Asia Pacific Coal Briquettes Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD8089

December 2024

89

About the Report

Asia Pacific Coal Briquettes Market Overview

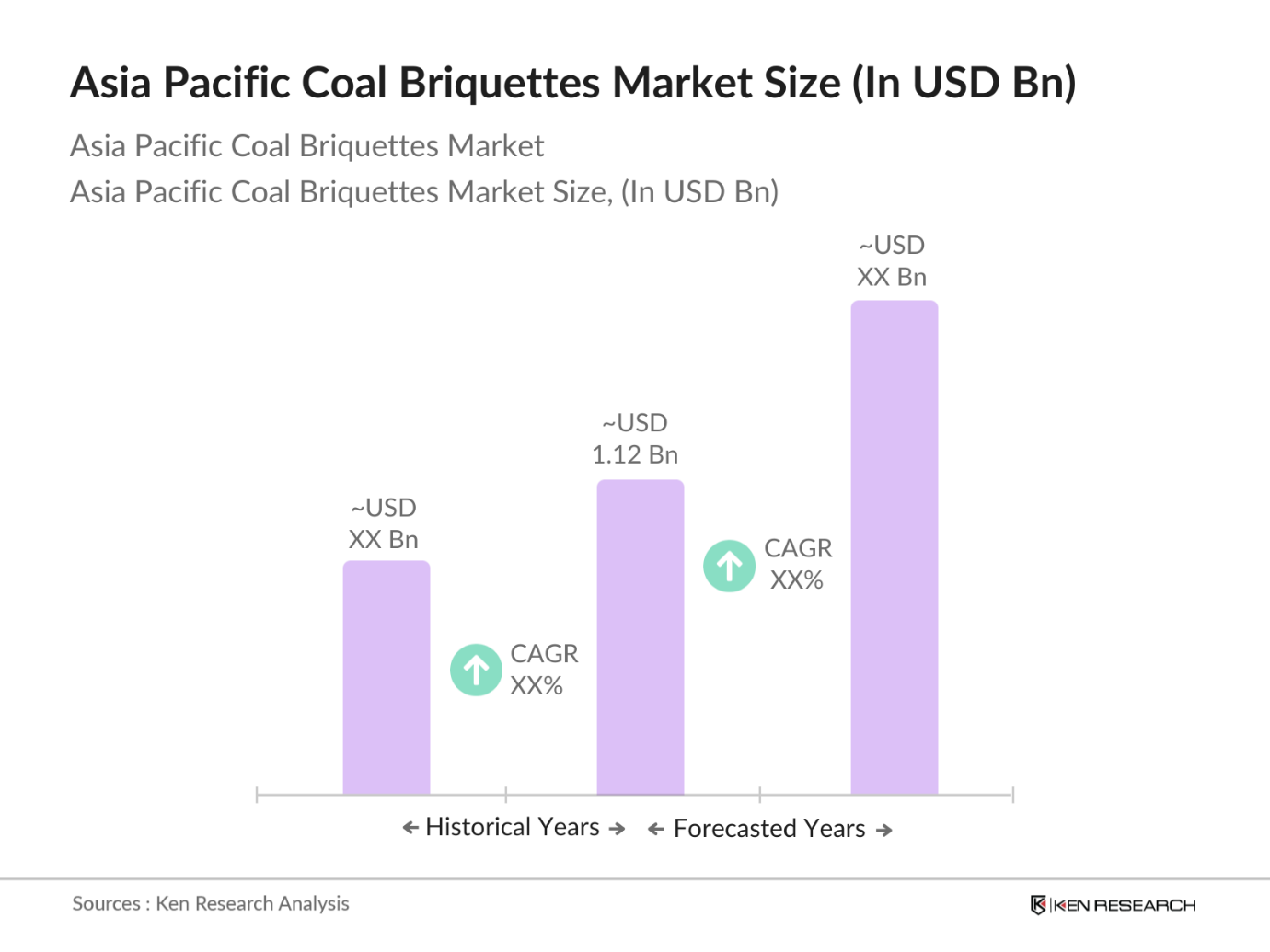

- The Asia Pacific coal briquettes market is valued at USD 1.12 billion, according to a five-year historical analysis. The market is driven by the region's strong reliance on coal for power generation and industrial processes, particularly in energy-intensive sectors such as steel and cement. Governments in countries like China and India have supported the adoption of coal briquettes due to their cost-efficiency and lower environmental impact compared to raw coal. Briquettes are particularly favoured for their higher calorific value and cleaner combustion.

- Countries like China, India, and Indonesia dominate the market due to their abundant coal reserves, large population, and rapid industrialization. China remains the largest consumer of coal briquettes, as the country prioritizes energy security and cost-effective industrial fuel alternatives. Indias dominance is driven by its growing industrial demand and government-backed initiatives promoting cleaner and more efficient coal usage. Indonesia, with its vast natural coal resources, also plays a key role as a producer and exporter of coal briquettes across the Asia Pacific region.

- Governments across the Asia Pacific region is enforcing stricter coal consumption and emission regulations to address environmental concerns. For instance, Chinas national carbon cap program mandates that coal-based industries must limit carbon emissions to 4.5 gigatons annually, a policy that impacts coal briquette producers by pushing them towards cleaner production methods. Similarly, countries like India have introduced sulphur content limits on coal used in power generation, reducing air pollution. Compliance with these regulations has become essential for market players to continue operations without penalties, pushing the adoption of clean coal technologies.

Asia Pacific Coal Briquettes Market Segmentation

Asia Pacific Coal Briquettes Market Segmentation

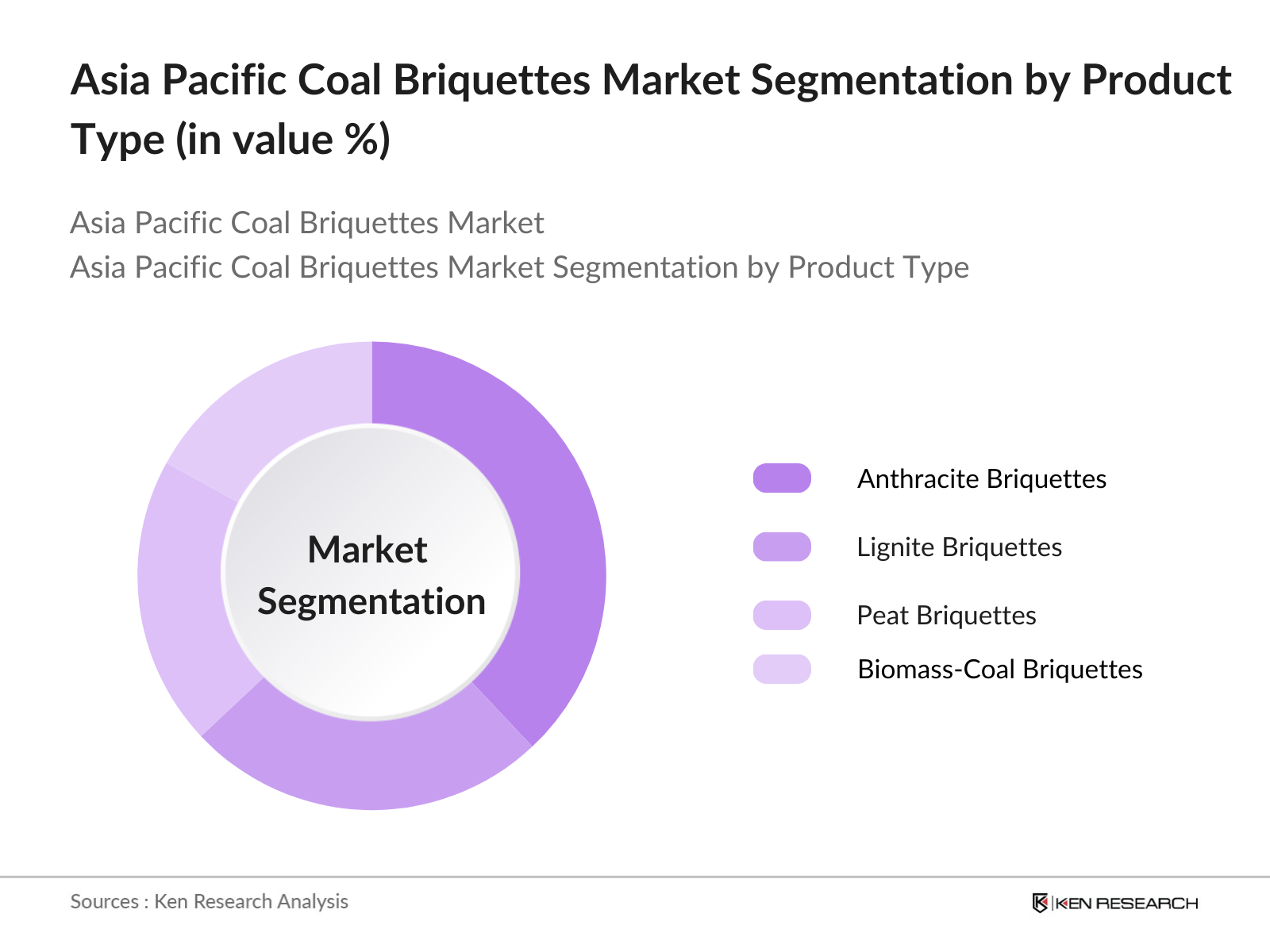

- By Product Type: The Asia Pacific Coal Briquettes Market is segmented by product type into anthracite briquettes, lignite briquettes, peat briquettes, and biomass-coal briquettes. Recently, anthracite briquettes have been leading the market under the product type segment due to their higher carbon content and energy efficiency. Anthracite briquettes are preferred in industries that require higher heat intensity, such as metal processing and power generation. Additionally, their lower environmental impact compared to other coal types has strengthened their demand in regions with stricter environmental regulations.

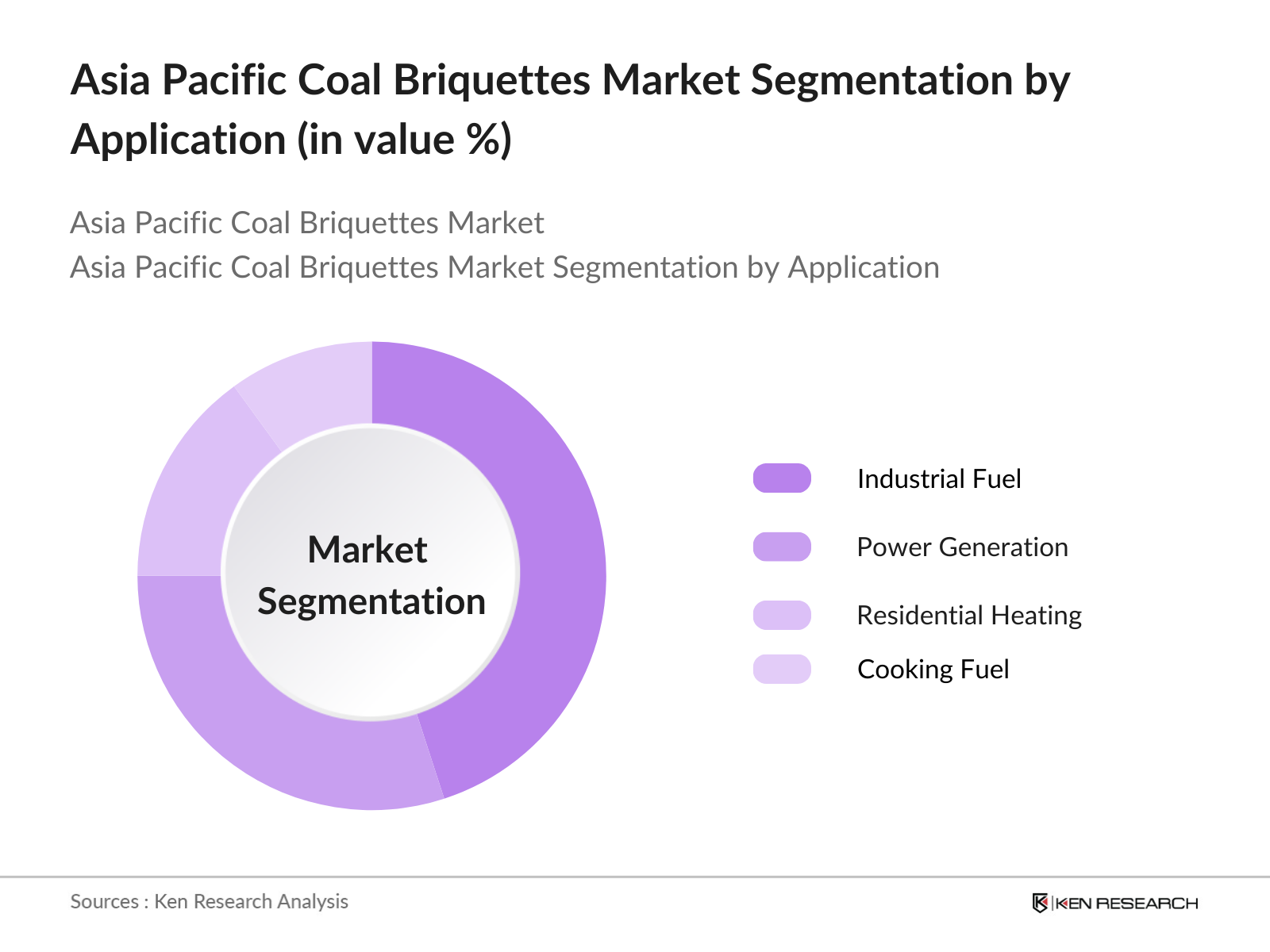

- By Application: The Asia Pacific Coal Briquettes Market is segmented by application into residential heating, industrial fuel, power generation, and cooking fuel. Industrial fuel remains the dominant sub-segment, accounting for the largest market share due to its widespread use in energy-intensive sectors like steel and cement manufacturing. Industrial operations prioritize coal briquettes for their consistent calorific value and cost-efficiency, allowing these industries to maintain energy-intensive operations at a lower cost compared to oil or natural gas alternatives.

Asia Pacific Coal Briquettes Market Competitive Landscape

The Asia Pacific Coal Briquettes Market is dominated by key players, both regional and global, that have invested heavily in the production, marketing, and technological advancements of briquetting. Leading companies are capitalizing on economies of scale, government incentives, and strategic partnerships. Market consolidation is also evident with frequent mergers and acquisitions.

Asia Pacific Coal Briquettes Market Analysis

Asia Pacific Coal Briquettes Market Growth Drivers

- Rising Demand from Emerging Economies: The Asia Pacific coal briquettes market is driven by increasing demand from emerging economies, especially in countries such as India, Indonesia, and Vietnam. With rapid economic growth, the demand for electricity has surged, pushing coal briquettes as a major source for power generation. For example, Indias total installed coal capacity reached 209.1 GW in 2024, contributing to energy production. Additionally, Vietnams coal-fired power plants supply more than 50% of its electricity. The World Bank forecasts that energy demand in Asia is expected to double from 2022 levels, emphasizing coals role in bridging the energy gap.

- Industrial Fuel Shift: A shift from crude oil-based fuels to coal briquettes in industrial sectors, particularly in metallurgy and cement, is a major driver in the market. In China, coal briquettes account for over 70% of the fuel used in cement production, driven by government policies promoting energy security. Moreover, the ASEAN region has seen a steady transition from liquid fuels to coal briquettes in heavy industries, resulting in lower operational costs. In 2024, industrial coal briquettes consumption in China is projected to remain steady at 1.3 billion tons.

- Cost-Effectiveness Compared to Alternatives: Coal briquettes offer a cost-effective alternative to natural gas and oil, with production costs being lower due to abundant local coal supplies in countries like Indonesia and Australia. For instance, in India, the average cost of producing coal briquettes is around $40 per ton, making it a more attractive option for energy generation compared to oil, which is subject to international price volatility. This price advantage has made coal briquettes a preferred choice for power producers and industries looking to reduce energy expenses.

Asia Pacific Coal Briquettes Market Challenges

- Environmental Concerns: The coal briquettes market faces challenges due to growing environmental concerns. Countries such as China and India have enacted stringent air pollution regulations to reduce carbon emissions, which have impacted coal consumption. In China, carbon emission regulations under the national carbon market cover around 40% of the countrys total CO2 emissions. Furthermore, India has pledged to reduce its carbon intensity by 33-35% under the Paris Agreement, forcing industries to explore alternative fuels. These regulations pose a challenge for coal briquette producers to meet compliance while maintaining profitability.

- High Initial Capital for Production Setup: Setting up coal briquette production facilities requires substantial initial capital investment, particularly in infrastructure and logistics. For example, the cost of establishing a briquetting plant in Indonesia is estimated to be around $25 million, covering land, machinery, and logistics. Additionally, poor infrastructure in countries like the Philippines further increases the cost of transporting coal briquettes to end-users, making it difficult for producers to achieve profitability in the short term. This capital-intensive nature has restricted market entry for smaller players and limited expansion in underdeveloped regions.

Asia Pacific Coal Briquettes Market Future Outlook

The Asia Pacific coal briquettes market is set to experience steady growth, driven by increasing demand for cost-effective and cleaner fuel alternatives. Government initiatives focusing on energy efficiency and emission reductions are expected to support the continued adoption of coal briquettes. Additionally, as industries in emerging economies continue to expand, the demand for industrial fuel, particularly in steel and cement production, will contribute to market growth. Advances in briquetting technologies, such as automated and low-emission systems, will further drive adoption in both the residential and industrial sectors.

Asia Pacific Coal Briquettes Market Opportunities

- Expansion into New Geographic Markets: Asia Pacific coal briquette producers have a opportunity to expand into new geographic markets, particularly in energy-deficient regions like Africa and the Middle East. For example, India exported 20 million tons of coal briquettes to African nations in 2023, driven by increased demand for low-cost energy sources. Strategic alliances between Asia Pacific producers and international markets are expected to drive growth, with countries like Vietnam and Indonesia poised to become major exporters of coal briquettes due to their abundant coal reserves and favourable trade policies.

- Waste-to-Energy Initiatives: The rising adoption of waste-to-energy initiatives presents a lucrative opportunity for the coal briquettes market. Countries like Japan and South Korea have launched programs to convert coal by-products into energy, reducing waste and improving overall energy efficiency. In Japan, coal waste recycling has generated over 10 terawatt-hours (TWh) of electricity annually. The circular economy model, where coal by-products are repurposed for energy production, not only reduces waste but also enhances the sustainability of coal-based industries, thereby driving growth in coal briquette production.

Scope of the Report

|

By Product Type |

Anthracite Briquettes Lignite Briquettes Peat Briquettes Biomass-Coal Briquettes |

|

By Application |

Residential Heating Industrial Fuel Power Generation Cooking Fuel |

|

By Distribution Channel |

Direct Sales Indirect Sales Online Sales |

|

By End-User Industry |

Power and Energy Cement Industry Chemical Industry Residential Users |

|

By Region |

China India Japan Australia Southeast Asia (Indonesia, Vietnam, Thailand) |

Products

Key Target Audience

Industrial Fuel Manufacturers

Power Generation Companies

Briquetting Equipment Manufacturers

Residential Fuel Providers

Government and Regulatory Bodies (Ministry of Coal, Asia Pacific Energy Regulatory Commission)

Environmental Agencies (Asia Pacific Clean Energy Council)

Banks and Financial Institutions

Investor and Venture Capitalist Firms

Export and Import Traders of Briquettes

Companies

Players Mentioned in the Report

Zhengzhou Zhongzhou Briquette Machinery Plant

EcoStan India Pvt Ltd

Radhe Engineering Co.

GEMCO Energy Machinery Co.

Biomass Briquette Systems

Henan Kefan Mining Machinery Co., Ltd.

Global Agrotech Engineering

Komarek (K.R. Komarek Inc.)

Jay Khodiyar Group

S. M. Group

Table of Contents

1. Asia Pacific Coal Briquettes Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Coal Briquettes Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Coal Briquettes Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand from Emerging Economies (Economic Growth, Power Generation)

3.1.2. Industrial Fuel Shift (Substitution from Crude Oil-Based Fuels)

3.1.3. Government Support for Energy Security (Energy Independence Initiatives, Subsidies)

3.1.4. Cost-Effectiveness Compared to Alternatives (Low Production Costs)

3.2. Market Challenges

3.2.1. Environmental Concerns (Carbon Emissions, Air Pollution Regulations)

3.2.2. High Initial Capital for Production Setup (Infrastructure and Logistics)

3.2.3. Volatile Coal Prices (Price Fluctuations, Global Supply Chain Constraints)

3.2.4. Transition Towards Renewable Energy (Decarbonization Efforts)

3.3. Opportunities

3.3.1. Technological Advancements in Briquetting (Efficient Machinery, Lower Emission Production)

3.3.2. Expansion into New Geographic Markets (Export Potential, Strategic Alliances)

3.3.3. Waste-to-Energy Initiatives (Circular Economy, Coal by-products Utilization)

3.3.4. Eco-Friendly Briquette Production (Biomass Blending, Clean Coal Technology)

3.4. Trends

3.4.1. Increasing Use of Biomass-Coal Briquettes (Hybrid Fuel Sources)

3.4.2. Automation in Briquette Manufacturing (Improved Efficiency and Output)

3.4.3. Regional Focus on Energy Security (Country-Level Initiatives, Subsidies)

3.4.4. Export Growth to Energy-Deficient Countries (Emerging Markets Demand)

3.5. Government Regulations

3.5.1. Coal Consumption and Emission Regulations (Carbon Caps, Sulfur Limits)

3.5.2. Environmental Taxation Policies (Carbon Taxes, Emission Trading)

3.5.3. Clean Coal Programs (Government Incentives, R&D Grants)

3.5.4. International Trade Policies (Tariffs, Bilateral Agreements)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Coal Briquettes Market Segmentation

4.1. By Product Type (In Value %) 4.1.1. Anthracite Briquettes

4.1.2. Lignite Briquettes

4.1.3. Peat Briquettes

4.1.4. Biomass-Coal Briquettes

4.2. By Application (In Value %) 4.2.1. Residential Heating

4.2.2. Industrial Fuel

4.2.3. Power Generation

4.2.4. Cooking Fuel

4.3. By Distribution Channel (In Value %) 4.3.1. Direct Sales

4.3.2. Indirect Sales (Dealers, Distributors)

4.3.3. Online Sales

4.4. By End-User Industry (In Value %) 4.4.1. Power and Energy

4.4.2. Cement Industry

4.4.3. Chemical Industry

4.4.4. Residential Users

4.5. By Region (In Value %) 4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Southeast Asia (Indonesia, Vietnam, Thailand)

5. Asia Pacific Coal Briquettes Market Competitive Analysis

5.1. Detailed Profiles of Major Companies 5.1.1. Zhengzhou Zhongzhou Briquette Machinery Plant

5.1.2. Henan Kefan Mining Machinery Co., Ltd.

5.1.3. S. M. Group

5.1.4. EcoStan India Pvt Ltd

5.1.5. Radhe Engineering Co.

5.1.6. Jay Khodiyar Group

5.1.7. Biomass Briquette Systems

5.1.8. Briquetting Systems Inc.

5.1.9. Komarek (K.R. Komarek Inc.)

5.1.10. Global Agrotech Engineering

5.1.11. GEMCO Energy Machinery Co., Ltd.

5.1.12. Ronak Engineering

5.1.13. Anyang Gemco Energy Machinery Co., Ltd.

5.1.14. Rico Biomass Briquette Machine

5.1.15. Agico Group

5.2. Cross Comparison Parameters (Headquarters, Revenue, Production Capacity, Product Line, No. of Employees, Market Share, Inception Year, Technological Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

5.9. Venture Capital Funding

6. Asia Pacific Coal Briquettes Market Regulatory Framework

6.1. Emission Standards Compliance

6.2. Certification Processes for Clean Coal Technologies

6.3. Waste Management Regulations

6.4. Environmental Impact Assessments

7. Asia Pacific Coal Briquettes Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Coal Briquettes Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Coal Briquettes Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this step, we mapped out the Asia Pacific Coal Briquettes Markets key stakeholders, including manufacturers, suppliers, and consumers. Secondary research was conducted using proprietary databases, industry reports, and government publications to identify critical market variables like production capacity, energy consumption patterns, and regulatory frameworks. These variables formed the foundation for the analysis.

Step 2: Market Analysis and Construction

We gathered historical data on production volumes, energy consumption by coal type, and revenue generation from multiple sources, including government reports and market databases. This data was used to estimate market penetration, assess key applications, and analyze end-user demand across regions.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts, including briquetting machine manufacturers and industrial fuel buyers, were conducted to validate the data. These experts provided insights into operational efficiencies, pricing trends, and future market opportunities, ensuring that the market estimates were accurate and reliable.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing the research findings into a comprehensive report. A bottom-up approach was used to validate the market size and growth figures. We also engaged with coal briquette exporters to gather additional insights on international trade trends, thus ensuring a robust and thorough analysis.

Frequently Asked Questions

01. How big is the Asia Pacific Coal Briquettes Market?

The Asia Pacific Coal Briquettes Market is valued at USD 1.12 billion, driven by strong demand from industrial sectors such as steel and cement manufacturing.

02. What are the challenges in the Asia Pacific Coal Briquettes Market?

Challenges include environmental concerns related to carbon emissions, fluctuating coal prices, and competition from renewable energy sources, which threaten the long-term growth of the market.

03. are the major players in the Asia Pacific Coal Briquettes Market?

Major players include Zhengzhou Zhongzhou Briquette Machinery Plant, EcoStan India Pvt Ltd, Radhe Engineering Co., GEMCO Energy Machinery Co., and Biomass Briquette Systems, known for their robust production capacity and innovative briquetting solutions.

04. What are the growth drivers of the Asia Pacific Coal Briquettes Market?

Growth drivers include government incentives for cleaner energy alternatives, cost-effective production, and strong industrial demand in sectors like power generation and manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.