Asia Pacific Currency Count Machine Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD6820

December 2024

100

About the Report

Asia Pacific Currency Count Machine Market Overview

- The Asia Pacific Currency Count Machine Market is valued at USD 1.5 billion, driven by the extensive cash economy in many countries and the increasing adoption of currency count machines across banks and financial institutions. Growth is supported by heightened demand for efficient and accurate currency handling solutions due to the high volume of cash transactions across various industries. According to recent studies, the market continues to be propelled by technological advancements, with increased integration of counterfeit detection systems and automation in currency processing, meeting the regions evolving financial infrastructure needs.

- In terms of regional dominance, China and India lead the market due to their large population base, high volume of cash transactions, and widespread usage in retail and financial sectors. Both countries are embracing automated solutions to streamline cash management in banking, retail, and government sectors. These economies also benefit from government initiatives that promote financial security and fraud prevention, creating a conducive environment for the growth of currency count machine usage.

- In 2024, companies launched IoT-enabled currency-counting machines with real-time monitoring capabilities, allowing for predictive maintenance and enhanced counterfeit detection. These machines were deployed across 10,000 banking and retail locations in the Asia Pacific, allowing seamless integration with existing infrastructure.

Asia Pacific Currency Count Machine Market Segmentation

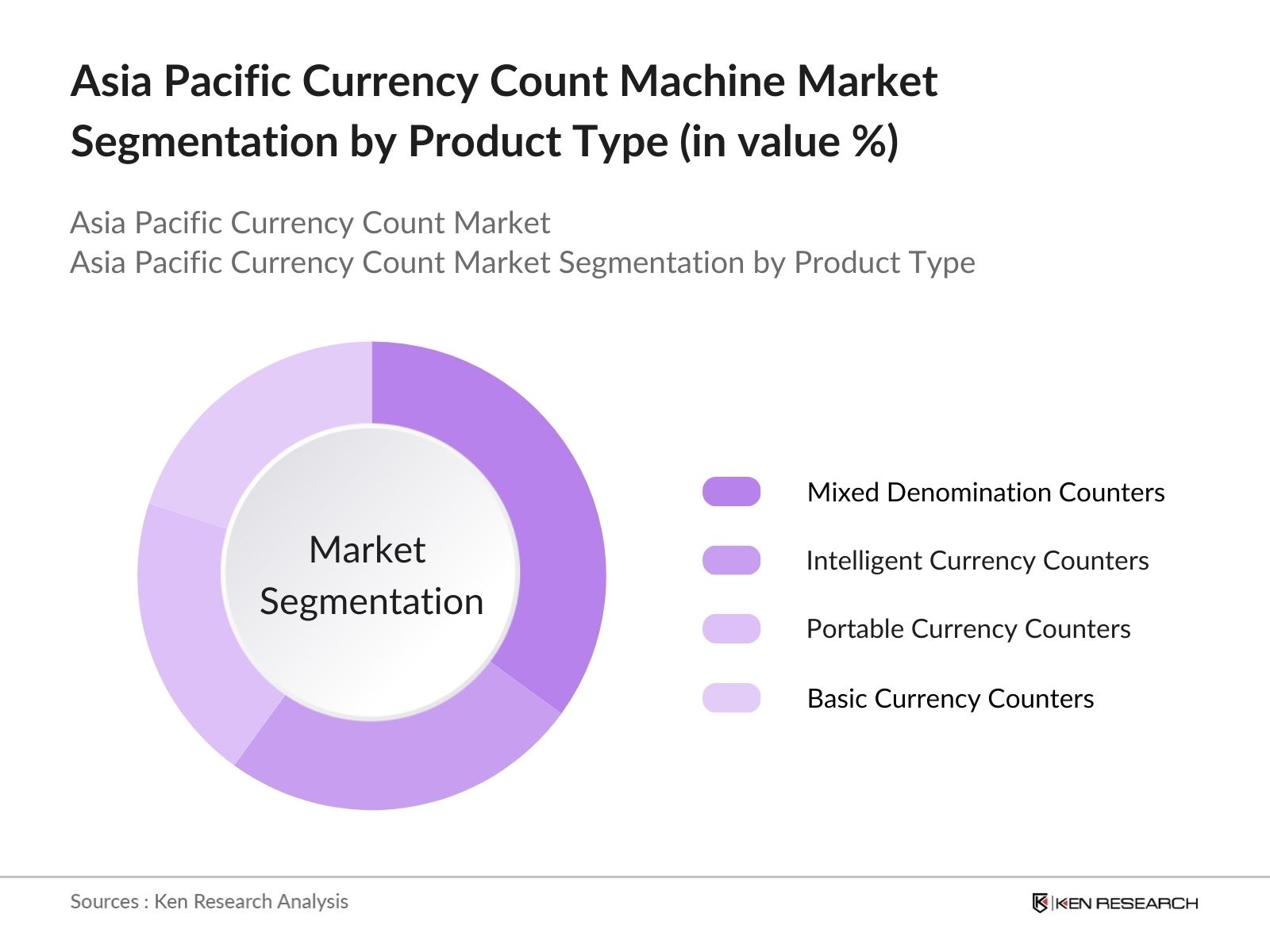

By Product Type: The Asia Pacific Currency Count Machine market is segmented by product type into Basic Currency Counters, Mixed Denomination Counters, Intelligent Currency Counters, and Portable Currency Counters. Among these, Mixed Denomination Counters dominate the market due to their capability to handle varied currencies simultaneously, which is highly valuable for high-volume institutions like banks and casinos. These machines offer speed and accuracy in sorting and counting mixed denominations, reducing the risk of human error and increasing operational efficiency in financial transactions.

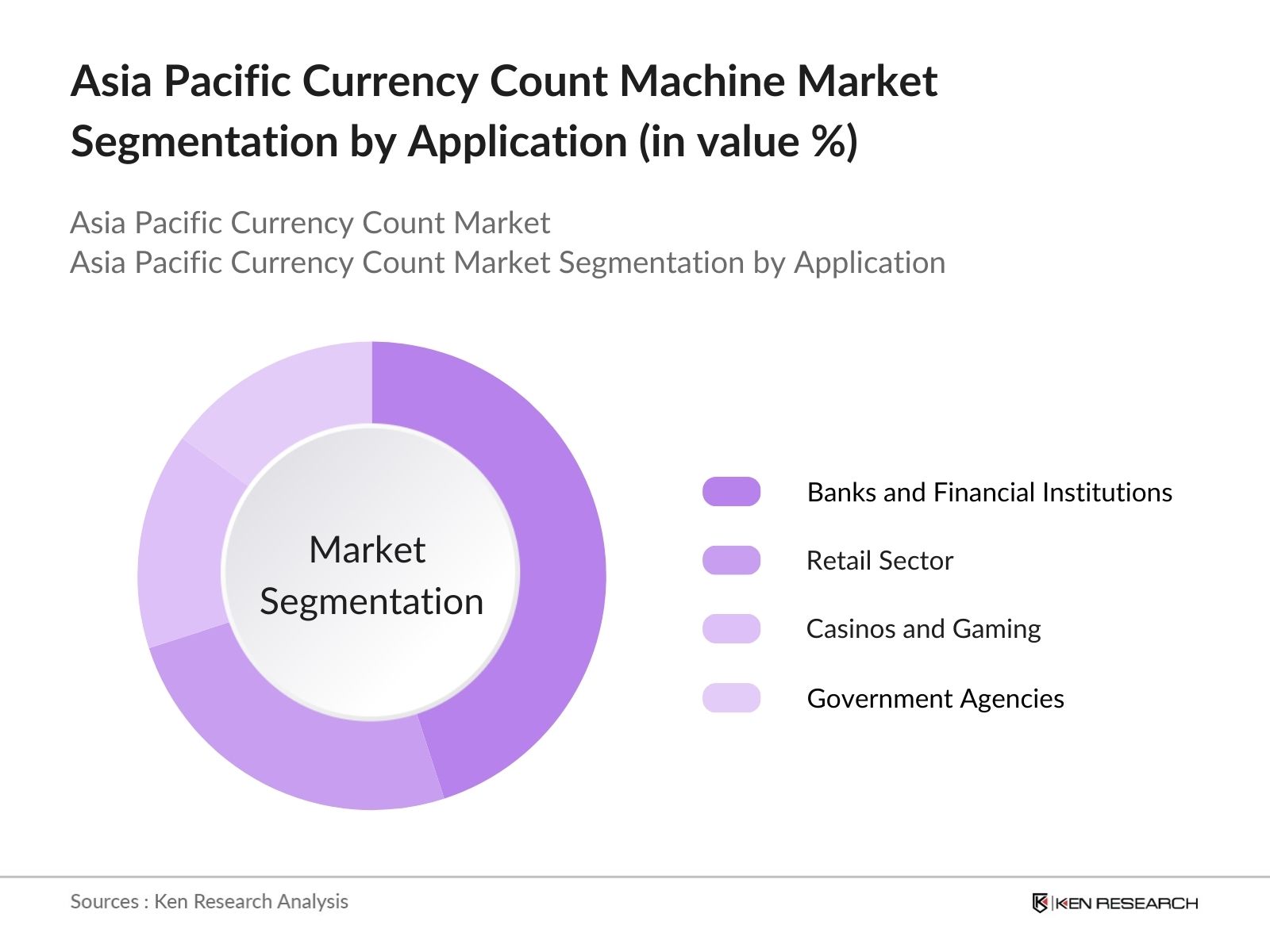

By Application: The Asia Pacific Currency Count Machine market is segmented by application into Banks and Financial Institutions, Retail Sector, Casinos and Gaming, and Government Agencies. Banks and Financial Institutions hold a leading market share, attributed to the high volume of cash transactions managed daily. The sector requires reliable and advanced counting solutions to maintain accuracy and operational efficiency, particularly as banking infrastructures modernize to prevent counterfeiting and optimize transaction processes.

Asia Pacific Currency Count Machine Market Competitive Landscape

The Asia Pacific Currency Count Machine market is dominated by a combination of global and regional players, focusing on technology integration and expanding product portfolios to cater to diverse end-user needs. Key companies prioritize advancements in counterfeit detection and regional partnerships to sustain their market position.

Asia Pacific Currency Count Machine Market Analysis

Growth Drivers

- Increasing Financial Transactions in Emerging Economies: Emerging economies in the Asia Pacific region, such as India, Indonesia, and the Philippines, are experiencing significant growth in financial transactions. In 2024, financial transactions in India alone are projected to reach around 150 billion, driven by the expansion of banking services in rural and semi-urban areas. This surge in transactions necessitates the adoption of efficient currency-counting solutions to handle the increased cash flow, particularly in cash-driven economies. The central banks and financial institutions in these regions are actively expanding infrastructure, further boosting demand for currency-counting machines to ensure accurate and efficient transaction handling.

- Rise in Cash Circulation: Despite the global push toward digital payments, cash remains a dominant mode of transaction in many Asia Pacific economies. In 2024, cash in circulation in countries like Indonesia and the Philippines is anticipated to surpass 10 trillion units, largely due to the unbanked and underbanked population segments that rely heavily on cash. The need for secure, counterfeit-proof, and efficient cash handling methods drives the adoption of currency-counting machines, which facilitate faster processing while reducing manual errors in cash handling across various sectors, from retail to banking.

- Adoption of Automated Systems in Banking Sector: The banking sector in Asia Pacific has been progressively adopting automated solutions to streamline operations. In 2024, banks across the region are expected to allocate nearly $2 billion toward automation, including currency-counting and counterfeit detection technologies. Automated currency-counting machines reduce human error, speed up transaction times, and provide enhanced counterfeit detection, meeting the sector's growing demand for accuracy and efficiency in cash handling, particularly in high-transaction environments.

Market Challenges

- High Initial Investment Costs: Currency-counting machines with advanced counterfeit detection and automation features require a substantial upfront investment. In 2024, the average cost for a high-end currency-counting machine in the Asia Pacific region is estimated at around $5,000, making it a significant expense for small and medium-sized enterprises (SMEs). This high cost poses a challenge for wider adoption among smaller businesses and regional banks that operate on limited budgets, thus limiting market penetration in cost-sensitive segments.

- Limited Awareness Among Small Retailers: Small and unorganized retailers, especially in rural and semi-urban areas, often lack awareness of the benefits and availability of currency-counting machines. In 2024, its estimated that around 70% of small retailers in emerging markets within the Asia Pacific region still rely on manual cash counting, leading to inefficiencies and potential inaccuracies in cash handling. This lack of awareness hinders the widespread adoption of currency-counting solutions, particularly among smaller enterprises that could benefit significantly from these technologies.

Asia Pacific Currency Count Machine Market Future Outlook

Over the next five years, the Asia Pacific Currency Count Machine market is anticipated to witness steady growth driven by ongoing investments in banking infrastructure, digitalization of cash handling processes, and advancements in machine capabilities. Increased adoption in government agencies and expanding applications in retail sectors are also expected to contribute to market expansion. The integration of AI and IoT technology into counting machines is set to further streamline currency handling and improve operational efficiencies across industries.

Market Opportunities

- Growing Demand from Cash-Intensive Industries: Cash-intensive sectors like retail, transportation, and hospitality are witnessing increased cash transactions, leading to higher demand for efficient cash handling solutions. In 2024, the retail sector in the Asia Pacific region is expected to handle over $1 trillion in cash transactions, a considerable portion of which occurs in small and medium enterprises. This growth presents a strong opportunity for currency-counting machine providers to expand their reach into these industries, offering solutions tailored to manage large volumes of cash accurately and efficiently.

- Integration of IoT and AI in Currency Counting: The integration of IoT and AI is transforming the currency-counting machine market by enabling real-time monitoring, predictive maintenance, and enhanced counterfeit detection capabilities. By 2024, around 500,000 IoT-enabled devices are expected to be operational in the Asia Pacific region, supporting automation in various sectors, including banking. The adoption of AI-powered machines that can detect patterns in counterfeit notes and predict maintenance requirements offers a value-added proposition for businesses, leading to operational efficiencies and cost savings in cash handling.

Scope of the Report

|

By Product Type |

Basic Currency Counters Mixed Denomination Counters Intelligent Currency Counters Portable Currency Counters |

|

By Application |

Banks and Financial Institutions Retail Sector, Casinos and Gaming Government Agencies |

|

By Technology |

UV Detection Infrared Detection Magnetic Detection Watermark Detection |

|

By End-User |

Large Enterprises Small & Medium Enterprises Individual Users |

|

By Region |

China India Japan Australia Southeast Asia |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Ministry of Finance)

Cash-Handling Solution Providers

Retail Chains and Supermarkets

Casinos and Gaming Operators

E-commerce and Payment Solutions Providers

Technology Integrators and Developers

Companies

Players Mentioned in the Report:

Giesecke+Devrient

Glory Global Solutions

Cummins-Allison Corporation

Toshiba Corporation

De La Rue plc

Royal Sovereign International, Inc.

Billcon Corporation

Kisan Electronics

GRGBanking

HENRY Electronics Co., Ltd.

Hitachi-Omron Terminal Solutions, Corp.

Julong Co., Ltd.

Amrotec Corporation

Laurel Bank Machines Co., Ltd.

Money Counting Machines Pvt Ltd.

Table of Contents

1. Asia Pacific Currency Count Machine Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Demand Analysis

1.4 Key Market Dynamics

2. Asia Pacific Currency Count Machine Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Milestones

3. Asia Pacific Currency Count Machine Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Financial Transactions in Emerging Economies

3.1.2 Rise in Cash Circulation

3.1.3 Adoption of Automated Systems in Banking Sector

3.1.4 Government Push for Counterfeit Detection Technology

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Limited Awareness Among Small Retailers

3.2.3 Maintenance and Service Challenges

3.3 Opportunities

3.3.1 Growing Demand from Cash-Intensive Industries

3.3.2 Integration of IoT and AI in Currency Counting

3.3.3 Expansion into Rural Banking Services

3.4 Trends

3.4.1 Adoption of Compact and Portable Currency Counters

3.4.2 Integration with Banking Infrastructure

3.4.3 Increasing Use of Multi-Currency Counting Machines

3.5 Regulatory Landscape

3.5.1 Standards for Currency Handling and Counting

3.5.2 Compliance with Anti-Counterfeiting Measures

3.5.3 Country-Specific Regulations for Banking Equipment

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. Asia Pacific Currency Count Machine Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Basic Currency Counters

4.1.2 Mixed Denomination Counters

4.1.3 Intelligent Currency Counters

4.1.4 Portable Currency Counters

4.2 By Application (In Value %)

4.2.1 Banks and Financial Institutions

4.2.2 Retail Sector

4.2.3 Casinos and Gaming

4.2.4 Government Agencies

4.3 By Technology (In Value %)

4.3.1 UV Detection

4.3.2 Infrared Detection

4.3.3 Magnetic Detection

4.3.4 Watermark Detection

4.4 By End-User (In Value %)

4.4.1 Large Enterprises

4.4.2 Small & Medium Enterprises

4.4.3 Individual Users

4.5 By Region (In Value %)

4.5.1 China

4.5.2 India

4.5.3 Japan

4.5.4 Australia

4.5.5 Southeast Asia

5. Asia Pacific Currency Count Machine Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Giesecke+Devrient

5.1.2 Glory Global Solutions

5.1.3 Cummins-Allison Corporation

5.1.4 Toshiba Corporation

5.1.5 De La Rue plc

5.1.6 Royal Sovereign International, Inc.

5.1.7 Billcon Corporation

5.1.8 Kisan Electronics

5.1.9 GRGBanking

5.1.10 HENRY Electronics Co., Ltd.

5.1.11 Hitachi-Omron Terminal Solutions, Corp.

5.1.12 Julong Co., Ltd.

5.1.13 Amrotec Corporation

5.1.14 Laurel Bank Machines Co., Ltd.

5.1.15 Money Counting Machines Pvt Ltd.

5.2 Cross Comparison Parameters (Technology Integration, Counterfeit Detection Capability, Product Range, Innovation Index, Market Presence, Customer Support, Production Capacity, Revenue)

5.3 Market Share Analysis

5.4 Strategic Initiatives and Partnerships

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Subsidies and Grants

5.9 Private Equity Investments

6. Asia Pacific Currency Count Machine Market Regulatory Framework

6.1 Anti-Counterfeiting Standards

6.2 Machine Certification Requirements

6.3 Currency Handling Compliance

7. Asia Pacific Currency Count Machine Future Market Size (In USD Mn)

7.1 Future Market Projections

7.2 Key Drivers for Future Growth

8. Asia Pacific Currency Count Machine Future Market Segmentation

8.1 By Product Type (In Value %) 8.2 By Application (In Value %) 8.3 By Technology (In Value %) 8.4 By End-User (In Value %) 8.5 By Region (In Value %)

9. Asia Pacific Currency Count Machine Market Analyst Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Customer Cohort Analysis

9.3 Strategic Marketing Initiatives

9.4 Opportunity Analysis for Emerging Markets

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping key stakeholders and identifying influential variables within the Asia Pacific Currency Count Machine Market. This step utilizes desk research, drawing from proprietary and secondary databases to establish a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data on the Asia Pacific Currency Count Machine Market, including assessing transaction volumes across various end-use industries. Additionally, service quality metrics are reviewed to ensure reliable revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through industry expert interviews, which provide insights into operational and technological trends. These consultations reinforce market data accuracy and align findings with real-world applications.

Step 4: Research Synthesis and Final Output

The concluding phase engages directly with industry stakeholders to verify and supplement bottom-up data, ensuring a validated, comprehensive analysis of the Asia Pacific Currency Count Machine market. This step synthesizes data from all phases, resulting in a precise market report.

Frequently Asked Questions

1. How big is the Asia Pacific Currency Count Machine Market?

The Asia Pacific Currency Count Machine market is valued at USD 1.5 billion, with significant growth driven by expanding cash handling needs and technological advancements in automated currency processing.

2. What are the challenges in the Asia Pacific Currency Count Machine Market?

Key challenges in the Asia Pacific Currency Count Machine market include high initial costs of advanced machines, lack of skilled technicians for maintenance, and limited awareness of modern currency counting solutions among small retailers.

3. Who are the major players in the Asia Pacific Currency Count Machine Market?

Prominent companies in the Asia Pacific Currency Count Machine market include Giesecke+Devrient, Glory Global Solutions, Cummins-Allison Corporation, Toshiba Corporation, and De La Rue plc, known for their strong market presence and advanced technologies.

4. What factors are driving growth in the Asia Pacific Currency Count Machine Market?

The Asia Pacific Currency Count Machine market is propelled by increasing cash transactions, demand for automation in banks and retail, and government initiatives focusing on counterfeit detection technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.