manufacturers using CVD technologies. The use of hazardous gases such as silane and ammonia in CVD processes is under increasing scrutiny, particularly in South Korea, which introduced stricter emissions standards in 2023. Penalties for non-compliance with these regulations can reach up to USD 1 million, according to the South Korean Ministry of Environment. These regulatory hurdles make it more difficult for smaller players to compete, thus stalling market growth.

Asia Pacific chemical vapor deposition Market Future Outlook

Over the next five years, the Asia Pacific Chemical Vapor Deposition market is expected to experience robust growth, fueled by the rapid expansion of the semiconductor industry, advancements in renewable energy technologies such as solar PV cells, and the increasing use of CVD in medical applications. The ongoing transition toward electric vehicles and 5G technologies will also drive the demand for more sophisticated electronic components, further boosting the CVD market.

Market Opportunities

- Rising Demand for Nano-Technology Applications: The rise of nanotechnology in the Asia Pacific is offering substantial opportunities for CVD applications. In 2023, the Japanese government invested over USD 3 billion in nanotechnology R&D, positioning the country as a leader in this sector. CVD is crucial in the production of nanoscale coatings used in electronics and biomedical devices. With Taiwan and South Korea making strides in nanomaterial development, the region is set to lead in advanced material manufacturing, offering a lucrative

- Growth in Automotive Electronics: The automotive industry in the Asia Pacific is shifting towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which rely heavily on semiconductor components manufactured using CVD processes. China, the worlds largest EV market, sold over 6 million EVs in 2023, according to the China Association of Automobile Manufacturers. With countries like South Korea and Japan also pushing for EV adoption, demand for CVD equipment in the production of electronic components is set to grow rapidly.

Scope of the Report

|

By Type |

Atmospheric Pressure CVD (APCVD) |

|

Low-Pressure CVD (LPCVD) |

|

|

Plasma-Enhanced CVD (PECVD) |

|

|

Metal-Organic CVD (MOCVD) |

|

|

By Application |

Semiconductors |

|

Solar Cells |

|

|

Medical Devices |

|

|

Data Storage Devices |

|

|

By Material Type |

Silicon Compounds |

|

Nitride Compounds |

|

|

Metal Oxides |

|

|

Others (Carbides, Borides) |

|

|

By Technology |

Batch Processing |

|

Single-Wafer Processing |

|

|

By Region |

China |

|

Japan |

|

|

South Korea |

|

|

Taiwan |

|

|

Rest of Asia Pacific |

Products

Key Target Audience

Semiconductor Manufacturers

Solar Energy Providers

Medical Device Manufacturers

Electronics Component Suppliers

Automotive Component Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (China National Development and Reform Commission, Ministry of Trade, Industry, and Energy Korea)

Industrial Equipment Manufacturers

Companies

Players Mentioned in the Report:

Applied Materials, Inc.

ASM International N.V.

Tokyo Electron Limited

Lam Research Corporation

Veeco Instruments Inc.

Hitachi High-Tech Corporation

ULVAC Technologies

Aixtron SE

Canon Anelva Corporation

CVD Equipment Corporation

PlasmaTherm LLC

Kokusai Electric Corporation

SCH Technologies

Thermo Fisher Scientific

IHI Corporation

Table of Contents

1. Asia Pacific Chemical Vapor Deposition Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Chemical Vapor Deposition Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Chemical Vapor Deposition Market Analysis

3.1. Growth Drivers

3.1.1. Semiconductor Manufacturing Expansion

3.1.2. Growing Demand in Solar PV Applications

3.1.3. Advancements in Thin-Film Coatings

3.1.4. Increasing Applications in Medical Devices

3.2. Market Challenges

3.2.1. High Initial Investment in Equipment

3.2.2. Complex Process Control and Monitoring

3.2.3. Environmental and Regulatory Pressures

3.3. Opportunities

3.3.1. Rising Demand for Nano-Technology Applications

3.3.2. Growth in Automotive Electronics

3.3.3. Focus on Advanced Material Development

3.4. Trends

3.4.1. Adoption of Plasma-Enhanced CVD (PECVD)

3.4.2. Shift Toward Low-Temperature CVD

3.4.3. Increasing Use of 3D Integration in Semiconductor Devices

3.5. Government Regulation

3.5.1. Clean Energy Policies Supporting CVD Adoption

3.5.2. Semiconductor Industry-Specific Regulations

3.5.3. Environmental Norms for Waste Emissions and Effluents

3.5.4. Subsidies for Advanced Manufacturing Technologies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Asia Pacific Chemical Vapor Deposition Market Segmentation

4.1. By Type (In Value %)

4.1.1. Atmospheric Pressure CVD (APCVD)

4.1.2. Low-Pressure CVD (LPCVD)

4.1.3. Plasma-Enhanced CVD (PECVD)

4.1.4. Metal-Organic CVD (MOCVD)

4.2. By Application (In Value %)

4.2.1. Semiconductors

4.2.2. Solar Cells

4.2.3. Medical Devices

4.2.4. Data Storage Devices

4.3. By Material Type (In Value %)

4.3.1. Silicon Compounds

4.3.2. Nitride Compounds

4.3.3. Metal Oxides

4.3.4. Others (Carbides, Borides)

4.4. By Technology (In Value %)

4.4.1. Batch Processing

4.4.2. Single-Wafer Processing

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Taiwan

4.5.5. Rest of Asia Pacific

5. Asia Pacific Chemical Vapor Deposition Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Applied Materials, Inc.

5.1.2. ASM International N.V.

5.1.3. Tokyo Electron Limited

5.1.4. Lam Research Corporation

5.1.5. Hitachi High-Tech Corporation

5.1.6. Veeco Instruments Inc.

5.1.7. ULVAC Technologies

5.1.8. Aixtron SE

5.1.9. Canon Anelva Corporation

5.1.10. CVD Equipment Corporation

5.1.11. PlasmaTherm LLC

5.1.12. Kokusai Electric Corporation

5.1.13. SCH Technologies

5.1.14. Thermo Fisher Scientific

5.1.15. IHI Corporation

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, R&D Expenditure)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Collaborations

5.8. Government Support Programs

5.9. Private Equity and Venture Capital Investments

6. Asia Pacific Chemical Vapor Deposition Market Regulatory Framework

6.1. Industry Compliance Standards

6.2. Environmental Certifications

6.3. IP and Patent Regulations

7. Asia Pacific Chemical Vapor Deposition Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Chemical Vapor Deposition Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Material Type (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Chemical Vapor Deposition Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Market Entry Plans

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we constructed an ecosystem map, encompassing major stakeholders within the Asia Pacific Chemical Vapor Deposition market. This involved desk research using a combination of proprietary and secondary databases to gather comprehensive industry data. Our goal was to define critical variables that influence market dynamics, including key demand drivers and regulatory frameworks.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data pertaining to the Asia Pacific CVD market, including market penetration across regions and the ratio of product type to application in semiconductor fabrication. This phase also involved analyzing service quality statistics to ensure the reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

We developed market hypotheses, which were then validated through expert consultations conducted via computer-assisted telephone interviews (CATI). Experts from semiconductor manufacturing companies and equipment suppliers provided insights that were used to refine and corroborate the market data.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with multiple semiconductor manufacturers to gain insights into CVD equipment, product performance, and customer preferences. This allowed us to verify and complement the statistics derived through the bottom-up approach, ensuring an accurate and comprehensive market analysis.

Frequently Asked Questions

01. How big is the Asia Pacific Chemical Vapor Deposition Market?

The Asia Pacific Chemical Vapor Deposition market is valued at USD 11.5 billion in 2023, driven by the semiconductor and electronics industries, particularly in China and South Korea.

02. What are the challenges in the Asia Pacific CVD Market?

Key challenges include high initial investment costs, the need for skilled labor, and complex process control, particularly in thin-film deposition and large-scale manufacturing environments.

03. Who are the major players in the Asia Pacific CVD Market?

Major players in the market include Applied Materials, ASM International, Tokyo Electron, Lam Research, and Veeco Instruments. These companies dominate the market due to their advanced technologies and extensive R&D investments.

04. What are the growth drivers of the Asia Pacific CVD Market?

Growth drivers include the rising demand for semiconductors, the increasing use of renewable energy technologies, and advancements in medical devices requiring precise coatings, such as stents and implants.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.