Asia Pacific Cut Flower Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD10057

November 2024

85

About the Report

Asia Pacific Cut Flower Market Overview

- The Asia Pacific Cut Flower Market is valued at USD 7.3 billion, driven primarily by the increased demand for fresh flowers across retail, event, and gifting sectors. This demand surge is supported by the growing popularity of e-commerce platforms and flower delivery services that cater to individual consumers and corporate clients. Floriculture exports have also seen significant growth, fueled by favorable trade agreements and expanding cold chain logistics infrastructure. The region's flourishing flower farms, particularly in countries like China and India, have further bolstered supply, meeting both local and international demand.

- Key players in the Asia Pacific cut flower market include China, Japan, and India, which dominate due to their established floriculture industries and favorable climatic conditions for flower cultivation. China, being a top exporter, benefits from large-scale flower farms and government support for the agriculture sector. Japan, known for its demand for high-quality and unique floral varieties, drives the market with its sophisticated consumer base. Meanwhile, India is a rising exporter, leveraging its cost-effective labor force and diverse agro-climatic zones to produce a wide variety of flowers for global markets.

- Governments across Asia Pacific are supporting the floriculture industry through subsidies and development programs. In India, the government allocated INR 500 crore (approx. USD 67 million) in 2023 for the promotion of floriculture under the National Horticulture Mission. This funding is aimed at improving cold storage facilities and providing financial assistance to flower growers to boost production and exports.

Asia Pacific Cut Flower Market Segmentation

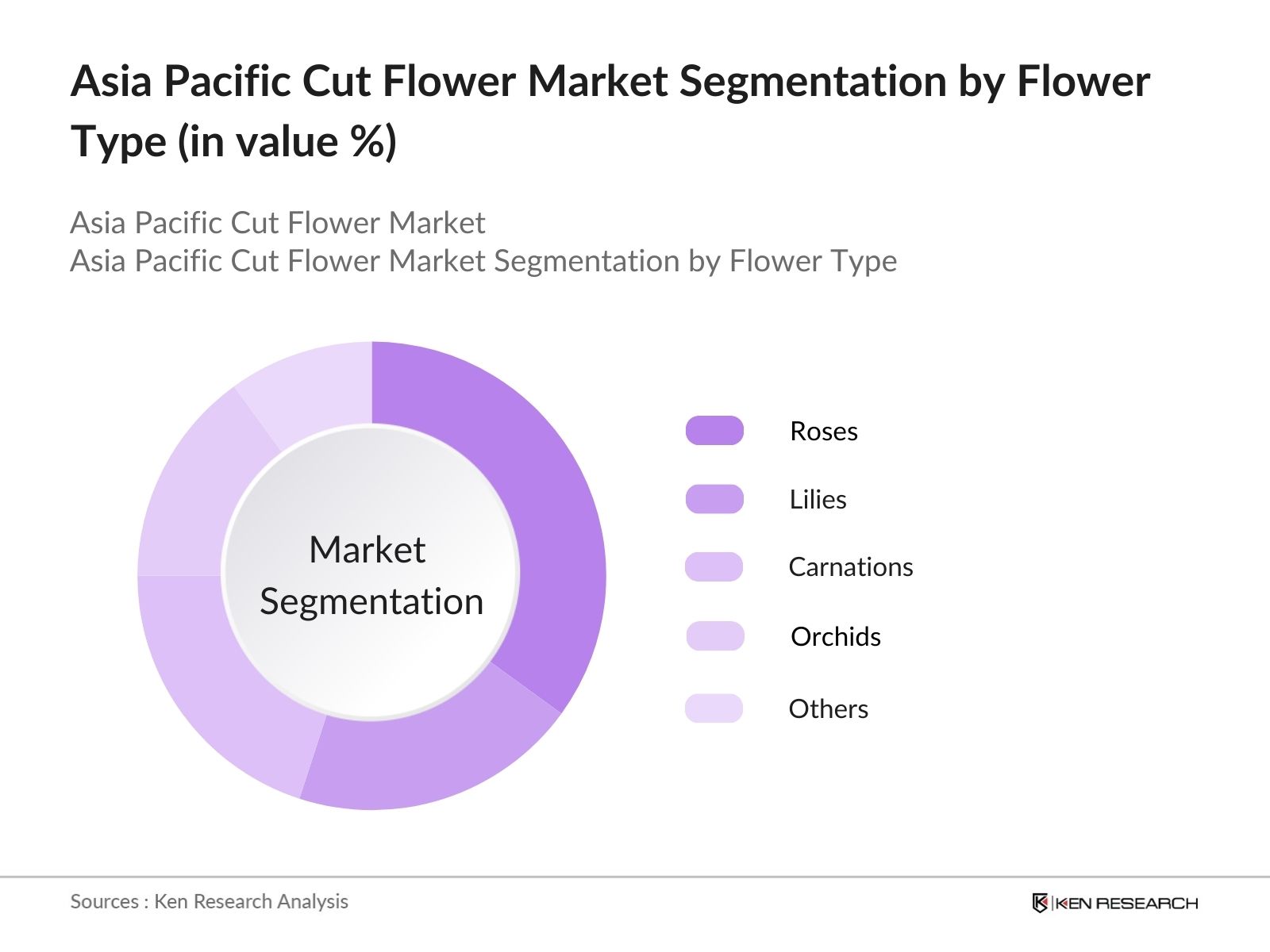

By Flower Type: The Asia Pacific cut flower market is segmented by flower type into roses, lilies, carnations, orchids, and others. Roses have the dominant market share due to their widespread popularity across various cultural events and ceremonies in the region. Their versatility, use in weddings, gifting, and decoration, along with strong domestic and export demand, contributes to their leading position. For instance, roses are heavily exported from India to Europe and the Middle East, further solidifying their place in the market.

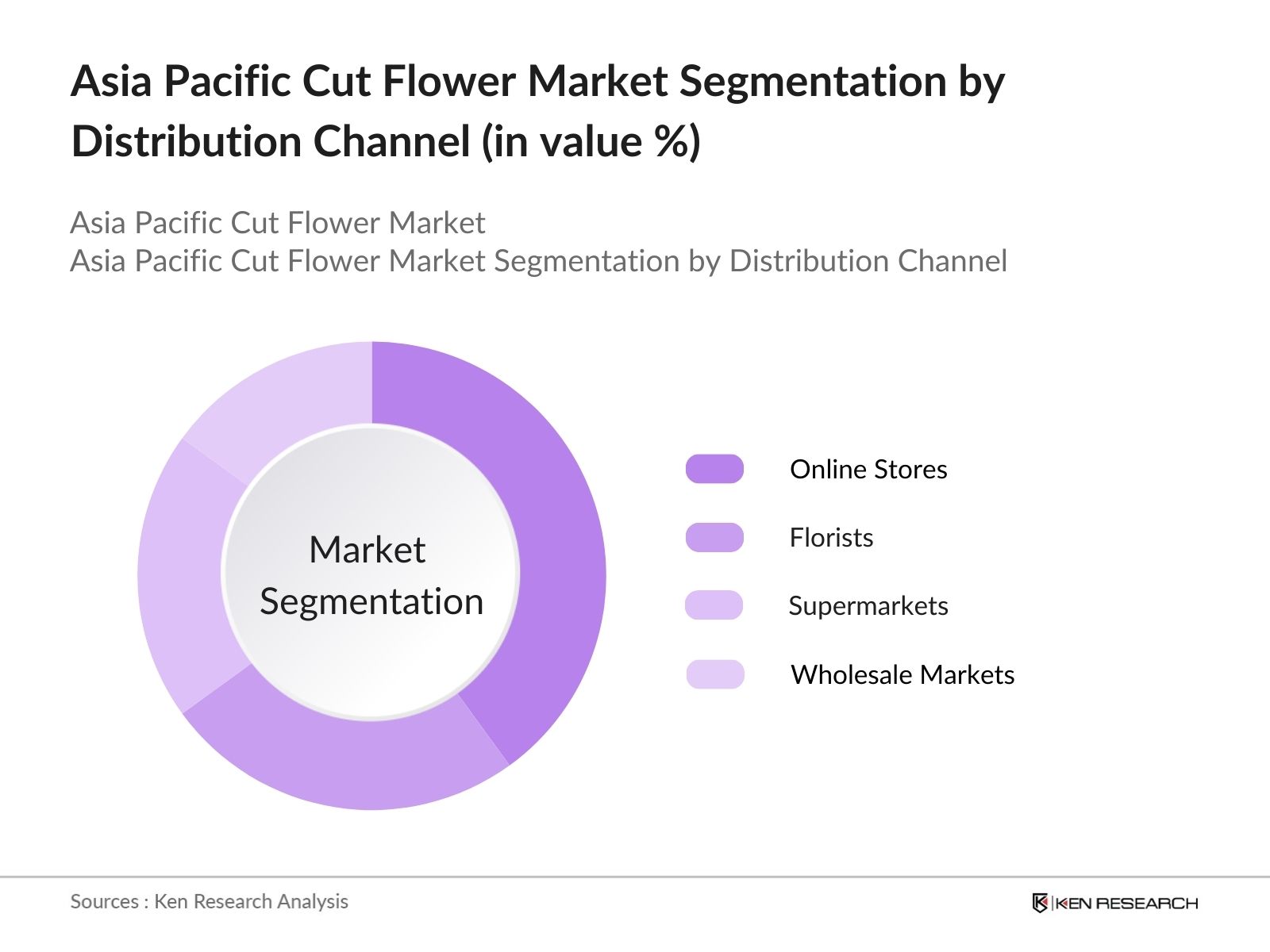

By Distribution Channel: The market is also segmented by distribution channels into florists, online stores, supermarkets, and wholesale markets. Online stores dominate this segment as e-commerce platforms become the primary mode of flower sales, especially post the pandemic. The convenience, customization, and efficient delivery services offered by these platforms have attracted urban consumers, particularly for events and personal gifting. Popularity for same-day or next-day flower delivery services has also driven the online segment ahead of traditional retail channels.

Asia Pacific Cut Flower Market Competitive Landscape

The Asia Pacific Cut Flower market is dominated by a few key players who have established significant market presence and operational efficiency in the supply chain, from cultivation to retail. This includes both local companies specializing in regional flower varieties and multinational companies expanding through exports. Competitive advantages such as large-scale production, cold chain logistics, and distribution networks play a key role in maintaining their stronghold in the market.

Asia Pacific Cut Flower Market Analysis

Growth Drivers

- Rising Consumer Demand for Fresh Flowers (Consumption metrics per capita): The demand for fresh cut flowers in the Asia Pacific region is increasing, with countries like Japan and South Korea recording high per capita consumption. For instance, Japan's annual flower consumption is over 5 billion stems, driven by cultural preferences for gifting flowers on occasions such as New Years Day and funerals. Similarly, China is seeing a notable rise in domestic flower consumption, driven by urban population growth and rising interest in home decoration with flowers.

- Expansion of Floriculture Exports (Key exporting countries in Asia Pacific): Asia Pacific has emerged as a major floriculture export hub, with countries like Thailand, India, and Malaysia exporting significant quantities of fresh flowers to markets such as Europe and the Middle East. Thailand exports around 1,200 tons of orchids annually, while India's floriculture exports reached over 22,000 tons of cut flowers in 2023. This is supported by strong trade agreements and lower labor costs, facilitating the expansion of export markets for floriculture products.

- Increasing Floral Use in Event and Wedding Sectors (Event-driven demand for flowers): The wedding and event industry in Asia Pacific has seen significant growth, leading to increased demand for fresh flowers. Countries such as India and Indonesia report that the wedding sector alone accounts for an estimated 30 million flower arrangements annually. The booming wedding industry, particularly in India where approximately 10 million weddings take place each year, is one of the primary drivers behind this heightened demand.

Market Challenges

- High Cost of Cold Chain Logistics (Cold chain supply disruptions and costs): The Asia Pacific cut flower market faces significant challenges related to the cost and efficiency of cold chain logistics. Fresh flowers are highly perishable and require temperature-controlled environments, which increases operational costs. Countries like India and Vietnam report logistical expenses exceeding USD 2 billion annually for the floriculture industry, driven by the need to maintain proper storage and transportation facilities.

- Impact of Climate Change on Flower Cultivation (Extreme weather effects on flower farms): Climate change poses a direct threat to the cultivation of flowers, particularly in regions prone to extreme weather events. Unpredictable rainfall and rising temperatures in countries like Thailand and the Philippines have resulted in the loss of significant portions of flower crops. For example, floods in Thailand in 2022 damaged over 10% of the total flower production, directly impacting the supply chain.

Asia Pacific Cut Flower Market Future Outlook

Over the next five years, the Asia Pacific Cut Flower market is expected to experience robust growth, driven by advancements in floriculture technologies, expanding export markets, and increasing demand for sustainable and pesticide-free flowers. The shift towards eco-friendly practices and sustainable flower packaging will also bolster market expansion. In addition, the growth of e-commerce and innovative marketing strategies are likely to attract new customer segments, especially in urban and semi-urban areas. Enhanced logistics and cold chain management systems will further facilitate the distribution of fresh flowers, boosting overall market growth.

Market Opportunities

- Technological Innovations in Floriculture (Use of technology in growing processes): Technological advancements in the floriculture industry are opening new opportunities for growth. The adoption of precision agriculture and automated irrigation systems is improving flower yield and quality in countries like Japan and Australia. For example, Japan has seen an increase in flower production by over 200 million stems annually, thanks to the use of vertical farming and LED lighting systems in controlled environments.

- Increasing Demand for Sustainable Flowers (Sustainability initiatives in cut flower industry): Sustainability trends are gaining traction in the cut flower market, with demand for eco-friendly flowers rising. Countries like India and Malaysia are implementing sustainable farming practices, such as organic fertilization and water-efficient growing techniques. Malaysia's floriculture industry reported a 30% increase in demand for pesticide-free flowers in 2023, reflecting a consumer shift towards environmentally friendly products.

Scope of the Report

|

By Flower Type |

Roses Lilies Carnations Orchids Other Cut Flowers |

|

By Application |

Floral Arrangements Event Decoration Personal Gifting Corporate Use Other Applications |

|

By Distribution Channel |

Online Stores Florists Supermarkets Wholesale Markets Event Coordinators |

|

By Cultivation Method |

Open-field Cultivation Greenhouse Cultivation Hydroponic Cultivation Organic Farming |

|

By Region |

China India Japan South Korea Rest of Asia Pacific |

Products

Key Target Audience

Flower growers and producers

Florists and retail flower chains

E-commerce platforms specializing in flower delivery

Event and wedding planners

Exporters of cut flowers

Government and regulatory bodies (e.g., China Ministry of Agriculture, India Ministry of Commerce)

Investors and venture capitalist firms

Cold chain logistics providers

Companies

Players Mentioned in the Report:

Dmmen Orange

Syngenta Flowers

Royal FloraHolland

Selecta One

Sakata Seed Corporation

Karuturi Global Ltd

Beekenkamp Plants B.V.

Oserian Development Co. Ltd

De Ruiter Innovations B.V.

Afriflora Sher

Table of Contents

1. Asia Pacific Cut Flower Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Driven by floral demand in retail, event decor, and gifting sectors)

1.4. Market Segmentation Overview

2. Asia Pacific Cut Flower Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones (Trade agreements, export growth, new floral varieties)

3. Asia Pacific Cut Flower Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Demand for Fresh Flowers (Consumption metrics per capita)

3.1.2. Expansion of Floriculture Exports (Key exporting countries in Asia Pacific)

3.1.3. Increasing Floral Use in Event and Wedding Sectors (Event-driven demand for flowers)

3.1.4. Growing Online Flower Delivery Services (E-commerce penetration in floral sector)

3.2. Market Challenges

3.2.1. High Cost of Cold Chain Logistics (Cold chain supply disruptions and costs)

3.2.2. Impact of Climate Change on Flower Cultivation (Extreme weather effects on flower farms)

3.2.3. Competition from Artificial Flowers (Market penetration of synthetic alternatives)

3.2.4. High Operational Costs for Flower Growers (Energy, labor, and input cost increases)

3.3. Opportunities

3.3.1. Technological Innovations in Floriculture (Use of technology in growing processes)

3.3.2. Increasing Demand for Sustainable Flowers (Sustainability initiatives in cut flower industry)

3.3.3. Growth in Flower Subscriptions Services (Monthly/annual flower delivery subscriptions)

3.3.4. Emerging Market for Organic and Pesticide-Free Flowers (Organic flower certifications)

3.4. Trends

3.4.1. Demand for Unique and Exotic Varieties (Rise in exotic flower varieties)

3.4.2. Shift Towards Sustainable Packaging (Eco-friendly packaging trends)

3.4.3. Flower Personalization Services (Customized bouquets and arrangements)

3.4.4. Integration of AI in Floriculture Supply Chains (AI-enabled optimization in distribution)

3.5. Government Regulation

3.5.1. Export Subsidies for Cut Flowers (Country-specific subsidy programs)

3.5.2. Phytosanitary Regulations (Regulations on the import and export of flowers)

3.5.3. Standards for Organic Flower Certification (Certification guidelines for organic flowers)

3.5.4. Tariff and Trade Policies Affecting Flower Exports (Tariff agreements for flower trade)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (Growers, wholesalers, retailers, exporters, delivery services)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem (Competitive landscape among suppliers, logistics providers, etc.)

4. Asia Pacific Cut Flower Market Segmentation

4.1. By Flower Type (In Value %) 4.1.1. Roses

4.1.2. Lilies

4.1.3. Carnations

4.1.4. Orchids

4.1.5. Other Cut Flowers

4.2. By Application (In Value %) 4.2.1. Floral Arrangements

4.2.2. Event Decoration

4.2.3. Personal Gifting

4.2.4. Corporate Use

4.2.5. Other Applications

4.3. By Distribution Channel (In Value %) 4.3.1. Online Stores

4.3.2. Florists

4.3.3. Supermarkets

4.3.4. Wholesale Markets

4.3.5. Event Coordinators

4.4. By Cultivation Method (In Value %) 4.4.1. Open-field Cultivation

4.4.2. Greenhouse Cultivation

4.4.3. Hydroponic Cultivation

4.4.4. Organic Farming

4.5. By Region (In Value %) 4.5.1. China

4.5.2. India

4.5.3. Japan

4.5.4. South Korea

4.5.5. Rest of Asia Pacific

5. Asia Pacific Cut Flower Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Dmmen Orange

5.1.2. Syngenta Flowers

5.1.3. Royal FloraHolland

5.1.4. Selecta One

5.1.5. Sakata Seed Corporation

5.1.6. Karuturi Global Ltd

5.1.7. Beekenkamp Plants B.V.

5.1.8. Oserian Development Co. Ltd

5.1.9. De Ruiter Innovations B.V.

5.1.10. Afriflora Sher

5.1.11. Arcadia Chrysanthemums

5.1.12. Porta Nova

5.1.13. Florensis

5.1.14. Flamingo Horticulture Investments

5.1.15. Van den Berg Roses

5.2. Cross Comparison Parameters (Market Share, Flower Varieties, Production Capacity, Distribution Network, Sustainability Initiatives, Revenue, International Presence, Key Markets)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, acquisitions, investments in R&D)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Key areas of investment in infrastructure, technology, etc.)

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Asia Pacific Cut Flower Market Regulatory Framework

6.1. Environmental and Sustainability Standards

6.2. Compliance Requirements for Organic and Pesticide-Free Flowers

6.3. Import and Export Certification Processes

7. Asia Pacific Cut Flower Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth (Increasing demand for sustainable flowers, expanding export markets)

8. Asia Pacific Cut Flower Market Future Segmentation

8.1. By Flower Type (In Value %)

8.2. By Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Cultivation Method (In Value %)

8.5. By Region (In Value %)

9. Asia Pacific Cut Flower Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping out the major stakeholders across the Asia Pacific Cut Flower market. Extensive desk research is conducted utilizing secondary data from government databases, trade associations, and proprietary databases to identify critical variables, including consumer demand, export data, and regulatory factors that shape the market.

Step 2: Market Analysis and Construction

During this phase, historical data related to the Asia Pacific Cut Flower market is analyzed, focusing on cultivation methods, export volumes, and revenue generation. This analysis also incorporates a study of cold chain logistics and technological integration in floriculture to assess operational efficiencies.

Step 3: Hypothesis Validation and Expert Consultation

A set of market hypotheses are developed based on initial data and validated through interviews with industry experts, including growers, wholesalers, and logistics providers. These consultations offer valuable insights on market trends, consumer behavior, and operational bottlenecks.

Step 4: Research Synthesis and Final Output

In the final stage, data from growers and exporters is synthesized with the bottom-up approach to produce an accurate and detailed market report. This includes verifying the trends in consumer preferences, flower varieties in demand, and competitive landscape developments.

Frequently Asked Questions

01. How big is the Asia Pacific Cut Flower Market?

The Asia Pacific Cut Flower market is valued at USD 7.3 billion, driven by the growing demand for fresh flowers, e-commerce platforms, and expanding export markets across the region.

02. What are the challenges in the Asia Pacific Cut Flower Market?

Challenges in the Asia Pacific Cut Flower market include the high cost of cold chain logistics, the impact of climate change on flower cultivation, and competition from artificial flowers that are gaining popularity in some segments.

03. Who are the major players in the Asia Pacific Cut Flower Market?

Major players in the Asia Pacific Cut Flower market include Dmmen Orange, Syngenta Flowers, Royal FloraHolland, Selecta One, and Sakata Seed Corporation, known for their wide distribution networks and technological innovations in floriculture.

04. What are the growth drivers in the Asia Pacific Cut Flower Market?

Key growth drivers in the Asia Pacific Cut Flower market include the increasing demand for sustainable and pesticide-free flowers, growth in flower subscription services, and the rising popularity of online flower delivery platforms in urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.