Asia Pacific Cruise Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6332

November 2024

100

About the Report

Asia Pacific Cruise Market Overview

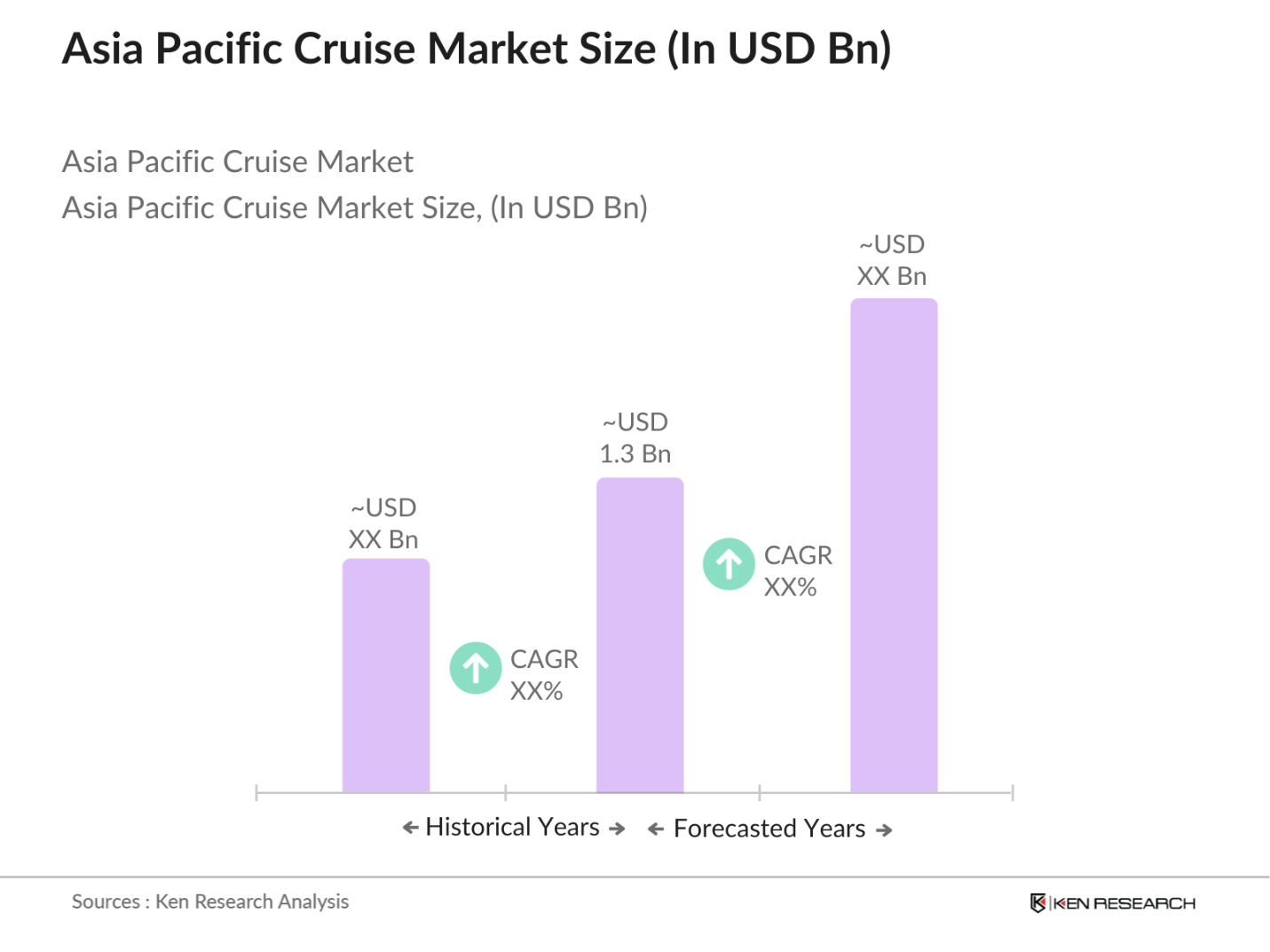

- The Asia Pacific cruise market is valued at USD 1.3 billion, based on a five-year historical analysis. It is driven by the regions booming tourism sector, increased disposable incomes, and a growing middle class eager for luxury and experiential travel. Additionally, government initiatives to boost tourism infrastructure, such as expanding port facilities in countries like China, Japan, and Australia, contribute to this growth. The integration of advanced technologies and a focus on sustainable tourism practices are also key driving forces.

- Countries like China, Japan, and Australia dominate the Asia Pacific cruise market due to their strong coastal economies, extensive port infrastructure, and high domestic demand for cruise travel. China, in particular, has seen exponential growth in cruise tourism due to its increasing wealth and strategic coastal locations. Japan's well-developed tourism sector and cultural attractions, combined with Australias thriving cruise hubs in Sydney and Brisbane, also solidify their dominance in the market.

- There has been a noticeable shift towards small-ship and boutique cruises, particularly among affluent travelers seeking personalized experiences. By 2023, small-ship cruises made up 15% of total cruise offerings in the Asia Pacific region, driven by demand for intimate, customizable itineraries. Cruise lines operating in the region have responded by introducing ships with capacities of fewer than 500 passengers, offering tailored luxury services, such as private excursions and gourmet dining. This trend is particularly strong in markets like Japan and Australia.

Asia Pacific Cruise Market Segmentation

By Cruise Type: The Asia Pacific cruise market is segmented by cruise type into ocean cruises, river cruises, expedition cruises, and luxury cruises. Ocean cruises dominate the market share due to their widespread appeal across a broad demographic, attracting travelers seeking both short and long-haul vacations. The presence of well-established routes and large, entertainment-packed ships makes ocean cruises the preferred choice for a majority of travelers. Brands such as Carnival and Royal Caribbean further solidify this segments dominance by offering extensive itineraries, diverse activities, and a variety of price points for different consumer segments.

By Passenger Demographics: The Asia Pacific cruise market is segmented by passenger demographics into age groups, income brackets, and travel group types. Among these, cruises catering to middle-aged travelers (aged 45-65) have the highest market share. This is attributed to the greater disposable income and inclination towards leisure and cultural experiences, which align with the typical cruise offerings. Moreover, this demographic often prefers extended vacations, which fit well with longer cruise itineraries that combine multiple destinations.

Asia Pacific Cruise Market Competitive Landscape

The Asia Pacific cruise market is characterized by a few dominant players that drive innovation, expand market penetration, and lead in market share. Companies such as Carnival Corporation, Royal Caribbean, and Genting Hong Kong lead the market by offering diverse cruise experiences across multiple destinations. The consolidation of the market around these key players reflects their strong financial resources, extensive fleet size, and a focus on customer experience enhancement.

Asia Pacific Cruise Industry Analysis

Growth Drivers

- Rising Disposable Income in Emerging Markets: Emerging economies in Asia, including China, India, and Southeast Asia, have seen significant increases in disposable income, particularly among the middle class. In China, disposable income per capita reached over 37,000 RMB ($5,710) in 2023, driving demand for luxury and leisure travel, including cruises. India's middle class, comprising over 400 million individuals, has also seen a rise in discretionary spending, creating a robust market for cruise vacations. This growing purchasing power enables more families and individuals to afford cruise holidays, contributing to the sectors expansion.

- Increased Interest in Luxury Travel: Luxury travel is on the rise, driven by growing wealth in key markets across the Asia Pacific. In 2023, Chinas high-net-worth individual population grew to over 2.1 million, providing a strong customer base for high-end cruise lines. The demand for exclusive, personalized travel experiences has become a major trend, especially in markets like Singapore, where cruise lines are offering premium services to meet the preferences of affluent travelers. Japans luxury travel market also expanded with an emphasis on experiential and wellness cruises catering to well-heeled tourists.

- Government Initiatives to Promote Tourism: Governments across Asia Pacific have recognized the potential of the cruise industry as a vital tourism driver. China's Ministry of Culture and Tourism, for instance, has been actively promoting maritime tourism by developing cruise ports and offering incentives to cruise operators. In 2023, China's Ministry reported 2.4 million outbound cruise passengers, with plans to increase this number through enhanced port infrastructure in Shanghai and Tianjin. Similarly, Australia and Japan have expanded cruise terminals, with Japan investing over 5 billion ($34 million) in Yokohama and Kobe ports.

Market Challenges

- High Operational Costs: Operating cruise lines in the Asia Pacific region involves high costs, including fuel, labor, port charges, and taxes. In 2023, fuel prices remained volatile, with Brent crude oil averaging around $84 per barrel, significantly impacting operational margins. Labor costs are also rising in key markets like Singapore and Japan, where crew wages have increased by 15% over the past five years. Additionally, port fees in Chinas major cruise hubs like Shanghai and Tianjin are among the highest in the world, adding to the financial strain on operators.

- Environmental Concerns and Regulatory Compliance: Environmental sustainability has become a critical issue for the cruise industry, with strict regulations imposed to minimize the environmental impact. In 2023, the International Maritime Organization (IMO) implemented stringent emission controls, including a 0.50% sulfur cap on fuel oil. This regulation alone has increased operational costs as cruise lines must either switch to more expensive low-sulfur fuel or invest in costly exhaust gas cleaning systems (scrubbers). In Australia, the government has tightened waste management laws, increasing compliance costs for cruise operators.

Asia Pacific Cruise Market Future Outlook

Over the next five years, the Asia Pacific cruise market is expected to witness considerable growth, driven by rising disposable incomes, increased tourism infrastructure investments, and a growing demand for unique travel experiences. Governments across the region are emphasizing tourism as a key economic driver, with several initiatives aimed at port development and expansion of cruise-related facilities. The shift towards eco-friendly travel, combined with advancements in cruise ship technology, will further enhance the markets appeal to environmentally-conscious travelers. Additionally, the regions untapped potential in lesser-known destinations is likely to drive growth in niche and expedition cruises.

Opportunities

- Rise of Eco-Friendly and Sustainable Cruises: There is growing demand for eco-friendly and sustainable cruising options in the Asia Pacific market. In 2023, several cruise lines introduced LNG-powered ships, which reduce carbon emissions by up to 20%. The demand for "green" cruises is rising, particularly in Australia and New Zealand, where environmental awareness is high. Singapore has also launched incentives for cruise operators to adopt sustainable technologies, including solar power and electric propulsion systems, making the region a hub for eco-conscious cruising.

- Technological Advancements in Cruise Experiences: The integration of smart technology on cruise ships is creating new opportunities in the Asia Pacific market. By 2023, over 60% of cruise ships operating in the region had adopted advanced technologies, such as facial recognition for check-ins, AI-powered personal assistants, and virtual reality entertainment options. These technologies enhance passenger experience and streamline operations, making cruises more appealing to tech-savvy travelers, particularly in high-tech markets like Japan and South Korea, where consumers expect cutting-edge digital experiences.

Scope of the Report

|

Cruise Type |

Ocean Cruises River Cruises Expedition Cruises Luxury Cruises |

|

Passenger Demographics |

Age Group Income Bracket Travel Group Type |

|

Destination Type |

Coastal Cruises Remote Island Cruises Cultural Cruises |

|

Duration |

Short Cruises (1-3 Days) Mid-Length Cruises (4-7 Days) Long Cruises (8-14 Days) Extended Cruises (15+ Days) |

|

Region |

Southeast Asia East Asia Oceania South Asia |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Cruise Line Operator Companies

Travel Companies

Hospitality and Tourism Associations

Government and Regulatory Bodies (e.g., International Maritime Organization, Asian Cruise Association)

Port Authorities (e.g., Shanghai Port, Sydney Harbour Port)

Cruise Technology Provider Companies

Investor and Venture Capitalist Firms

Luxury Tour Operator Companies

Companies

Players Mentioned in the Report

Carnival Corporation

Royal Caribbean Cruises Ltd.

Genting Hong Kong

Norwegian Cruise Line

Princess Cruises

MSC Cruises

P&O Cruises

Dream Cruises

Seabourn Cruise Line

Viking Cruises

Table of Contents

1. Asia Pacific Cruise Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Asia Pacific Cruise Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Asia Pacific Cruise Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income

3.1.2. Expanding Middle-Class Population

3.1.3. Surge in Coastal Tourism

3.1.4. Shift Towards Leisure and Experiential Travel

3.1.5. Government Infrastructure Investments

3.2. Market Challenges

3.2.1. Environmental Regulations

3.2.2. Seasonality and Weather-Related Risks

3.2.3. High Operating Costs

3.2.4. Limited Port Capacity

3.3. Opportunities

3.3.1. Expansion into New Cruise Destinations

3.3.2. Rise in Luxury and Niche Cruise Experiences

3.3.3. Technological Advancements in Ship Design

3.3.4. Collaborations with Hospitality and Airline Industries

3.4. Trends

3.4.1. Sustainability Initiatives

3.4.2. Growth in Domestic Cruises

3.4.3. Integration of Wellness and Health-Oriented Services

3.4.4. Increasing Popularity of Themed Cruises

3.5. Government Regulations

3.5.1. Environmental Compliance (Emission Controls, IMO Regulations)

3.5.2. Safety Standards (Passenger Safety, Health Protocols)

3.5.3. Maritime Laws (Cabotage Laws, Port Access Regulations)

3.5.4. Taxation Policies (Port Charges, Berthing Fees)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Asia Pacific Cruise Market Segmentation

4.1. By Cruise Type (In Value %)

4.1.1. Ocean Cruises

4.1.2. River Cruises

4.1.3. Expedition Cruises

4.1.4. Luxury Cruises

4.2. By Passenger Demographics (In Value %)

4.2.1. Age Group (Millennials, Gen X, Baby Boomers)

4.2.2. Income Bracket

4.2.3. Travel Group Type (Solo Travelers, Families, Couples)

4.3. By Destination Type (In Value %)

4.3.1. Coastal Cruises (Southeast Asia, East Asia)

4.3.2. Remote Island Cruises (Pacific Islands)

4.3.3. Cultural Cruises (Japan, China, South Korea)

4.4. By Duration (In Value %)

4.4.1. Short Cruises (1-3 Days)

4.4.2. Mid-Length Cruises (4-7 Days)

4.4.3. Long Cruises (8-14 Days)

4.4.4. Extended Cruises (15+ Days)

4.5. By Region (In Value %)

4.5.1. Southeast Asia (Thailand, Indonesia, Vietnam)

4.5.2. East Asia (China, Japan, South Korea)

4.5.3. Oceania (Australia, New Zealand, Pacific Islands)

4.5.4. South Asia (India, Sri Lanka, Maldives)

5. Asia Pacific Cruise Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Carnival Corporation

5.1.2. Royal Caribbean Cruises Ltd.

5.1.3. Genting Hong Kong Limited

5.1.4. Norwegian Cruise Line Holdings Ltd.

5.1.5. Princess Cruises

5.1.6. MSC Cruises

5.1.7. P&O Cruises

5.1.8. Dream Cruises

5.1.9. Seabourn Cruise Line

5.1.10. Viking Cruises

5.1.11. Holland America Line

5.1.12. Regent Seven Seas Cruises

5.1.13. Silversea Cruises

5.1.14. AIDA Cruises

5.1.15. Celebrity Cruises

5.2 Cross Comparison Parameters (Fleet Size, Headquarters, No. of Passengers, Market Share, Cruise Length, Itinerary Diversity, Revenue, Expansion Strategy)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Support Programs

5.8 Sustainability and ESG Strategies

6. Asia Pacific Cruise Market Regulatory Framework

6.1 Maritime Environmental Regulations

6.2 Passenger and Crew Safety Protocols

6.3 Port Regulations and Compliance

7. Asia Pacific Cruise Market Future Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Asia Pacific Cruise Market Future Segmentation

8.1 By Cruise Type (In Value %)

8.2 By Passenger Demographics (In Value %)

8.3 By Destination Type (In Value %)

8.4 By Duration (In Value %)

8.5 By Region (In Value %)

9. Asia Pacific Cruise Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Marketing Initiatives

9.3 Customer Behavior and Preference Analysis

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves building a detailed ecosystem of the Asia Pacific cruise market by identifying all major stakeholders. This is supported by extensive desk research, leveraging secondary data sources to collect industry-level information and key market drivers, constraints, and opportunities.

Step 2: Market Analysis and Construction

Next, historical data is analyzed to understand market penetration and growth trends. Metrics such as passenger volume, cruise occupancy rates, and ship itineraries are examined to construct a robust analysis of revenue generation within the market.

Step 3: Hypothesis Validation and Expert Consultation

To validate market assumptions, expert interviews and consultations are conducted with industry executives and stakeholders. This step ensures the accuracy of the data and refines the projections based on real-world insights from leading cruise operators.

Step 4: Research Synthesis and Final Output

Finally, the data is synthesized into a comprehensive report that is cross-verified with primary sources. The final output provides a detailed analysis of key market segments, competitive landscape, and market growth projections.

Frequently Asked Questions

01. How big is the Asia Pacific Cruise Market?

The Asia Pacific cruise market is valued at USD 1.3 billion, driven by strong demand for leisure travel, increasing disposable incomes, and expanding tourism infrastructure in countries such as China, Japan, and Australia.

02. What are the challenges in the Asia Pacific Cruise Market?

Challenges include strict environmental regulations, fluctuating fuel costs, and seasonality risks. Additionally, the market faces capacity limitations in popular cruise ports, leading to congestion and operational inefficiencies.

03. Who are the major players in the Asia Pacific Cruise Market?

Major players include Carnival Corporation, Royal Caribbean Cruises Ltd., Genting Hong Kong, Norwegian Cruise Line, and Princess Cruises. These companies dominate the market due to their vast fleets, established routes, and diverse cruise offerings.

04. What are the growth drivers of the Asia Pacific Cruise Market?

The market is driven by the rise of middle-class travelers, increased government investment in tourism infrastructure, and the growing appeal of experiential travel. Additionally, technological advancements in cruise ships, such as green energy solutions, are boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.