Asia Pacific Consumer Health Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD10808

December 2024

86

About the Report

Asia Pacific Consumer Health Market Overview

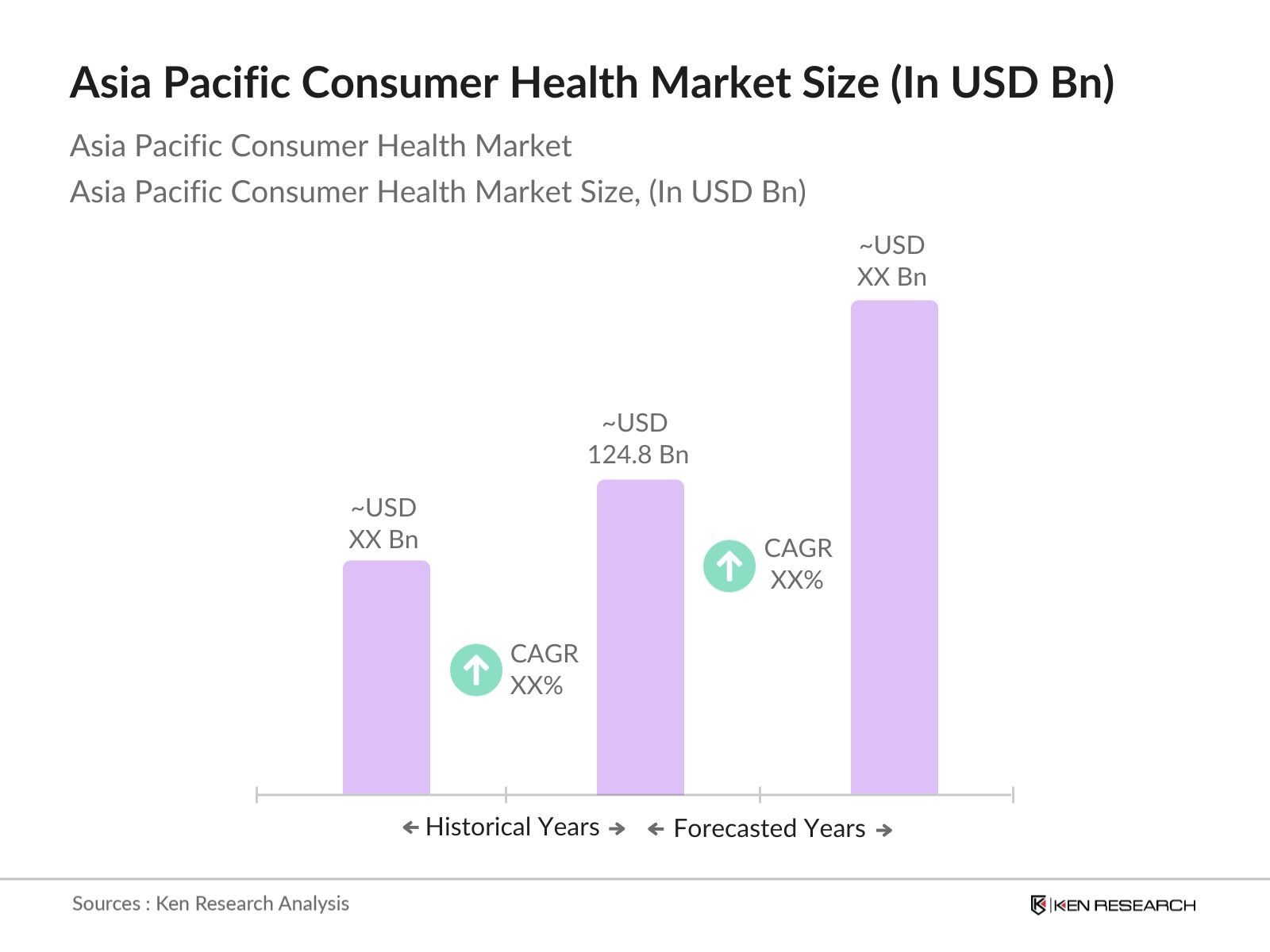

- The Asia Pacific consumer health market has seen notable growth, reaching a valuation of USD 124.8 billion. This market expansion is driven by an increasing focus on preventive healthcare, along with rising disposable incomes and the growing trend of self-care and wellness. Consumers are investing more in over-the-counter (OTC) pharmaceuticals, vitamins, dietary supplements, and wellness products to support their health goals. This consumer shift reflects greater health awareness across the region, where maintaining wellness has become a priority.

- Among the countries in the Asia Pacific region, China and Japan lead the market. China benefits from its large population base, rapid urbanization, and a burgeoning middle class with greater spending power. In Japan, the aging population has driven demand for health supplements and OTC medications tailored to managing age-related health concerns. In both countries, established healthcare systems and consumer access to health-related products amplify this demand, making them dominant forces in the Asia Pacific consumer health market.

- Governments in the Asia-Pacific region have implemented regulations to ensure the safety and efficacy of health supplements. For example, the Food Safety and Standards Authority of India (FSSAI) has established guidelines for the manufacture and sale of health supplements to protect consumers. These regulations aim to ensure that products meet safety standards and are accurately labeled, thereby enhancing consumer confidence in the market. As regulatory frameworks continue to evolve, companies must stay informed and compliant to maintain their market presence.

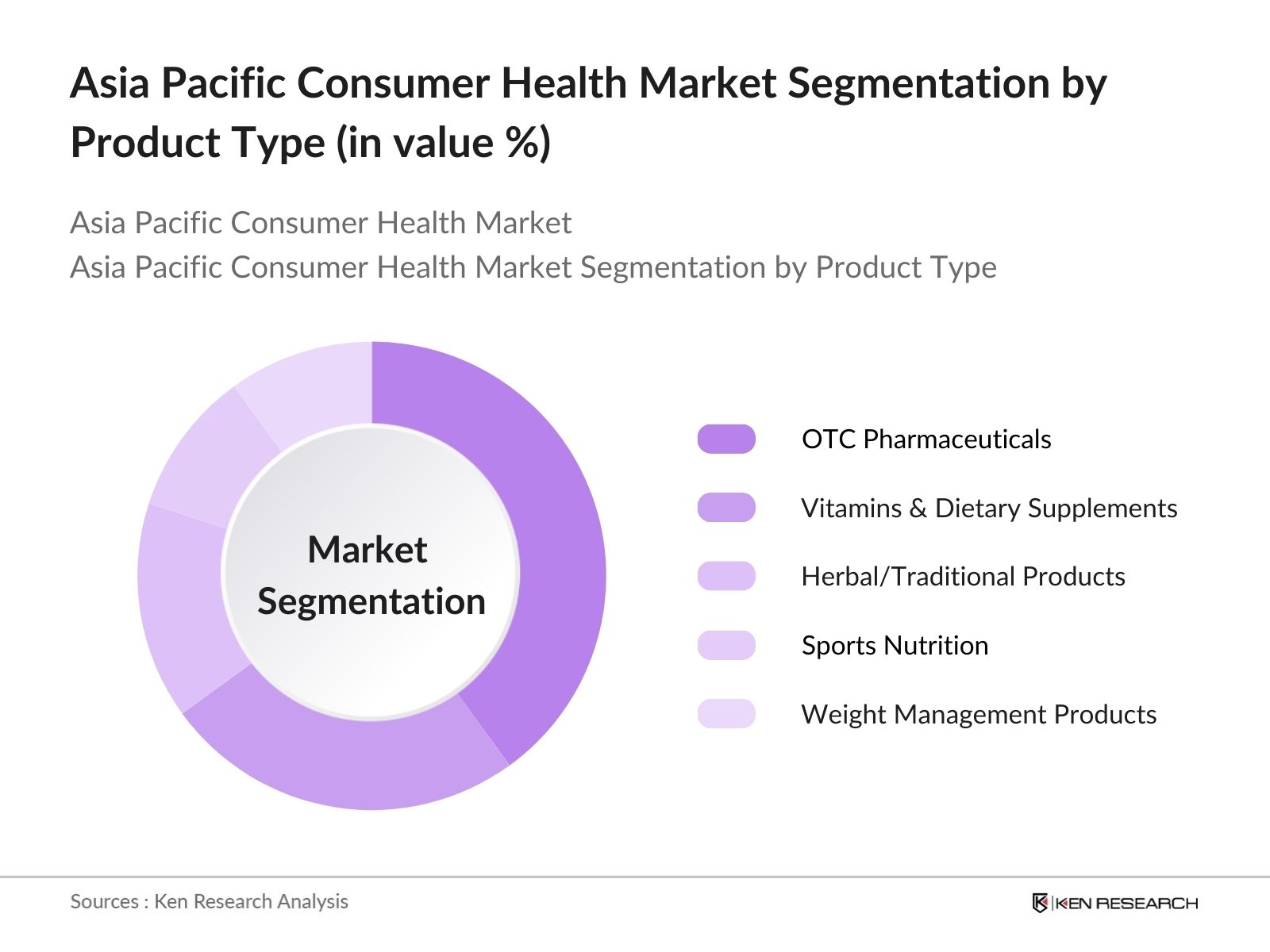

Asia Pacific Consumer Health Market Segmentation

- By Product Type: The Asia Pacific consumer health market is segmented by product type into OTC pharmaceuticals, vitamins and dietary supplements, herbal/traditional products, sports nutrition, and weight management products. OTC pharmaceuticals hold a dominant market share due to their ease of accessibility and consumer confidence in self-medication for minor health issues. Products in this category are widely available across various channels, and pharmaceutical companies' extensive marketing efforts have built strong consumer trust in these products.

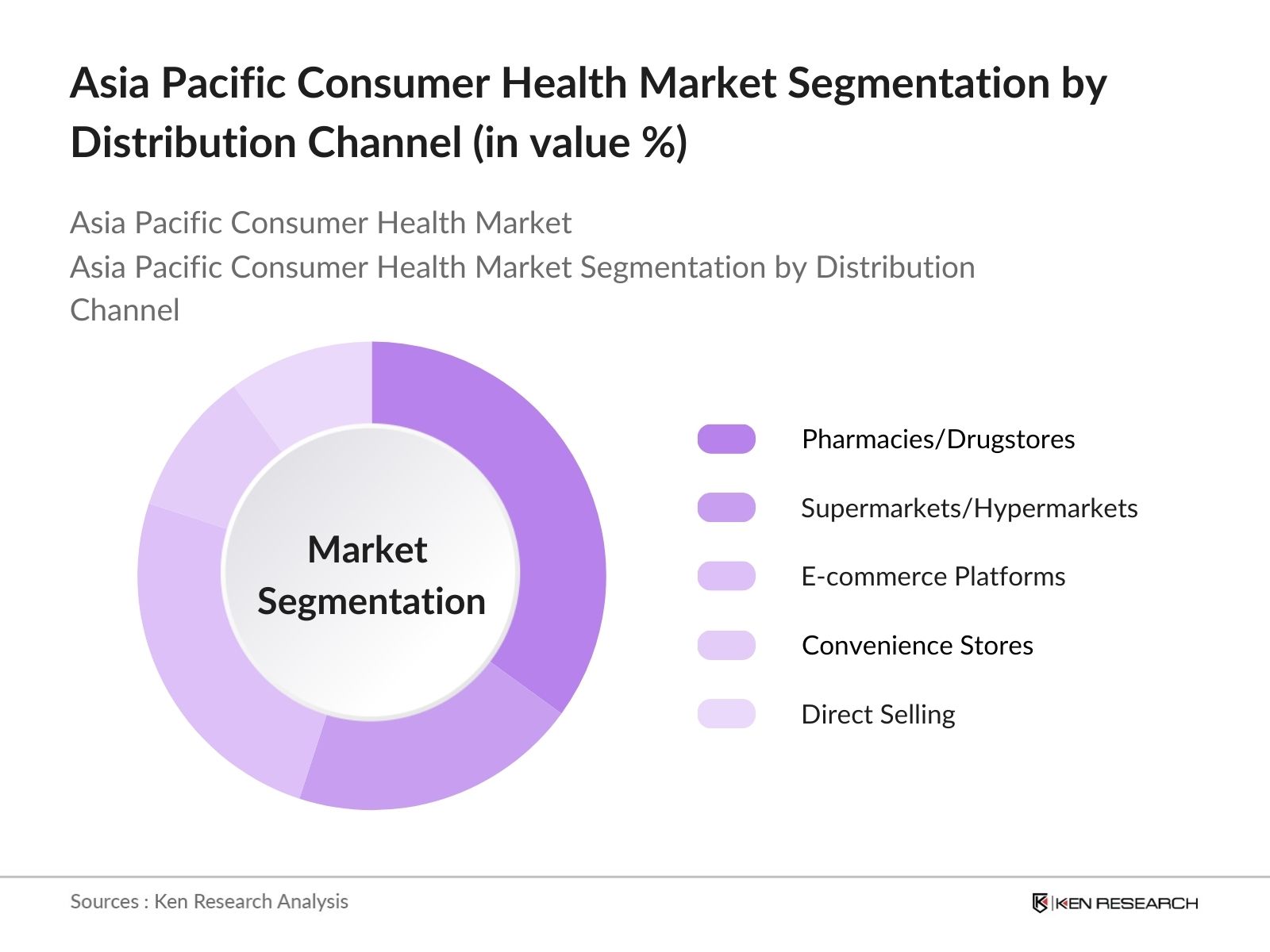

- By Distribution Channel: The market is segmented by distribution channel into pharmacies/drugstores, supermarkets/hypermarkets, e-commerce platforms, convenience stores, and direct selling. Pharmacies and drugstores lead among distribution channels due to their accessibility and established reputation as trusted health advisors. These channels are preferred by consumers as they offer professional advice and a wide range of health-related products, from prescription drugs to OTC health supplements.

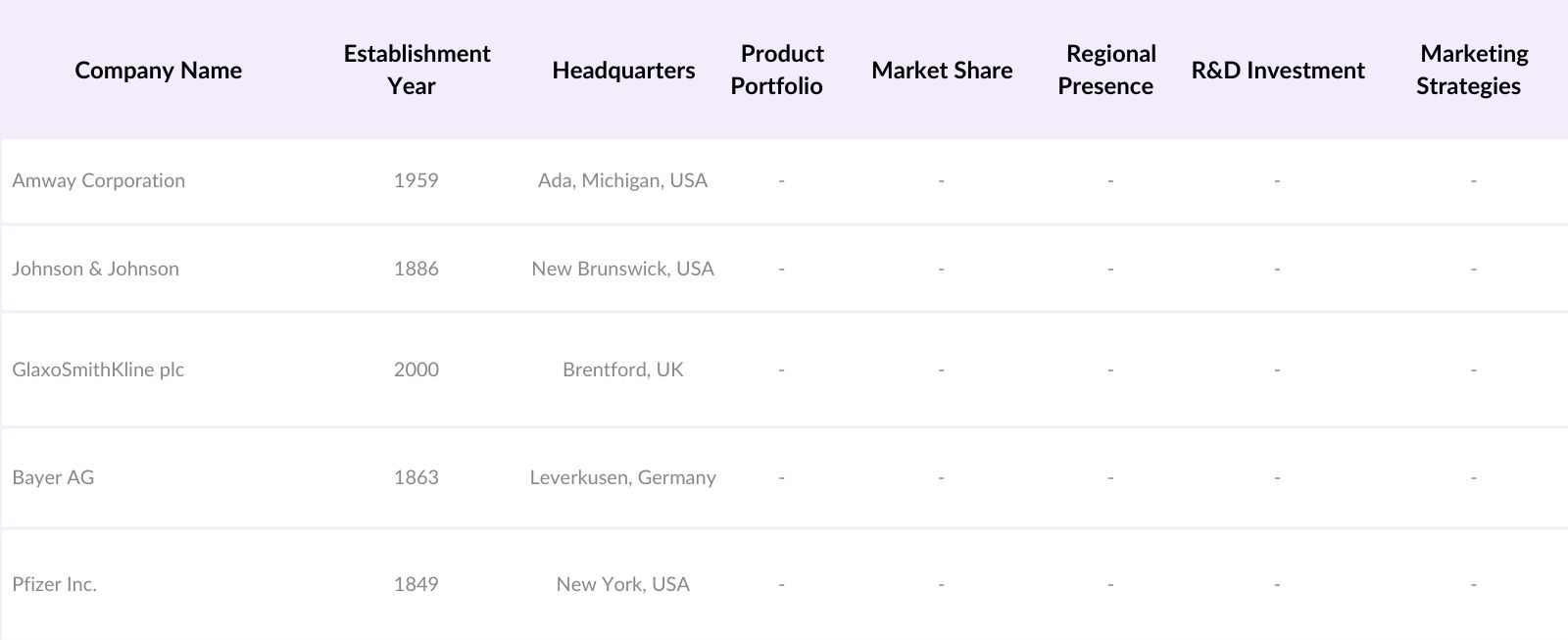

Asia Pacific Consumer Health Market Competitive Landscape

The Asia Pacific consumer health market is characterized by the presence of both multinational and regional players. Key companies include Amway Corporation, Johnson & Johnson, GlaxoSmithKline plc, Bayer AG, and Pfizer Inc. This consolidation underscores the significant influence these companies wield through their extensive product portfolios, strategic distribution networks, and R&D investments.

Asia Pacific Consumer Health Market Analysis

Market Growth Drivers

- Increasing Health Awareness: In the Asia-Pacific region, health awareness has surged, leading to a higher demand for consumer health products. For instance, a 2023 survey by Bain & Company revealed that approximately 85% of consumers in the region are interested in health maintenance and lifestyle changes, indicating a proactive approach to personal well-being. This growing awareness is reflected in the increased consumption of vitamins, dietary supplements, and wellness products, which has become a priority for many consumers seeking to improve their overall health and prevent chronic diseases. This trend is expected to continue as educational campaigns promote the importance of health and wellness.

- Rising Disposable Income: The Asia-Pacific region has experienced significant economic growth, resulting in increased disposable incomes. According to the World Bank, the region's GDP per capita rose from $5,000 in 2022 to $5,500 in 2023, enabling consumers to allocate more funds toward health-related products and services. This increase in disposable income has empowered consumers to invest in higher-quality health products, contributing to the overall growth of the consumer health market. Moreover, as the middle class expands, there is a growing willingness to spend on preventive healthcare and wellness products.

- Aging Population: The Asia-Pacific region is witnessing a demographic shift with a growing elderly population. Data from the United Nations indicates that the number of individuals aged 65 and above increased from 350 million in 2022 to 370 million in 2023, driving demand for healthcare products tailored to age-related health issues. This aging demographic is influencing the consumer health market significantly, as older adults typically require more healthcare services and products, such as supplements and chronic disease management solutions. As the population ages, the demand for healthcare services and products that cater to their specific needs will continue to rise.

Market Challenges

- Regulatory Variations Across Countries: The Asia-Pacific region comprises diverse regulatory environments, posing challenges for consumer health companies. For example, the World Health Organization notes that while some countries have stringent regulations for health supplements, others have minimal oversight, complicating market entry and compliance. This inconsistency creates hurdles for businesses trying to maintain compliance across different markets, often resulting in increased operational costs and complexities. Companies must navigate these regulatory landscapes carefully to ensure product safety and efficacy while also meeting the diverse needs of consumers.

- Presence of Counterfeit Products: The prevalence of counterfeit health products remains a significant concern in the Asia-Pacific market. Interpol's Operation Pangea XV in 2022 seized over 3 million illicit and counterfeit medical products in the region, highlighting the risks to consumer safety and brand integrity. The presence of counterfeit products not only undermines consumer trust but also poses serious health risks, as these products may contain harmful substances. Companies in the consumer health sector must implement robust anti-counterfeiting measures and educate consumers on how to identify genuine products to protect both their brands and consumers.

Asia Pacific Consumer Health Market Future Outlook

The Asia Pacific consumer health market is expected to demonstrate substantial growth over the next five years, fueled by ongoing government initiatives promoting wellness, advancements in health technology, and the increasing popularity of preventive healthcare solutions. As digital health platforms and personalized wellness products gain traction, the market is poised for expansion.

Market Opportunities

- Technological Advancements in Product Development: Advancements in technology are enabling the development of innovative consumer health products. The Asia-Pacific region has seen increased investment in health tech startups, with countries like Singapore investing $500 million in health technology research and development in 2023, fostering innovation in the sector. This technological progress facilitates the creation of more effective health solutions, such as personalized supplements and smart health devices that monitor user health metrics. Companies that leverage technology can better meet consumer demands and improve their market position.

- Untapped Rural Markets: A notable portion of the Asia-Pacific population resides in rural areas, presenting untapped markets for consumer health products. According to the World Bank, 60% of the region's population lived in rural areas in 2023, indicating substantial opportunities for market expansion. Many rural consumers are increasingly seeking health solutions, creating a demand for affordable and accessible health products. Companies that develop strategies to reach these underserved markets can benefit from increased sales and brand loyalty as they fulfill the health needs of rural populations.

Scope of the Report

|

Segment |

Sub-segments |

|

Product Type |

Over-the-Counter (OTC) Pharmaceuticals |

|

Distribution Channel |

Pharmacies/Drugstores |

|

Demographics |

Children |

|

Country |

China |

|

Health Concern |

Digestive Health |

Products

Key Target Audience

Pharmaceutical Companies

Nutraceutical Manufacturers

Health and Wellness Product Distributors

Retail Pharmacies and Drugstores

E-commerce Health Platforms

Government and Regulatory Bodies (e.g., Ministry of Health)

Healthcare Providers and Practitioners

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Amway Corporation

Johnson & Johnson

GlaxoSmithKline plc

Bayer AG

Pfizer Inc.

Sanofi S.A.

Abbott Laboratories

Nestl S.A.

Procter & Gamble Co.

Herbalife Nutrition Ltd.

Table of Contents

1. Asia Pacific Consumer Health Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Consumer Health Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Consumer Health Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness

3.1.2. Rising Disposable Income

3.1.3. Aging Population

3.1.4. Expansion of E-commerce Platforms

3.2. Market Challenges

3.2.1. Regulatory Variations Across Countries

3.2.2. Presence of Counterfeit Products

3.2.3. Cultural Diversity Affecting Consumer Preferences

3.3. Opportunities

3.3.1. Technological Advancements in Product Development

3.3.2. Untapped Rural Markets

3.3.3. Growing Demand for Natural and Organic Products

3.4. Trends

3.4.1. Shift Towards Preventive Healthcare

3.4.2. Integration of Digital Health Solutions

3.4.3. Personalized Nutrition and Wellness Products

3.5. Government Regulations

3.5.1. Health Supplement Regulations

3.5.2. Advertising and Labeling Standards

3.5.3. Import and Export Policies

3.5.4. Initiatives Promoting Self-Care

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Asia Pacific Consumer Health Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Over-the-Counter (OTC) Pharmaceuticals

4.1.2. Vitamins and Dietary Supplements

4.1.3. Herbal/Traditional Products

4.1.4. Sports Nutrition

4.1.5. Weight Management Products

4.2. By Distribution Channel (In Value %)

4.2.1. Pharmacies/Drugstores

4.2.2. Supermarkets/Hypermarkets

4.2.3. E-commerce

4.2.4. Convenience Stores

4.2.5. Direct Selling

4.3. By Demographics (In Value %)

4.3.1. Children

4.3.2. Adults

4.3.3. Elderly

4.4. By Country (In Value %)

4.4.1. China

4.4.2. Japan

4.4.3. India

4.4.4. Australia

4.4.5. South Korea

4.4.6. Rest of Asia Pacific

4.5. By Health Concern (In Value %)

4.5.1. Digestive Health

4.5.2. Immune Health

4.5.3. Bone and Joint Health

4.5.4. Heart Health

4.5.5. Mental Health

5. Asia Pacific Consumer Health Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amway Corporation

5.1.2. Johnson & Johnson

5.1.3. GlaxoSmithKline plc

5.1.4. Bayer AG

5.1.5. Pfizer Inc.

5.1.6. Sanofi S.A.

5.1.7. Abbott Laboratories

5.1.8. Nestl S.A.

5.1.9. Procter & Gamble Co.

5.1.10. Herbalife Nutrition Ltd.

5.1.11. Blackmores Limited

5.1.12. Takeda Pharmaceutical Company Limited

5.1.13. Unilever plc

5.1.14. Reckitt Benckiser Group plc

5.1.15. Sun Pharmaceutical Industries Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Regional Presence, R&D Investment, Marketing Strategies, Distribution Networks, Mergers & Acquisitions)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Asia Pacific Consumer Health Market Regulatory Framework

6.1. Health Supplement Regulations

6.2. Compliance Requirements

6.3. Certification Processes

7. Asia Pacific Consumer Health Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Asia Pacific Consumer Health Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Demographics (In Value %)

8.4. By Country (In Value %)

8.5. By Health Concern (In Value %)

9. Asia Pacific Consumer Health Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase constructs an ecosystem map, including all major stakeholders within the Asia Pacific Consumer Health Market. Extensive desk research, incorporating both secondary and proprietary databases, forms the foundation for identifying and defining critical variables that shape market dynamics.

Step 2: Market Analysis and Construction

Historical data collection and analysis is conducted, focusing on market penetration, product availability, and revenue trends across various segments. Service quality statistics are assessed to ensure the precision and reliability of the revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through computer-assisted telephone interviews (CATIs) with industry experts, providing insights that refine and corroborate market data through direct industry insights.

Step 4: Research Synthesis and Final Output

The final phase includes engagement with multiple consumer health product manufacturers to obtain detailed data on product segments, sales performance, and consumer preferences. This synthesis validates the data derived from the bottom-up approach, ensuring an accurate analysis of the Asia Pacific Consumer Health Market.

Frequently Asked Questions

01. How big is the Asia Pacific Consumer Health Market?

The Asia Pacific consumer health market is valued at USD 124.8 billion, driven by increasing health awareness and rising disposable incomes.

02. What are the challenges in the Asia Pacific Consumer Health Market?

Challenges include regulatory variations across countries, the prevalence of counterfeit products, and the diversity in consumer preferences due to cultural differences.

03. Who are the major players in the Asia Pacific Consumer Health Market?

Key players include Amway Corporation, Johnson & Johnson, GlaxoSmithKline plc, Bayer AG, and Pfizer Inc.

04. What are the growth drivers of the Asia Pacific Consumer Health Market?

The market is driven by factors such as increasing health awareness, rising disposable incomes, and a shift towards preventive healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.