Asia Pacific Chocolate Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD9784

December 2024

91

About the Report

Asia Pacific Chocolate Market Overview

- The Asia Pacific Chocolate Market is valued at USD 18 billion, reflecting steady growth over the past five years. This growth is driven by a combination of rising disposable income across emerging economies, expanding consumer preference for premium products, and the increasing availability of chocolate products through both traditional retail and e-commerce platforms.

- Dominant countries in the Asia Pacific chocolate market include China, India, Japan, and Australia. China and India are major players due to their large populations and growing middle-class consumers with rising disposable incomes. Meanwhile, Japan and Australia dominate the premium chocolate segment, driven by a sophisticated consumer base that values high-quality, gourmet, and single-origin chocolate products.

- Governments across Asia Pacific have implemented sustainability and environmental regulations to reduce the environmental impact of food production. In 2023, Australia introduced a policy that mandates food companies, including chocolate manufacturers, to reduce packaging waste by 25%. Similarly, Japan has implemented carbon emission reduction targets for the food industry, pushing companies to adopt greener practices in production and logistics.

Asia Pacific Chocolate Market Segmentation

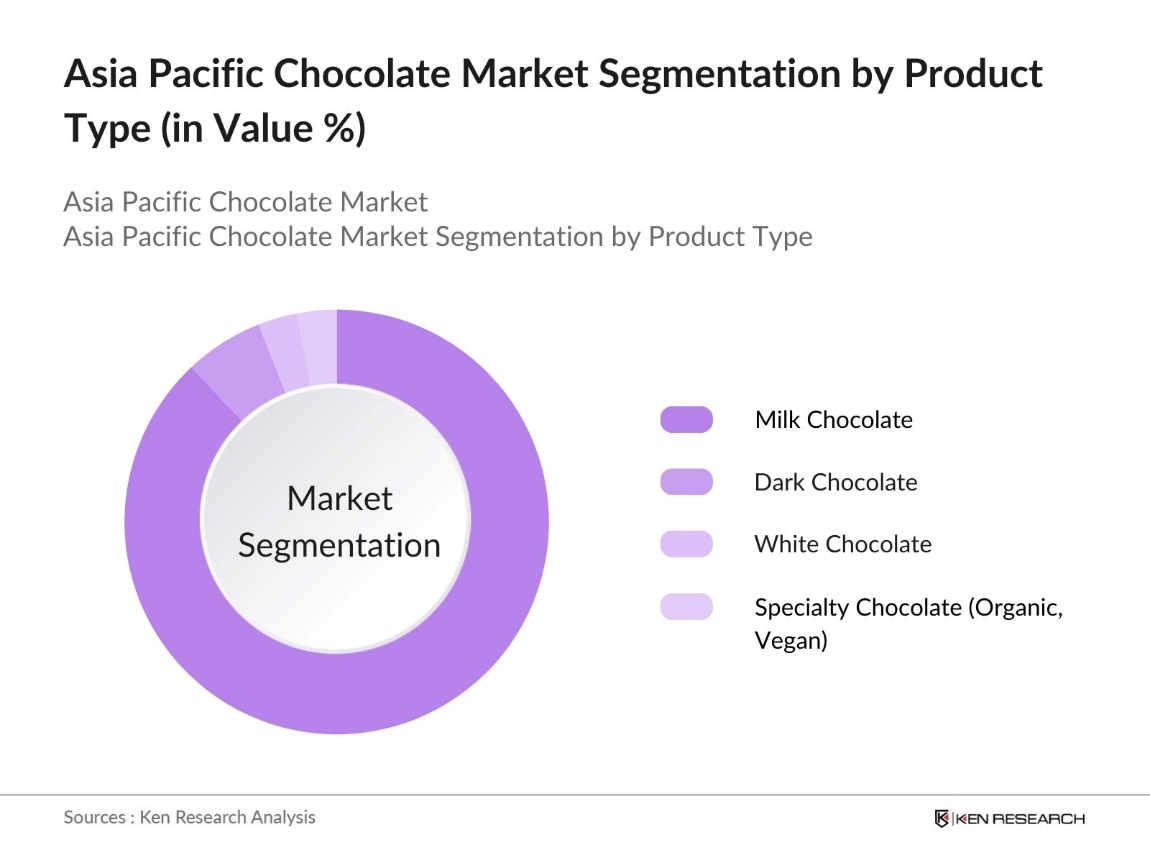

By Product Type: The Asia Pacific chocolate market is segmented by product type into milk chocolate, dark chocolate, white chocolate, and specialty chocolate (organic and vegan). Recently, milk chocolate has maintained a dominant market share due to its widespread popularity across different consumer demographics. Milk chocolates appeal lies in its smooth and creamy texture, making it a staple for mainstream consumers. Its affordability and availability across mass-market retailers further contribute to its dominance, especially in countries like India and China, where the preference for sweeter chocolate products is high.

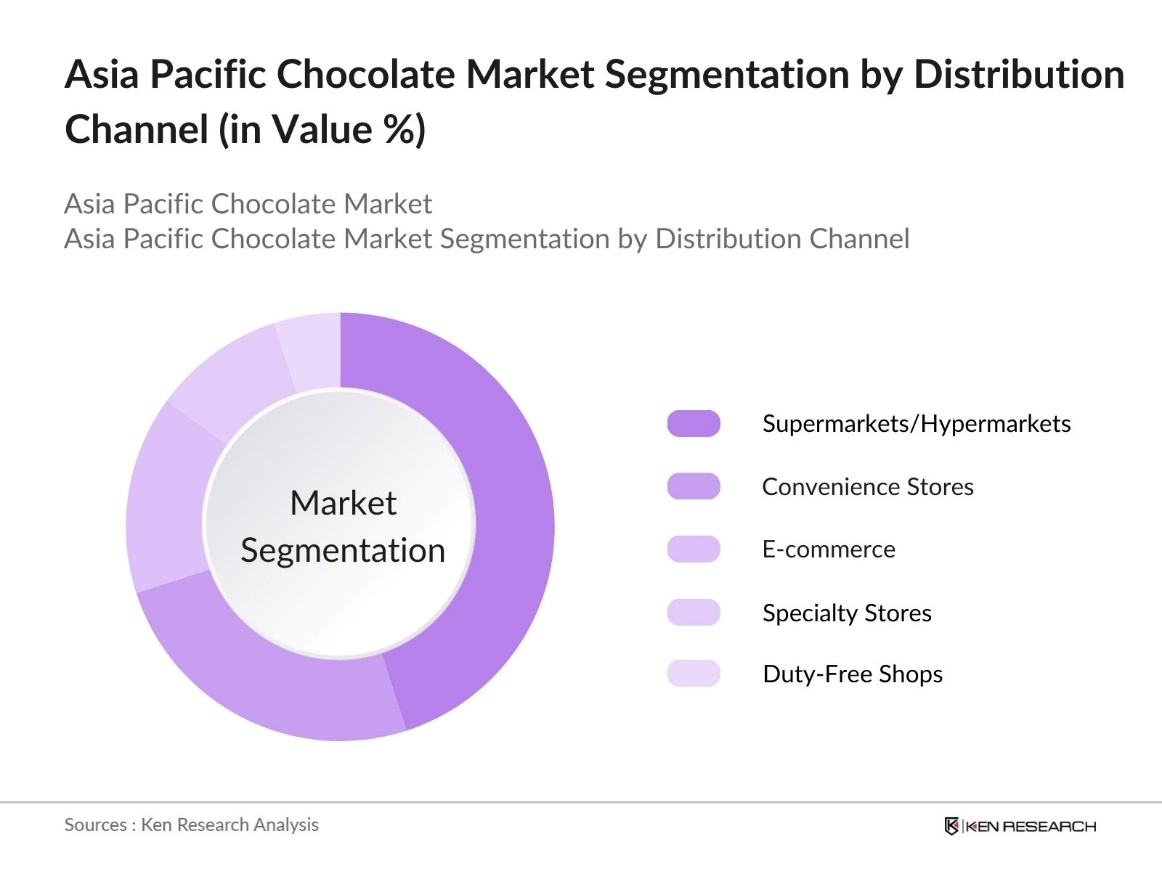

By Distribution Channel: The chocolate market in the Asia Pacific is also segmented by distribution channels, including supermarkets & hypermarkets, convenience stores, specialty stores, e-commerce, and duty-free shops. Supermarkets and hypermarkets have a dominant market share due to their extensive presence and ability to provide consumers with a wide variety of products. Additionally, the increasing number of hypermarket chains in countries like India and China, coupled with competitive pricing, have bolstered this segment's growth. The convenience of shopping at one-stop destinations for a wide range of products continues to attract consumers in these regions.

Asia Pacific Chocolate Market Competitive Landscape

The market is characterized by both global and regional players. The market's competitive landscape is dominated by a handful of key companies that hold significant market shares due to their strong distribution networks, extensive product portfolios, and established brand equity. International brands like Mondelez International and Nestl have captured the mainstream market, while regional companies such as Meiji and Lotte Confectionery have gained strong footholds in specific localities due to their understanding of local consumer preferences.

|

Company |

Year Established |

Headquarters |

No. of Employees |

Revenue (USD) |

Market Share |

Sustainability Initiatives |

Product Range |

Regional Presence |

|

Mondelez International |

1923 |

Chicago, USA |

||||||

|

Nestl S.A. |

1867 |

Vevey, Switzerland |

||||||

|

The Hershey Company |

1894 |

Pennsylvania, USA |

||||||

|

Meiji Holdings Co., Ltd. |

1916 |

Tokyo, Japan |

||||||

|

Lotte Confectionery Co. Ltd. |

1967 |

Seoul, South Korea |

Asia Pacific Chocolate Industry Analysis

Growth Drivers

- Rising Disposable Income: The increase in disposable income across Asia Pacific has led to higher consumer spending on luxury and indulgent products, including chocolates. For instance, China Gross Domestic Product (GDP) per Capita reached 12,621.721 USD in Dec 2023, compared with 12,674.900 USD in Dec 2022. This rising income has driven demand for premium products, especially in urban centers. In India, household consumption expenditure increased showing an increase in discretionary spending, which includes food items like chocolates.

- Increasing Urbanization and Changing Lifestyle: The rapid urbanization across Asia Pacific has significantly altered consumption patterns. Countries like Vietnam, with an urbanization rate of 39.48% in 2023, have seen shifts in dietary preferences towards more Westernized products like chocolate. The higher accessibility to supermarkets, convenience stores, and modern retail formats in these regions further boosts chocolate consumption. The Chinas urban population leading to a substantial shift in lifestyle choices and an increase in convenience foods, including chocolates.

- Rising Demand for Premium and Dark Chocolate: In the Asia Pacific region, the demand for premium and dark chocolates is on the rise, driven by health-conscious consumers seeking products with higher cocoa content. Countries like Japan and China are witnessing increased interest in dark chocolate due to its perceived health benefits. This trend is encouraging manufacturers to offer more premium options to meet the growing demand for quality and healthier indulgences.

Market Challenges

- Volatility in Cocoa Prices: Cocoa prices have fluctuated significantly due to supply chain disruptions and climate-related challenges in key cocoa-producing regions. These price swings directly impact the cost of production for chocolate manufacturers in the Asia Pacific. As a result, businesses face challenges in managing pricing strategies and maintaining profitability, making it crucial for companies to carefully navigate these unpredictable price shifts.

- Health Concerns Around Sugar Consumption: Growing awareness of the negative health effects of excessive sugar intake presents a challenge for the chocolate industry in Asia Pacific. Governments in several countries have introduced stricter regulations on sugar content in food products. This has prompted manufacturers to innovate and develop lower-sugar chocolate alternatives to meet changing consumer preferences and comply with new health standards.

Asia Pacific Chocolate Market Future Outlook

Over the next five years, the Asia Pacific chocolate market is expected to show significant growth due to rising consumer spending on premium and healthy chocolate products. Increasing awareness of the health benefits of dark and sugar-free chocolates is likely to drive demand, particularly among health-conscious consumers. The market is also poised to benefit from advancements in supply chain logistics, facilitating the wider availability of chocolate products across remote areas.

Market Opportunities

- Growth in Organic and Fair-Trade Chocolate; The demand for organic and fair-trade chocolate is increasing across the Asia Pacific as consumers become more aware of sustainability and ethical sourcing. Retailers are responding by offering a wider range of organic and ethically sourced chocolate options. These products appeal to environmentally and socially conscious consumers who prioritize responsible choices, driving a shift in purchasing behavior towards more sustainable options.

- Innovation in Product Offerings (Sugar-Free, Vegan): Innovation in chocolate products, particularly sugar-free and vegan varieties, is opening up new market opportunities in the Asia Pacific region. Health-conscious consumers are driving demand for plant-based and lower-sugar alternatives, encouraging manufacturers to develop new chocolate options. This shift is meeting the growing consumer preference for healthier and more inclusive product choices, leading to diversified offerings in the market.

Scope of the Report

|

Product Type |

Milk Chocolate Dark Chocolate White Chocolate Compound Chocolate Specialty Chocolate (Organic, Vegan) |

|

Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores Specialty Stores E-Commerce Duty-Free Shops |

|

Category |

Premium Chocolate Mass Chocolate |

|

Application |

Confectionery Beverages Bakery and Pastry Ice Cream and Frozen Desserts |

|

Region |

China India Japan Australia & New Zealand Rest of Asia Pacific |

Products

Key Target Audience

Chocolate Manufacturers

Luxury and Premium Chocolate Manufacturers

Food and Beverage Industry

Chocolate Importers and Exporters

E-Commerce Platforms

Government and Regulatory Bodies (Food Safety and Standards Authority of India (FSSAI))

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Mondelez International

Nestl S.A.

The Hershey Company

Meiji Holdings Co., Ltd.

Lotte Confectionery Co. Ltd.

Barry Callebaut AG

Ferrero Group

Mars, Incorporated

Fuji Oil Holdings Inc.

Puratos Group

Table of Contents

1. Asia Pacific Chocolate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, USD Value, Volume Growth)

1.4. Market Segmentation Overview

2. Asia Pacific Chocolate Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Chocolate Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Increasing Urbanization and Changing Lifestyle

3.1.3. Rising Demand for Premium and Dark Chocolate

3.1.4. Expanding Retail and E-Commerce Channels

3.2. Market Challenges

3.2.1. Volatility in Cocoa Prices

3.2.2. Health Concerns Around Sugar Consumption

3.2.3. Stringent Food Safety Regulations

3.2.4. Sustainability Concerns in Cocoa Production

3.3. Opportunities

3.3.1. Growth in Organic and Fair-Trade Chocolate

3.3.2. Innovation in Product Offerings (Sugar-Free, Vegan)

3.3.3. Expansion into Rural and Emerging Markets

3.3.4. Technological Advancements in Packaging and Storage

3.4. Trends

3.4.1. Increasing Popularity of Single-Origin Chocolate

3.4.2. Customized Chocolate and Limited-Edition Offerings

3.4.3. Integration of Smart Packaging and Augmented Reality

3.4.4. Sustainable Sourcing and Ethical Supply Chain Management

3.5. Government Regulations

3.5.1. Import Tariffs and Cocoa Quotas

3.5.2. Food Labeling and Nutritional Disclosure Requirements

3.5.3. Sustainability and Environmental Regulations

3.5.4. Regional Trade Agreements Impacting Chocolate Imports/Exports

3.6. SWOT Analysis (Market-Specific)

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Bargaining Power, Threat of Substitutes, etc.)

3.9. Competitive Landscape and Market Ecosystem

4. Asia Pacific Chocolate Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Milk Chocolate

4.1.2. Dark Chocolate

4.1.3. White Chocolate

4.1.4. Compound Chocolate

4.1.5. Specialty Chocolate (Organic, Vegan)

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Convenience Stores

4.2.3. Specialty Stores

4.2.4. E-Commerce

4.2.5. Duty-Free Shops

4.3. By Category (In Value %)

4.3.1. Premium Chocolate

4.3.2. Mass Chocolate

4.4. By Application (In Value %)

4.4.1. Confectionery

4.4.2. Beverages

4.4.3. Bakery and Pastry

4.4.4. Ice Cream and Frozen Desserts

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia & New Zealand

4.5.5. Rest of Asia Pacific

5. Asia Pacific Chocolate Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Mondelez International, Inc.

5.1.2. The Hershey Company

5.1.3. Nestl S.A.

5.1.4. Mars, Incorporated

5.1.5. Ferrero Group

5.1.6. Meiji Holdings Co., Ltd.

5.1.7. Lotte Confectionery Co. Ltd.

5.1.8. Barry Callebaut AG

5.1.9. Lindt & Sprngli AG

5.1.10. Godiva Chocolatier

5.1.11. Guan Chong Berhad (GCB)

5.1.12. Fuji Oil Holdings Inc.

5.1.13. Puratos Group

5.1.14. Cargill Inc.

5.1.15. PT Mayora Indah Tbk

5.2. Cross Comparison Parameters (Market-Specific)

5.2.1. Number of Employees

5.2.2. Production Volume (in Metric Tons)

5.2.3. Market Share by Region

5.2.4. Revenue (In USD)

5.2.5. Chocolate Portfolio Range

5.2.6. Sustainability Initiatives

5.2.7. Innovation in Product Formulation

5.2.8. Distribution Network Reach

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity, Venture Capital)

5.7. Government Grants and Subsidies

6. Asia Pacific Chocolate Market Regulatory Framework

6.1. Cocoa Trade Agreements

6.2. Certification Programs (Rainforest Alliance, Fair Trade)

6.3. Food Safety and Quality Certifications

6.4. Import and Export Regulations

7. Asia Pacific Chocolate Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Asia Pacific Chocolate Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Category (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Chocolate Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Branding Strategies

9.4. White Space Opportunity Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the major stakeholders in the Asia Pacific Chocolate Market. This included conducting in-depth desk research, using proprietary and secondary data sources to gather critical market information, including revenue estimates, market penetration, and distribution channels.

Step 2: Market Analysis and Construction

In this phase, historical data was compiled to analyze market trends, particularly focusing on product innovation, distribution network reach, and shifts in consumer preferences. The analysis incorporated supply chain logistics and the revenue generated through online and offline channels.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of the data, interviews with industry experts and stakeholders were conducted. Insights gathered from market practitioners helped validate the market hypotheses and provided real-world operational and financial data.

Step 4: Research Synthesis and Final Output

The final phase involved cross-verifying the data with major chocolate manufacturers and retailers, confirming sales data, consumer behavior insights, and product segmentation. This approach ensured a comprehensive and validated market report.

Frequently Asked Questions

01. How big is the Asia Pacific Chocolate Market?

The Asia Pacific Chocolate Market was valued at USD 18 billion, driven by rising disposable incomes, increasing demand for premium products, and a growing chocolate culture across countries like China, India, and Japan.

02. What are the challenges in the Asia Pacific Chocolate Market?

Challenges in Asia Pacific Chocolate Market include fluctuating cocoa prices, concerns about the environmental impact of cocoa farming, and stringent regulations around food safety and sustainability. Additionally, the rise of health-conscious consumers poses a threat to sugar-laden chocolate products.

03. Who are the major players in the Asia Pacific Chocolate Market?

Key players in Asia Pacific Chocolate Market include Mondelez International, Nestl S.A., The Hershey Company, Meiji Holdings Co., and Lotte Confectionery. These companies dominate the market due to their expansive distribution networks and strong product portfolios.

04. What are the growth drivers of the Asia Pacific Chocolate Market?

The Asia Pacific Chocolate Market is propelled by rising consumer incomes, an increasing preference for premium and healthier chocolate options, and the growth of e-commerce channels. Additionally, festivals and gifting traditions in countries like India and China significantly boost sales during peak seasons.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.