Asia Pacific Construction Market

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD5180

December 2024

93

About the Report

Asia Pacific Construction Market Overview

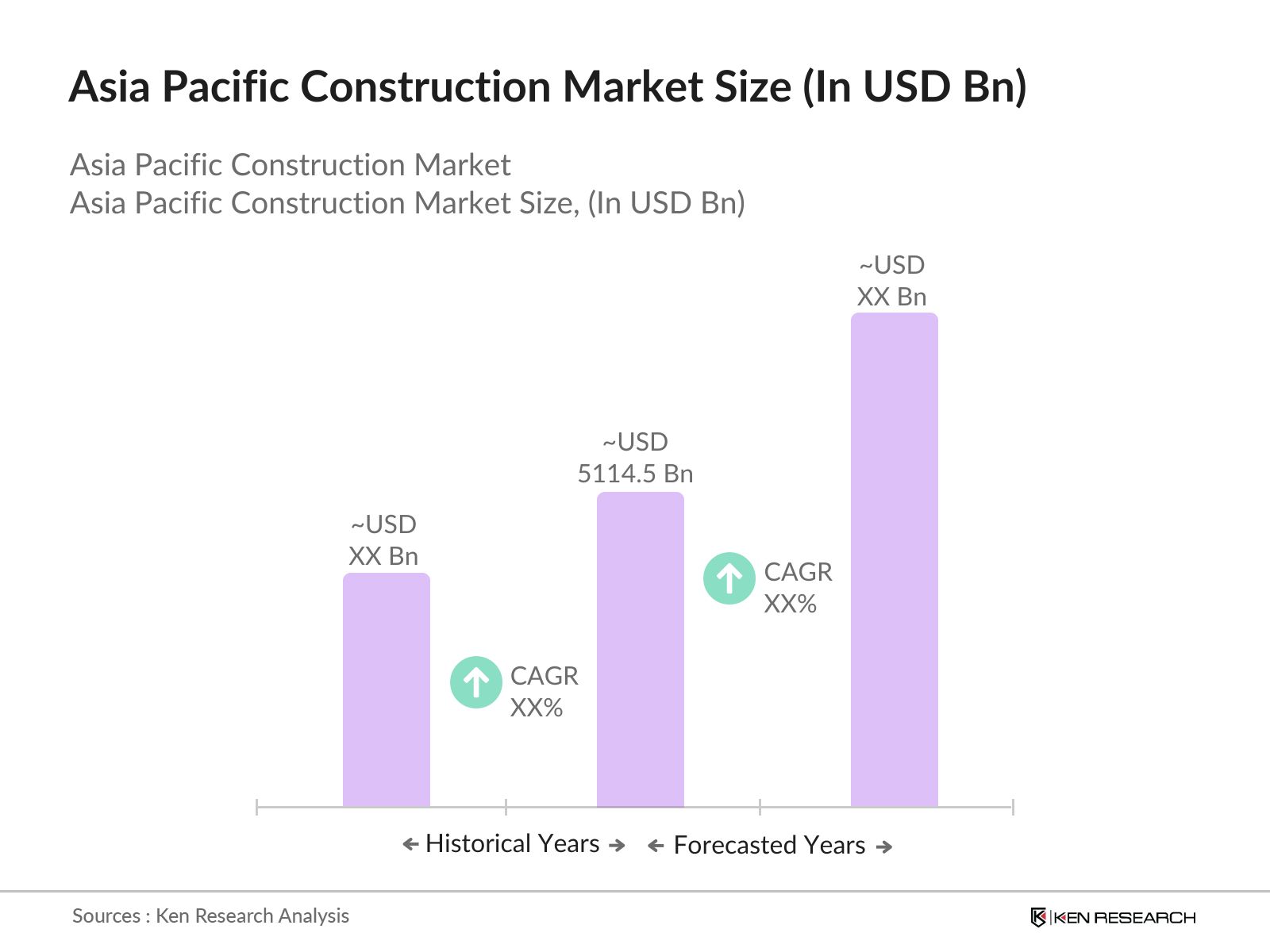

- The Asia Pacific Construction Market is valued at USD 5114.5 billion, driven primarily by the rapid urbanization and industrialization across key regions. The consistent rise in infrastructure projects, including the development of smart cities and industrial zones, has significantly contributed to the market size. Public and private investments in large-scale projects such as residential complexes, highways, airports, and energy plants continue to bolster growth. Furthermore, advancements in construction technology like Building Information Modeling (BIM) and automation are further driving expansion.

- Dominant regions in the Asia Pacific construction market include China, India, and Japan, with China leading due to its robust infrastructure spending and government-backed initiatives like the Belt and Road Initiative. India follows closely, driven by its growing urban population and investments in smart city projects. Japans dominance stems from its advanced construction technology, which emphasizes sustainability and innovation in infrastructure development. These regions benefit from strong governmental support, favorable policies, and massive urbanization projects.

- The Belt and Road Initiative (BRI) remains a critical engine for construction activities across the Asia Pacific region. Since its inception in 2013, BRI has facilitated massive infrastructure investments, with China committing substantial financial resources to develop cross-border connectivity and foster regional economic integration. As of 2024, China had invested an estimated $710 billion in BRI-related infrastructure projects, with a primary focus on enhancing transportation networks, energy infrastructure, and trade routes across participating countries.

Asia Pacific Construction Market Segmentation

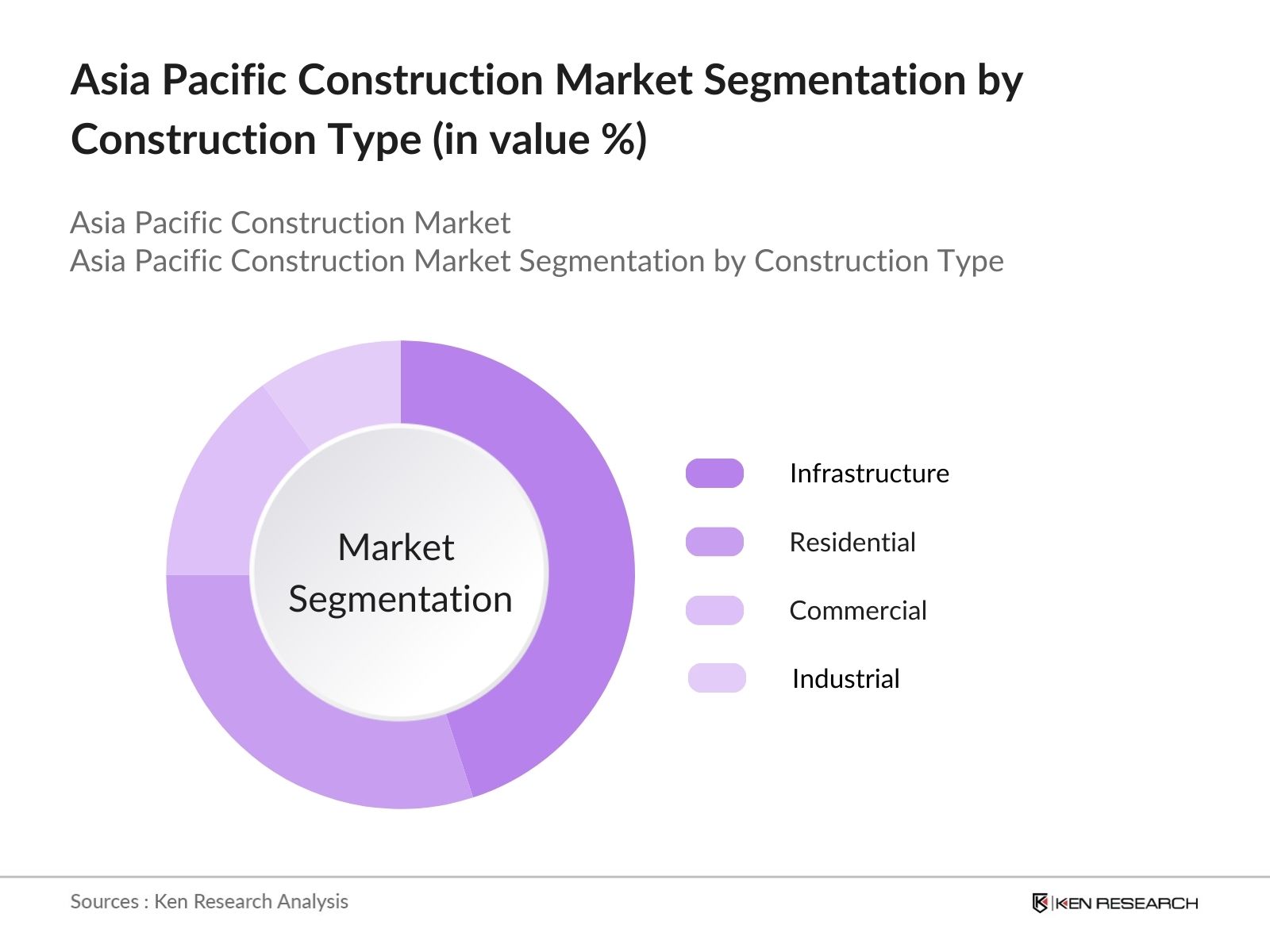

By Construction Type: The Asia Pacific Construction market is segmented by construction type into residential, commercial, industrial, and infrastructure. Infrastructure construction holds the dominant market share in this segment. This is largely attributed to the massive investments in roadways, bridges, and smart city projects across the region, especially in countries like China and India. These countries prioritize infrastructure development to sustain their growing economies and improve trade connectivity, further supported by international investments in public infrastructure.

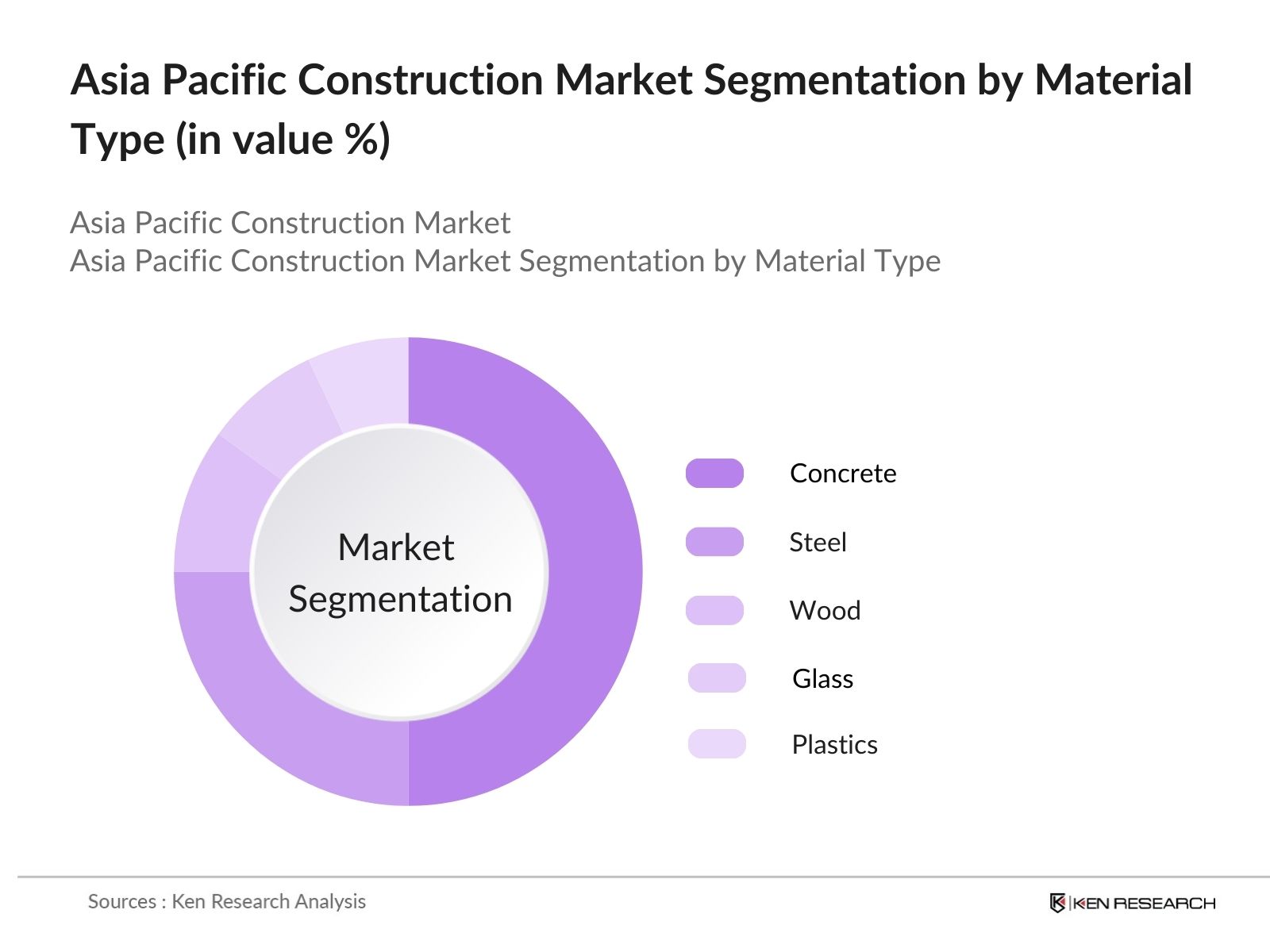

By Material Type: The market is segmented by material type into concrete, steel, wood, glass, and plastics. Concrete dominates the market, holding the largest market share due to its widespread use in infrastructure and residential construction. Concrete's affordability, durability, and strength make it the preferred material for large-scale projects like highways, bridges, and high-rise buildings. Additionally, innovations in eco-friendly concrete mixtures are contributing to its continued dominance in the market.

Asia Pacific Construction Market Competitive Landscape

The Asia Pacific Construction Market is dominated by a few key players, with a mix of local giants and global construction firms. Companies like China State Construction Engineering Corporation and Larsen & Toubro dominate the market due to their ability to handle mega infrastructure projects and advanced construction technologies. The competition in this market is fierce, with companies focusing on securing government contracts, investing in sustainable practices, and expanding their presence across different segments of construction.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

No. of Projects |

Presence in Asia Pacific |

Technological Edge |

Sustainability Initiatives |

Strategic Acquisitions |

|

China State Construction Engineering Corporation |

1982 |

Beijing, China |

- | - | - | - | - | - |

|

Larsen & Toubro |

1938 |

Mumbai, India |

- | - | - | - | - | - |

|

VINCI Construction |

1899 |

Rueil-Malmaison, France |

- | - | - | - | - | - |

|

Samsung C&T |

1938 |

Seoul, South Korea |

- | - | - | - | - | - |

|

Hyundai Engineering & Construction |

1947 |

Seoul, South Korea |

- | - | - | - | - | - |

Asia Pacific Construction Market Analysis

Growth Drivers

- Government Infrastructure Investment: The Asia Pacific region has seen a surge in government spending on infrastructure projects. In 2024, China allocated $710 billion towards the Belt and Road Initiative, focusing on transportation and energy infrastructure, while India has allocated 10 lakh crore ($120 billion) for infrastructure developments, such as highways and railways. Indonesia is also investing heavily in public infrastructure with IDR 417 trillion ($28 billion) in its 2024 budget, prioritizing projects like roads, ports, and airports.

- Real Estate Growth in Key Markets: Countries such as India and China are witnessing a real estate boom. India recorded the sale of 260,000 residential units in 2023 across major cities like Mumbai and Bangalore. In China, over 10 million residential units were constructed in the same year, driven by increasing demand for housing in urban areas. The commercial real estate sector is also expanding, with multinational companies investing heavily in office spaces in Southeast Asia.

- Foreign Direct Investment (FDI): FDI inflows are boosting the Asia Pacific construction market. In 2023, India attracted $80 billion in FDI, with a significant portion allocated to infrastructure and real estate. Indonesia followed with $45 billion in FDI, primarily directed toward large infrastructure projects like airports and seaports, positioning both countries as investment hotspots.

Market Challenges

- Material Price Volatility: Fluctuating prices of essential construction materials, such as steel and cement, are a major challenge for the Asia Pacific construction sector. Steel prices fluctuated between $550 and $730 per metric ton between 2022 and 2023. Cement prices in Indonesia increased by 5% in 2023, creating significant budgetary challenges for large-scale infrastructure projects.

- Labor Shortage: The region is facing a shortage of skilled labor, particularly in countries like Japan and Australia. Japan saw an 8% decline in its construction workforce in 2023 due to its aging population. Meanwhile, Australia is facing a shortfall of over 105,000 construction workers as of 2024, affecting project timelines and increasing labor costs.

Asia Pacific Construction Market Future Outlook

Over the next five years, the Asia Pacific Construction Market is expected to see significant growth, driven by sustained investments in infrastructure, the rise of smart city initiatives, and the increasing adoption of advanced construction technologies. Governments across the region are prioritizing construction projects to support economic growth and meet the needs of expanding urban populations.

Market Opportunities

- Green Buildings: Green building initiatives are gaining traction in the Asia Pacific, driven by increasing demand for energy-efficient, sustainable constructions. In 2023, China surpassed the US in terms of Leadership in Energy and Environmental Design (LEED) certifications, with over 1,300 projects certified that year. India follows closely, with more than 1,000 projects awarded LEED certification. The green building market is expected to grow, as both governments and corporations shift towards eco-friendly infrastructure solutions to meet sustainability goals and reduce operational costs.

- Smart Cities Development: Smart city projects across the Asia Pacific are driving the adoption of cutting-edge technologies, such as IoT and AI, in construction. Chinas investment in smart city initiatives reached $500 billion in 2023, with over 500 smart city pilot projects underway. Similarly, India has allocated 6,500 crore ($780 million) in its 2024 budget to promote smart cities under the Smart Cities Mission. These technologies improve project efficiency, reduce waste, and enable real-time monitoring, creating opportunities for construction firms to contribute to the development of future-ready urban infrastructure.

Scope of the Report

|

By Construction Type |

Residential Commercial Industrial Infrastructure |

|

By Material Type |

Concrete Steel Wood Glass Plastics |

|

By Construction Technique |

Traditional Modular Prefabricated Sustainable |

|

By End-User Industry |

Real Estate Transport & Logistics Energy & Utilities Public |

|

By Region |

China India Japan Australia South Korea Southeast Asia |

Products

Key Target Audience

Real Estate Developers

Infrastructure Project Contractors

Investment and Venture Capitalist Firms

Construction Equipment Manufacturers

Energy and Utility Companies

Public-Private Partnership Organizations

Sustainable Construction Solution Providers

Government and Regulatory Bodies (e.g., China Ministry of Housing and Urban-Rural Development, India Ministry of Road Transport & Highways)

Companies

Players Mentioned in the Report:

China State Construction Engineering Corporation

Larsen & Toubro

VINCI Construction

Hyundai Engineering & Construction

Samsung C&T Corporation

Obayashi Corporation

Kajima Corporation

CPB Contractors

Shimizu Corporation

Tata Projects

Table of Contents

1. Asia Pacific Construction Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Construction Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Construction Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Infrastructure Development (Rise in Urban Infrastructure Projects)

3.1.2. Government Spending (Public Infrastructure Investment)

3.1.3. Real Estate Boom (Demand for Residential and Commercial Properties)

3.1.4. Technological Advancements (Construction Automation, Use of Drones)

3.2. Market Challenges

3.2.1. High Material Costs (Steel, Cement Price Volatility)

3.2.2. Labor Shortage (Skilled Labor Availability)

3.2.3. Regulatory Barriers (Building Codes, Zoning Regulations)

3.2.4. Environmental Concerns (Sustainability Regulations, Carbon Emissions)

3.3. Opportunities

3.3.1. Green Buildings (LEED-Certified Projects)

3.3.2. Smart Cities Development (Integration of IoT and AI in Construction)

3.3.3. Modular Construction (Off-site Construction Techniques)

3.3.4. International Investment (FDI in Infrastructure)

3.4. Trends

3.4.1. Sustainable Construction (Energy-Efficient Materials, Waste Reduction)

3.4.2. Use of 3D Printing (Additive Manufacturing in Construction)

3.4.3. Digital Twin Technology (Virtual Construction Models)

3.4.4. Autonomous Construction Equipment (Self-operating Machinery)

3.5. Government Regulation

3.5.1. Infrastructure Development Programs (Country-Specific Initiatives)

3.5.2. Construction Safety Standards (Workplace Safety Regulations)

3.5.3. Environmental Protection Laws (Sustainable Construction Requirements)

3.5.4. Building Code Updates (Seismic-Resistant Construction Standards)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Construction Market Segmentation

4.1. By Construction Type (In Value %)

4.1.1. Residential

4.1.2. Commercial

4.1.3. Industrial

4.1.4. Infrastructure

4.2. By Material Type (In Value %)

4.2.1. Concrete

4.2.2. Steel

4.2.3. Wood

4.2.4. Glass

4.2.5. Plastics

4.3. By Construction Technique (In Value %)

4.3.1. Traditional Construction

4.3.2. Modular Construction

4.3.3. Prefabricated Construction

4.3.4. Sustainable Construction

4.4. By End-User Industry (In Value %)

4.4.1. Real Estate

4.4.2. Transport & Logistics

4.4.3. Energy & Utilities

4.4.4. Public Sector

4.5. By Region (In Value %)

4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. Australia

4.5.5. South Korea

4.5.6. Southeast Asia

5. Asia Pacific Construction Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. China State Construction Engineering Corporation (CSCEC)

5.1.2. Samsung C&T Corporation

5.1.3. Larsen & Toubro

5.1.4. VINCI Construction

5.1.5. Obayashi Corporation

5.1.6. Kajima Corporation

5.1.7. Daewoo Engineering & Construction

5.1.8. Leighton Asia

5.1.9. Bouygues Construction

5.1.10. Shimizu Corporation

5.1.11. Hyundai Engineering & Construction

5.1.12. Tata Projects

5.1.13. CPB Contractors

5.1.14. China Communications Construction Company (CCCC)

5.1.15. AECOM

5.2. Cross Comparison Parameters (Revenue, Employee Strength, Headquarters, Regional Presence, Core Competencies, Strategic Initiatives, R&D Investment, ESG Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Funding Programs

5.8. Private Equity Investments

6. Asia Pacific Construction Market Regulatory Framework

6.1. Environmental Standards (Carbon Emissions, Green Building Certification)

6.2. Compliance Requirements (Building Code Adherence, Safety Standards)

6.3. Certification Processes (ISO Certifications, Green Certifications)

7. Asia Pacific Construction Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Urbanization, Infrastructure Investment, Technological Innovations)

8. Asia Pacific Construction Future Market Segmentation

8.1. By Construction Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Construction Technique (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Construction Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying the major stakeholders within the Asia Pacific Construction Market. This includes extensive research on infrastructure developers, contractors, material suppliers, and government bodies. Data is collected from proprietary databases, news articles, and industry reports.

Step 2: Market Analysis and Construction

In this stage, historical data from the construction industry is analyzed to assess market trends, growth rates, and construction techniques. We review revenue data, assess project completions, and evaluate government investments to understand market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from leading construction firms are consulted to validate market projections. Key hypotheses regarding market drivers, challenges, and opportunities are confirmed through interviews and expert feedback, ensuring accuracy and relevance.

Step 4: Research Synthesis and Final Output

In the final stage, the data is consolidated, and insights are generated to provide a comprehensive analysis of the Asia Pacific Construction Market. Detailed information on construction projects, material usage, and future trends are compiled to create an actionable market report.

Frequently Asked Questions

1. How big is the Asia Pacific Construction Market?

The Asia Pacific Construction Market is valued at USD 5114.5 billion, driven by infrastructure investments and urbanization projects.

2. What are the challenges in the Asia Pacific Construction Market?

Challenges in the Asia Pacific Construction Market include rising material costs, labor shortages, and regulatory hurdles in certain countries, which can delay large infrastructure projects.

3. Who are the major players in the Asia Pacific Construction Market?

Key players in the Asia Pacific Construction Market include China State Construction Engineering Corporation, Larsen & Toubro, VINCI Construction, Hyundai Engineering & Construction, and Samsung C&T Corporation.

4. What are the growth drivers of the Asia Pacific Construction Market?

Growth of Asia Pacific Construction Market is driven by government investments in infrastructure, technological advancements like modular construction, and rising demand for residential and commercial spaces.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.