Asia Pacific Condensed Milk Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD10029

November 2024

87

About the Report

Asia Pacific Condensed Milk Market Overview

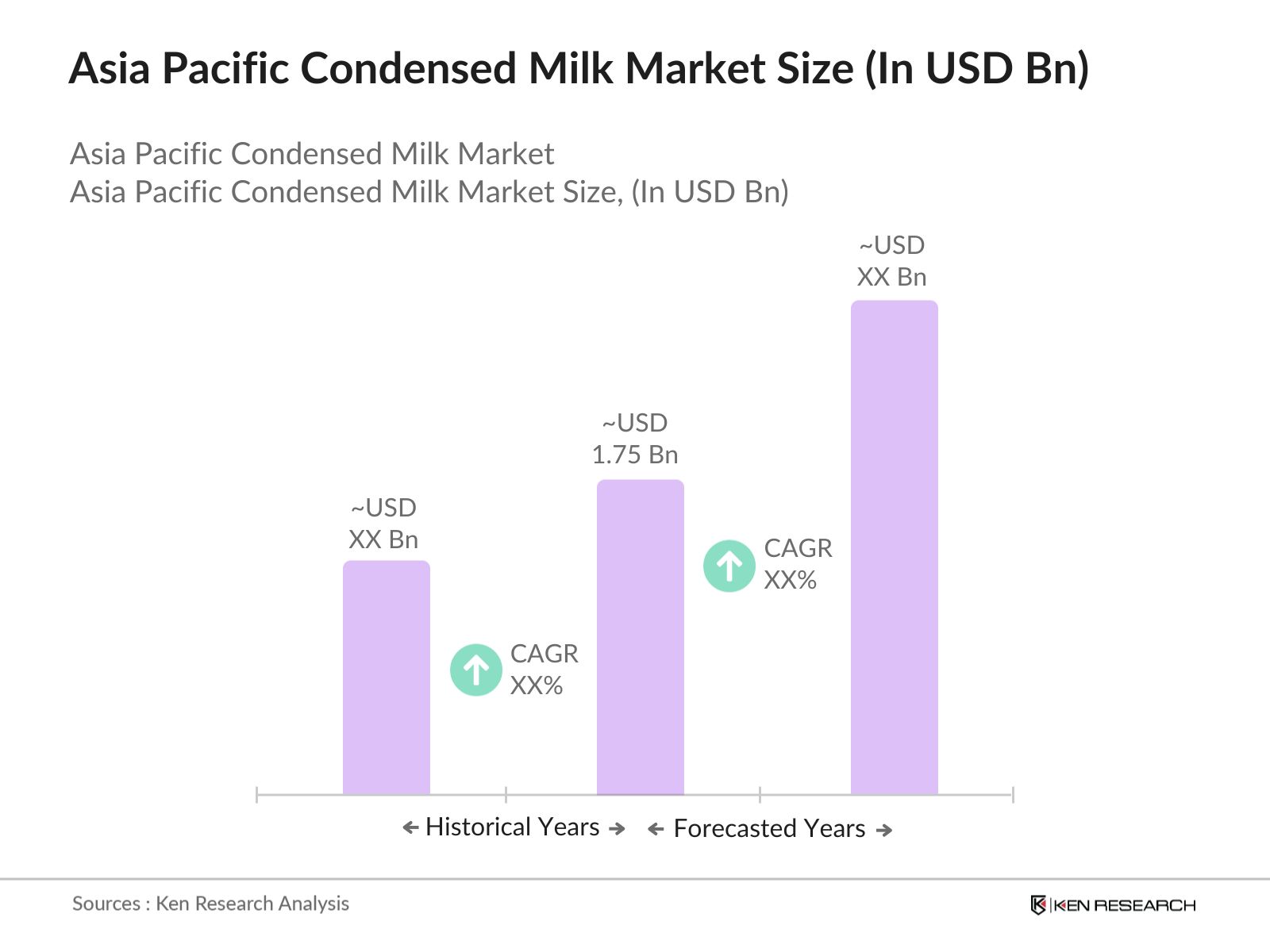

- The Asia Pacific condensed milk market is valued at USD 1.75 billion, driven by the increasing demand for dairy products across the region. The market's expansion is supported by the growing urbanization, rising disposable incomes, and the increasing use of condensed milk in the food and beverage industry, especially in bakery and confectionery products. The demand for long shelf-life dairy products and the convenience of condensed milk for home cooking further contribute to its market growth.

- The market is dominated by countries like China, India, and Japan due to their large consumer bases and rapidly expanding food processing industries. China's dominance is primarily due to the widespread use of condensed milk in desserts and beverages, while India's dairy-rich culture and extensive milk production capacity drive its market position. Japan's preference for premium dairy products and its sophisticated food processing sector also make it a key player in the market.

- The Indian government continues to invest heavily in its dairy sector, with the National Dairy Development Boards initiatives aimed at increasing milk production and processing capabilities. By 2024, the governments dairy development fund will further enhance infrastructure, benefiting condensed milk manufacturers by improving supply chain efficiency and raw milk availability.

Asia Pacific Condensed Milk Market Segmentation

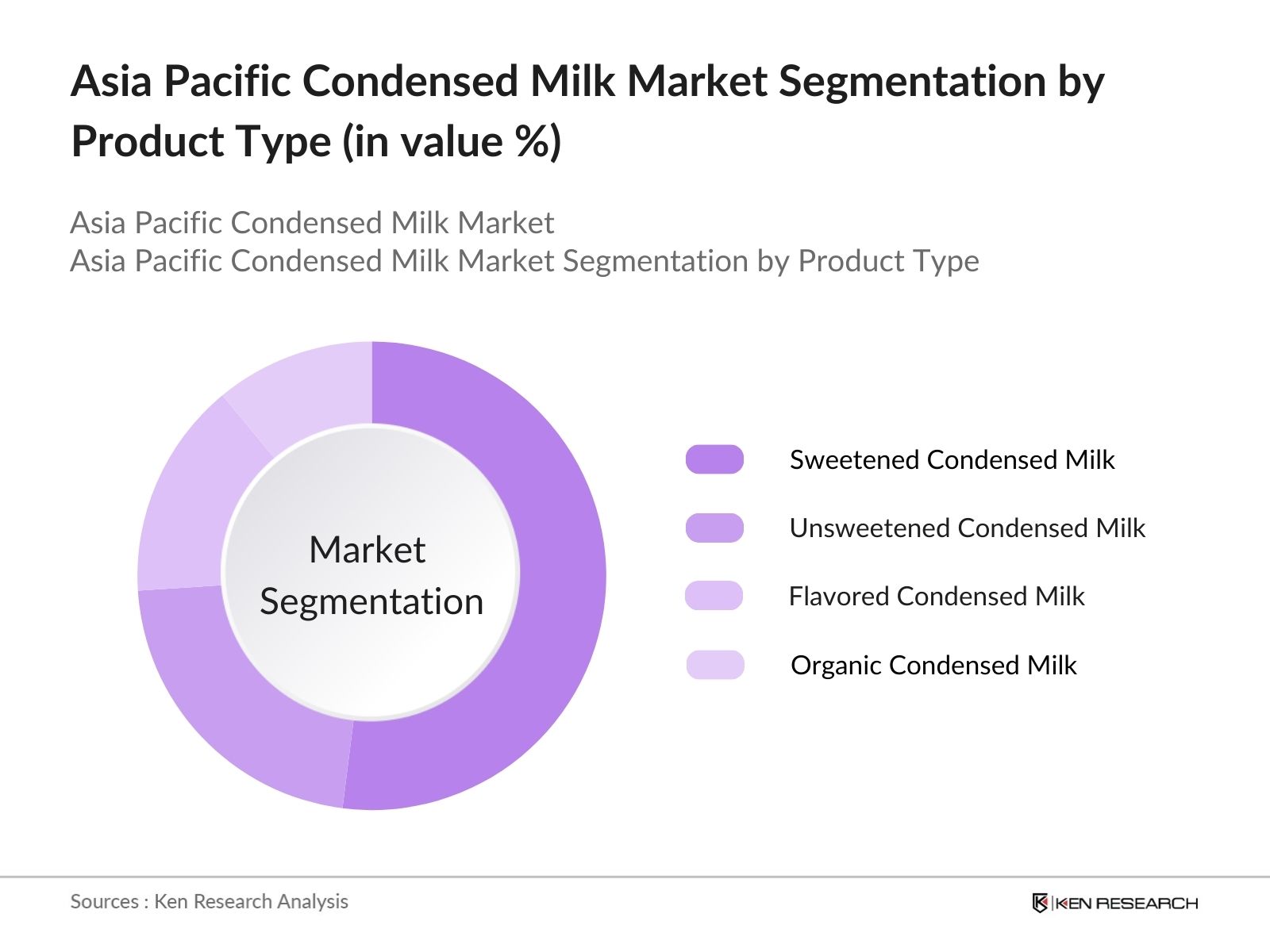

By Product Type: The Asia Pacific condensed milk market is segmented by product type into sweetened condensed milk, unsweetened condensed milk, flavored condensed milk, and organic condensed milk. Sweetened condensed milk holds the dominant market share due to its high usage in desserts, beverages, and confectionery. Its long shelf life and rich taste make it a preferred choice in both home cooking and commercial applications. The demand for sweetened condensed milk is particularly high in India and Southeast Asia, where it is a key ingredient in traditional sweets and beverages.

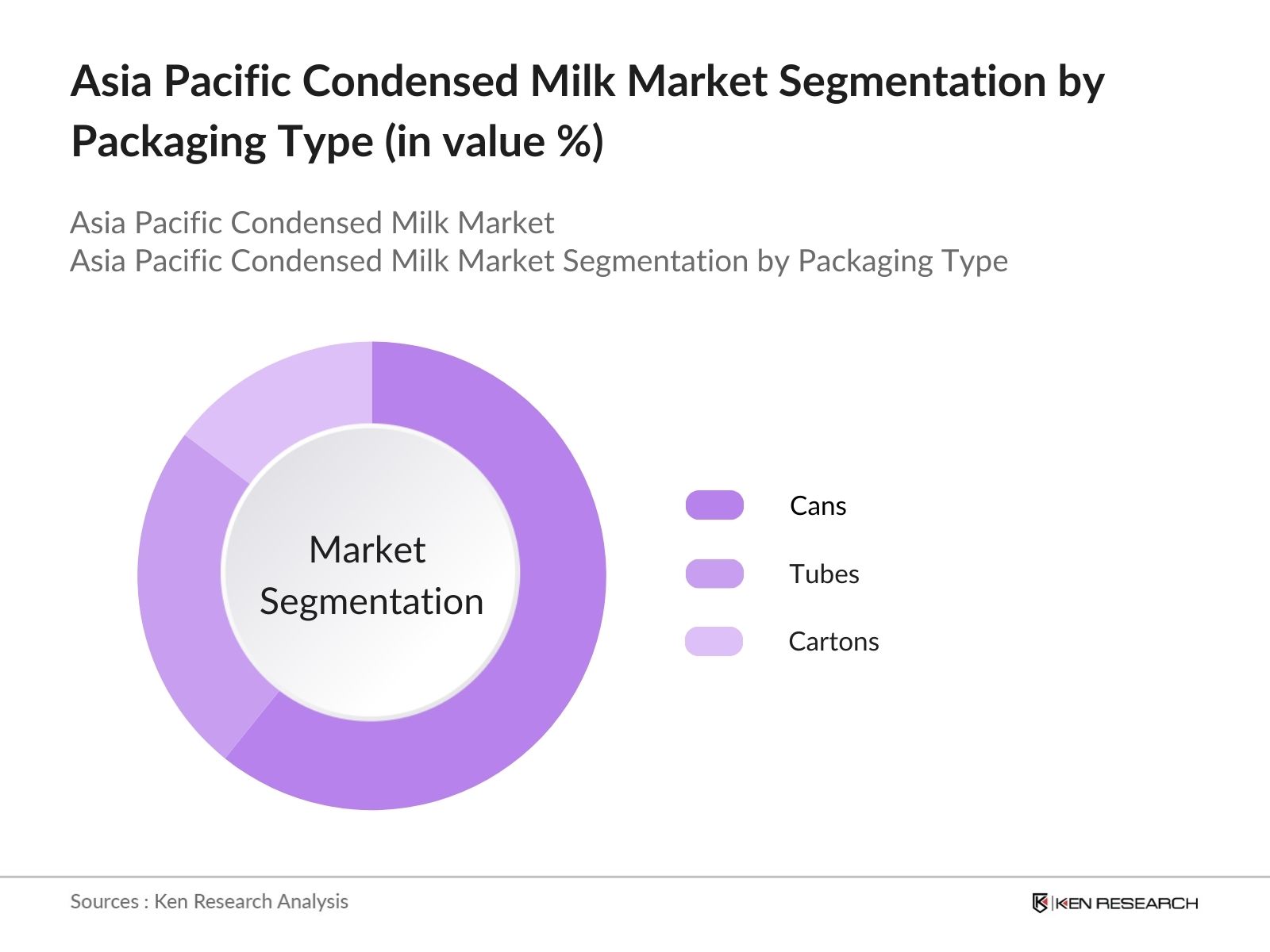

By Packaging Type: The market is also segmented by packaging type into cans, tubes, and cartons. Cans dominate the market due to their durability and extended shelf life. They are widely preferred by manufacturers and consumers alike for their ease of storage and transport. Additionally, cans offer better protection against contamination and spoilage, which is crucial for dairy products. Cartons, however, are gaining traction, particularly in Japan and Australia, where there is a growing demand for environmentally friendly packaging.

Asia Pacific Condensed Milk Market Competitive Landscape

The Asia Pacific condensed milk market is characterized by the presence of both global dairy giants and local manufacturers. Major players like Nestl and FrieslandCampina dominate the market with their extensive product portfolios, strong distribution networks, and innovative packaging solutions. Local companies such as Vinamilk and Amul also hold significant shares in their respective countries due to their strong brand presence and extensive supply chains.

Asia Pacific Condensed Milk Market Analysis

Growth Drivers

- Increasing Demand for Dairy Products: The demand for dairy products, including condensed milk, is steadily growing in Asia Pacific. In 2024, the regions dairy consumption is estimated to reach nearly 320 million metric tons, supported by expanding middle-class populations and rising consumer preferences for dairy-based products. Major dairy-producing countries, like India and China, are pushing dairy demand, driven by cultural significance and the widespread use of condensed milk in traditional cuisines. Government dairy development programs are also boosting this demand across rural and urban regions.

- Expanding Use in Bakery and Confectionery: Condensed milk is gaining popularity as a key ingredient in bakery and confectionery industries across Asia Pacific, where annual revenue in these sectors is expected to grow significantly by 2024. In countries like Japan and Thailand, the use of condensed milk in premium and artisanal products has expanded rapidly. This trend is further driven by the increase in specialty cafes and patisseries that incorporate condensed milk into various dessert offerings, bolstering its demand across the foodservice sector.

- Export Opportunities: Asia Pacific has become an important exporter of dairy products, including condensed milk, with dairy exports from key countries like New Zealand and Australia expected to surpass 1.6 million metric tons in 2024. International markets such as the Middle East and Southeast Asia have shown a growing preference for high-quality condensed milk products from the region, particularly for use in bakery products and confectioneries. The easing of trade barriers and new trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), are further enhancing these export opportunities.

Market Challenges

- Fluctuating Dairy Prices: Volatile dairy prices, driven by fluctuating global demand and supply chain disruptions, present a significant challenge to the condensed milk market. In 2024, dairy price inflation has surged due to increased feed costs, logistics disruptions, and changing trade dynamics. As a result, manufacturers face challenges in maintaining price stability for consumers. Countries like India and China, which are major consumers of condensed milk, are particularly vulnerable to these fluctuations, affecting both producers and consumers.

- Stringent Food Safety Regulations: Food safety regulations across the Asia Pacific region are becoming stricter, especially concerning dairy products. In 2024, countries like China, Australia, and Japan have introduced more rigorous standards for food processing, packaging, and labeling, impacting manufacturers costs and compliance requirements. The adherence to these regulations is essential, as non-compliance could lead to severe penalties or product recalls, which could harm the market reputation and consumer trust.

Asia Pacific Condensed Milk Market Future Outlook

Over the next five years, the Asia Pacific condensed milk market is expected to experience steady growth, driven by increasing demand for dairy products in urban areas and the continued expansion of food processing industries in emerging markets like India, Vietnam, and the Philippines. The growing popularity of ready-to-eat and convenience foods, combined with innovations in dairy product offerings such as organic and low-sugar options, will likely contribute to the market's positive trajectory. Government support for the dairy industry, along with technological advancements in dairy production and packaging, will further fuel the growth.

Market Opportunities

- Innovation in Packaging: The condensed milk industry is seeing a shift towards innovative packaging solutions, with demand for single-use sachets and eco-friendly materials on the rise. In 2024, the focus on sustainable packaging is expected to grow, driven by government policies and consumer demand for environmentally responsible options. For example, India's government initiatives encourage the use of biodegradable packaging for food products, opening opportunities for companies to innovate and capture the growing market of eco-conscious consumers.

- Expansion into Untapped Rural Markets: There is significant potential for growth in untapped rural markets across Asia Pacific. By 2024, rural areas in India, Vietnam, and the Philippines will contribute significantly to dairy product consumption, as access to processed foods improves. Government programs promoting rural development and dairy consumption, such as India's National Dairy Development Board initiatives, are facilitating the entry of condensed milk into these underserved markets, increasing overall demand.

Scope of the Report

|

By Product Type |

Sweetened Condensed Milk Unsweetened Condensed Milk Flavored Condensed Milk Organic Condensed Milk |

|

By Packaging Type |

Cans Tubes Cartons |

|

By Application |

Bakery and Confectionery Dairy Products Beverages Personal/Home Use |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores |

|

By Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience

Dairy Product Manufacturers

Food and Beverage Companies

Supermarkets and Hypermarkets

Specialty Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Food Safety and Standards Authority of India, Codex Alimentarius)

Dairy Exporters and Importers

Packaging Manufacturers

Companies

Players Mentioned in the Report:

Nestl S.A.

FrieslandCampina

Vinamilk

Amul (Gujarat Cooperative Milk Marketing Federation)

Royal FrieslandCampina N.V.

Arla Foods

Eagle Family Foods Group

Danone

Parag Milk Foods

Devondale Murray Goulburn

Table of Contents

1. Asia Pacific Condensed Milk Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Drivers (Consumer Demand, Urbanization, Expanding Dairy Industry)

1.4. Market Segmentation Overview

2. Asia Pacific Condensed Milk Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Condensed Milk Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Dairy Products

3.1.2. Growth in Urbanization (Rising Consumption in Urban Areas)

3.1.3. Expanding Use in Bakery and Confectionery (New Product Applications)

3.1.4. Export Opportunities (Increasing Trade with Global Markets)

3.2. Market Challenges

3.2.1. Fluctuating Dairy Prices

3.2.2. Stringent Food Safety Regulations (Quality Standards and Compliance)

3.2.3. High Competition from Substitutes (Alternative Dairy and Plant-Based Products)

3.3. Opportunities

3.3.1. Innovation in Packaging (Convenient and Sustainable Options)

3.3.2. Expansion into Untapped Rural Markets

3.3.3. Government Support for Dairy Sector (Incentives and Subsidies)

3.3.4. Rising Health-Conscious Consumer Base (Low-Sugar and Fortified Products)

3.4. Trends

3.4.1. Increased Popularity of Ready-to-Eat and Dessert Applications

3.4.2. Organic and Clean Label Condensed Milk (Health-Focused Products)

3.4.3. Growth of E-commerce Distribution Channels

3.4.4. Dairy-Free Alternatives Impacting Market Dynamics (Plant-Based Growth)

3.5. Government Regulations

3.5.1. Food Safety and Standards Authority of India (FSSAI) Guidelines

3.5.2. Australia and New Zealand Food Standards Code

3.5.3. Codex Alimentarius Regulations on Condensed Milk

3.5.4. Import/Export Tariffs and Trade Agreements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Dairy Farmers, Producers, Distributors, Retailers)

3.8. Porters Five Forces (Supplier Power, Buyer Power, Competition, Threat of Substitutes, Market Entry Barriers)

3.9. Competition Ecosystem

4. Asia Pacific Condensed Milk Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Sweetened Condensed Milk

4.1.2. Unsweetened Condensed Milk

4.1.3. Organic Condensed Milk

4.1.4. Flavored Condensed Milk

4.2. By Packaging Type (In Value %)

4.2.1. Cans

4.2.2. Tubes

4.2.3. Cartons

4.3. By Application (In Value %)

4.3.1. Bakery and Confectionery

4.3.2. Dairy Products

4.3.3. Beverages

4.3.4. Personal/Home Use

4.4. By Distribution Channel (In Value %)

4.4.1. Supermarkets/Hypermarkets

4.4.2. Online Retail

4.4.3. Convenience Stores

4.4.4. Specialty Stores

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. Southeast Asia

5. Asia Pacific Condensed Milk Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestl S.A.

5.1.2. Fraser and Neave, Limited

5.1.3. Dutch Lady Milk Industries Berhad

5.1.4. Vinamilk

5.1.5. Eagle Family Foods Group

5.1.6. Arla Foods

5.1.7. Amul (Gujarat Cooperative Milk Marketing Federation)

5.1.8. Danone

5.1.9. F&N Magnolia

5.1.10. Royal FrieslandCampina N.V.

5.1.11. Parag Milk Foods

5.1.12. Devondale Murray Goulburn

5.1.13. Dairy Farmers of America

5.1.14. Alaska Milk Corporation

5.1.15. Lactalis Group

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Product Range, Sustainability Initiatives, Distribution Reach, Market Share, Brand Value, Partnerships/Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers & Acquisitions, New Product Launches, Geographical Expansion)

5.5. Investment Analysis

5.6. Government Subsidies and Support (Incentives, Dairy Development Programs)

6. Asia Pacific Condensed Milk Market Regulatory Framework

6.1. Food Safety Regulations (Packaging and Labeling Standards, Ingredient Quality Control)

6.2. Trade Agreements and Tariff Structures (Impact of Free Trade Agreements)

6.3. Sustainability Certifications (Organic, Non-GMO)

6.4. Compliance with International Dairy Export Regulations

7. Asia Pacific Condensed Milk Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth (Evolving Consumer Preferences, Increasing Export Demand)

8. Asia Pacific Condensed Milk Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Packaging Type (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Condensed Milk Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Consumer Cohort Analysis

9.3. Market Penetration and Expansion Strategies

9.4. White Space Opportunities (Product Innovation, Geographic Expansion)

Research Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map was developed that includes all significant stakeholders within the Asia Pacific Condensed Milk Market. A combination of primary research and secondary data sources, such as government publications and industry reports, were used to identify and define the critical variables driving market dynamics.

Step 2: Market Analysis and Construction

The analysis focused on historical data collection and its impact on market performance. Market penetration, sales figures, and consumer preferences were assessed to ensure the reliability of the revenue estimates. This analysis provides a detailed understanding of the growth trends and market structure.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions were validated through expert interviews and consultations with industry leaders. Feedback from these professionals helped to refine the market data and ensure accuracy in reporting, further enhancing the report's credibility.

Step 4: Research Synthesis and Final Output

The final report was synthesized by engaging with major manufacturers and distributors of condensed milk to obtain direct insights into market dynamics. This step ensured a comprehensive analysis, merging both top-down and bottom-up approaches for a balanced market outlook.

Frequently Asked Questions

1. How big is the Asia Pacific Condensed Milk Market?

The Asia Pacific condensed milk market is valued at USD 1.75 billion, driven by rising demand for dairy products across multiple segments including beverages, bakery, and confectionery.

2. What are the challenges in the Asia Pacific Condensed Milk Market?

Challenges in Asia Pacific condensed milk market include fluctuating raw material prices, competition from non-dairy alternatives, and stringent food safety regulations that impact manufacturers.

3. Who are the major players in the Asia Pacific Condensed Milk Market?

Key players in the Asia Pacific condensed milk market include Nestl, FrieslandCampina, Vinamilk, and Amul, which dominate due to their extensive product portfolios and strong distribution networks.

4. What are the growth drivers of the Asia Pacific Condensed Milk Market?

Growth in the Asia Pacific condensed milk market is driven by increasing urbanization, rising disposable incomes, and the expanding food processing sector in countries like China, India, and Japan.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.