Asia Pacific Construction Toys Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD6118

November 2024

96

About the Report

Asia Pacific Construction Toys Market Overview

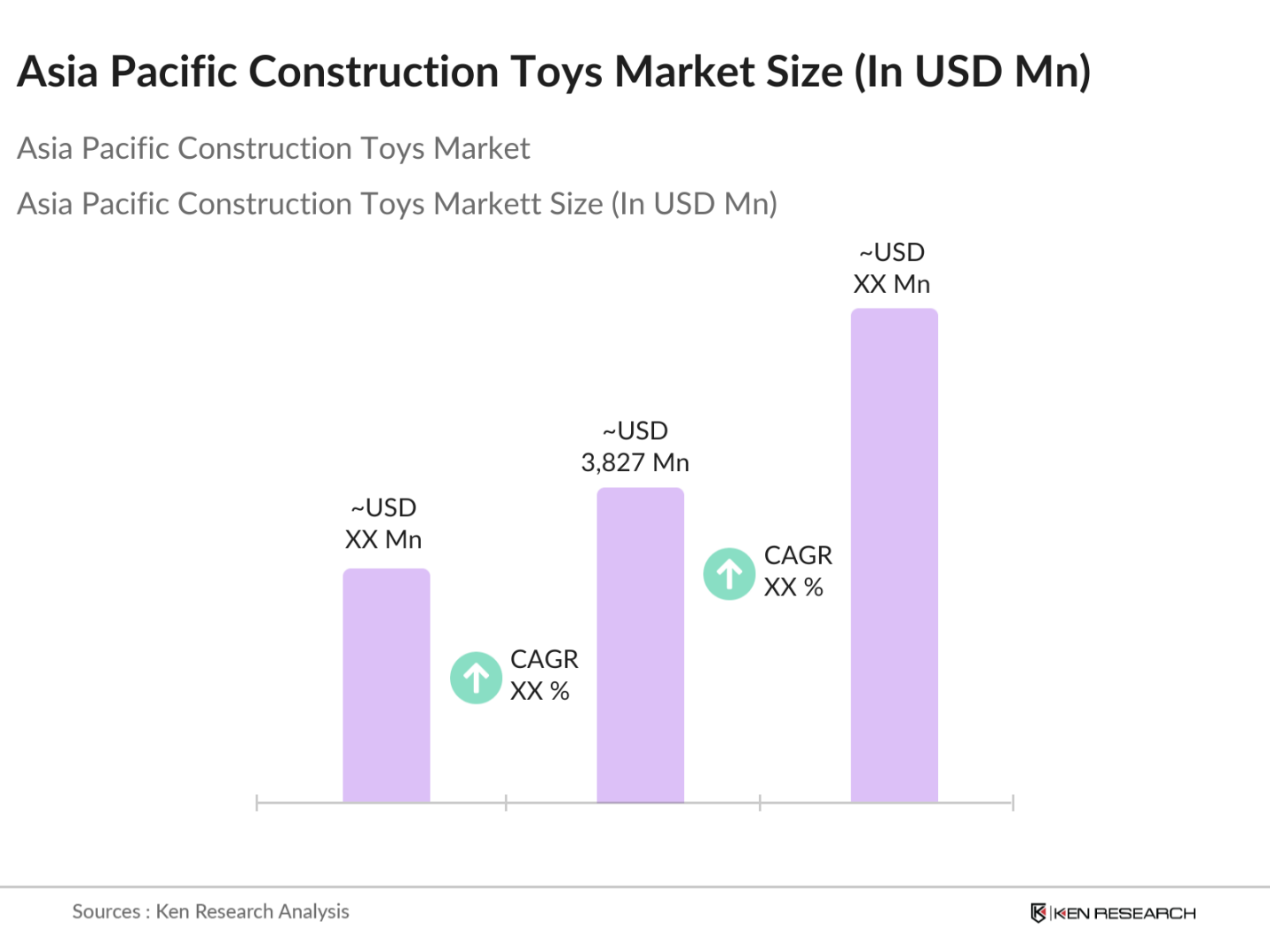

- The Asia Pacific Construction Toys market is valued at USD 3,827 million, based on a five-year historical analysis. This market's growth is largely fueled by rising consumer demand for educational toys that foster cognitive development, along with increasing disposable incomes in countries such as China and India. With a strong emphasis on early childhood education and the integration of learning through play, construction toys are increasingly preferred by parents and educators alike, further supporting the markets expansion across the region.

- China and Japan are dominant players in the Asia Pacific construction toys market. China's dominance is attributed to its vast manufacturing capabilities and a large consumer base, while Japan's strong emphasis on quality and innovation in toy manufacturing contributes to its significant market presence.

- Governments enforce strict safety standards for toys to protect children from potential hazards. In India, the Bureau of Indian Standards (BIS) certification is mandatory for toy manufacturers, ensuring compliance with safety norms and boosting consumer confidence in domestically produced educational toys.

Asia Pacific Construction Toys Market Segmentation

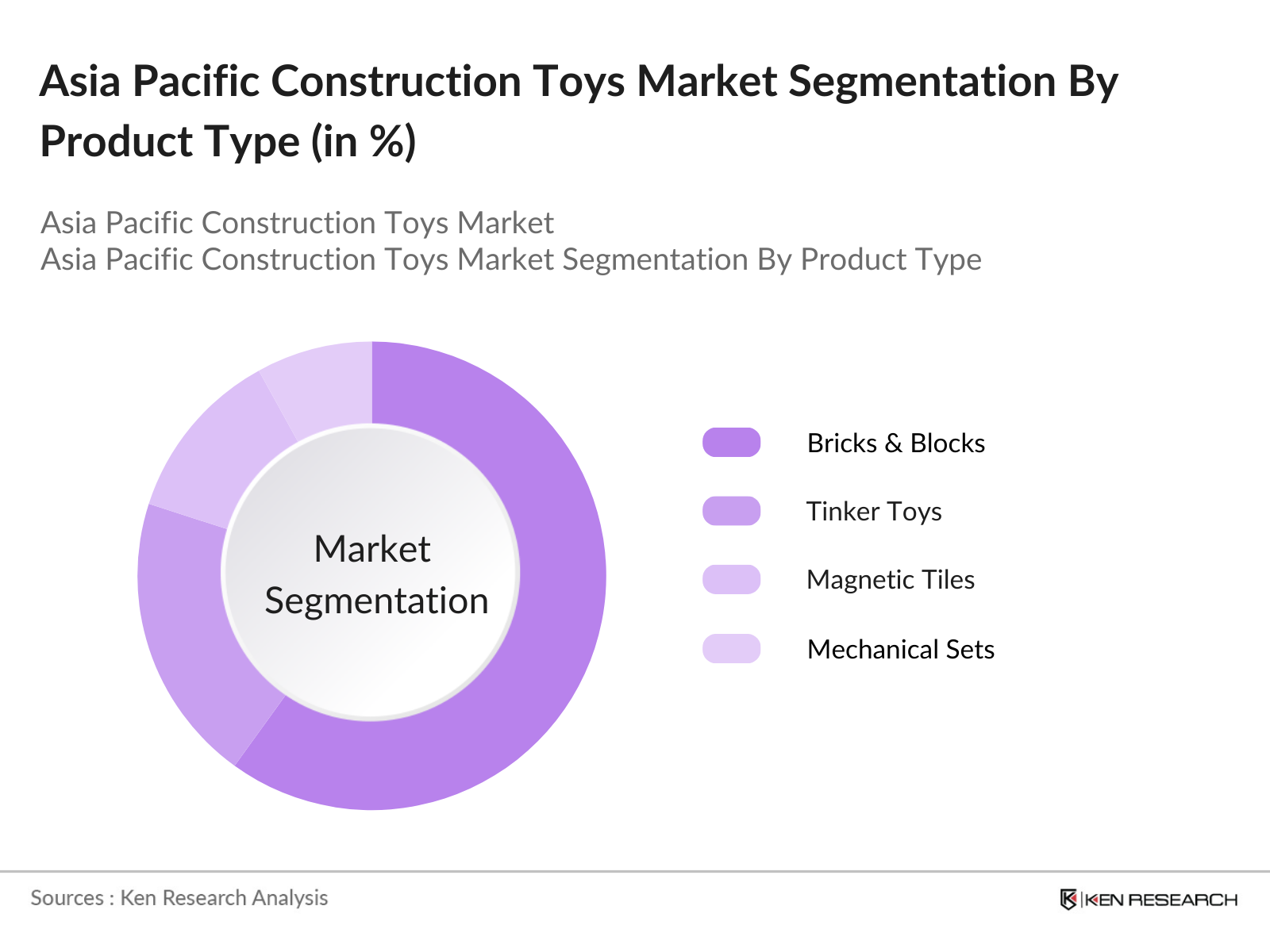

By Product Type: The market is segmented by product type into bricks & blocks, tinker toys, magnetic tiles, mechanical sets, and others. Bricks & blocks hold a dominant market share due to their versatility and widespread appeal among children. These toys encourage creativity and problem-solving skills, making them a preferred choice for both parents and educators.

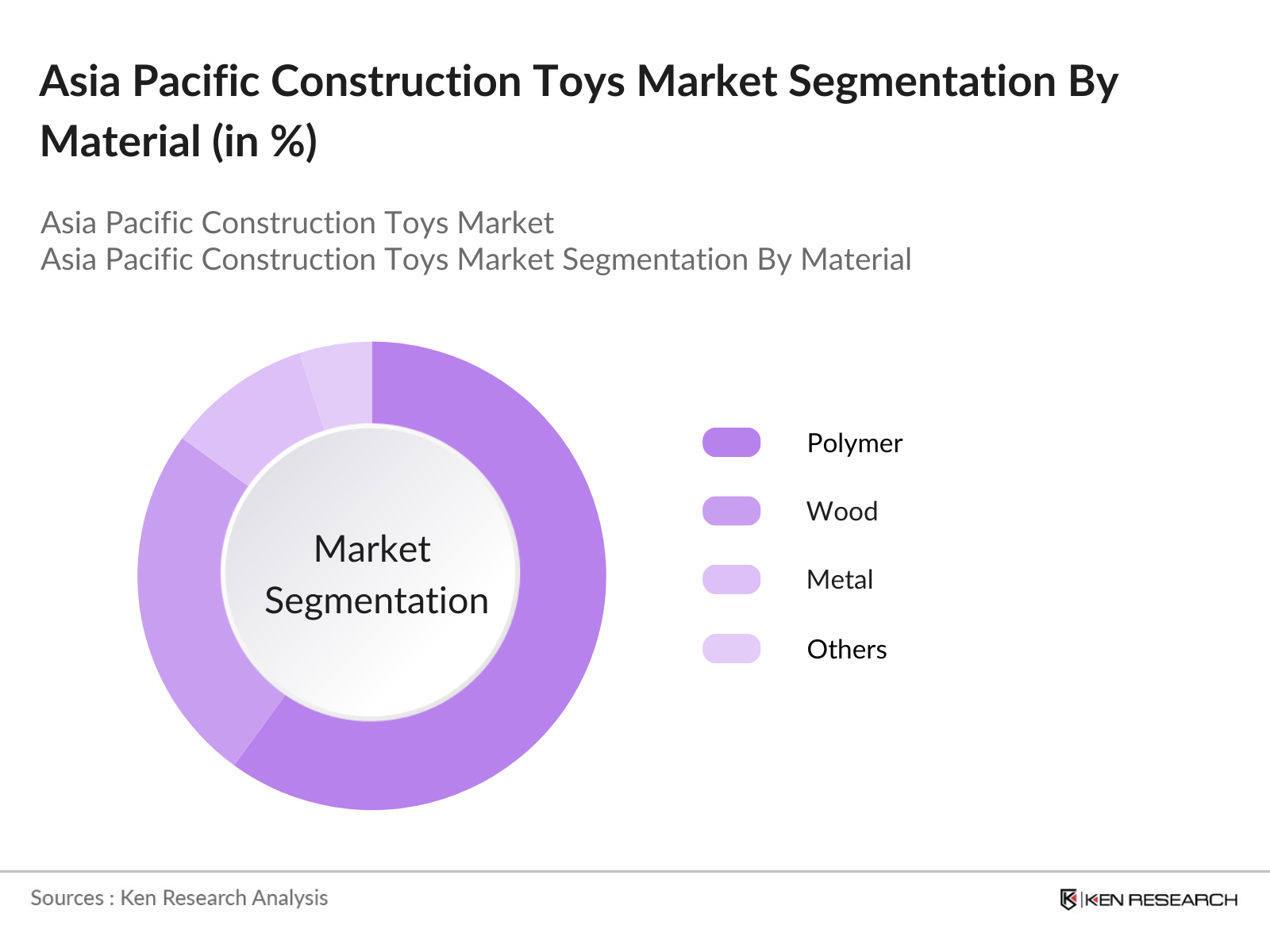

By Material: The market is also segmented by material into polymer, wood, metal, and others. Polymer-based construction toys dominate the market share, primarily because of their durability, safety, and cost-effectiveness. Manufacturers prefer polymers for their ease of molding into various shapes and the ability to produce vibrant colors, which are attractive to children.

Asia Pacific Construction Toys Market Competitive Landscape

The Asia Pacific construction toys market is characterized by the presence of several key players who contribute to the market's growth through innovation and extensive distribution networks. The competitive landscape includes both global and regional companies, each striving to capture a significant share of the market.

Asia Pacific Construction Toys Industry Analysis

Growth Drivers

- Rising Demand for Educational Toys: The global emphasis on foundational learning has intensified, with reports indicating that in low- and middle-income countries, the share of children living in learning poverty could reach 70% due to prolonged school closures and ineffective remote learning during the pandemic. This alarming statistic has led parents and educators to seek supplementary educational tools, such as educational toys, to bridge learning gaps and enhance cognitive development.

- Increasing Disposable Income: In 2024, the global economy is projected to grow by 3.2%, with emerging markets and developing economies experiencing significant income growth. This rise in disposable income enables families to allocate more funds toward educational products, including toys that promote learning and development.

- Expansion of E-commerce Platforms: The proliferation of internet access has led to a surge in e-commerce activities. In India, for instance, the number of internet users is expected to reach 1.1 billion by 2025, facilitating online purchases of educational toys. This digital shift provides consumers with a wider selection and convenient access to educational toys, driving market growth.

Market Challenges

- Competition from Digital Entertainment: The rise of digital entertainment platforms poses a challenge to the educational toy market. With over 2.7 billion smartphone users globally, children have increased access to digital games and applications, which can detract from traditional educational toys. This shift necessitates innovation in the toy industry to integrate digital elements that engage tech-savvy children.

- Safety Concerns Regarding Materials: Ensuring the safety of materials used in toy manufacturing is paramount. Regulatory bodies have stringent standards to prevent the use of hazardous substances. For example, the European Union's Toy Safety Directive mandates rigorous testing, impacting production processes and costs for manufacturers aiming to comply with these regulations.

Asia Pacific Construction Toys Market Future Outlook

Over the next five years, the Asia Pacific construction toys market is expected to experience significant growth, driven by continuous government support for educational initiatives, advancements in toy manufacturing technologies, and increasing consumer demand for interactive and educational toys. The integration of technology into traditional construction toys is anticipated to open new avenues for market expansion.

Market Opportunities

- Adoption of Eco-friendly Materials: There is a growing consumer preference for sustainable products. The global market for eco-friendly toys is expanding, with manufacturers exploring materials like bamboo, organic cotton, and recycled plastics. This shift not only appeals to environmentally conscious consumers but also aligns with global sustainability goals.

- Technological Integration in Toys: The integration of technologies such as augmented reality (AR) and artificial intelligence (AI) into educational toys offers interactive learning experiences. Companies like Smartivity in India are developing AR-based educational toys that enhance engagement and learning outcomes for children.

Scope of the Report

|

Product Type |

Bricks & Blocks |

|

Material |

Polymer |

|

Age Group |

0-4 Years |

|

Distribution Channel |

Hypermarkets & Supermarkets |

|

Country |

China |

Products

Key Target Audience

Toy Manufacturers

Educational Institutions

Retailers and Distributors

Parents and Guardians

Child Development Specialists

Government and Regulatory Bodies (e.g., Ministry of Education)

Investment and Venture Capitalist Firms

E-commerce Platforms

Companies

Players Mentioned in the Report

LEGO Group

Mattel, Inc.

Hasbro, Inc.

Bandai Namco Holdings Inc.

Spin Master Corp.

Ravensburger AG

Magformers LLC

PlayMonster LLC

Basic Fun, Inc.

Melissa & Doug, LLC

Table of Contents

1. Asia Pacific Construction Toys Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Construction Toys Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Construction Toys Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Educational Toys

3.1.2. Increasing Disposable Income

3.1.3. Expansion of E-commerce Platforms

3.1.4. Government Initiatives Promoting STEM Education

3.2. Market Challenges

3.2.1. Competition from Digital Entertainment

3.2.2. Safety Concerns Regarding Materials

3.2.3. High Manufacturing Costs

3.3. Opportunities

3.3.1. Adoption of Eco-friendly Materials

3.3.2. Technological Integration in Toys

3.3.3. Untapped Rural Markets

3.4. Trends

3.4.1. Customization and Personalization of Toys

3.4.2. Collaboration with Educational Institutions

3.4.3. Licensing and Themed Construction Sets

3.5. Government Regulations

3.5.1. Safety Standards and Certifications

3.5.2. Import and Export Policies

3.5.3. Environmental Regulations

3.5.4. Support for Local Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia Pacific Construction Toys Market Segmentation

4.1. By Product Type (Value %)

4.1.1. Bricks & Blocks

4.1.2. Tinker Toys

4.1.3. Magnetic Tiles

4.1.4. Mechanical Sets

4.1.5. Others

4.2. By Material (Value %)

4.2.1. Polymer

4.2.2. Wood

4.2.3. Metal

4.2.4. Others

4.3. By Age Group (Value %)

4.3.1. 0-4 Years

4.3.2. 5-8 Years

4.3.3. 9-12 Years

4.3.4. 13 Years and Above

4.4. By Distribution Channel (Value %)

4.4.1. Hypermarkets & Supermarkets

4.4.2. Specialty Stores

4.4.3. Online

4.4.4. Others

4.5. By Country (Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

4.5.6. Rest of Asia Pacific

5. Asia Pacific Construction Toys Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. LEGO Group

5.1.2. Mattel, Inc.

5.1.3. Hasbro, Inc.

5.1.4. Bandai Namco Holdings Inc.

5.1.5. Spin Master Corp.

5.1.6. Ravensburger AG

5.1.7. Magformers LLC

5.1.8. PlayMonster LLC

5.1.9. Basic Fun, Inc.

5.1.10. Melissa & Doug, LLC

5.1.11. KNEX (Basic Fun, Inc.)

5.1.12. Tegu

5.1.13. Schylling Inc.

5.1.14. Polydron (UK) Limited

5.1.15. TOMY Company, Ltd.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Recent Developments, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Asia Pacific Construction Toys Market Regulatory Framework

6.1. Safety Standards and Certifications

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Construction Toys Future Market Size (USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Construction Toys Future Market Segmentation

8.1. By Product Type (Value %)

8.2. By Material (Value %)

8.3. By Age Group (Value %)

8.4. By Distribution Channel (Value %)

8.5. By Country (Value %)

9. Asia Pacific Construction Toys Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Asia Pacific Construction Toys Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Asia Pacific Construction Toys Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple toy manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Asia Pacific Construction Toys Market.

Frequently Asked Questions

01 How big is the Asia Pacific Construction Toys Market?

The Asia Pacific Construction Toys market is valued at USD 3,827 million, based on a five-year historical analysis. This market's growth is largely fueled by rising consumer demand for educational toys that foster cognitive development, along with increasing disposable incomes in countries such as China and India.

02 What are the challenges in the Asia Pacific Construction Toys Market?

Challenges include competition from digital entertainment, safety concerns regarding materials, and high manufacturing costs. Additionally, the market faces issues related to counterfeit products and fluctuating raw material prices.

03 Who are the major players in the Asia Pacific Construction Toys Market?

Key players in the market include LEGO Group, Mattel, Inc., Hasbro, Inc., Bandai Namco Holdings Inc., and Spin Master Corp. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04 What are the growth drivers of the Asia Pacific Construction Toys Market?

The market is propelled by factors such as rising demand for educational toys, increasing disposable income, expansion of e-commerce platforms, and government initiatives promoting STEM education. The growing emphasis on child development and learning through play also contributes to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.