Asia Pacific Collaborative Robots Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2784

November 2024

96

About the Report

Asia Pacific Collaborative Robots Market Overview

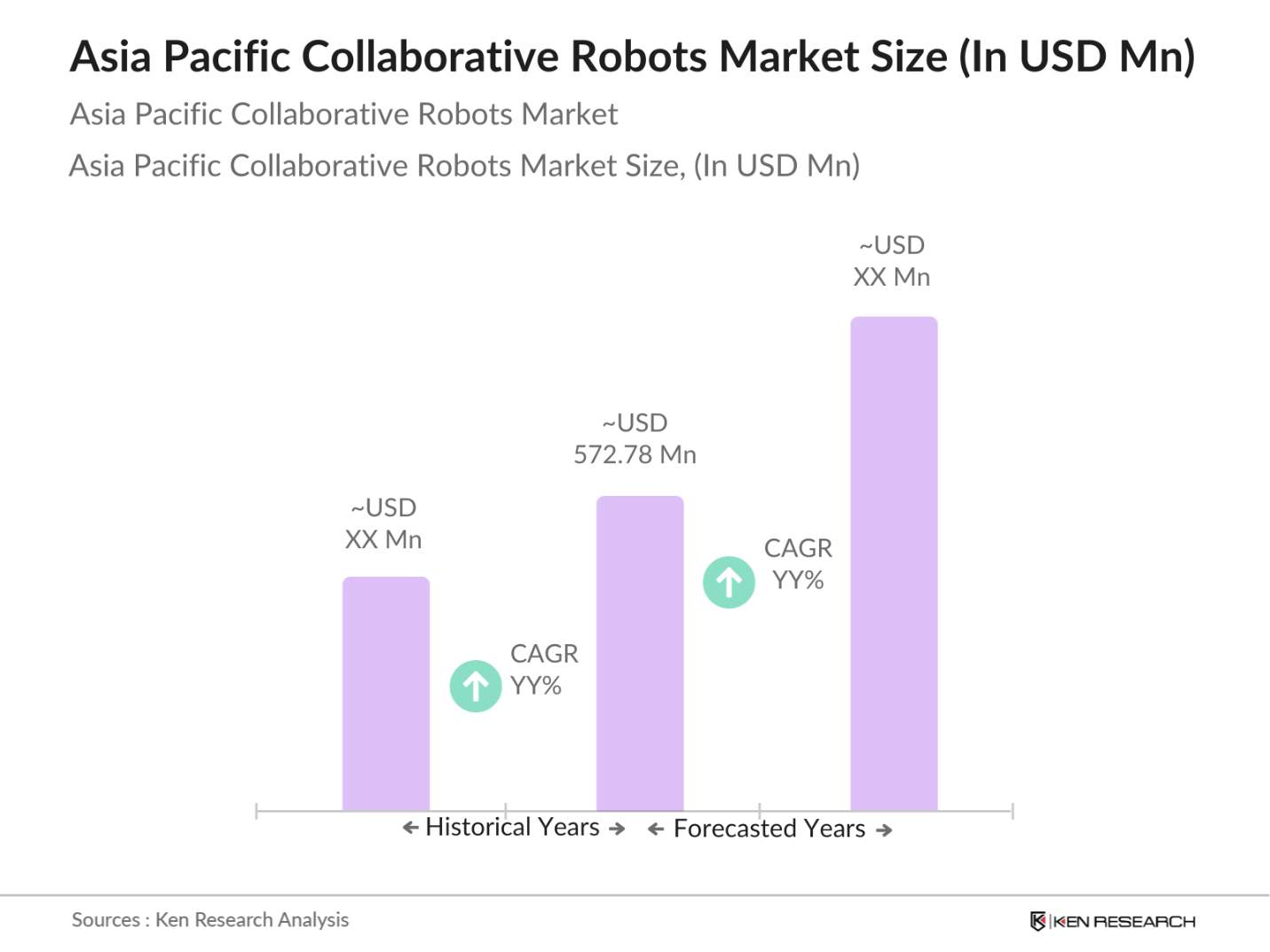

- The Asia Pacific Collaborative Robots Market is valued at USD 572.78 million, driven by the increased need for automation in manufacturing and rising labor costs. The market growth is supported by demand from electronics and automotive industries seeking cost-effective, safe, and flexible automation solutions.

- Key countries like China, Japan, and South Korea dominate the market due to their advanced manufacturing ecosystems and heavy investment in robotics. Chinas large-scale manufacturing and Japans early adoption of robotic technology position them as leaders in collaborative robot applications.

- Safety standards for collaborative robots are evolving as the technology becomes more widely used across industries in Asia Pacific. In 2023, the International Organization for Standardization (ISO) is expected to introduce new safety guidelines specifically designed for collaborative robots. These guidelines ensure that cobots operate safely alongside human workers by incorporating features such as force-limiting sensors and emergency stop mechanisms. Governments in the region are adopting these standards to regulate the deployment of cobots, ensuring that workplaces remain safe and compliant with national safety regulations.

Asia Pacific Collaborative Robots Market Segmentation

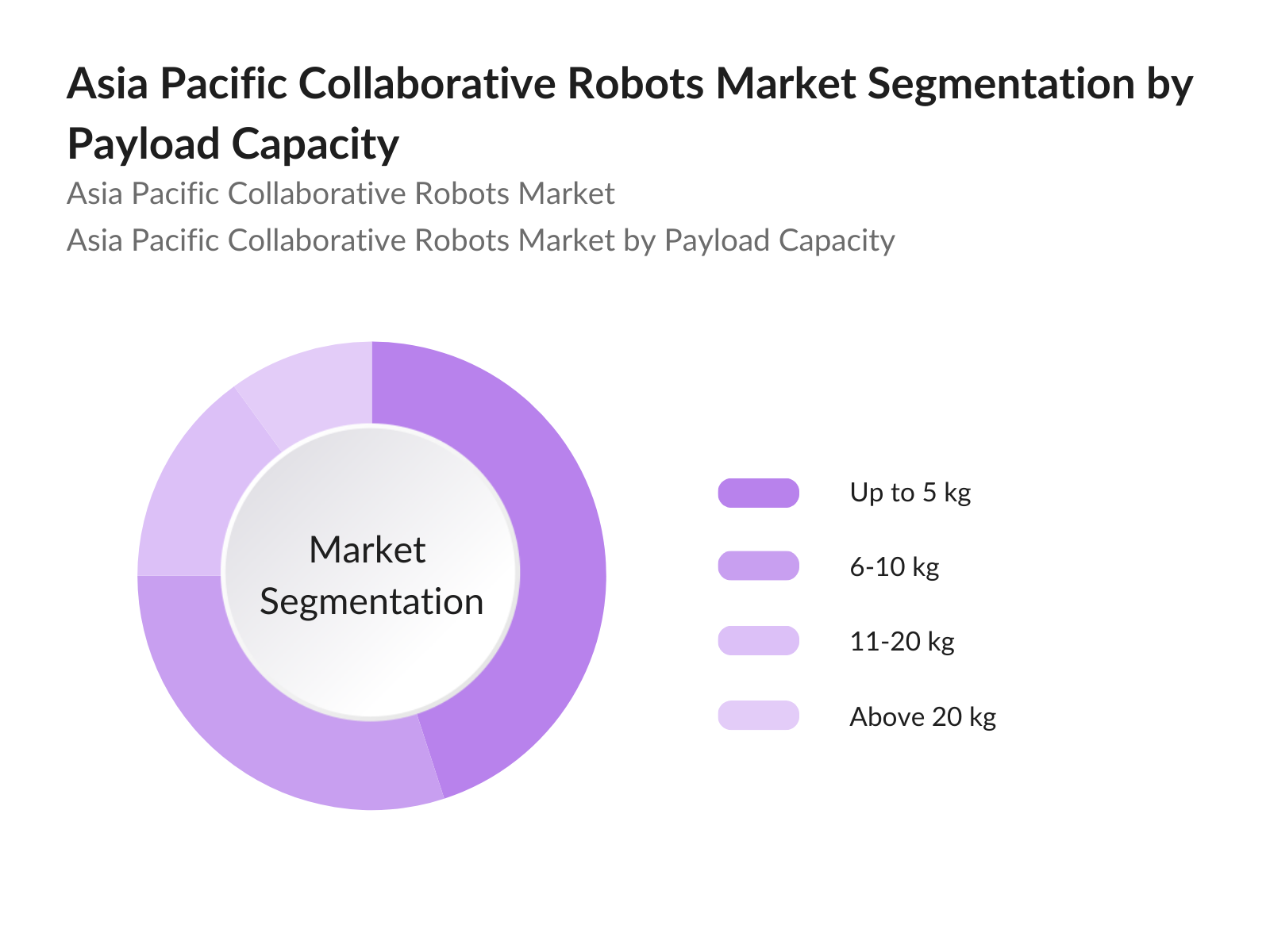

By Payload Capacity: The market is segmented by payload capacity into up to 5 kg, 6-10 kg, 11-20 kg, and above 20 kg. Collaborative robots with payload capacities up to 5 kg lead the market share due to their widespread application in electronics and light assembly tasks. Their flexibility and affordability make them popular among small to medium-sized enterprises.

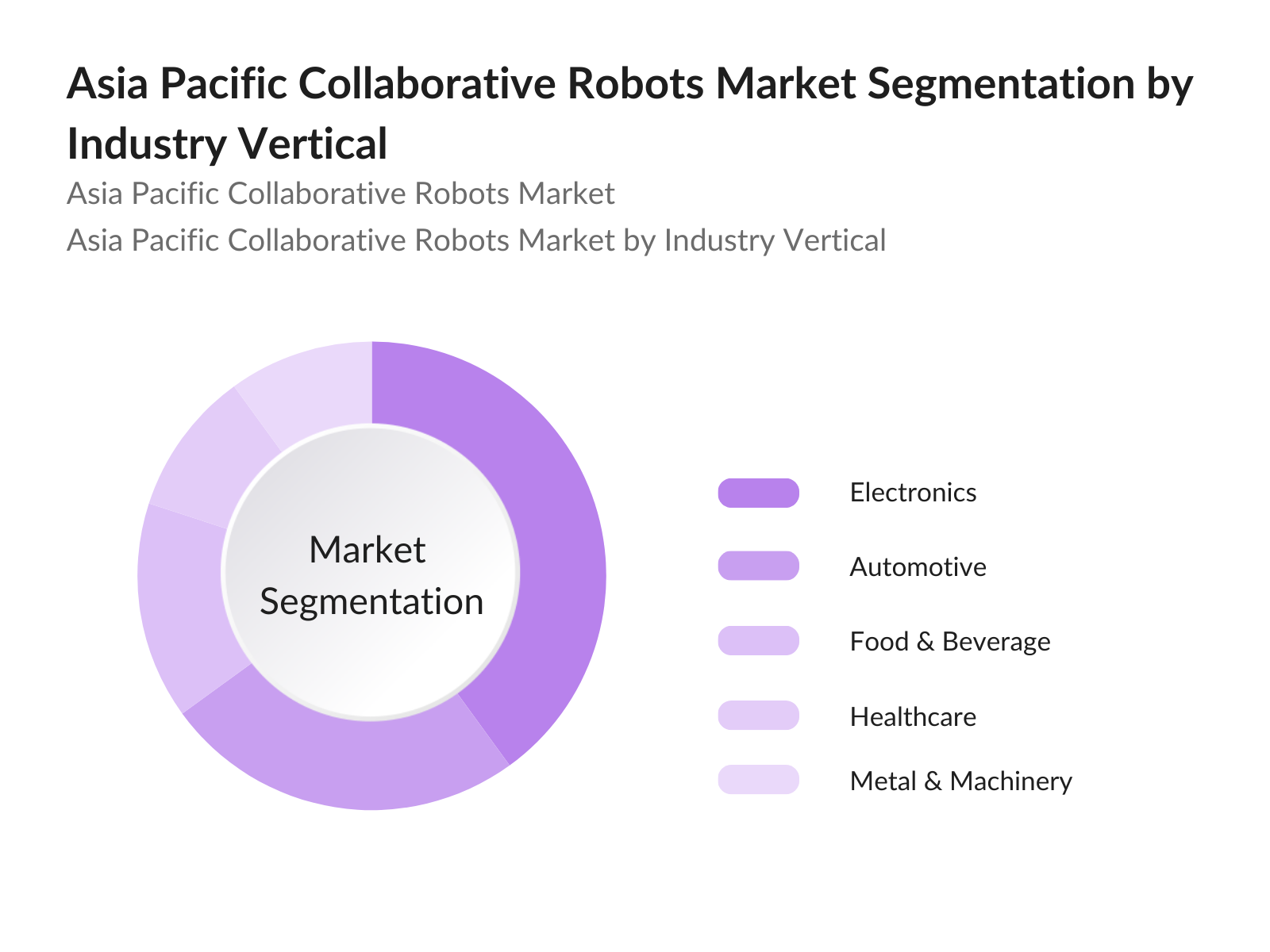

By Industry Vertical: Segmentation by industry includes electronics, automotive, food and beverage, healthcare, and metal and machinery. Electronics dominates the market share due to its high demand for precision and repetitive tasks that collaborative robots can handle efficiently, reducing production time and labor costs.

Asia Pacific Collaborative Robots Market Competitive Landscape

The Asia Pacific Collaborative Robots Market is highly competitive, with key players including Universal Robots, FANUC, and ABB. These companies focus on expanding their collaborative robot portfolios, enhancing human-robot interaction technology, and forging strategic partnerships with local manufacturers to increase their market penetration.

|

Company |

Establishment Year |

Headquarters |

Revenue ($ Mn) |

Collaborative Robot Range |

Compliance Certifications |

Product Innovation |

Key Partnerships |

|

Universal Robots |

2005 |

Odense, Denmark |

|||||

|

FANUC Corporation |

1972 |

Yamanashi, Japan |

|||||

|

ABB Ltd. |

1988 |

Zurich, Switzerland |

|||||

|

Yaskawa Electric Corp. |

1915 |

Kitakyushu, Japan |

|||||

|

KUKA AG |

1898 |

Augsburg, Germany |

Asia Pacific Collaborative Robots Market Analysis

Market Growth Drivers

- Adoption of Automation in Manufacturing: The adoption of automation in manufacturing is a significant growth driver for the collaborative robots (cobots) market in Asia Pacific. As manufacturers seek to improve efficiency, precision, and productivity, the demand for automation solutions like cobots has surged. In 2023, the manufacturing sector in Asia Pacific is expected to invest heavily in automation, with cobots being a key component of these efforts. Cobots are increasingly being deployed for tasks such as assembly, welding, and packaging, contributing to improved productivity and reduced operational costs, thus driving the market for cobots.

- Rising Demand in Electronics and Automotive Sectors: The electronics and automotive sectors in Asia Pacific are seeing a significant rise in the demand for collaborative robots. The region is a global hub for electronics manufacturing, with countries like China, Japan, and South Korea accounting for a large share of global production. In 2023, the automotive industry in Asia Pacific is expected to adopt cobots for tasks like assembly, part handling, and quality inspection. The flexibility, safety, and precision offered by cobots make them ideal for these industries, where high-volume production and fast cycle times are essential, thus further driving the market.

- Increasing Need for Worker Safety: The increasing focus on worker safety in industrial environments is driving the adoption of cobots across Asia Pacific. With safety regulations becoming more stringent and the need to protect workers from dangerous or repetitive tasks, cobots are seen as an ideal solution. In 2023, of factories in Asia Pacific are expected to implement cobots for collaborative work alongside human operators. This is particularly relevant in sectors such as electronics and automotive manufacturing, where cobots are used to perform tasks that could otherwise pose risks to human workers, thereby improving safety standards.

Market Challenges:

- High Initial Investment Costs: Despite the cost-effectiveness of collaborative robots in the long run, the high initial investment remains a major challenge for many companies in Asia Pacific, particularly SMEs. The price of a collaborative robot system, including hardware, software, and training, can be substantial, which discourages smaller companies from adopting the technology. In 2023, the average cost of deploying a cobot in Asia Pacific is expected to be around $50,000$100,000, which is a barrier for businesses with limited capital, thus slowing the pace of adoption in certain sectors.

- Limited Awareness Among SMEs: While large enterprises are increasingly adopting collaborative robots, awareness remains limited among small and medium-sized enterprises (SMEs) in Asia Pacific. In 2023, of SMEs in the region are expected to be unaware of the potential benefits of cobots, including their ability to reduce labor costs, enhance productivity, and improve safety. The lack of awareness, combined with financial constraints, limits the adoption of collaborative robots in the SME sector, which represents a significant portion of the manufacturing industry in Asia Pacific.

Asia Pacific Collaborative Robots Market Future Outlook

The Asia Pacific Collaborative Robots Market is expected to see robust growth driven by advancements in AI, machine learning, and IoT integration. Demand for automation in diverse applications like packaging, medical assistance, and smart manufacturing will bolster market expansion in the coming years.

Market Opportunities:

- Expansion into Emerging Markets: Emerging markets in Asia Pacific present a significant growth opportunity for collaborative robots. As countries like India, Indonesia, and Vietnam continue to industrialize and modernize their manufacturing sectors, the demand for automation solutions like cobots is expected to rise. In 2023, the governments push for Make in India and similar initiatives in other emerging economies is expected to accelerate the adoption of collaborative robots. These markets are characterized by increasing labor costs and a growing focus on improving manufacturing efficiency, creating an ideal environment for cobot adoption.

- Advancements in AI and Machine Learning: The integration of artificial intelligence (AI) and machine learning (ML) into collaborative robots is transforming their capabilities. In 2023, of new cobots in Asia Pacific are expected to feature AI-powered software that enhances their ability to adapt to different tasks and environments. AI and ML allow cobots to learn from their interactions and improve their performance over time, making them more versatile and efficient. This integration expands the range of applications for cobots, driving their adoption across industries such as manufacturing, healthcare, logistics, and retail.

Scope of the Report

|

By Payload Capacity |

Up to 5 kg |

|

By Application |

Assembly |

|

By Industry Vertical |

Electronics |

|

By Component |

Robotic Arm |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Electronics Manufacturers

Automotive Assembly Plants

Food and Beverage Processing Units

Healthcare Robotics Suppliers

Investments and Venture Capital Firms

Government and Regulatory Bodies(e.g., Ministry of Industry, Japan)

AI and Robotics Research Institutions

Packaging and Logistics Companies

Companies

Players Mention in the Report

Universal Robots

FANUC Corporation

ABB Ltd.

KUKA AG

Yaskawa Electric Corporation

Kawasaki Heavy Industries

Denso Corporation

Doosan Robotics

Techman Robot

Rethink Robotics

Festo Corporation

Mitsubishi Electric

Nachi-Fujikoshi Corporation

Staubli International AG

Comau S.p.A

Table of Contents

01. Asia Pacific Collaborative Robots Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Asia Pacific Collaborative Robots Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Asia Pacific Collaborative Robots Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of Automation in Manufacturing

3.1.2. Rising Demand in Electronics and Automotive Sectors

3.1.3. Increasing Need for Worker Safety

3.1.4. Cost-effectiveness of Collaborative Robots

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Limited Awareness Among SMEs

3.2.3. Technical Limitations in Certain Applications

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Advancements in AI and Machine Learning

3.3.3. Growing Applications in Non-manufacturing Sectors

3.4. Trends

3.4.1. Integration of IoT in Collaborative Robots

3.4.2. Focus on Human-Robot Interaction

3.4.3. Growth in Cloud Robotics

3.5. Government Regulation

3.5.1. Safety Standards for Collaborative Robots

3.5.2. Data Privacy and Cybersecurity Regulations

3.5.3. Subsidies for Automation in Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Asia Pacific Collaborative Robots Market Segmentation

4.1. By Payload Capacity (In Value %)

4.1.1. Up to 5 kg

4.1.2. 6-10 kg

4.1.3. 11-20 kg

4.1.4. Above 20 kg

4.2. By Application (In Value %)

4.2.1. Assembly

4.2.2. Material Handling

4.2.3. Quality Inspection

4.2.4. Packaging and Palletizing

4.3. By Industry Vertical (In Value %)

4.3.1. Electronics

4.3.2. Automotive

4.3.3. Food and Beverage

4.3.4. Healthcare

4.3.5. Metal and Machinery

4.4. By Component (In Value %)

4.4.1. Robotic Arm

4.4.2. Controller

4.4.3. End Effector

4.4.4. Drives

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. India

4.5.5. Southeast Asia

05. Asia Pacific Collaborative Robots Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Universal Robots

5.1.2. FANUC Corporation

5.1.3. ABB Ltd.

5.1.4. KUKA AG

5.1.5. Yaskawa Electric Corporation

5.1.6. Kawasaki Heavy Industries

5.1.7. Denso Corporation

5.1.8. Doosan Robotics

5.1.9. Techman Robot

5.1.10. Rethink Robotics

5.1.11. Festo Corporation

5.1.12. Mitsubishi Electric

5.1.13. Nachi-Fujikoshi Corporation

5.1.14. Staubli International AG

5.1.15. Comau S.p.A

5.2. Cross Comparison Parameters (Revenue, Headquarters, Year of Establishment, Product Range, Patents Held, Market Share, Strategic Collaborations, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Asia Pacific Collaborative Robots Regulatory Framework

6.1. Safety Standards and Compliance

6.2. Import-Export Regulations

6.3. Certification Processes for Collaborative Robots

07. Asia Pacific Collaborative Robots Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

08. Asia Pacific Collaborative Robots Future Market Segmentation

8.1. By Payload Capacity (In Value %)

8.2. By Application (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Component (In Value %)

8.5. By Region (In Value %)

09. Asia Pacific Collaborative Robots Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Product Development and Innovation

9.3. Strategic Marketing Initiatives

9.4. Identification of Untapped Opportunities

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

Defining the ecosystem, understanding key stakeholders, and establishing variables such as automation demand and industry-specific applications for collaborative robots.

Step 2: Market Analysis and Construction

Analyzing historical data on market penetration and application in manufacturing, logistics, and quality control to project growth patterns and segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Consulting industry experts to validate findings on collaborative robot adoption trends, compliance requirements, and investment flows.

Step 4: Research Synthesis and Final Output

Integrating all research findings to produce a comprehensive and actionable report on the Asia Pacific Collaborative Robots Market.

Frequently Asked Questions

01. How big is the Asia Pacific Collaborative Robots Market?

The Asia Pacific Collaborative Robots Market is valued at approximately USD 572.78 million, supported by rapid automation and high demand in the electronics and automotive sectors.

02. What are the main challenges in this market?

Challenges include high initial costs, limited awareness among SMEs, and technical limitations in non-standardized applications.

03. Who are the major players in the Asia Pacific Collaborative Robots Market?

Key players include Universal Robots, FANUC, ABB, KUKA AG, and Yaskawa Electric, which lead the market through technological innovation and strategic partnerships.

04. What drives the Asia Pacific Collaborative Robots Market?

The market growth is driven by labor shortages, rising production costs, and advancements in AI and IoT that enhance robot efficiency and functionality.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.