Asia Pacific Communications Platform as a Service (CPaaS) Market Outlook to 2030

Region:Asia

Author(s):Shreya

Product Code:KROD1863

November 2024

80

About the Report

Asia Pacific Communications Platform as a Service (CPaaS) Market Overview

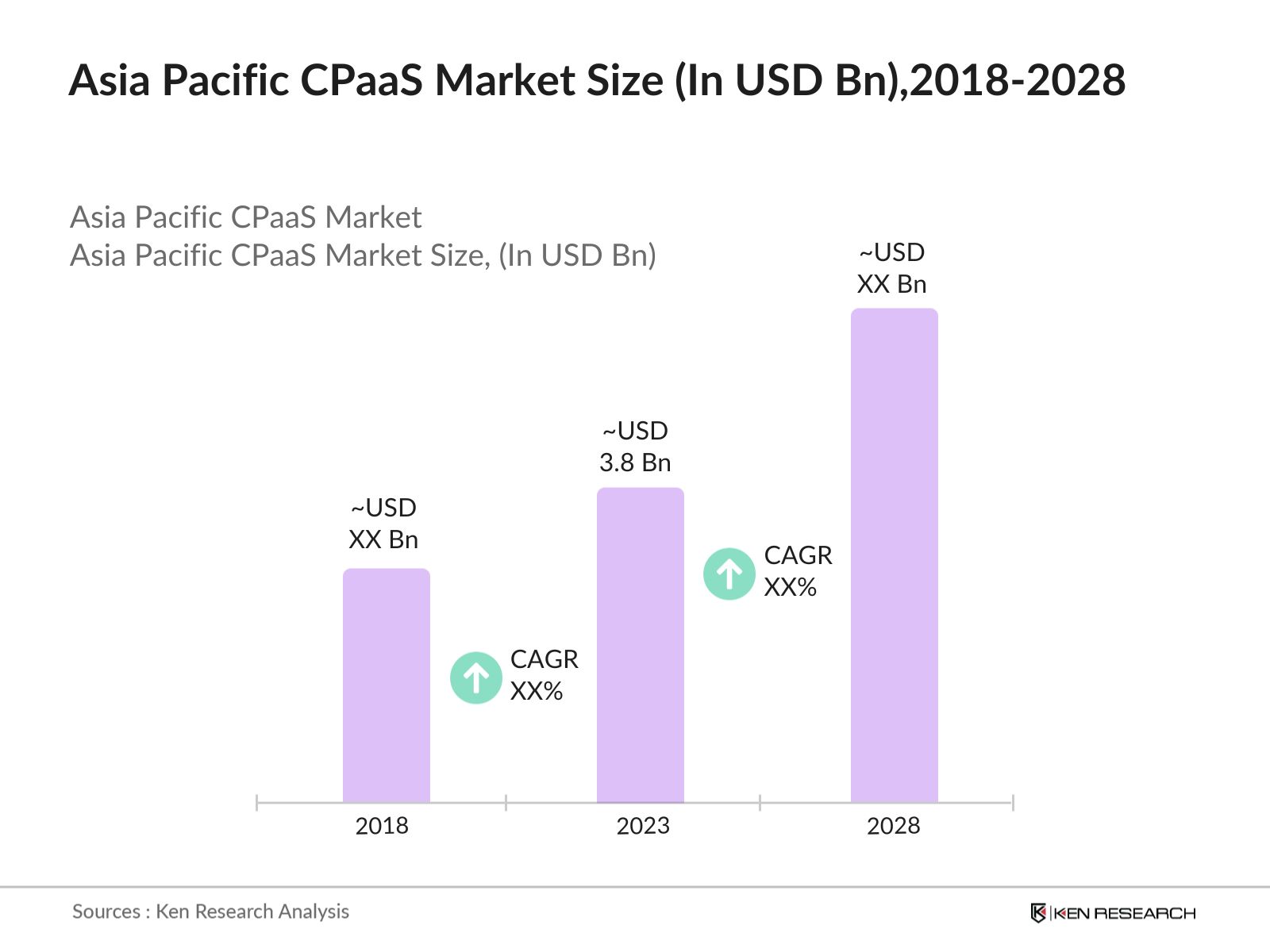

- The Asia Pacific CPaaS market was valued at USD 3.8 billion in 2023. This rapid growth is driven by the increasing demand for real-time communication solutions across industries such as retail, healthcare, and BFSI (Banking, Financial Services, and Insurance). The adoption of CPaaS solutions is propelled by the need for businesses to enhance customer engagement and improve operational efficiencies through seamless communication platforms.

- Major players in the Asia Pacific CPaaS market include Twilio, Sinch, Vonage, Plivo, and Infobip. These companies have established a strong presence in the region by providing a wide range of communication services, including messaging, voice, video, and email through APIs. Their continuous innovation and expansion strategies, such as partnerships and acquisitions, have contributed to the growth and competitiveness of the market.

- In May 2022, Twilio invested USD 750 million in Syniverse, making Twilio a minority owner of Syniverse. This investment was part of an expanded strategic and commercial partnership aimed at enhancing innovation in mobile communications and capitalizing on the growth of 5G and Communications Platform as a Service (CPaaS) technologies. The investment was intended to provide Syniverse with improved liquidity and financial flexibility to accelerate its innovation.

- In the Asia Pacific market, China dominates with a market share in 2023, according to Frost & Sullivan. This dominance is attributed to the country's advanced digital infrastructure and high smartphone penetration rate in 2023. The government's strong support for digital initiatives, such as the "Made in China 2025" policy, has further determined the growth of the market in China.

Asia Pacific Communications Platform as a Service (CPaaS) Market Segmentation

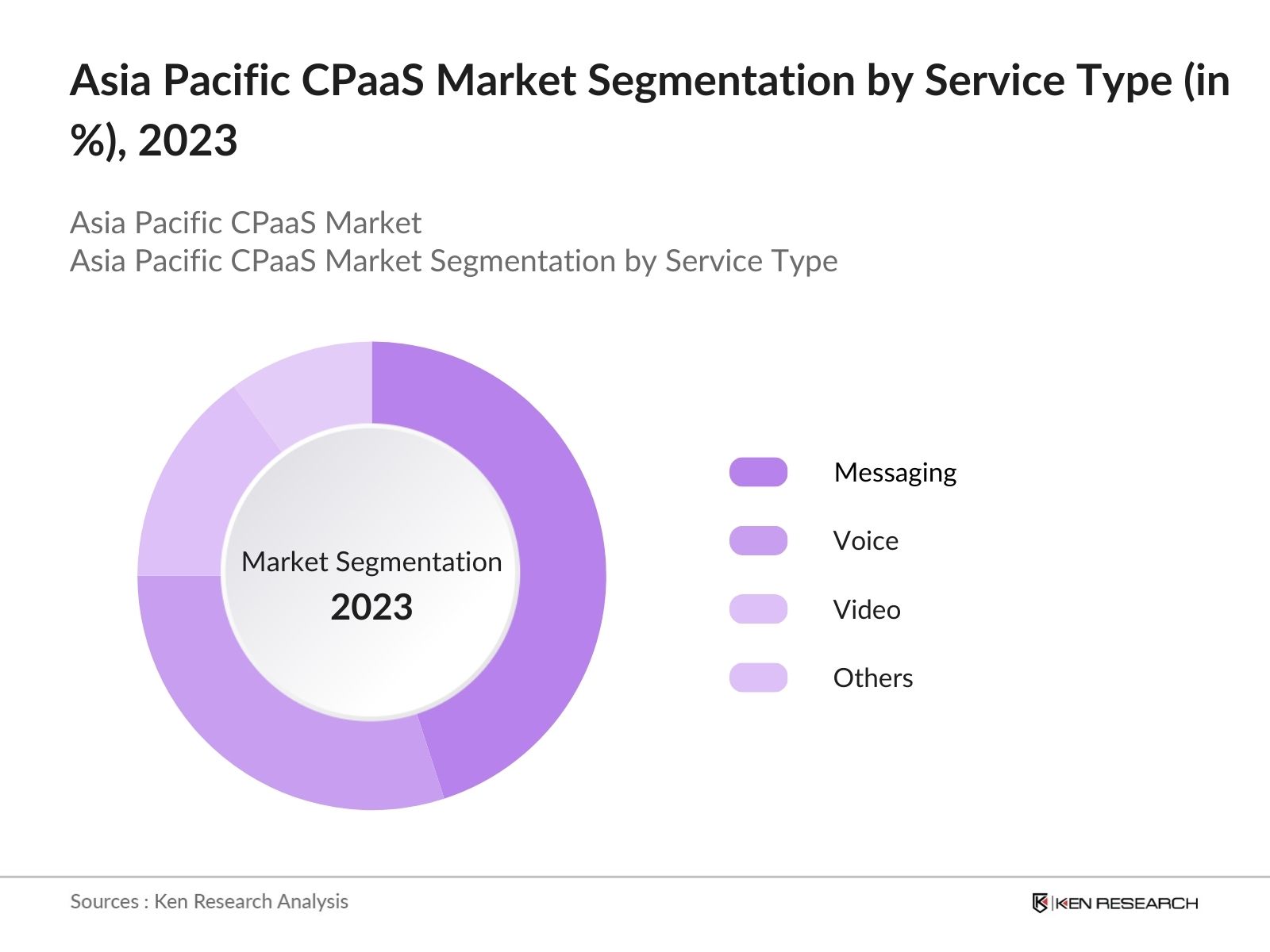

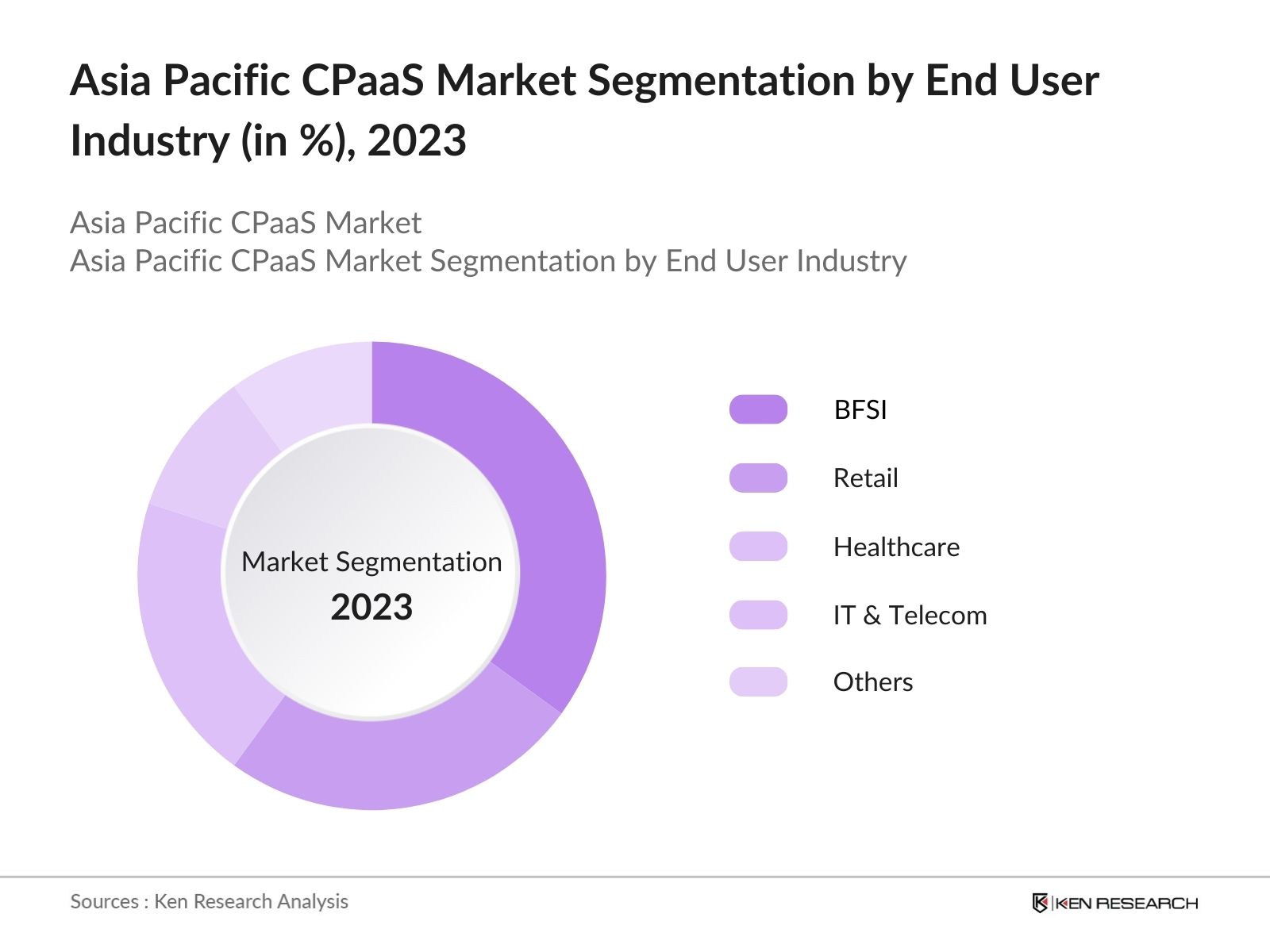

The Asia Pacific Communications Platform as a Service (CPaaS) Market is segmented into service type, end user industry and region.

By Service Type: The market is segmented by service type into Messaging, Voice, Video, and Others. In 2023, the messaging segment holds a dominant market share, primarily due to the widespread use of SMS and chat applications for customer communication. The demand for messaging services is driven by the need for real-time updates, notifications, and marketing campaigns, making it a preferred communication channel for businesses across industries.

By End-User Industry: The market is also segmented by end-user industry into Retail, Healthcare, BFSI, IT & Telecom, and Others. In 2023, the BFSI segment leads with a market share, owing to the industry's need for secure and reliable communication solutions. The BFSI sector utilizes CPaaS for various applications, including customer service, fraud detection, and transactional notifications, ensuring compliance

By Region: The market is also segmented by end-user industry into China, South Korea, Japan, India, Australia and Rest of APAC. China dominates the Asia Pacific CPaaS market share in 2023, driven by its advanced digital infrastructure, high smartphone penetration, and strong governmental support for digital communication technologies. The country's rapid adoption of 5G and extensive user base further enhances its leadership position in the market.

Asia Pacific CPaaS Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Twilio |

2008 |

USA |

|

Sinch |

2008 |

Sweden |

|

Vonage |

2001 |

USA |

|

Plivo |

2011 |

USA |

|

Infobip |

2006 |

Croatia |

- Vonage: The company expanded its presence in the Asia Pacific region by entering the Japanese market through a joint venture with a local telecommunications company. This strategic move allows Vonage to tap into the growing demand for CPaaS solutions. As of 2023, the demand for CPaaS in Japan was projected to reach a valuation of USD 668.7 million, with expectations of significant growth in the coming years.

- Infobip: They announced USD 200 million investment in R&D which also includes development in the new communication technologies and enhance its existing CPaaS platform. This investment is focused on integrating advanced features such as real-time analytics, AI-driven customer insights, and enhanced security protocols, enabling businesses to deliver more personalized and secure communication experiences.

Asia Pacific CPaaS Industry Analysis

Growth Drivers

- Expansion of 5G Networks and Enhanced Connectivity: The rollout of 5G networks across the Asia Pacific region in 2024 is expected to boost the adoption of CPaaS solutions. In North East Asia, 5G subscription growth continued strongly in 2023, rising by 234 million to total 908 million subscriptions. The improved network capabilities of 5G, including lower latency and higher bandwidth, will enable businesses to provide seamless and high-quality communication experiences to their customers.

- Rising Demand for Omnichannel Communication: It is estimated that over 500 million customers in the Asia Pacific region will engage with businesses through various digital channels, including SMS, voice, video, and social media. This trend is driving the need for CPaaS platforms that can integrate these channels into a single interface, allowing businesses to manage customer interactions more effectively.

- Increased Adoption of Cloud-based Solutions: The shift towards cloud-based solutions in the Asia Pacific region continues to accelerate, driven by the need for scalable, flexible, and cost-effective communication platforms, reflecting the growing preference for cloud-native CPaaS solutions among businesses. Cloud-based CPaaS platforms enable companies to quickly deploy and scale their communication services without the need for capital investment in infrastructures.

Challenges

- Technical Challenges in Integration: Integrating CPaaS solutions with existing business systems and applications can be technically challenging and time-consuming. Asia Pacific region will face integration issues when adopting CPaaS platforms, leading to delays in implementation and additional costs. These challenges are often due to the complexity of legacy systems and the need for custom API development.

- Security Concerns Related to Cloud-Based Solutions: While cloud-based CPaaS solutions offer numerous benefits, they also present security concerns, particularly regarding data storage and transmission. In 2024, the Asia Pacific region witnessed over 1 million cyberattacks targeting cloud-based services, highlighting the need for robust security measures. CPaaS providers must invest in advanced security protocols, such as end-to-end encryption and multi-factor authentication, to protect sensitive customer data.

Government Initiatives

- Subsidies for Small and Medium-sized Enterprises (SMEs): Singapore's Ministry of Finance has announced measures totaling USD 359 million aimed at supporting businesses in their digital transformation efforts. This includes assistance for SMEs through the SMEs Go Digital program. This initiative is expected to benefit SMEs in the country, enabling them to leverage CPaaS solutions to improve customer engagement and operational efficiency.

- Regulatory Reforms to Encourage Innovation: Several countries in the Asia Pacific region are implementing regulatory reforms to encourage innovation in the market. In 2024, the Japanese government revised its telecommunications regulations to facilitate the entry of new CPaaS providers and promote competition. The reforms include reducing licensing requirements and streamlining the approval process for new communication services.

Asia Pacific Communications Platform as a Service (CPaaS) Market Future Outlook

The Asia Pacific CPaaS market is projected to continue its robust growth driven by the increasing integration of artificial intelligence (AI) and machine learning (ML) in CPaaS solutions, enhancing the capabilities of communication platforms and enabling businesses to offer personalized customer experiences.

Future Trends

- Expansion of Use Cases Beyond Traditional Communication: The scope of CPaaS solutions is expected to expand beyond traditional communication channels over the next five years. By 2028, CPaaS platforms will be increasingly used for advanced applications such as remote healthcare consultations, virtual events, and real-time IoT communication.

- Growing Demand for Video Communication Solutions: The demand for video communication solutions is expected to rise in this market over the next five years. By 2028, the video communication segment is projected to grow, driven by the increasing adoption of remote working and telehealth services highlighting the growing importance of video as a key communication channel for businesses.

Scope of the Report

|

By Service Type |

Manufacturing Healthcare Automotive Aerospace Energy |

|

By End User |

Industrial Commercial Residential |

|

By Region |

United States Canada Mexico |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunications Companies

E-commerce Platforms

Retail Chains

Government and regulatory bodies(e.g., Ministry of Communications)

Large Enterprises

Mobile Network Operators (MNOs)

Cloud Service Providers

Application Developers

Banking and Financial Institutions

Investors and VC Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Twilio

Sinch

Vonage

Plivo

Infobip

Nexmo

Bandwidth

MessageBird

Telestax

8x8

Voxbone

Kaleyra

Mitto

Soprano Design

Route Mobile

Tata Communications

Tencent Cloud

China Mobile International

Telstra

Huawei Cloud

Table of Contents

Asia Pacific CPaaS Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Asia Pacific CPaaS Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

Asia Pacific CPaaS Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of 5G Networks

3.1.2. Rising Demand for Omnichannel Communication

3.1.3. Increased Adoption of Cloud-based Solutions

3.1.4. Growing Focus on Customer Engagement

3.2. Restraints

3.2.1. Regulatory Compliance and Data Privacy Issues

3.2.2. High Competition and Market Saturation

3.2.3. Technical Challenges in Integration

3.3. Opportunities

3.3.1. Integration with AI and Machine Learning

3.3.2. Expansion into Emerging Markets

3.3.3. Increased Demand for Video Communication Solutions

3.4. Trends

3.4.1. Adoption of Blockchain for Secure Communication

3.4.2. Expansion of Use Cases Beyond Traditional Communication

3.4.3. Development of Industry-specific CPaaS Solutions

3.5. Government Initiatives

3.5.1. Digital Transformation Programs

3.5.2. Subsidies for SMEs

3.5.3. National Digital Communication Strategies

3.5.4. Regulatory Reforms

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

Asia Pacific CPaaS Market Segmentation, 2023

4.1. By Service Type (in Value %)

4.1.1. Messaging

4.1.2. Voice

4.1.3. Video

4.2. By End-User Industry (in Value %)

4.2.1. BFSI

4.2.2. Retail

4.2.3. Healthcare

4.2.4. IT & Telecom

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

Asia Pacific CPaaS Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Twilio

5.1.2. Sinch

5.1.3. Vonage

5.1.4. Plivo

5.1.5. Infobip

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

Asia Pacific CPaaS Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

Asia Pacific CPaaS Market Regulatory Framework

7.1. Data Privacy Standards

7.2. Compliance Requirements

7.3. Certification Processes

Asia Pacific CPaaS Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

Asia Pacific CPaaS Future Market Segmentation, 2028

9.1. By Service Type (in Value %)

9.2. By End-User Industry (in Value %)

9.3. By Region (in Value %)

Asia Pacific CPaaS Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Asia Pacific CPaaS industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different CPaaS Market to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output

Our team will approach multiple construction companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such CPaas companies.

Frequently Asked Questions

-

How big is the Asia Pacific CPaaS Market?

The Asia Pacific CPaaS (Communications Platform as a Service) market, valued at USD 9.4 billion in 2023, is driven by the expansion of 5G networks, rising demand for omnichannel communication, and increased adoption of cloud-based solutions. -

What are the challenges in the Asia Pacific CPaaS Market?

Challenges in the Asia Pacific CPaaS market include regulatory compliance and data privacy issues, high competition and market saturation, technical challenges in integration, and security concerns related to cloud-based solutions. -

Who are the major players in the Asia Pacific CPaaS Market?

Key players in the Asia Pacific CPaaS market include Twilio, Sinch, Vonage, Plivo, and Infobip. These companies lead the market with their strong service offerings, extensive geographic presence, and continuous innovation in communication technologies. -

What are the growth drivers of the Asia Pacific CPaaS Market?

The growth drivers of the Asia Pacific CPaaS market include the expansion of 5G networks, rising demand for omnichannel communication, increased adoption of cloud-based solutions, and a growing focus on customer engagement and experience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.